Last Update: June 2023 (Regulatory Bodies in India)

Table of Contents

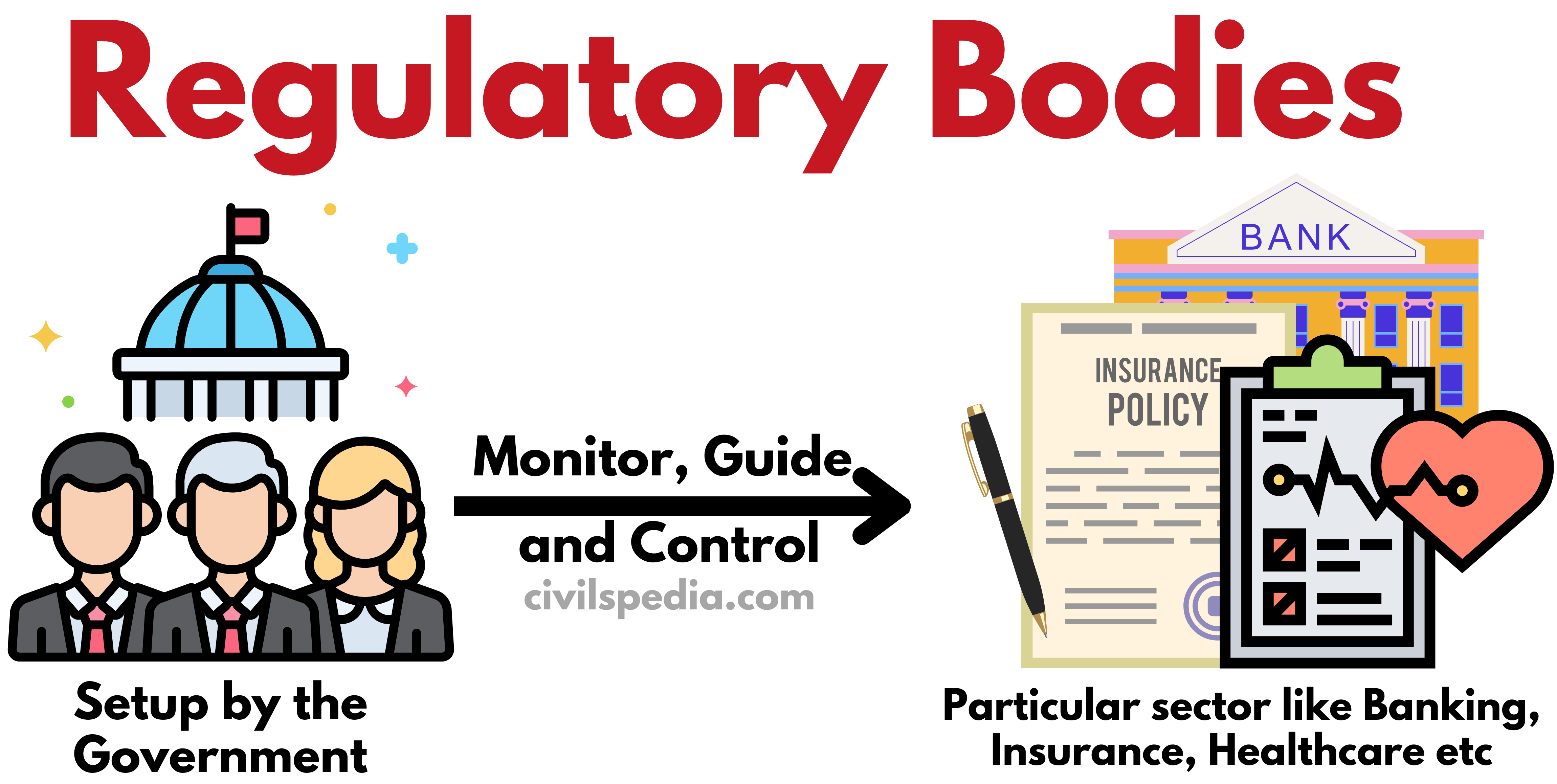

Regulatory Bodies in India

This article deals with ‘Regulatory Bodies in India.’ This is part of our series on ‘Governance’ which is important pillar of GS-2 syllabus . For more articles , you can click here.

Introduction

- The regulatory body is an organization set up by the government to monitor, guide and control a particular sector, such as banking, insurance, education or healthcare.

- It is in contrast to laissez-faire which demands an entirely unregulated/free economy. But since we know the perils of a completely free market economy, regulation, up to a certain extent, is very much desirable.

- After Liberalization and Privatization, the state’s role changed to rule-maker and regulator. With this, we saw the emergence of a special category of regulatory systems, i.e., Independent Statutory Regulating Agencies.

Need of Regulation

In the case of Natural Monopoly

- A natural monopoly is a condition when an entire market is more efficiently served by one firm than by two or more firms.

- In the case of a natural monopoly, regulation is necessary to protect consumer interests, control prices, and ensure the quality of service, as there is no competition in the market.

- In India, the sectors such as transmission and distribution of electricity and railways are still natural monopolies.

Asymmetric Information

- It is a situation when one party has more information than another. In India, asymmetric information is a significant reason for government intervention.

- For example, In many sectors, like healthcare, insurance, and financial services, consumers may not possess the same expertise as service providers. Hence, regulation helps protect consumers by mandating disclosure requirements, ensuring transparency, and setting product quality and safety standards.

Presence of Externalities

- Negative externalities refer to the costs or harms imposed on third parties not directly involved in a transaction or activity. When negative externalities exist, market forces alone may not be adequate to address the issue. In India, regulation is often implemented to address negative externalities in various sectors.

- For example, Industries or activities that generate pollution or degrade natural resources often impose negative externalities on the environment and surrounding communities. India has implemented regulations governing air and water pollution, waste management, and environmental impact assessments to mitigate these externalities.

Check Anti-Competitive practices

Detecting and preventing anti-competitive practices is a crucial reason for regulation in India. For example,

- The regulation targets cartels and collusive behaviour, where competitors engage in agreements to fix prices, allocate markets, or rig bids, aiming to restrict competition and maximize their profits.

- Regulatory bodies monitor and address cases where a dominant firm exploits its market power to restrict competition, drive competitors out of the market, or engage in predatory pricing.

- Regulations govern mergers, acquisitions, and combinations that have the potential to reduce competition significantly.

Promote Public Interest

- Government regulations are implemented to safeguard the welfare, rights, and well-being of the general public.

Categories of Regulation in India

Regulation in India can be mapped under three broad categories: economic regulation, regulation in the public interest and environmental regulation.

1. Economic Regulation

- Economic regulation aims at preventing market failure.

- It is achieved by punishing market-distorting behaviour.

- Examples include the Competition Commission of India (CCI), which addresses anti-competitive practices, and the Telecom Regulatory Authority of India (TRAI), which regulates the telecommunications sector.

2. Regulation in Public Interest

- Public health and safety regulations aim to protect individuals and communities from health risks, hazardous substances, and unsafe practices. E.g., the Bureau of Indian Standards (BIS) sets quality and safety standards for various products

3. Environmental Regulation

- Regulations on environmental protection focus on conserving natural resources, preventing pollution, and promoting sustainable development.

Reasons for the Proliferation of Regulatory Bodies from the 1990s

- To Sustain Market Economy: The market economy demands competition. Regulatory Bodies were made to ensure a level playing field.

- To Attract Foreign Investment: Regulatory Bodies were made to ensure Foreign Investors that Populistic considerations will not guide decisions.

- After LPG, the capacity of states to answer various business problems was limited. Bureaucracy failed to answer many questions related to emerging sectors. Hence, the government decided to rope in Technocrats via Technocratic Regulators.

Issues related to Regulatory Bodies in India

Based on the recommendations of the Damodaran Committee (formed in 2012 when the World Bank ranked India 132 on Ease of Doing Business) and the 2nd Administrative Reforms Commission.

1. Independence

Functional independence of Regulatory Bodies is curbed by the dependence of regulators on concerned line ministries for

- Regulatory bodies in India face financial constraints as their budgets and resources are subject to approval by the government.

- The lack of transparent and merit-based appointment processes can undermine the independence and credibility of regulatory bodies.

- Political pressure on regulators can impact their ability to make impartial and unbiased decisions, particularly in cases involving influential individuals or corporations.

2. Over-Regulation

India is an over-regulated country, but many of the regulations are not implemented in the right earnest due to complex procedures & outdated regulations.

- RBI has been criticized for over-regulating the banking sector with numerous regulations, including stringent capital adequacy requirements, lending restrictions, and extensive reporting obligations.

- Real Estate Regulatory Authorities (RERAs) were established to regulate real estate and protect the interests of the homebuyer. But they have imposed excessive burdens by imposing excessive paperwork, multiple approvals, and delays in project clearances.

3. Regulatory Gaps

Regulatory gaps refer to deficiencies or shortcomings in existing regulations or the absence of regulations in certain areas. For Example

- Sectors like e-commerce face challenges in ensuring consumer rights, addressing grievances, and holding businesses accountable for unfair practices.

- Although the financial sector is regulated by various authorities, including the RBI and SEBI, regulatory gaps exist in areas such as fintech and shadow banking.

4. Accountability

In India, there have been instances where regulatory bodies have faced criticism for a perceived lack of accountability.

- SEBI has faced criticism for handling several high-profile cases, where it was perceived to have failed to ensure accountability. For example, the case of the Satyam Computer Scandal of 2009 revealed significant gaps in SEBI’s oversight, where it failed to detect the financial irregularities in Satyam’s accounts.

- Reserve Bank of India’s accountability has been questioned due to cases such as the Punjab National Bank (PNB) fraud involving unauthorized transactions worth billions of rupees.

- Central Board of Film Certification (CBFC) has faced criticism for delays in certification, leading to debates on the infringement of creative freedom and the need for greater accountability of the CBFC.

5. Regulator vs Executive

- Executive tries to encroach space given to regulators to enforce populistic agendas

- E.g., Electricity Sector, where State Governments try to keep charges low to keep consumers, and farmers lobby happy

6. Overlapping functions

In India, regulatory overlap between different regulators can sometimes occur due to the complex nature of the regulatory landscape. For example

- Competition-related Regulation: The Competition Commission of India (CCI) and sector-specific regulators, such as the Telecom Regulatory Authority of India (TRAI) or the Securities and Exchange Board of India (SEBI), may encounter areas of regulatory overlap.

- Financial regulation: There can be overlaps in financial regulation between different regulatory bodies such as the RBI, SEBI), IRDAI), and PFRDA.

7. Lack of Transparency

There is a lack of transparency in regulatory bodies in India

- The Environmental Impact Assessment (EIA) process, which assesses the potential environmental impacts of projects, suffers from a lack of transparency due to non-disclosure of project-specific information, limited public participation, and inadequate dissemination of environmental impact assessment reports.

- Central Electricity Regulatory Commission (CERC) has faced criticism for its lack of transparency in its functioning, such as non-disclosure of tariff-related information, limited access to relevant data, and insufficient transparency in decision-making processes.

Ways to Improve Regulatory Bodies

- Regulate where necessary and don’t over-regulate the sector because it chokes development (2nd ARC).

- 2nd ARC has given 5 Principles on which Regulatory Mechanism should be based. These include

- Simplicity

- Objectivity

- Transparency

- Convergence

- Speedy Disposals

- A Regulatory Impact Assessment (RIA) of every proposed regulation should be carried out

- Ensure independence of regulatory bodies

- Self Regulation is the best form of regulation. E.g. the News Broadcasters and Digital Association is an industry-led regulator regulating current affairs and news broadcasts.

- Still, many sectors are under the regulation of State Departments—E.g., DGCA under Civil Aviation Ministry. Government should move towards Independent Statutory Regulators for all non-strategic sectors.

- There should be constant interaction between Regulators and Policy makers and Regulators and other stakeholders so that regulators are aware of the concerns of stakeholders and also the regulator can explain the rationale of various regulatory decisions.

- Introducing Multi-Sector Regulators: The government should establish multi-sector regulators for sectors like communications; transport; electricity, fuels and gas. It would eliminate the proliferation of regulatory commissions. Even Justice BN Srikrishna Commission (also known as Fiscal Sector Legislative Reforms Commission (FSLRC)) has recommended to form the Unified Financial Agency (UFA), which will subsume the functions of SEBI, IRDI and PFRDA.

Example: Good Regulator vs Bad Regulators

For a regulator to work independently, it must be independent of the Executive, Pressure Groups, Industrial Lobbies etc., which can pressurize them to get favourable outcomes

Example of Bad Regulators

- Forward Market Commission (FMC): FMC regulated Commodity Markets but couldn’t stop NSEL Scam. Hence, it was dissolved by the government.

- MCI (Medical Council of India): Its Chairman, Ketan Desai, took bribes to grant clearance to medical colleges.

- Nuclear Safety Regulatory Authority (NSRA): NSRA falls under the Department of Atomic Energy. But the Promoter of any sector can’t be its Regulator.

- FSSAI: In 2015, FSSAI banned the sale and production of Nestle Maggi due to alleged excessive lead content and mislabeling of MSG (monosodium glutamate). However, later, the Bombay High Court overturned the ban, stating that FSSAI had failed to follow proper testing procedures and acted arbitrarily.

Examples of Good Regulators

- RBI: It has played a crucial role in maintaining monetary stability, safeguarding financial stability, and ensuring the integrity of the financial system.

- TRAI: It has protected Mobile Customers against Mobile Companies by ensuring competition and regulating tariffs.

- Competition Commission of India: CCI broke the cartelisation of cement companies

- SEBI: SEBI managed the Security Market well (in stark contrast to FMC)

In questions about the Independence of Regulators is necessary to regulate the sector effectively; give examples of both good and bad regulators. Don’t just stick to bad ones.

Important Regulatory Bodies (Prelims Point of view)

| IRDA | Regulator of the Insurance Sector |

| SEBI | Regulator of Equity Market |

| CCI | To check monopolistic tendencies in the market |

| TRAI | Regulator of the telecom sector |

| CERC | Central Electricity Regulatory Commission was under the Electricity Act of 2003 to regulate the sector in India. |

| FMC | – Forward Market Commission (FMC) was the Regulator of the Commodity Market – It was dissolved in 2015. Now the Commodity market is regulated by SEBI |

| FSSAI | – FSSAI regulates the Food Safety and Standards in India – It establishes food safety standards for various categories of food products, permissible levels of contaminants, labelling requirements, food additives, packaging, and hygiene practices. |

This informative blog post provides a comprehensive overview of regulatory bodies in India. It highlights the crucial role these bodies play in maintaining standards, ensuring compliance, and protecting consumer interests across various sectors. The article effectively summarizes the functions and significance of key regulatory bodies, making it a valuable resource for anyone seeking to understand India’s regulatory landscape. A well-structured and insightful piece that contributes to a better understanding of the regulatory framework in India.

Thank you for the comment