Table of Contents

Budgeting Process

This article deals with the ‘Budgeting Process.’ This article is part of our series on ‘Economics’ which is an important pillar of the GS-3. For more articles, you can click here.

What is Budgeting?

Budgeting is the process/strategy with which the budget is prepared.

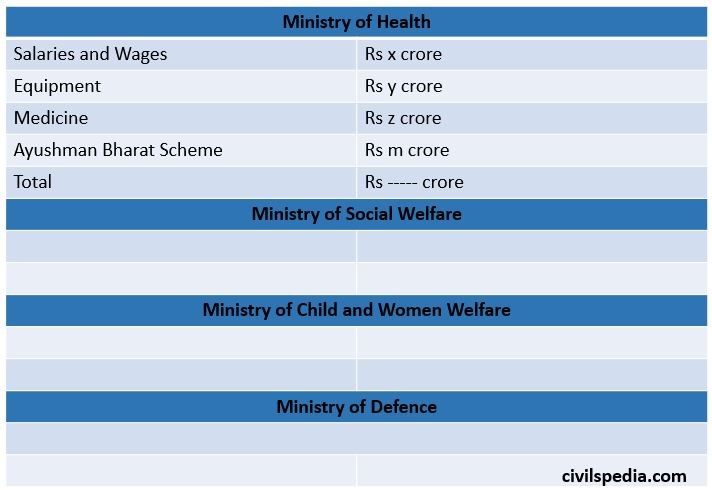

Line Item Budget

- Line item budget clusters proposed expenses of each department. It represents the allocation of funds to each item in a single line. It includes detailed ceilings on the amount of salaries, travelling allowances, office expenses, etc. The focus is on ensuring that the agencies or units do not exceed the ceilings prescribed.

Advantages

- This type of budget is easily understandable and implementable.

- It facilitates centralized control and fixing of authority and responsibility of the spending units.

- This aggregation method can easily illustrate which department and cost centre absorbs the bulk of the entity’s funds.

Disadvantages

- It leads to incrementalism.

- It does not provide enough information to the top levels about the activities and achievements of individual units.

Weaknesses of the line item budgeting were sought to be remedied by introducing certain reforms. Performance budgeting was the first such reform.

Performance Budget

It was propounded by First Hoover Commission (USA) and implemented by President Truman in 1950. On the recommendations of the First ARC in 1968, Indira Gandhi Government tried to implement it in 1968. But this experiment doesn’t prove to be successful. Hence, Line Item Budget is still popular in India.

A performance budget reflects the resource inputs and service outputs for each unit of an organization.

Process to make Performance Budget

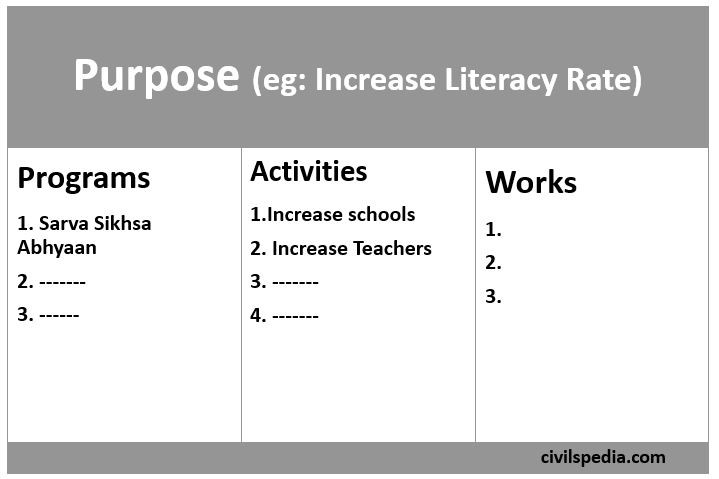

- The purpose of every Organisation / Ministry is defined.

- Programmes, activities, projects and works are charted out to meet that purpose.

- It is different from Line Item Budget in the sense that it doesn’t look only into expenditure. Instead, the main emphasis is on programs, activities and works that will be carried out to achieve the stated purpose. (Eg: to increase Primary Education, Line Item Budget will tell the amount to be spent on Education whereas the Performance Budget will tell us about programs, activities and works that will be carried out to achieve that purpose.)

Line Item Budgeting vs Performance Budgeting

| Line Item | Performance Budget |

| Expenditures are arranged from Major Expenditure Item to Smaller Expenditure Items. | Itemised Expenditures are not shown. Emphasis is on showing accomplishment of program, activity and work with given expenditure. |

| Aim: Reducing the expenditure | Aim: Achieving the purpose and objectives with given expenditure. |

| Old projects and programmes are continued, and new items are joined with it. | The budget maker has to perform more work every year. For every financial year, he has to define purpose, programme, activity and work. Hence, new programs are seen every year. |

| Generalists are required for its operationalisation. | Specialists are required for its operationalisation. |

For a developing country like India, reasons for failure of its implementation

- Performance Budget requires Specialist Bureaucracy, but Generalists are powerful in India.

- Frank Cruze, in 1964, commented that until Accounting is decentralised, it cant be implemented in India.

- It becomes difficult to stop old programs in developing countries. In such a situation, a Performance Budget cant be implemented because, in this system, programs keep on changing every year.

- In India, the Budget is used for political purposes. For that, Line Item Budget is more helpful as more items can be added to it.

- Everything from purpose to work has to be defined every year. In India, it is impossible because here, even the aims of Organisations / Ministries are not defined in a proper way.

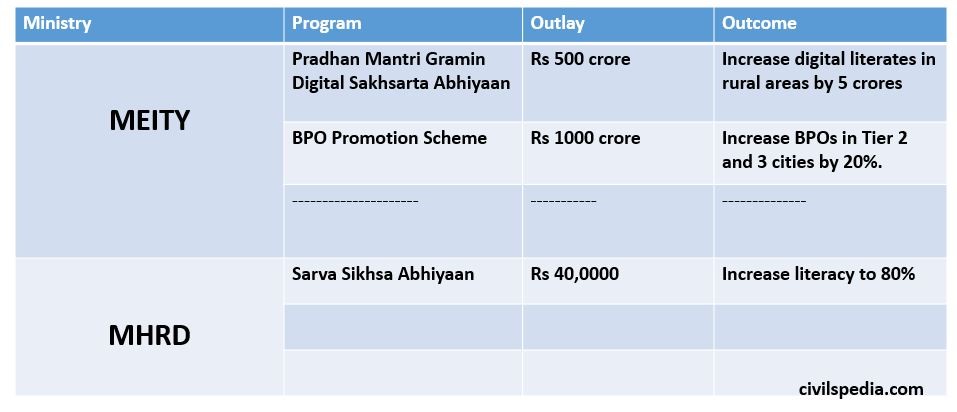

Output Budget

- It was introduced in India in the financial year 2005-2006.

- It is an Indian version of Performance Budget.

- Budgeting scheme that gives program / project-wise outlays for all central ministries, departments and organisations listed against corresponding outcomes (measurable physical targets) to be achieved during the year.

- The government is continuously increasing the number of departments whose Budget is made on this basis. It started with the Department of Space.

- 2017: Delhi Government introduced Outcome Based Budgeting in 2017 Budget.

Features / Nature

- Under Outcome Budget, Organisation’s Budget is made in such a way that it has monitorable and measurable targets.

- Cost-benefit analysis of every unit is carried out to yield maximum benefit at minimum cost.

- Benchmarking of services and goods is provided.

- The feedback mechanism is strengthened to get feedback from customers / citizens

- Management Information System (MIS) is operationalised to digitalise expenditure and outcomes for rapid evaluation.

Impact of Outcome Budget

More than one decade has passed since India has adopted the Outcome Budget. The number of Departments under this has increased.

- In Winter Session (in September), every Department where Outcome Budget is operational presents their Report Card.

- Accountability of the Executive: Linking funds to the results is a powerful tool to increase the accountability of the executive.

- It helps in better utilisation of money.

Problems in Outcome Based Budgeting

- Difficulty to define targets.

- A large number of ministries are involved in achieving the target. E.g. to achieve an IMR of say 20, the Ministry of Health and the Ministry of Woman and Child Welfare need to work in synergy.

- Not only the Union but help of States and Local Governments is also needed to achieve targets.

What more needs to be done?

- Apart from implementing Outcome Budget in all Central Departments, it should also be implemented in all the states.

- Many programmes are run jointly by states and union. These programs always face the issue of ‘Match Funding’. This need to be brought under the Outcome Budget.

- Like Performance Budget, Outcome Budget also requires decentralisation of accounts to make it a success.

Zero Based Budget (ZBB)

- It was invented by Peter Pyhrr in 1969 and implemented in Texas Instrument (company) for the first time.

- It was implemented in 1972 in the Georgia state of USA by Jimmy Carter as Governor, and in 1978-79, it was implemented in the Federal Budget of USA.

- In India, we tried to implement it in 1974. But it proved to be a failure.

What is Zero Based Budgeting (ZBB)

The budgeting process in which the rationale of every expense needs to be justified for a new period is known as Zero-Based Budgeting (ZBB).

Process of formation of ZBB

- In this Budget, all the running programs and projects are zeroed at the end of each financial year, i.e. old facts and figures aren’t taken.

- Budget maker plans for next financial year keeping in mind which programs and projects are needed for the present situation.

Reasons for failure of ZBB in India

- The digitalisation of records of finances is required. But in India, all the departments are not digitalised even today.

- Managerial autonomy is required. But in India, the enormous influence of politics can be seen on administration.

- Citizens in India don’t like frequent changes in government programs. But in ZBB, there are chances of changing programs.

- For operationalisation of ZBB, Specialist Bureaucracy is required (India has Generalist Bureaucracy).

Sharma Academy is Perfect Coaching for UPSC, IAS, MPPSC in Indore. Providing Best UPSC, IAS, MPPSC Coaching in Indore, MPPSC Online Coaching Available