Last Updated: Feb 2023

Direct Cash Support

This article deals with ‘Direct Cash Support.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

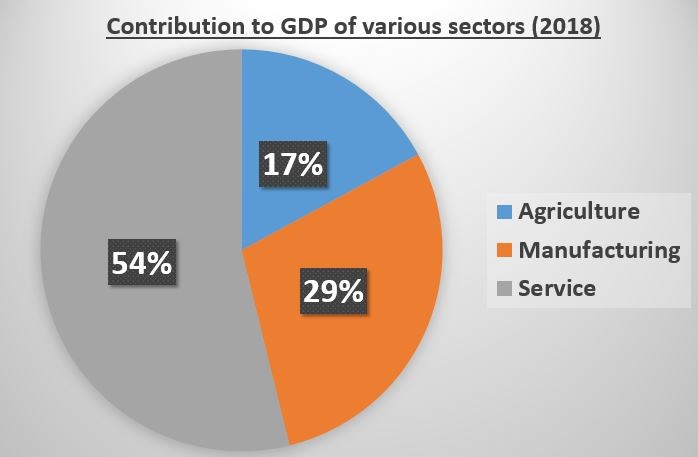

According to NABARD’s All India Rural Financial Inclusion Survey, the average monthly income of the agricultural household is Rs 8900, out of which agriculture brings barely Rs 3100. Hence, farming is not a profitable enterprise in India. Along with that, there are inherent deficiencies with the crop procurement system and MSP.

Schemes for Direct Cash Support for farmers

To deal with these issues, Central Government and various state governments have started Direct Cash Support Schemes for farmers.

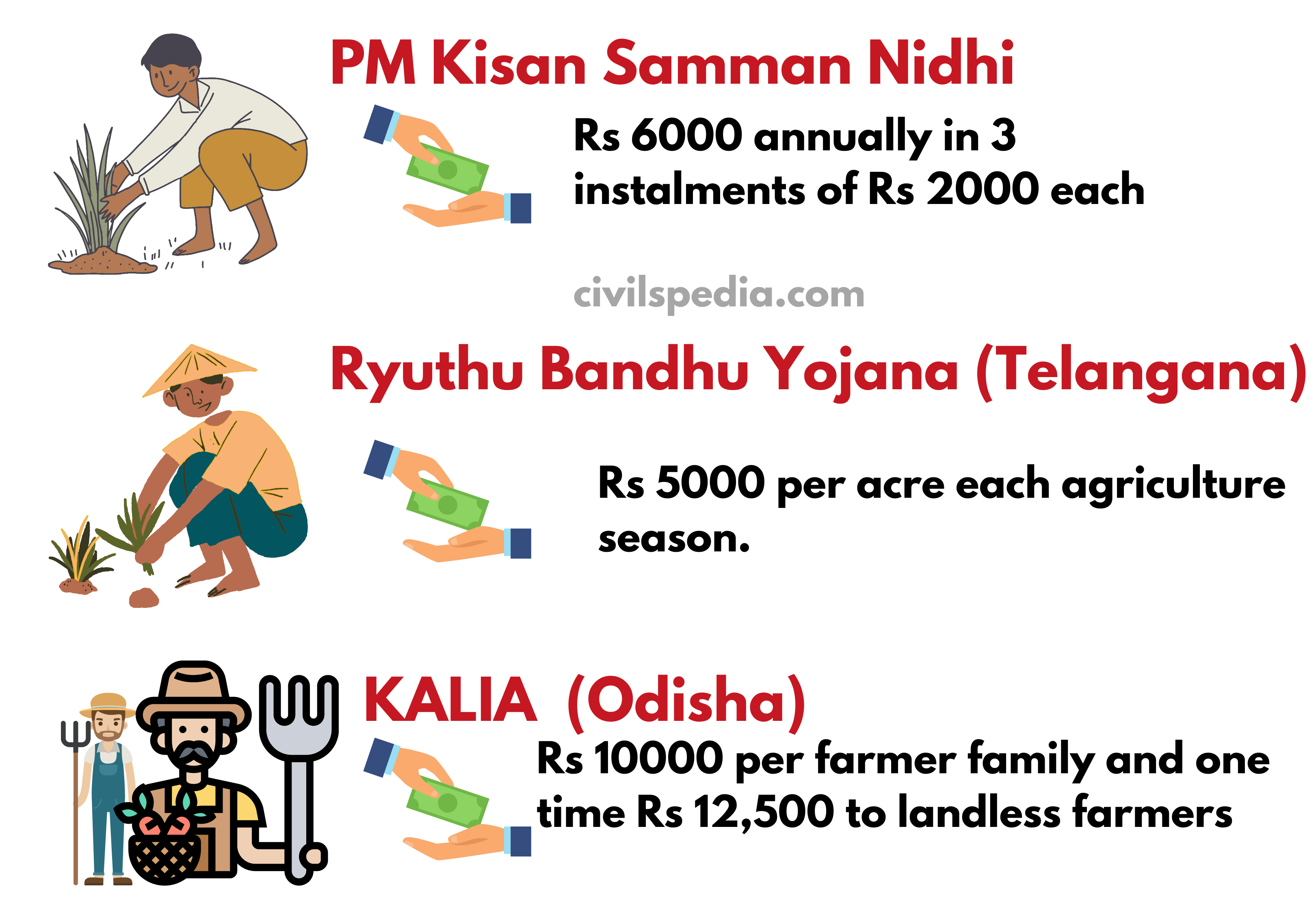

1 . PM-KISAN

- PM-KISAN = Pradhan Mantri Kisan Samman Nidhi

- The Agriculture Ministry runs this scheme.

- Under this, income support of ₹6,000 / annum is given to all farmers in three instalments of ₹ 2,000 each.

Schemes by other states

2. Ryuthu Bandu Yojana

- The Telangana government started it.

- The government gives Rs 5,000/acre to land-owning farmers for two seasons in a year.

- Many experts have criticized it, saying that it is pro-big farmers and neglects tenants (since it is per acre and not per farmer).

3. KALIA Scheme

- KALIA (Krushak Assistance for Livelihood and Income Augmentation) is the scheme of the Odisha government.

- All farmers are given Rs 10,000 per family as assistance.

- Landless households, specifically SC and ST families, are given one time Rs 12,500 for activities like goat rearing, mushroom cultivation, beekeeping, poultry farming and fishery.

- It is not linked to landholding. Hence, there is lesser exclusion than PM KISAN, and it isn’t pro- big farmers.

Benefits

- Farmers can avoid distress sales to buy inputs for the next crop. Hence, it will help in better crop price realization.

- Direct Cash Scheme doesn’t distort the market (which was the case with MSP).

- This system is consistent with India’s obligations to the WTO since it doesn’t distort market prices. Hence, subsidies given under Direct Cash Transfer are not counted under the De-Minimus limit.

- It will increase the disposable income in the farmer’s hands and spur growth in rural markets.

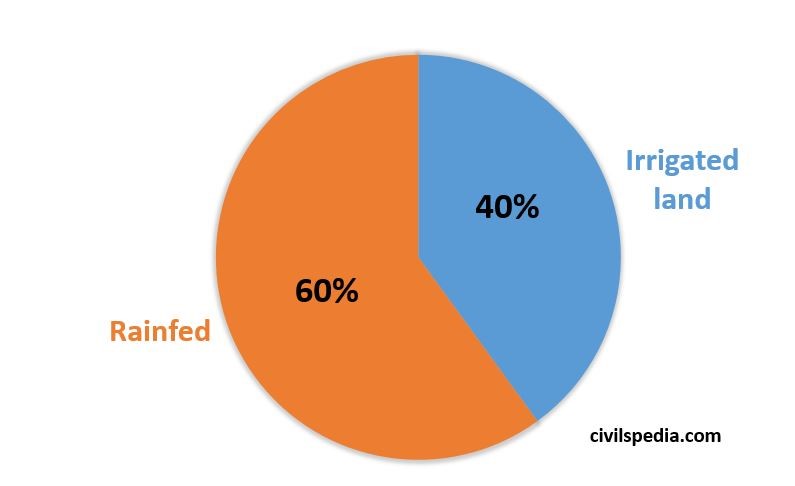

- It will help farmers to deal with problems related to climate change. Economic Survey (2018) noted that farmers income could decrease by 25% due to climate change and global warming.

- Better than indirect subsidies: Direct Cash Schemes are better than Subsidies given to agriculture. E.g., In Punjab, the average power subsidy per hectare comes out to be ₹14,000 / ha. If this 14,000 is given as Direct Income Support, it will lead to better outcomes like education, investment in the field etc.

Issues with these schemes

- Fiscal implications: It will increase the subsidy of the bill of the Union and States, forcing them to deviate from their FRBM targets.

- Schemes are subject to gross exclusionary errors as the land records are not digitalized in many states ((for instance, in Jharkhand, Bihar etc.), and tenants are not covered.

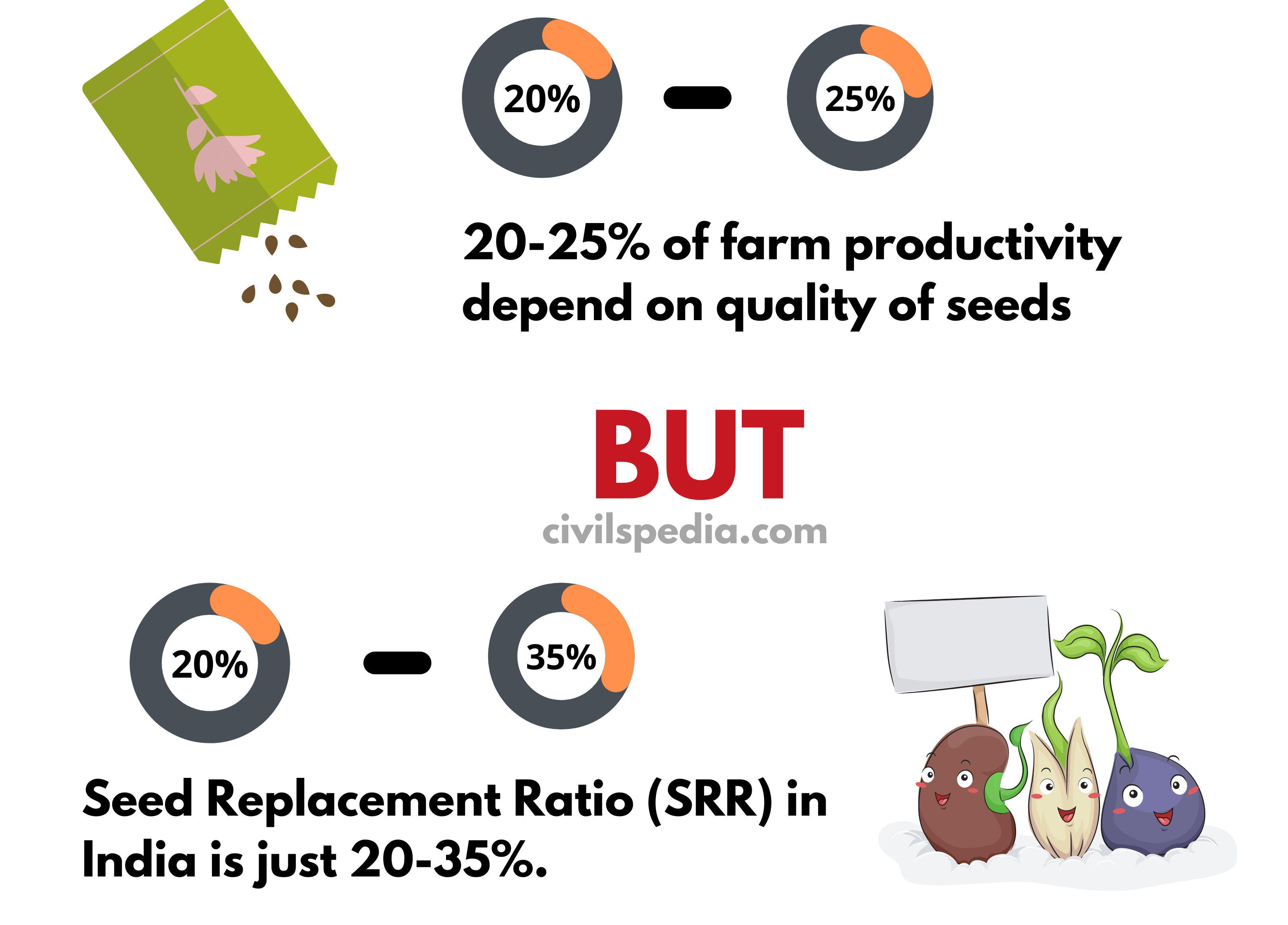

- The amount given under these schemes (for example, Rs 6000 per annum under PM-KISAN) is too low to cover the cost of seeds, fertilizers etc. Input costs for hectare land are around Rs 25,000.

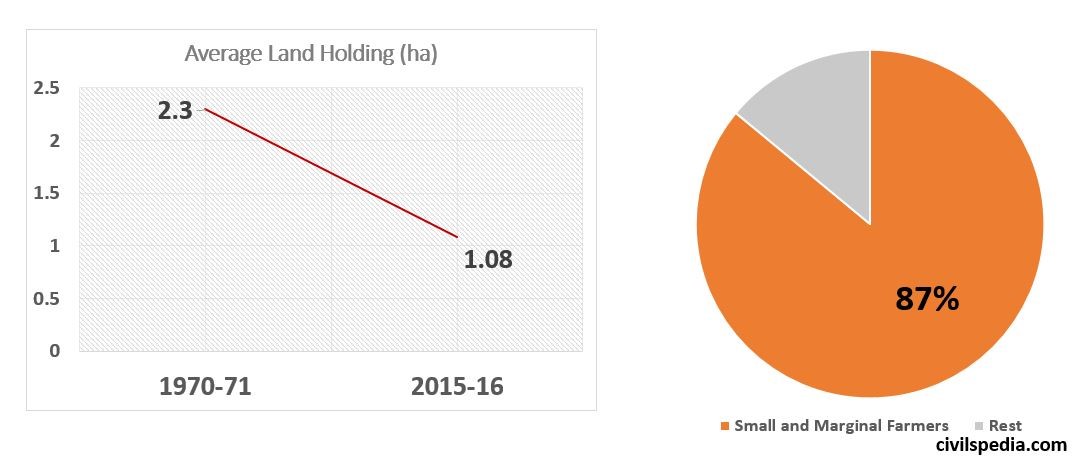

- It will encourage further fragmentation of already fragmented landholdings. Farming households holding larger land parcels will try to split holdings to more benefits under the scheme.

- Role of Banks: Cases of banks settling the amount received under PM Kisan Samman Nidhi against the past liabilities of the farmers with banks have emerged, which goes against the spirit of the scheme.

- Inadequate financial support: The amount offered by PM-KISAN is insufficient for even the bare minimum sustenance of vulnerable farmers.

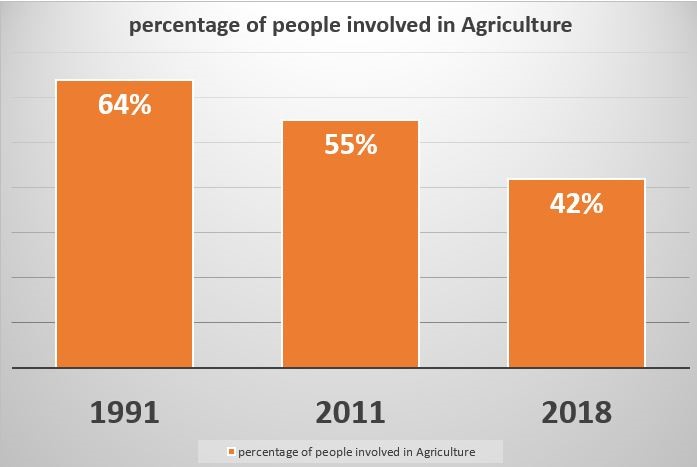

After a particular stage of economic development, it becomes difficult for average per capita agricultural incomes to keep pace with the rest of the economy, as land productivity becomes a limiting factor. Therefore, moving workers away from agriculture is the only sustainable solution: Such schemes can only provide temporary relief in the interim.