Table of Contents

Money

This article deals with ‘Money.’ This is part of our series on ‘Economics’, which is an important pillar of the GS-2 syllabus. For more articles, you can click here.

Barter System

People have been trading with each other even before the advent of money, coin, cash, currency, rupee, dollar, euro or Yuan. They exchanged goods and services with each other through the barter system. E.g.,

- 1 kg rice for 200 grams of tomatoes

- 1 kg tomatoes for 50 gm almonds and so on

Problems with Barter System

- It can happen only with a Double-Coincidence of wants.

- Search Cost / Cost of Transaction is high.

- Don’t favour Division of Labour / Specialization: Due to the above problems, all persons will try to become Jack of all trades but master none.

- Don’t favour Industrialization: Industrialists will have to find a large supply line with every person having a double coincidence of demands.

- Don’t favour concentration of wealth: Since all the wealth is perishable. E.g., one can’t store tomatoes for an extended period.

- The problem of Divisibility of Value: In Barter System, you cannot always divide the value to buy whatever you want.

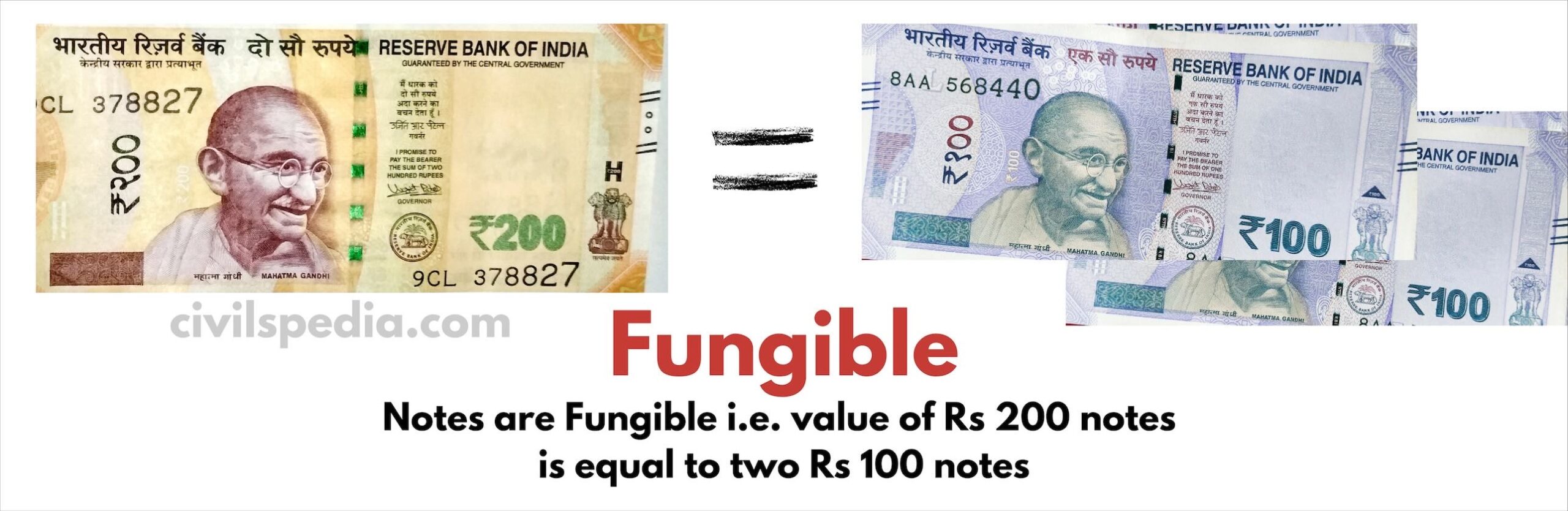

- Not always Fungible: In Fungible items, division & mutual substitution is possible, e.g. Gold bars, Currency Notes & Coins. But barter goods are not always fungible. E.g., if a diamond is cut into smaller pieces, the summation of all the smaller parts will not equal one bigger diamond. Hence, diamond isn’t fungible.

Benefits of the Barter System

- Barter System promotes Joint Family

- Food Inflation will be lower in Barter Economy compared to Money Economy.

Money

- Money is anything that is generally accepted as a means of payment.

- The money System was invented to answer the above limitations of the Barter System.

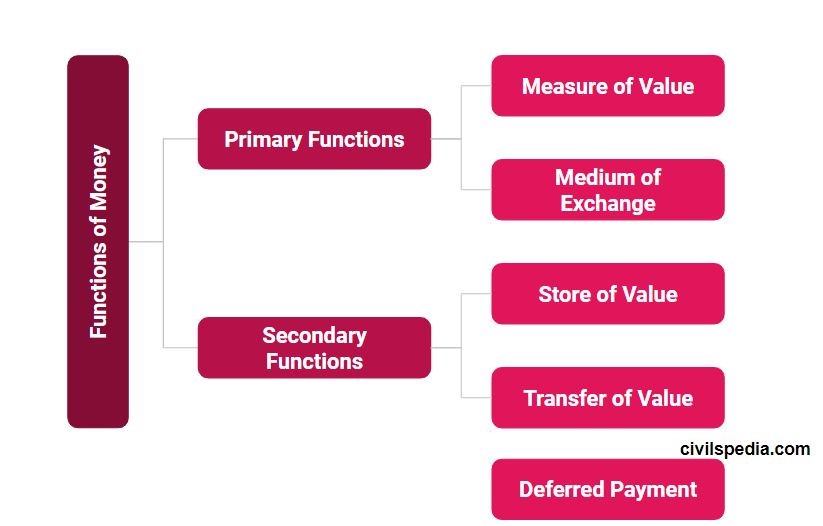

- Money serves the following functions

a. Primary Functions

| Measure of Value | Money serves as a measure of value. E.g., – Labour’s value in Money System is Wage – Land’s value in Money System is Rent |

| Medium of Exchange | – It is the medium of exchange because it has generalized purchasing power. – E.g., a person earns money from his labour, and that money is used to buy food. |

b. Secondary Functions

Due to the above Primary Functions, it can be used for various Secondary Functions as well

| Store of Value | – The value of labour paid in the form of money can be stored for later use – E.g., A person can store the value of his labour, i.e. wage, for later use. |

| Transfer of Value | – The value paid in the form of money can also be transferred to another place. – E.g., A person earning in Bangalore can transfer it to his Parents in Punjab. |

| Deferred Payment | – It serves as a standard for the settlement of future monetary obligations. We can make deferred payments like paying in advance (like Paying Rent of Dish TV at once) or Paying later (e.g. taking the car on loan). – It is possible because we can measure the Time value of Money using an Interest Rate. |

Benefits of the Money Economy

- Due to money’s primary and derivative functions, it can be used for social empowerment, dalit entrepreneurship etc. Labour and Service of each kind can be paid, which wasn’t possible in Barter Economy.

- It also helps in the Redistribution of National Income (via a taxation system).

Evolution of Money

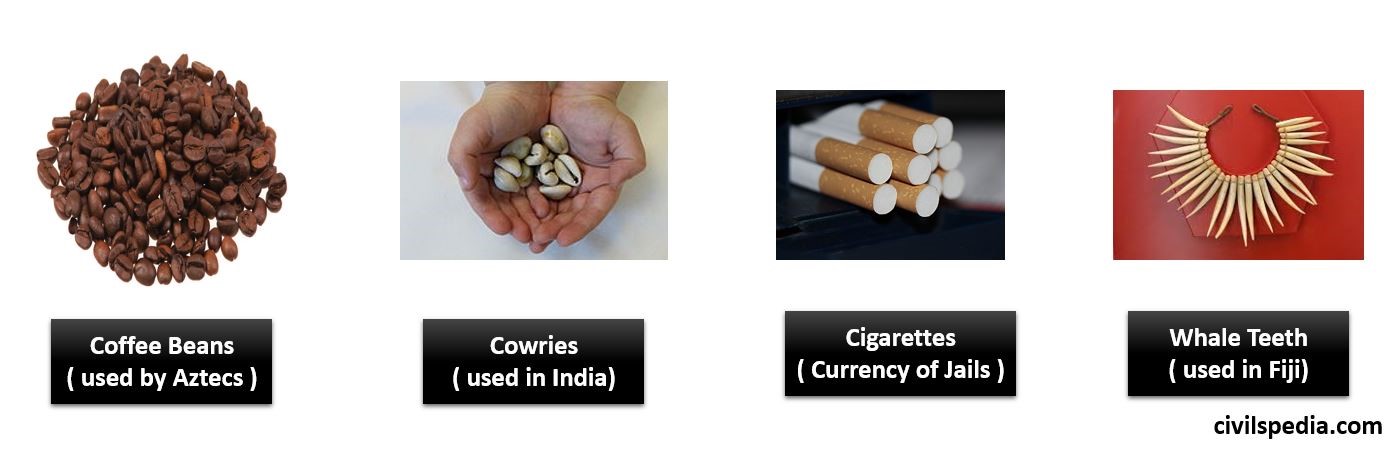

1. Commodity Money

- It is the first stage in the Evolution of Money.

- In this, a particular commodity is used to measure the value.

- E.g., Cocoa Beans (used by Aztecs), Cowry Shells (in India), Cigarettes (in Jails) etc.

- Note: Commodity Money has Intrinsic Value too.

Different Examples of Commodity Money

2. Metallic Money

Traders and Kings used to stamp their marks on the coins to ensure that the metal was of uniform quantity and quality.

Benefits

- It has intrinsic value.

- It is non-perishable

- It is divisible & fungible.

- Even foreign trade is possible

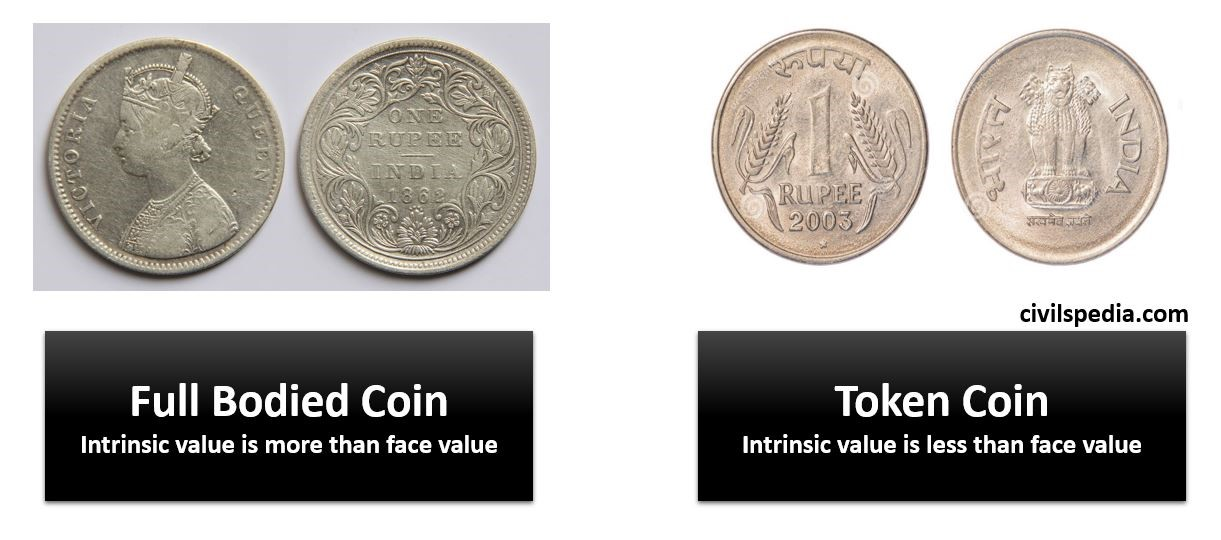

Full-Bodied Coin vs Token Coin

1. Full-Bodied Coin

- It is the money whose intrinsic value is equal to or greater than face value.

- It is also known as good money.

- E.g., One Rupee Coin of British India (shown below) had a face value of 1 ₹, but if somebody melted the silver and sold that in the market, it was greater than 1 ₹.

2. Token Coin

- It is money whose intrinsic value is lower than its face value.

- It is also known as Bad Money.

- E.g., Present 1 ₹ Coin.

Issues with Full Bodied coin

- Full-Bodied coins result in various problems. People start to melt metal from the coin and use it for other things. (The same thing was seen in the recent past in Indian Coinage too. Indian ₹5 coins were sent to Bangladesh, where the cost of metal was more than the face value of the coin. People used to melt the coin and make blades out of that. Cupro-Nickel coins were introduced to tackle such activities.)

- Apart from that, to adjust to inflation, the government keeps on reducing the metal content in the coins to keep the intrinsic value of the coin lesser than its face value.

Note: It should be noted that melting coins for other purposes is a punishable offence.

3. Paper Currency

- The genesis of paper currency can be traced back to Hundis, where traders used to pay using metal at one place and take Hundi to avoid any theft while carrying metal during an extensive voyage. Later, the State started to do the same work and introduced Paper Currency.

- It is called Fiduciary Money, i.e. although the paper has no intrinsic value, it is circulated because of trust in issuing authority.

Types of Fiduciary Money

1. Non-Legal Tender

- It is not issued by the government

- E.g., Bill of Exchange, Cheque, Bank Draft, Postal Orders etc.

- It is also called Optional Money because its acceptance is optional.

2. Legal Tender/Fiat Money

- It is issued by the government and acts as money on the fiat or order of the national government.

- It can be classified as Coin and Currency.

- Its acceptance is not optional within the boundary of the country. It can’t be denied for settlement of any monetary obligation.

Types of Legal Tenders

1. Limited Legal Tender (Coin)

- It can be used to settle a limited amount of debt.

- According to the Coinage Act of 2011

- Using 50 paisa Coins, a maximum debt of ₹10 can be settled.

- Using ₹1 coin or above, a maximum debt of ₹1,000 can be settled.

- All coins below 50 paise are not legal tenders (since 2011).

2. Unlimited Legal Tender (Currency)

- It can be used to settle the unlimited debt binding by the government’s command.

- Every bank note is legal tender in India.

Who Issues what?

Government

- The government issues all coins. Government can issue any amount of coin (even 1,000 ₹ coins).

- The government issues ₹ 1 Note with the sign of the Finance Secretary on it.

RBI

- Under RBI Act, all Notes except ₹1 can be issued by RBI with the sign of the RBI Governor.

How Fiat Money is issued?

a . Earlier Times

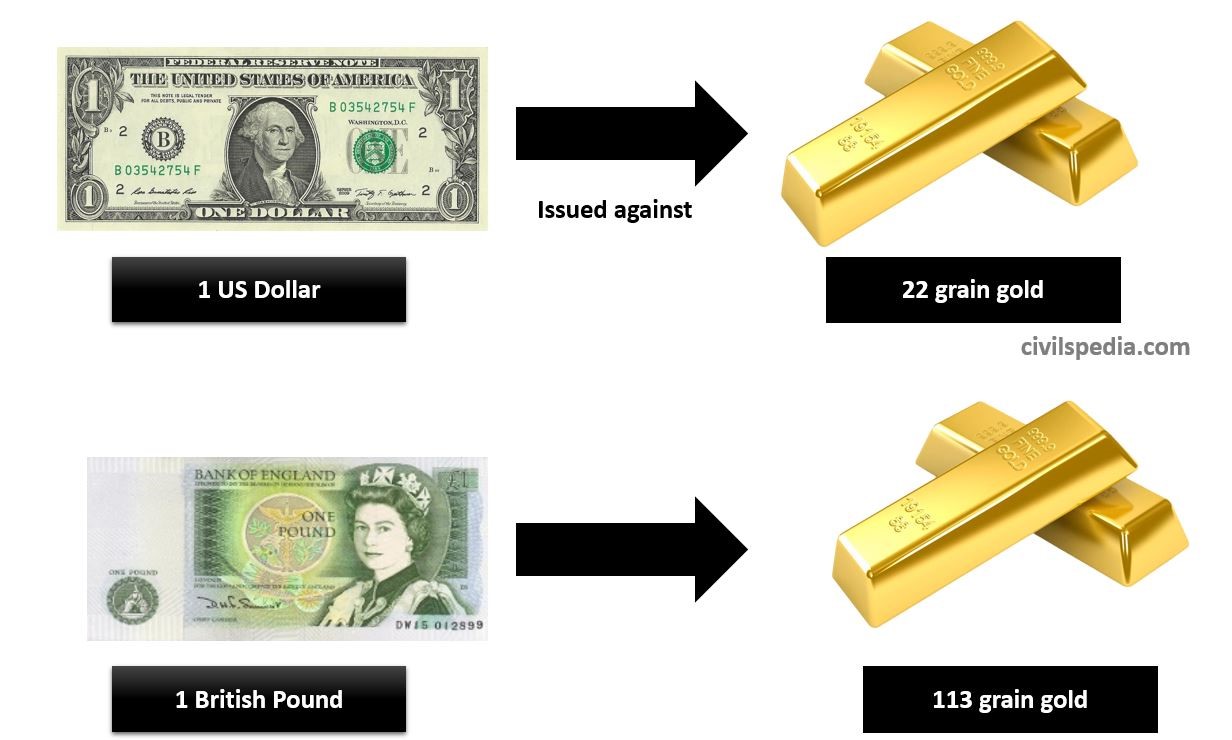

- Gold Standard System: Earlier, Bank Notes were backed by an equivalent amount of gold. Notes amounting to the equal reserve of gold were issued. E.g.,

- 1 US dollar was issued against 22-grain gold

- 1 British Pound was issued against 113-grain gold

- If this note was taken to Central Bank, it paid an equivalent amount of gold in return.

- But later, due to various problems like printing more cash during wars, the cold war and depressions, this system was discarded.

b. Indian System

Earlier, the following system was used

1935 to 56

- RBI used to maintain 40% gold to the value of currency issued.

1956 to 95

- India abandoned the old system and moved to the ‘Minimum Foreign Reserve System.’

- Under this, RBI was required to maintain a total reserve of at least Rs. 200 crores, with at least Rs.115 crore in the form of gold and the rest in the form of Foreign Securities.

1995 to Present

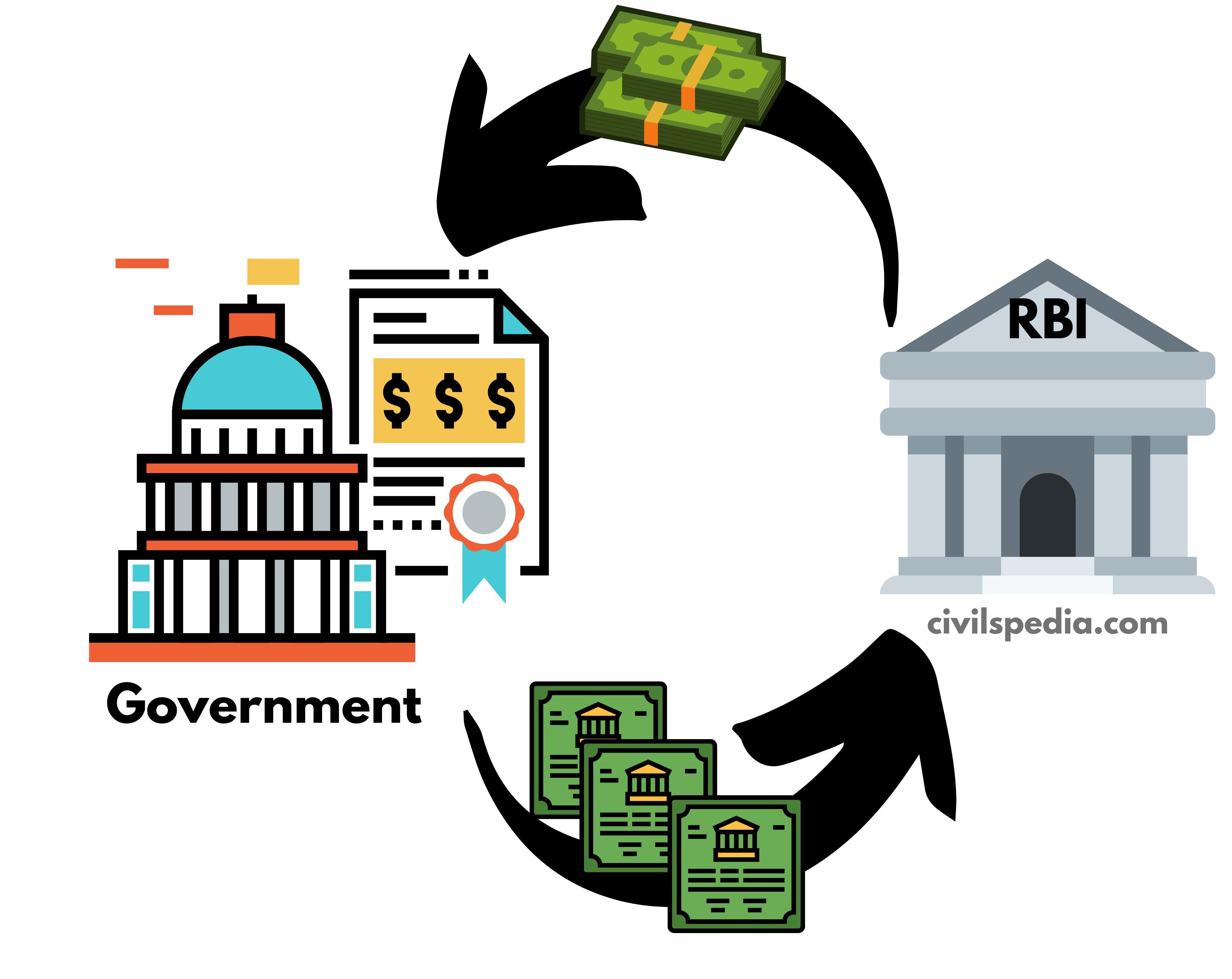

- India is following the ‘ Managed Paper Currency Standard‘.

- Under this system, the Government of India can print any amount of money under the backing of gold, foreign securities and Government of India-backed Securities.

- Hence, if the government wants to print more money (than gold and foreign currency), the government will issue securities (G-Secs) to RBI, and RBI, in return, will print equivalent money with the backing of those securities.

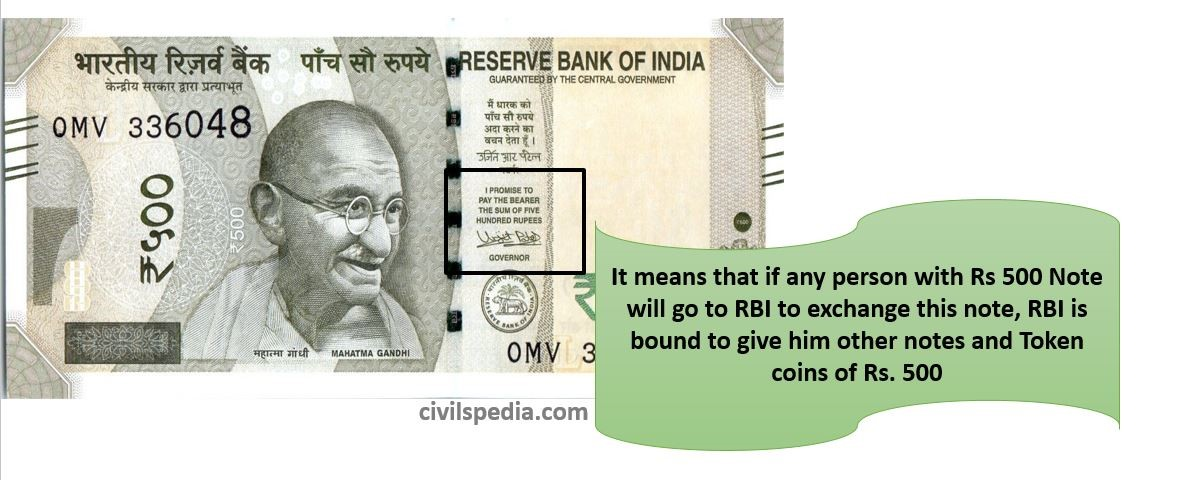

What does it mean?

It means that if any person with any bank note issued by RBI goes to RBI to exchange that note, RBI is bound to give him other notes and Token coins of equal face value.

Demonetisation

- Demonetisation is the wholesale withdrawal of currency from circulation.

- Although every banknote is “legal tender”, but on the RBI Board’s recommendation, the Government of India can notify that Specific Bank Notes (SBN) are no longer legal tender (i.e. Demonetized).

- On 8th Nov 2016, ₹500 & ₹1000 notes were demonetised.

- Specified Bank Notes (Cessation of Liabilities) Act 2017: The government passed this Act to give legislative backing to Demonetisation. RBI was not required to honour the promise written on old banknotes.

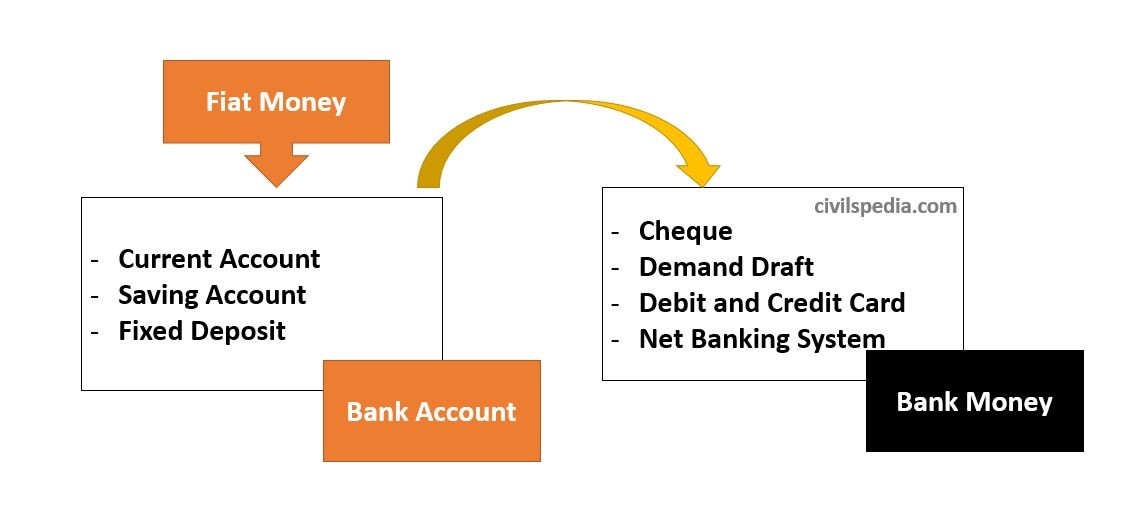

4. Bank Money

- The backend of Bank Money is Fiat Money as well.

Examples of Bank Money

- Cheques

- Demand Draft: Can’t be dishonoured because the amount is prepaid.

- Overdraft: When a person’s bank account has an insufficient balance, he is still allowed to draw more money than is available in his bank (as a loan).

- Debit and Credit Cards

- Net Banking System

- Unified Payment Interface (UPI) System

Advantages of Bank Money

- Easy to transfer over a long distance.

- The exact amount can be transferred

- Hard to counterfeit

- Can freeze if stolen

- Leave behind a digital trail

- Legally recognized for high-value payment

Types of Accounts

1. Saving Account

- These are opened by households.

- There are some restrictions on transactions.

- Banks offer low interest on these accounts.

- It has demand and time liability.

2. Current Account

- These are opened by business entities (firms or businessmen).

- There are no restrictions on transactions.

- Banks offer no interest on these accounts.

- It has demand liability.

3. Fixed Deposit Account and Recurring Deposit Account

- Anyone can open this account (but generally, these are opened by households because they are the savers in the economy).

- There are some restrictions as banks are not liable to pay back until the end of the period for which money was deposited in the bank.

- Banks offer a relatively high-interest rate on these deposits (6 to 10%).

- It has time liability.

Digital Currency

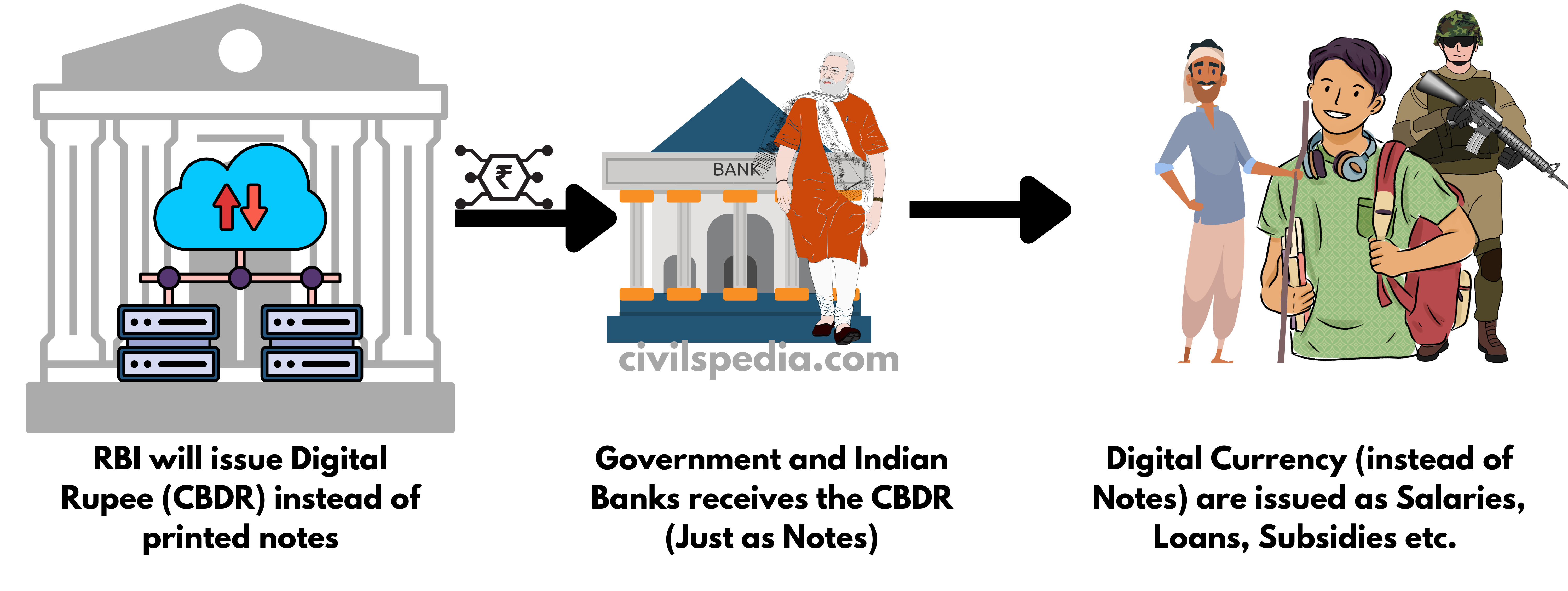

Central Bank Digital Currency (CBDC)

Budget 2022 announced that RBI would issue a digital rupee using blockchain technology. It will be a digital form of India’s fiat currency.

CBDC will be a legal tender in India. The definition of banknote under the RBI Act 1934 is also amended to broaden the banknote. “Banknote” now means a bank note issued by the bank either in physical or digital form. It will allow the introduction of CBDC from the RBI.

Issuing digital currency has many benefits, such as

- Cheaper: Significant cost is incurred on printing money in India (more than ₹4900 crores in 2020-21).

- Efficient management of currency

- It will break the monopoly of crypto-currencies, which are not backed by any sovereign authority.

- It will give impetus to the development of the fintech sector.

But there are issues as well.

- Encroaches privacy as every transaction will be known to the government

- It goes against the traditional banking system.

- It makes the financial sector vulnerable to cyber attacks