Last Update: May 2023 (Gold Imports in India (UPSC Notes))

Gold Imports in India (UPSC Notes)

This article deals with ‘Gold Imports in India (UPSC Notes).’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

- India is the 2nd largest gold importer in the world (1st = China). India imports gold from the following destinations.

- Switzerland

- UAE

- South Africa

- Due to cultural factors, Indians have a high obsession with gold.

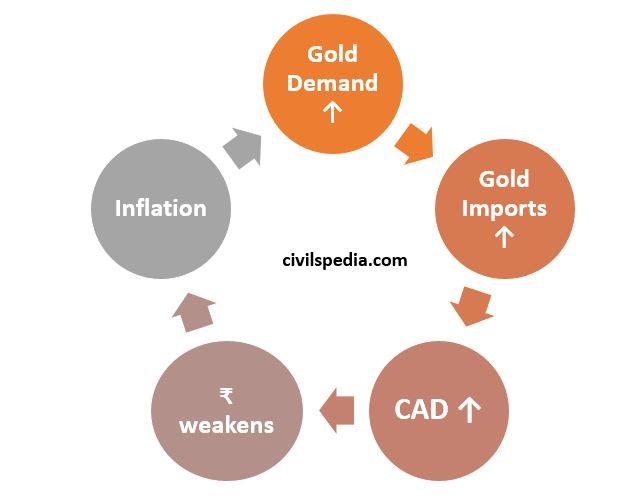

- As India imports most of its gold, it leads to a significant current account deficit and a weakening of ₹ against $.

- Along with that, high usage of gold results in following vicious cycle.

Why is high gold demand in India?

- Cultural Factors: Indians have a great love for gold ornaments.

- Intrinsic Value: Gold preserves its value in the long run and generates an above-inflation return, making investors gravitate towards gold in times of high inflation.

Steps taken by the government to reduce gold imports

To control imports of gold, the Government has taken various measures.

- Inflation Indexed Bonds: During the period of high inflation, people invest in Gold because other investments have a negative real interest rate. Interest Rates of Inflation Index Bonds are pegged to inflation.

- Custom Duty on Gold was hiked (Budget 2023).

- 80:20 Rule: 20% of imported Gold must be exported after adding value to it.

- Various Schemes like Gold Monetisation Scheme, Sovereign Gold Bond Scheme and Indian Gold Coin have been started by the Government (dealt in detail below).

Detail of Gold Schemes

#1 Gold Monetisation Scheme (GMS)

- GMS offers an option to resident Indians to deposit their precious metal and earn interest on it (up to 2.5%).

- But that Gold will be melted into Gold Coins and Bars for valuation.

- All residents can invest in this scheme but are subject to Know Your Customer (KYC) Norms & have to disclose the source of the Gold.

- Deposit limit: Minimum deposit at any one time is 30 grams with 995 fineness. There is no maximum limit for the deposit.

- Tenure and interest rate:

- Short Term (1-3 years): 2.25% interest

- Medium (5-7 years): 2.5% interest

- Long (12-15 years): 2.5 % interest

- Upon maturity, one can redeem a deposit in gold or cash equivalent.

#2 Sovereign Gold Bond Scheme

- The scheme seeks to shift part of the demand for physical gold for investment into Demat (Dematerialised) gold bonds to reduce the demand for physical gold.

- These gold bonds are interest-giving (up to 2.75% interest). On the redemption date, one gets the principal equivalent of the latest price of gold in grams. So, if the gold price increases, then investors get more profit.

- Investment Limits:

- Minimum Investment: 2 grams of physical gold

- Maximum Investment: 500 grams

- Tenure of Gold Bonds: There is a lock-in period of 5 years. 8 years is the maximum tenure. But there is an exit option from the 5th year.

- These Bonds are tradable and exchangeable.

#3 Indian Gold Coin

- It is India’s first ever Indian gold coin and bullion to be officially issued by Union Government.

- Denominations: The coins will be available in 5 and 10 grams and 20-gram bullion denominations.

- These coins and bullion can be easily liquidated.