Reserve Bank of India

This article deals with ‘The Reserve Bank of India .’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

- RBI is India’s Central Bank of India, i.e. apex monetary institution.

- It was established in 1935 with a share capital of ₹ 5 crores under the provisions of the RBI Act, 1934, on the recommendations of the Hilton Young Commission.

- Initially, the share capital was owned by private shareholders.

- Government ownership in RBI was just 4.4%.

- The First Governor of RBI was Sir Osborne Smith.

- RBI was Nationalized in 1949

- It was done using the RBI (transfer of ownership) Act 1948.

- Now RBI is 100% owned by the Government.

- Hence, RBI’s Governor is answerable to Parliament and pays a dividend to the Government from their profit.

- Other important points about RBI

- It was initially headquartered in Kolkata and later shifted to Mumbai in 1937.

- The financial year of RBI is from 1 July to 30 June.

Functions

- RBI is the Controller of the Money Supply in India.

- RBI is the currency authority of India and has the sole power to print currency.

- RBI is the controller of Foreign Exchange through the FEMA Act of 1999.

- RBI act as Banker to Governments & Public Debt Manager.

- RBI is Banker’s Bank as the Lender of Last resort to the banks. It also advises banks in monetary matters.

- RBI is the Regulator of all “BANKS”. RBI gets these powers through Banking Regulation Act.

- RBI is the Regulator of All India Financial Institutions and Non-Banking Financial Companies (Deposit Taking).

- RBI represents India in financial organizations such as IMF, World Bank etc.

- RBI perform some Promotional Roles like

- Customer protection through Ombudsman,

- Financial Inclusion etc

- RBI is responsible for Data Publications like the Report on Currency and Finance, Financial Stability Report etc.

- RBI is responsible for economic development by promoting financial inclusion and controlling inflation.

Structure of RBI

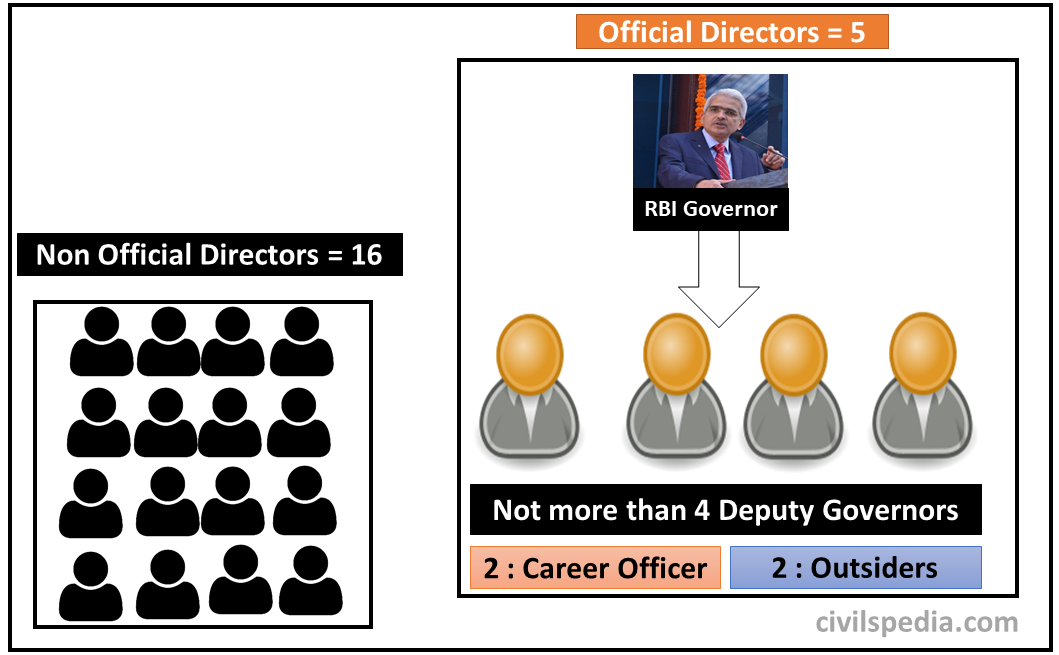

RBI Act provides for Governor & NOT MORE than 4 Deputy Governors. By convention, two are outsiders, and two are career officers of RBI. Their tenure usually is of 3 years. Re-appointment is also possible. Apart from that, there are 16 Non-Official Directors.

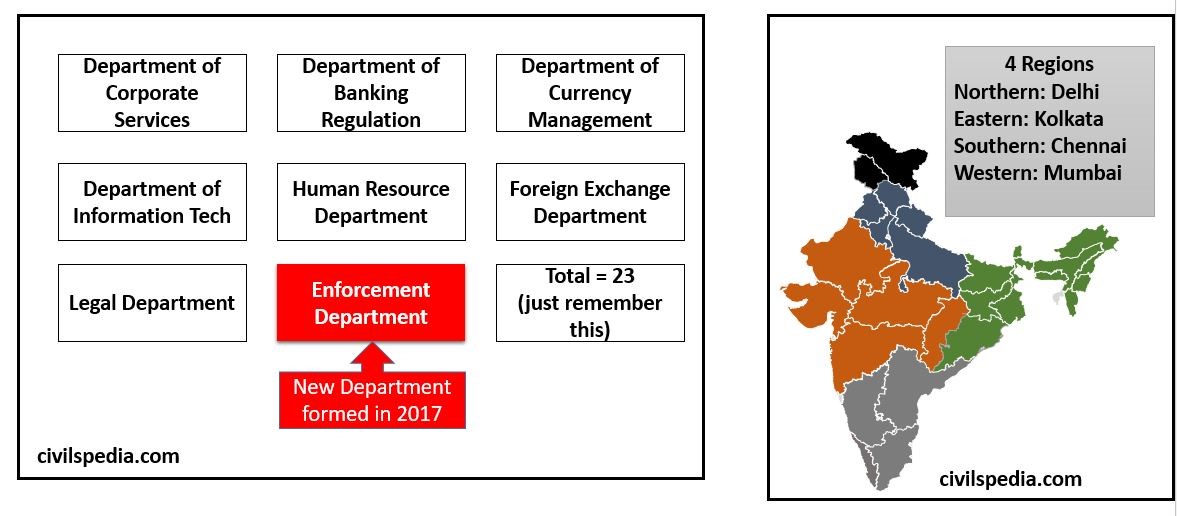

RBI has 4 regions:

- Northern: Delhi

- Eastern: Kolkata

- Southern: Chennai

- Western: Mumbai

RBI has 23 departments for looking after Banks, NBFCs, Payment Systems, Foreign Exchange Management etc. The latest department is the Enforcement Department, formed in 2017 to act against the violators of RBI directives.

Issue: RBI’s Autonomy

Why RBI’s Autonomy is important?

- Enable RBI to take decisions based on economic rationale uninfluenced by political considerations.

- It ensures Sustainable Economic Growth.

- It helps in attracting more Foreign Investment as RBI’s independence acts as an assurance to foreign investors that decisions willn’t be taken keeping the vote bank in mind.

RBI versus Government impacting RBI’s autonomy

- Tight Money Policy: The Government always pressurizes the RBI to follow the Easy Money Policy to give cheap loans to spur growth, while RBI is mandated to follow such a monetary policy that can maintain inflation between the 2-6% range.

- Diluting Prompt Corrective Action framework (PCA): PCA of RBI restricted the lending of 11 state-owned banks, which irked the Government. Also, due to this, Government was not getting a dividend from these banks, impacting the finances of the Government. It led to a direct face-off between RBI and the Government.

- Section 7 of the RBI Act: It has never been invoked since independence. It allows the Government to instruct the RBI governor in the public interest. Governor can’t refuse the instructions given to him under Section 7 of RBI.

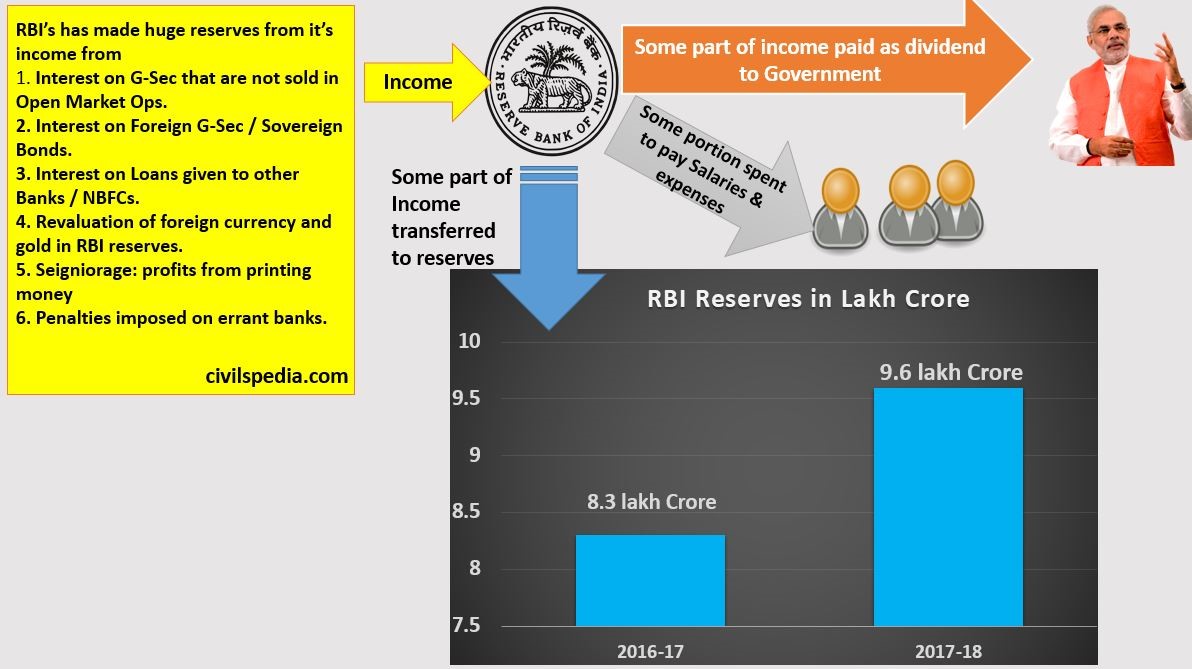

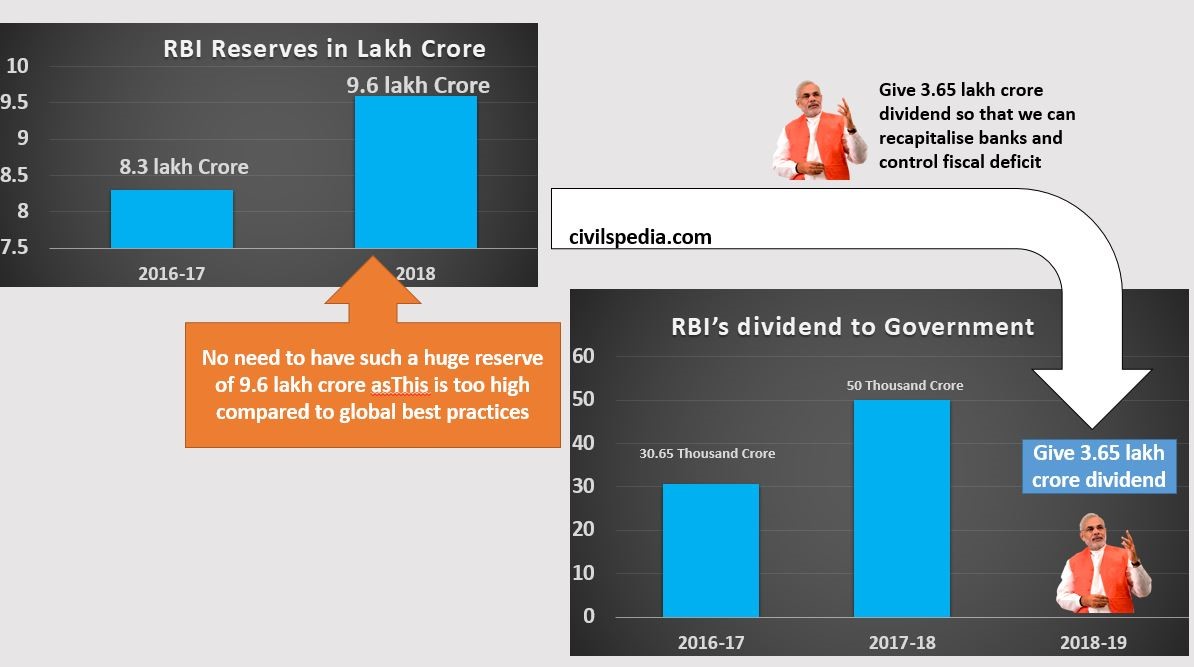

- Issue of higher dividend: Recently, the Government demanded higher dividends from RBI to recapitalize Public Sector Banks and reduce the fiscal deficit. However, Governor Urjit Patel felt RBI’s higher reserves are necessary to check any financial crisis. It led to RBI’s Governor versus Government type of situation.

Due to such issues, RBI Governor Urijit Patel resigned from his post. Although that was not the first time when RBI Governor resigned before his tenure ended like

- First Governor, Sir Osborne Smith, left the office before completing his three and a half years term, apparently following differences with the Government’s Member of Finance.

- Sir Benegal Rama Rau, who served as Governor from 1949 to 1957, resigned before the end of his second extended term following serious differences with Finance Minister TT Krishnamachari.

Issue: Public Debt Management Agency (PDMA)

RBI is the Government’s Debt manager, but this has led to a conflict of interests.

1. As a Debt Manager

- RBI borrows money from the market by issuing Government-securities (G-sec). These G-Secs are, in reality, issued by RBI on Government’s behalf.

- As Debt Manager, RBI will always want to sell at the lowest interest rate (cheaper credit).

2. To control inflation

- RBI uses the same G-sec to control money supply via OMO (Hence, depending upon the situation, RBI, in this case, has to sell it at a high rate or low rate).

If the central bank acts as a debt manager, too, it would be caught in a conflicting dilemma of keeping the interest rates low to raise the loan at the lowest price possible for the Government while controlling inflation.

Most central banks focus on controlling inflation in the developed world, and government debt management has been shifted to separate agencies.

Timeline: PDMA

| 2000 | – RBI proposed amendments to RBI Act to end its role as Public Debt Manager and hand it over to an independent agency. – But the issue of the high fiscal deficit came up. Hence, in 2002 Bimal Jalan said that debt management couldn’t be transferred to other agencies until the government controlled the fiscal deficit |

| 2007 | Finance Minister announced in the budget to set up the statutory body for public debt management. |

| 2011 | PDMA bill introduced |

| 2012 | Bill not passed |

| Modi Regime | Modi government is keen on making PDMA. (Reason = They can ask PDMA to borrow as much as they want | RBI is an independent agency, and it cant be pressurized above a specific limit) |

Debate

Against RBI working as Debt Manager

- Conflict Of Interest: Discussed Above

- Relieve RBI so that it can focus on Monetary Policy and Regulatory work.

- Globally Accepted practice: All OECD countries follow this practice.

- Various Committees like Percy Mistry Committee (2007), Raghuram Rajan Committee (2008), and FSLRC (2011) have accepted this

Continue as Debt Manager

- Conflict of Interest Argument Questioned: There is no evidence in India that RBI has compromised either debt management or monetary management.

- Pragmatic Fiscal and Monetary Coordination: In the interest of pragmatic monetary and fiscal coordination, it is prudent to leave debt management to the RBI.

- The Indian situation is unlike OECD countries due to high Fiscal Deficit and Current Account Deficit levels.

- Separation Challenged Globally: The conventional view on separation has been challenged after the financial crisis. Denmark and Iceland have shifted debt management back to the central bank.

- Various scholars, notably Bimal Jalan, have spoken against separate PDMA in Indian conditions.