Last Updated: May 2023 (Exchange Rate Regimes)

Exchange Rate Regimes

This article deals with ‘Exchange Rate Regimes.’ This is part of our series on ‘Economics’ which is important pillar of GS-2 syllabus . For more articles , you can click here .

Types of Exchange Rate

1. Fixed exchange Rate

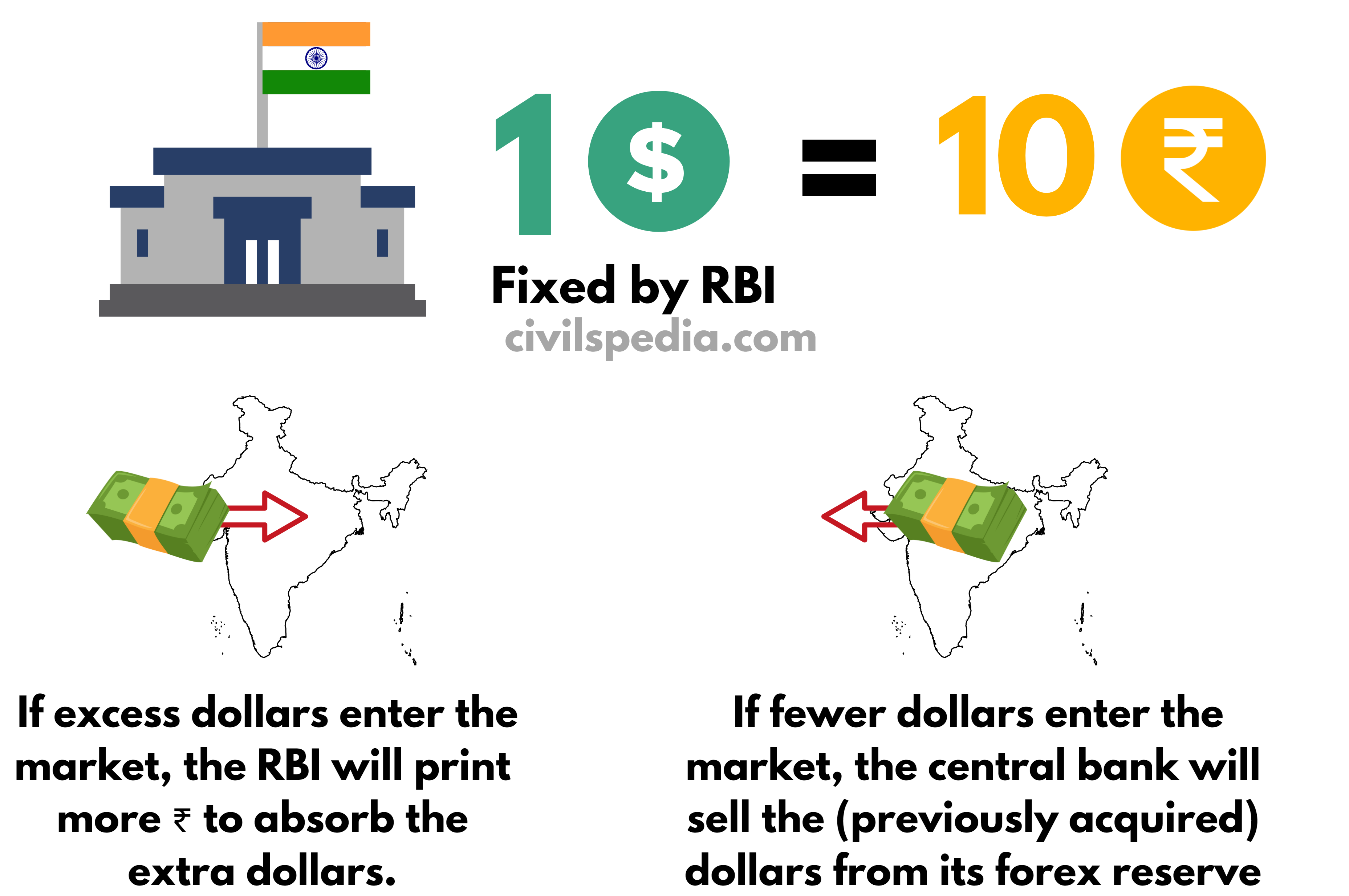

- In the Fixed Exchange Rate, the central bank of a country decides the exchange rate of the local currency for foreign currency.

- E.g., Consider an imaginary situation where RBI fix an exchange rate of 1$ = 10 ₹. If excess dollars enter the market, the RBI will print more ₹ to absorb the extra dollars. If fewer dollars enter the market, the RBI will sell the dollars from its forex reserve to ensure ₹ doesn’t weaken.

- It was operational in India up to March 1992.

Challenge: External Shocks & Fixed Exchange Rate

- In some situations, if the demand for a foreign currency in India increases exponentially, then the RBI maintained equilibrium will disturb. Initially, RBI will try to stabilize the situation by selling $s from its forex reserve. But, since RBI will not have an infinite amount of dollars in its reserve, ultimately, it will be forced to devalue ₹. Hence, the biggest drawback of the Fixed Exchange Rate Regime is that it is highly prone to external factors.

Side Note: Devaluation

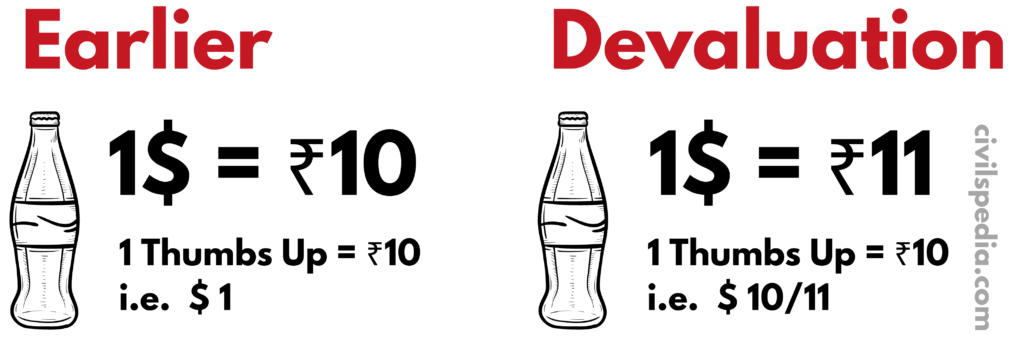

- Central Bank uses the devaluation process in the Fixed Exchange Rate Economy to cope with the abovementioned situations.

- Devaluation involves weakening the domestic currency vis-à-vis foreign currency. E.g., RBI reduces the exchange rate to 1$ = 11 ₹ (instead of earlier 1$ = 10 ₹)

- Implications of the above devaluation are as follows.

- The demand for foreign currency will decrease because (say) what work could be done earlier with ₹10 lakh abroad will now need 11 Lakh. So, some people will abandon their plans.

- Tourism and Foreign Investment: A lower currency value can attract tourists and foreign investors, making visiting or investing in the country more affordable.

- Export Competitiveness: Devaluing a currency can make a country’s exports more affordable and competitive in international markets. A lower exchange rate makes the country’s goods and services relatively cheaper when priced in foreign currencies, boosting exports and stimulating economic growth.

2. Floating Exchange Rate

- In Floating Exchange Rate Regime, the Central Bank of the country doesn’t intervene at all & the market forces (i.e. demand and supply) determine the exchange rate.

- USA and UK are the major economies following this system

- But in this case, the exchange rate is very volatile. Along with that, this system is also prone to currency speculation.

3. Managed Floating Exchange Rate

- It is the middle path between the two extremes (floating and fixed).

- In this, Central Bank doesn’t decide the exchange rate. In ordinary times, Central Banks will let the market forces determine the exchange rate. But if there is too much volatility, Central Bank will intervene by buying or selling the foreign reserves to keep the volatility under control.

- Canada, Japan, India (since 1992–93) etc., follow Managed Floating Exchange Rates.

Exchange Rate in India

| 1928 to 1948 | ‘Rupee’ was linked with the British Pound Sterling. |

| 1948 to 1975 | After the formation of the IMF, India shifted to the fixed currency system and committed to maintaining the Rupee’s exchange rate in terms of gold or the US ($ Dollar). |

| 1975 to 1992 | RBI started determining the Rupee’s exchange rate with respect to the exchange rate movements of the basket of world currencies (£, $, ¥, DM, Fr.). |

| 1992 | India shifted to Managed Floating Exchange Rate. |

NEER & REER

We keep on reading in the newspaper that ₹ has weakened against $. Does that mean ₹ is a weak currency & has become fragile? Nope, because the US is not the only country we trade with & $ is not the only currency we use to do all our transactions.

- If we want to measure the volatility of ₹ objectively, we have to compare volatility with multiple currencies.

- 1$= ₹50 or 1$ = ₹40 doesn’t decide demand of goods & services between India & USA . It also depends on relative inflation.

For this, we use NEER & REER

1. NEER

- NEER = Nominal Effective Exchange Rate

- It is the weighted average of bilateral nominal exchange rates of home currency in terms of foreign currencies.

2. REER

- REER = Real Effective Exchange Rate

- REER is the weighted average of nominal exchange rates adjusted for inflation. Hence, it captures inflation differentials between India & its major trading partners.

- REER = NEER X ( Indian Inflation (CPI) / US Inflation )

What do we get with the help of NEER & REER?

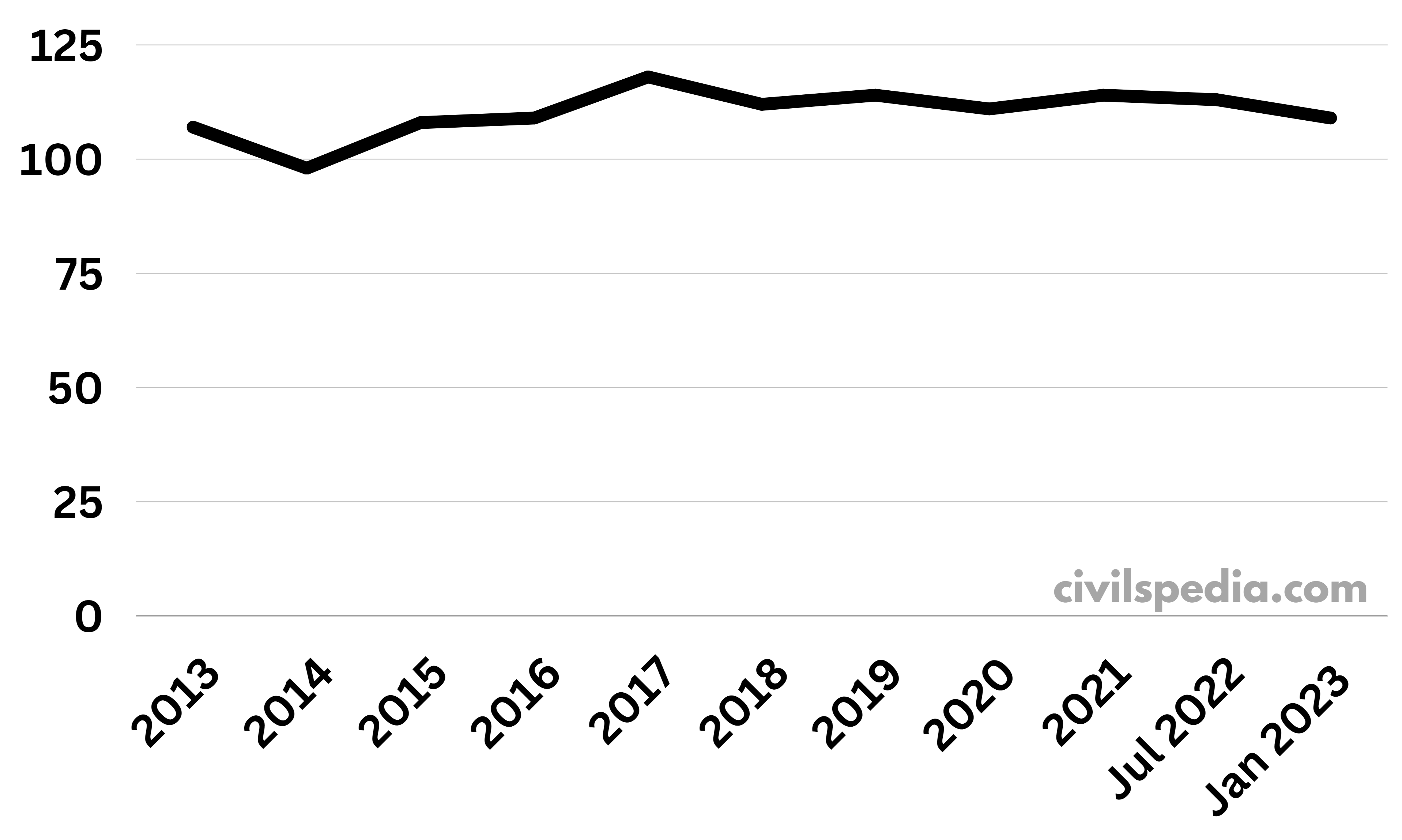

- If REER > 100: Currency is overvalued

- REER < 100: Currency is undervalued

REER Trends

Indian ₹ is overvalued (since REER > 100), and according to Economic Survey, this is bad for Indian Exports)

Purchasing Power Parity (PPP)

- It is a theoretical concept that compares the exchange rate of two currencies through their purchasing power in respective countries.

- For example, if 1 packet of bread in India costs ₹ 20 whereas it costs $2 in the USA, then Dollar to Rupee exchange rate (PPP) will be $1 = ₹ 10.

- According to OECD, in PPP terms, $1=₹ 17.

- This exchange rate can happen in real life if both countries have Floating Exchange Rate without any intervention of the respective Central banks; and if the bilateral trade is free of protectionism.

- If we look into the GDP of various countries in terms of PPP, then India is the world’s third-largest economy. The ranking is 1) USA, 2) China, 3) India, 4) Japan and 5) Germany.

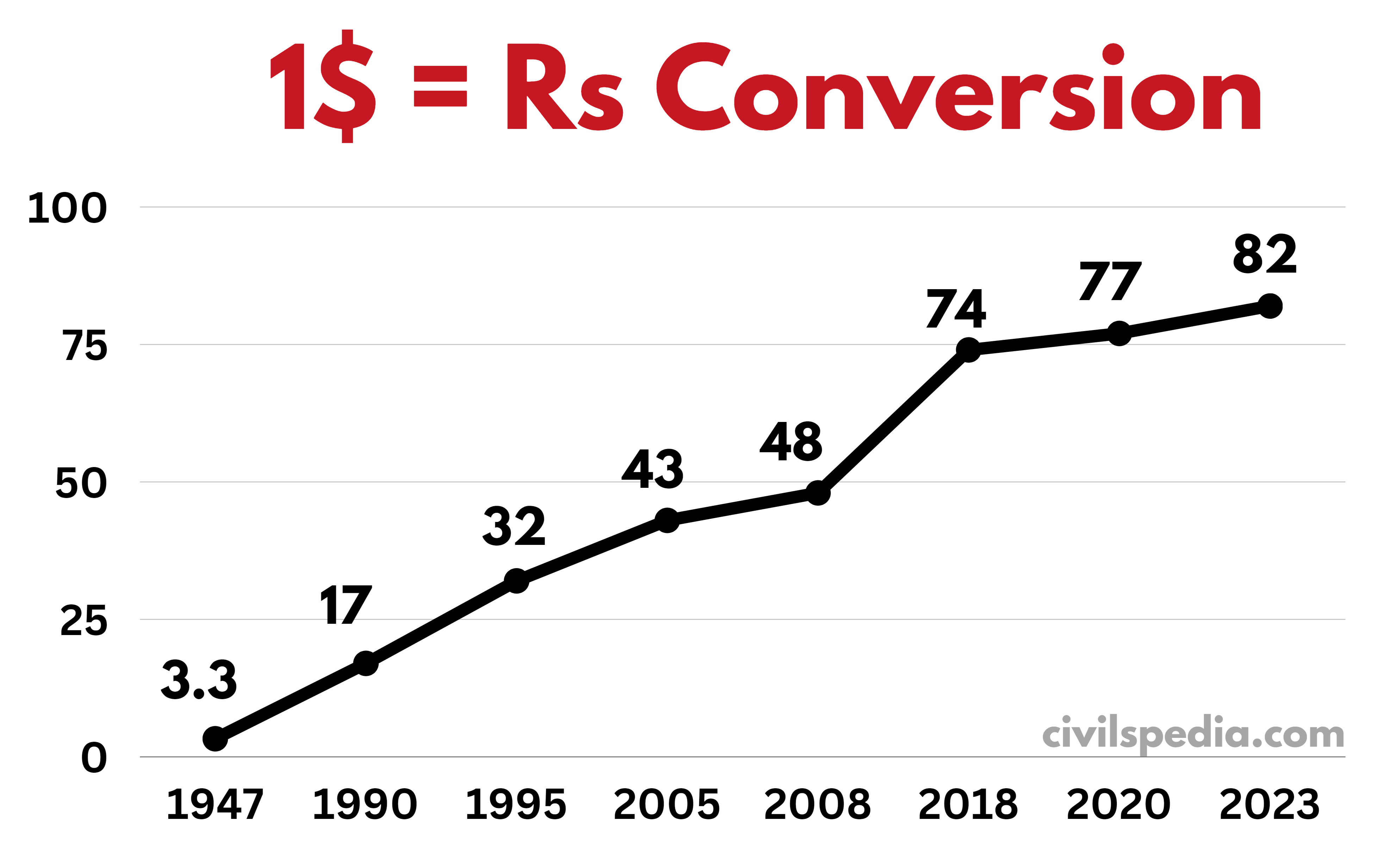

Great Fall of the Indian Rupee

Why this happened?

- Russia’s Ukraine Invasion: Due to the invasion, currencies worldwide have shown depreciation as the supply of crude oil was disrupted due to sanctions imposed on Russia.

- The outflow of funds: Capital is moving out of India because of rising interest rates in the US, making it more attractive to invest there.

- Current Account Deficit: Historically, India had a current account deficit, i.e. it spends more on imports than it earns from exports. A higher current account deficit puts pressure on the Indian Rupee, leading to its depreciation.

- Inflation Differential: The rate of inflation in India is higher than in the US, which erodes the purchasing power and the value of the Rupee relative to USD.

But according to Economic Survey (2023), with monetary tightening (by US Fed Reserve), the US dollar has appreciated against several currencies, including the Rupee. However, the Rupee has been one of the better-performing currencies worldwide.

What India did to fight?

- FPI investment limits have been relaxed to attract foreign investors to India.

- Currency Swap Agreements have been signed with countries like Japan.

- Agreement with countries like Iran to buy Crude Oil directly in ₹.

Internationalization of Rupee

The Tarapore Committee on Full Capital Account Convertibility defined international currency as ‘a currency that is widely used for international transactions. Internationalization of a currency (Rupee here) is a process to increase rupee acceptance (credibility) worldwide.

Benefits of Internationalization of the Rupee

- Reduced Foreign Exchange Reserves requirement for the balance of payment. It can also reduce the imposed cost of forex on the economy by Interest Rate Differential (IRD). IRD is the change in interest rates between the currencies of two countries.

- Reduced Vulnerability to External Shocks because of reduced dependence on foreign currencies.

- Mitigates Currency Risks for Indian Enterprises by eliminating foreign exchange fluctuation, reducing the cost of doing business and supporting the global growth of Indian businesses.

- Enhance India’s global stature and respect, helping Indian Businesses through increased bargaining power.

Steps taken by Government in this regard

- Cross Border Borrowing in Indian Rupees: Introduction of Rupee Denominated Bonds or Masala Bonds

- Currency Swap Agreements: India has signed currency swap agreements with countries such as Japan, UAE etc.

- International Trade Settlement in Indian Rupees (EXPLAINED BELOW)

International Trade Settlement in Indian Rupees

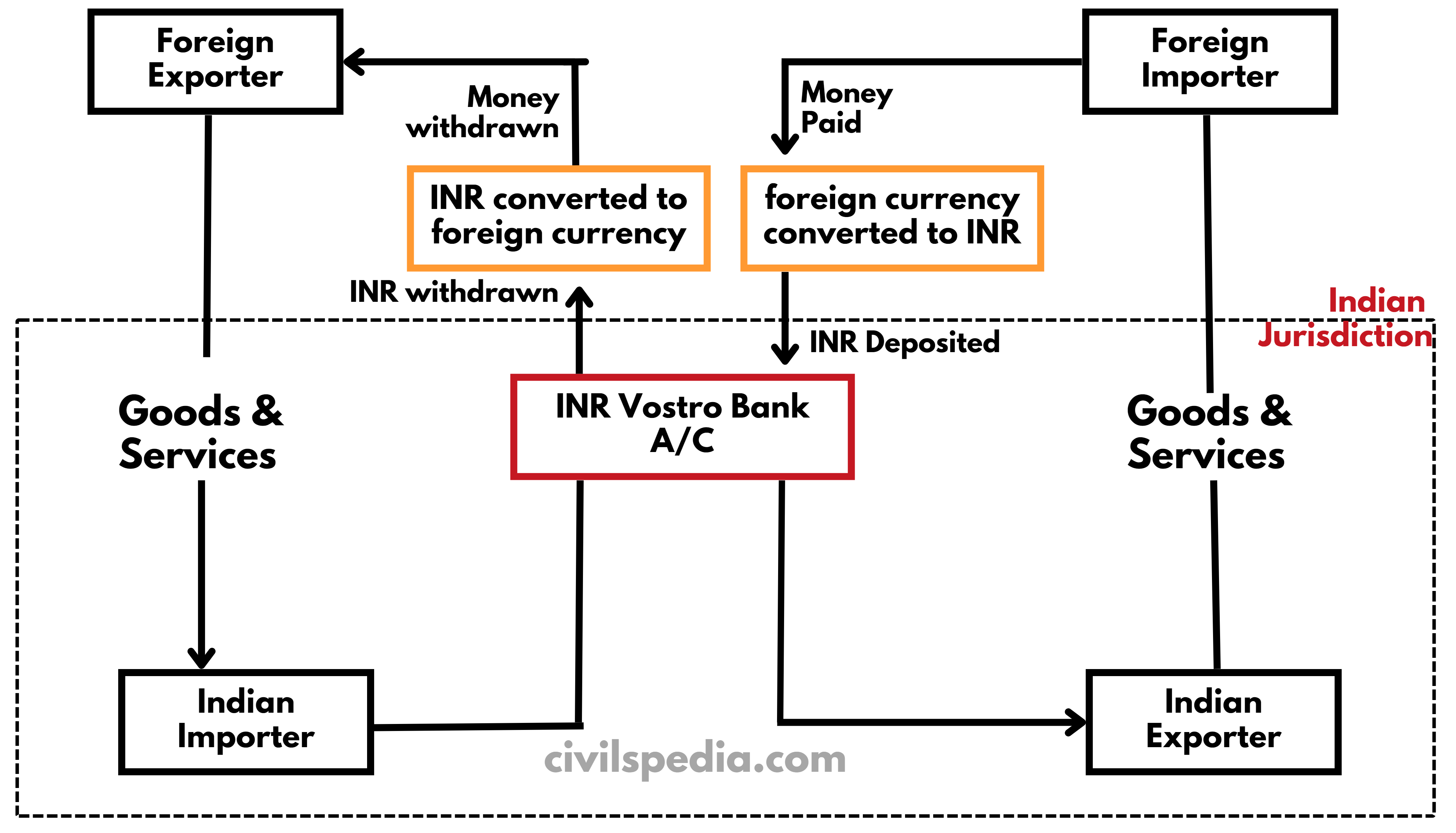

In July 2022, RBI issued a circular that allowed a new arrangement for conducting international trade transactions using Indian Rupees (INR) facilitated through special Rupee Vostro accounts held by authorized dealer banks in India.

A Vostro account is a type of account maintained by a domestic bank on behalf of a foreign bank in domestic currency (Rupee in the case of India), allowing domestic banks to provide international banking services to clients with global banking requirements.

In this settlement arrangement, when Indian importers engage in imports, they will make payments in Indian Rupees (INR). These payments will be credited to the Vostro account of the partner country’s correspondent bank. On the other hand, Indian exporters involved in the export of goods and services through this mechanism will receive their export proceeds in INR from the balances held in the designated Vostro account of the partner country’s correspondent bank.

The framework could largely reduce the net demand for foreign exchange, the US dollar in particular, for the settlement of current account related trade flows.