BASEL Norms and India – UPSC Notes

This article deals with ‘BASEL Norms and India – UPSC Notes .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

BASEL and BASEL Norms

Bank of International Settlement (BIS) is owned by 60 Central Banks & has Committee on Banking Supervision at Basel (Switzerland), which made Basel Norms.

- BASEL I -1988

- BASEL II – 2004

- BASEL III – 2011

The rationale of BASEL Norms or Capital Adequacy Ratio

Central Banks around the world have been making provisions to act as shock absorbers in case of a bank run (bank bankruptcy). Providing shock absorbers to banks has seen three major developments.

- Provision of Cash Reserve Ratio, i.e. keeping a cash ratio of total deposits mobilized by the banks (already studied).

- Provision of Statutory Liquidity Ratio (SLR), i.e. maintaining some assets of the deposits mobilized by the banks with the banks themselves in non-cash form (already studied).

- Provision of the Capital Adequacy Ratio (CAR) norm (BASEL Norms that we will study in this article).

BASEL III norms explained

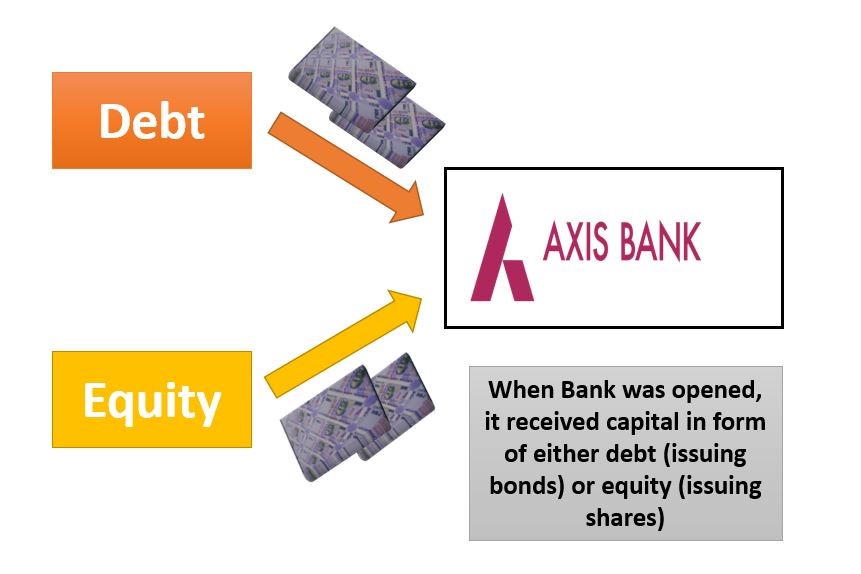

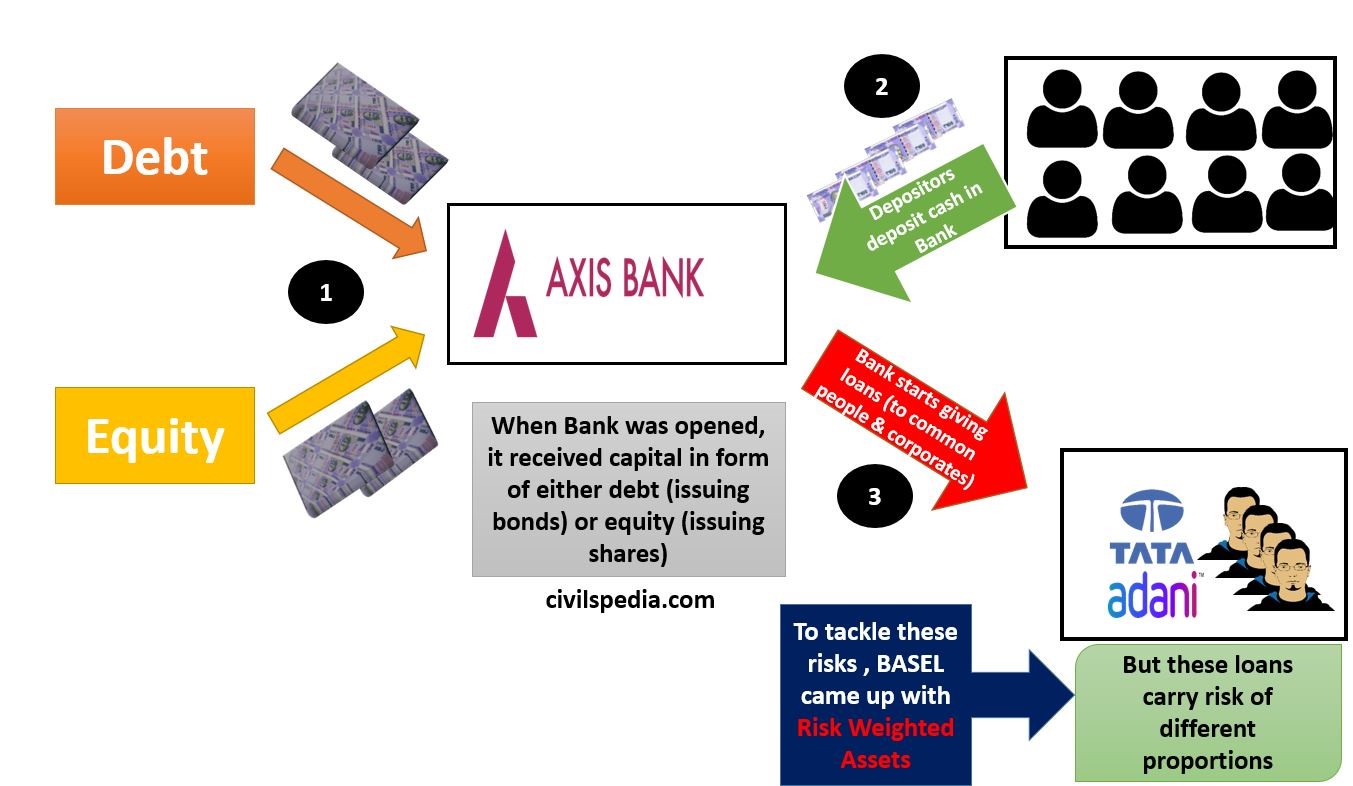

When a bank opens after getting a license from RBI, it will initially gather capital in the form of Debt & Equity.

After that, when operations of the Bank start, it will receive money in the form of cash deposited by the depositors, which it will further lend in loans after keeping aside CRR & SLR Obligations. But these loans also carry RISK, which measures the probability that the loan will not return.

Note: What Bank is getting in deposits is not capital but raw material. The capital of the Bank is what Bank will get via issuing bonds or shares.

Hence, BASEL developed the concept of Risk Weighted Assets to tackle the risk that loans carry.

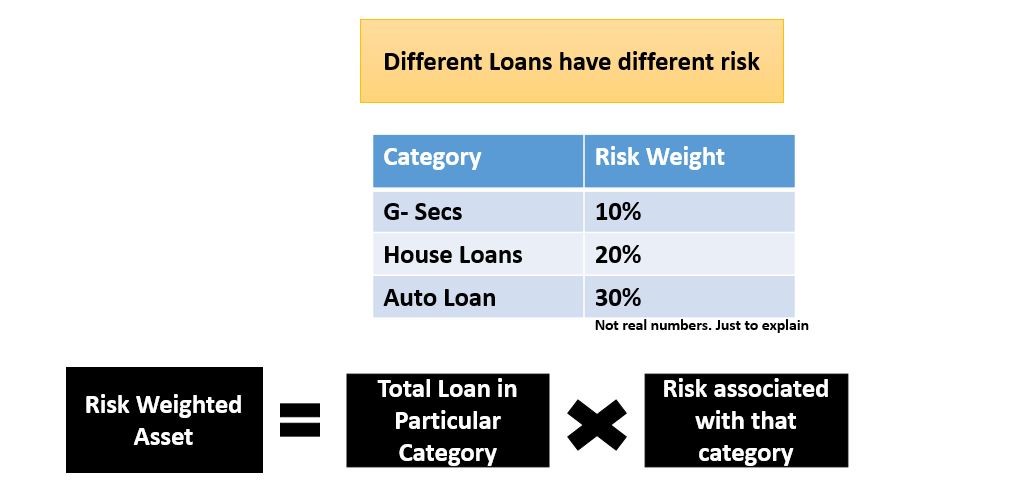

- Some loans are riskier than others. Hence, more risky loans will carry more Risk Weight.

- E.g., Home Loans are riskier than G-Secs. Hence they will be assigned more Risk Weight

- Then total Risk Weighted Asset of the Bank is calculated using the following formula

Risk Weighted Asset = (Total Loan in Particular Category) X (Risk associated with that category)

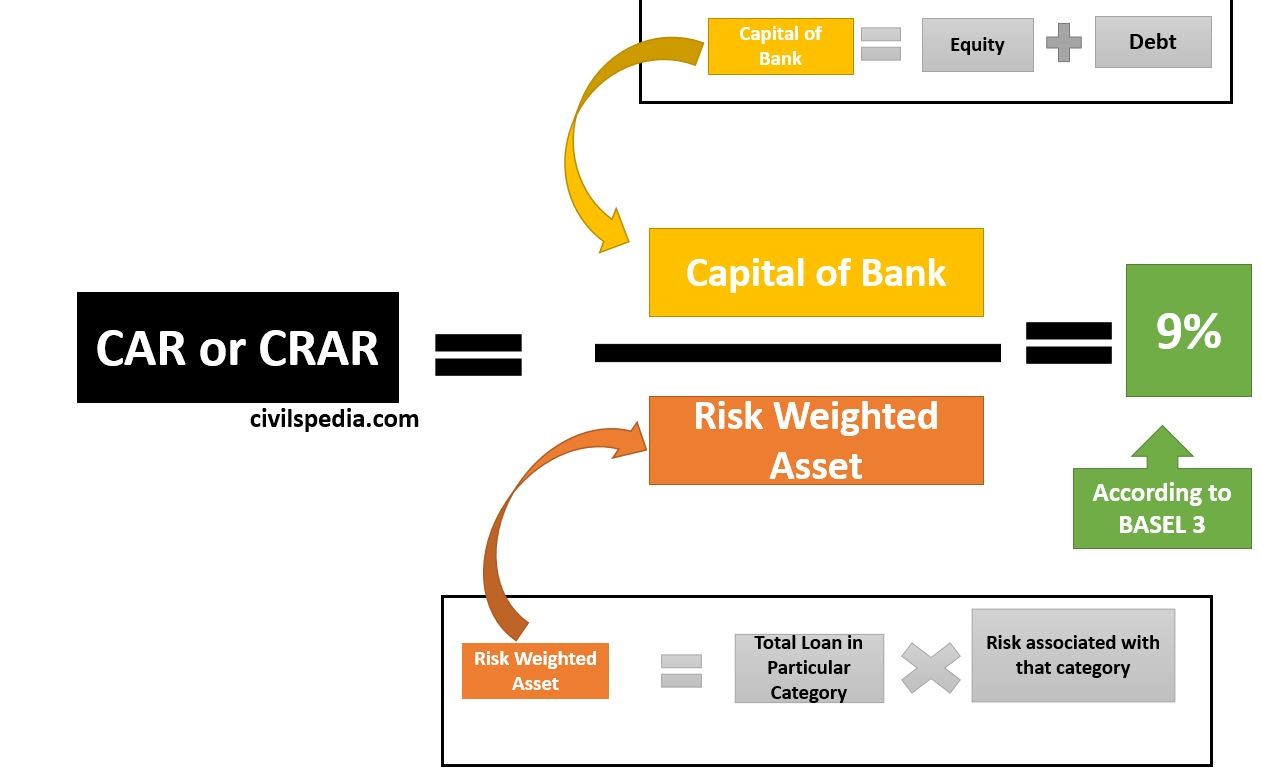

BASEL III norms say that the Ratio of Capital of a Bank to its Risk Weighed Asset must be 9% (i.e. Capital to Risk Weighted Asset Ratio (CRAR), aka Capital Adequacy Ratio (CAR), should be 9%).

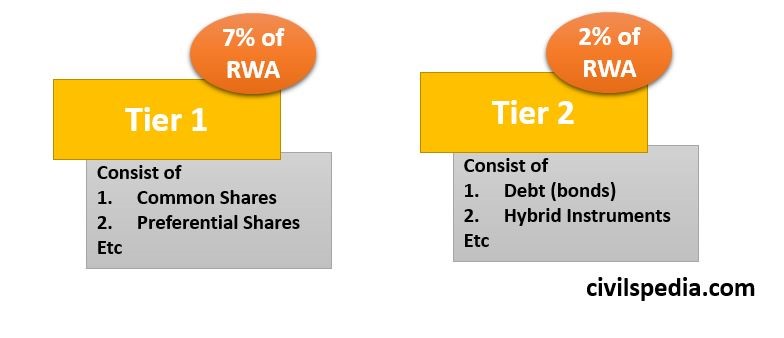

& in the capital, there are two types of capital – Tier I (Shares) & Tier II (Debt) so that there is a balance between debt and equity of the Bank.

Domestic Systematic Important Banks (DSIB)

- The Financial Stability Board has advised countries to identify their Systemically Important Financial Institutions and put a framework to reduce risk.

- In pursuance of the directive, RBI has started identifying the banks that are ‘too big to fail’ and labelled them as Domestic Systematic Important Banks (DSIB). These banks are called so because of their size, cross-jurisdictional activities, complexity and interconnection. If these banks fail, they can have a disruptive effect on the whole economy.

- Since 2015, annually, RBI has identified banks that are ‘too big to fail’ (=if they fail, it’ll severely hurt the economy)’ and labelled them as Domestic Systematic Important Banks (D-SIB), & ordered them to keep additional capital & technical norms.

- In India, DSIBs include banks whose assets cross 2% of the GDP are considered DSIBs—the list of DSIBs includes SBI, ICICI, and HDFC.

What do they have to do?

- D-SIBs are categorized under five buckets.

- According to these buckets, the banks must keep additional CAR under the Tier 1 Category (Equity).

- Three Banks: HDFC (latest entry in 2017), ICICI & SBI are D-SIBs

- HDFC & ICICI = Bucket 1 (additional 0.15% CAR, i.e. they have to keep 9.15 % CAR)

- SBI = Bucket 3 (additional 0.45% as CAR)

But, the additional capital D-SIBs need to keep aside is much lower than in other nations. Therefore, RBI should develop more stringent measures.

Recapitalization of PSBs

- For state-run banks to achieve capital adequacy standards, they require a capital infusion, known as the Recapitalization of the Bank.

- To comply with BASEL 3 Norms, Public Sector Banks (PSBs) require additional capital. But issue is

- Due to the weak situation of Banks, it is difficult for Banks to raise capital via the Equity route as their shares are not fetching a good amount.

- Interest rate to raise capital via Debt is also high due to the weak position of Banks.

- Along with that, there are Tier 1 and Tier 2 requirements, and Tier 1, i.e. Equity (7%) requirement, is more compared to Debt (2%).

- Hence, Banks have stopped giving loans to decrease their Risk Weighted Assets (RWA) and, consequently, the capital required to meet the CAR target. But it negatively affects the economy as businesses and households are not getting loans.

To solve this issue, the government decided to Recapitalize the PSBs

| 2015 | Government to infuse ₹70,000 crores in PSBs as part of Mission Indradhanush. |

| 2017 | ₹ 70,000 crores were found to be insufficient. So the government decided to infuse ₹ 2.11 lakh crore. The plan was to raise this via Bank Recapitalization Bonds. |

| 2018 | Even this ₹2.11 lakh crore package was found insufficient. So, the Govt. sought supplementary grants from Parliament to infuse an additional ₹41,000 crores in PSBs. |

Other benefits of Recapitalization of Banks

- It will help create a ‘virtuous cycle of investment and jobs’ through Credit Growth.

- Tackling Non-Performing Assets (NPAs) by strengthening the capital base.

- Provide stimulus to the economy by pulling down lending rates.

- Help to save large and systemically important banks from failing.

But there are concerns associated with the Recapitalization of Banks as well.

- Increased Fiscal Deficit of government or cuts in welfare and capital expenditures

- Use of Public Funds or taxpayer money without any intrinsic changes in the PSBs governance

- Impact working culture as PSBs might not take adequate precautions in future while lending when they know that the government will step in to help if the loans turn sour.

- No Accountability from PSBs as bank recapitalization is an ad-hoc measure with no linkage to the banks’ performance or efficiency.

High-Quality Liquid Assets (HQLA)

- BASEL-III norms have also mandated that banks must keep enough amount in High-Quality Liquid Assets (HQLA) so that Bank can survive a 30-day stress-test scenario. HQLA-eligible assets include:

- Cash beyond CRR

- G-Sec beyond SLR

- High rated Marketable securities (e.g., backed by PSE, Multilateral development banks, and Foreign Governments)

- RBI Order: From 1/1/2019, banks have to maintain HQLA for 30 days stress scenario