Excessive fragmentation in thinking and action

When

multiple departments or ministries are responsible for addressing different

aspects of a particular sector, it can lead to challenges such as lack of

coordination, conflicting objectives, and duplication of efforts. For

example,

- Five departments/Ministries in India deal with the transport sector, whereas in the US and UK, it is a part of one department.

- Environmental protection in India involves multiple ministries and departments, including the Ministry of Environment, Forest and Climate Change, the Ministry of Water Resources, River Development and Ganga Rejuvenation, and the Ministry of Power.

Excessive Overlap between Policymaking and Implementation

- Those who formulate are themselves involved in implementation. Hence status-quo or a minimum amount of changes are presented in the new policy. E.g., In the education sector, policymakers who formulate education policies often include officials from the Ministry of Education and other relevant government bodies. However, these policymakers are also responsible for implementing the policies they create. This overlap can result in limited innovation and transformative changes in the education system.

Lack of Non-governmental Inputs and Informed Debates

- In India, policymakers exclude or marginalize inputs from non-governmental actors, such as NGOs and civil society organizations. Hence, the resulting policies may fail to adequately address the needs, perspectives, and concerns of the affected communities. For example, in the formulation of public health programs, the exclusion of NGOs working with marginalized communities can result in policies that inadequately address their specific health challenges.

Lack of Evidence-based Research

In

India, the policies are often developed without a robust foundation of

empirical data, analysis, and research, leading to suboptimal outcomes. E.g.,

- Implementing the National Health Insurance Scheme (Ayushman Bharat) faced challenges due to a lack of evidence-based research. While the intent was to provide health coverage to economically vulnerable populations, the design and implementation of the scheme encountered issues related to inadequate infrastructure, limited healthcare provider networks, and low awareness among beneficiaries. Insufficient research on existing healthcare systems, demand patterns, and cost projections hindered the effectiveness of policy implementation and limited the scheme’s impact.

Politically Motivated policies

Politically

motivated policies can lead to inadequate policy formulation, flawed design,

and suboptimal implementation in India. These policies are driven primarily by

political considerations, such as electoral gains or appeasing specific

interest groups, rather than being based on sound evidence, expert advice, or

the long-term welfare of the nation. E.g.,

- Agriculture Sector: The introduction of populist measures like loan waivers and high minimum support prices (MSP) for crops, without considering market dynamics or fiscal sustainability, can distort market forces, create inefficiencies, and burden the government finances.

- Education Sector: The introduction of reservation quotas in educational institutions based solely on political calculations rather than the principles of merit and equal opportunity can undermine the quality of education and compromise the overall academic environment.

- Infrastructure Sector: Projects driven by electoral considerations rather than economic viability can result in poor planning, cost overruns, delays, and inadequate infrastructure quality.

Centralized Policy Making

Centralized

policy making, which follows a one-size-fits-all approach, can lead to

challenges in policy formulation, design, and implementation in India. This

approach overlooks the diversity of contexts, needs, and challenges across the

country’s different regions, sectors, and communities. E.g.,

- A uniform Minimum Support Price (MSP) for crops across the country does not account for variations in production costs, market dynamics, and local demands, leading to unequal benefits and discontent among farmers.

- Centralized educational policies, such as uniform curriculum frameworks or standardized assessments, may not align with the specific needs and aspirations of students and communities in different states or regions.

Insufficient Capacity and Expertise

Effective

policy formulation and implementation require skilled personnel, adequate

resources, and institutional capacity. Limited technical expertise and a lack

of capacity-building initiatives can impede the implementation of policies. For

example

- Implementing the Continuous and Comprehensive Evaluation (CCE) system in schools faced challenges due to a lack of trained teachers, resulting in inconsistent implementation and ambiguity in assessment practices.

- Implementation of Crop Insurance Schemes has faced difficulties due to limited awareness among farmers, inadequate risk assessment capabilities, and challenges in timely claim settlements.

- Implementation of pollution control measures in industrial sectors has been hampered by limited expertise in monitoring and enforcement.

Complex Procedures

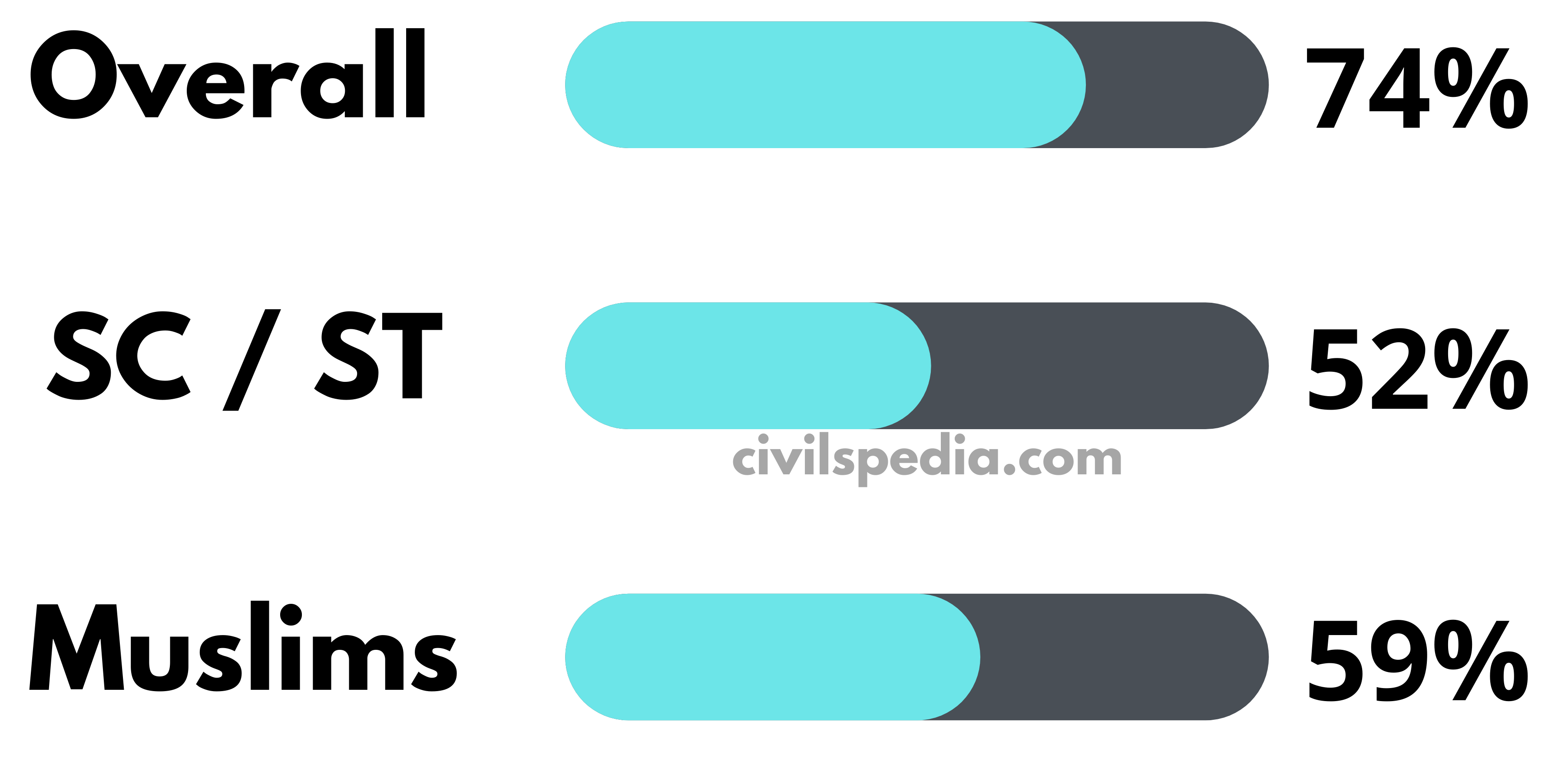

- Complex procedures in policy implementation can hinder the participation of individuals, especially those from disadvantaged backgrounds.

- According to a World Bank report, when schemes are designed with intricate procedures that require poor individuals to visit offices, fill out forms, and navigate complex rules, their participation decreases significantly, often to as low as 10%. However, when these schemes are revamped and local officials, such as Asha workers or postmen, go door-to-door to implement them, participation increases substantially, reaching as high as 70%.

Fear of Unknown

- The fear of the unknown, particularly prevalent among individuals with limited resources, can contribute to challenges in policy formulation, design, and implementation in India. This fear stems from the constant worry about potential financial loss and the inability to absorb setbacks.

- Due to their precarious financial situations, individuals with limited resources may prioritize immediate gratification over long-term investment. Individuals with limited resources may not show significant interest in schemes designed to promote financial inclusion. Despite the potential long-term benefits of financial inclusion, immediate concerns and the need for immediate gratification take precedence for these individuals.

- Programs focused on skill development and vocational training may struggle to attract individuals from economically disadvantaged backgrounds. The fear of investing time and resources in acquiring new skills without a guaranteed immediate return on investment can discourage participation, hindering the effectiveness of such initiatives.

- Addressing the fear of the unknown and aligning policies with immediate needs and concerns can contribute to better policy formulation, design, and implementation in sectors aiming to uplift the economically disadvantaged population.

Social Dynamics and Obligations

Policies

must be formulated and implemented while keeping in mind the social dynamics

and obligations that influence the behaviour and decision-making of the poor.

When policies are formulated, designed, and implemented without considering

these factors, they might not work. E.g.,

- In rural India, where agriculture is a predominant occupation, poor farmers often face pressures to conform to social expectations. It can influence their cropping decisions and practices. For instance, if a farmer chooses to cultivate a crop that differs from what their neighbours or relatives cultivate, they may face the risk of crop theft or vandalism.

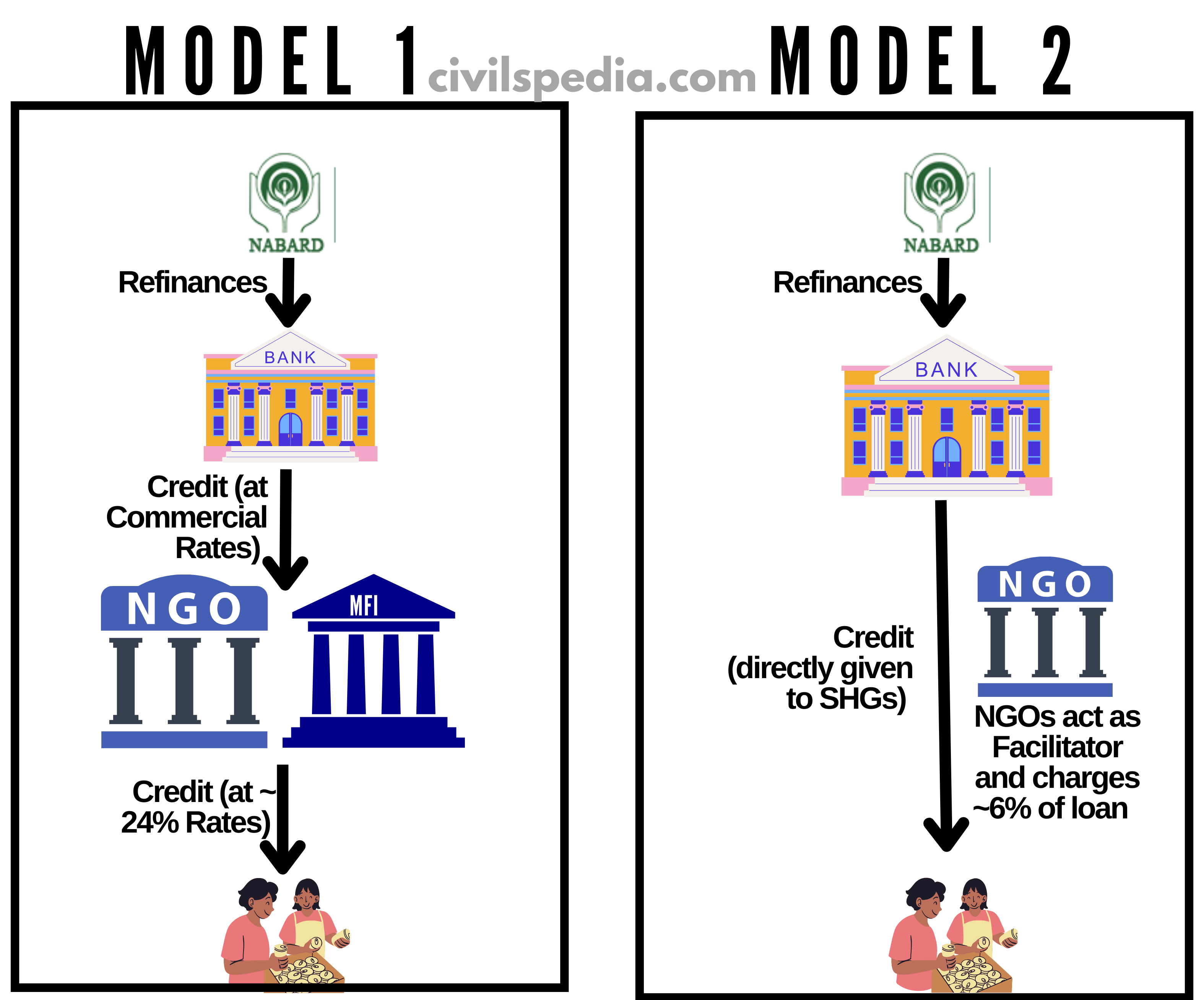

- Microfinance plays a crucial role in providing financial services to the poor, especially in rural India. However, some poor individuals may take microfinance loans not necessarily because of their dire need for cash but to signal their relatives and neighbours that they do not have spare money. This stems from the social obligation to help others in times of need, even if it means taking on debt. If policymakers fail to recognize this underlying motivation, it can lead to misinterpretation of the actual financial needs of the poor and the effectiveness of microfinance interventions.