Table of Contents

Rural Banking

Last Update: March 2023

This article deals with ‘Rural Banking.’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Steps taken to promote Rural Banking

Various steps have been taken to penetrate Banking into Rural Areas.

1. Before Independence

- During the British Raj & initial years of independence, Banks (& insurance companies) operated in Urban Areas only.

- Result: Villagers used to rely on money lenders, who lend money at exorbitant rates & they remained in debt & poverty.

2. After Independence

| 1950s | Cooperative Banks/Societies |

| 1955 | Birth of SBI & ICICI |

| 1960s | Bank Nationalisation (1960 & 1969) |

| 1969 | Lead Bank Scheme |

| 1975 | Regional Rural Banks (RRB) setup |

| 1980s | NABARD setup + Bank Nationalisation(2nd Round) |

| Early 90s | Self Help Group & Bank linking |

| Late 90s | Kisan Credit Card |

| Mid 2000s | No Frills Account Banking Business Correspondent Interest Subvention Schemes on crop loans |

| Present | RRB Amendment + Payment Banks |

Lead Bank Scheme

- During the 1960s, Narsimham Committee recommended that the responsibility of development be given to banks. Hence, Lead Bank Scheme was launched.

- In 1969, the State Bank of India and its subsidiaries, along with 14 national banks and 3 Private banks, were selected under this. Every district was given to a specific bank making it responsible for the development of Banking in that district called Lead Bank.

- Later, in 1975, these banks were asked to set up subsidiary banks in their districts known as Regional Rural Banks.

Rural Infrastructure Development Fund (RIDF)

- RIDF was started in the mid-1990s.

- NABARD operates RIDF.

- This fund provides cheap loans to state & state-owned corporations so that they can complete projects related to

| Medium & minor irrigation | Community Irrigation Wells |

| Soil conservation | Village Knowledge centres |

| Watershed Management | Desalination plants in coastal areas |

| Flood Protection | Building schools & Anganwadi centres |

| Forest development | Building toilet blocks |

| Cold storage | Rural roads & bridges |

- Banks that don’t meet their Priority sector lending requirements provide money to RIDF.

Regional Rural Banks

- Already studied in the previous article.

Cooperative Banks

- Dealt below

Priority Sector Lending

- In the next article.

Cooperative Banks

- A cooperative bank is a financial entity that belongs to its members, who are, at the same time, the owners and the customers of their bank.

- These banks work on the principle of NO PROFIT & NO LOSS and ONE MEMBER, ONE VOTE.

- They are subjected to CRR & SLR requirements. However, the requirements are less than for commercial banks.

- PSL requirements are not applicable to them.

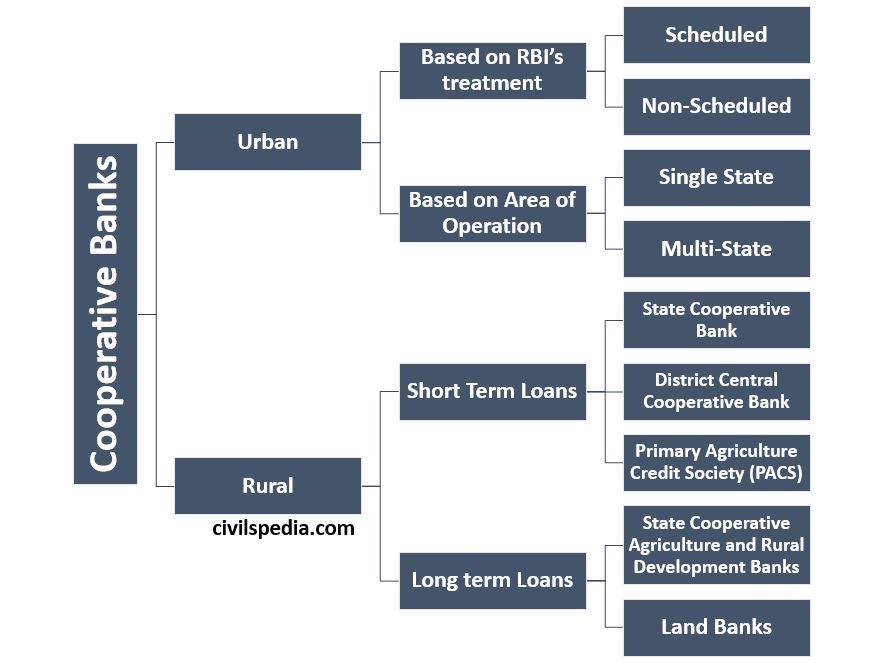

- They can be Scheduled or Non-Scheduled.

- They were instrumental in dismantling the hegemony of money lenders in rural finance.

- Before the nationalization drive took place in the 1960s, Cooperative banks constituted 80% of institutional credit. But after the nationalization of banks, their share decreased significantly due to stiff competition from commercial banks.

- Due to the One Member, One Vote, they suffer from caste politics.

- These banks don’t have an all-India presence & are present in selected regions like Gujarat, Maharashtra, Andhra Pradesh and Tamil Nadu, where the cooperative movement was strong.

- In 2018, RBI allowed Urban Cooperatives to voluntarily transform into Small Finance Banks, with conditions.

Comparison

| Commercial | Cooperative | |

| Banking Regulation Act | Yes | Yes (Since 1966) |

| CRR and SLR requirements | Yes | Yes ( but lesser than Commercial Banks) |

| PSL | Yes | No |

| Who can borrow? | Anyone | Only Members |

| Voting Power | Proportionate to Shareholding | One Member, One Vote |

| Profit Motive | Yes | No Profit, No Loss |

| Presence | All India | Present all over India but mainly concentrated in Gujarat, Maharashtra, Andhra & Tamil Nadu. |

Who Regulates Cooperative Banks?

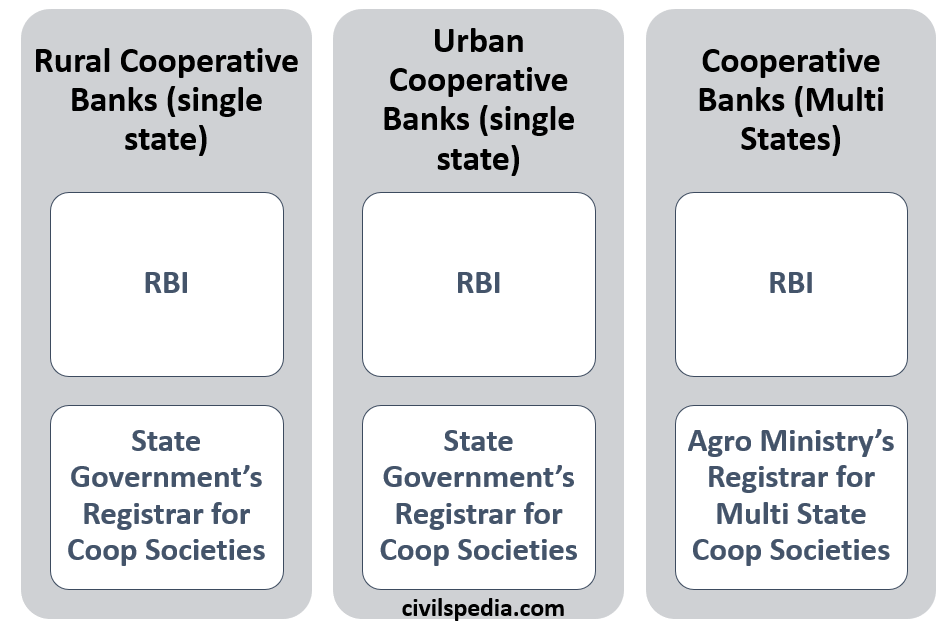

Earlier, Cooperative Banks were under the dual regulation of RBI and the Registrar of Cooperative Societies, as shown in the figure below. But this led to delays in the corrective actions, which culminated in corruption and the fall of banks (like Punjab and Maharashtra Cooperative Bank)

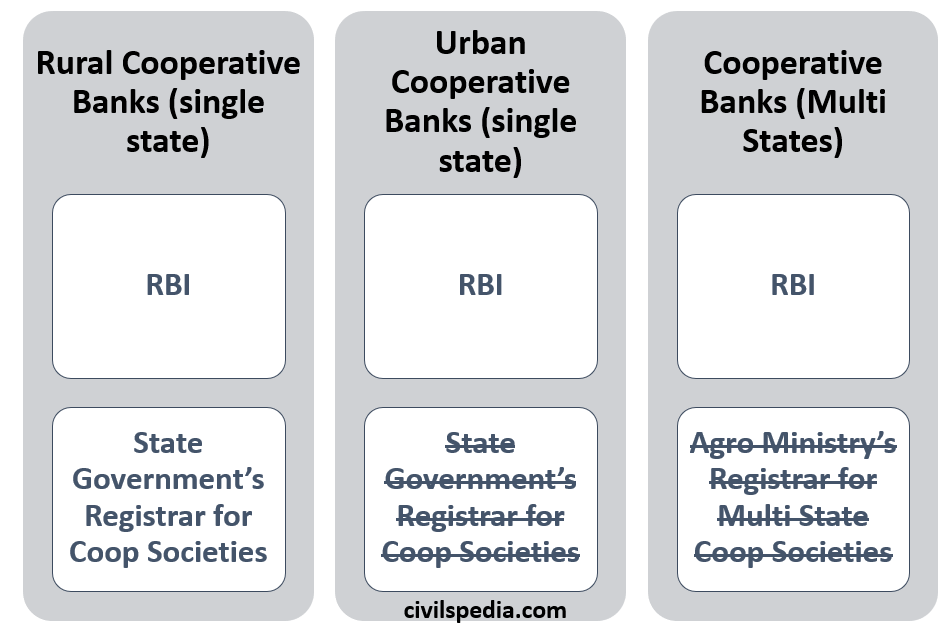

Hence, Banking Regulation Act has been amended, and the problem of dual regulation has been solved wrt Urban and Multi-State Cooperative Banks. Now, RBI has been made the sole regulator in the case of Urban and Multi-State Cooperative Banks.

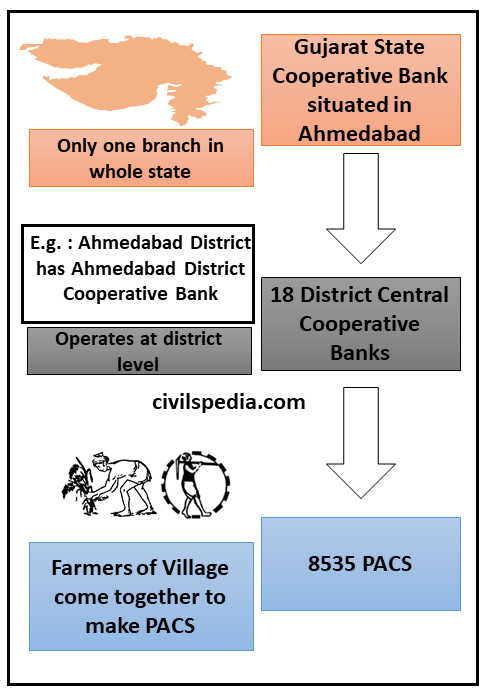

Rural Co-Operative Banks

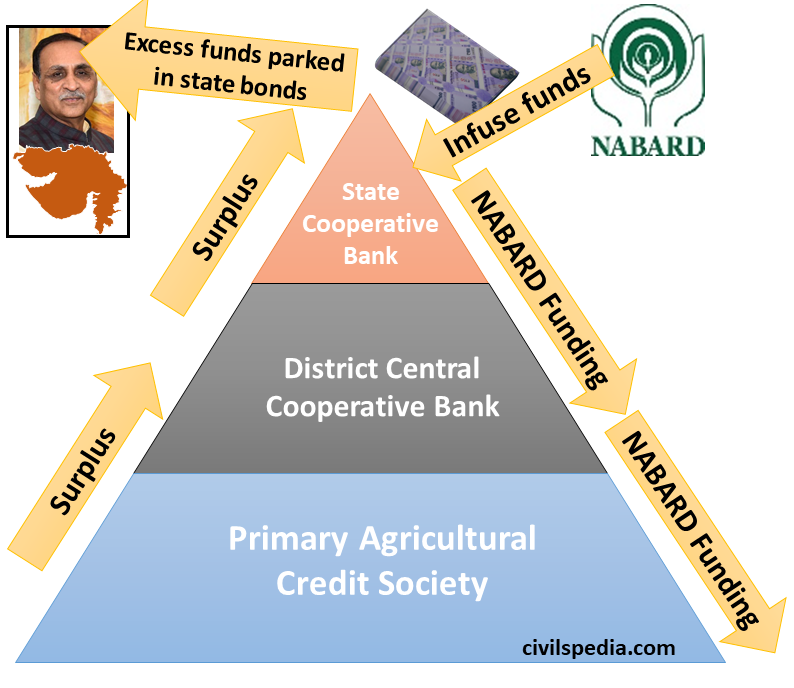

Structure and Funding of Rural Co-operative banks is as follows

Challenges

- Rural Cooperatives suffer from huge NPAs. The NPA level in these banks was around 25% in 2015.

- Due to 1 person 1 vote, they suffer from Casteism during voting. After that, they serve people belonging to their caste only.

- Although SARFAESI Act powers are given to these banks, these banks don’t take action on defaulters due to political backing.

- Deposits are very low because rates are not competitive against Scheduled Commercial Banks & Post Office Deposits. Hence, they have to depend on NABARD funding.

- Large-scale manipulation goes on in District Central Cooperative Banks (DCCBs) and PACS as their operations are not digitalized and aren’t connected to Core Banking Solution. During demonetization, District Cooperative Banks changed black money in the back-date.

- They are under the dual supervision of RBI and the Registrar of Cooperative Societies (RCS) of the respective states. It has led to poor supervision and control.

Solution

- Close down PACS & form LAMPS (LArge Sized Multipurpose Society) in their place. Their operations will not be restricted to giving loans. Apart from banking, LAMPS will also be involved in food processing, supplying fertilizers and seeds etc.

Urban Cooperative Banks (UCBs)

- Traditionally, the area of operation of the UCBs was confined to metropolitan, urban or semi-urban centres and catered to the needs of small borrowers, including MSMEs, retail traders, small entrepreneurs, professionals and the salaried class. However, there is no formal restriction as such, and today UCBs can conduct business in the entire district in which they are registered, including rural areas.

- UCBs are suffering from losses.

Reasons for losses

- UCBs are dominated by builders and manipulators. They indulge in Zombie-lending. E.g., Punjab and Maharashtra Cooperative Bank kept on doing zombie-lending to a weak company called HDIL due to corrupt nexus between directors and HDIL owners. When HDIL failed, the NPA of the bank increased exponentially, and the depositor’s money was stuck in the bank.

- Although they are given powers under the SARFAESI Act, bank officials don’t use them because debtors are their friends and relatives.

Steps taken

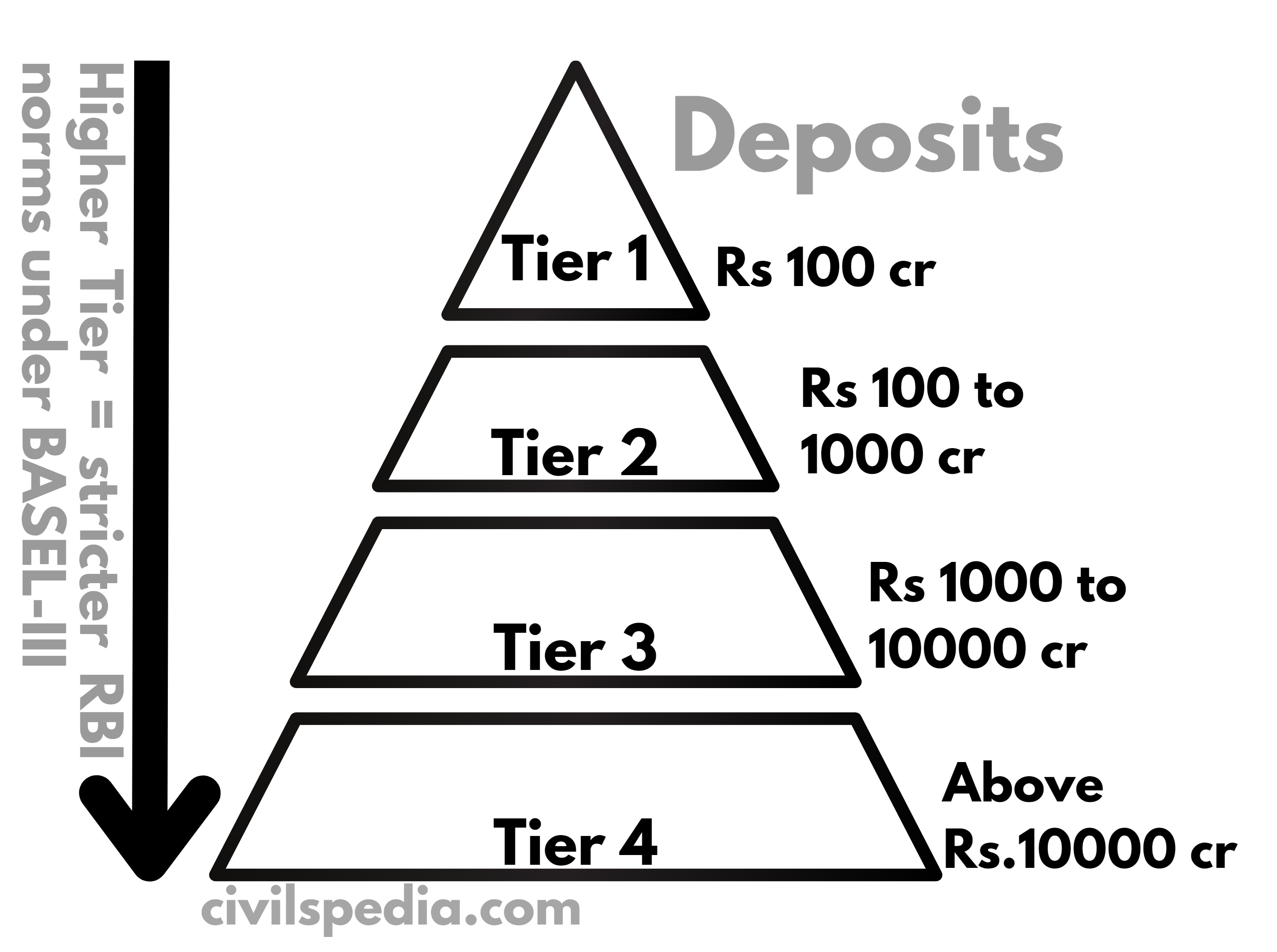

- RBI’s 4-tiered Regulatory Framework for Urban Cooperative Banks: To ensure the safety of deposits in Urban Cooperative banks, a 4-tiered Regulatory Framework has been introduced. It will ensure that banks with more deposits are subjected to stricter regulations (explained in the diagram below).

- In 2020, the power of the Union and State Government’s Registrar for Cooperative Societies to regulate the Cooperative Banks had been scrapped. These Cooperative Banks have been brought under the direct regulation of RBI. It will ensure effective regulation and curtail scams such as PMC Bank (Punjab and Maharashtra Cooperative Bank).

- Banking (Regulation) Act has been amended, and according to the new provisions, 51% of the Directors should have knowledge of accountancy, banking, economics or law. This will solve the problem of the nomination of directors based on political considerations.

- RBI has offered all Urban Cooperative Banks to convert to Small Finance Banks so that RBI can have more regulation over these Banks. But most UCBs are least interested in converting because of the benefits accruing from present loopholes.

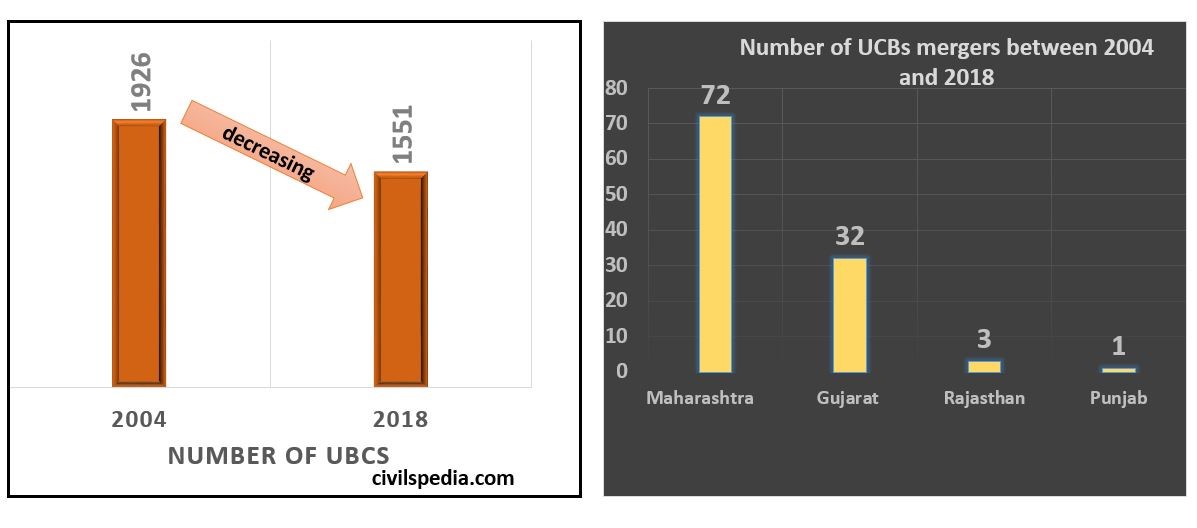

- RBI is forcing shutdowns (reduced from 1900 (2004) to 1500 (2018)) and mergers (Maharashtra = 72 mergers between 2004 to 2018) due to frauds and scams.

This marks the end of ‘rural banking.’ For more articles, CLICK HERE.