Last Updated: Feb 2023

Minimum Support Price

This article deals with ‘Minimum Support Price.’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

What is the Minimum Support Price?

- The government introduced MSP in the 1960s in the wake of the Green revolution. Minimum Support Price is the minimum price at which the government buys crops from the farmers, even if the market price is below that rate. It serves as a “floor” price, below which government will not allow prices to fall, EVEN if there was a bumper crop.

- MSP has been in place since 1966-67.

- In PUCL vs Union of India (2001), the Supreme Court of India declared MSP essential to ensure food to every Indian, which is an integral part of Article 21. Later, National Food Security Act (NFSA) gave legal sanctity to this.

- MSP is announced in the

- Beginning of sowing season

- For 23 Crops

- Based on the recommendations of CACP (Committee on Agriculture Cost & Prices)

- Approved and announced by CCEA (Cabinet Committee on Economic Affairs )

- MSPs are important because

- It enhances the production of targeted crops.

- Protect farmers against the bumper crops which bring down the market prices.

- Protect farmers from the cartelization/price-fixing by the mandi-merchants.

- Motivate farmers to adopt improved crop technologies.

- MSP also helps in creating the benchmark for the price of the crop.

In the absence of such a guaranteed price, there is a concern that farmers may shift to other crops, causing a shortage in these commodities.

23 crops for which MSPs are announced are

| 7 Cereals | Paddy, wheat, barley, jowar, bajra, maize and ragi |

| 5 Pulses | Gram, arhar/tur, moong, urad and lentil |

| 7 Oilseeds | Groundnut, rapeseed/mustard, soyabean, sunflower seed, sesamum, safflower seed and Niger seed |

| 4 Commercial crops | Sugarcane, raw cotton, raw jute and Virginia flu cured (VFC) tobacco |

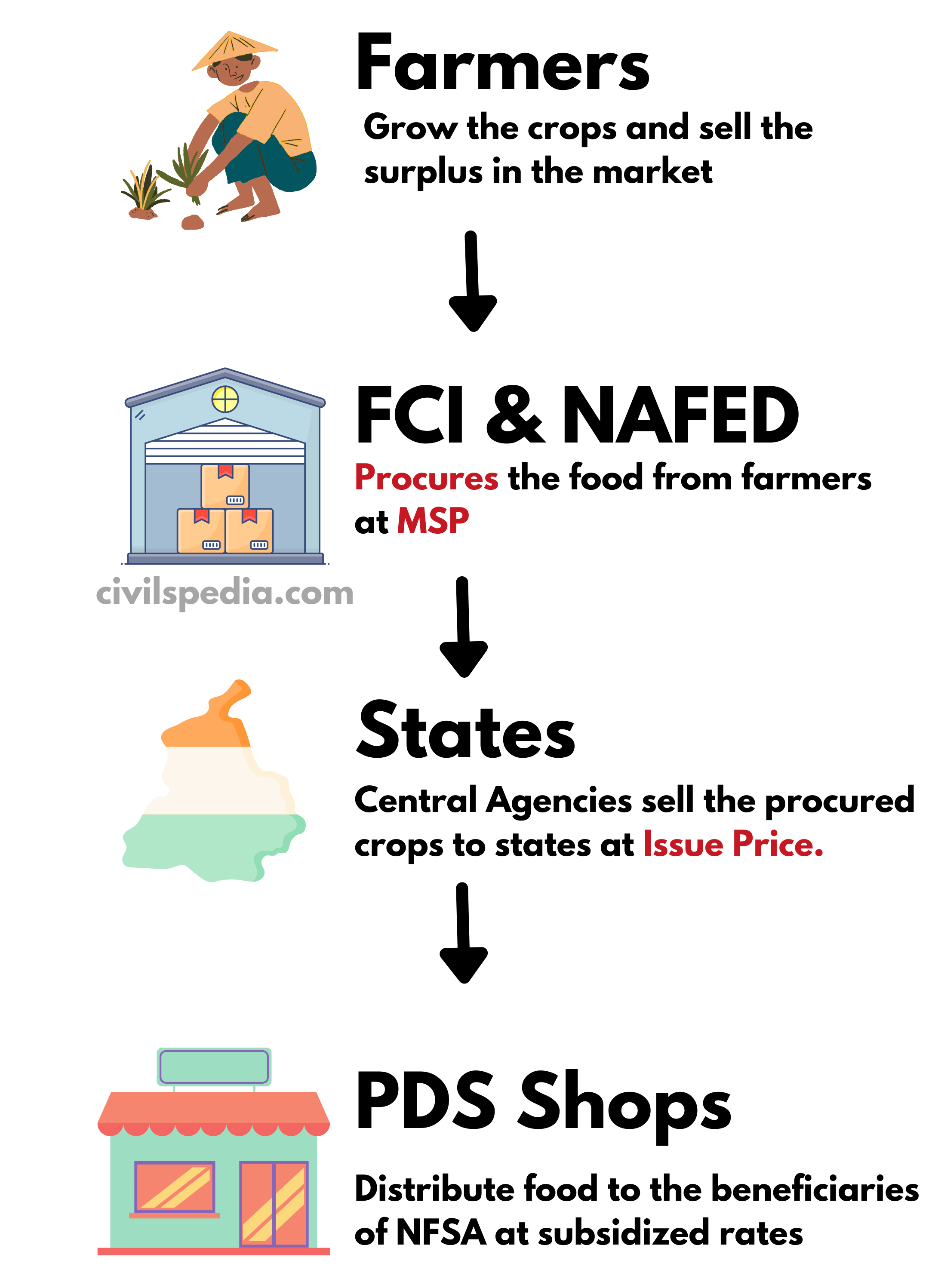

MSP Procurement Process

- The primary duty to purchase, store, transport, distribute and sell foodgrains is of two Central Agencies.

- Food Corporation of India (FCI)

- NAFED, i.e. National Agricultural Cooperative Marketing Federation of India Limited

Open-Ended Procurement is for Wheat and Rice

| Wheat and Rice | – FCI conducts “Open-ended procurement” for Wheat and Rice. – It means the government will buy at MSP from any farmer who comes forward to sell. (even if market prices are running higher than MSP). |

| Other crops | – Procurement is not open-ended. – It means the government buy ONLY when their prices fall below MSP in the open market. |

- Procurement is done at MSP, and then Central Agencies sell the produce to States at Issue Price. States, in turn, distribute this under the provisions of the National Food Security Act, 2003, to 75% of the rural population and 50% of the urban population at a low price (Rs 3/kg – Rice, Rs 2/ Kg – Wheat and Rs 1/ Kg – Coarse grains).

- The issue price is significantly lower than MSP, and the Centre bears the whole of this subsidy load.

Costs: A2, A2+FL and C2

The Commission for Agricultural Costs and Prices (CACP) calculates and recommends MSP. It computes three types of costs.

A2

Actual costs directly incurred by the farmer on

- Inputs like seeds, fertilizers, pesticides and hired labour

- Diesel, electricity to run tractors and pumps.

- Depreciation of machinery.

A2 + FL

- It is the summation of A2 and imputed value of wages to family labour (based on the assumption that, if members of the family were paid for their labour, how much it would have cost).

C2

- C2 = A2 + FL + rent paid for any leased-in land or the imputed rent for the owned land and the interest on owned fixed capital.

- Generally, CACP announces MSP which is 1.5 times (A2 + FL).

- But, MS Swaminathan Commission or National Commission on Farmers (2006) suggested 50% profit on C2.

Side Topic: Market Intervention Scheme (MIS)

- Market Intervention Scheme (MIS) is similar to MSP, but it is implemented at the request of state governments to procure perishable and horticultural commodities in the event of a fall in market prices.

- The scheme is implemented if there is at least a 10% increase in production or a 10% decrease in rates over the previous year.

- The concerned state has to bear 50% loss while Union bears the rest of the 50%.

Critical analysis of Minimum Support Price in modern times

Presently MSP is being announced for 23 crops, but the primary emphasis remains on two crops, i.e. rice & wheat.

Pros

- MSP provides financial assurance and security to the farmers.

- Production of targeted crops increases. For example, India, once an importer of wheat, is now one of the largest producers.

- Historically, the increased production has helped India in achieving food security.

- Protect farmers from exploitation of middlemen

Cons

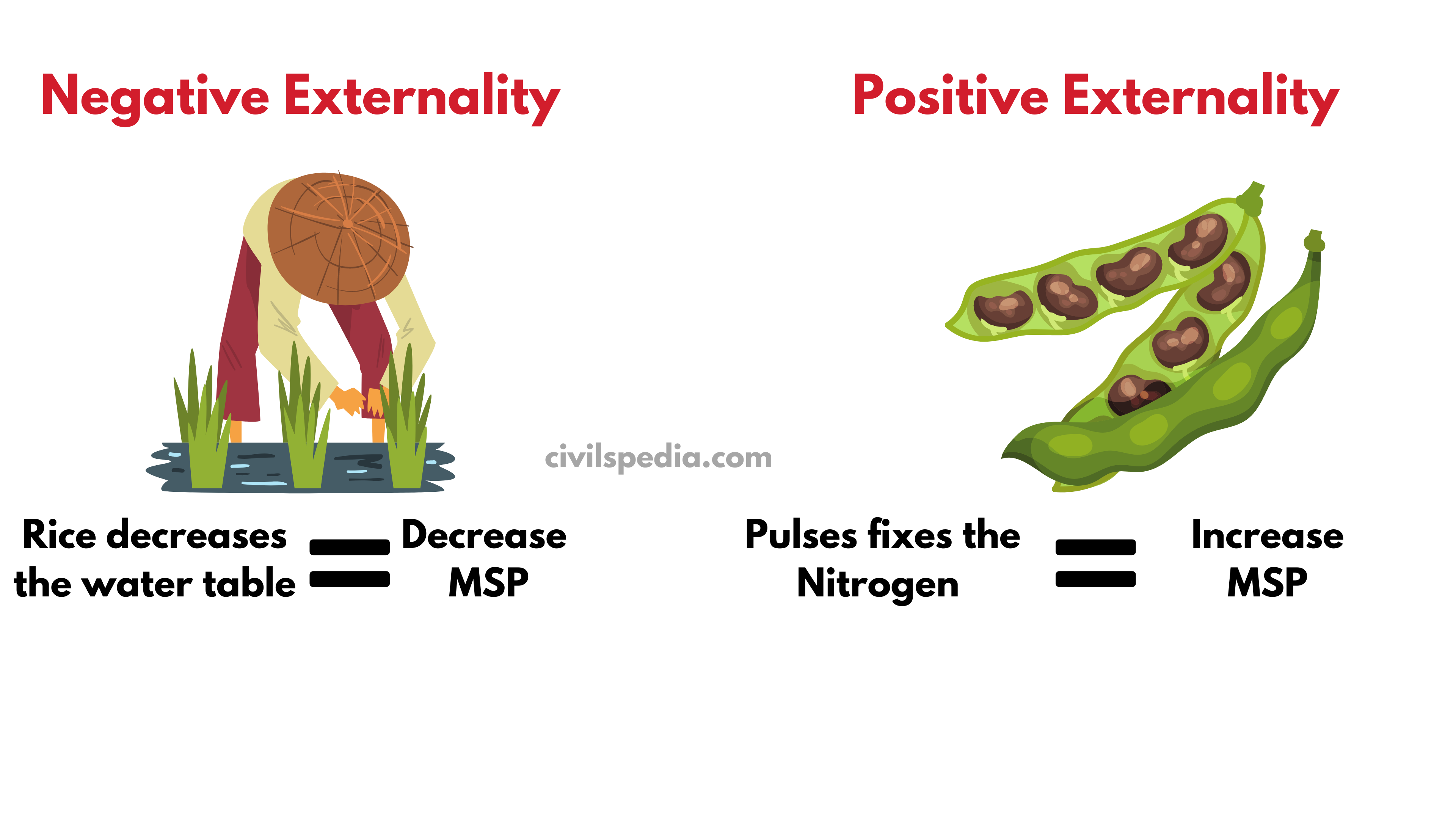

- It has distorted the cropping pattern in India. For example, rice is grown in Punjab and Haryana due to high MSP, which impacts the soil health and overexploitation of groundwater.

- MSP mainly focuses on rice and wheat, resulting in the attainment of food security at the cost of nutrition security (as pulses, oilseeds, and coarse cereals are not grown).

- MSP regime concentrated on wheat, and rice has led to monoculture, destroyed agricultural biodiversity and led to massive consumption of pesticides.

- According to Economic Survey (2020), due to guaranteed procurement of Wheat and Rice at MSP, Government procures around 40-50% of the total market surplus of rice and wheat, making the government virtually a monopsonist in the domestic grain market. It disincentivizes the private sector to undertake long-term procurement, storage, and processing investments.

- MSP benefits only large farmers because large farmers have a surplus to sell.

- It goes against WTO Obligations as overall subsidies given to the agriculture sector, including MSP subsidies, exceed the De-Minimus limit.

- MSP goes against the Principle of Laisse Faire (Free Market Principles).

- Poor Procurement System: MSP procurement is absent for most crops (except Rice and Wheat) in most states (except Punjab and Haryana). For example, in the case of wheat, of the average of 33 per cent of marketed surplus procured, 90 per cent procurement is accounted only from Punjab, Haryana and Madhya Pradesh.

- Lack of Safeguards: The farmers are not paid any compensation in case they sell their produce in the open market below the MSP.

Solutions to Minimum Support Price Problems

- MSP should be rationalized to depict social rather than private returns on production

- Three models have been suggested by NITI Aayog ( Price Deficiency Payment (PDP)), Market Assurance Scheme (MAS), (Private Procurement & Stockist Scheme (PPSS))

- Price Deficiency Payment: The government doesn’t have any role in procurement (but MSP is announced). If the price in an APMC Mandi fell below the MSP, then the farmer would be entitled to a price difference. This system is consistent with India’s obligations to the WTO since it doesn’t distort market prices. Bhavantar Bhugtan Yojana in MP and Haryana follows this model.

- Market Assurance Scheme: State will procure from the farmer and sell it. The Centre will compensate the state for losses incurred.

- Private procurement and stockist Model: Under this, private entrepreneurs would do procurement at MSP announced by the government.

PM-AASHA Scheme

- PM – AASHA = Pradhan Mantri Annadata Aay SanraksHan Abhiyan

- It was rolled out in September 2018.

- It is a Central Sector Scheme and is 100% funded by the Union.

Why this scheme was started?

- To give better returns to farmers.

- To plug the gaps in food procurement & MSP system like

- MSP & procurement has limited geographical reach (mainly operational in Punjab, Haryana, UP only).

- MSP & Procurement concentrate on Wheat & Rice & excludes oilseeds, coarse cereals etc.

Components of PM-AASHA

It has three components for complementing the existing schemes of procurement

- Price Deficiency Payment Scheme (PDP): This will cover all oilseeds for which MSP is notified, and the Centre will pay the difference between the MSP and actual selling price to the farmers directly into his bank account

- Price Support Scheme (PSS): Under this, physical procurement of pulses, oilseeds and copra will be done by NAFED & FCI. The Centre would bear expenditure and losses due to procurement.

- Private Procurement and Stockist Scheme (PPS): Roll out PPS in select districts where a private player can procure crops at MSP when market prices drop below MSP. The private player will then be compensated up to a maximum of 15% of the MSP of the crop.

Should MSP be legalized?

The farmers protest against the farm laws has ignited the debate regarding the legalization of MSP in India.

Present Status of MSP: Presently, MSP does not enjoy statutory recognition. It means that there is no onus on the private sector to buy at MSP. Legalization of MSP would ensure that the private sector would buy commodities at MSP. Failure to buy at MSP would be penalized.

Need of Legalization

- It will enhance the income levels of the Indian farmers as most of the farmers sell their produce below MSP in the present regime.

- It will reduce the exploitation of farmers by the corporations in case they force the farmers to sell their produce below MSP.

How can MSP be given Statutory Backing?

- Forcing the private traders to buy the crops at least at MSP announced by the government. This system is already working in the case of sugarcane.

- Government can procure all the crops through its agencies such as FCI, NAFED etc., at MSP.

- Price Deficiency Payments: Government can allow the sale at the market price but give the difference between the average market price and MSP to farmers. But PDPS is based on the Bhavantar Bhugtan Yojana implemented in the State of Madhya Pradesh. In Madhya Pradesh, there was unfair collusion between traders and farmers wherein the traders asked the farmers to sell the agricultural produce below the MSP. The compensation amount given by the Madhya Pradesh government was then shared between the traders and farmers.

Challenges

- In the case of bumper harvest, the private buyers might not buy anything from the farmers in fear of punishment by the government.

- Inflation: It will lead to inflation in the economy as buying below the statutory MSP will not be possible.

- Negatively impacts agricultural exports: Agricultural exports will be greatly impacted as exporters can’t buy below the MSP even when the international prices are low.

- Financing issue: The government can’t buy all the agricultural produce as it will cost the government half of its budget. Even now, the government is spending Rs. 2 lakh crore on food grain management.

- Violation of WTO Agreement: Legalizing the MSP goes against the WTO agreements as India will breach the de-minimus limit in such a scenario.

- Goes against free-market economics: According to the Principles of Laize Faire, the price of the goods must be decided by the forces of supply and demand and governments shouldn’t intervene to impact the price.