Last Update: May 2023 (Ease of Doing Business)

Ease of Doing Business

This article deals with ‘Ease of Doing Business.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

What is Ease of Doing Business Report?

- Ease of Doing Business is an index released by World Bank to measure how easy or difficult it is to run a business in a given country.

- It ranks country based on 10 parameters like

- Construction permits required.

- Documents required to start a firm.

- Provisions for enforcement of contracts.

- Trading across the country.

- Getting credit.

- Getting electricity connection.

- Ease in paying taxes.

- The process to resolve insolvency.

- Registering new property.

- Provisions for protection of minority investors.

Ranking

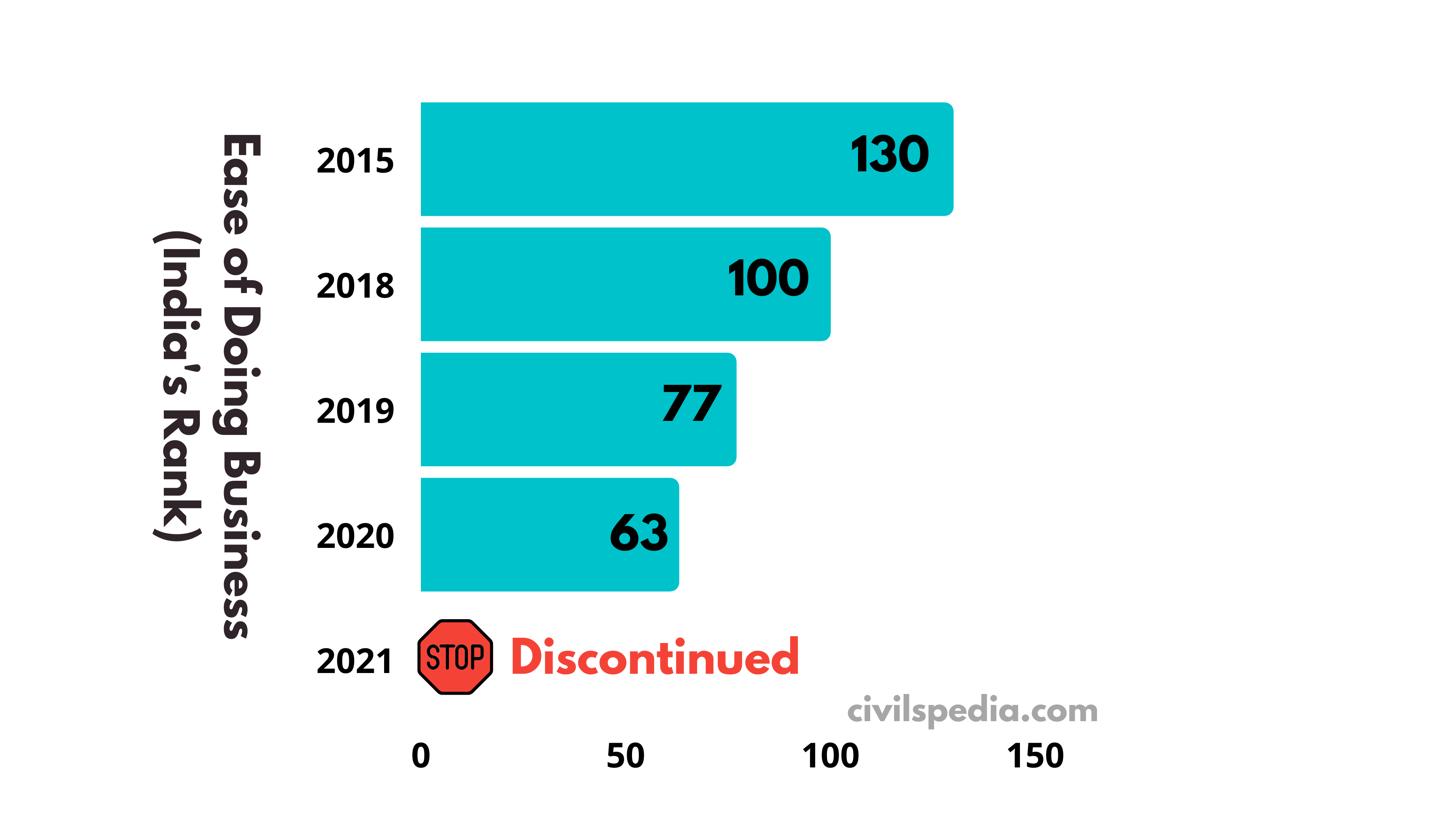

- Indian rank was improving continuously. From 130 in 2015, India’s ranking improved to 63 in 2020.

- But in 2021, World Bank suspended the Ease of Doing Business Report due to the allegations of data manipulation.

What is the government doing in this regard?

- Labour Laws have been rationalized from 44 Union Labour laws to 4 codes to make compliance easy.

- The government is promoting the Self Certification Regime Promotion through steps such as Shram Suvidha Portal.

- Insolvency and Bankruptcy Code passed for efficiently resolving insolvency.

- FDI limits have been liberalized, and more sectors have been opened.

- GST Reform has rationalized the indirect taxation system.

- The government has made incorporating new companies easy.

- Investor Facilitation Cell has been created under Invest India Program to guide, assist & handhold investors.

- Judiciary: Commercial Courts have been set up to deal specifically with cases of commercial nature.

- Protecting Minority Investors: India has strengthened minority investor protections by increasing the remedies available in cases of prejudicial transactions between interested parties.

- Simplifying the process to pay statutory dues such as provident fund contributions and corporate taxes.

- Introduction of paperless court procedures and systems including e-fling, e-payment, e-summons etc.

- Record of rights of lands has been digitalized.

What more can be done?

- Enforcement of contracts now takes longer than it did 15 years ago. (Wayout: Fast Judiciary)

- Registering property is still difficult. (Wayout: Computerization of land records)

- Paying taxes is still difficult in India.

- Trading across borders is still difficult. (Wayout: Infrastructure building like ports + Computerization at Customs)

- There is still no legislation for Land Acquisition.

Side Topic: Indian State’s Ease of Doing Business

- Department of Industrial Promotion and Internal Trade (DIPIT) publishes this report with the help of the World Bank.

- Latest such report was published in July 2022, and top-ranked states wrt Ease of Doing Business were

- Haryana

- Andhra Pradesh

- Gujarat

- Karnataka

- Punjab

Economic Survey (2020) Topic: Overregulation and Uncertainty in India

According to Economic Survey (2021), India suffers from over-regulation. For example, the time to settle a commercial dispute in India is 1445 days compared to just 120 days in Singapore.

Moreover, there is policy uncertainty in India. In such a situation, Government officials like CAG, CBI etc., create a number of rules to save themselves as these rules can be interpreted in several ways. It gives an opportunity for corruption and nepotism to the officials.

Solutions

1. Doctrine of Business Judgement Rule

- This doctrine assumes that the company’s board of director and higher officials has taken all the decisions in good faith. Hence, officials willn’t be presumed guilty unless the contrary is proved.

2. Doctrine of Minimum Government and Maximum Governance

- Government should reduce the number of regulatory bodies and rationalize the obsolete statutes.

3. Rationalize the Tribunals

- Government should rationalize the number of Tribunals. In this regard, the government is already working on explaining the number of tribunals. The government has abolished tribunals such as the Film Certification Appellate Tribunal and various tribunals under the Customs Act, Patents Act, Airport Authority of India Act etc.

4. TORA

- Government should implement the Transparency of Rules Act (i.e. TORA), under which all the organizations will have to publish the rules and regulations on their websites. Any rule not published on the website will not be applicable.