Last Update: May 2023 (Insolvency and Bankruptcy Code)

Table of Contents

Insolvency and Bankruptcy Code

This article deals with ‘Insolvency and Bankruptcy Code.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

What is Bankruptcy?

Bankruptcy is a legal status usually imposed by a Court on a firm or individual unable to meet their debt obligations.

Drawbacks of Earlier System of Bankruptcy

- It takes 4.3 years to resolve insolvencies in India (compared to 0.7 years in Japan ).

- Creditors recover just 25% in India compared to 93% in Japan.

- It was difficult to wind up an unviable company in India, and this acted as a considerable barrier for entrepreneurs (as StartUps are prone to failure).

- It has inhibited the development of a vibrant corporate bond market in India.

- It has led to the ‘Evergreening of loans’, which has resulted in a large NPA of Banks.

- The multiplicity of Acts to deal with Insolvency like the Sick Companies Act, 1985; SARFAESI Act, etc., led to delays and corruption because of overlapping provisions.

Provisions of the Act

- Who can Initiate Insolvency Resolution Process? – It can be initiated by

- Business or debtor who has defaulted on dues (but he shouldn’t be Wilful Defaulter), OR

- Lenders and creditors to the firm.

- Speed will be the main essence of insolvency proceedings

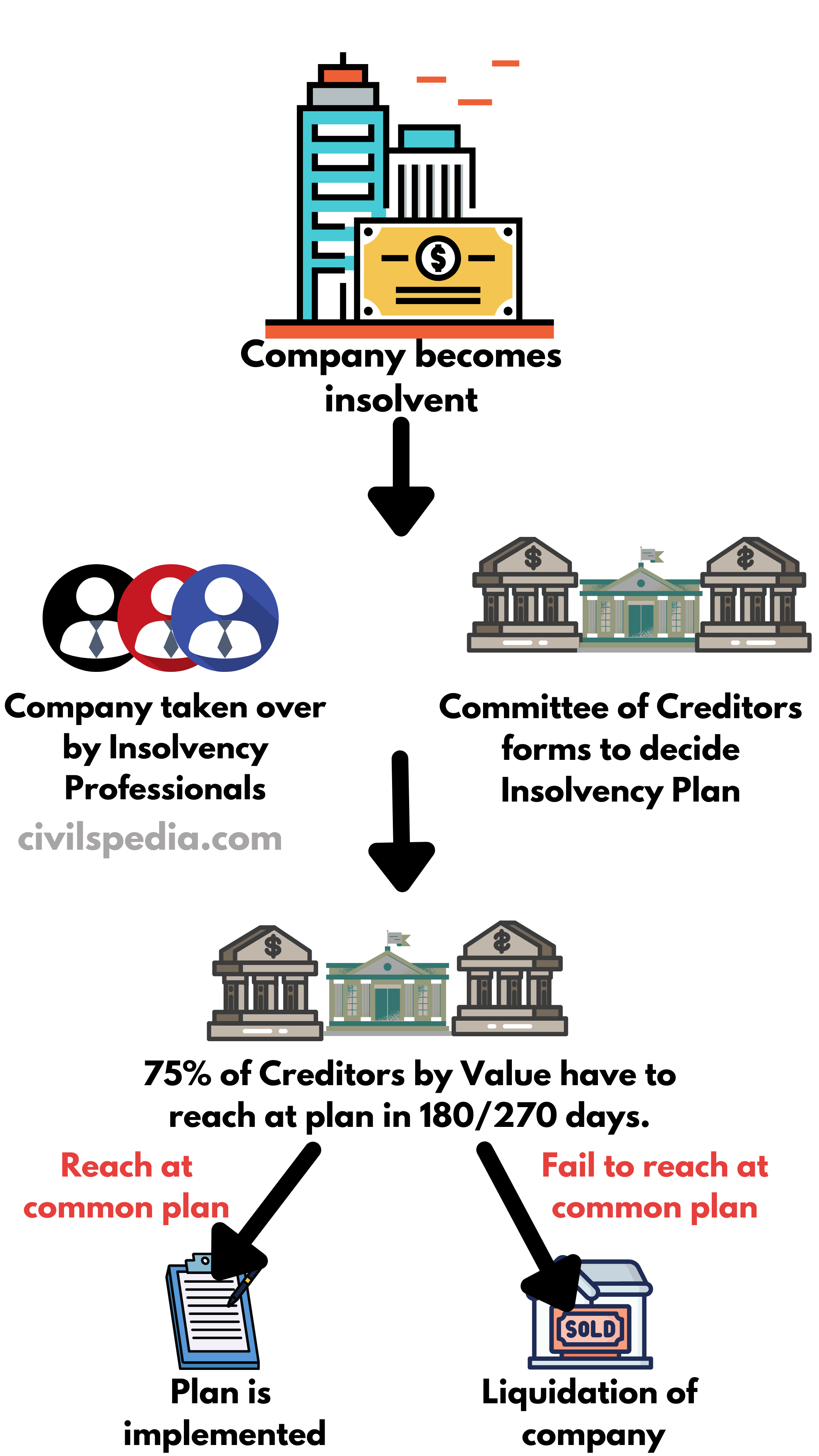

- The 180-day limit for the Committee of Creditors’, which will have representation of all lenders in proportion to their advances, to decide one of three alternatives — liquidation of the company, sale of the company as a going concern, or restructuring of debt.

- They can demand 90 extra days from Adjudicating Authority in exceptional cases.

- If three-fourths in value of creditors cannot agree on one of the three options within the 180/270 -day period, then the liquidation process will automatically commence.

- Such speedy winding up is achieved by creating a host of new institutions. These include:

- During the time insolvency proceedings are going on, Insolvency Professionals will take over the management of a company, assist creditors in the collection of relevant information, and later manage the liquidation process,

- Insolvency Professional Agencies who will examine and certify these professionals,

- Information Utilities collect, collate, and disseminate financial information related to debtors to facilitate insolvency, liquidation & bankruptcy (NeSL (National E-Governance Services Limited) is the first Info Utility).

- Insolvency Regulator: The Insolvency and Bankruptcy Board of India (IBBI) exercises regulatory oversight over the whole process.

- Insolvency Adjudicating Authority: The final decision to accept or reject the insolvency resolution plan rests with the adjudicating authority. Adjudicating Authority in these cases are

- Debt Recovery Tribunal (“DRT”) in individuals and unlimited liability partnership firms.

- National Company Law Tribunal (“NCLT”) in companies & limited liability entities.

- The act has provisions to tackle issues of cross-border insolvency. India must enter into bilateral agreements with these countries to settle cross-country insolvency. Budget 2022 announced that IBC would be amended to deal with cross-border insolvency efficiently.

- The bill has the provision of personal insolvency in case the promoter of the company has given a personal guarantee against the loans taken by the company. (For Example: A personal insolvency procedure was initiated by SBI against Anil Ambani, who had given a personal guarantee for a loan of ₹1200 crore taken by his companies RCom & Reliance Infratel Limited (RITL).

- 2018 Amendment: Earlier, Promoters and defaulters bided for their companies and repurchased them. 2018 amendment stopped promoters and defaulters from bidding for companies undergoing resolution.

Side Topic: Pre-Packing

Insolvency and Bankruptcy Code is amended to allow the procedure of pre-packing in India. Pre-packing is a process under which a resolution is agreed upon between corporate debtor and lender before approaching the courts for bankruptcy proceedings.

What is Pre-Packing?

- If the matter goes to NCLT for the formal insolvency proceedings, it negatively impacts the company’s image. It affects the future clients and customers of the company.

- To avoid such incidents, advanced economies (like the UK and the USA use the system of PRE-PACKING, i.e. borrower company informally (discretely) negotiates a resolution plan with its lenders or buyer parties before approaching the NCLT process.

Benefit

- It has the benefit of quick resolution and a discreet way of completing the insolvency process without negatively impacting its brand image.

Positive effects of Insolvency and Bankruptcy Code

- Easy exit policies will be a significant boost for StartUp India.

- It will improve the rank of India on the ease of doing business index.

- It can help in reducing the menace of NPA.

- Cases in High Courts will decrease because the adjudicating authority is DRT & NCLT.

Shortcomings of Insolvency and Bankruptcy Code

- It lacks provisions equivalent to Chapter 11 of the US bankruptcy law, which allow a voluntary appeal by a debtor to be given a chance for a turnaround that the bankruptcy court can grant, if the court finds it feasible, regardless of the creditors’ verdict.

- IBC interacts with numerous laws. E.g. labour laws and the Industrial Disputes Act, 1947.

- The proposed resolution plan requires 75% in value of creditors to sign for it. It creates the risk of the minority creditors being disenfranchised.

- Code provides a hard deadline of 180/270 days to complete the corporate insolvency process, failing which liquidation starts. Negotiating under the shadow of liquidation may lead parties not to conduct a broad enough market search for the ailing corporate debtor and will likely result in fire sales (translating into creditor under-recoveries).

- There is a need to increase the number of NCLT benches, IP professionals, and ICT technology for faster case proceedings.

- Issue of Group insolvency needs to be fixed. Group insolvency means insolvency of one company of a group of companies. E.g., Tata Sons have many companies like Tata Motors, Tata Capital, TCS etc. More clarity on the issue when one or more than one company of group undergoes insolvency process.

Working Appraisal of Insolvency and Bankruptcy Code

Achievements

- IBC Regime is working better than any other previous regime. Since the inception of the IBC in December 2016, 5,893 Corporate Insolvency Resolution Processes (CIRPs) have commenced by end-September 2022, of which 67 per cent have been closed.

- The time to settle insolvencies decreased to 1.6 years in 2020 (from 4.3 years). It is an improvement, but it should also be noted that in 64% of the cases where the Insolvency Process was started under the Act, the threshold of 270 days was breached (as of Feb 2023)

- Corporate behaviour change wrt outstanding unpaid loans: Earlier, the Insolvency process used to take 4.3 years. Hence, Corporate houses used to be non-serious about paying these unpaid loans. Now, the time to solve insolvency has decreased to less than a year, and as a result, they have started repaying loans in fear of losing control over the company.

- Amount recovered – Shows mix trend

- In the case of big loans like that of Bhushan Steel, banks have recovered 85%.

- But in the case of MSME loans, the recovery rate is below 50% (but still higher than the previous recovery)

- Uniform and universal application: RBI has withdrawn other resolution schemes such as Strategic Debt Restructuring (SDR) Scheme, Scheme for Sustainable Structuring of Stressed Assets (S4A) etc.

- In Ease of Doing Business, the Rank of India wrt resolving insolvency has decreased due to these changes.

Challenges

- Low recovery rates: The recovery rate is meagre, with some of the insolvency processes giving haircuts of up to 90-95%.

- Delays: The timeline for settling the cases under the act is not followed as more than 71% of the cases remains pending for more than 180 days.

- Staffing and infrastructure issues: NCLT is not equipped to handle the load as it operates with just half of the sanctioned strength.

- Need for strengthening homebuyer rights: According to a 2018 amendment to the IBC, a minimum of 100 homebuyers, or 10% of the total flat purchasers, are needed for initiating the process. However, homebuyers face practical difficulties in gathering the required number to initiate insolvency proceedings against the real estate owner.

- Cross-Border Insolvency: IBC lacks standardized cross-border insolvency, as observed in Videocon and Jet Airways cases.