Table of Contents

Non Performing Assets

This article deals with ‘Non Performing Assets .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

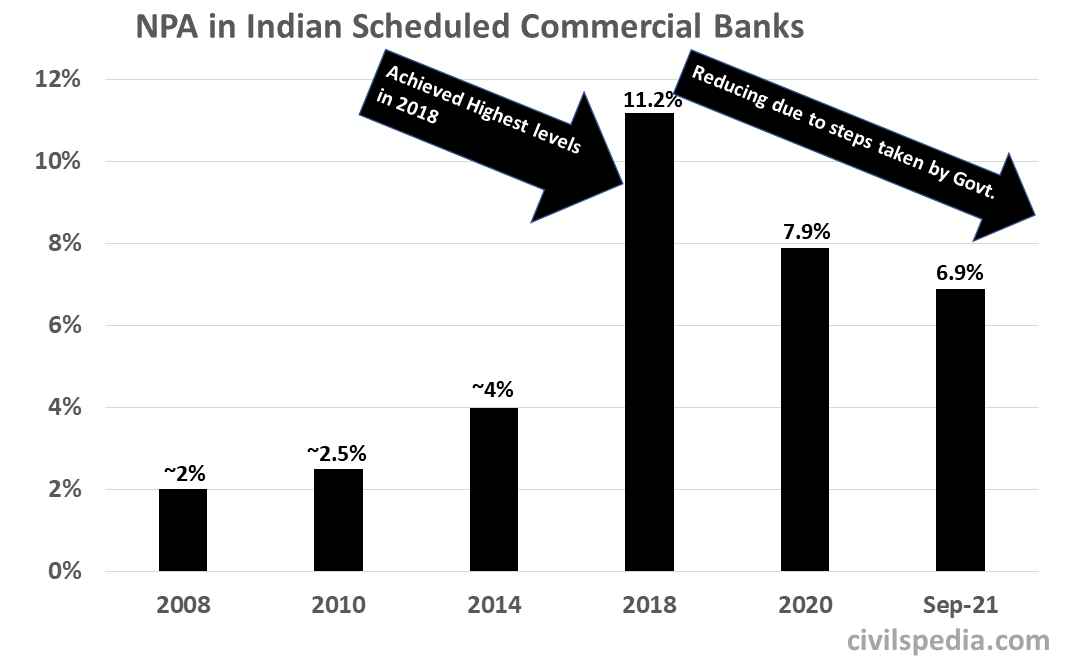

Scale of Problem

- India is facing a serious NPA problem.

- Indian Commercial Banks’ NPA reached ₹12 lakh crores in 2018; and 11.2% of total lending. Although NPAs are declining after achieving a peak in 2018.

- RBI has placed a moratorium on Indian banks like Lakshmi Vilas Bank and Yes Bank capping deposit withdrawals due to a large amount of NPAs in these banks.

- The majority of these NPAs is in Public Sector Banks (Rs 10 lakh crore in 2018) and are in the name of Big Business Houses, leading to the Twin Balance Sheet Problem.

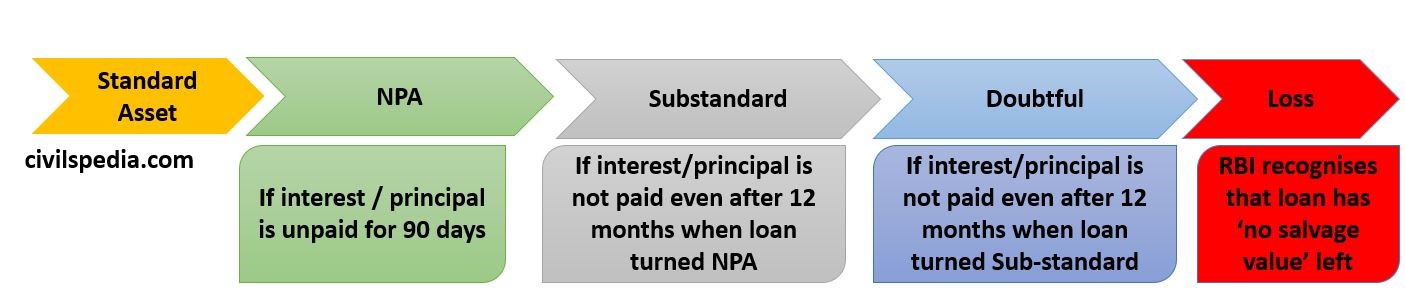

What is NPA?

- Generally speaking, NPA is any asset of a bank that is not producing any income.

- On a bank’s balance sheet, loans made to customers are listed as assets. The biggest risk to a bank is when customers who take out loans stop making their payments, causing the value of the loan assets to decline.

Criteria of deciding NPA

- Loans don’t go bad straightaway. Customers are allowed a certain grace period.

- Commercial Loans: More than 90 days overdue.

- Agriculture Loans: More than 2 harvest seasons or 2 years, whichever is lesser.

Categories

Net NPA

- Above is Gross NPA. Net NPA is obtained by taking into account Provisioning.

- Provisioning means banks are required to set aside some funds to cover the losses done by NPAs.

Net NPA = Gross NPA – Provisioning

Stressed Assets

- Stressed Assets = NPA + Loans Written Off

- Banks generally write-off loans to reduce their taxable income & corporate tax & also to clean up their balance sheet. But Write-off doesn’t mean Loan Waiver. They still have the right to recover their loans.

Causes of huge NPA

NPA has reached the level of ₹12 lakh crore. The main reasons that the situation has reached such a level are

- Over-optimism of the Banking Sector: Many NPAs can be traced back to 2006-2008 when banks didn’t pay due diligence while giving loans to power and infrastructure projects, anticipating high economic growth.

- Global and domestic macro-economic instabilities in the recent decade: Due to this, a slowdown was seen in the economy diluting the capability of the borrowers to service the loans.

- Cost Overruns: Projects suffered from delays due to Policy Paralysis, Judicial Activism and Environmental activism, thus impacting the loan servicing capability of the borrowers was dented in a big way.

- Projects were not able to recover their costs due to the Global Financial Crisis of 2008.

- Poor Credit Appraisal System: The banks have not developed sufficient capacity to undertake credit appraisal before giving loans.

- Wait & Watch Approach of Banks: Evergreening of loans (i.e. zombie lending or giving the loan to pay back the old loan) by banks before forming Bankruptcy code.

- Regulatory and Policy Risks: The past few years in India saw a volatile regulatory framework that built stress in certain industries. Some examples include

- Mining ban in certain southern Indian states

- The decision to cancel and re-auction the telecom airwaves

- Industry-Specific Risks: Industry-specific reasons caused a rise in NPA levels in India. Sectors that are seeing advanced stress are aviation, textile, and telecom. The higher NPAs in the aviation sector can be attributed to the high cost of aviation turbine fuel, which accounts for 45% of total operating costs.

- Poor Credit Appraisal System: The banks have not developed sufficient capacity to undertake credit appraisal before giving loans.

- Wilful Defaulters: There has been an increase in the number of wilful defaulters who have failed to repay their loans in spite of having the capability to do so.

- Priority Sector Lending loans turned NPA because they cater to economically vulnerable sections.

- Credit Culture: The announcement of farm loan waivers by the Central Government and various state governments has affected the credit culture in India.

- Lack of Policy foresight: Delay in the formulation of insolvency and bankruptcy code for faster resolution of NPAs.

- Lack of Integrated database on Credit Information: Presently, multiple agencies capture credit-related information without proper coordination. Further, the RBI’s proposal to create Public Credit Registry faces legal challenges.

Impact of higher NPAs

- Reduced Profitability of Banks: Due to the provisioning, banks are forced to keep 25 to 30% of NPAs, impacting banks’ profitability.

- Capital Adequacy: With the increase in the NPAs, the banks’ capital requirements become higher, thus putting additional pressure on the government to recapitalize the banks.

- Lower confidence of shareholders: The increase in the levels of NPAs decreases shareholders’ confidence, making it difficult for the banks to raise capital from the market.

- Public confidence: It lowers the confidence of the common public in weak banks, making it difficult for such banks to gather cash for their operations.

- It has led to the scarcity of funds in the Indian market. Consequently, businesses can’t get loans to expand their businesses.

- Fall in value of shares of Banks: Return on Assets (ROA) of Indian banks has become lower than international norm of 1.5%. Hence, Investors are not willing to invest in shares of Banks.

- Total NPAs have touched figures close to the size of the UP budget. Imagine if all the NPA was recovered and how well it can augur for the Indian economy.

In a nutshell, the high incidence of NPA has a cascading impact on all important financial ratios of the banks, viz., Net Interest Margin, Return on Assets, Profitability, Dividend Payout, Provision coverage ratio, Credit contraction etc., which may likely erode the value of all stakeholders including shareholders, depositors, borrowers, employees and public at large.

But Indian Case is unique in some sense

- When Japan (1990s) , East Asia (1998), US & UK (2008) faced an such NPA crisis, their economies collapsed. But it isn’t likely in India because the Indian NPA crisis is unique.

Reasons for this are

- NPAs are concentrated in Public Sector Banks which enjoy Sovereign Backing. No bank run has happened due to this.

- The majority of NPA is in infrastructure loans like Power Plants, Ports etc. Once the world economy starts to boom, these projects will begin to generate income (in contrast to US Subprime Crisis, NPAs were concentrated in Housing loans).

- Most NPAs are concentrated in a few big corporate houses. Hence, banks have to deal with a few cases.

What RBI has done to tackle this menace?

1. Special Mention Account

- Loans become NPA after 90 days. If we can classify assets that are approaching to become an NPA but haven’t yet become NPA, we can tackle them.

- Hence, RBI came with a new category known as Special Mention Accounts (SMA) between Standard Asset and NPA.

| SMA 0 | If loan principal / interest unpaid for 1-30 days from its due date |

| SMA 1 | 31-60 days |

| SMA 2 | 61-90 days |

2. Asset Quality Review

- In 2015, RBI ordered the Banks to conduct Asset Quality Review (AQR) and start rectifying bad loans, i.e. Bank doesn’t change loan interest, tenure or terms but asks the client to rectify his irregularity in loan repayment.

3. Strategic Debt Restructuring

- Under Strategic Debt Restructuring, Bank converts its debt to equity (shares with voting rights). Later, the bank sells this equity to the highest bidder.

- But scheme remained unsuccessful as floating shares with voting rights require the approval of existing shareholders.

4. 5/25 for Infra loans

- RBI allowed banks to extend the tenure of infrastructure loans o 25 years and even reduce loan interest rates for the client so that tenure of the loans matches the long gestation period in the sectors. But, such an interest rate was to be reviewed every 5 years.

6. Scheme for Sustainable Structuring of Stressed Assets (S4A)

- Under S4A , the unsustainable portion of the debt is converted to equity (Preferential Shares without voting rights).

- This scheme was more successful than the Strategic Debt Restructuring as no permission is required for floating such shares as it doesn’t affect the voting powers of existing shareholders.

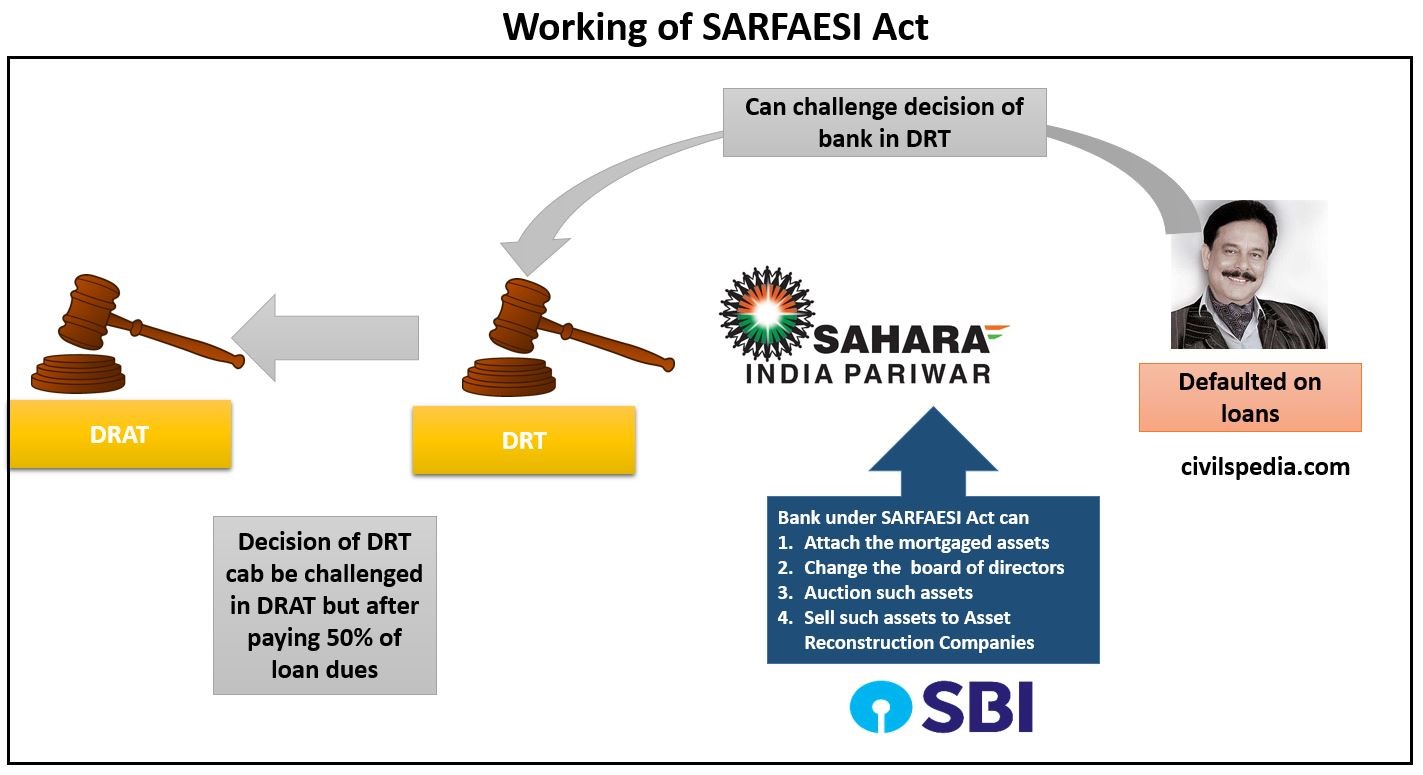

7. SARFAESI

- Earlier, banks couldn’t recover their loans because clients used to obtain stay orders from ordinary courts. Hence, Narsimham Committee recommended the formation of the Debt Recovery Tribunal (DRT). DRT was formed in 1993 so that ordinary courts couldn’t interfere in loan recovery cases.

- To further empower Banks, the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act was enacted in 2002, under which

- Banks and Housing Finance Companies (NBFCs) can attach the mortgaged assets when the loan is not repaid. They can also change the board of directors, auction such assets, and sell them to Asset Reconstruction Companies (ARC).

- SARFAESI is not applicable on farm loans.

- If the loan-defaulter wants to obtain a stay order against the decision of the Bank, he can’t go to ordinary courts. He will have to approach DRT. The decision of DRT can be challenged in the Debt Recovery Appellate Tribunal (DRAT) after depositing a minimum 50% of the loan dues.

8. Insolvency & Bankruptcy Code

Dealt in Separate Article (Click here)

Now, just the Insolvency and Bankruptcy Code will be used to settle all the cases involving NPAs. All other schemes have been scrapped.

9. Haircut / One Time Settlement (OTS) Scheme for Agriculture Loans

Agricultural Loans don’t come under SARFAESI Act. The Haircut / One Time Settlement (OTS) Scheme is used to settle such cases.

- Under the scheme, some part of the loan is waived, and the rest is recovered from the farmer.

- E.g., For Tractor Loans given before September 2011, there was a total of 6,000 crores worth of doubtful/loss cases. One Time Settlement with a Haircut of 40% (i.e. have to pay 60%) was announced in 2017.

10. Amendment to Banking Regulation Act

- Earlier, Officers of the Banks were not able to take decisions to resolve NPAs in fear of persecution by CVC, CBI, CAG etc., as resolving such cases requires giving haircuts and restructuring loans.

- To solve these problems, the government amended Banking Regulation Act. The amendment has the following provisions.

- Government can order RBI to initiate Insolvency & Bankruptcy proceedings against defaulters.

- It empowers Central Bank to identify specific stressed assets and initiate Insolvency and Bankruptcy proceedings against them.

- The decisions of bank officials will be ratified by Oversight Committees appointed by the RBI, which will ensure that due process was followed to reach a particular decision.

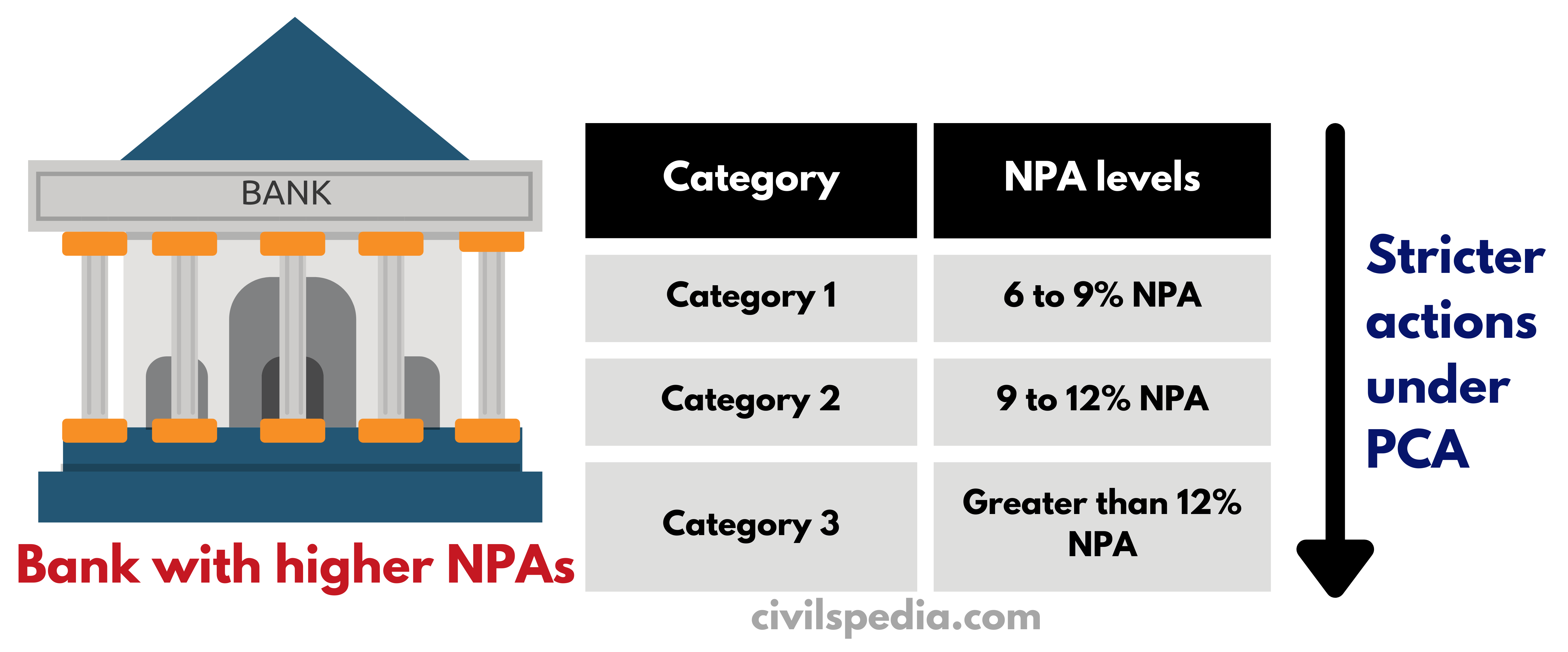

11. Prompt Corrective Action

- Under Prompt Corrective Action (PCA), Banks are categorized in Category 1, 2 or 3 based on levels of NPA in that bank.

- Then, accordingly, RBI will take corrective actions against weaker banks with high NPA like :

- Restricting raise in salaries of bank directors.

- Stopping banks to give a dividend to their investors.

- Restricting branch expansion.

- Restricting lending operations of weak banks.

- Forcing merger and shutdown of the weak bank.

- If a bank wants to come out of restrictions, it will have to reduce its NPA.

- In 2022, RBI brought the NBFC (D) or Deposit Taking NBFCs into the ambit of PCA.

12. Wilful Defaulters

- A Wilful Defaulter is one who

- is financially capable of repaying and yet does not do so OR

- diverts the funds for purposes other than what the fund was availed for OR

- has sold or disposed of the property used as a security to obtain the loan.

- If an entity’s or individual’s name is figured in the list of wilful defaulters, it is barred from availing of any banking facility and accessing financial institutions for five years. The lenders can initiate the recovery process and can even initiate criminal proceedings if required.

13. Fugitive Economic Offenders Act, 2018

- This act targets economic offenders accused of cheque dishonour, loan and investment scam, money laundering etc., worth ₹ 100crores or more & left India to avoid prosecution.

- Special courts under the PMLA (Prevention of Money-Laundering Act, 2002) have the power to order a fugitive to appear within 6 weeks. If the person doesn’t comply, he is declared a “Fugitive Economic Offender”. Subsequently, Indian & Overseas & Benami properties of such fugitives can be attached.

- No ordinary civil court or tribunal can issue a stay order. The person can appeal only in High Court and Supreme Court.

Economic Survey (2021): Regulatory Forbearance

Regulatory forbearance means emergency relief from the strict regulations provided by the RBI to banks to deal with the spillover effects of the Subprime crisis of 2008 in India. Under the provisions, RBI allowed the restricting bank loans and their reclassification from NPA to Standard loans. It proved helpful as Banks were not required to keep a large amount in the provisioning.

But what went wrong was the fact that such forbearance was allowed to continue till 2015, even when the crisis was over. Ideally, such relief should have been a temporary measure and should have stopped after 2011, when economic recovery happened.

Regulatory forbearance was an emergency medicine that started to show its side effects when it was allowed to continue forever. The side effects were in the form of detrimental impacts on the health of the banking sector and economy like

- Unviable loans were restructured by the banks to dress up their accounts and further deepen the NPA crisis.

- Encouraging banks to do zombie lending.

- Banks indulged in the ever-greening of loans, i.e. gave new loans to non-creditworthy borrowers to pay back their previous loans.

As a result, NPAs were doubled compared to pre-forbearance levels.

Policy Lessons for the Post-Corona Recover

- During the Covid pandemic, RBI has again announced regulatory forbearance measures such as loan moratoriums, loan restrictions etc. But, the government shouldn’t continue these measures once the situation normalises.

- Bank auditors who fail to report the malpractices such as ever-greening and zombie lending should be penalized.

- Economic Survey believes it can be counterproductive when emergency medicine becomes a staple diet. Moreover, Spanish philosopher George Santayana says, “those who don’t learn from the history are condemned to repeat it.”

The Wayout

1. Recover NPA

The simplest approach to cut down NPA is to recover the debt by

- Making Bad Bank/ PARA (explained below).

- Amending Bankruptcy Act to make it friendly for creditors to recover their money.

2. Using tools of Information Technology

Economic Survey (2020) has suggested to used AI and ML to fight the menace of NPAs. It can be used in the following ways

- Using Artificial Intelligence (AI) and Machine Learning (ML): AI can be used to monitor transactions of Wilful defaulters so that they can be stopped from transferring assets of the company to other accounts before applying for insolvency.

- Geo-tagging the assets of the company (using GPS technology) so that defaulters can’t pledge the same assets to take different loans and move assets from the property before undergoing bankruptcy.

- Using Blockchain Technology to check the authenticity of data provided by the creditors.

- Tracking Social Media accounts and travel history of the defaulters using AI and ML to know about the actual financial position of the defaulter.

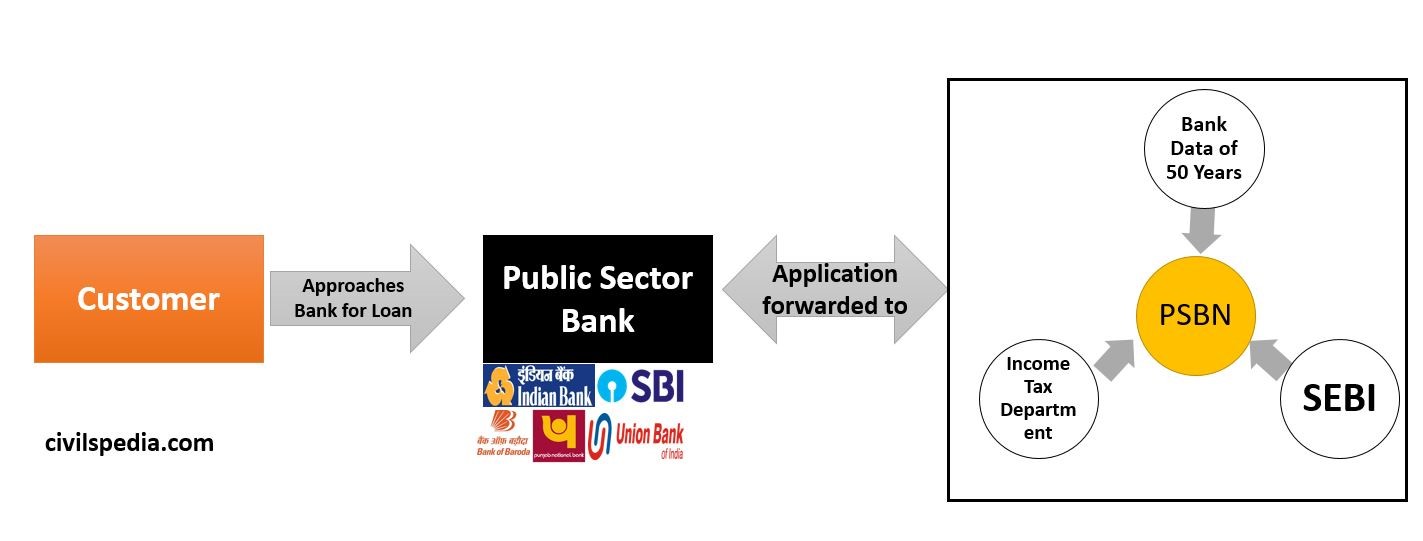

3. Using PSBN

- Economic Survey (2020) has recommended creating Public Sector Bank Network (PSBN).

- PSBN will act as a Financial Technology Hub that will connect all the banks to a single server containing data from the past 50 years, Financial data from the Corporate Affairs Ministry, SEBI, Income Tax Department etc.

4. Employee Stock Option Plans (ESOPs)

- ESOP is a type of benefit plan wherein employees are given some company shares apart from regular salary (companies like Facebook, Google and many other StartUps already use ESOPs).

- The existing salary-based compensation mechanism encourages employees to prefer safety and conservatism over risk-taking and innovation. But giving them some shares via ESOP may encourage risk-taking and a possible change of mindset from that of an employee to that of an owner.

6. Conservatism

- Banks need to be more conservative in granting loans to sectors that have traditionally been contributors to NPAs. The infrastructure sector is one such example.

7. Deregulate economy

- Government should promote the Corporate Bond market so that Corporate houses and entrepreneurs can directly raise debt from the market instead of approaching the banks.

8. Merger and Privatization

- Government should recapitalize only profit-making banks, while loss-making PSBs with high levels of NPAs should either be merged with some anchor bank or privatized.

Once the Twin Balance Sheet problem is resolved, there could be significant moral hazards. Newly cleaned-up balance sheets may encourage bank managers to lend freely, ignoring past lessons. Structural reform aimed at preventing this can take many forms, but serious consideration must also be given to the issue of government majority ownership in the public sector banks. It leads to Governance Reforms in the Banking sector.

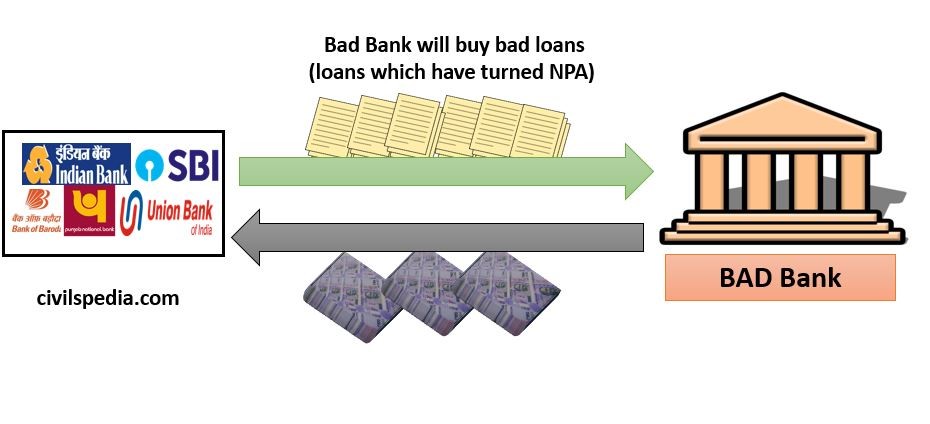

Bad Bank / PARA

- To solve the NPA problem, PARA/ Bad Bank buys bad loans from PSBs and tries to salvage the loan’s maximum value by either restructuring loan or liquidation, auctioning or changing ownership of the company and absorbing the losses.

- July 2021: The government of India set up National Asset Reconstruction Company Ltd (NARCL) and Indian Debt Resolution Company Ltd. (IDRCL) (together NARCL and IDRCL will act as the Bad Bank) to clean up the NPAs.

Process

- NARCL will acquire the NPAs up to the worth of Rs 2 lakh crore from commercial banks by paying 15% of the agreed price as upfront money and the rest of 85% in the Security Receipts. NARCL will be capitalised through equity and debt from various banks and has a limited life of 5 years.

- These NPAs will then be transferred to Indian Debt Resolution Company Ltd. (IDRCL), which will sell the stressed assets to recover the money.

Why Bad Bank can be a good idea?

- East Asian Economies have successfully used this approach to solve the mess created during the South Asian Currency Crisis of the mid-1990s. Similarly, other countries such as Malaysia, Finland, Belgium, Indonesia etc., have also set up Bad Banks to deal with NPAs.

- Decentralised Decision making isn’t working because there are coordination problems since large debtors have many creditors. Bad Bank can solve this issue.

- Stressed debt in India is heavily concentrated in large companies. Such big debts can be solved by a professional organisation like PARA or Bad Bank.

- Before this arrangement was put in place, India has 28 ARCs (Asset Reconstruction Companies). But they haven’t proved any more successful than banks in resolving bigger NPAs due to limited capitalisation. But international experience shows that a professionally run central agency with government backing can provide the solution in this regard.

- It will lead to the unlocking of capital locked up as provisioning requirements, thus increasing the credit creation.

- Enable the bank to focus on its core areas of accepting deposits and lending loans when the recovery of bad loans gets transferred to the specialist Bad Bank.

- Aggregating debt: Set up of NARCL will help address the problem of contradictory views (lack of consensus) among different lenders, allowing debt recasts.

Arguments against

- Moral Hazard: Shifting of NPAs without accountability risks the moral hazard of reckless lending, further amplifying the problem.

- It will not have a long term impact because it doesn’t solve the underlying problem of NPAs in the country and only leads to the transfer of NPAs.

- Financing a Bad Bank in India is also very difficult.

- Qualified Professionals: India lacks adequately trained manpower.

- Mere shift of bad loans: According to ex-RBI Governor Raghuram Raman, the setting up of a Bad bank will merely transfer Assets from one entity to another.

- RBI has raised issues over the structure of this mechanism. According to the SARFAESI Act, which deals with the ARCs, there needs to be one entity that deals with both the purchase of the bad loans and the resolution of those loans.

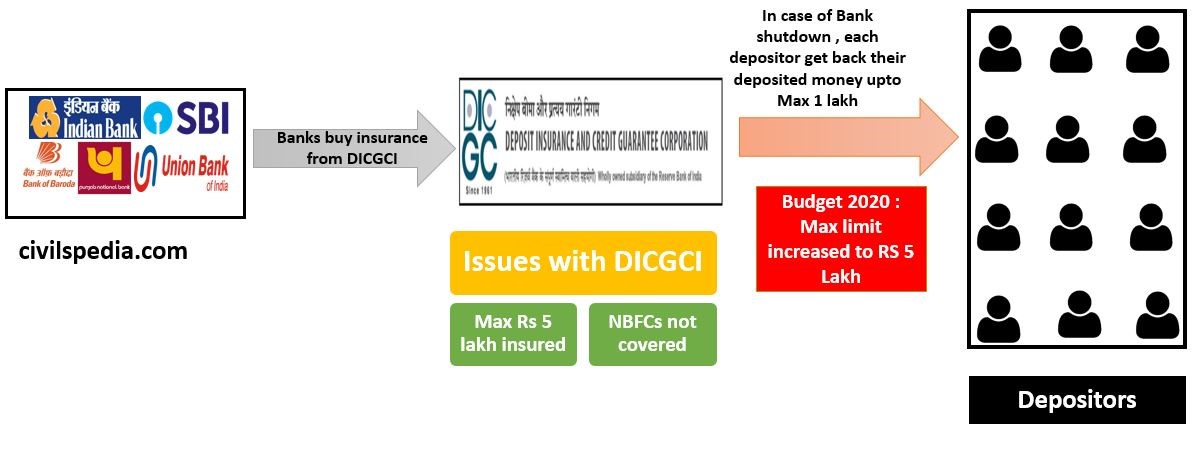

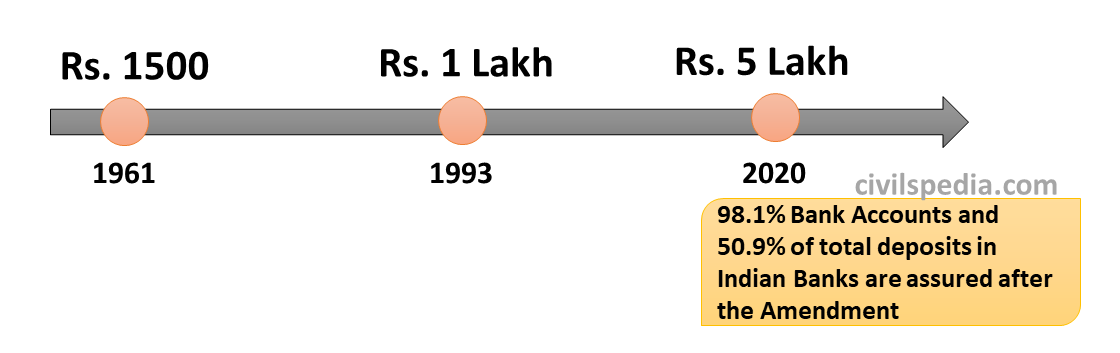

Side Topic: Deposit Insurance & Credit Guarantee Corporation of India (DICGCI)

The acts came to the scene due to the higher probabilities of bank failures due to large NPAs. There are some issues in DICGCI which needs to be corrected.

DICGCI

- Deposit Insurance & Credit Guarantee Corporation of India.

- It is a 100% RBI owned company.

- This insurance cover is provided to Commercial banks, Regional Rural Banks, Local Area Banks, Payment Banks, Small Finance Banks and Cooperative Banks.

- All Banks have to buy insurance from DICGCI on their deposit. A maximum of 5 lakh (changed in Budget 2021 – earlier it was Rs 1 lakh) of each depositor is insured in the case of a Bank shut down or if the bank is placed under moratorium.

Problem

- If a customer had deposited more than ₹5 lakh in a single commercial bank, then he gets only ₹5 lakh from DICGCI. For the remaining amount, he must wait till RBI liquidates the bank.

- DICGCI doesn’t cover NBFCs. E.g., UTI Mutual Fund Case of 2002.