Table of Contents

Union Public Service Commission (UPSC)

This article deals with ‘Union Public Service Commission (UPSC) – Indian Polity.’ This is part of our series on ‘Polity’ which is important pillar of GS-2 syllabus . For more articles , you can click here.

Introduction

- The Union Public Service Commission (UPSC) serves as the central recruiting agency in India and is responsible for conducting examinations and selecting candidates for various government posts.

- The Constitution of India directly created this body, highlighting its significance and constitutional mandate.

- The provisions related to the UPSC are outlined in Articles 315 to 323, which fall under Part XIV of the Indian Constitution.

- Article 315 establishes the UPSC and outlines its composition, functions, and powers.

- Articles 316 to 319 detail the appointment, removal, suspension, prohibition to hold office after ceasing to be member and term of office of members of the UPSC, ensuring their independence and impartiality.

- Article 320 empowers the UPSC to conduct examinations for appointments to civil services and other positions, ensuring a merit-based selection process.

- Article 321 provides for the power to extend the functions of Public Service Commission.

- Articles 322 and 323 deal with the expenses and annual reports of the UPSC

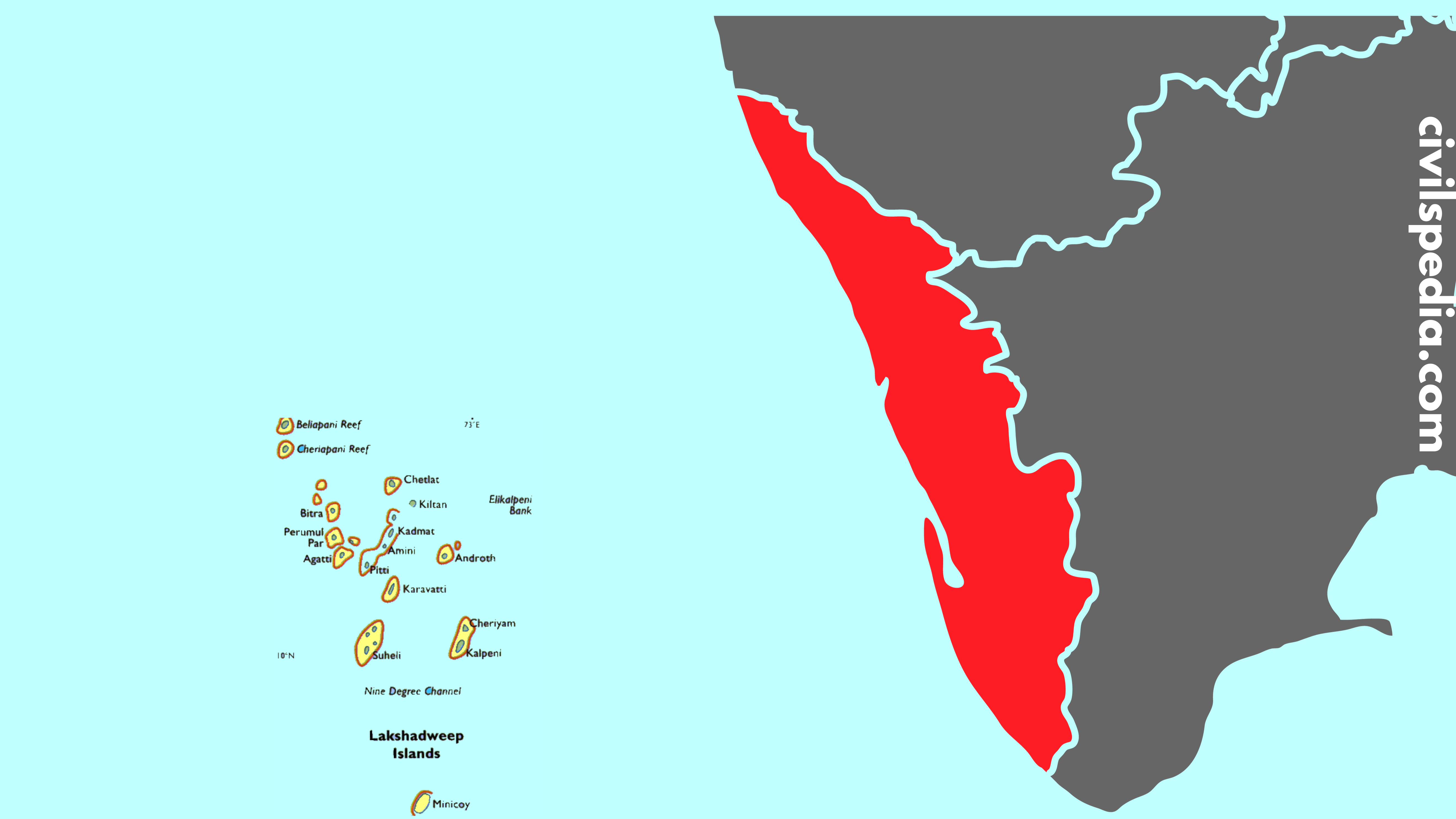

Composition

- UPSC consists of a Chairman and other Members appointed by the President of India.

- The Constitution hasn’t specified the strength of the Commission & left the matter to the discretion of the President.

- No qualifications are prescribed except that one-half of the members of the Commission should be persons who have held office for at least ten years, either under the Government of India or the Government of a state.

- The Constitution also authorizes the President to determine the conditions of service of the Chairman and other members.

Term of Chairman and Members

The Chairman and members of the Commission hold office for

- Term of 6 years or

- Until they attain the age of 65 years

Whichever is earlier.

However, members of the UPSC have the option to relinquish their positions at any time by submitting their resignation to the President of India.

Removal of Chairman and Members

- The President can remove the Chairman or Members of UPSC.

- If he is adjudged insolvent (that is, has gone bankrupt)

- If he engages in any paid employment outside of his office

- Infirmity of mind or body

- The President can also remove them due to misbehaviour. However, in this case, the President has to refer the matter to the Supreme Court for an enquiry and act according to the advice.

Independence

- The manner of removal of members of the UPSC ensures their independence, as they can only be removed on the grounds mentioned above, safeguarding their security of tenure.

- Conditions of service for UPSC members cannot be altered to their disadvantage after their appointment, ensuring stability and protection against arbitrary changes.

- The entire expenses of the UPSC are charged on the Consolidated Fund of India, ensuring financial autonomy.

- The Chairman of UPSC (on ceasing to hold office) is not eligible for further employment in the Government of India or a state.

- Member of UPSC (on ceasing to hold office) is eligible for appointment as the Chairman of UPSC or a State Public Service Commission (SPSC), but not for any other employment in the Government of India or a state.

- Neither the Chairman nor a member of the UPSC is eligible for reappointment to that office.

Functions

- The UPSC conducts examinations for appointments to the All-India Services, Central Services, and Public Services of centrally administered territories, ensuring merit-based selection.

- It assists the States in Joint Recruitment for any services for which candidates possessing special qualifications are required.

- It serves the needs of a state at the request of the State Governor and with the approval of the President of India.

- It is consulted on matters related to personnel management (like suitability of candidates, promotions, transfers, extension of service etc. of civil servants).

- The jurisdiction of UPSC can be extended by an act made by the Parliament.

The UPSC annually presents a report on its performance to the President. The President places this report before both Houses of Parliament, along with a memorandum explaining the cases where the advice of the Commission was not accepted and the reasons for such non-acceptance.

Limitations

The following matters are kept outside the functional jurisdiction of UPSC. In other words, the UPSC is not consulted

- While making reservations of appointments or posts in favour of any backward class of citizens.

- While taking into consideration the claims of SCs & STs in making appointments

- Posts of the highest diplomatic nature and a bulk of group C and D services.

- With regard to the selection for temporary post (less than a year.)

The President holds the authority to exempt certain posts, services, and issues from the jurisdiction of the UPSC. However, any regulations established by the President for this purpose must be presented before both Houses of Parliament for a minimum of 14 days. Parliament retains the power to modify or revoke these regulations as deemed necessary.

Role of UPSC

- The Constitution visualises the UPSC to be the ‘watchdog of the merit system‘ in India, ensuring that recruitment to various civil services is based on merit and fairness.

- UPSC’s responsibilities are specifically focused on the selection process. It does not involve itself in matters such as service conditions, cadre management, training, and other administrative aspects. These areas fall under the jurisdiction of the Department of Personnel and Training (DoPT).

- The recommendations made by UPSC are advisory in nature and are not binding on the government. However, the government is answerable to Parliament if it chooses to deviate from UPSC’s recommendations.

- The emergence of the Central Vigilance Commission (CVC) in 1964 affected the role of UPSC in disciplinary matters. This is because both are consulted by the government while taking disciplinary action against a civil servant. However, the UPSC, being an independent constitutional body, has an edge over the CVC, which is a statutory body.