Last Updated: May 2023 (MSME Industry)

Table of Contents

MSME Industry

This article deals with ‘MSME Industry.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

MSME Definition

Amendment to MSME Act, 2018

Under the Amendment to MSME Act 2006, changes have been made in the criteria of classifying Micro, Small and Medium enterprises from ‘investment in plant & machinery/equipment to ‘annual turnover’. Accordingly, Act will be amended.

| Micro Enterprise | Annual turnover does not exceed 5 crore rupees |

| Small Enterprise | Annual turnover is more than 5 crore rupees to Rs 50 crore |

| Medium Enterprise | Annual turnover is more than 50 crore rupees to Rs 250 crore. |

Central Government may, by notification, vary turnover limits.

The change has been made because there was a drawback in the earlier classification system. Earlier, if the businessman wanted to expand the productivity of his enterprise and invest in machinery, the MSME tag would have been lost. Hence, Businessmen resisted investing in machinery, impacting the economy’s overall efficiency.

Previous System of MSME Classification

Previously, MSMEs were defined on the basis of investment in plant and machinery.

| Manufacturing Sector | Services Sector | |

| Micro | Upto 50 lakh | Upto 10 lakh |

| Small | Between 50 lakh and 10 crore | Between 10 lakh and 2 crore |

| Medium | Between 10 crore and 30 crore | Between 2 crore and 5 crore |

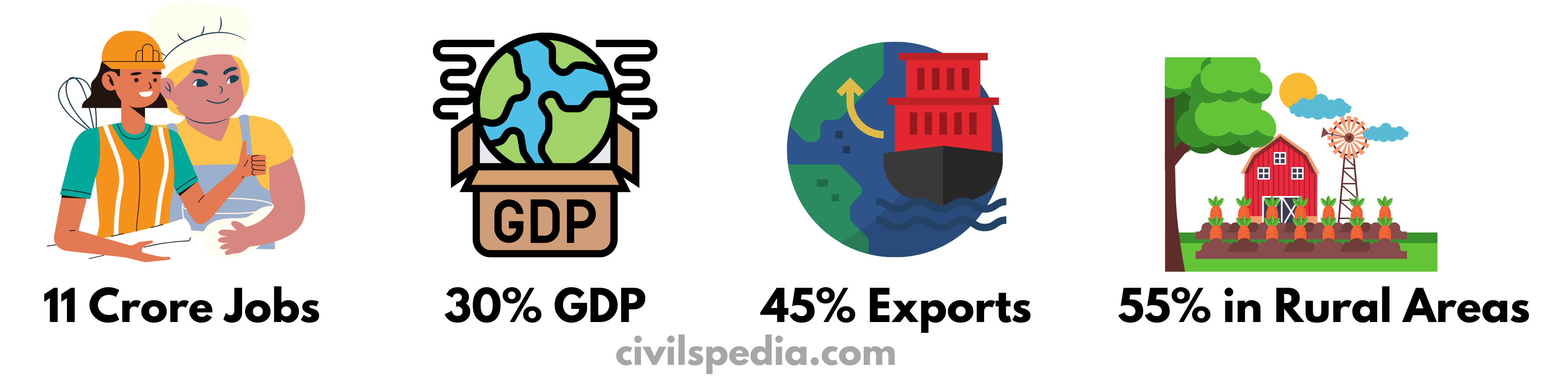

Importance of MSME Industry

- MSMEs employ 11 crore people (after agriculture, the largest sector in India).

- MSME sector contributes 30% to the country’s GDP.

- 45% of manufacturing in India is done in MSME industries.

- MSME constitutes 40% of Indian exports.

- More than 55% of MSMEs are located in rural areas. Hence, they are essential for rural development.

- SC/ST/OBC owns the majority of MSMEs.

- The sector has enormous potential to address structural problems like unemployment, regional imbalances, unequal distribution of national income and wealth across the country.

Issues faced by them

- Lack of access to Institutional Credit: Banks prefer to give a few large loans to big corporations instead of providing a large number of small loans to MSMEs because the administrative cost of managing small loans is high.

- NPAs: More than ₹80,000 crore worth of loans given to the MSME sector has turned NPA. Many MUDRA loans given to the MSME Sector without checking the credit history have also turned NPA.

- Implementation of GST: GST Reforms has disrupted MSME Sector due to the following reasons

- Input Tax Credit: Credit is paid after a long delay. MSME sector can’t bear it and face a credit crunch due to this

- Increased Compliance Cost.

- Insolvency and Bankruptcy Code Issue: Most of the MSME entities are Operational Creditors of big companies, but while the Insolvency process is going on, voting power is given only to Formal Creditors and not Operational Creditors. Hence, MSMEs don’t get back the right amount of recoveries.

- MSMEs can’t achieve an Economy of Scale & hence can’t compete with big industries.

- MSMEs can’t invest in branding their products.

- MSMEs lack access to improved technology

- MSME sector faces deficiencies in basic infrastructural facilities like power supply, road/rail connectivity, etc.

- MSME sector has not been able to get back their markets after the disruption caused by the Covid pandemic.

German Model of MSME – Mittelstand

- German MSMEs Model is known as Mittelstand Model.

- German MSMEs invest in R&D and produce high-quality products. As a result, German MSMEs export their products to western markets. This has played an important in making Germany a trade surplus economy.

- India can follow this model to encourage MSMEs to produce high-quality products which can be exported to foreign markets.

Scheme: Zero Defect – Zero Effect Scheme

- Prime Minister launched it on Independence day of 2016.

- Scheme emphasize that Indian MSMEs should manufacture goods in the country with

- “Zero defects”: Zero non-conformance/non-compliance.

- “Zero effect” on the environment: Zero air pollution/liquid discharge /solid waste.

- It would enable the advancement of Indian industry to a position of eminence in the global marketplace through the ‘Made in India’ mark.

Schemes for MSMEs

1. Support & Outreach Initiative (SOI) for MSME Sector

- It was started in 2018.

- Various initiatives announced under the scheme are

- 59 minutes Loan portal launched: MSMEs can get an easy loan ranging from ₹10 lakh to 1 crore

- 2 % Interest Subvention for all GST registered MSMEs.

- Companies with turnover up to ₹500 crores must compulsorily be brought on the Trade Receivables e-Discounting System (TReDS).

- Labour Inspector will inspect the MSME unit via computerized random allotment to prevent corruption.

- Self Declaration of air and water pollution laws.

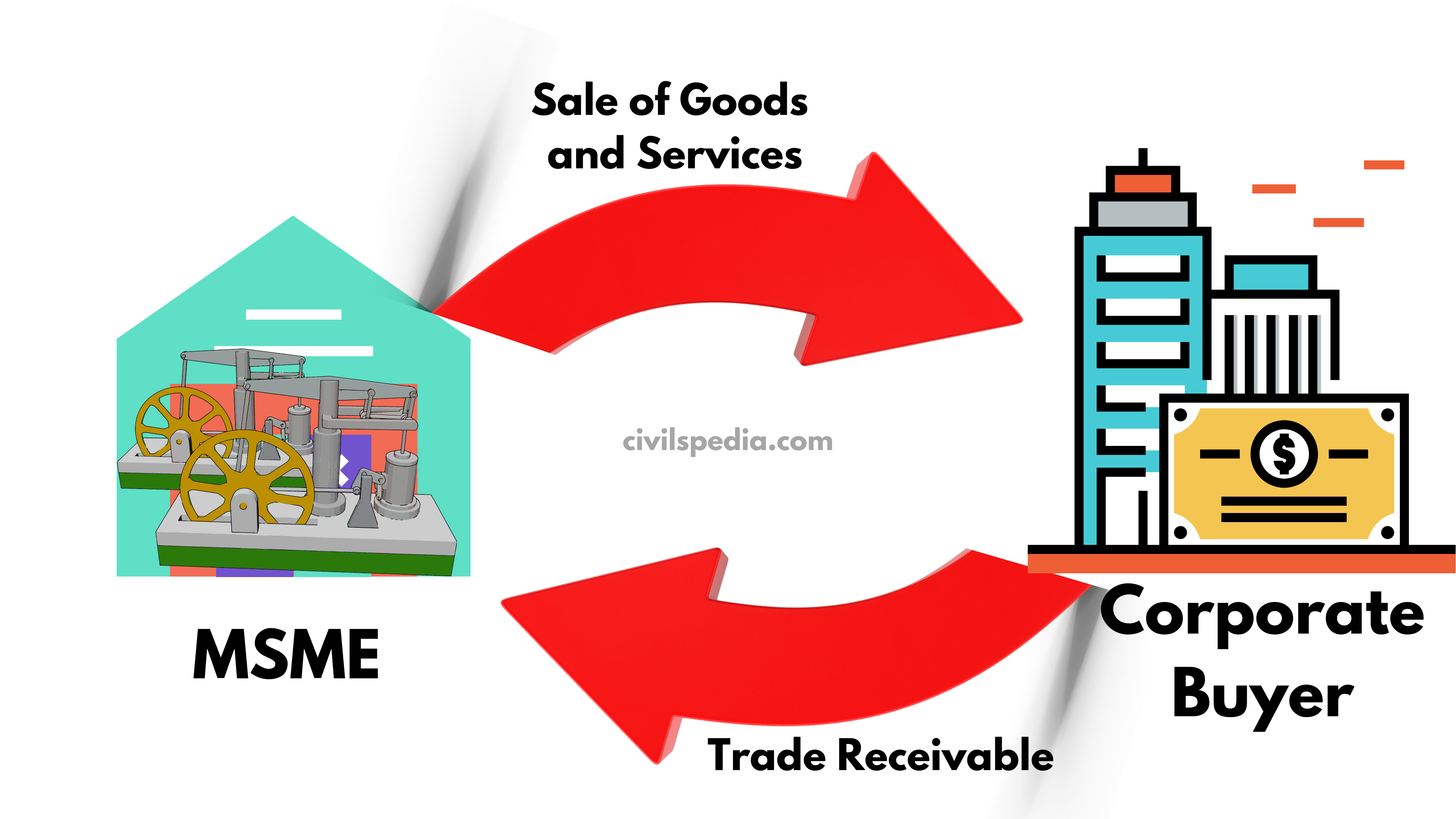

Side Topic: TReDS Platform

- TReDS platform aims to solve the issue of delayed payment to the MSME sector.

- When MSMEs sell their goods to any corporate buyer, they mostly get Trade Receivable, i.e. invoice saying that buyer will pay back after, say 4 months. But this creates an issue for MSME, which is short on funds. They need immediate cash to get their operations going. Hence, they can sell that invoices to a third party like a bank or NBFC at a discount and get immediate cash.

- TReDS platform is a sort of intermediary that will check the invoice’s authenticity and upload it on its system so that Banks and NBFCs can look at the available trade receivable and place their bids to buy those trade receivables (not going into many technicalities).

- Presently, RBI has approved three TReDS platforms i.e.

- Receivables Exchange of India (RXIL): Joint venture of SIDBI and NSE

- Invoicemart

- Mind Online National Exchange

- Parliament has also passed Factoring Regulation (Amendment) Act giving legal sanctity to MSMEs to use this platform.

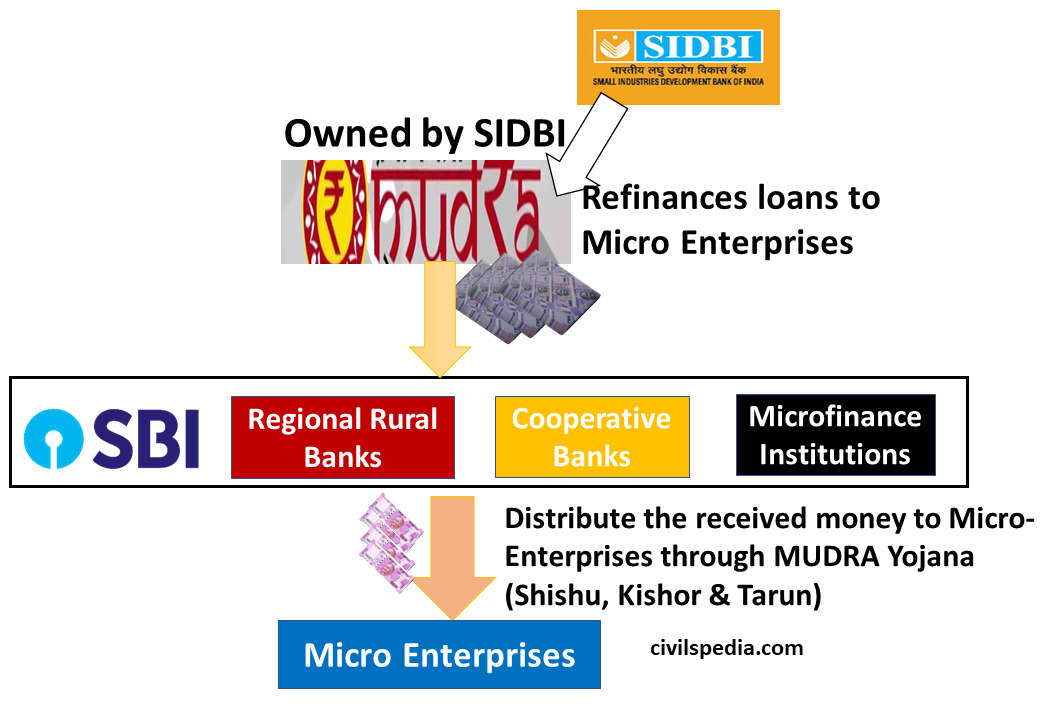

2 . MUDRA

What MUDRA bank will do?

- MUDRA is a Non-Banking Financial Corporation (NBFC).

- Objective: Refinance lending to Micro-Enterprises via Scheduled Commercial Banks, Regional Rural Banks, Cooperatives, Microfinance Institutions & other NBFCs.

- Ownership: It is wholly owned by SIDBI.

- It is not the first of its kind & such institutions are already operating in many countries, with the first such institution opened in Bangladesh in 1990.

Works

- Refinance Micro Enterprise Loans, i.e. give money to Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Micro Finance Institutions (MFIs) etc., so that they can give money to Micro Enterprises. These institutions distribute money received from Mudra Bank to Micro-Enterprises under Mudra Yojana.

- 3 types of loans are given under Mudra Yojana

- Shishu: loans up to 50,000

- Kishor : >50,000/- up to 5 lakh

- Tarun : > 5 lakh and up to 10 lakh

- Mudra loans are collateral-free.

3. Ubharte Sitare Program

- It is an Alternate Investment Fund (AIF) created by EXIM Bank and SIDBI (in 2021).

- Objective: To finance the export-oriented MSMEs using debt or equity finance.

4. One District One Product

- The scheme was started Commerce Ministry.

- Under the scheme, one unique product will be recognized from every district of India, and the Commerce Ministry will support that to increase its export.

- For example, Blue Pottery has been recognized from Jaipur and Pickle from Amritsar.

5. RAMP (Raising and Accelerating MSME Performance) Scheme

It is a World Bank-supported scheme that aims to

- Improve access of MSMEs to market & credit

- Helps in technology upgradation of MSMEs

- Addressing issues of delayed payments to MSMEs

- Greening (i.e. reducing carbon footprint) of MSMEs

6. Prime Minister Employment Generation Program (PMEGP)

- Under PMEGP, financial support of Rs 25 lakh is provided to the beneficiaries for the setting up of new MSMEs.

7. Other Government Initiatives for MSME industries

7.1 No GST

- If turnover is up to 20 lakh (10 lakh for Special Category State), then no need to REGISTER for GST

7.2 Priority Sector Lending

- 7.5% of the bank loans should be given to MSMEs.

7.3 Public Procurement Order

- Every central ministry, department and PSU should procure 25% of their total purchase from the MSME sector.

7.4 Easier Registration

- The process to simplify the registration of MSMEs. Now MSMEs can be registered using only PAN Card and Aadhaar.

7.5 SME Exchanges

- SME exchange is dedicated to trading the shares of small and medium scale enterprises (SMEs) who, otherwise, find it difficult to get listed in the main exchanges.

- BSE has named its SME platform BSESME, while NSE has named it Emerge.

7.6 SIDF

- Small Industries Development fund (SIDF) is operated by SIDBI for the development of MSMEs.

7.7 SFURTI

- Scheme of Fund for Regeneration of Traditional Industries aims to set up clusters of Khadi, Coir, Handicraft; & help the entrepreneurs inside them.

7.8 MSME Samadhaan

- If a buyer (Govt organisation at Union/State) is not paying money to MSME supplier within the specified time limit. In that case, Organisation can be ordered to pay money with interest rate.

Economic Survey Topic: Nourishing Dwarfs to become Giants- Reorienting policies for MSME Growth

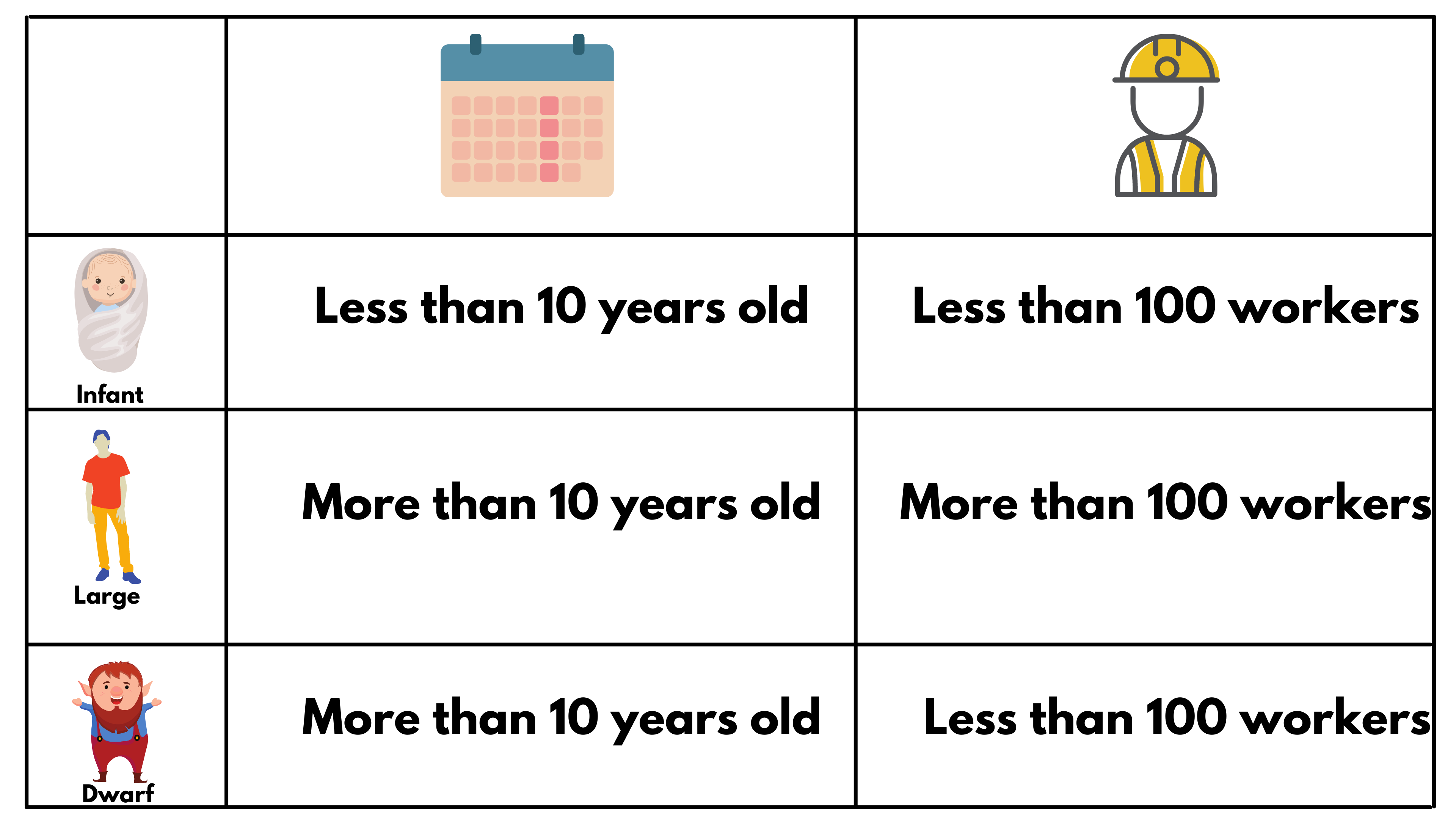

Companies in the Model

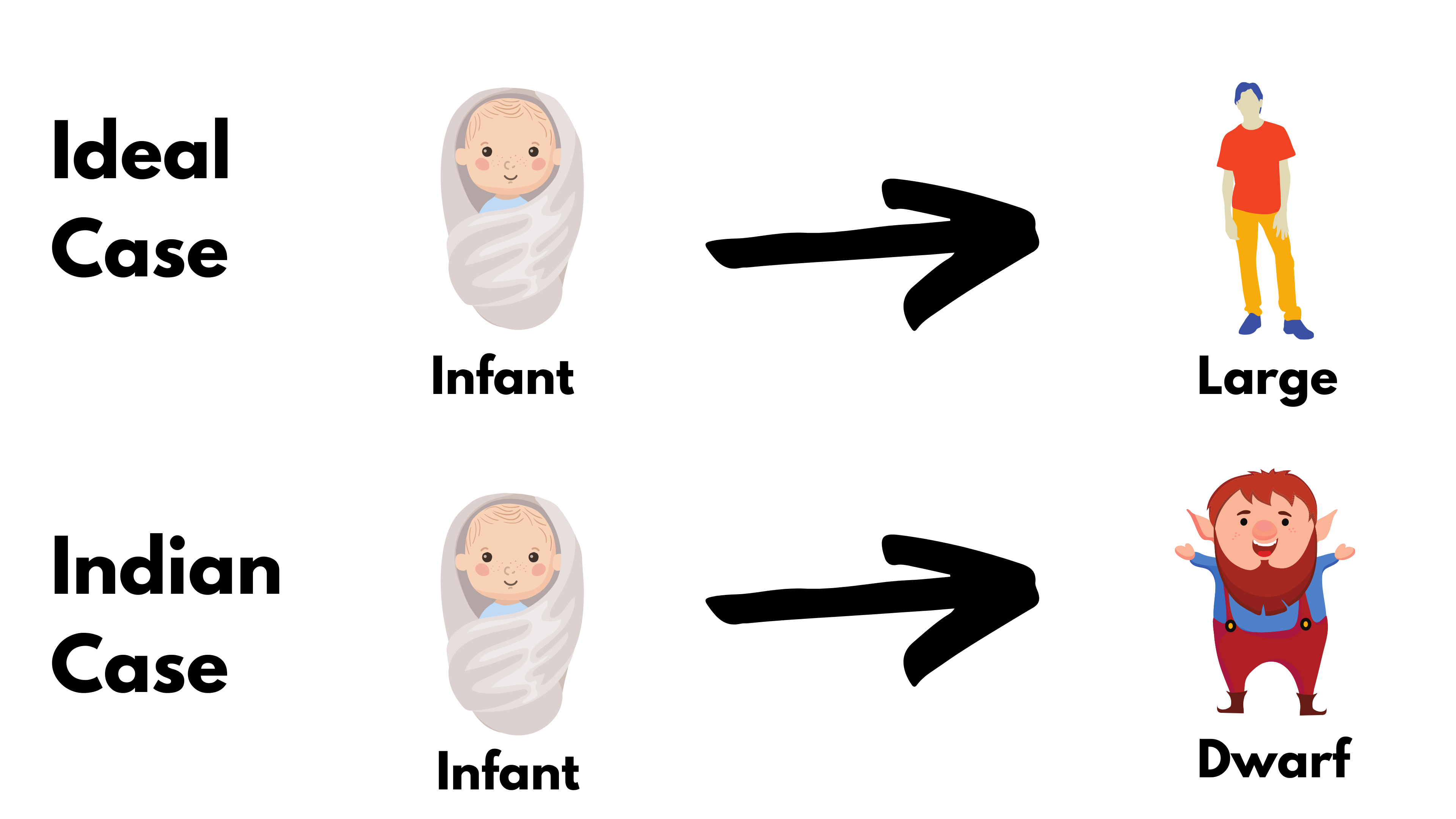

Ideally, an Infant firm (i.e. formed less than 10 years ago and employing less than 100 workers) should gradually become Large (employing more than 100 workers). But over the last seven decades, the government’s policies have stifled the growth of MSMEs in the economy, and there is a domination of Dwarfs (employing less than 100 employees, despite being in existence for more than 10 years) in the Indian economy.

Issues with Dwarfs

- Firms that can grow over time to become large are the biggest contributors to employment and productivity in the economy. In contrast, dwarfs that remain small despite becoming older remain the lowest contributors to employment and productivity in the economy.

How do government policies promote Dwarfism?

- Labour Regulations: For example,

- Industrial Disputes Act (IDA), 1947 mandates firms with more than 100 employees to get permission from the government before retrenchment of employees.

- Employees’ Provident Fund & Miscellaneous Provisions Act, 1952 mandates that firms with more than 20 employees are required to co-contribute in insurance/pension accounts of low-salaried workers.

- MSMEs are eligible for Priority Sector Lending, Public Procurement Quota and many other government schemes designed especially for MSMEs.

Indian policies have created a “perverse” incentive for firms to remain small. If the firms grow beyond the thresholds that these policies employ, they will not obtain the said benefits. Therefore, entrepreneurs find it optimal to start a new firm to continue availing these benefits rather than grow the firm beyond the said threshold. But then, the firm cannot benefit from economies of scale.

Ways to promote Dwarf MSMEs to become Giants

- Under Priority Sector Lending (PSL), banks are required to lend 7.5% of their annual loans to Micro enterprises. These norms should be tweaked to give first preference to loan applications by ‘start ups’ and ‘infants’ firms.

- Sunset Clause for Incentives: MSME benefits should have a ‘sunset’ clause, say, after 5-7 years, the firm will no longer be able to claim it.

- Focus on High Employment Elastic Sectors like the manufacture of rubber and plastic products, electronic and optical products, transport equipment, machinery, basic metals and fabricated metal products, chemicals and chemical products, textiles and leather & leather products.