Last Updated: May 2023 (Type of Securities)

Table of Contents

Type of Securities

This article deals with ‘Type of Securities.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

What is Security instrument?

Securities are fungible and tradable financial instruments that are used to raise capital from public and private markets.

There are three types of Securities, i.e. (1) Debt, (2) Equity and (3) Derivatives.

Security Market

- It is the segment of the financial market of an economy where long term capital is raised via security instruments such as Debt, Equity and Derivatives.

- There are different ways to classify Security Markets.

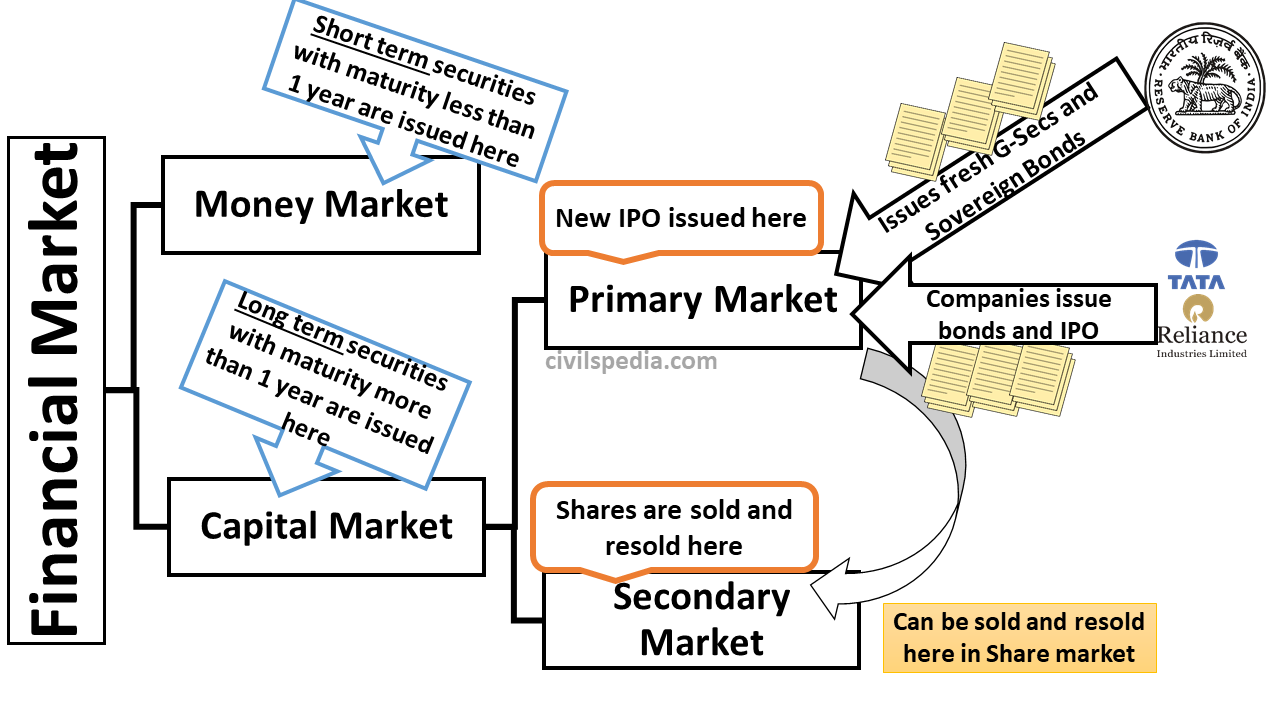

Classification 1: Type of Security being Traded

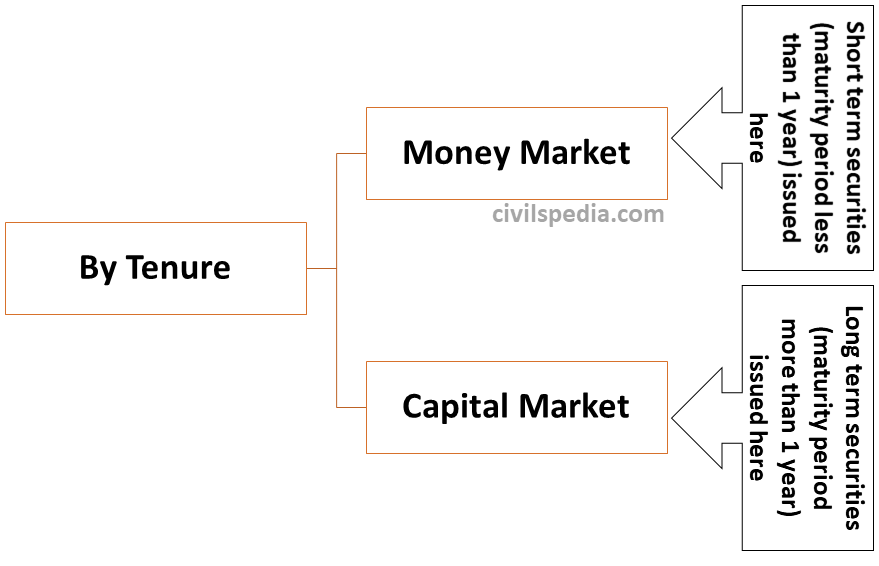

Classification 2: By Tenure of Securities

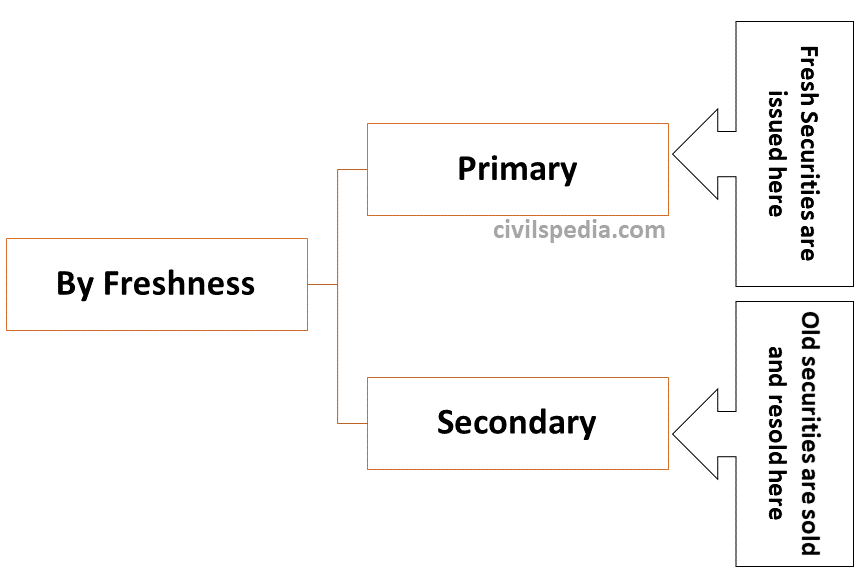

Classification 3: By Freshness of Security

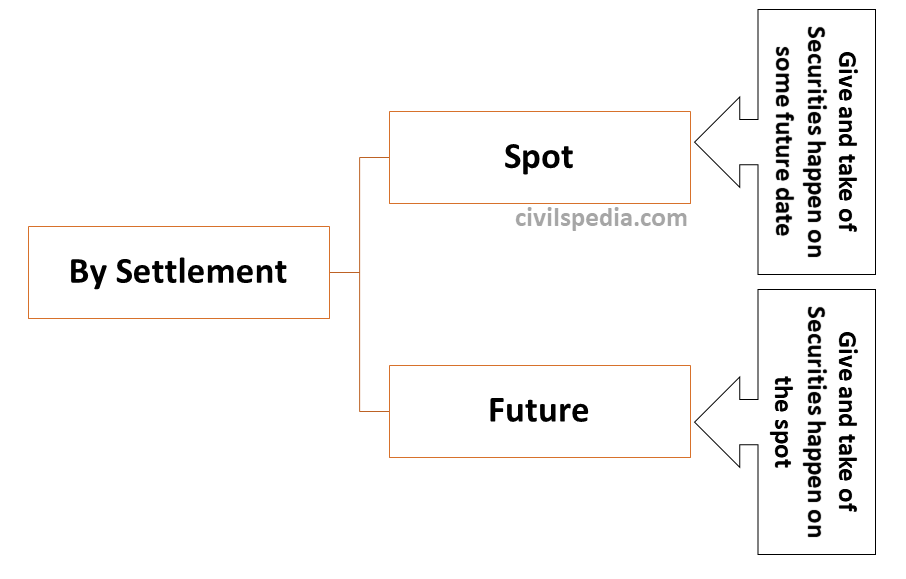

Classification 4: By Settlement of Security

Different Instruments to raise Money from the Market

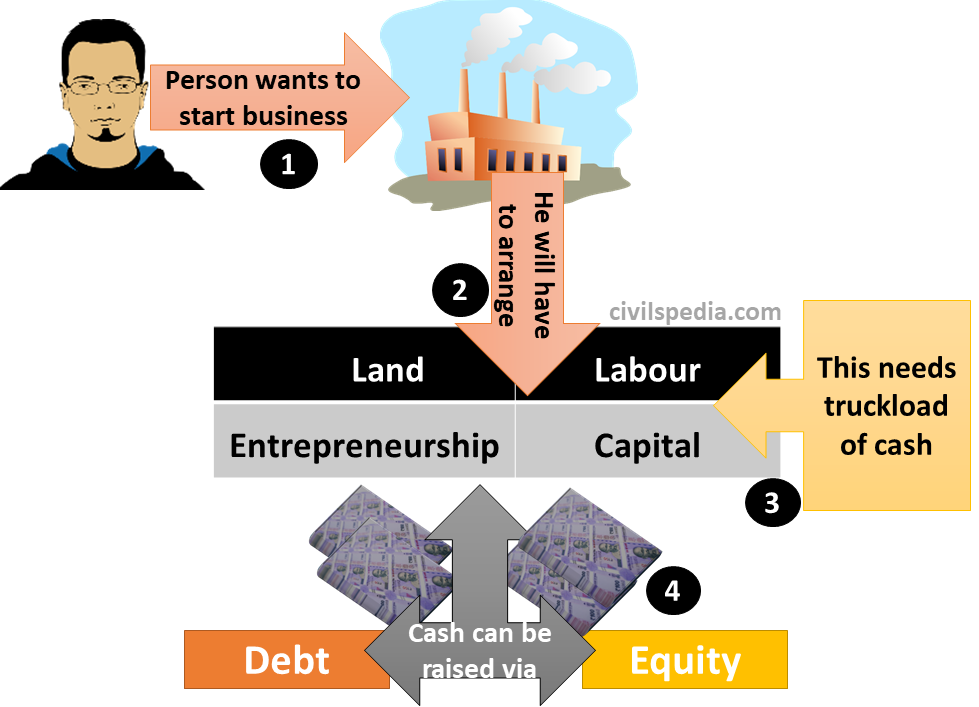

- Consider a hypothetical situation – A businessman has ₹5 Lakh & to start a business, he needs ₹10 Lakh. Now the question arises that, how can he arrange the rest 5 Lakhs? Answer – He can approach Security Market to raise capital via Debt or Equity.

- In general, if anybody wants to start a business, he/she will need 4 factors of production

| Entrepreneurship | Land |

| Capital | Labour |

- And to arrange these factors of production, one needs a truckload of money which can be raised via Debt or Equity. These instruments have their advantages and disadvantages, which we will discuss in detail in the chapter.

Debt Instruments

- It is self-explanatory, i.e., you borrow money from someone & say that I will give you 10% annual interest for 5 years & at the end will pay you principle (minimum period more than 1 year).

- It is a type of security paper.

- If a company raises money via debt, it will have to pay the debt owner whether it is in profit or loss.

- Examples of debt include Bonds, Debentures, External Commercial Borrowing, T-Bills, Commercial Papers, Certificate of deposit etc.

- The holder of the debt instrument is called the Creditor of the Company (not the owner).

- Benefits of becoming Creditor

- Fixed Income whether the company is making profit or loss.

- First claim during liquidity.

Short and Long-Term Debt Instruments

#1: Short-Term Debt Instruments

- They have a maturity period of less than 1 year.

- The market where they are sold is called Money Market.

- They are highly liquid as they can be sold and resold very easily.

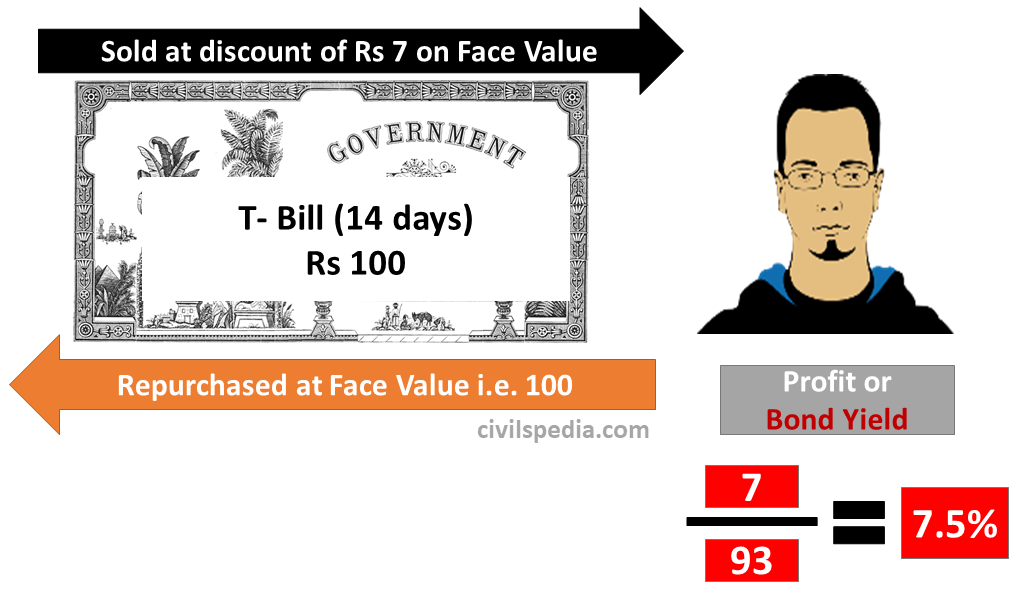

- These are sold at a discount to face value and bought at face value after a fixed number of days (all Short Term Debt instruments that are mentioned below are sold and purchased in this way)

- E.g., T-Bill issued by the government for a period of up to 14 days.

Short Term Debt Instruments issued by various agencies

1 . Government

1.1 T-Bills or Treasury Bills

- T-Bills have a maturity period of 14, 91, 182 or 364 days.

- Treasury bills are zero-coupon securities as they don’t pay interest. They are issued on a discount to face value and redeemed at face value upon maturity.

- Note: State Governments don’t issue T-Bills (till 2001, they used to issue, but RBI stopped this in 2001).

1.2 Cash Management Bills (CMB)

- They can have a maturity period of up to 90 days.

1.3 Ways & Means Advances

- The mechanism through which RBI lends money to the government for temporary short term needs when there is a mismatch in receipt and expenditure of the government.

2 . Companies

- Commercial Papers

- Promissory Notes

Both work the same as T-Bills but are issued by Companies.

3 . Banks

- Certificate of Deposits: Work same as T-Bills.

- Call Money: Banks inter-borrow among themselves for 1 day for CRR Adjustment.

- Notice Money: Same as Call Money but for a period between 2 to 14 days.

- Repo Agreements: Monetary Policy instrument under which bank lends from RBI for up to 14 days.

4 . Merchant

- Commercial Bill: Merchant sells his unpaid invoice to bank at a discount and again buys the same invoice at face value when recovery date of invoice arrives.

5 . MSMEs

- Factoring: Under Factoring, MSME owner pledges his unpaid invoice made to Corporates to Bank or NBFC at a discount and then again buys invoice at face value when recovery date of invoice arrives. It is conducted through electronic system called Trade Receivables Electronic Discounting System (Treds).

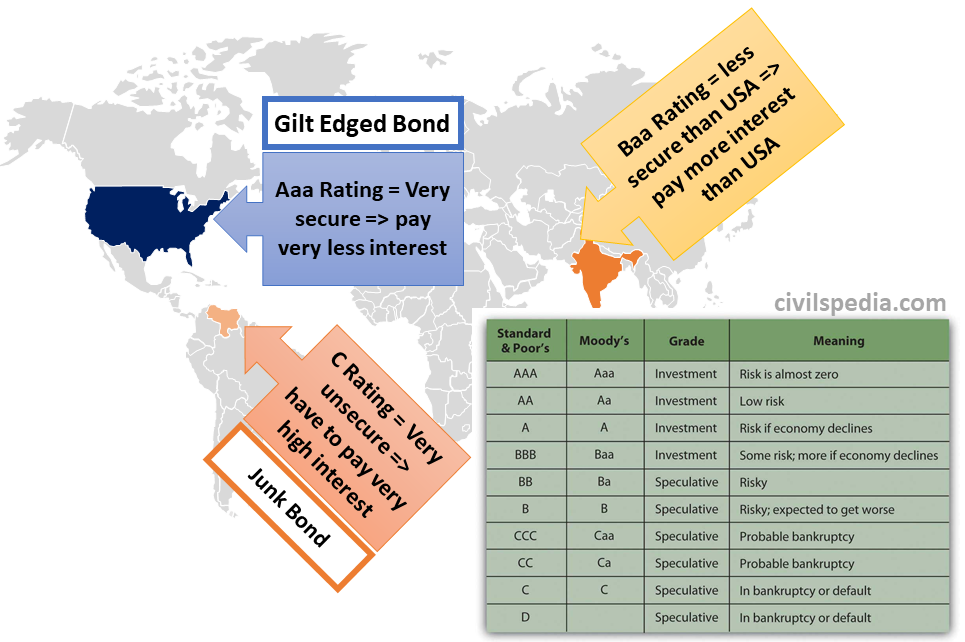

Side Topic: Credit Rating

Before reading about Long Term Debt Instruments, we need to know Credit Rating and Bond Yield.

- Credit Rating is the process to access the creditworthiness of a prospective borrower to meet future debt obligations.

- Credit Rating can be given to individuals, individual companies & countries (sovereign).

- SEBI regulations mandate that the company’s credit rating is required to raise money via a debt instrument having a maturity period greater than 18 months.

- Usually, equity share is not rated here.

- The interest rate paid on Bonds is not fixed & depend on the credit rating of the entity issuing that:-

- Companies and countries with high credit ratings are least to default on their loans. Hence, the interest rate on bonds issued by them is the lowest (Gilt Edged).

- Companies and countries with low credit ratings are most likely to default on their loans. Hence, to attract buyers, they have to offer a high-interest rate.

- Companies that do the work of Credit Rating are known as Credit Rating Companies. These include Fitch, CRISIL, S&P, Moody’s etc. and they give rating like AAA,A,BBB,BB,C,D etc.

- In India, Credit rating agencies are regulated by SEBI under SEBI (Credit Rating Agencies) Regulations, 1999 of the Securities and Exchange Board of India Act, 1992. Presently, we have seven domestic rating agencies

- Acuite Rating and Research

- Brickwork Ratings

- CARE Ratings

- CRISIL Ratings

- ICRA

- India Ratings and Research

- Infomercial Valuation and Rating

- Credit Rating of Individual Persons are maintained by Credit Information Companies (CIC) such as Equifax, CIBIL TransUnion etc.

Side Note: Gilt Edged vs Junk Bond

1. Junk Bond

- Junk Bonds are also known as High Yield Bond.

- If a company has a low rating like C& D issue bonds, nobody will invest in them because they are insecure.

- They offer a high-interest rate like 15-17% to seduce investors.

2. Gilt Edged Bond

- Gilt Edged Bonds are issued by companies and countries with high credit ratings.

- These bonds are highly secure.

- They offer very low interest, like 1 to 4%

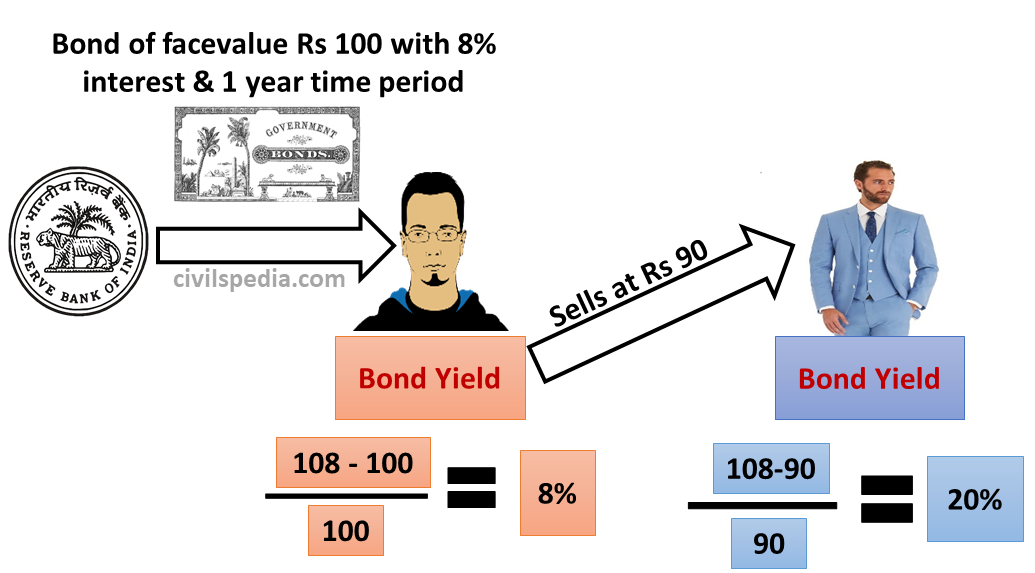

Side Topic: Bond Yield

Bond Yields, in essence, shows the financial return the owner of the bond is going to get from the bond at any given time. The simplest version of yield is calculated in the following manner:

If the bond price remains constant (i.e., equal to the face value), then the yield of the bond is the same as the interest rate. But the Bond prices seldom remain constant and are subject to change.

Bond Yield is the profit percentage that an investor is earning from the given bond. It is calculated by dividing interest earned by the investor with the Par Value of Bond for that investor.

Bond Yield increases in two cases

- During Boom Period: In this period, the investor is interested in investing his money in companies likely to grow faster and sell his existing bonds even at a lesser value to invest his money in growing companies.

- When the country’s economy is about to collapse, investors try to sell it at lower rates before sovereign default and get whatever they can. The implication is that when the government issues new shares, the government has to offer very high interest (greater than the Bond Yield of earlier floating bonds) to attract investors toward new bonds.

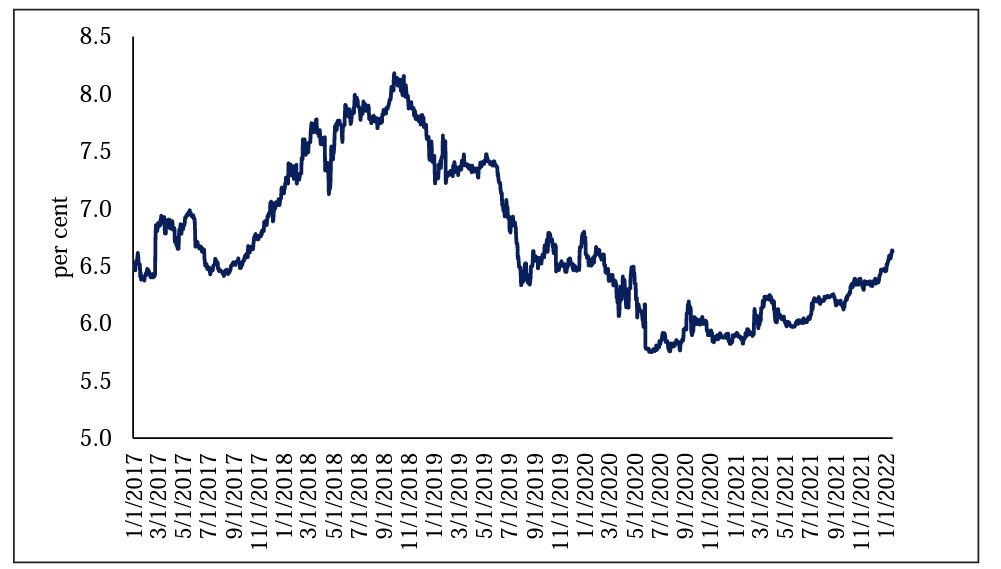

Bond Yield on G-Secs

- The yields on 10-year G-sec, which had reached 8.2 per cent on 26th September 2018, reduced substantially to reach 5.75 per cent in June 2020. It has since then increased to stand at 6.45 per cent as of 31st December 2021.

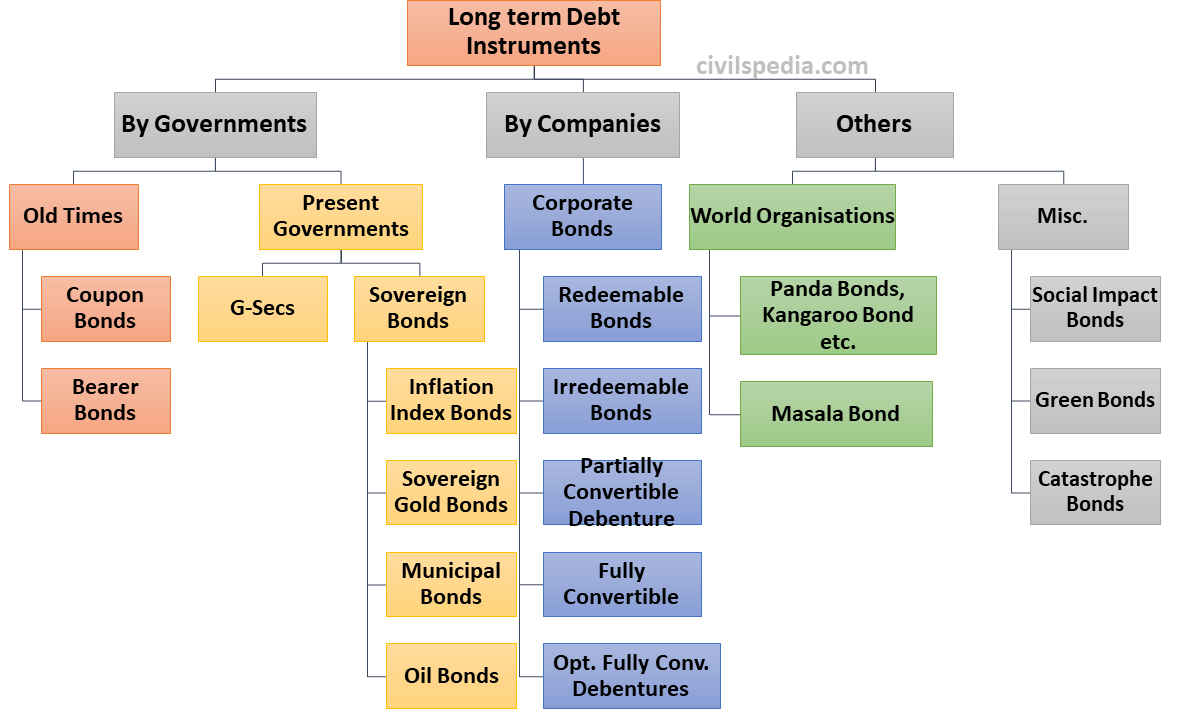

#2: Long Term Debt Instruments

- Long Term Debt Instruments have a period of maturity greater than 1 year.

- They are sold in called Capital Market.

Types

2.1 Long-Term Debt Instruments issued by Governments

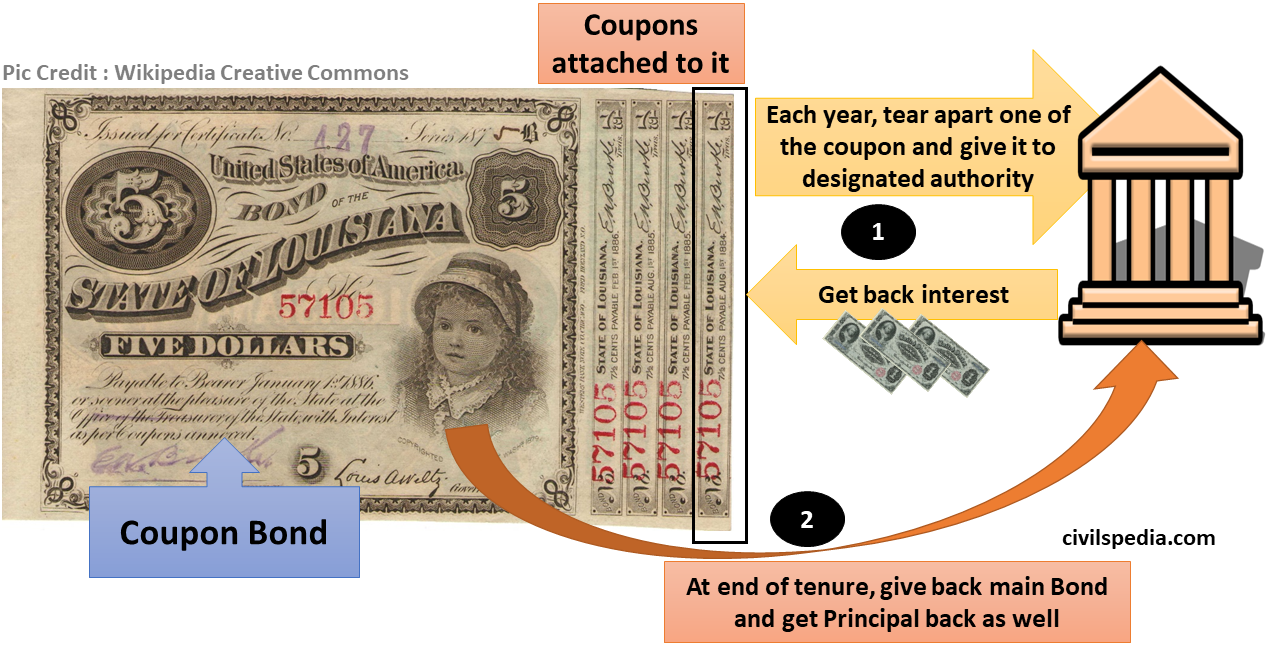

2.1.1 Coupon Bonds

- Coupons bonds are bonds issued by the government with Coupons attached to them. The person who has bought the Coupon Bond can get interest each year by tearing the coupon from the bond and giving it to the designated authority. The person will get his initial amount back by giving back Coupon Bond at the maturity period.

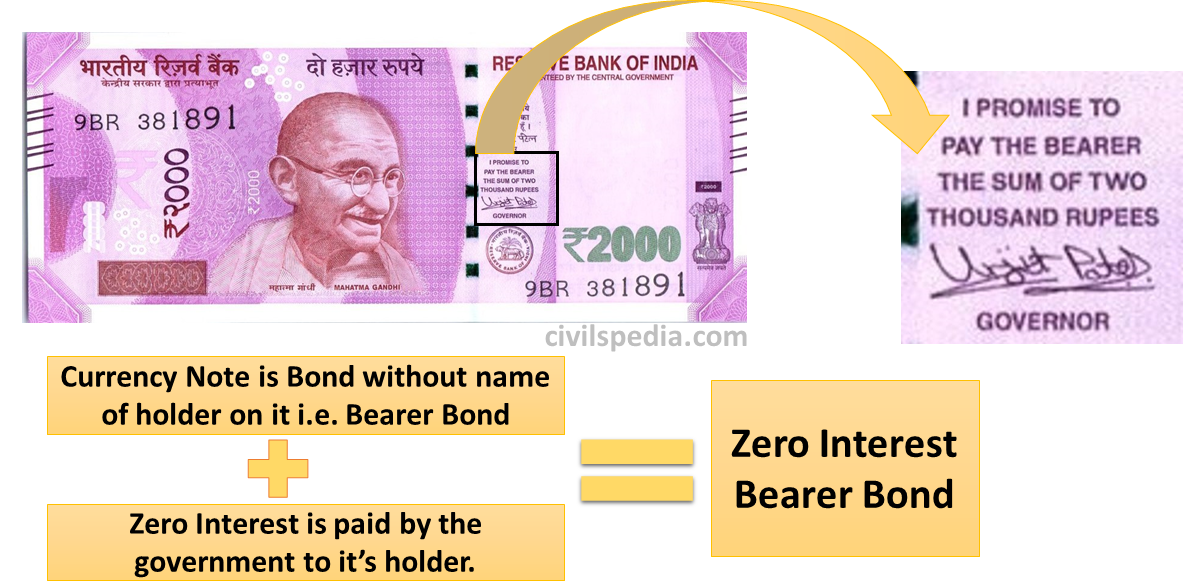

2.1.2 Bearer Bonds

- They are regular bonds, but they don’t have the holder name.

- Nobody can keep a record of them because no name is written on them. Hence, it can be easily used in money laundering and illegal activities.

Why do Governments issue bearer bonds?

- When the Government is in dire need of money like at the time of war, they can’t go in a lengthy procedure of checking the credentials.

Note: Currency is Zero Interest Bearer Bond.

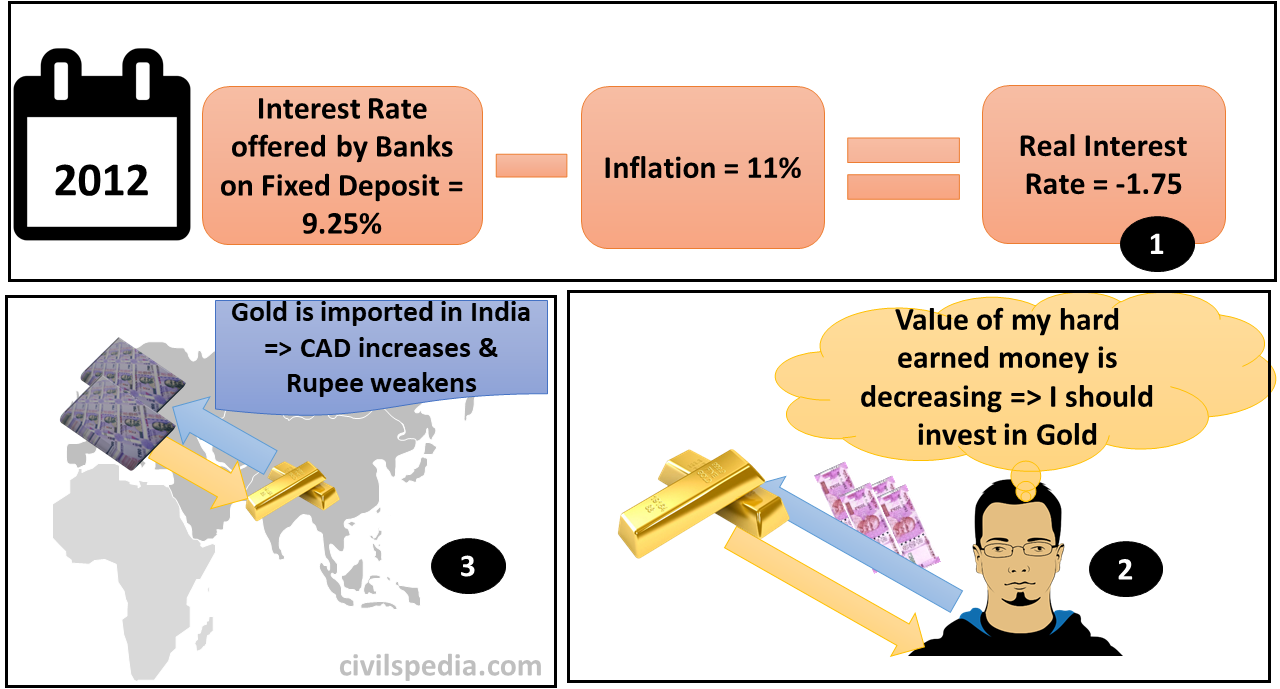

2.1.3 Inflation Index Bonds

- If interest offered by the bond is less than the inflation, a person who has invested in these bonds will lose his money’s purchasing power. Hence, in these situations, people start to invest in Gold to preserve the purchasing power of their hard-earned cash, thereby increasing the Current Account Deficit and weakening the rupee further.

- To deal with such situations, the Government of India came up with Inflation Index Bonds in 1997, 2013 and 2018 to provide positive real interest rates to households, thereby reducing Gold consumption.

- Inflation-indexed bonds provide returns that are always in excess of inflation, ensuring that price rise does not erode the value of savings.

- In Inflation Index Bonds, Interest Rate is relative to the inflation in the economy. Eg : CPI + 1.5% or WPI + 2.0% .

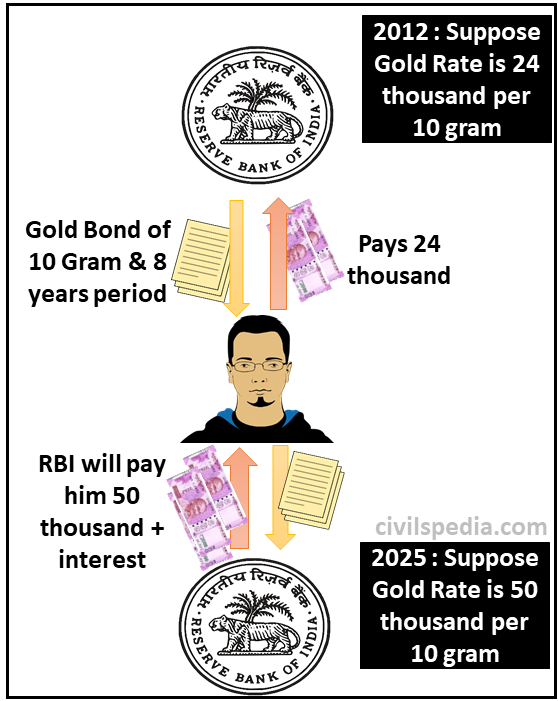

2.1.4 Sovereign Gold Bond

- RBI issues Sovereign Gold Bonds on behalf of the government to deal with the problem of gold imports in India.

- These bonds are denominated in Gold Grams, and apart from that, the interest of 2.5 to 2.75% is also given. At the end of the tenure of a bond, the person gets an amount equivalent to prevailing gold prices at that time, along with interest.

2.1.5 Municipal Bond

- Municipal Bonds are issued by Municipal Corporations.

- In India, Bangalore Municipal Corporation was the first to launch Municipal Bond in 1997. Other Municipal Corporations like Ahmedabad, Surat, Pune, Indore, Lucknow, Vadodara etc., have also used this route.

- Municipalities are permitted to raise up to ₹10,000 crores via Municipal Bonds.

- The urban local bodies (ULBs) are encouraged to tap the bond market under the AMRUT scheme.

Need of Municipal Bonds

- Smart Cities & Municipal Bonds: To build smart cities, we need a huge capital, which can be raised via Municipal Bonds.

- Financial Crunch of Urban Local Bodies (ULBs): ULBs need to gather huge funds from all available sources to improve the conditions of urban infrastructure. Municipal bonds are a good option.

- Committee on urban infrastructure headed by Isher Judge Ahluwalia (2011) had estimated that Indian cities would need to invest around ₹ 40 trillion at constant prices in the two decades till 2031 in urban infrastructure.

- 14th Finance Commission & Niti Aayog’s 3-Year Agenda also recognise the role of Municipal Bonds in building Urban Infrastructure.

- Financial discipline: Raising money from capital markets incentivises municipal corporations to fund new projects and encourages them to become financially disciplined and governance oriented

Challenges

- Municipal Bonds are not time tested, and it won’t be easy to attract investors.

- It can also be a source of inequalities because the better rated municipal corporations would corner most of the investment, crowding out the investment for the already infrastructurally backward cities.

- PFRDA classifies municipal bonds as Class C instruments instead of Class G (Government securities), making them compete with other Class C instruments having higher yields, thus making municipal bonds unattractive.

- Most of the Municipalities under Smart City Projects are below BBB- ratings on S&P which means below investment grade.

- It will be a challenge to use the capital raised via Municipal Bonds. ULBs can’t absorb huge funds.

- No tax benefits: Unlike many Western countries, there are no special tax benefits.

The way forward: Denmark has an agency to protect bondholders if one city in the pool defaults. The Indian government can look into the feasibility of this to instil confidence in the minds of investors.

2.1.6 Consol Bonds

- Consol Bond is the short form used for ‘Consolidated Bond‘.

- Features of Consol Bond

- It doesn’t have any maturity date.

- It has an annual interest rate of 4-5% for perpetuity (but will not return principal).

- However, the government can buy back the bond when it has sufficient money.

- It was in the news because during the Covid pandemic, economists argued for issuing such bonds to revive the economy.

2.1.7 Oil Bonds

Before 2010 for petrol and 2014 for diesel, the government forced the oil marketing companies to sell oil at subsidised rates. Instead of paying the oil companies for their losses, the government issued them oil bonds to contain the fiscal deficit.

Features of Oil Bonds

- These Oil Bonds were Long Term (15 -20 years) Government Securities.

- They weren’t considered while calculating Fiscal Deficit, but they were part of Public Debt.

- They aren’t considered in the SLR requirements of Banks.

2.2 Long-Term Debt Instruments issued by Companies

They are of various types

2.2.1 Redeemable Bonds

- The company will pay regular interest and return the principal on maturity.

2.2.2 Irredeemable Bonds

- The company will pay only interest, but the principal is not returned.

2.2.3 Partially Convertible Debenture

- The company will pay interest, but at the time of maturity, some portion of the bonds will be converted to shares, and on the rest, the principal will be repaid.

- Eg : 70% Debenture + 30% Share .

2.2.4 Fully Convertible

- The company will pay interest, but at maturity, bonds will be converted to shares (and the principal is not paid).

2.2.5 Optionally Fully Convertible Debentures

- The company will pay interest, but at the time of maturity, the company can give the investor an option to convert his bonds/ debentures to shares (just an option that the investor can accept or reject). But the ‘rate’, will be decided by the company (i.e., how many shares against how many debentures).

2.3 Long Term Debt Instruments issued by World Bank

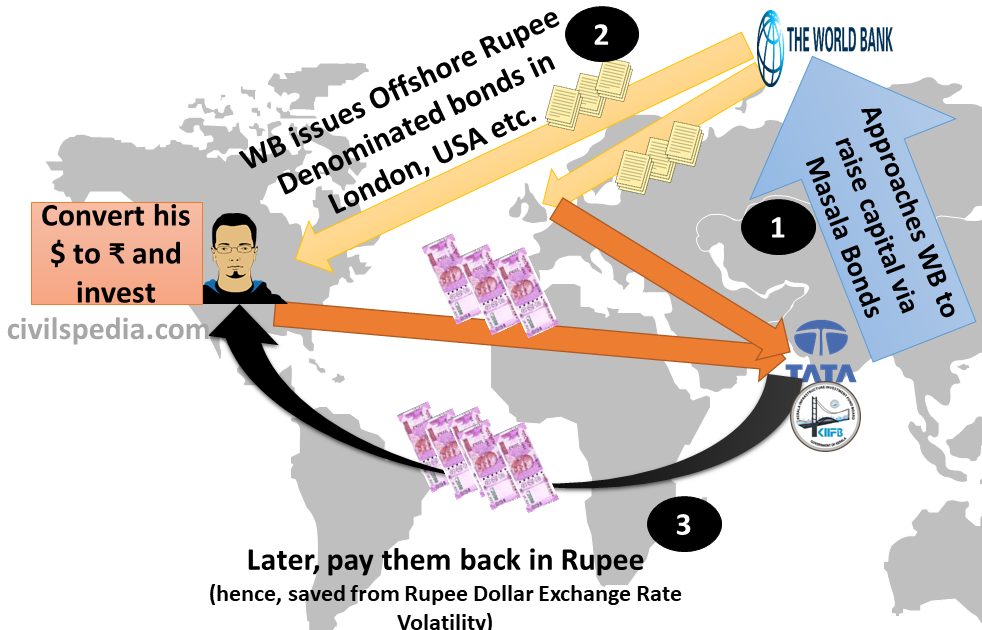

International Finance Corporation (IFC) (organ of World Bank) helps in raising offshore capital via various types of Offshore Bonds called Panda Bonds (for China), Kangaroo Bonds (for Australia) and Masala & Maharaja Bonds (for India).

2.3.1 Masala Bond

- These are offshore ₹ denominated bonds.

- They are known as Masala Bonds because India is famous for Spices (Formosa Bonds for Taiwan, Samba Bonds for Brazil, Samurai Bond for Japan).

- They are called ‘Offshore‘ because they are floated in London and other foreign Exchanges.

- ‘₹ denominated’ because they are sold & bought in ₹ (& not $).

- Benefits of Masala Bond

- They help in fighting local currency volatility. The investor must bear the currency volatility in Masala Bonds because they buy these bonds in Rupee and later get back their principal and interest in Rupee.

- Interest Rate is also low because they are issued by World Bank (IFC) and not the company itself. Hence, they are very secure (Aaa rated) because in case the company refuses to pay, World Bank will pay on its behalf.

- The move to permit Masala bonds is an attempt to increase the international status of ₹ and is also a step toward full currency convertibility.

Recent activities in Masala Bonds

- Indian Railway Finance Corporation (IRFC) has raised $ 1 billion via Masala Bonds.

- NHAI raised capital via Masala Bonds to fund their highway projects.

- Kerala Government’s Kerala Infrastructure Investment Fund Board raised capital via Masala Bonds, becoming the first state.

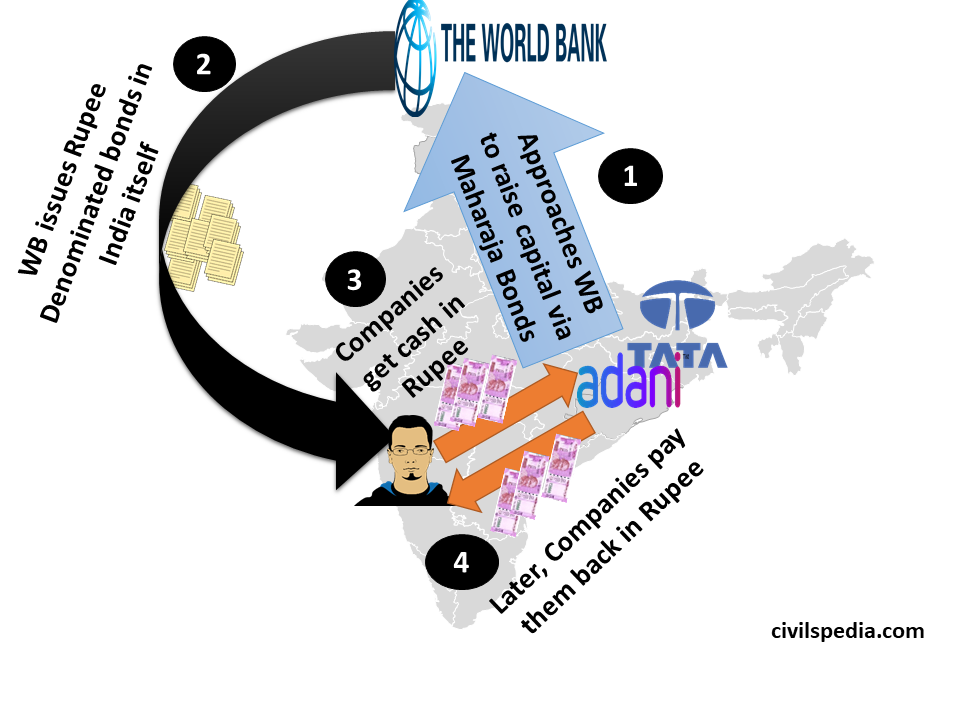

2.3.2 Maharaja Bonds

- Rupee Denominated Bond issued in India by World Bank’s IFC.

- Maharaja Bonds are the same as Masala Bond, but these bonds are issued in India.

- They are also ‘Aaa’ rated, so interest rates are very low.

Side Topic: Formosa Bonds

- Formosa bonds are bonds issued in Taiwan and denominated in currencies other than the Taiwanese Dollar.

- Formosa bonds are issued by foreign companies in Taiwan.

- In 2022, SBI has raised $300 million from Taiwan in the form of Formosa Bonds.

Appendix: Offshore Bonds

| Currency of Bond | Issued in which country | Who issues? | |

| Masala Bond | Rupee denominated | Outside India | Indian Companies and IFC |

| Maharaja Bond | Rupee denominated | Inside India | IFC |

| Uridashi Masala Bond | Rupee denominated | Japan | Indian Companies |

| Panda Bond | Yuan denominated | China | Foreign Companies |

| Dim Sum Bond | Yuan denominated | Hong Kong | Foreign Companies |

| Samurai Bond | Yen denominated | Japan | Foreign Companies |

| Yankee Bond | Dollar denominated | USA | Foreign Companies |

| Formosa Bond | Denominated in currencies other than Taiwanese Dollar | Taiwan | Foreign Companies |

2.4 Miscellaneous Type of Long Debt Instruments

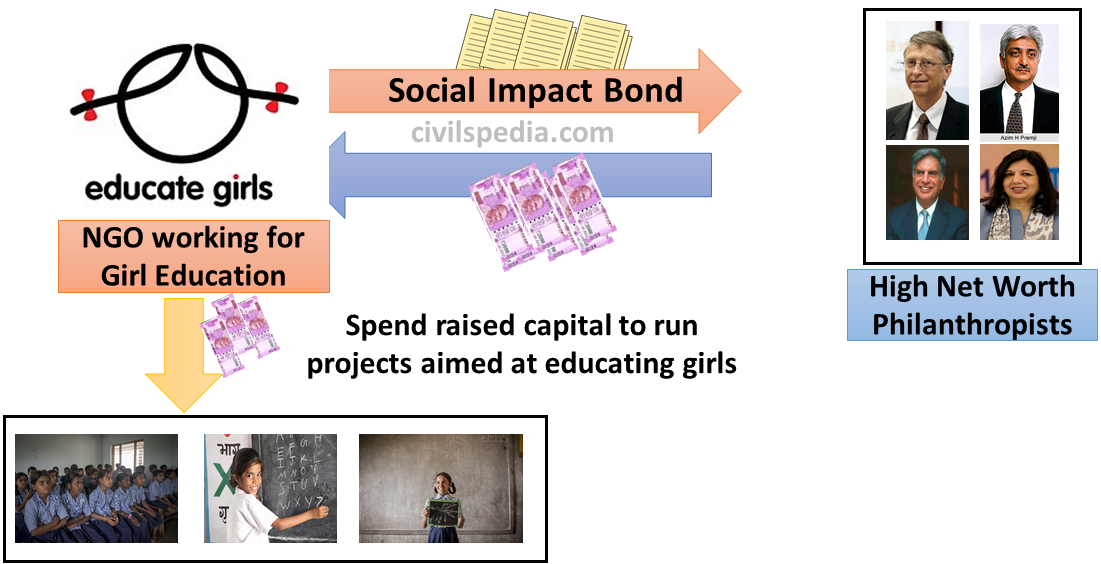

2.4.1 Social Impact Bond

- Social Impact Bonds are offered to High Net worth Individuals (HNI) interested in doing philanthropic works like Bill Gates, Premji, Ratan Tata etc. Although interest offered on these Bonds is lower than general bonds, they aim to do social welfare.

- E.g. :

- NGO named Educate Girls issued Social Development Bonds to raise money to educate girls in India.

- SIDBI issued Women’s Livelihood Bonds to invest in projects targeted at improving the livelihood of women.

- In 2021, Pimpri Chinchwad Municipal Corporation signed MoU with UNDP to launch Social Impact Bond to raise capital to improve residents’ healthcare services.

2.4.2 Green Bonds

- The green bond is a type of long term bond, but the issuer of a green bond publicly states that capital is being raised to fund ‘green’ (environment friendly) projects, like renewable energy, clean transportation etc. There is no standard definition of green bonds as of now.

- Examples of Green Bonds

- World’s first Green Bond was launched by World Bank (2007).

- India’s first Green Bond was launched by Yes Bank (2015).

- Indian Renewable Energy Development Agency (IREDA) launched India’s first Masala Green Bond at London Stock Exchange (2018).

- CLP India (Wind Energy Company) was the first Indian company to tap this route.

- In 2022, Indian government announced that it is planning to launch Sovereign Green Bonds.

- India became the seventh-largest green bond market in the world in 2017.

Side Topic: Blue Bonds

- The concept of Blue Bonds is the same as Green Bonds.

- The issuer publicly states that capital is being raised to fund climate-resilient water conservation or marine protection projects.

- Seychelles (a small island nation in the Indian Ocean) issued the world’s first Blue Bond in 2018 for marine protection and sustainable fishery projects.

2.4.3 Catastrophe Bond

- Catastrophe Bonds are high-yield bonds issued by Insurance Companies. Their interest can be as high as 18%, but if a natural disaster happens, then the principal is returned (although if a natural disaster doesn’t occur within the tenure of bond, the principal is returned).

- They are frequently issued in developed western countries.

- Suggestion: Indian Insurance Companies can also use this.

Equity

- The basic concept behind equity: You borrow money from someone & in return, you offer a partnership.

- Equity holders are called owners/ proprietors of the company.

- Equity holders are given dividends in case the company earns a profit. But they have the last claim during the liquidation of the company.

Types of Equity /Shares

There are two types of shares

1. Ordinary shares

- They are the most common type of Shares.

- Ordinary shareholders have voting power in shareholders’ meetings, and they have the last claim during liquidation.

2. Preference shares

- Although retail investors are also eligible, they are generally issued to banks by companies.

- Preference is given to them in the following things.

- Holders of Preference Shares are given dividends even if equity shareholders are not.

- When a company is to be closed, preference shareholders are given money first from the proceeds of sales of the company’s assets.

- They may have enhanced voting rights such as the ability to veto mergers or acquisitions or the right to the first refusal when new shares are issued.

Order of Claim

Bond (Debenture) > Preferential share > Ordinary Share

Terminology in Shares

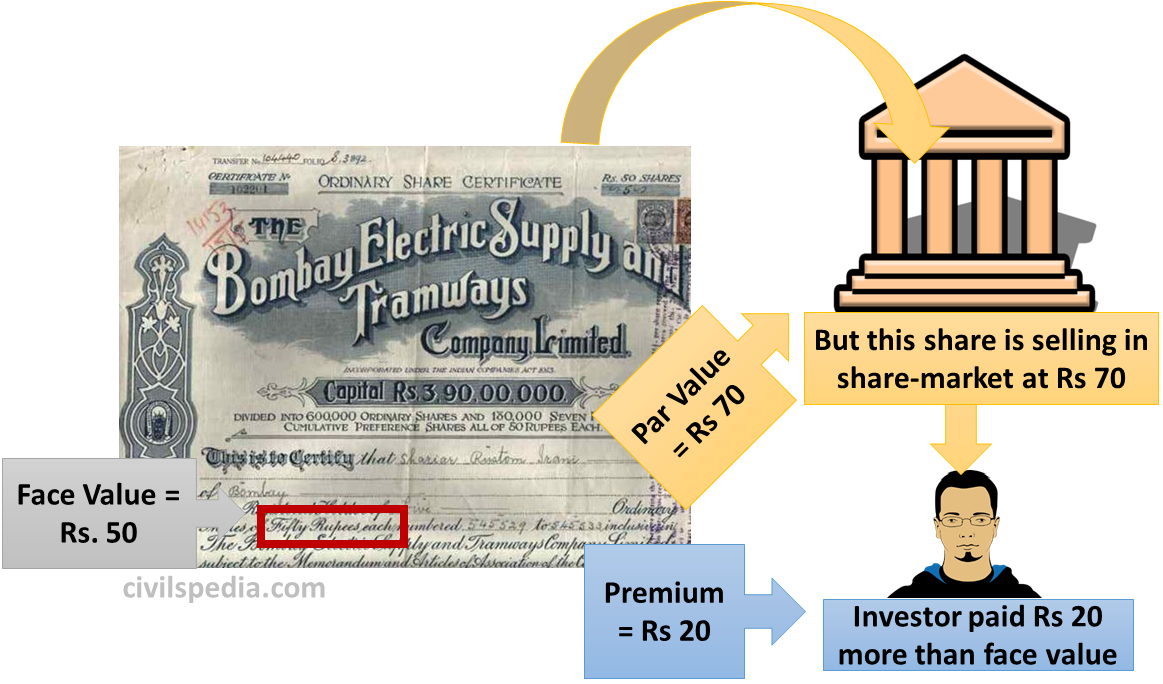

1. Face Value

- Face Value is the value of the share written on the share itself.

- It can be any integer – 1, 2, 3 ___25, 50, 100 (But can’t be decimal like 1.50) .

- Condition: When IPO is issued, the company cannot sell Share below its Face Value.

2. Par Value

- Par Value is the market-determined value of the share.

- When IPO is launched, Par Value can’t be lower than Face Value. After that, the Par value is decided by the market forces. It can be lower or greater than face value.

3. Premium

- If the company is doing well, a person can think that he can get a big dividend when the dividend is announced. So he can buy those shares from the Share Market at a greater price than its Face Value.

- The value above Face Value is called Premium. For example, if the above share having a face value of ₹50 is selling at ₹ 70, its Premium is ₹ 20.

Digital Shares

Problems with Paper Shares

- Delivery Problem

- Fear of Theft

- Transfer delays leading to speculations

Demat Account

- Demat Account is the short form for Dematerialised Account.

- This system was started in the mid-1990s.

- Earlier, when investors bought shares, they got a certificate.

- But now, the shares are electronically transferred to the investor’s account, known as the Demat account.

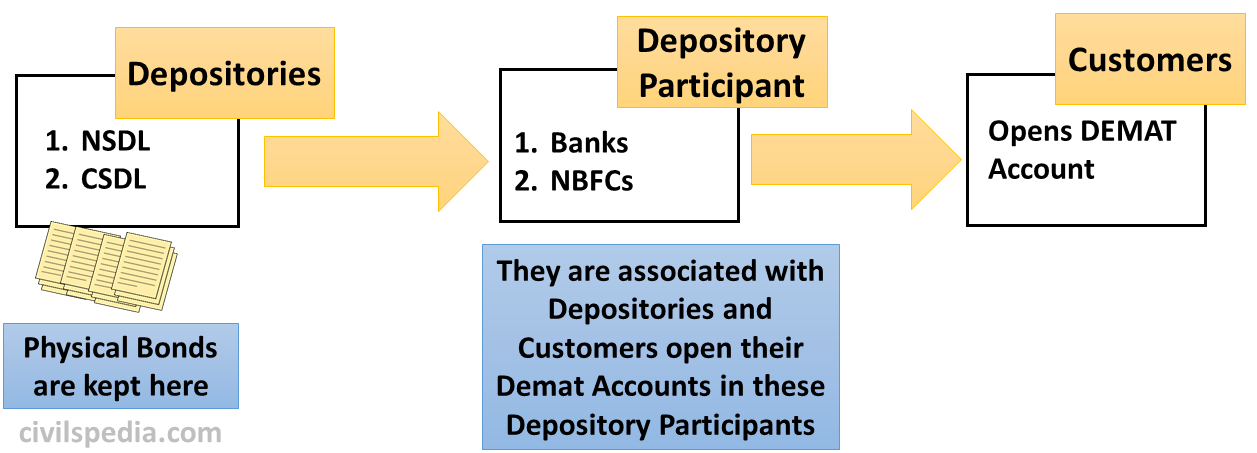

Depositories

- It is like a bank locker where securities are held in physical form.

- In India, there are two depositories

- National Securities Depository Limited (NSDL)

- Central Depository Service Limited (CDSL)

Depository Participant (DP)

- Depository Participants are the agents of depositories acting as an intermediary between the depository and the investors.

- The customer must open a “Demat” account in a depository-partner (DP) which can be a bank or an NBFC.

- E.g., ICICI, HDFC, SBI etc.

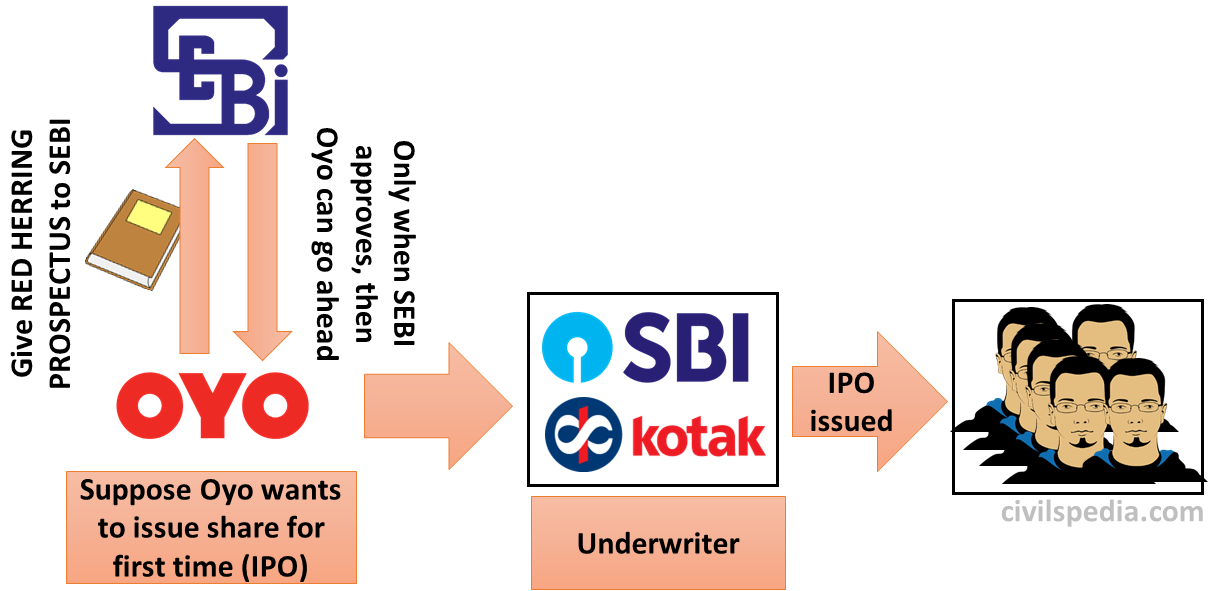

IPO (Initial Public Offer)

When a company sell the shares for the first time to the public, it is called IPO.

Red Herring Prospectus

- Before the company launches its IPO to get capital via equity finance, the company has to give Red Herring Prospectus mentioning all the information about their promoters, business plan, address etc. (all details except on which date IPO would be launched & what would be the price of IPO).

- Only when SEBI approves they have the permission to go ahead.

Underwriter

- Underwriters are the companies who do lengthy legal work & accounting before launching IPO that require CA, Corporate Lawyers etc. They charge a commission for providing these services.

- E.g.: Mahindra, ICICI etc.

How price of an IPO would be fixed?

Two methods

Method 1: Fixed Pricing Method

- Suppose the company announces face value and premium in advance. Eg

- Face value = ₹ 10

- Premium = ₹15

- Final Price = ₹25

- 1 lakh such shares will be issued

- Hence, it would be announced that ₹25 Lakh IPO would be launched in the market.

Method 2: Book Building Method

- Suppose the application for 1 Lakh shares are invited, and investors are asked to send applications at which price they want to get these shares. E.g.,

| Quoted price of share | Number of Applications received |

| ₹ 500 X | 10,000 |

| ₹200 X | 50,000 |

| ₹ 125 X | 40,000 |

| ₹100X | 500 |

| And so on |

- In the above example, at ₹125, all 1 Lakh shares have been booked. Hence, the face value of each share will be fixed at ₹125, and all shares will be sold at Rs 125 per share.

- Hence, all the shares are sold at face value in this case.

Follow-up Public Offer (FPO)

- If the company has already issued shares previously and now issuing more shares to obtain more capital, it is called Follow-up Public Offer.

- It is obligatory for the company that it can offer FPO only to the existing shareholders of the company, known as the Rights issue of share.

- If the company doesn’t want the rights issue of a share, the company will have to hold a general meeting of shareholders & pass a resolution about it.

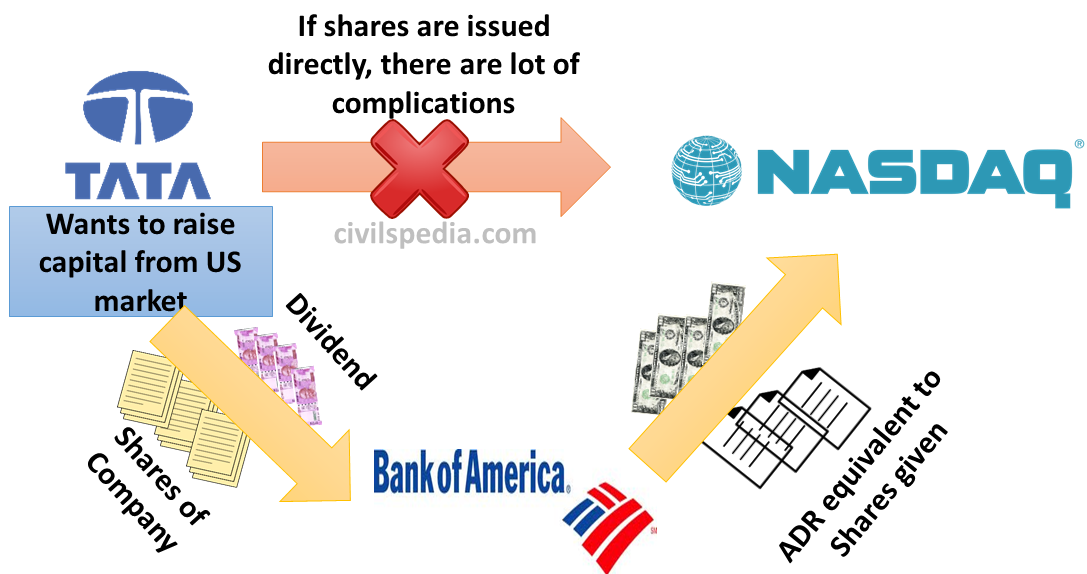

American Depository Receipts(ADR) & Bharat Depository Receipts

1. American Depository Receipts (ADR)

- If Indian Company wants to issue their shares in the USA, they can’t do it directly as they will have to register in the USA and comply with other domestic regulations.

- Hence, to simplify the matters, the Indian Company can sell its shares to American Intermediary (e.g. Bank of America). The Bank can issue an equivalent amount of American Depository Receipts, which Americans can buy from US Stock Exchanges.

- When an Indian Company issues a dividend, they will give that to American Intermediary, and American Intermediary will distribute it to ADR Holders.

2. Global Depository Receipts (GDR)

- GDR is same as ADR for European Union countries.

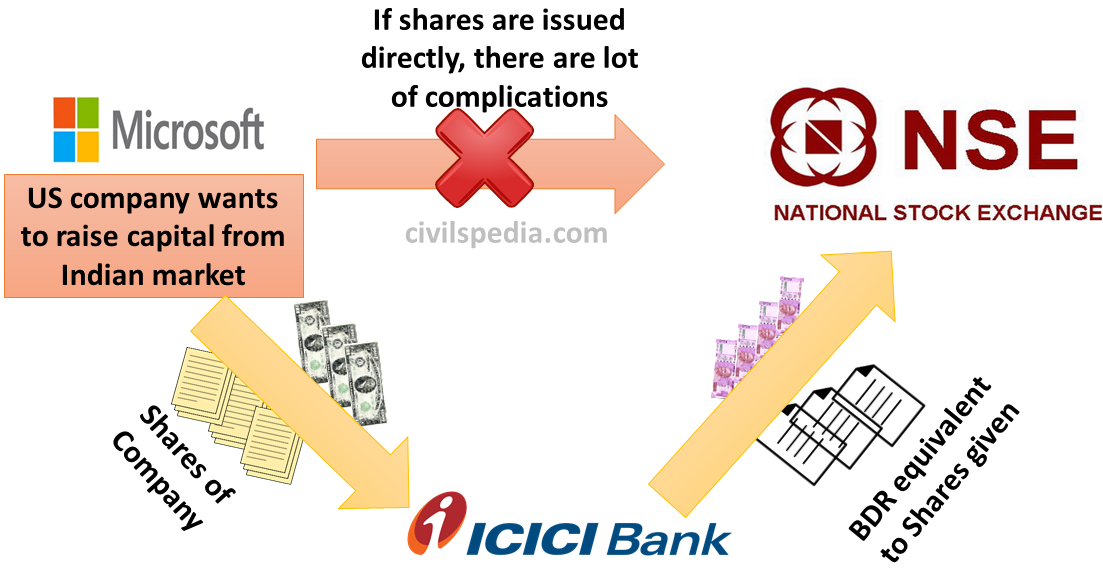

3. Bharat Depository Receipts (BDR)

- BDR is opposite to ADR.

- It is used when foreign companies want to issue shares in India.

Other Terms associated with Shares

1. Share Buyback

- Share Buyback is the process when corporations repurchase the stock it has issued.

- It reduces the number of shares outstanding, giving each of the remaining shareholders a larger percentage of the company’s ownership.

- Buyback prices are more than market prices.

- According to the legal provisions, companies can buy back with reserves but can’t borrow to buyback.

- Share Buyback has been allowed in India since 1998.

- Reasons for buyback

- When companies have significant retained earnings, they don’t issue big dividends because a large amount of money will be wasted in tax. They generally use that money to buy back shares.

- If management is optimistic about the future & believe that the current share price is undervalued.

- Putting unused cash into use.

- Raising earnings per share.

- Reducing the number of shareholders to reduce the cost of servicing them.

2. Employee Stock Option Plan (ESOP)

- The company gives shares to employees at a discounted rate so that employees become more committed to the company’s success (if the company makes more profit, you make more profit). Employees can sell these shares at a later date depending on the company’s share buyback policy.

- Economic Survey (2020) has suggested that the government give ESOP to public sector banks’ employees to improve their performance.

3. Sweet Equity

- If Company sells its shares to directors, employees etc. at a discount for their value addition like IPR & know-how.

4. Penny Stocks and Blue Chip Stocks

| Penny Stock | Penny Stock are the shares whose market price remains excessively low compared to their face value. Such pathetic companies give zero or little dividends. |

| Blue Chip Stock | Blue Chip Stock are the shares of a nationally recognized, well-established and financially sound company with a history of generating good dividends whose market price is very high than its face value. |

5. Share Pledging

- When a company raises a loan from the Bank or NBFC by pledging its shares as collateral.

6. Bull and Bear Investors

There are two types of investors

| Bull Investors | – Bulls represent charging. – An optimistic speculator who purchases a particular share hoping that share prices will rise (to sell them later at a much higher price). |

| Bear Investors | – Bears represent hibernation. – A pessimistic speculator who fears that share prices will fall and sells his shares. |

7. Short Selling

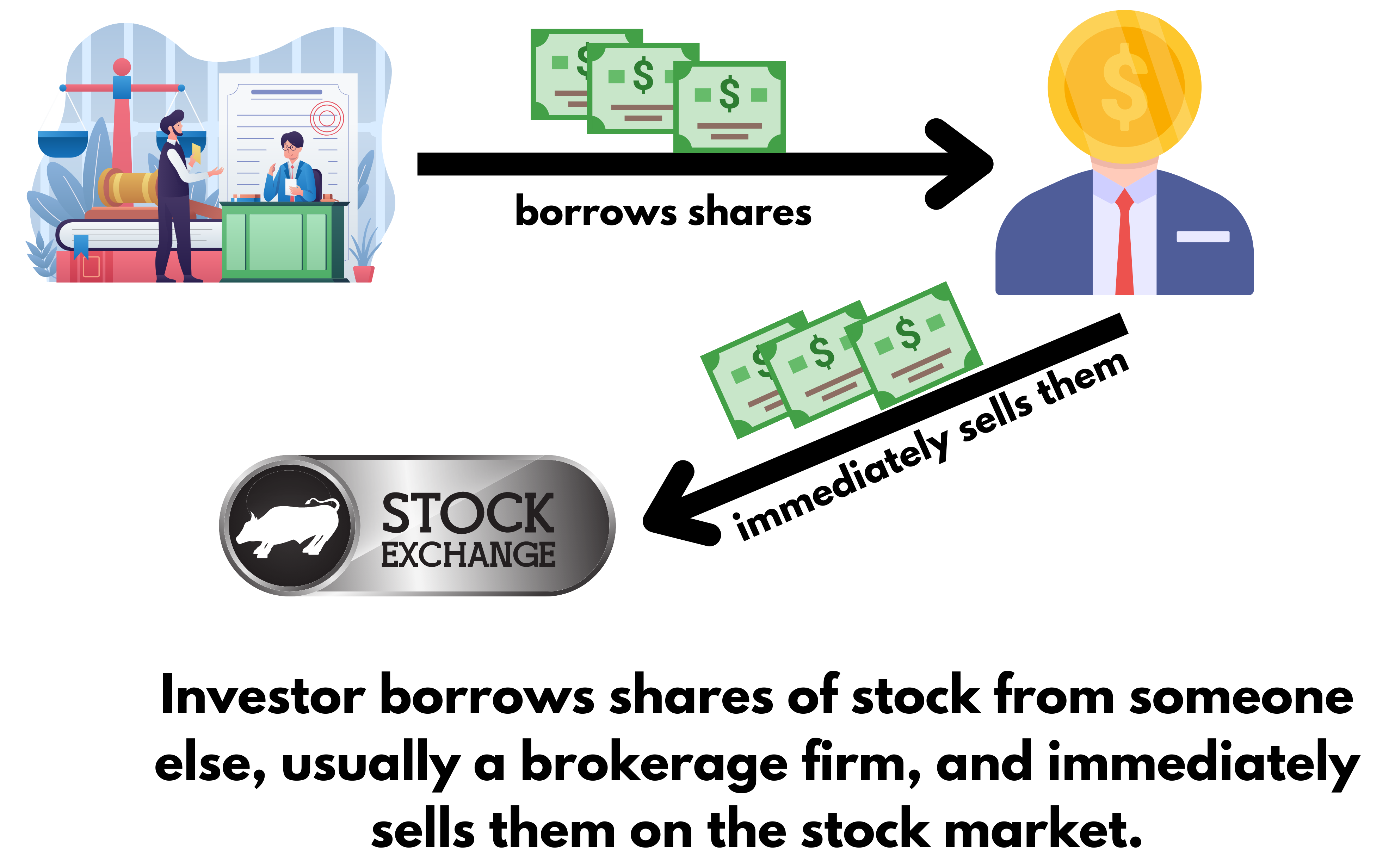

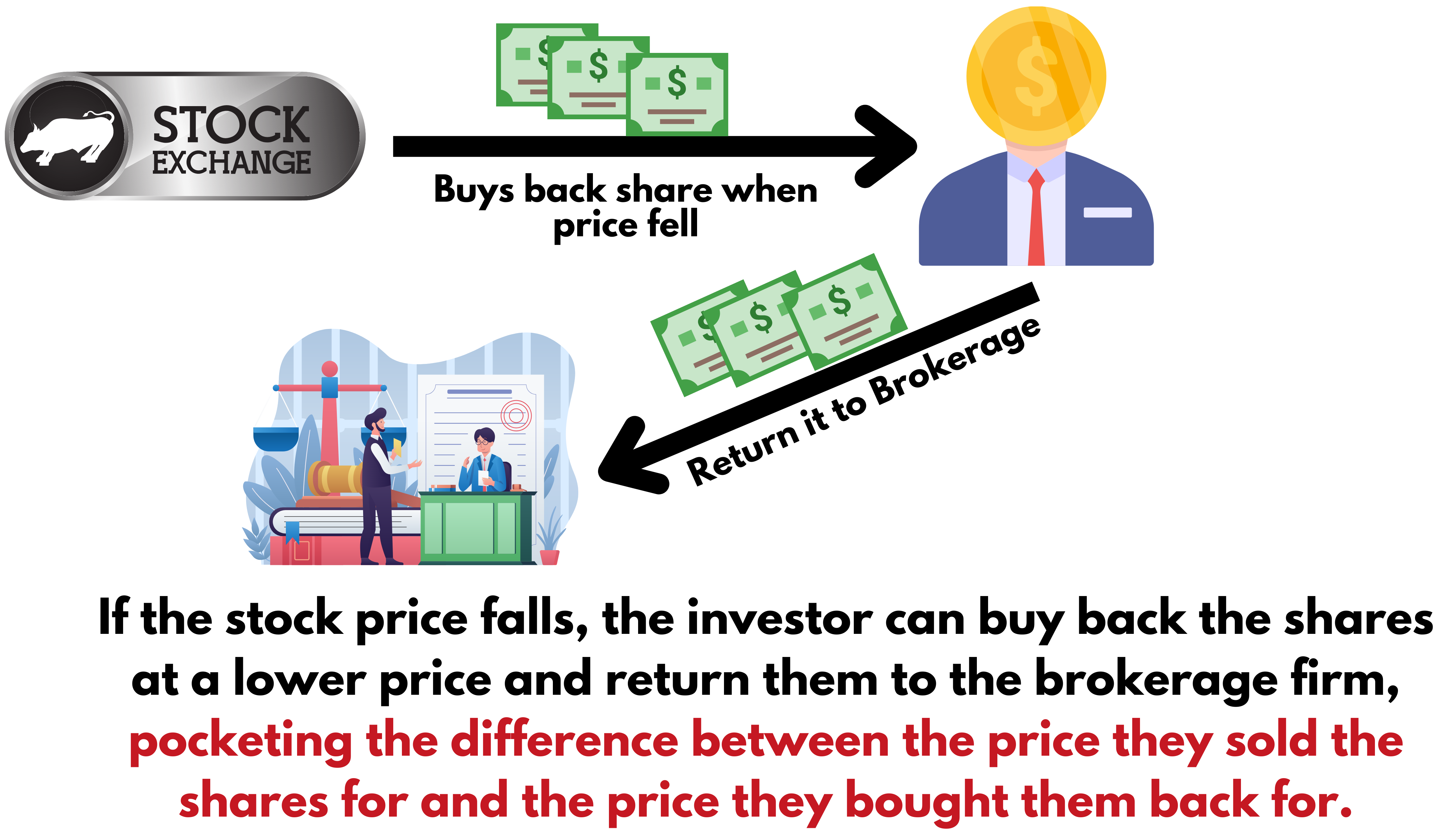

Short selling is a way to make money by betting that a company’s stock price will go down instead of up.

How it works?

Step 1

Step 2

The investor will experience a loss if the stock price increases, as he will have to pay more to repurchase their shares. Theoretically, this loss can be unlimited because there is no limit to the price of the stock. Hence, it is advisable to conduct proper research before involving in short selling.

Short selling was in news due to Hindenburg Adani issue.

Equity funding for Start-ups

1. Venture Capitalist

- The venture capitalist is a company that is willing to invest in projects that are risky but have a promising prospect. Venture Capital bridges the gap where traditional sources of funds cannot participate actively in funding new ventures.

- They deal only with big things- big projects & big investments.

- Venture capitalist companies arrange this money either by borrowing from companies like mutual funds, pension funds, or they may issue their bonds.

- They demand part in the company and seats in the company’s Board of Directors. Hence along with capital, Venture Capitalists also bring in smart advice, hands-on management support and other skills.

- The venture capital industry in India is still at a nascent stage. To promote innovation, enterprise and conversion of scientific technology and knowledge-based ideas into commercial production, it is essential to encourage venture capital activity in India.

- For decades, venture capitalists have nurtured the growth of America’s high technology and entrepreneurial communities. Companies such as Compaq, Sun Microsystems, Intel, Microsoft, and Genentech are famous examples of companies that received venture capital early in their development. Now, venture capitalists in India have a chance to do the same for Indian firms.

2. Angel Investors

- These are rich gentlemen who provide financial backing to entrepreneurs for starting their business’. Angel investors are usually found among an entrepreneur’s family and friends, but they may be from outside also. They can give debt or equity, but mostly they play in equity.

- They are focused on helping the business succeed rather than reaping a huge profit from their investment.

- What is the need for Angel Investors?

- You can take capital from Banks, IPO or venture capitalists if your business project is likely to make success based on previous experience.

- But if your idea is untested & new, nobody would be interested in financing you. E.g., Steve Jobs was funded by Angel Investor when he started Apple.

- In India, examples of Angel Investors include Ratan Tata, who invested in Urban Ladder, and TVM Pai, who invested in ZoomCar.

- Angel investors can be recognized as Category I Alternate Investment Fund (AIF).

3. Crowd Funding

- Crowd Funding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet.

- Various platforms like Grex, LetsVenture, etc., provide this service in India.

- This funding can be of various types.

- Equity-Based

- Debt Based

- Cause Based

- Reward-Based

- A large number of startups, software developers, filmmakers (e.g. Kannada movie Lucia), music festivals (e.g. Control ALT Delete) etc., have raised funds via this platform.

Debt vs Equity

Debt

| Pros | 1. Don’t have to share ownership. 2. Can claim an income tax deduction. 3. Less paperwork & permissions. |

| Cons | 1. Even if the company doesn’t make a profit, it has to pay interest. 2. Have to mortgage something to get a loan. |

Equity

| Pros | 1. No obligation to pay interest even if the company makes a profit. 2. Less tension compared to bank loans & debt. |

| Cons | 1. Have to share ownership. 2. Have to make the board of directors. 3. Require heavy paperwork & time to initiate IPO. |

Derivatives

There is another type of security as well, known as Derivatives. We will have just an overview of this as it is not that important from an examination point of view.

Question: What is derivative ?

- The financial instrument that derives its price from some underlying asset is known as Derivatives.

- The price of derivatives are directly dependent upon the underlying asset in the present & projected future trends, which can be equity, foreign exchange, commodity or mortgaged Backed securities etc.

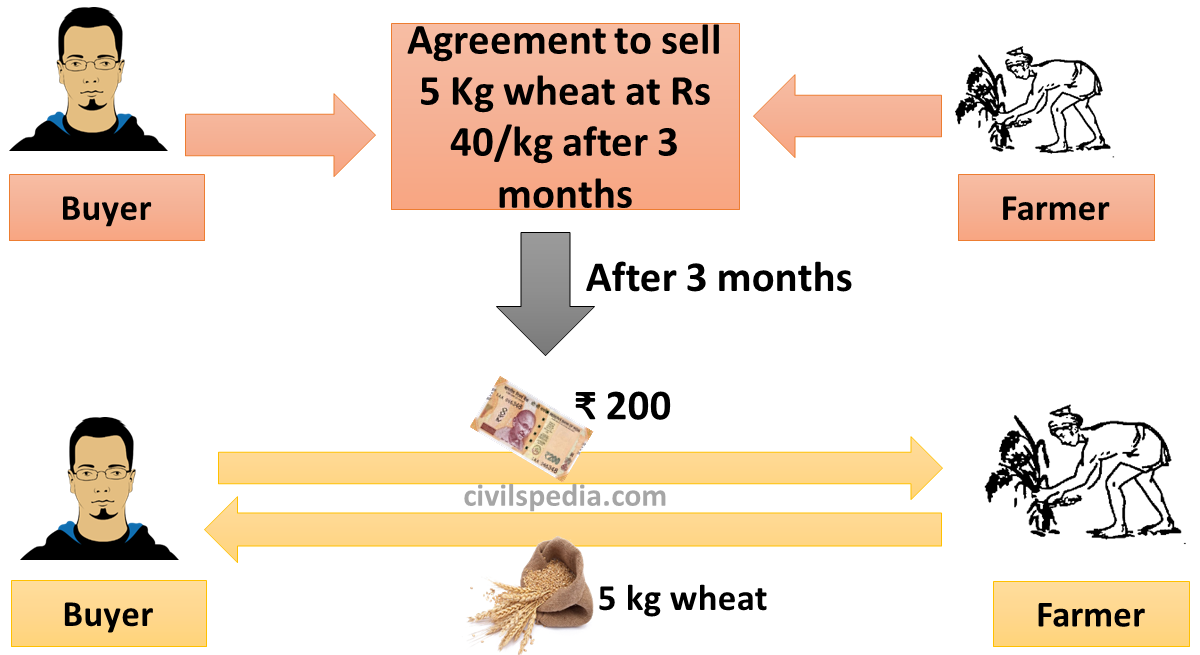

- For example, wheat farmers may wish to sell their harvest at a future date to eliminate the risk of a change in prices. Such a transaction is an example of a derivative. The price of this derivative is driven by the spot price of the underlying asset, i.e. wheat.

There are four types of Derivative contracts

1. Forward

- A Forward is a contract between two parties to buy or sell an asset at a specified future time at a price agreed on in the contract.

2. Future

- Future is a legally binding contract that obligates the parties to transact an asset at a predetermined date and price. Here, the buyer must purchase or seller must sell the underlying asset at the set price, regardless of the current market price.

- Future and forward are almost similar. But forward distinguishes itself from a future as it is traded between two parties directly without using an exchange.

3. Option

- If a person buys an option, it grants him the right but not the obligation to buy or sell an underlying asset at a set price.

4. Swap

- Swap refers to exchanging one financial instrument for another between the transacting parties concerned at a predetermined time.