Table of Contents

Financial Relations between Centre and States

This article deals with ‘Financial Relations between Centre and States – Indian Polity.’ This is part of our series on ‘Polity’ which is important pillar of GS-2 syllabus. For more articles , you can click here

Introduction

Articles 268 to 293 in Part XII of the Indian constitution deal with financial relations.

Allocation of Taxing Powers

The division of taxing powers is as follows

| Parliament | Parliament can levy taxes on subjects in the Union List (13 items). |

| State Legislature | State Legislatures can levy taxes on subjects enumerated in the State List (18 items) |

| Both | – Both Parliament and State Legislatures can levy taxes on subjects enumerated in the Concurrent List. – Initially, the Concurrent List had no tax entries, but the 101st Amendment Act of 2016 introduced a special provision for GST. Parliament and State Legislatures now have concurrent power to make laws related to GST. |

| Residuary | The residual power of taxation is vested in the Parliament. |

There is a difference between the power to levy taxes, collect taxes & appropriate the proceeds of taxes. For example, the income tax is levied and collected by the Centre, but its proceeds are distributed between the Centre and the states.

The Indian Constitution has placed various restrictions on the state’s taxing powers. These are as follows:-

- Tax on Professions, Trades, Callings, and Employments: State legislatures can levy taxes on professions, trades, callings, and employments, but there’s a cap of ₹2,500 per year on the total amount imposed on any individual.

- Prohibition on Taxing Goods and Services: State legislatures cannot impose tax on goods or services in two instances: (1) when the transaction happens outside the state and (2) when it occurs in the course of import or export.

- Tax on Consumption or Sale of Electricity: States have the authority to levy taxes on the consumption or sale of electricity.

- No tax can be imposed on electricity consumed or sold to the Centre

- No tax can be imposed on electricity utilised in the construction, maintenance, or operation of railways

- Tax on Water or Electricity by Interstate Authorities: State legislatures can levy taxes on water or electricity generated, consumed, sold or distributed by authorities established by Parliament for regulating or developing interstate rivers or river valleys.

Distribution of Tax Revenues

Major changes in the scheme to distribute tax revenue between the Centre and the States were introduced by the 80th and 101st Constitutional Amendments.

80th Constitutional Amendment, 2000 (Alternative Scheme of Devolution)

- The 80th Amendment was passed to implement the 10th Finance Commission’s suggestion of allocating 29% of specific central taxes and duties to the states.

- It was retroactively applied from April 1, 1996, and brought various central taxes, including corporation taxes and customs duties, in line with income tax regarding their constitutional sharing with the states.

101st Constitutional Amendment

- The 101st Amendment enables the implementation of a new tax system, Goods and Services Tax (GST), in the country. It grants both the Parliament and State Legislatures the authority to enact laws for imposing GST on transactions involving the supply of goods or services.

- The proceeds of GST are divided between the Center and the state on the recommendation of the GST Council.

The present situation regarding tax distribution between the Centre and states is as follows

- Article 268 (Taxes levied by the Centre but collected and appropriated by States): It includes stamp duties on cheques, bills of exchange, promissory notes, insurance policies, transfer of shares, and similar transactions.

- Article 269 (Taxes levied and collected by Centre but assigned to States): There are two categories of taxes under this category

- Taxes on interstate sale or purchase of goods (excluding newspapers)

- Taxes on the consignment of goods in interstate trade.

- Article 269-A (Levying and Collecting of GST in the Course of Inter-State Trade): The responsibility for levying and collecting this tax rests with the Centre. However, the distribution of this tax between the Centre and the States is determined by Parliament based on the recommendations of the GST Council.

- Article 270 (Taxes Levied and Collected by the Centre but Distributed between the Centre and the States): This category includes all taxes and duties listed in the Union List, excluding those mentioned in Articles 268, 269, and 269-A, surcharge on taxes in Article 271, and specific-purpose cess. Based on the Finance Commission’s recommendation, the President determines the distribution of the net proceeds of these taxes and duties.

- Article 271 (Surcharges for the purpose of the Centre): The Parliament has the authority to impose surcharges on certain taxes and duties mentioned in Articles 269 and 270. The funds generated from these surcharges are allocated exclusively to the Centre. However, the Goods and Services Tax (GST) is exempted from such surcharges.

- Taxes Levied, Collected, & Retained by the States: These include taxes enumerated in the state list (18 in number).

Distribution of Non-tax Revenues

a. The Centre

The primary contributors to the non-tax revenues of the Centre are the following.

b. The States

The primary contributors to the non-tax revenues of the States are the following.

Grants-in-Aid to the States

The Centre can give money to States via Grants in Aid. These are of two types

1 . Statutory Grants

- General Provision: Under Article 275, Parliament can give money to states which need financial assistance on the recommendation of the Finance Commission. They are charged on the Consolidated Fund of India.

- Specific Provision: The Constitution has provisions for specific grants aimed at enhancing the well-being of scheduled tribes within a state or improving the administrative standards of scheduled areas in a state, including the State of Assam.

2. Discretionary Grants

- Under Article 282, the states & centre can make grants even if it is not in their Legislative competence. For example, the Central Funds given on the advice of the Planning Commission.

- They are discretionary because the centre is under no obligation.

- These grants serve a dual purpose: firstly, to assist the state in meeting its financial obligations for achieving plan targets, and secondly, to provide the Centre with a means to influence and coordinate state activities in line with the national plan.

3. Other Grants

- These grants, stipulated by the Constitution, were temporary in nature.

- For the initial 10 years following the commencement of the Indian Constitution, a provision of grant was made in lieu of export duties on Jute products to states of Assam, Bihar & Orissa & were charged on Consolidated Fund.

GST Council

- GST Council is a Constitutional Body made under the provisions of Article 279-A.

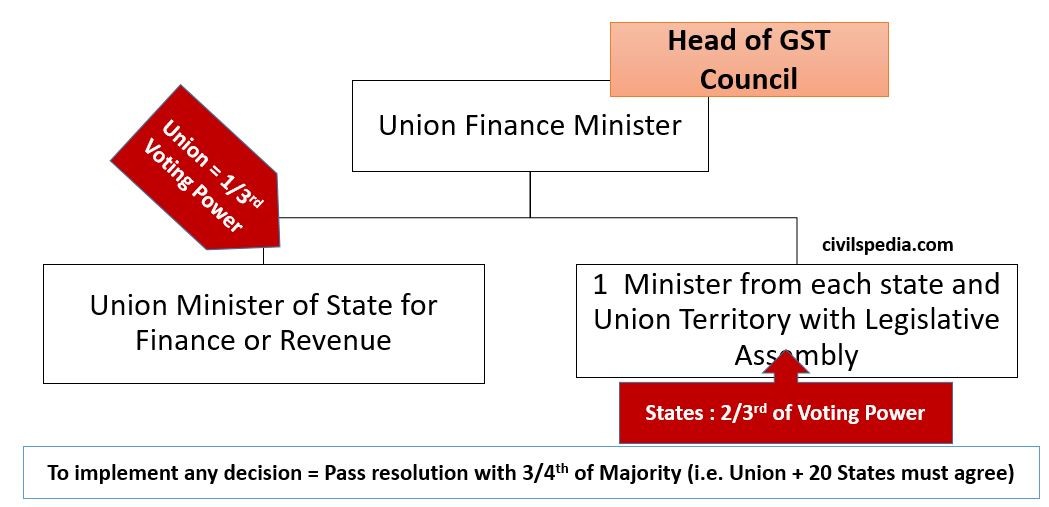

Membership of GST Council

- Its membership is as follows

- Headed by Union Finance Minister

- Union Minister of State of Finance / Revenue

- 1 Minister from each State and Union Territory with the Legislative Assembly

- Weighted Voting Powers: 1/3rd of Voting Power is with the Union and 2/3rd with States.

- In order to implement any decision, at least a three-fourths majority is necessary, which translates into votes of the Union and a minimum concurrence of 20 states.

Functions of GST Council

- Determine the inclusion of Union and State Taxes, Cess, and Surcharge under the GST regime.

- Establish standard rates for CGST, SGST, and UTGST within the GST framework.

- Set the effective date for including Crude Oil, Petrol, Diesel, Aviation Turbine Fuel, and LPG under the GST regime, until which the Union and individual States will unilaterally determine Excise and State VAT on these hydrocarbons.

- Define the categories of ‘Exempted Goods and Services’ under GST.

- Determine ‘Special Rates’ applicable during calamities, exemplified by the GST Council allowing Kerala in January 2019 to impose a 1% Calamity Cess on Intra-State trade for the subsequent two years for the rehabilitation of flood victims from 2018.

- Address dispute settlements within this system involving conflicts between states or between a state and the Union.

Finance Commission

- Article 280 establishes the Finance Commission as a quasi-judicial entity.

- The President forms the Finance Commission every five years, or sooner if necessary.

The Finance Commission is required to make recommendations to the President of India on the following matters:

- Distribution of the divisible pool of taxes between the Centre and states (Vertical Distribution) and among states (Horizontal Distribution).

- It provides recommendations on the principles guiding grants-in-aid from the Centre to the states.

- The Finance Commission suggests measures to enhance a state’s consolidated fund for supporting Panchayats and municipalities.

It can address any other finance-related matter referred to it by the President.

The Constitution permits the Finance Commission to make broader recommendations in the interest of sound finance.

Protection of State’s Interests

To protect the interest of States, certain bills can be introduced in Parliament only on the recommendation of the President

- Bill which imposes or varies any Tax in which states are interested

- Bill, which varies the meaning of the expression Agriculture income

- Bill, which affects the principle on which money is distributed to state

- Bill which imposes any surcharge on any specified tax or duty for the purpose of the centre.

Borrowing and Loans by Centre & States

Borrowing

- Centre can borrow either within India or outside upon security of the Consolidated Fund of India within the limit fixed by Parliament (no limit fixed yet)

- State Government can borrow within India (& NOT ABROAD) upon security of the Consolidated Fund of State

Loans

- The central government can make loans to any state or give guarantees regarding loans.

- The state can’t raise a loan without the consent of the centre if any part of a loan made by the centre to the State or in which the centre has guaranteed is still outstanding.

Effects of Emergencies on Financial Relations

National Emergency

- During a National Emergency, the President can modify the Constitutional distribution of revenues between the Centre & and the State.

- Modification continues until the end of the financial year when emergencies cease to operate.

Financial Emergency

During Financial Emergency, the centre can give direction to states

- Observe specified canons of financial propriety

- Reduce the salaries & allowances of all classes of persons in states

- Reserve money bills & financial bills for consideration by the President.

Inter-Government Tax Immunities

There are certain rules of IMMUNITY FROM MUTUAL TAXATION

- Property of the centre is exempted from all taxes imposed by the state or any authority within the state like Panchayat, Municipal Corporation, etc.

- Property & income of the state is exempted from central taxation.

- Property & income of local bodies like panchayat are not exempted from central taxation.

Analysis: Centre-State Financial Issues

- Vertical Imbalance in Resource Sharing: The States feel that the resource transfers to them haven’t been commensurate with their growing responsibilities.

- Growing Central Expenditure on Functions in the State List: The 12th Finance Commission estimated that a fifth of the expenditure incurred by the Centre was on subjects that were in the domain of the States.

- Compliance and Enforcement Cost of Central Legislation: There are several Central legislations, the compliance and enforcement costs of which are entirely borne by the States. At present, States are not compensated for the cost of compliance and the revenue loss on account of compliance.

- Impact of Pay Revision by the Central Government on State Finances: The periodic pay revision by the Central Government gives rise to demand on the part of State government employees for a similar pay hike. States have demanded that the Central government should bear at least 50 % of the increase.

- Sharing of Offshore Royalty and Sale Proceeds of Spectrum: Under the present Constitutional arrangements, offshore royalty accrues entirely to the Centre.

- Profession Tax: it can not exceed Rs. 2,500 per annum. As income and salary levels are increasing, a limit on the professional tax constraints revenue mobilization

- FRBM Legislation: The deficit reduction targets are uniform across all States. This ‘one-size-fits-all’ approach has constrained fiscally strong States to raise more resources.