Merger and Consolidation of Public Sector Banks

Last Updated: March 2023

This article deals with ‘Merger and Consolidation of Public Sector Banks.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Bank Mergers

- In 2016, it was decided in Gyan Sangam II that since Public Sector Banks aren’t performing well, there is a need to consolidate banks by merging small banks with the State Bank of India, Punjab National Bank, Bank of Baroda, Canara Bank etc. as Anchor Banks.

- The crux of the matter is the government is working on a consolidation of public sector banks to create 3-4 global-sized banks and reduce the number of state-owned banks to about 10-12.

Mergers happened till now

- 2017: SBI’s 5 Associated Banks & Bhartiya Mahila Bank merged with SBI.

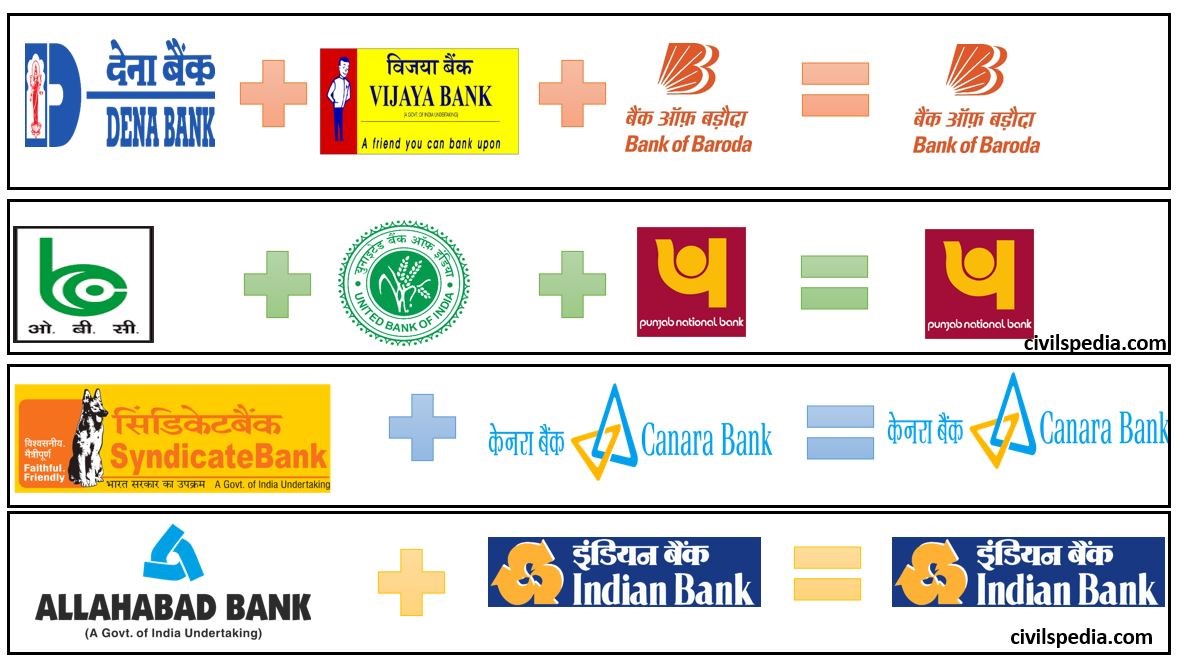

- 2019: Vijaya & Dena Bank merged with Bank of Baroda.

- 2019: Oriental Bank of Commerce and United Bank of India merged into Punjab National Bank.

- 2019: Syndicate Bank merged with Canara Bank.

- 2019: Andhra Bank and Corporation Bank merged with Union Bank of India.

- 2019: Allahabad Bank merged with Indian Bank.

Points in favour of Merger of Banks

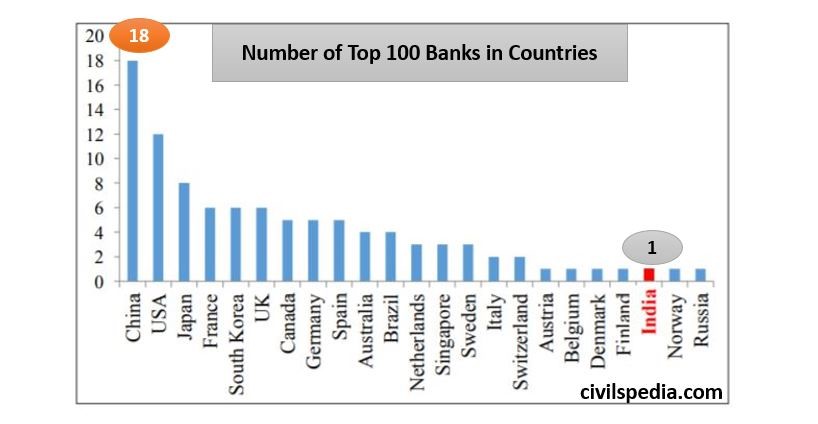

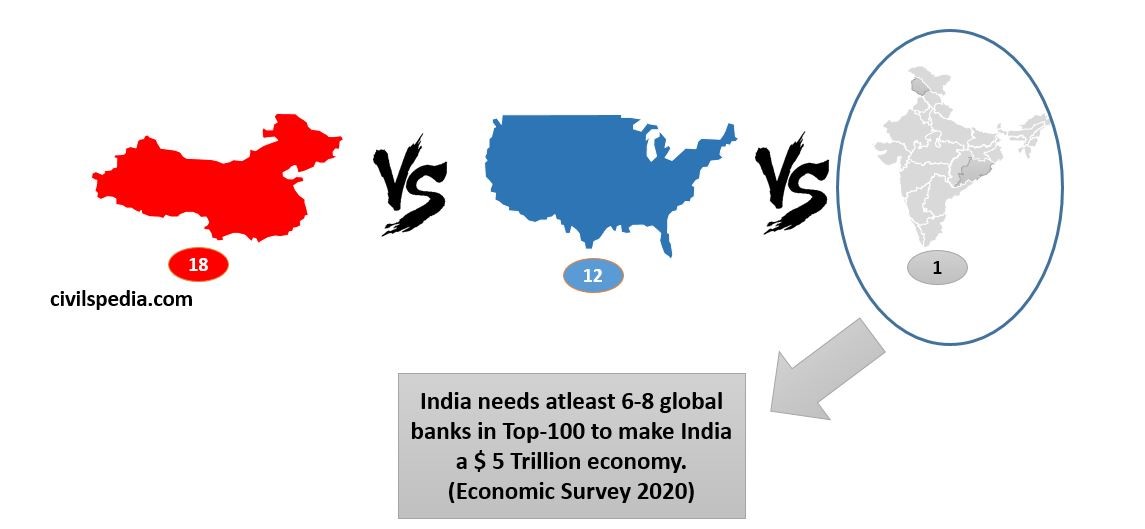

- (Economic Survey 2020) It will help in placing more Indian Banks in the top 100 banks of the world. It is sine quo non to have at least 6-8 top-100 banks of the world in India if we want to make India a financial hub of Asia and channelize global savings towards India to make India a $ 5 trillion economy. Currently, India has just one bank in the top 100 banks (SBI = 55 Rank), while China has 18.

- Earlier State Bank of Saurashtra (2008) & Indore (2010) merger into SBI was successful. Hence, previous experience is pleasant.

- Larger banks provide financial stability and act as engines of growth in times of trouble. E.g. Chinese Banks in 2008.

- It will lead to branch rationalization and reduce operating costs.

- Larger Public Sector Banks can support the corporate sector better in overseas acquisitions as done by Chinese Banks.

- To comply with BASEL III Norms, if big banks like Consolidated SBI issue shares, they can fetch a good response.

- Enhanced geographical reach: For example, Vijaya Bank has strength in the South, while Bank of Baroda and Dena Bank had a stronger base in Western India. That would mean wider access for the proposed new entity and its customers.

Points against Merger of Banks

- Mergers eat up a lot of top management time. At a time when Public Sector Banks need razor focus to deal with the NPA menace, mergers will be very distracting.

- Large banks aren’t necessarily efficient banks: The quest to create an Indian banking giant is an old one when the world looked in awe at the Japanese banking giants. But their big size emboldened them to do excessive lending and ultimately they had to be bailed out by taxpayers’ money.

- The merged State Bank of India is likely to be five times larger than its nearest competitor and can stifle the competition.

- Setback to corporate governance: The merger sends out a poor signal of a dominant shareholder (the government) dictating decisions that impact the minority shareholders.

- Banks will lose their regional identities.

- Political Implications: Kerala Legislative Assembly has passed a resolution that the State Bank of Travancore’s merger with SBI will affect the state’s economic growth negatively.

- Protests: Addressing the concerns of unions and shareholders will be challenging.

- Harmonization of Technology: It is a big challenge as various banks are currently operating on different technology platforms.

Best way to Merge: Merge complementary banks. E.g., Bank of Baroda with Dena and Vijaya Bank so that layoffs aren’t large.