Last Updated: May 2023 (Self Help Groups (SHGs) – UPSC Notes)

Table of Contents

Self Help Groups (SHGs) – UPSC Notes

This article deals with ‘Self Help Groups (SHGs) – UPSC Notes.’ This is part of our series on ‘Governance’ which is important pillar of GS-2 syllabus . For more articles , you can click here

Introduction

SHGs are an association of people(20-30 persons, primarily women, from similar socio-economic backgrounds) who choose to come together (either on their own or organized by outside Institutions like NGOs) to find ways to improve their living conditions. They help build social capital by providing mutual support, encouraging savings, and promoting entrepreneurship among their members.

Success stories include Kudumbashree in Kerala, Jeevika in Bihar, Mahila Arthik Vikas Mahila Mandal in Maharashtra, and recently, Looms of Ladakh.

Functions of SHGs

The main functions of SHGs are

- Financial Inclusion: SHGs encourage savings and provide access to small loans and credit facilities. Members pool their savings, which are then used to provide loans to members at affordable interest rates.

- Skill Development and Capacity Building: SHGs focus on enhancing the skills and capacities of their members by providing training and support in various areas

- Empowerment and Social Support: SHGs create an environment where individuals (particularly women) can share their experiences, discuss issues, and collectively find solutions.

- Collective Bargaining: SHGs enable members to negotiate collectively with various stakeholders, such as banks, suppliers, and local authorities.

- Social Capital to solve livelihood problem: Social Capital is the network of relationship among people living and working in a particular society, enabling that society to function effectively. Self Help Groups use the concept of Social Capital to solve the problem of livelihood and income generation by organizing the poor and marginalized people to come together to solve individual problems. They do this by pooling their resources, creating a common fund to make small interest-bearing loans among themselves.

How are SHGs formed?

Most of the SHGs have come through the help of mentor bodies (either government or NGO), which provided initial information and guidance to them.

- Identification of Potential Members: The first step is identifying individuals willing to join and participate in an SHG.

- Formation Meeting: Once potential members are identified, a formation meeting is organized. This meeting serves as a platform to explain the concept, purpose, and benefits of an SHG.

- Group Formation and Membership: During the formation meeting, interested individuals formally express their commitment to forming an SHG. They agree to abide by the group’s rules and regulations and actively participate in its activities.

- Group Registration (Optional): SHGs have the option to register themselves formally under various government schemes, programs, or society acts.

- Regular Meetings and Activities: Once the SHG is formed, regular meetings are held at a mutually agreed frequency, such as weekly or monthly. These meetings serve as a platform for members to discuss and plan their activities, share experiences, address issues, and make collective decisions.

- Savings and Internal Lending: A crucial aspect of SHGs is promoting savings and internal lending. Members contribute a predetermined amount of money as savings during each meeting. These savings are pooled together and kept as a common fund, which can be used for internal lending within the group.

- Capacity Building and Linkages: SHGs often collaborate with NGOs, government agencies, or other stakeholders to access training programs, skill development initiatives, market linkages, and government schemes.

Evolution of Self Help Groups in India

The Self-Help Groups (SHGs) in India have developed over the span of several decades, with the following significant milestones.

| 1954 | The first initiative came from Gujarat. Textile Labour Association (TLA) of Ahmedabad formed its women’s wing to organize & train the women belonging to households of mill workers in primary skills like sewing, knitting, embroidery, typesetting and, stenography etc. |

| 1970s | The MYRADA (Mysore Resettlement and Development Agency) in Karnataka initiated the formation of village-level savings and credit groups with the objective of ending poverty, which later evolved into SHGs |

| 1980s | NABARD introduced the concept of SHGs as a strategy for financial inclusion and rural development. |

| 1988 | Kudumbashree Program was started in Kerala |

| 1990s | NABARD launched the SHG-Bank Linkage Program in 1992 to provide formal banking services to SHGs. |

| Present | Presently, various SHGs are successfully working in diverse sectors. E.g., 1. Prerna Canteens in Uttar Pradesh running community kitchens 2. Aajeevika Farm Fresh in Jharkhand selling vegetables online 3. Gamusa Masks in Assam produced masks during Covid 4. Floating Supermarkets in the backwaters of Kerala |

Case Study: Kudumbashree Program

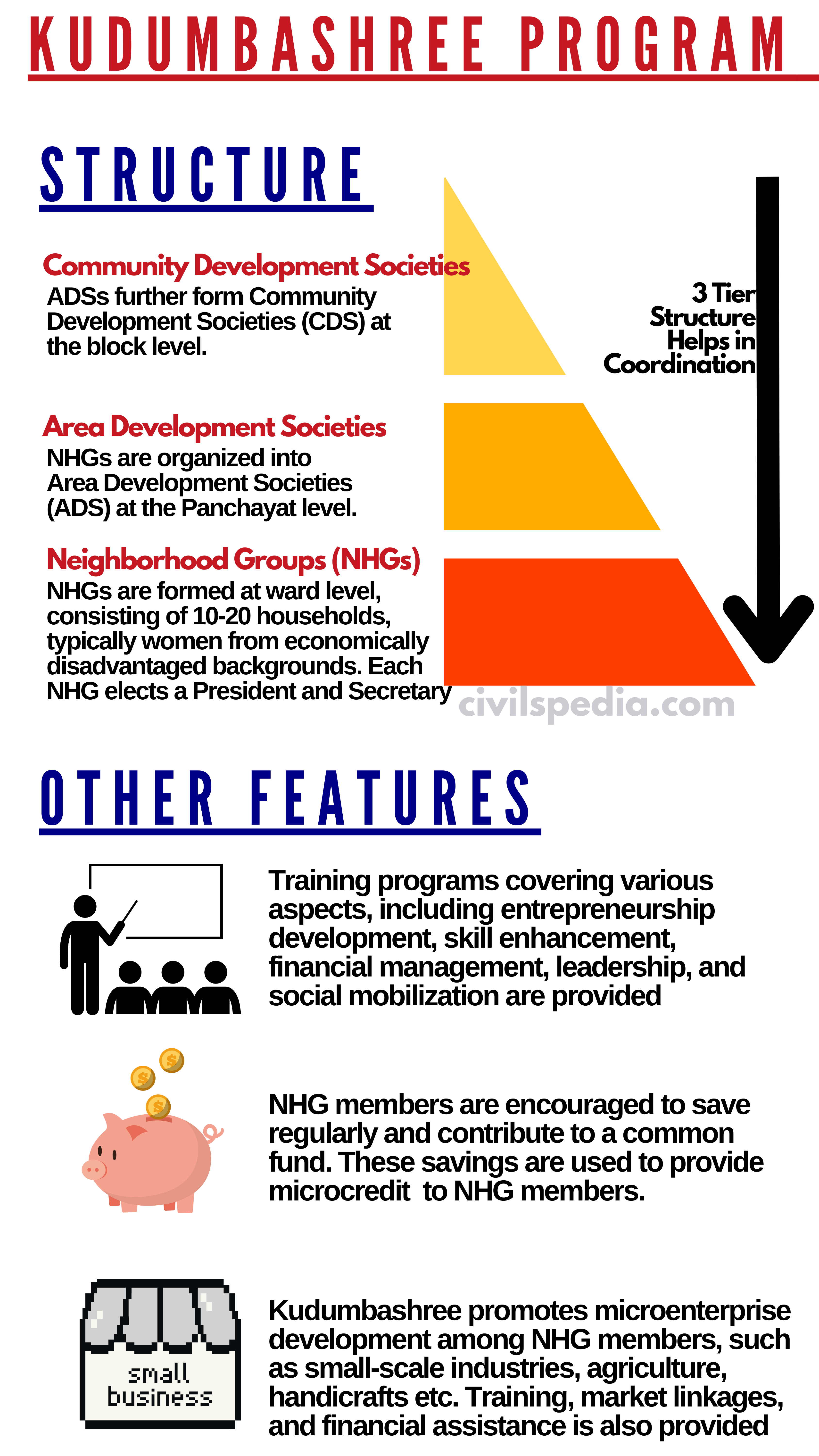

Kerala Government launched Kudumbashree Program for poverty eradication and women’s empowerment in 1998, which translates to “prosperity of the family” in Malayalam.

SHG-Bank linkage Program

Earlier Issue

SHG Movement was mainly started in the 1980s with the help of NGOs which wanted to provide alternate models of Credit Services to the poor. All the members of SHG were saving and anybody in the group who wanted the money could take out money from that collective savings at a nominal interest rate.

But these groups comprised poor women. Their savings were low & hence, members cant get large loans. As a result, linking SHGs with banks was necessary, which could provide credit in multiple of savings of the SHG.

Main feature of the loans under SHG – Bank Linkage Program

- Lending is to the group as a whole.

- The group decides how to use loan without outside interference

- Lending is without any collateral

- SHGs have to practice the ‘Panchasutra’, i.e. regular meetings, savings, regular inter-loaning, timely repayment and updated account books to avail of loans from banks.

- The loan is in Multiple of the savings. For groups having a good credit history, this can be up to 1:4 wrt their savings. Hence, they can get loans as large as 4 times their savings without collateral. It was the major turning point in the whole movement.

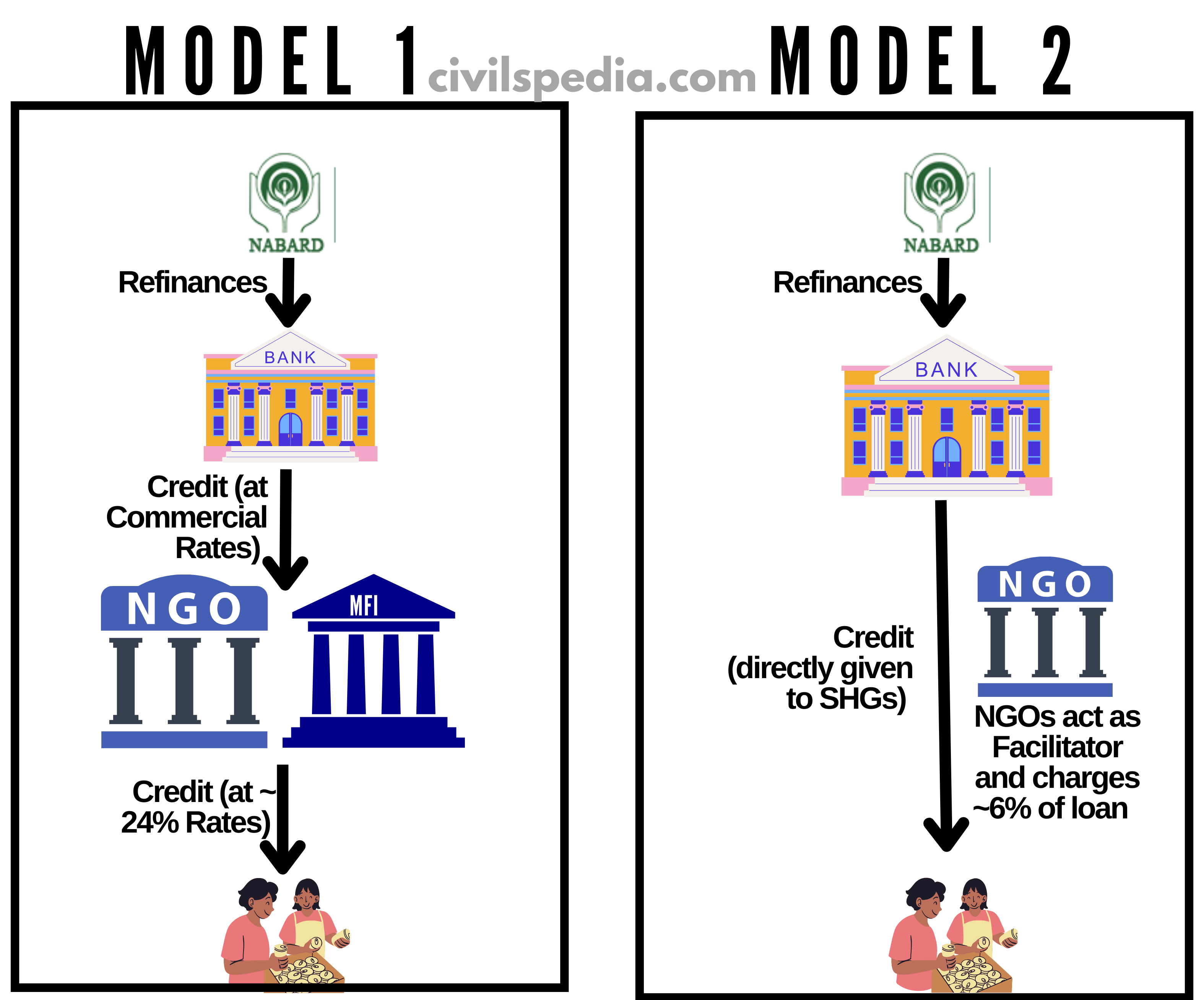

- NABARD refinances the banks for this project. It is the money of NABARD that these banks give to SHGs.

Models of SHG-Banking Linkage

- In the first model, Banks give loans to NGOs or some Microfinance Institutions, and these NGOs and MFIs lend this money to SHGs. Banks provide loans to MFIs at commercial rates, and these MFIs / NGOs charge around 24% so that they can make their administrative costs out of the difference

- In the second model, NGOs act as facilitators between SHGs and Banks and charge 6% of the loans given by Banks to SHGs as their commission (to make up their administrative charges)

How does making groups help?

- SHG work as a collective guarantee system for members who propose to borrow from organized sources. As a result, commercial banks and other institutions which otherwise are not receptive to the demands of marginalized individuals start considering such groups as their potential customers.

- The loan is issued in the name of SHG & not to a particular person. Hence, it is the collective responsibility of the group to repay that loan. It is the main reason the repayment rate is very high in SHG loans. If the person is not paying, extreme peer pressure works in that situation

Fodder to be used in answers: NGOs involved in SHG Movement

| SEWA | Ahmedabad |

| MYRADA | Karnataka |

| PRADHAN | Rajasthan |

| ADITHI | Bihar |

| DHAN foundation, Janodaya, Cohesion Foundation, Jan Chetna Sansthan | Other prominent NGOs in this field |

Steps taken by Govt. to promote SHGs

SHG Bank Linkage Program

- Discussed above

Village Poverty Reduction Plan

- All the SHGs are involved in the preparation of Village Poverty Reduction Plans

StartUp Village Entrepreneurship Program (SVEP)

- It is a component of the Deen Dayal Upadhaya National Rural Livelihood Mission.

- The program helps SHG members to setup non-farm enterprises at the village level.

SHG & Empowerment of Women

In rural India, where the wind of development is yet to reach, farm labour is the primary employment for women, but this doesn’t fulfil all their needs. Hence, participation in SHG helps them in saving some money out of their daily household expenses & can also avail of loans with lower interest which has the potential to change the situation

1. Social Empowerment

- Members of SHG are mainly women. They can save money & invest in SHG & can use it in time of need. With money in hand, they get status in their family & this increases their self-confidence & esteem.

- SHGs discuss women-centred issues which help them in gaining social security.

2. Political Empowerment

- SHGs gave women a taste of leadership which they had never experienced earlier and gave them the aspiration to become leaders of society.

- Also, SHGs organized women, and they started acting as local pressure groups for and against particular candidates.

3. Social Justice

- SHGs have taken up issues like domestic violence, bigamy, dowry deaths, prevention of child marriage, support for separated women to remarry etc.

4. Financial Inclusion

- SHG program has contributed to reduced dependency on informal money lenders & other non-institutional sources

- This financial inclusion has led to increased spending on the education of children, lower drop rate, reduction in child mortality, improved maternal health & ability of the poor to combat diseases through proper nutrition.

- Due to loans, they have managed to come out of poverty. With these loans, women started small businesses, bought dairy animals, or helped their husbands start some work. It is argued that this program has played a most important and effective role in reducing poverty.

5. Skill Development

- SHGs often organize training programs to enhance the skills and capacities of their members. Women are trained in various areas, such as entrepreneurship, vocational skills, financial literacy, and leadership development.

Key Issues with SHGs

Although in a short span, a lot has been done, a lot needs to be done to make SHG a success story

1. Changing nature of SHGs today

- After the SHG program’s success was shown to the world, the government decided to use it as a policy tool. But this changed the whole scenario. Now it has become a top-down approach. Banks are given targets to give loans to SHGs, and these targets need to be met each financial year. Hence, Banks don’t check the quality of SHG work and provide loans to untrained groups. As a result, these SHGs aren’t able to pay back loans. Hence, due to the mistake of Banks and Authorities, questions are raised on the viability of projects nowadays.

2. Moral Hazards

- Bankers have always warned that giving low-interest loans to people living in areas where getting a loan is difficult and the rate is higher can set in moral hazards where people who get loans at lower can start giving that loans to others at even higher rates.

- Since credit available is large and banks don’t bother to go and check whether the loan is used in a constructive way, people have indulged in this practice.

3. Giving credit is mean and not an end in itself

- Banks and officials think that giving easy loans is an end in itself. But it is just a means to help these people come out of poverty and empower them.

- Only a minority of the Self-Help Groups can raise themselves from a micro-finance level to that of micro-entrepreneurship.

- Hence, along with loans, the government should merge these schemes with skill development and entrepreneurship programs. The time has come to take this program to a higher level.

4. Need to Expand (to urban areas & excluded states)

- There is a need to extend small group organizations (SHGs) to peri-urban and urban areas. As per the existing statutory provisions, NABARD’s mandate is to provide micro-finance facilities only to rural and semi-urban areas.

5. Financial Assistance to Self-Help Promoting Institution SHPI

- 45% of women SHGs are situated in AP because of the initiative shown by promoter NGOs called SHPI. If we want SHG to spread throughout India, the SHPI model needs to be replicated in the whole of India.