Table of Contents

Comptroller and Auditor General (CAG)

This article deals with ‘Comptroller and Auditor General (CAG) – Indian Polity.’ This is part of our series on ‘Polity’ which is important pillar of GS-2 syllabus . For more articles , you can click here.

Introduction

- The Constitution of India (Article 149) provides for an independent office of CAG

- CAG is the head of the Indian Audit and Accounts Department

- CAG is the guardian of the public purse at both levels—Centre and State.

Appointment and Term

- CAG is appointed by the President of India by a warrant under his hand and seal.

- CAG holds office for a period of six years or up to the age of 65 years, whichever is earlier.

- He can also be removed by the President on the same grounds and in the same manner as a judge of the Supreme Court.

To ensure the Independence of Office

- CAG is provided with the security of tenure. He can be removed by the President only in the same manner as the Judge of the Supreme Court. Thus, the CAG doesn’t hold his office till the pleasure of the President, although the President appoints CAG.

- CAG is not eligible for further office under the Government of India or any state after he ceases to hold his office (controversy erupted when former CAG Vinod Rai was appointed as Head of Bank Board Bureau )

- Neither his salary nor his rights regarding leave of absence, pension, or age of retirement can be altered to his disadvantage after his appointment.

- Administrative expenses of the office of the CAG are charged upon the Consolidated Fund of India.

System of Auditing in India

- Articles 148 to 151 of the Indian Constitution institutionalized the Auditing Mechanism and office of CAG. But this system is a continuance of British rule. The same Auditing System is continuing in India.

- The Comptroller and Auditor General (CAG) of India is a constitutional authority responsible for auditing. CAG operates independently of the Government and reports directly to the Parliament or State Legislatures, thereby ensuring impartiality and objectivity in its auditing processes.

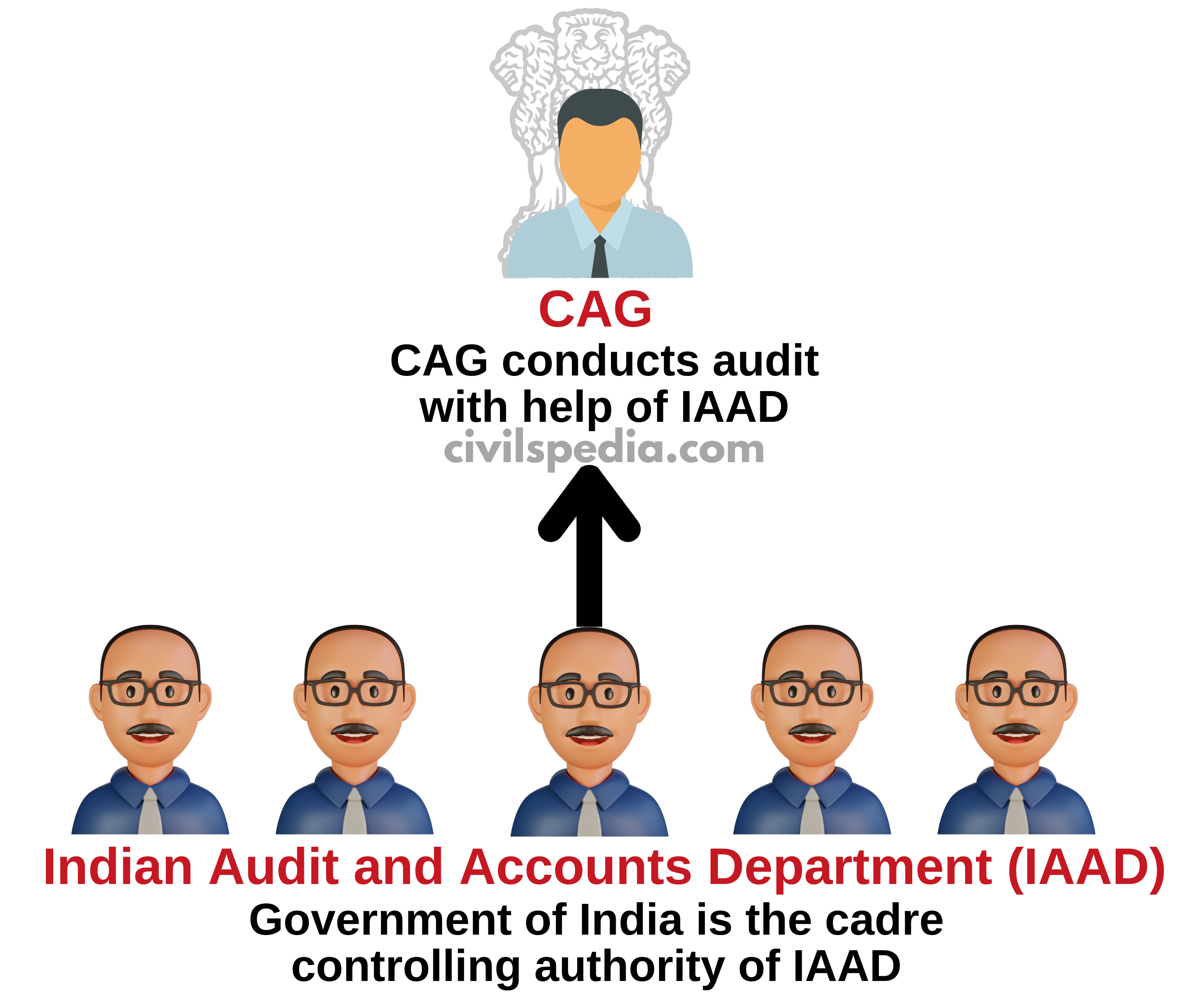

- The Indian Audit and Accounts Department (IA&AD) is the primary body through which CAG conducts audits.

Issue with the System

- CAG (IAAD) conducts Audit on behalf of Parliament. Principally, it should be entirely out of the influence of the Executive. However, the Government of India is the Cadre controlling Authority of the Indian Audit and Accounts Department (IAAD), which is headed by CAG and with whose help CAG conducts audits. This is a continuance of the British Era Model (1937 rules) in which the Executive indirectly controlled CAG.

Duties and Powers of the CAG

Article 149

Constitution (Article 149) authorises the Parliament to prescribe the duties and powers of the CAG. Accordingly, Parliament enacted CAG’s (Duties, Powers and Conditions of Service) Act, 1971. The Act was amended in 1976 to separate accounts from audits in the Central government.

The duties and functions of the CAG

- CAG audits the accounts related to all expenditures from

- Consolidated Fund of the Union of India and each state

- Contingency Fund of the Union of India and each state

- Public Account of the Union of India and each state

- CAG audits the balance sheets of the departments of the Central Government and state governments.

- CAG can audit the accounts of any other authority when requested by the President or Governor. For example, audit of local bodies

Earlier, CAG used to compile and maintain accounts of the Central Government as well. In 1976, he was relieved of his responsibility to compile and maintain accounts of the Central Government due to the separation of accounts from Audit.

Article 150

- CAG advises the President with regard to the prescription of the form in which the accounts of the Centre and states shall be kept.

Article 151

- CAG submits the audit reports related to the accounts of the Centre to the President, who shall, in turn, place them before both Houses of Parliament

He acts as a guide, friend and philosopher of the Public Accounts Committee of the Parliament.

Role of CAG

- The role of the CAG is to uphold the Constitution of India and the laws of Parliament in the field of financial administration. The audit reports of the CAG secure accountability in the sphere of financial administration of the executive.

- CAG is an agent of the Parliament and conducts an Audit of expenditure on behalf of the Parliament. In addition to legal and regulatory Audit, CAG can also conduct the propriety audit; that is, he can look into the ‘wisdom, faithfulness and economy’ of expenditure and comment on the wastefulness and extravagance of such expenditure. However, legal and regulatory Audits are obligatory, but propriety audit is discretionary (but CAG can’t audit Secret service expenditure).

- The Constitution of India visualises the CAG as the Comptroller as well as the Auditor General. However, in practice, the CAG is fulfilling the role of an Auditor-General only and not that of a Comptroller, as the CAG has no control over the issue of money from the Consolidated Fund and is concerned only at the audit stage when the expenditure has already taken place (unlike Britain)

Problems with CAG

- Paralysing Unwillingness to Act: The Comptroller and Auditor General’s (CAG) presence in India is often cited as a primary cause of bureaucratic inertia. Officials fear making decisions due to the scrutiny they may face from the CAG, leading to indecision and stagnation in governance processes.

- Post-Mortem Examination: CAG audits often serve as post-mortem examinations of government expenditures. CAG is concerned only at the audit stage when the expenditure has already taken place

- Appointment of Generalists: The practice of appointing generalist bureaucrats, such as those from the Indian Administrative Service (IAS), as the CAG is criticized. Many argue that specialists from services like the Indian Audit and Account Service, Indian Economic Service, Indian Statistical Service, or Indian Revenue Service would be better suited for the role due to their expertise in auditing and financial matters.

- CAG & Defence: CAG reports have sometimes been accused of jeopardizing national security, as seen in instances where revelations about defence preparedness were made public. For example, a CAG report in 2017 warned that the Indian Army’s ammunition stock would be depleted within 10 days of the war, potentially compromising the country’s defence capabilities.

- Issue of Notional Loss: The CAG’s estimation of notional losses, such as in the 2G spectrum case, has been a subject of controversy. These estimates, which are based on assumptions and methodologies that may not always align with legal standards, can lead to inflated figures and subsequent legal challenges.

- CAG Activism: Some critics perceive the CAG’s involvement in high-profile cases like the 2G spectrum and Coalgate as examples of activism beyond its mandate. While the CAG’s role is primarily to audit government expenditures and ensure accountability, its involvement in such cases has been seen as overstepping boundaries and encroaching into policy and regulatory domains.

- Much of the government expenditure is kept out of CAG Audit by Governments.

- CAG’s Authority doesn’t extend to Government Corporations created with special laws. Parliament or State Legislature can make provisions regarding Audit within the Act itself. Additionally, new organizational structures in the form of public-private partnerships are also out of the scope of CAG’s Audit. E.g., GMR Airport

- NGOs and Private Agencies take up many Government works at delivery points. These private agencies and NGOs are also out of the ambit of CAG.

- Issue of Redactment: CAG, in the Audit Report of Acquisition of Rafale, redacted, i.e. removed sensitive information from the document citing security concerns expressed by the Government.

- Politicization of CAG’s office: The politicization of the Comptroller and Auditor General (CAG) post in India has become a subject of concern in recent years. The Constitution of India explicitly states that the CAG should not be given a post-retirement posting, emphasizing the need for the CAG to maintain impartiality and independence from political influence. However, there have been instances where former CAGs have been appointed to positions that raise questions about their independence and neutrality. For example

- Former CAG Vinod Rai (who unearthed the Coal Scam) was appointed as Chairman of the Bank Board Bureau.

- TN Chaturvedi (CAG from 1984 to 89) joined the BJP after retirement and contested the election using BJP’s ticket. He was later made Governor of Kerala too.

- Appleby’s Criticism

- Paul H. Appleby was highly critical of the role of the Comptroller and Auditor General (CAG) in India, going as far as recommending its abolition.

- He argued that the institution of the CAG was inherited from colonial rule, implying it may not be suitable for modern governance needs.

- Appleby criticized the CAG for fostering a paralysing unwillingness to act within government circles, suggesting that its oversight role may stifle decision-making and action.

- He questioned the competence of auditors to understand the nuances of good administration, asserting that their expertise lies in auditing rather than administration.

Side Topic: Presumptive Loss / 2G Spectrum Case

The theory of presumptive and notional loss involves calculations by the CAG to estimate the potential revenue lost by the Government due to irregularities or lack of adherence to proper procedures in resource allocations, such as natural resources like spectrum and coal.

Using the Theory of Presumptive and Notional Loss

- In the case of the 2G Spectrum Allocation, the CAG calculated a notional loss of Rs 1.76 lakh crore due to the use of a “first come, first served” policy instead of an auction, which could have potentially generated higher revenue.

- In the Coal Scam, the CAG initially estimated a notional loss of ₹10 lakh crore, later revised to Rs 1.86 lakh crore, highlighting discrepancies in the allocation process.

However, in December 2017, a Special CBI Court acquitted A Raja and Kanimozhi and rejected the presumptive loss theory proposed by the CAG.

It’s also important to recognize that the Government’s objectives extend beyond profit maximization; considerations such as socio-economic factors and job creation also play a significant role in decision-making.

Hence, CAG has failed to accommodate the changing dynamics of doing business in the LPG Era