Priority Sector Lending

Last Update: March 2023

This article deals with ‘Priority Sector Lending .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

- The basic principle in Economics states that ‘No Risk-No Reward’ & ’High Risk-High Reward’.

- Hence, Banks will charge a high rate of interest from farmers, students, small entrepreneurs, etc. To tackle this, RBI in the 1980s came with PSL norms.

Who is covered under Priority Sector Lending (PSL)?

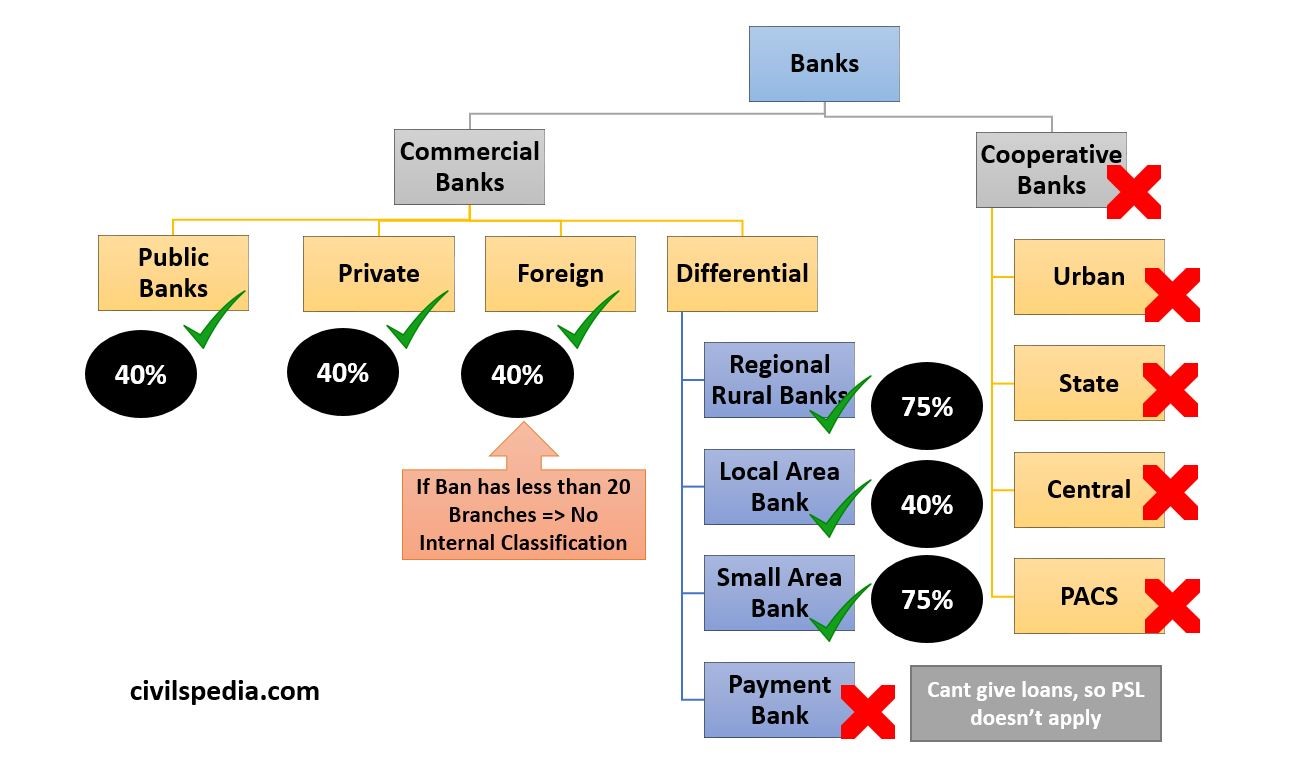

The following classes of Banks are required to give a certain percentage of their total loans to Priority Sector

- Domestic Scheduled Commercial Bank (Public and Private) = 40%

- Foreign Scheduled Commercial Bank (SCB) = 40%

- RRB = 75 %

- Small Finance Banks = 75%

- Cooperative Banks = No Requirement

What includes PSL?

| Category | % SCB | |

| Weaker Sections | 10% | |

| Agriculture & Allied Activities | 10% | |

| Marginal & Small farmer | 8% | – Added as a new category in April 2016. – Earlier Agriculture and Allied Activities were given 18% but due to broad categories, small & marginal farmers weren’t getting anything. |

| Micro-Enterprise – Khadi-Village industry | 7.50% | |

| All other PSL categories | 4.5% | These include 1. Small & Medium Enterprises 2. Affordable housing loans to beneficiaries under PMAY 3. Food processing companies 4. Vermicompost, biofertilizer, seed production 5. Student-Education loans (up to Rs.10 lakh) 6. Social Infrastructure (schools, health care, drinking water, sanitation facilities) 7. Renewable Energy Projects (windmills, solar etc.) |

| Total PSL | 40% |

Note: For Foreign Banks with less than 20 branches, 40% PSL is there, but there is no internal classification. Their consolidated PSL should be 40%.

Benefits of Priority Sector Lending

- It helps in channelizing credit to the vulnerable section.

- PSL helps in Financial Inclusion.

- PSL provides higher social returns on lending.

- It helps in the diversification of the credit portfolio of the banks.

- Credit Formalization: It helps break the hold of non-institutional lenders, especially in rural areas.

Issues with Priority Sector Lending

- Rising NPA: Second Narsimham Committee (1998 ) observed that 47% of all NPA have come from PSL. It recommended ending the system of PSL for the betterment of the Banking Sector.

- Lethargy in Lending: Most banks seem reluctant to lend to the priority sectors.

- Not used for the intended purpose, especially in the Agriculture sector. The loan given to farmers under PSL is to increase productivity, but it is used for unproductive purposes like marriages and other social obligations.

- Targeting issues: Suitcase farmers benefitted instead of poor farmers.

- Deter banks from expanding their scale of lending as the more they lend, the more they will have to contribute to PSL.

What if the PSL quota is not met?

Most banks aren’t able to meet their PSL quotas. In this case, they have to invest the remainder in RIDF or SIDF as the case may be

Indian Banks + Foreign banks (with 20 or more branches)

1. RIDF =Rural infra. Development fund

- Managed by NABARD

- For funding rural infrastructure projects

2. UIDF = Urban Infrastructure Development Fund

- New Fund announced in Budget 2023

- Managed by National Housing Bank (NHB)

- For funding urban infrastructure projects, especially in Tier-2 cities.

Foreign Banks with less than 20 branches

SEDF = Small Enterprises development fund

- Managed by SIDBI

But the problem with both of the above is that money is given for the long term, i.e. around 20 years. Hence, banks’ money is gone for a long time which they cant use & as a result, they suffer in the meantime. To address this, RBI came with Priority Sector Lending Certificates.

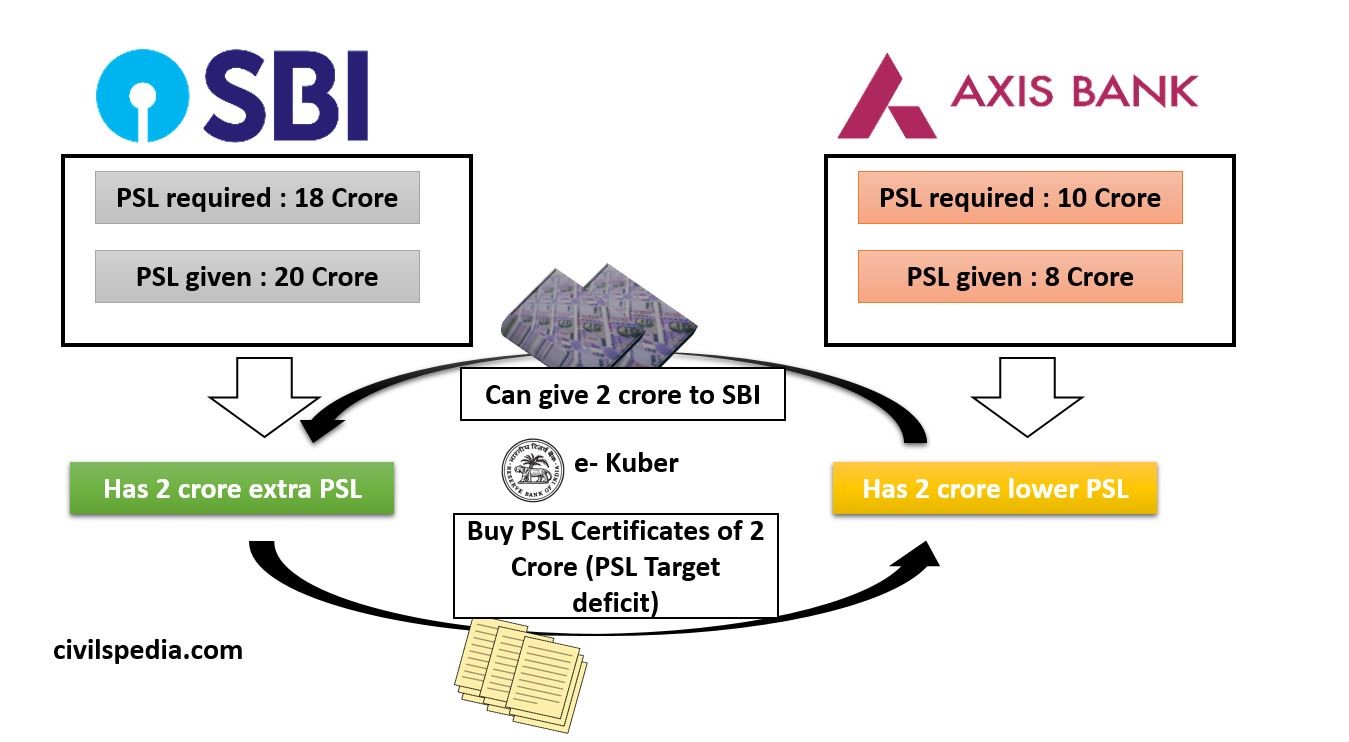

Priority Sector Lending Certificates

- In this arrangement, the overachieving Banks can sell their excess PSL in the form of ‘certificates’ to underachieving banks without transferring the loan assets or its risk.

- Four kinds of PSLCs are traded through RBI’s e-Kuber Portal, viz

- Agriculture (PSLC-A)

- Small and Marginal Farmers (PSLCSM)

- Micro Enterprises (PSLC-ME)

- General (PSLC-G)