Differential Banks

Last Updated: March 2023

This article deals with ‘Differential Banks (Payment Banks, Small Area Banks, Local Area Banks etc.).’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Differential Banks vs. Universal Banks

| Universal Banks | Differential Banks | |

| Branches | Universal Banks can open Branches anywhere. For example SBI, ICICI etc. | Differential Banks have geographical restrictions on branch opening for Local Area Bank (LAB), Regional Rural Banks (RRB) etc. |

| Money acceptance | Universal Banks can accept both Time & Demand Deposits of any amount can be accepted. | Restrictions are there. Eg: Payment Bank: Can accept the maximum amount of Rs 1 lakh only in deposit. |

| Give Loans to | Anyone | Restrictions are present. Eg: 1. Small Finance Bank, Regional Rural Bank: must give 75% to Priority Sector. 2. Payment Bank can’t give loans. |

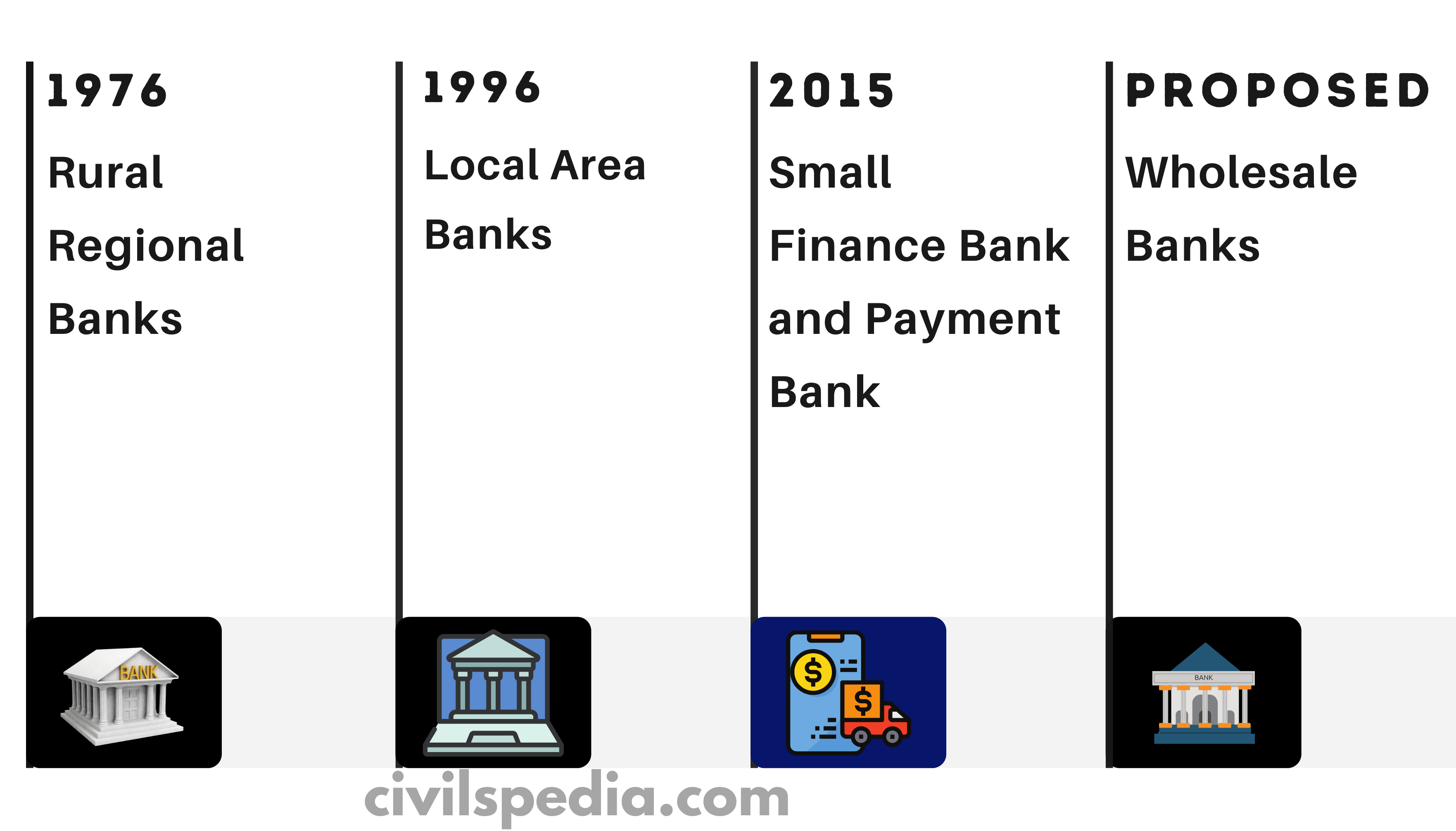

1. Regional Rural Banks (RRB)

Need of RRBs

- In 1975, the government appointed MM Narsimham Committee to look into rural banking.

- Observations of the Narsimham Committee were as follows:-

- The staff of the Banks has expertise in banking & financial matters but is not aware of rural people’s problems.

- Primary Agriculture Credit Societies (PACS) have members from villages & are aware of the needs and problems of the villagers.

- Recommendation: CREATE HYBRID OF BOTH, i.e. BANKS HAVING FINANCIAL STRENGTH OF COMMERCIAL BANKS & GRASSROOT PROBLEM AWARENESS OF COOPERATIVES. Hence, the concept of RRB came to being.

- As a result, Regional Rural Banks (RRBs) were first set up on 2 October 1975 (only 5 in numbers) under RRB Act.

Client of RRBs

RRB provide loan & saving facilities to villagers & they include

| Farmers | Rural Entrepreneurs |

| Agricultural Labourers | Cooperative societies |

| Rural Artisans | Primary Agricultural Credit Societies |

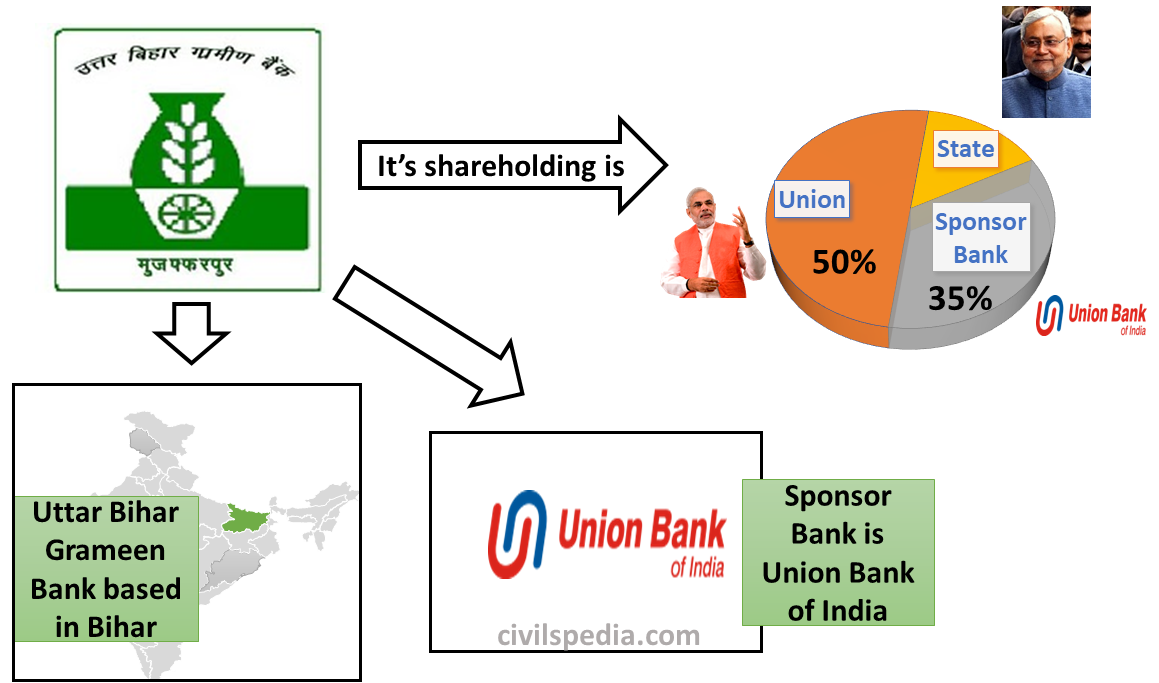

Structure

- RRBs are sponsored by Commercial Banks

- Sponsor Bank provides training to the staff of RRB.

- Sponsor Bank also provides initial capital to set up RRB.

- RRB operates in selective districts & doesn’t have all India presence.

- The provisions of Priority Sector Lending (PSL) are applicable to RRB (75% of loans should be PSL).

- According to the original RRB Act, paid up capital ( ownership) of RRBs was Central Government: State Government: Sponsor Bank = 50: 35: 15

Failure of RRBs

- Due to excessive lending towards social banking & catering to highly weaker sections, these banks started to incur huge losses by the early 1980s.

- Private & Public banks too started to operate in rural areas, which resulted in low deposits in RRBs. As a result, RRBs had to depend on NABARD for credit.

- Debt waivers to farmers & NPA also created a lot of problems.

Subsequently, following the suggestions of the Kelkar Committee, the government stopped opening new RRBs in 1987—by that time, their total number stood at 196.

Steps to revive

RRB Amendment Act, 2015

- Earlier shareholding requirements – Central : State : Sponsor Bank = 50:15:35 .

- After Amendment, Centre, State & Sponsor Bank’s cumulative shareholding can reduce up to 51%.

- In 2005, the amalgamation process of RRBs with their’ Parent Banks’ was initiated so these banks could become more viable (As of April 2020, there are only 53 RRBs ).

- Jan 2021: RBI enabled the RRBs to avail the benefits through the Liquidity Adjustment Facility (LAF).

- June 2021: RBI has allowed the RRBs to issue the Certificate of Deposits.

- The obligation of concessional loans has been abolished & RRBs have started to charge commercial interest rates on lending.

- Target client restrictions have been ended & RRBs can now serve anybody.

- Dr KC Chakrabarty Committee has recommended that CAR/CRAR for RRBs should also be 9% & to achieve this, the government should recapitalize RRBs.

Note – Recently launched Priority Sector Lending Certificates (PSLC) will help them because they do a lot of PSLs.

2. Local Area Banks (LAB)

- In 1996, Manmohan Singh (as Finance Minister) mooted to start Local Area Bank (LAB).

- They are licensed under Banking Regulation Act but not included in the 2nd Schedule of the RBI Act.

- The vision was to increase financial inclusion.

Conditions

- They can operate only in Rural & Semi-Urban Areas.

- LAB can operate in a maximum of 3 geographically contiguous districts.

- LAB can open only 1 branch in an Urban / District city.

- PSL norms apply to LABs as well. 40% of loans should go to Priority Sector.

- They are not Scheduled Commercial Banks because their names are not mentioned in RBI Act.

Problems with Local Area Banks

- MSME loans given by LABs aren’t covered under the Credit Guarantee Scheme of the Government.

- Farm loans aren’t covered under Interest Subvention Scheme.

- State/Central PSUs/Institutes don’t open accounts in them.

- Branch expansion is heavily restricted in rural & semi-urban areas.

- They can’t get loans from RBI at Bank Rate /MSF.

- They can’t get refinance from NABARD /SIDBI.

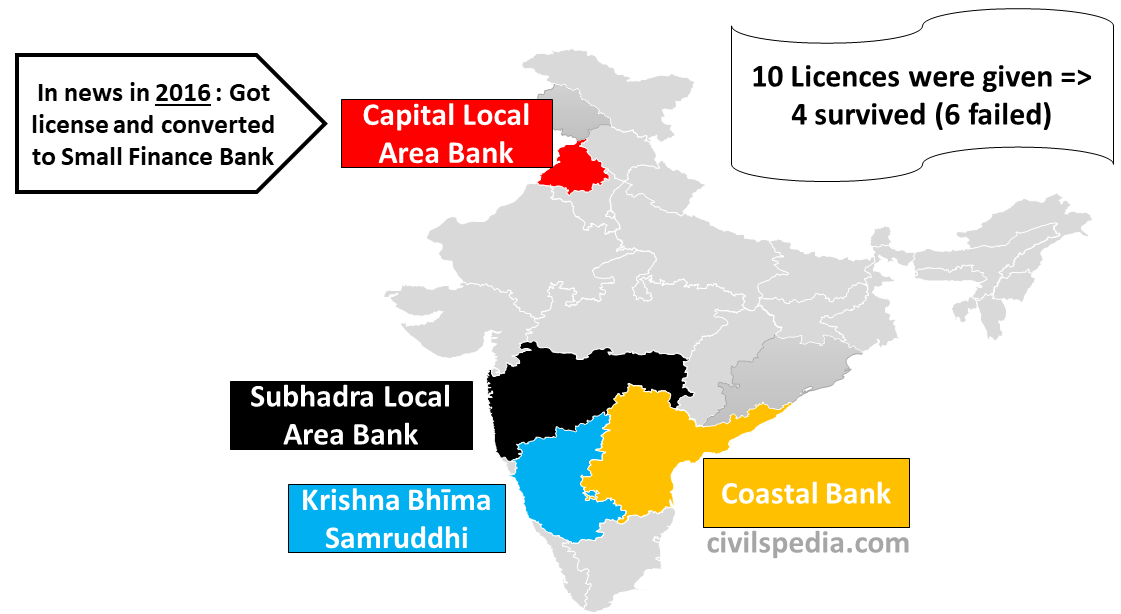

Operating Banks

- 10 Licenses were given at that time & only 4 are operating presently.

- LABs were in the news in 2016 when applications for Small Financial Banks were called. Usha Thorat Committee allowed them to apply for Small Finance Banks & one out of them, i.e. Capital Local Area Bank based in Punjab got the license to open Small Finance Bank

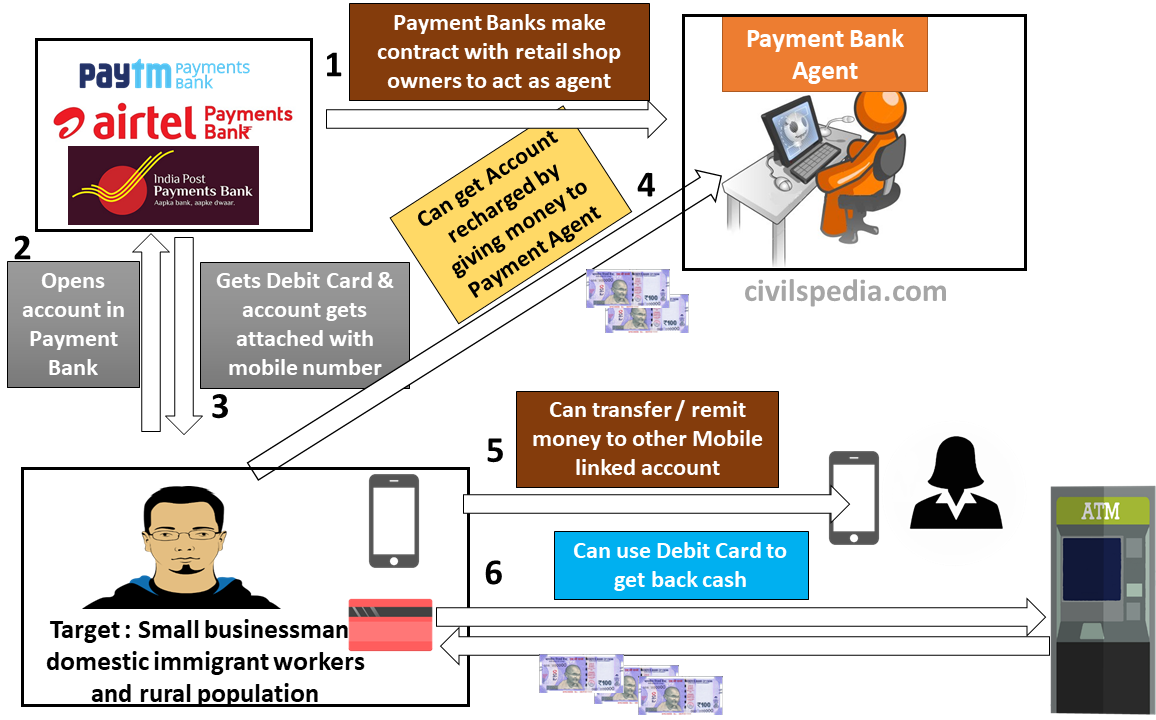

3. Payment Banks

What are Payment Banks?

- Payment Banks are a new stripped-down type of bank expected to reach customers mainly through mobiles rather than traditional bank branches.

- Payment Banks were formed under the recommendations of the Nachiket Mor Committee. Consequently, in 2015, RBI granted ‘in-principle’ approval for payment banks to 11 entities. Later, 3 backed out of business. Hence, 8 in the market now.

- Aditya Birla Nuvo Ltd.

- Airtel M-Commerce Services Ltd.

- Department of Posts

- Fino PayTech Ltd.

- National Securities Depository Ltd

- Reliance Industries Ltd. (Jio)

- Vijay Shekhar Sharma (Pay TM)

- Vodafone m-Pesa Ltd.

Cholamandalam Distribution Services Ltd (withdrew later)Dilip Shantilal Shanghvi (withdrew later)Tech Mahindra Ltd. (withdrew later)

Characteristics of Payment Banks

1. Target Audience

- Small businessmen, poor (domestic) immigrant workers and the rural population

2. Potential candidate to run

- Mobile companies, consumer goods companies, post office systems, Agri/dairy type cooperatives and Corporate Business correspondents.

3. CRR

- Banks have to keep Cash Reserve Ratio (CRR) just as Scheduled Commercial Banks.

4. Entry Capital

- Payment Banks require ₹ 100 crores as entry capital/

5. Features

- Payment Banks can hold up to ₹ 1 Lakh in an account and pay interest on these balances like a savings bank account.

- But they cant involve in any credit risk, i.e. can’t give loans to others. However, they can invest in SLR-approved securities.

- They must maintain the Capital Adequacy Ratio (CAR) of 15% (compared to ordinary Banks which are required to maintain a CAR of 9%).

- They can issue debit cards and ATM cards usable on ATM networks of all banks. But they can’t issue credit cards.

- They can enable transactions, transfers and remittances through a mobile.

- Since Payment Banks can become Banking Correspondents of Universal Banks, the customer can use the same account as that of Universal Bank and take services of Payment Bank from that account.

- The Payment bank will enjoy all the rights and responsibilities of Scheduled commercial banks.

- Payments Banks must use the word ‘Payments’ in their name to differentiate them from other banks.

Working of Payment Banks

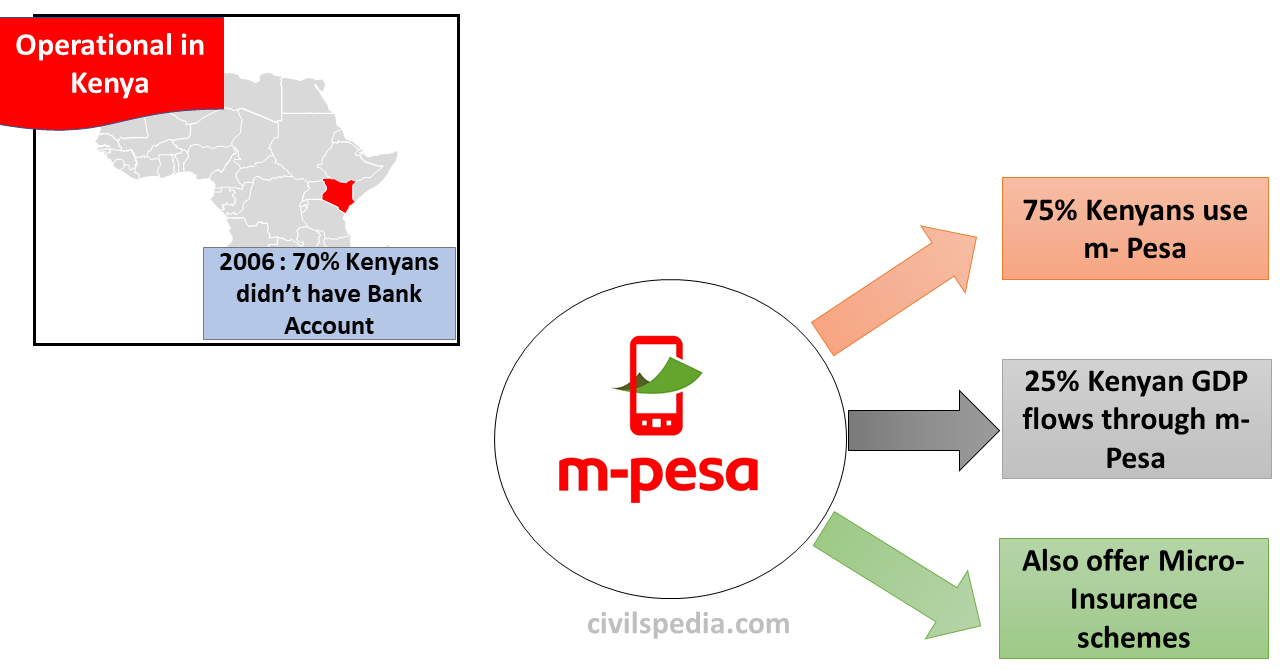

Case Study of m-Pesa: Why India should get Payment Banks (case study)

- M-Pesa is Kenya’s Payment bank.

- M = mobile & Pesa = Money in Swahili .

- It provides banking services through mobile and works in the same way as Payment Banks. Nachiket Mor Committee recommended starting Payment Banks based on the success story of m-Pesa in Kenya.

Benefits of Payment Banks

- Help in financial inclusion: It is uneconomical for traditional banks to open branches in every village, but mobile coverage is a promising low-cost platform.

- Remittances at Zero Cost: Their main target is migrant labourers. It will tap India’s domestic remittance market.

- Increase in disposable income of poor migrant families: Since Remittances will happen at zero cost, it will increase disposable income in the hands of low-income migrant families.

- These banks will help in the easy implementation of Direct Benefit Transfer.

- They will help in moving India towards a less-cash society.

- They will create job opportunities in the form of Payment Bank’s Agents.

Problems with Payment Banks

- Low revenue: Payment Banks can’t undertake any lending businesses and can only invest in SLR-approved securities.

- Banks are already offering most services that payments banks can offer. Hence, offering a new and differentiated proposition will not be easy for payments banks.

- RBI has launched Unified Payment Interface (UPI), giving a blow to the business plans of Payment banks.

As a result, after initial enthusiasm in applying for payment banks, companies like Tech Mahindra, Sanghvi’s, and Cholamandalam Investment have opted out.

Started till now

| Jan 2017 | (1) Airtel (first to start) |

| May 2017 | (2) PayTM |

| 2018 | (3) Reliance Jio, (4) Fino, NSDL and (5) Birla launched their Payment Banks |

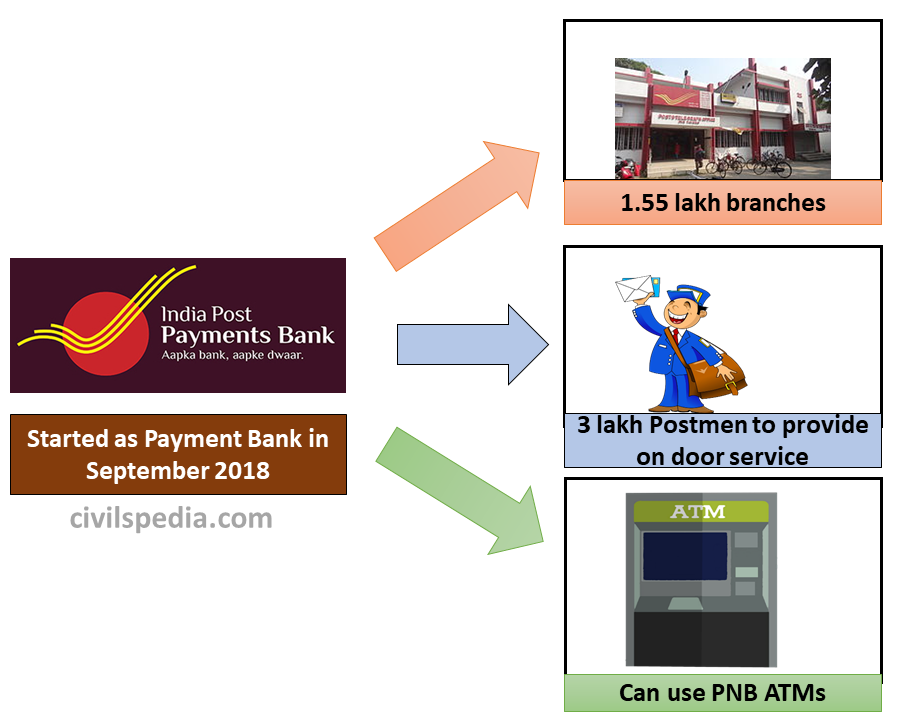

| September 2018 | (6) India Post Payment Bank |

Side Topic: Indian Post

Post office as Financial Intermediary

In September 2018, India Post Payment Bank was launched.

- All 1.55 Lakh Post Offices were linked to Payment Bank System.

- 3 lakh Postmen and Grameen Dak Sewaks now provide on-the-door banking facilities.

- India Post Payment Bank has all the features & benefits of Payment Banks like 1. Up to 1 lakh deposit 2. 4% interest Rate 3. Debit Card facility 4. Free withdrawals from own ATMs and Punjab National Bank’s ATMs and 5. No minimum balance (with the added benefit that they already have post office infrastructure).

- They have also partnered with Bajaj Alliance Life Insurance (BALIC) to sell insurance policies.

Post office as Financial Intermediary

- Indian Post is the oldest & largest organization involved in resource mobilization in India.

- It has a huge network of 1.55 lakh post offices, 3 lakh postmen & 5 lakh employees.

- 90% of the post offices are present in Rural areas.

- Earlier, too, it provided a wide array of ‘financial services’ such as saving and other time deposit accounts, Public provident funds, Monthly Investment schemes, and National saving certificates.

- It comes to rescue the government when the banking system cannot deliver cash benefits such as under MGNREGA, Old age/disability Pension Schemes, etc.

- Post offices worldwide have gone through this transformation in many countries & experience was quite successful there. Most notable is Royal Post in the UK, which, apart from Banking services, also provides mobile and broadband services. The US is also considering such plans.

- It can free bigger commercial banks to concentrate on competitive commercial operations leaving social security works to be handled by Postal Bank.

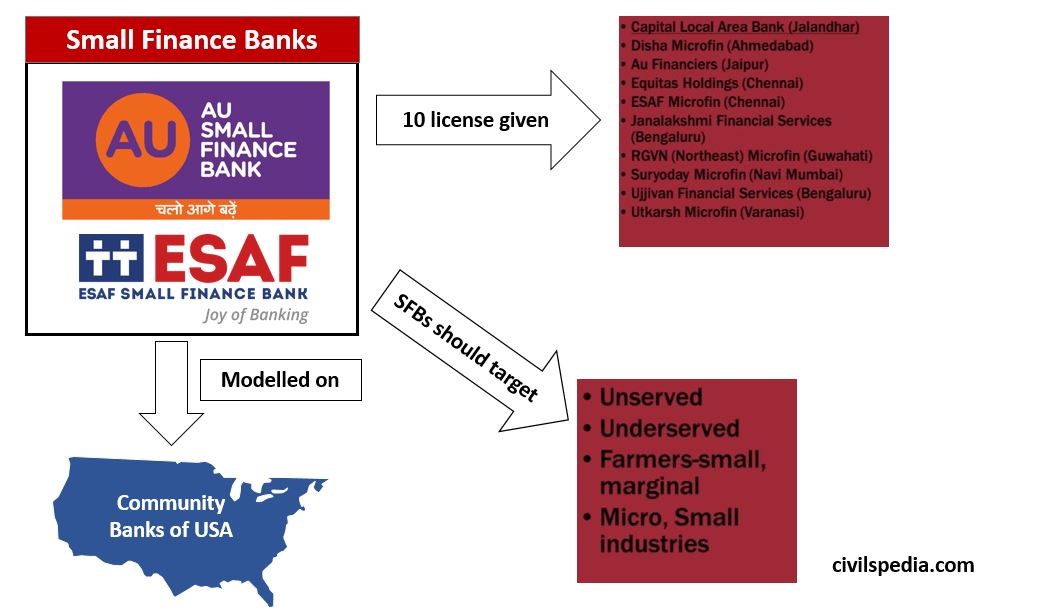

4. Small Finance Banks

- The purpose of the small banks will be to provide a whole suite of basic banking products, such as deposits and supply of credit but in a limited area of operation (contiguous districts in a homogenous cluster of states or union territories).

- These are modelled on Community Banks of USA.

- In Community Banks, Employees of banks know almost every family and therefore are well aware of their assets, credit history, financial position and business. As a result, MSME Industry, Retail Businessmen and Farmers can take loans from them without any problem.

Indian Parallels of Community Banks

- Old Private Banks like Catholic Syrian Bank of Kerala, Nainital Bank etc.

- Local Area Banks

- Regional Rural Banks

- Microfinance Institutions

Unlike big PSBs (like SBI) and New Private Banks (like Axis, ICICI Bank), their employees know their customers very well.

Hence, Nachiket Mor recommended the creation of Small Financial Banks based on the Community Banks of the USA. They should focus on unserved, underserved, small and marginal farmers along with MSMEs. Even Indian parallels can get an SFB license. At last, 10 contenders got a license. e.g., Capital Area Bank (Punjab), Au Financiers (Jaipur) etc

Prelims related information regarding Small Finance Banks

- They are licensed under Banking Regulation Act.

- PSL requirement = 75% (40% category wise (as Universal Banks) + 35% into PSL with competitive edge).

- They are Scheduled Banks under RBI Act.

- CRR and SLR requirements are similar to existing Commercial Banks.

- CRAR/CAR requirements – 15% (ordinary Banks – 9%).

- FDI – up to 74% allowed.

- They can open bank branches with the condition that 25% of branches should be in rural unbanked areas.

- The maximum loan size and investment limit exposure to single/group borrowers/issuers would be restricted to 15% of capital funds.

- Loans and advances of up to ₹25 lakhs, primarily to micro-enterprises, should constitute at least 50 per cent of the loan portfolio.

- They can evolve into Universal Banks after 5 years, subject to RBI’s discretion.

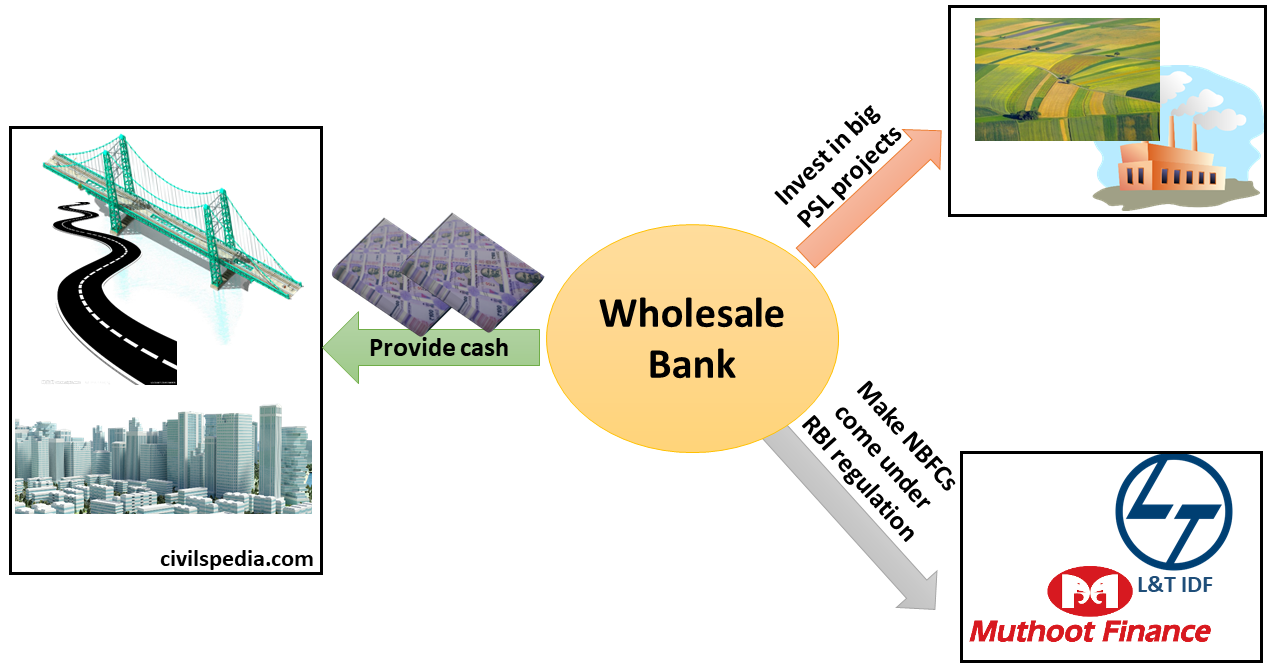

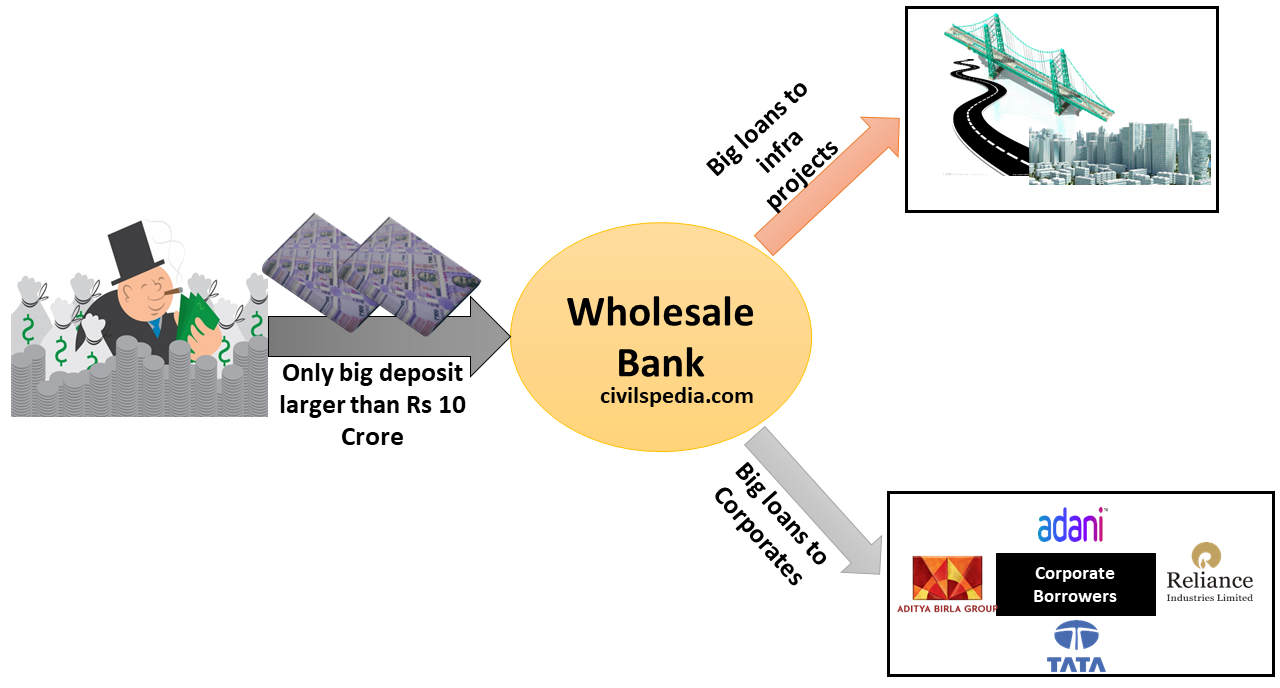

5. Wholesale Bank

It has not formed yet. RBI proposed it in 2017.

- Wholesale Bank will be regulated under the Banking Regulation Act.

- They can only accept deposits larger than Rs.10 crore from big investors. Apart from that, they will raise money by issuing bonds.

- It will not give a loan to a retail /common person. It will only lend in wholesale markets such as the infrastructure sector or corporates.

- PSL norms are applicable but at the wholesale level. They will finance big projects in Priority Sector and can sell extra PSL certificates to Scheduled Banks to fulfil their targets.

Why do we need Wholesale Banks?

- India needs huge investments in the Infrastructure Sector (₹40 trillion in the next decade). But there are issues.

- The government is the biggest spender in the infrastructure sector (45% of total infrastructure spending). But government can’t invest more because of Fiscal Deficit problems.

- The next biggest investor is banks. But they too cant invest more due to NPA Problem.

To get more investment in infrastructure, the government plans to come up with Wholesale Banks.

- The tenor of the infrastructural loans is very long, and therefore it does not incentivize institutions like Banks. Thus there is a need for separate infrastructure banks. Wholesale Banks will perform that work.

- Right now, NBFCs are not under the supervision of RBI (and act somewhat like Shadow Banks) and are not covered under SARFAESI to recover their Bad Loans. It is not in the government’s interest to let them continue because they don’t have protection cover of CRR & SLR. By making Wholesale Banks, bigger NBFCs can be made to come under RBI’s regulatory supervision.

- Apart from that, they will help Banks to achieve their PSL Targets. They will invest huge amounts in PSL Projects and then issue their PSL Certificates which Banks can buy.