Last Updated: May 2023 (National Incomes)

National Incomes

This article deals with ‘National Incomes.’ This is part of our series on ‘Economics’ which is important pillar of GS-2 syllabus . For more articles , you can click here .

Introduction

- Income level is the most commonly used tool to determine the wellbeing and happiness of nations and their citizens.

- GDP, NDP, GNP, and NNP are the four ideas/ways to calculate a nation’s income.

Gross Domestic Product (GDP)

- Gross Domestic Product or GDP is the market value of all the final goods and services produced within the boundary of a country during one year period.

- In GDP, the boundary of the country matters and not the citizenship of the person. If the good or service is produced within the nation’s boundary, then it will be counted in the GDP.

- Interpretation

Nominal GDP and Real GDP

GDP at Current Price (Nominal GDP) vs GDP at Constant Price (Real GDP)

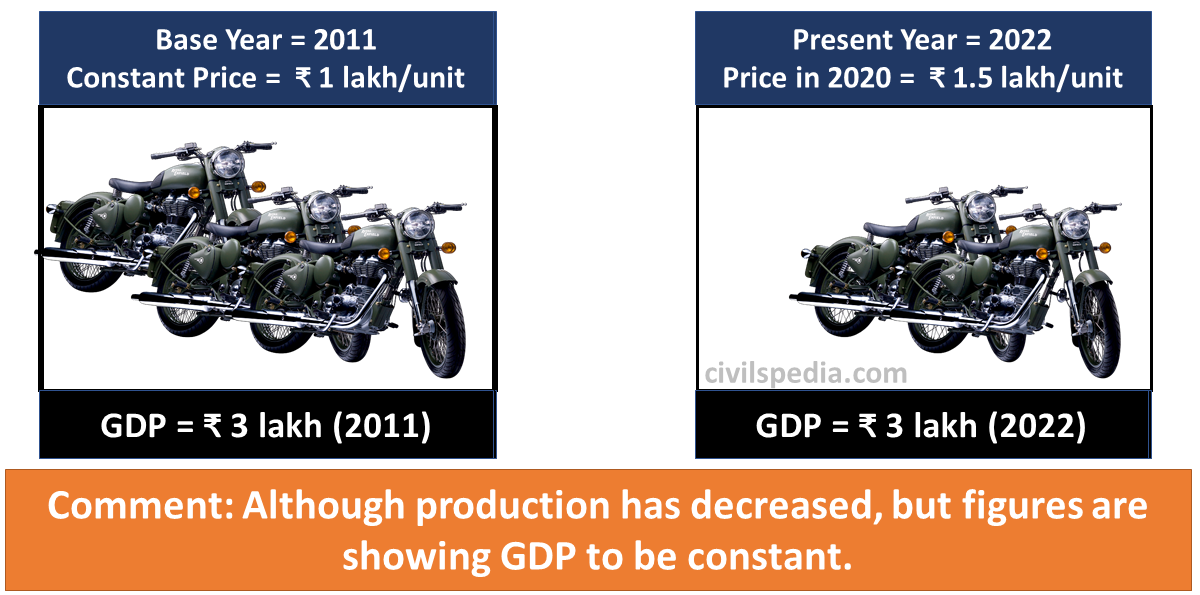

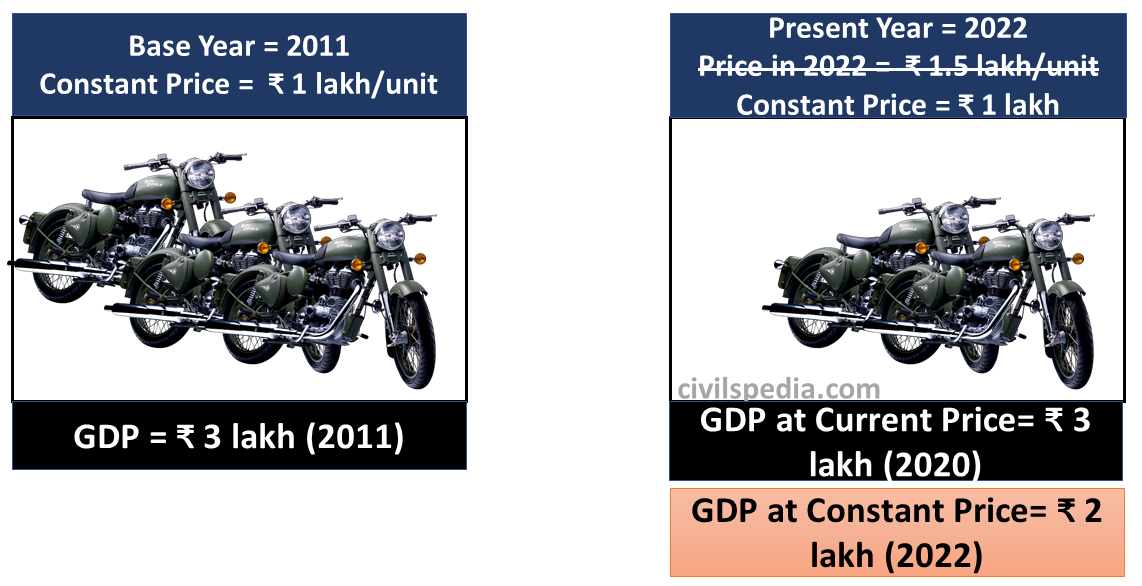

- After looking at Nominal GDP/ GDP @ Current Price, we can’t say whether the economy has improved or not. E.g., in the example shown in the infographic below, quantity-wise production has decreased, but figures show that GDP has remained constant.

- To rectify this problem, economists set a Base Year (2011 for India) & then use the production data of the current year but the price of goods that of the base year. Using this process, GDP at a Constant Price or Real GDP can be calculated.

In FY22-23, the nominal GDP growth is 15.4%. But the real GDP growth is expected to be close to 7%.The difference (8.4%) is the effect of price inflation.

GDP Deflator

The GDP deflator measures the price changes of goods and services. It is calculated in the following way

GDP deflator can also be used to measure inflation in the economy.

GDP at Factor Cost & GDP at Market Price

GDP at Factor Cost

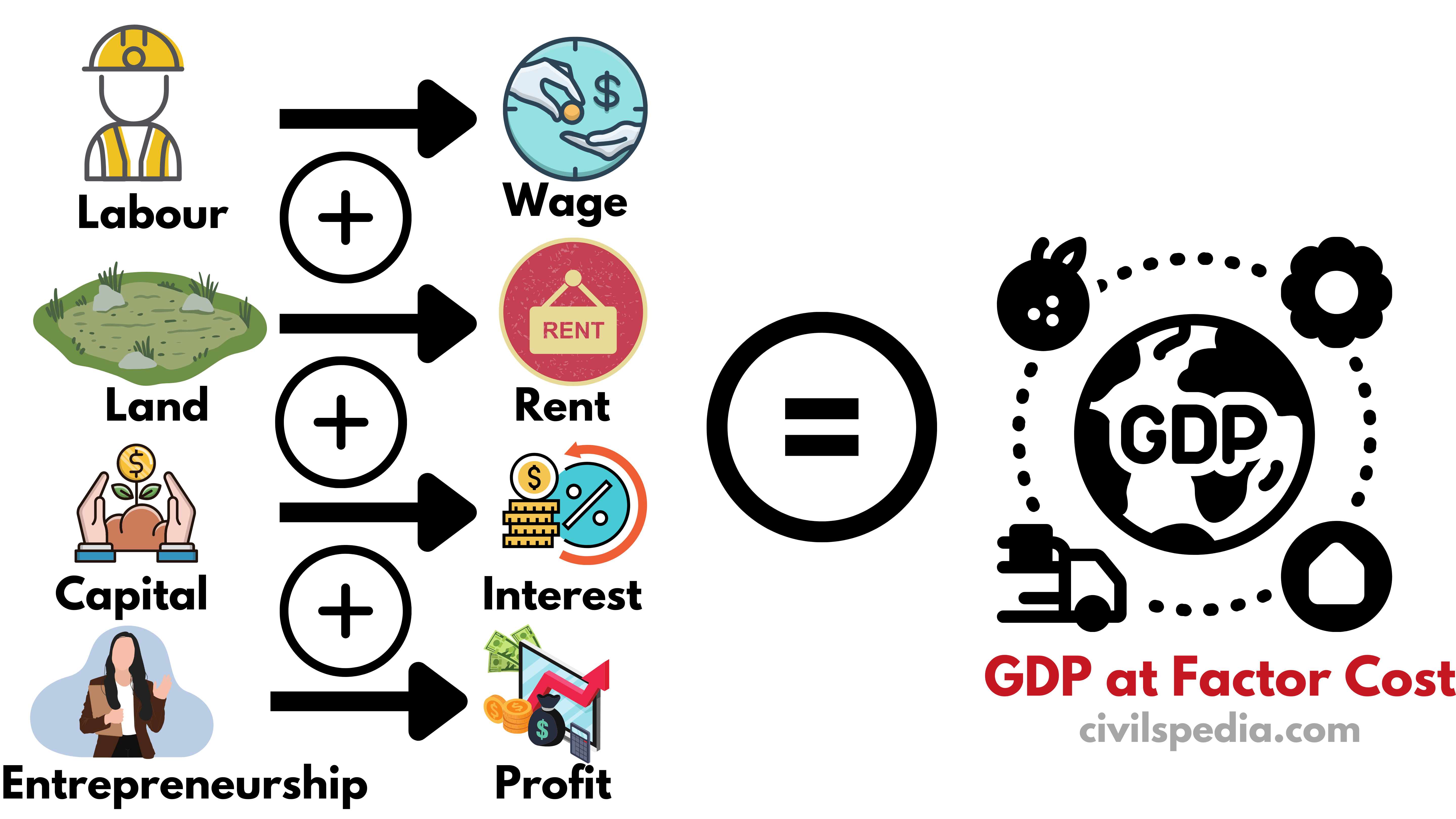

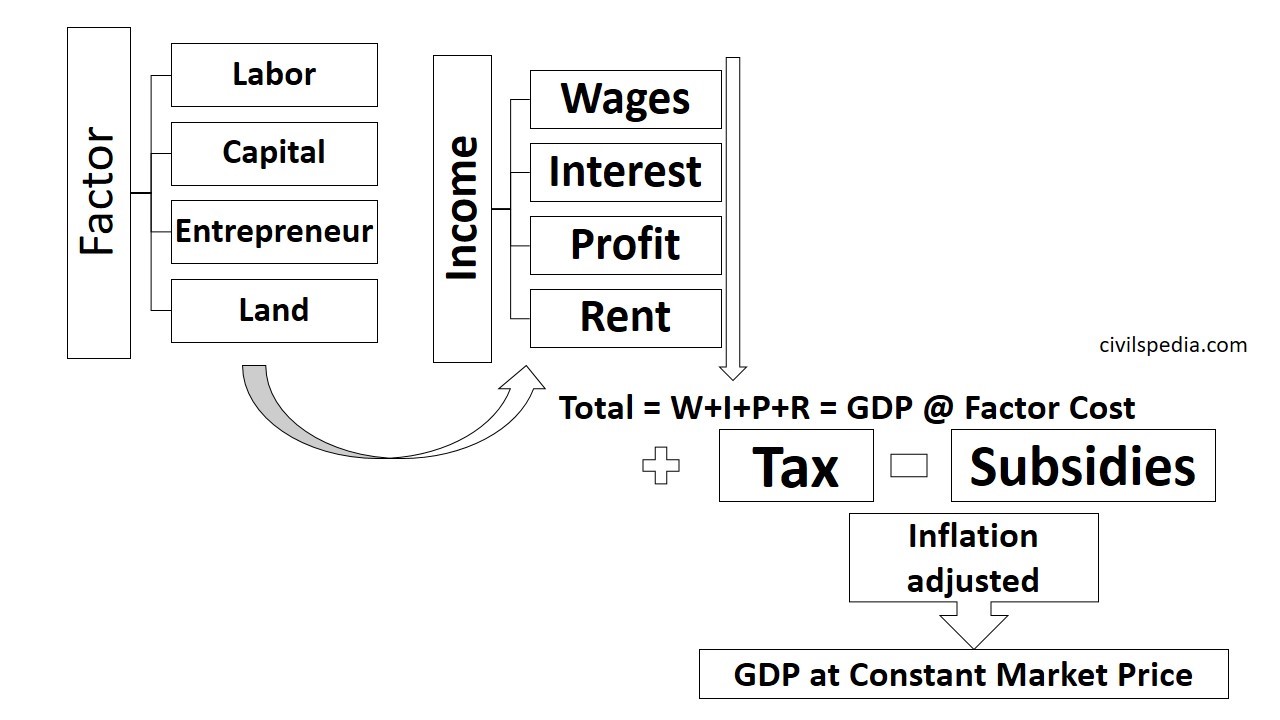

- There are four factors of production & each factor will be paid in money in the following way

- Land: Rent

- Labour: Wage

- Capital: Interest

- Entrepreneurship: Profit

- GDP at factor cost is obtained by adding the value of these factors of production.

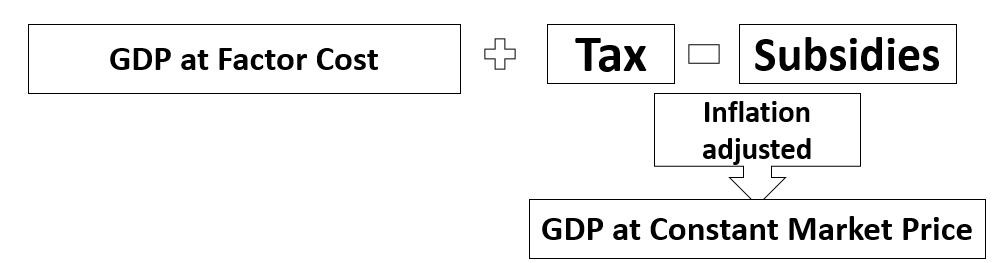

GDP at Market Price

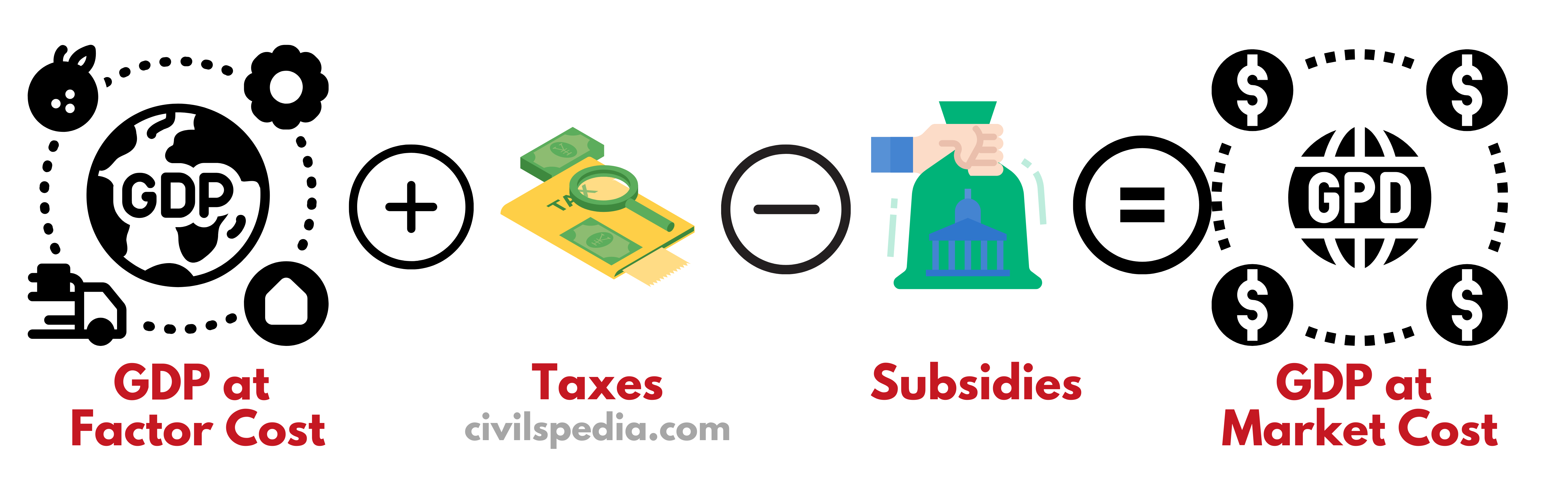

- But GDP at factor cost will attract some tax & subsidies, which need to be added and subtracted respectively to get GDP at market price.

- The official GDP of India is GDP AT CONSTANT MARKET PRICE.

Methods to calculate GDP

There are three methods to calculate GDP

In India, we use Income method to calculate GDP.

Method #1: Income Method

- In India, we use the Income method to calculate GDP.

- In any economy, a person will get wage (w) for his labour, interest (I) on his capital, profit (P) on his entrepreneurship and rent (R) on his land or building. Under this method, GDP (at factor cost) is calculated by adding up all the incomes generated in the course of producing final goods and services.

- Subsequently, if we add taxes and subtract subsidies and adjust that for inflation, we will get GDP at constant and market prices.

Method #2: Expenditure Method

- An alternative way to calculate the GDP is by looking at the demand side of the products.

- All the final goods & services produced in the economy will ultimately be purchased. Hence, if we add the expenditure of all the persons in an economy, we can calculate GDP (at the current market price).

- Under this method, the total expenditure incurred by the society in a particular year is added together. .

Precautions

- Second-hand goods: The expenditure made on second-hand goods should not be included.

- Purchase of shares and bonds: Expenditures on purchasing old shares and bonds in the secondary market should not be included.

- Transfer payments: Expenditures towards payments incurred by the government like old age pension should not be included.

- Expenditure on intermediate goods: Expenditure on seeds and fertilizers by farmers and cotton and yarn by textile industries are not to be included to avoid double counting.

Method #3: Gross Value Addition or Production Method

- The final goods and services are produced by passing through value addition in various stages. GDP can be calculated by adding value-added during each step of the finished product. This method is known as GVA or Production Method.

- By doing that, we get GDP at factor cost, which can be easily converted to GDP at constant market price by adding taxes, subtracting subsidies and adjusting it with inflation.

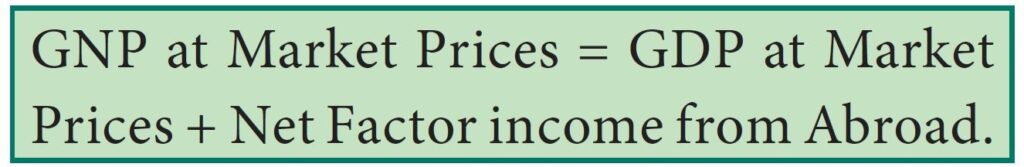

Gross National Product (GNP)

- GNP is the monetary value of all the goods and services produced by NORMAL RESIDENTS of a country.

- Here, boundary of territory is not important but normal residency is important.

- Interpretation

- Indian earning in India => His income will be counted in Indian GNP.

- Indian earning in Saudi Arabia => His income will be added in Indian GNP.

- Earnings of Korean-owned Hyundai car factory in India => It’s earning will not be counted in Indian GNP.

Net National Product (NNP)

- NNP is obtained by deducting the value of depreciation from the GNP.

- Capital assets get consumed due to wear and tear whenever something is produced. This wear and tear is called depreciation. Naturally, depreciation does not become part of anybody’s income.

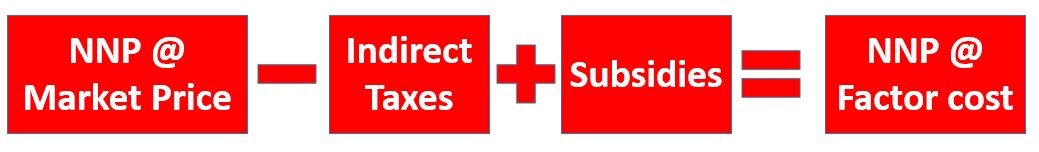

Net National Product at Factor Cost

- Through the expression given above, we get the value of NNP evaluated at market prices. But market price includes indirect taxes and subsidies as well.

- If we add taxes and subtract subsidies from NNP evaluated at market prices, we obtain Net National Product at factor cost.

- India’s National Income is NNP at Factor Cost.

Per Capita Income

- Per Capita Income is the average income of a person in a country in a particular year.

- It is calculated by dividing national income (Net National Product at Factor Cost) by population.

- India’s Per Capita Income is ₹ 1,35,000 (2019-20).

Personal Income

- Personal income is the total annual income received by all the individuals of a country from all the sources before the payment of direct taxes.

- Personal income is calculated by deducting the undistributed corporate profit and employees’ contributions to social security schemes and adding transfer payments to the national income.

Disposable Income

Disposable Income is the individual’s income after the payment of income tax.

Limitations in measuring National Incomes

- Illegal Activities not accounted: Income earned through illegal activities such as smuggling, gambling, illicit extraction of liquor, etc., is not included in National Incomes.

- Nature of Statistics: Statistics lag behind the actual happening in the economy, thus increasing the time to capture and understand the significant structural change. E.g., In India, the most accurate GDP data, i.e., revised estimates, comes after a lag of almost 3 years.

- Many activities in an economy can not be evaluated in monetary terms. For example, the domestic services women perform at home are not paid for. These Non-marketed activities are not accounted in National Incomes.

- Barter exchanges which are still prevalent in rural and tribal areas are not accounted in National Incomes.

- Externalities refer to the benefits (or harms) a firm or an individual causes to another for which they are not paid (or penalized). Negative externality is also not accounted .

- National Incomes doesn’t give any picture of distribution of income and income inequality within the economy. The trickle down of benefits failed in most nation’s with rise in inequalities in almost all major economies. These inequalities are further pushed by the recent pandemic

- The deduction of depreciation allowances, accidental damages, repair and replacement charges from the national income is not an easy task. It requires high degree of judgment.

Rise in national incomes and welfare

- National Income is considered an indicator of the economic wellbeing of a country. The country’s economic progress is measured in terms of its GDP per Capita and annual growth rate.

- But the rise in GDP or per capita income need not always promote economic welfare as

- Economic welfare depends upon the composition of goods and services provided. The greater the proportion of capital goods over consumer goods, the lesser will be the improvement in economic welfare.

- Higher GDP with greater environmental hazards such as air, water and soil pollution will be little economic welfare.

- Production of war goods will show an increase in national output but not welfare.

- An increase in national output can also result from the exploitation of labour. This exploitation doesn’t lead to the welfare of people.

Indian GDP Trends and Analysis

- The base year for India is 2011. (there is news of changing it to 2018, but as of now, it is 2011)

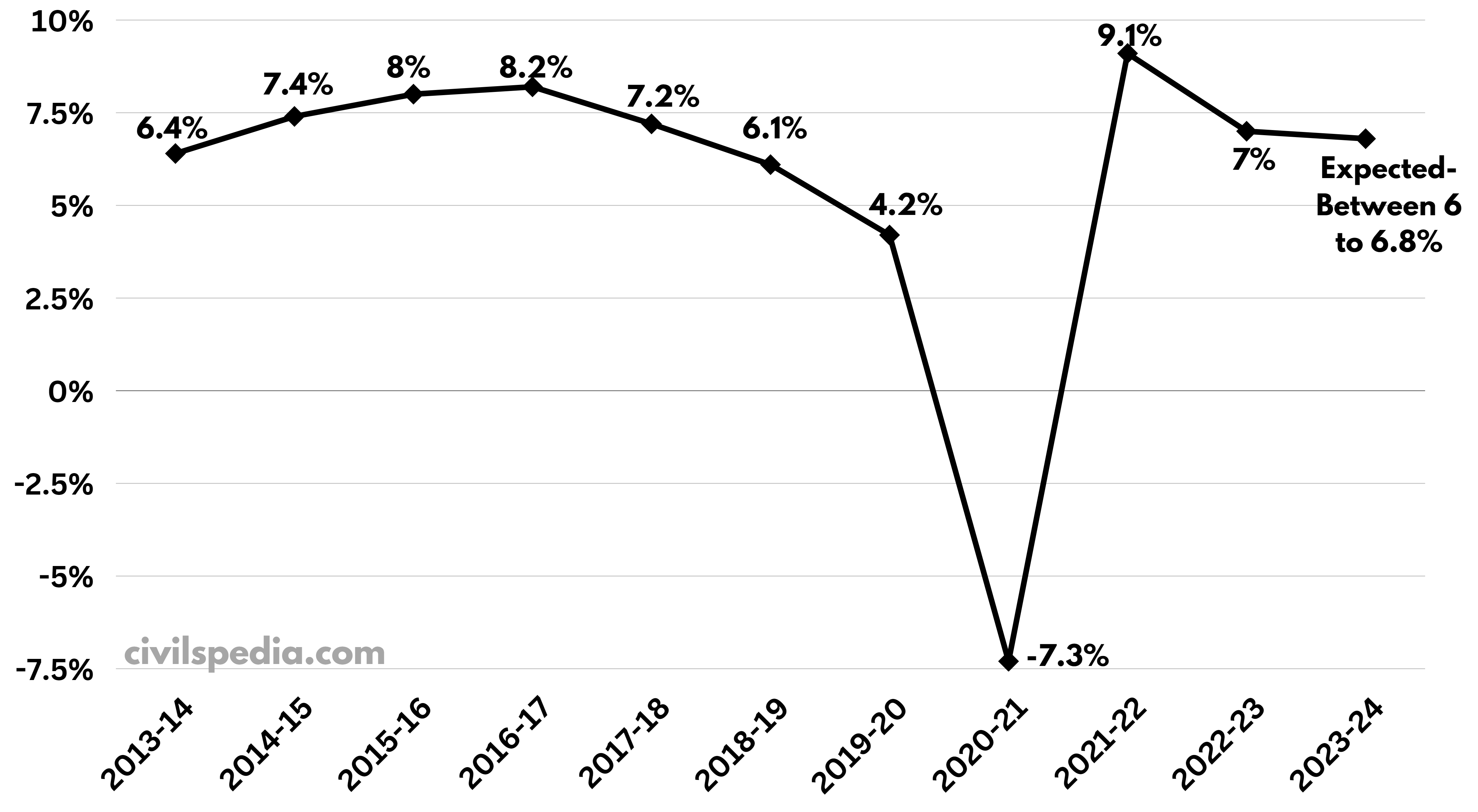

- In the recent years, GDP growth rate (at constant price) trends was as follows:-

Note regarding above graph: When we say that the Indian economy grew by 10 per cent in a particular year, what it essentially means is that the total GDP of the country in that year was 10 per cent more than the total GDP produced a year ago. Similarly, when we say the economy contracted by 8 per cent this year, we mean that the total output of the economy (as calculated by GDP) is 8 per cent less than the total output of the preceding year. This is called the year-on-year (YoY) method of arriving at the growth rate.

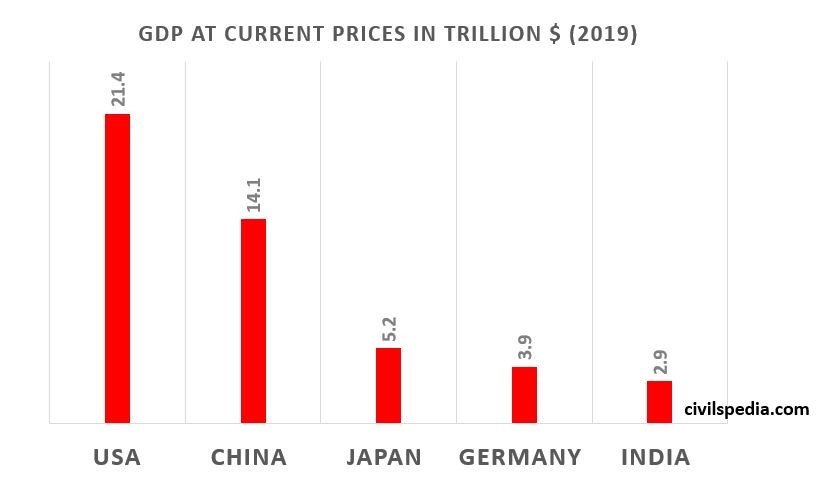

- India is the fifth largest economy of the world considering GDP at current prices in US dollars. The top 5 economies are as follows .

Global Shocks and impact on India’s GDP

Global Financial Crisis of the past had a limited impact on India. This was due to following reasons

- Prior to 1991, Indian economy had limited integration with the world economy. Hence, it was insulated from the crisis the economic crisis happening in other countries.

- There was significant gaps in the global economic crisis and they didn’t happen one after another. For example, Oil Price Shock of 1973, East Asian Crisis of 1997 and Financial Crisis of 2007-08.

But now the situation is different. Indian economy is very well connected with the world economy. Moreover, global economy is facing ‘Triple Shocks’ one after another

- Covid-19 Pandemic: It slowed down the global economy as world was virtually shut down.

- Russia-Ukraine Crisis: It led to supply chain disruptions and massive increase in price of fuel, food and fertilizers.

- Rate Hike by Advanced Economies: The Easy Money Policy followed by Advanced Economies during Covid led to massive inflation in advanced economies. To control the situation, Central Banks of Advanced Economies started to increase their Repo Rates which led to FPI outflows from emerging economies (like India), depreciation of currency and increase in the yield of government bonds.

But inspite of that, the impact of these shocks can be withstood by the Indian Economy

Side Topic: K Shaped Recovery

- The Economic Survey (2021) predicted the ‘V-Shaped Recovery’ of the Indian economy post-Covid pandemic. It was hoped that the GDP growth rate would bounce back quickly owing opening up of economic activities. Historically, a similar trend was observed in the Spanish Flu of 1918-20. But other economists tend to differ and present various scenarios like

- U-Shaped Recovery: GDP growth will remain low for a longer time before bouncing back.

- W-Shaped Recovery: GDP growth will bounce back, then dip and bounce back again.

- K-Shaped Recovery: Some sectors of the economy (like e-education, e-commerce etc.) will see massive growth while other sectors (like tourism, restaurants etc.) will continue to shrink or suffer losses.

- But, India has witnessed a K-shaped recovery. In simple terms, while some sectors/ sections of the economy have registered a speedy recovery, many are still struggling. The entities that have done well are firms already in the formal sector and had the financial wherewithal to survive the repeated lockdowns and disruptions. Many big firms in the formal economy have increased their market share during the Covid-19 pandemic and this has come at the cost of smaller, weaker firms that were mostly in the informal sector.