Last Updated: May 2023 (Famous Scams)

Famous Scams

This article deals with ‘Famous Scams.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

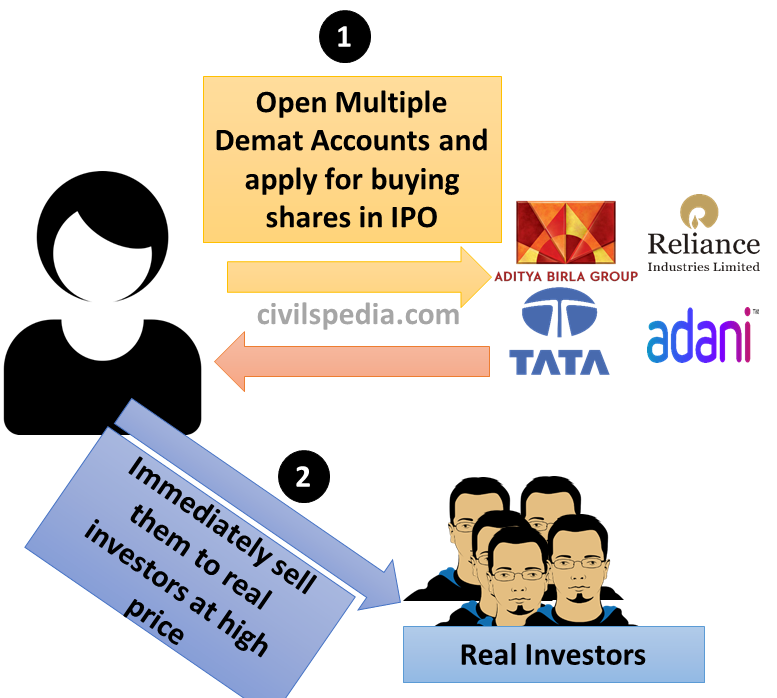

1. Roopal Panchal IPO Scam (2003-05)

- Period of Scam: 2003 to 2005

- Roopa Panchal forged documents to create multiple DEMAT Accounts (she opened more than 55,000 Demat Accounts).

- At that time, PAN Card wasn’t mandatory for IPO Applications up to ₹50,000.

- Since she was bidding from multiple accounts, there was more chance of allotment of shares in IPO sale.

- After that, she sold those shares in the Secondary Market at a high rate and earned a lot of money.

- She was busted and jailed.

To stop such scams, PAN Card was made compulsory for all bidding.

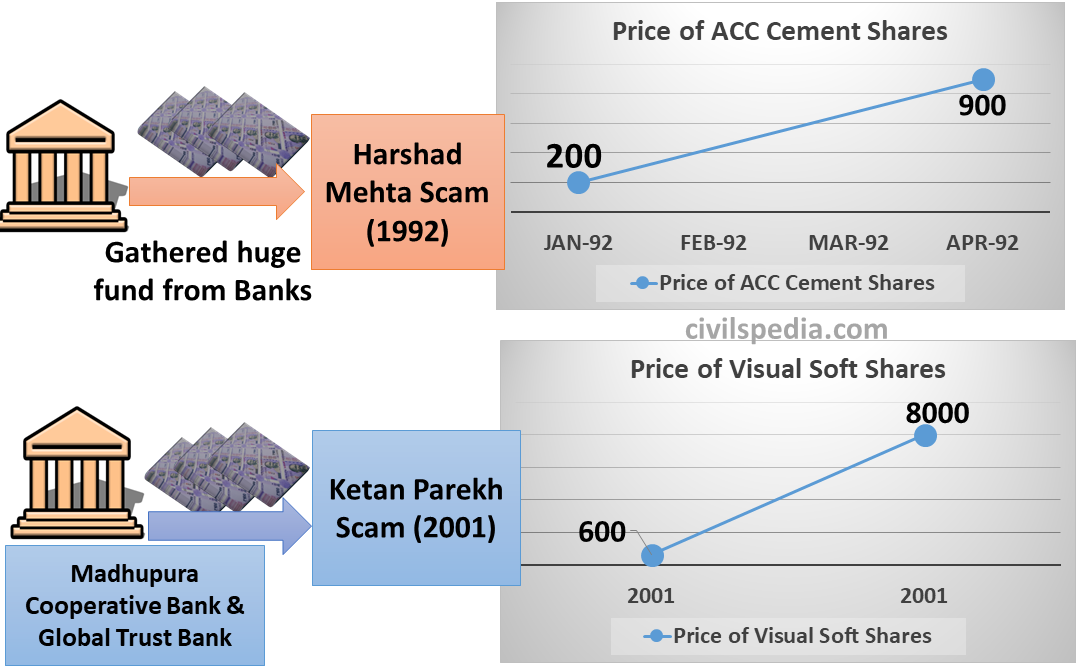

2. Harshad Mehta & Ketan Parekh Scam

- Both used the same idea => Gathered a large amount of money from banks and started to buy a share of the particular company, raising its price. The common public thought to invest their money in shares of these companies since their price is rising. But after raising the price, they sold all those shares at a high price and earned huge profits.

Why are these types of scams are bad?

- If we don’t stop them, small investors will lose faith. It will hurt the deepening of the Capital Market in India.

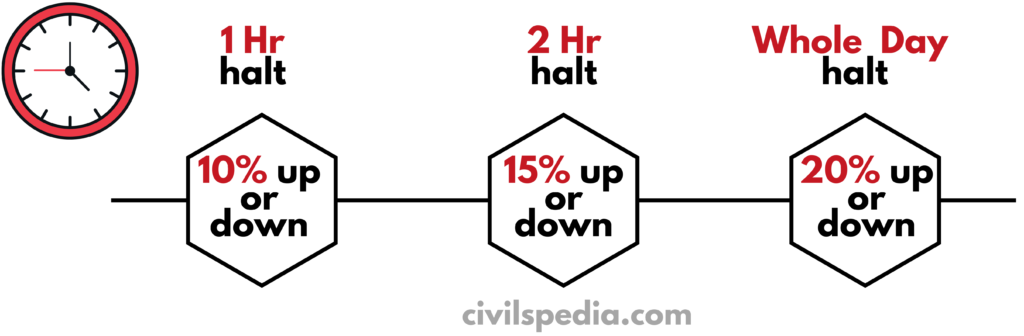

How to contain such Scams? – Circuit Breaker

- SEBI introduced Circuit breakers to stop these types of scams.

- In this, trading of a particular share showing high volatility is stopped by Stock Market for a particular time

3. Chit Fund Scams

Two major Chit Fund Scams have happened in the recent past.

- Rose Valley Scam (West Bengal) – Gautam Kundu (scam worth ₹40-60 Thousand Crore)

- Saradha Chit Fund Scam (WB) – Sudipto Sen

What is Chit Fund?

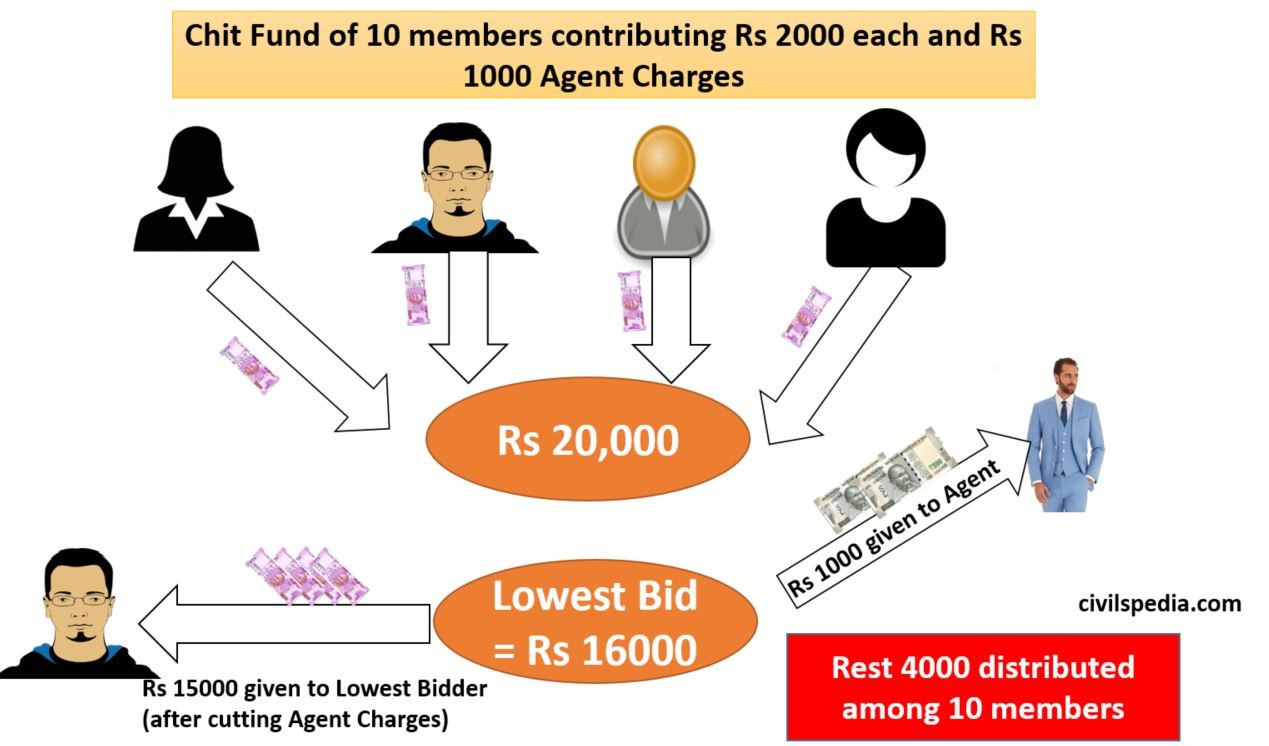

- Chit Funds are a rotating savings and credit association system practised in India.

- In Chit Fund, all the members who have subscribed to a particular Chit Fund Scheme contribute equally every month for a pre-determined period. The person who gives the lowest bid takes money for that month, distributing the remainder equally between all members.

- Agent (Foreman), the organiser of a particular Chit Fund Scheme, gets his Fixed Commission.

- The person who has already taken the bid continues to pay his subscription fee for the remaining months.

- They are also known as ‘Kuri’ or ‘Fraternity Fund’ or ‘Committee’ (in Punjab) or ‘Rotating Savings and Credit Institution (ROSCA)’.

Laws to regulate Chit Funds

- Supreme Court Judgement says that Chit Fund is a type of Contract. Since Contracts are in Concurrent List, both State and Centre can make law on it. Accordingly, Union and State Governments have made laws to regulate them.

- Union: Chit Funds Act, 1982 (Chit Fund Managers have to register with Ministry of Corporate Affairs)

- States: Some states like Andhra, Kerala, Tamil Nadu, West Bengal etc., had made their laws. (Chit Fund Managers have to register with State Government)

- Hence, Chit Fund Manager can either register with the State government or Central Ministry and run Chit Fund Schemes legally.

How do frauds happen?

- Farmer can store his produce in Warehouse and get Negotiable Warehouse Receipt(NWR).

- After that, the farmer can sell these Warehouse Receipts to traders in Commodity Exchange. The trader can get delivery from the Warehouse using a receipt after a certain number of days (T + days SYSTEM).

Recent steps to control Chit Funds

- SEBI REGULATION 2014: Amendment in SEBI act was done by the Parliament, which states that if pooled money in any scheme is more than ₹100 crore, it will be categorized as Collective Investment Scheme and comes under SEBI Regulation.

- Banning of Unregulated Deposit Schemes Bill, 2018: Bill prohibits Deposit Takers from promoting, operating, issuing advertisements or accepting deposits in any Unregulated Deposit Scheme. Strict penalties and jail terms have been provided in the bill.

What needs to be done

- Improve financial literacy of the investors.

- Resolve multiple regulation problems. Implement FSLRC (Financial Sector Legislative Reforms Commission/ Justice BN Srikrishna Committee Report) to make Unified Financial Agency (UFA).

- Powers to impose a heavy penalty on the non-registration of such schemes should be given to the regulator.

4. NSEL Scam

How trading happens in Commodity Exchanges

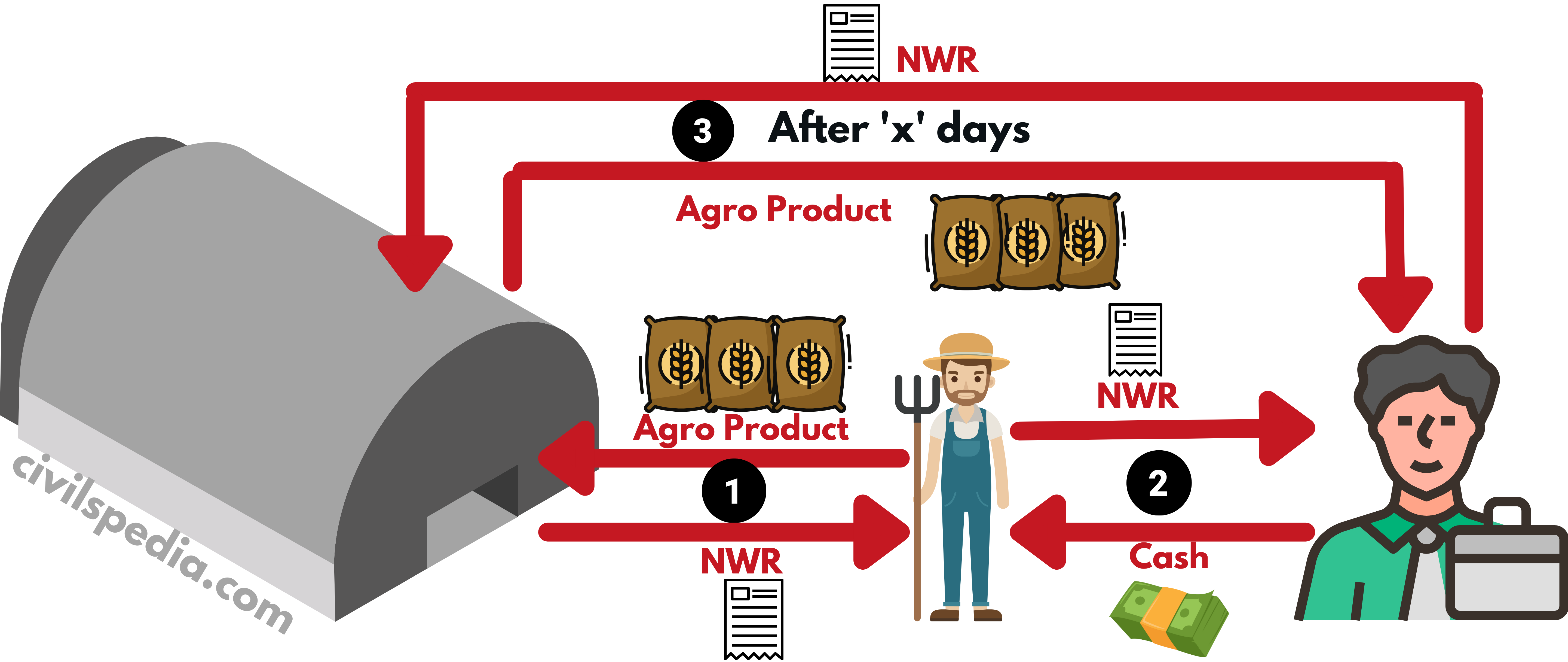

- Farmer can store his produce in Warehouse and get Negotiable Warehouse Receipt(NWR).

- After that, the farmer can sell these Warehouse Receipts to traders in Commodity Exchange. The trader can get delivery from the Warehouse using the Receipt after a certain number of days (T + ‘x’ days SYSTEM).

NSEL Scam

- NSEL is the name of the Commodity Market Exchange promoted by Jignesh Shah.

- Commodity Exchanges earn Money by taking a certain percentage of the price of the commodity they sell as their share.

- In the scam, Jignesh Shah used to generate fake warehouse receipts and sell those receipts to traders. In the meantime, he used to gather real receipts from farmers as actual settlement takes place after some time (under the T+ ‘x’ days System). But he couldn’t sustain this system for long, and the whole scheme busted.

- The whole scam was of tune of ₹5600 Crore.

When this scam happened, Commodity Market Exchanges were under the regulation of the Forward Market Commission (under Agriculture Ministry). But after that, SEBI took over the regulation of Commodity Market Exchanges.

Steps taken by Government to stop such Scams

- Empowered SEBI: New provisions of the amended SEBI Act, 2014

- Made it mandatory for money pooling schemes collecting over Rs.100 crore to register with SEBI.

- Enhanced the powers of SEBI, giving the authority to conduct searches, confiscate assets such as property and bank accounts and detain suspected violators, making it one of the most powerful regulators in the world.

- Budget 2021 announced that The government intends to formulate a new Security Market Code by merging SEBI Act, Depositors Act, Securities Contracts (Regulation) Act and Government Securities Act.

- Budget 2021 also announced that the government intends to make Investor’s Charter to address investors’ issues and create a proper redressal mechanism. Charter will also include the rights and responsibilities of investors.

- Depositor Protection Acts by States: State Depositor Protection Acts empowered district magistrates to take action against any entity collecting unauthorised deposits. Twenty states and Union Territories have already enacted Depositor Protection Act.

- Creation of alternate schemes & Financial Inclusion: Merely curbing the Ponzi schemes won’t solve the problem. Thus, while SEBI is doing the job of the market watch, RBI is directing the banks to ensure financial inclusion.