Last Updated: May 2023 (Fiscal Policy – Explained Using Budget 2023)

Table of Contents

Fiscal Policy – Explained Using Budget 2023

This article deals with ‘Fiscal Policy .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

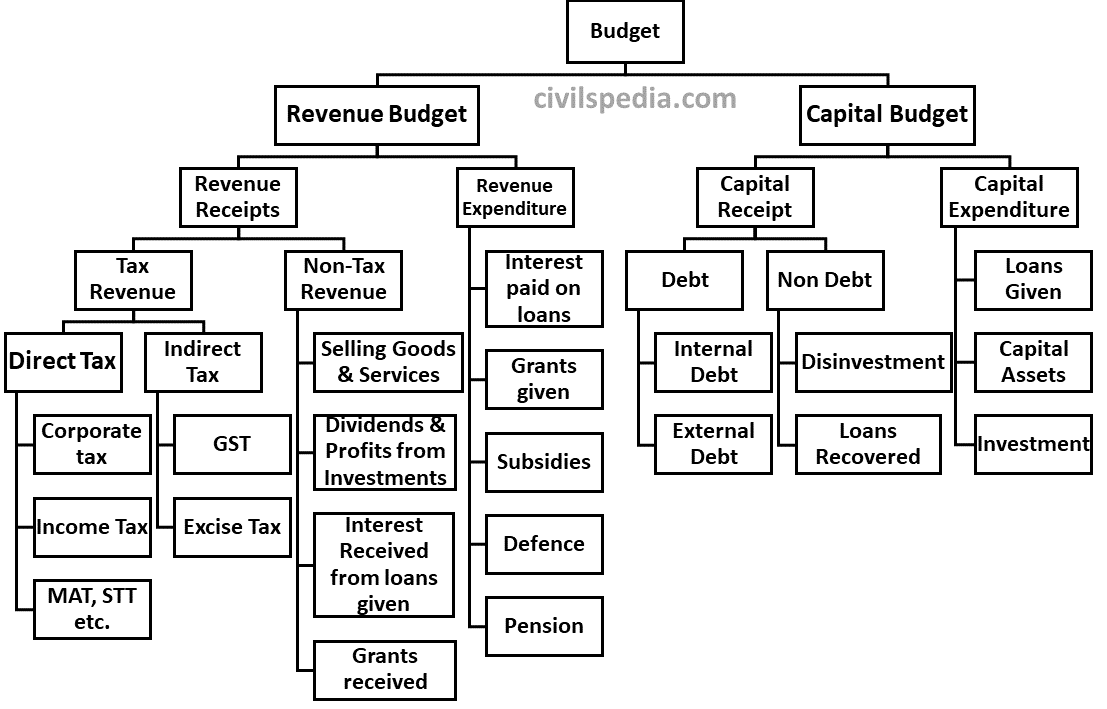

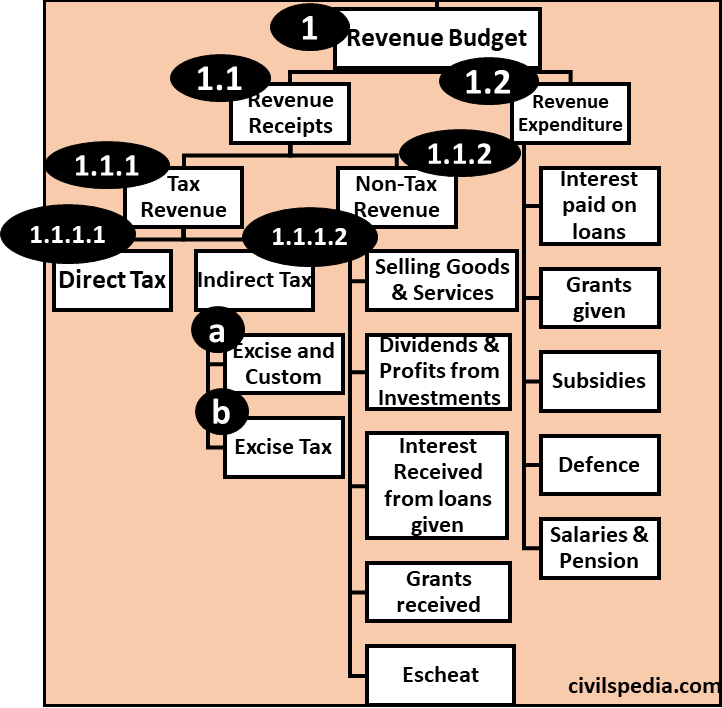

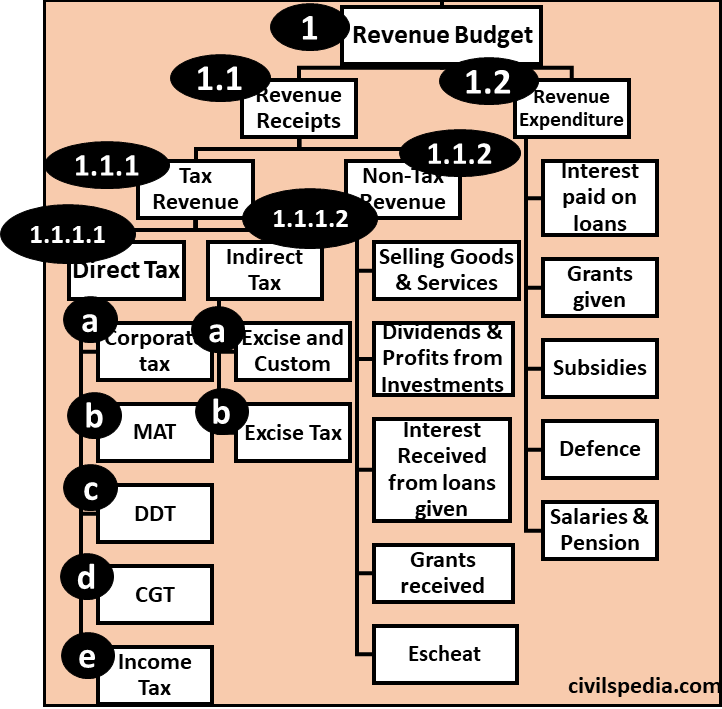

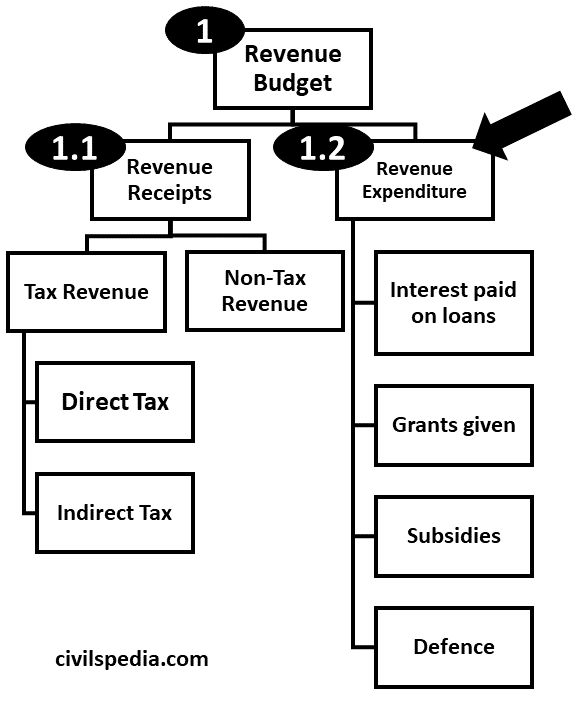

Components of Government Budget

Various components of the budget are shown in the chart given below. The budget can be broadly divided into Revenue and Capital parts, which can be further divided into the following categories.

Why do we divide the Budget like this?

- According to Article 112, the Annual Financial Statement shall distinguish expenditure on revenue from other expenditures. Hence, any type of division following this condition is acceptable.

- The method shown above is one way; constitutionally, we can divide it in any way as long as the above condition is satisfied.

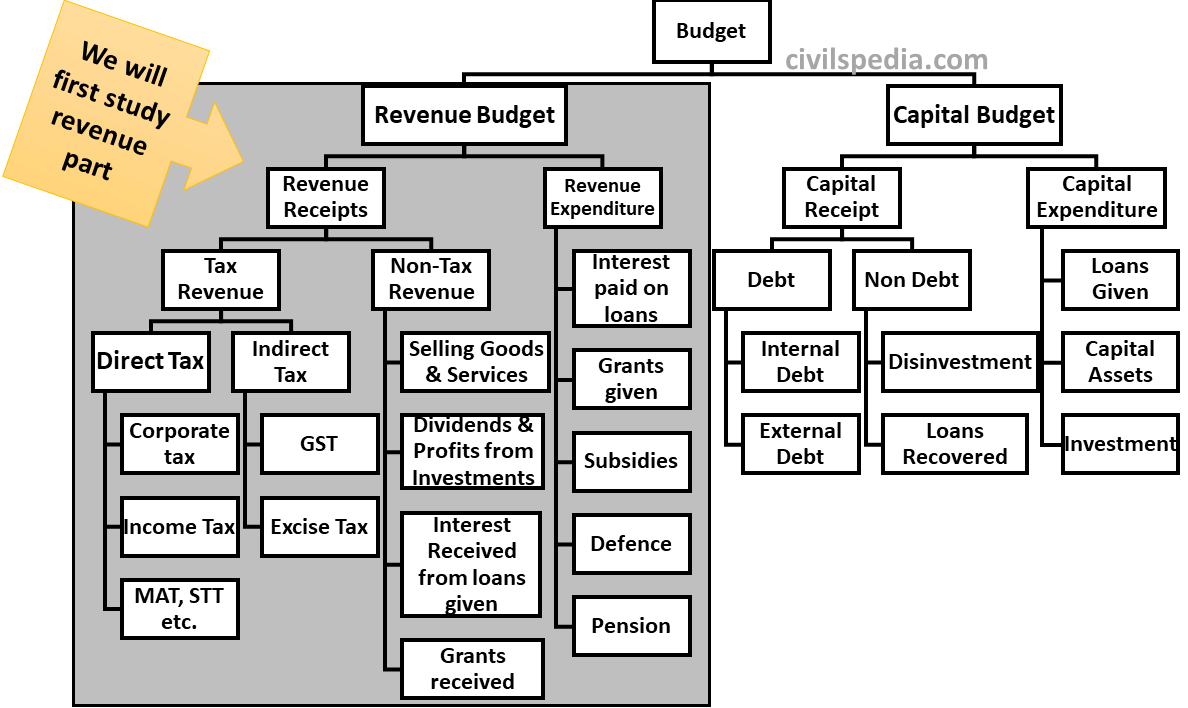

We will read all these components one by one starting with the Revenue part, discussing all the divisions and subdivisions of the Revenue part and subsequently moving to the Capital part.

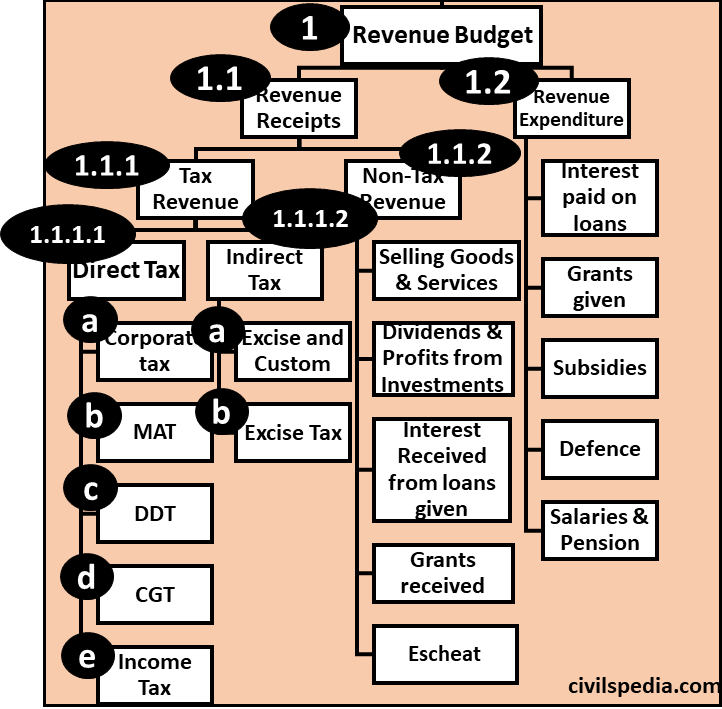

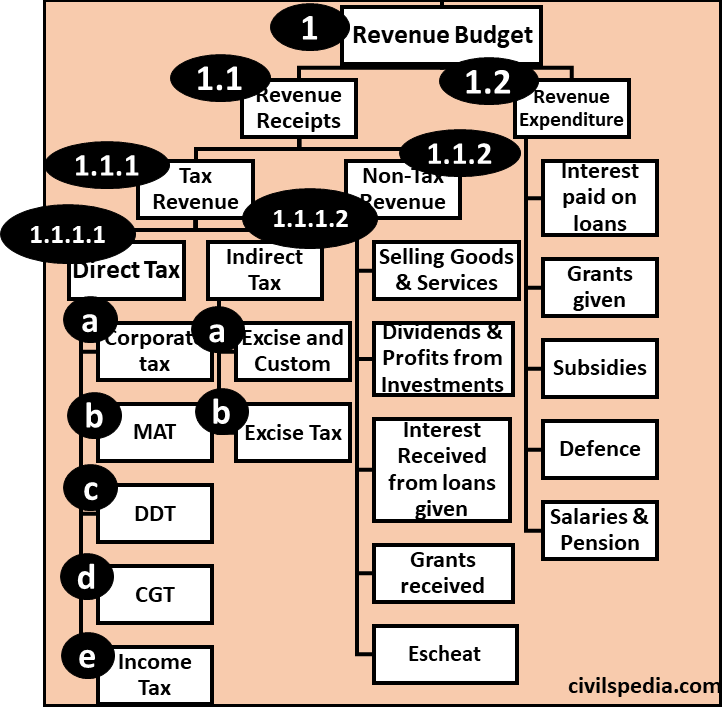

Part 1: Revenue Budget

- Revenue Budget contains the revenue receipts and the revenue expenditure.

- Further, the revenue receipts can be divided into tax revenue and non-tax revenue.

- Revenue expenditure can be further categorised into components like Interest paid by the government on loans taken, Grants given by the Union to States, Subsidies, Grants etc.

1.1 Revenue Receipt

- Receipts that don’t lead to a claim on the government. They are also termed as non-redeemable.

- In simple words, this is such cash received by the government which doesn’t need to be paid back by the government in future. Take the example of tax in which money received by the government in the form of tax is not to be paid back by the government.

- They are further divided into tax revenues and non-tax revenues.

1.1.1 Tax Revenue

What is Tax?

- Tax is a compulsory payment by the person or legal entity (like a company) to the government in return for which the payer can’t claim any specific benefit from the government.

- Tax is a legal obligation that taxpayers can’t refuse to pay.

Methods of taxation

| Progressive Taxation | – The tax rate increases with increasing value or volume. – This method discourages more earnings. |

| Regressive Taxation | – The tax rate decreases with increasing volume or value. – It is sometimes used as a provision to increase production. – It is not a popular mode of taxation & not in favour of the spirit of modern democracy. |

| Proportional Taxation | – The tax rate remains fixed for all levels of income. – This method is neutral from a poor & rich point of view. |

Proportional taxation is typically used in combination with either progressive or regressive taxation. Proportional with progressive taxation is used in India.

Canons of Taxation

Canons of taxation are the characteristics of a sound taxation system.

Adam Smith has enumerated four canons of taxation. These include

| Canon of Ability | – Taxes imposed by the government should be according to the paying ability of people. – Hence, the rich should pay more taxes than the middle and low-income classes. |

| Canon of Certainty | – There should be certainty about the time and rate of payment. – Arbitrariness in tax collection adversely impacts the efficacy of the taxation system. |

| Canon of Convenience | – The method of tax collection should suit the convenience of the people. – E.g., the Indian government allowed online payment of taxes following this canon. |

| Canon of Economy | – Tax collection involves certain costs, such as salaries paid to tax collectors. Hence, taxes, where collection costs are more, are considered bad. Thus, according to Smith, the government should impose only those taxes whose collection costs are significantly lower. |

If a tax doesn’t follow these canons, it is scrapped. E.g., the Gift Tax was abolished in India because it didn’t follow the Canon of the Economy (hardly Rs. 10 crores were used to be collected, and the government had to maintain a large workforce for its collection).

Importance of Taxation

- Revenue generation: The government uses taxation to generate revenue for its operations, infrastructure development, welfare programmes, education, defence, etc.

- Resource Redistribution: Tax can be used to transfer resources from the affluent to the weaker section of society. The government uses the cash received through tax to run welfare schemes for weaker sections.

- Behaviour Discouragement: Also referred to as social engineering, taxes can be used to discourage people from antisocial behaviour. It is often done by heavily taxing the commodity, increasing its price.

- Protecting local Industry: The government usually protects local industries through heavy import tariffs, making imported goods more expensive than local goods, thereby encouraging local production.

- Improving Accountability: Taxes help build up a country’s economy and make the government accountable to its taxpayers. Taxpayers demand accountability from the government of the day.

1.1.1.1 Direct Taxes

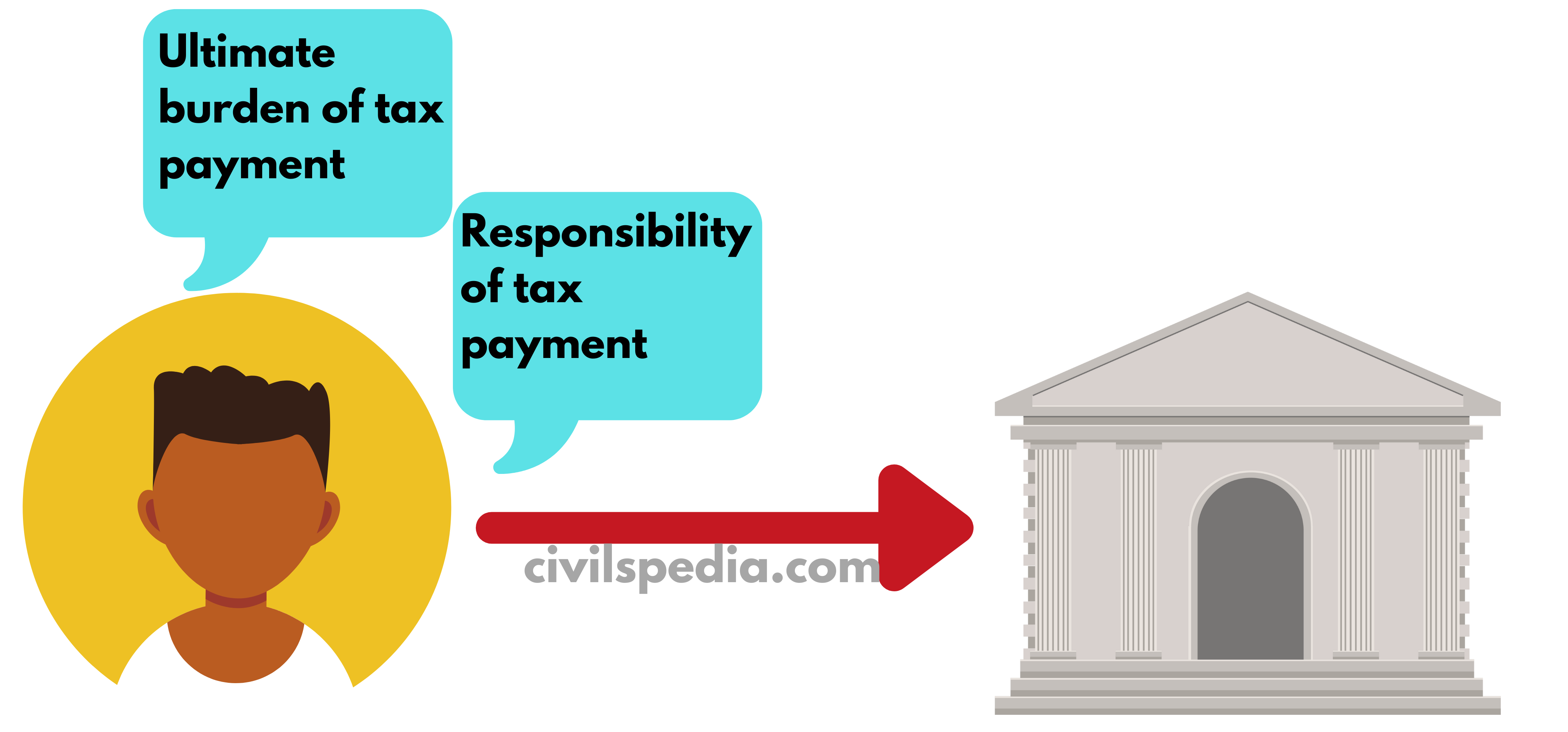

- It is levied on a person’s income or wealth and is paid directly to the government.

- Direct Tax has incidence & impact both at the same point

- It depends on the paying capacity of a person, i.e. rich pay more than the poor.

Pros & Cons of Direct Tax

Pros of Direct Tax

- Direct tax is progressive in nature. Hence, the richer pays higher.

- Inequality in income can be reduced using this as direct tax helps in income redistribution.

- Direct taxes can ensure the canon of certainty as the income taxpayer knows when and at what rate he has to pay income tax.

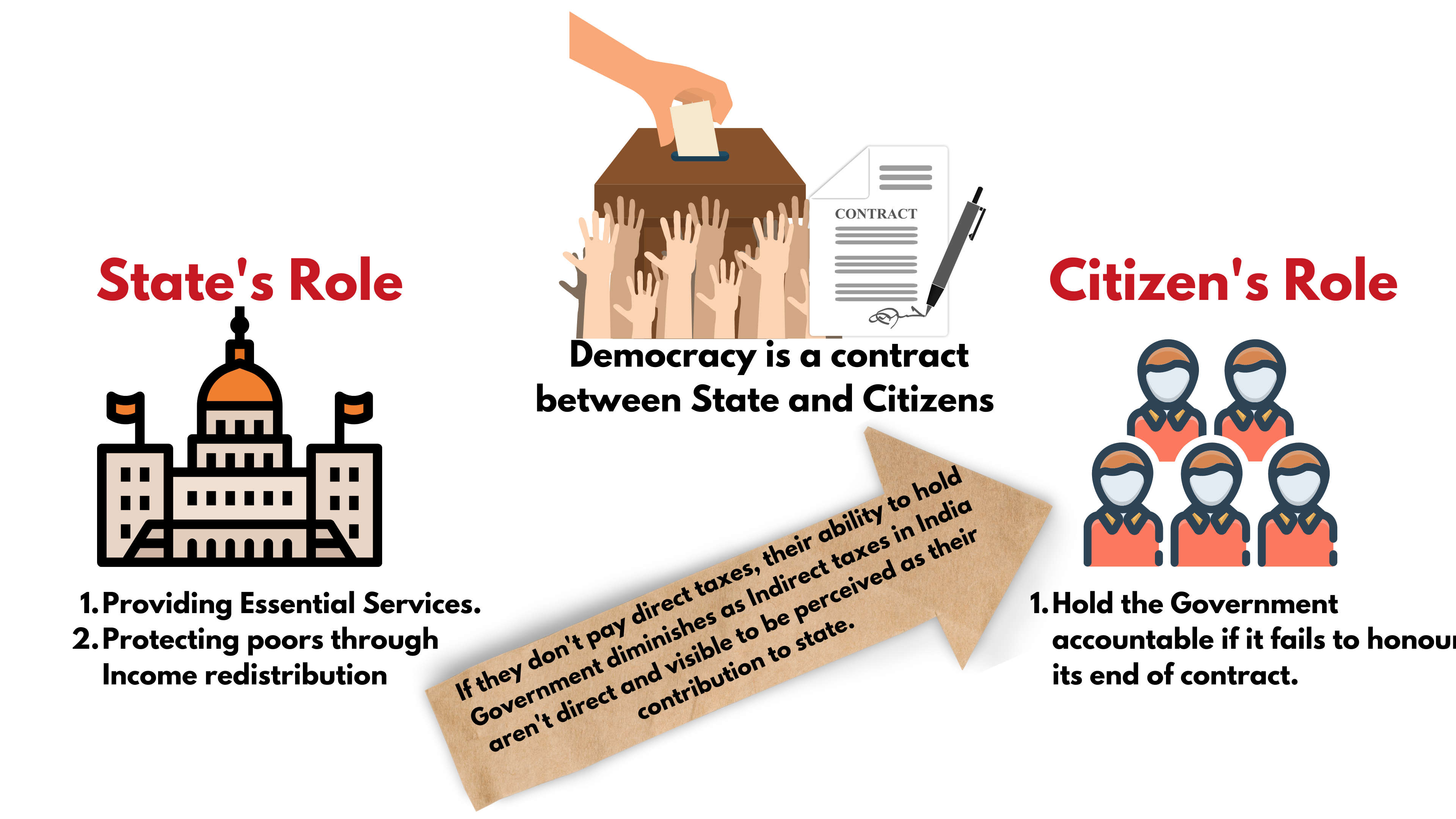

- It increases the accountability of the government. When a person pays directly to the state, he becomes more conscious about the efficacy of the government’s spending.

- It encourages savings and investments. E.g. to avail deductions, people invest in Provident Fund, Insurance etc.

- It is elastic, i.e. quick results are shown when raised or lowered.

Demerits of Direct Tax

- Expensive collection: Government has to maintain salaried employees to collect direct taxes. Hence, the base is kept narrow (mainly to reduce staff expenses, a lot of poor are kept out).

- Inconvenient: The taxpayers find it problematic to maintain accounts & submit returns.

- The externality is not counted (e.g., if a particular company is producing tobacco & another company is making medicine, both will be subjected to the same corporate tax, although the tobacco producer is damaging public health).

- Hardship is not counted (e.g. carpenter & landlord have to pay the same direct tax (income tax)).

- If direct taxes are raised above a certain point, it leads to less tendency to do work as the citizens are not willing to earn more as they have to pay more taxes.

- They are prone to loopholes, litigations and tax evasion.

Question: Why is it important to take more people into the direct tax ambit when the government can raise tax indirectly?

Different Direct Taxes

a. Corporation Tax

- It is the direct tax levied on a company’s net profit.

- Earlier, Corporate Tax was in the range of 30% of net profit. But to provide a boost to the economy, the government has been continuously decreasing the rate so that more surplus can be reinvested in the economy. The present rate of Corporate Tax is as follows:-

| Existing Indian Companies | 22% + 10% Surcharge (on tax) + 4% Health & Educational Cess (on tax+ surcharge) |

| New Manufacturing Companies | 15% +10% Surcharge (on tax) + 4% Health & Educational Cess (on tax+ surcharge) |

| Foreign Companies | 40% + Surcharge + 4% Health & Educational Cess |

| Startups | 0% for (any) 3 years out of 10 years |

Side Topic: Equalisation Levy (Google Tax) and Concept of Significant Economic Presence

- Issue: Foreign Companies have to pay 40% Corporate Tax on profits in India. But Indian Taxation System is designed to tax companies that are based in India. However, most Internet giants, such as Google, Facebook etc., are headquartered outside India. Along with that, almost all the digital companies, like Apple, Google, Amazon, Uber etc., have shifted to countries like Luxembourg (Amazon) and Ireland (Google), which have almost zero tax rates. They channel their profits from operations in the host country to zero-tax economies and pay zero tax to the host country.

- To deal with this, the Government of India imposed an equalization levy and introduced the concept of ‘Significant Economic Presence’ (SEP). It implies that if a foreign company is making money from Indians through digital services, it has ‘SEP’ in India, and the Indian government can tax it. In 2016, an Equalisation Levy or Google Tax of 6% was imposed on digital advertisers. Countries like France have also implemented a tax on large technology companies called GAFA Tax (Google-Amazon-Facebook-Apple) in 2019.

- In Budget 2020, the Government imposed an Equalisation Levy of 2% on the revenues generated through the online sale of digital goods and services by non-resident e-commerce companies, streaming companies (like Netflix, Amazon Prime etc.) and online travel aggregators (like Trivago), provided that their revenue exceeds Rs 2 crore.

- The US government has raised an issue against it by arguing that this levy is a burdensome restrictive measure, has costly compliance requirements and subjects US companies to double taxation. But India has claimed that it is not discriminatory against US companies as it is charged equally to all the foreign companies operating in India. Along with that, it is also in line with OECD-G20 suggestions to tackle tax challenges.

But there are issues with Equalisation Levy

- MNCs can’t get the input tax credit. Hence, they increase their subscription price, which the Indian consumer ultimately bears.

- These MNCs, especially American companies like Google, Microsoft, Adobe, Netflix etc., lobby the US Senate to retaliate by imposing more taxes on Indian products.

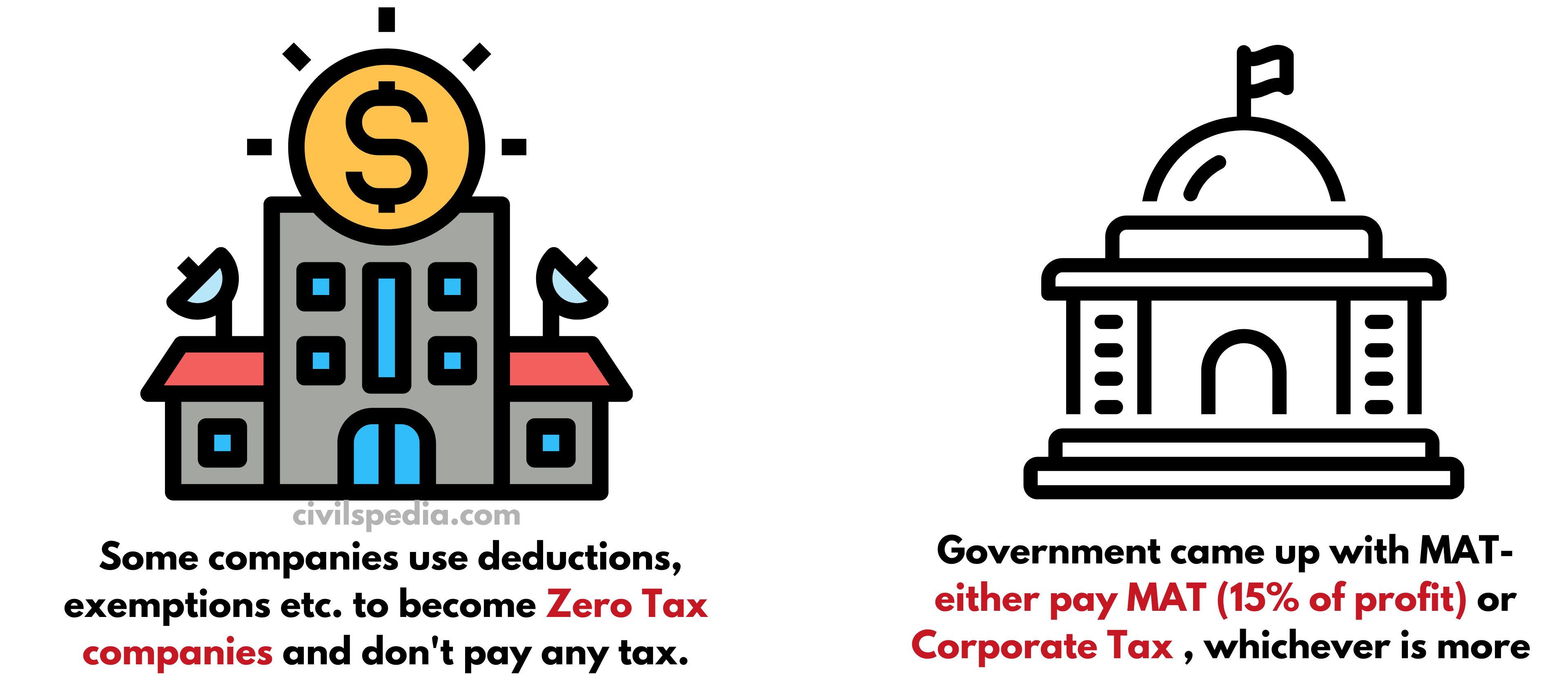

b. Minimum Alternate Tax (MAT)

- Some companies use deductions, exemptions, further investments and dividends to become Zero Profit Companies and escape the tax liabilities (as corporate tax is calculated on net profit).

- To take them into tax ambit, the government took the following measures:-

- 1987: Rajiv Gandhi introduced Minimum Corporation Tax.

- 1996: Chidambaram introduced MAT at the rate of 18.5% on book profit.

- 2019 Budget: MAT was reduced to 15% of book profit

- The concept is EITHER PAY 15% of TOTAL PROFITS or CORPORATE TAX AFTER ALL DEDUCTIONS, WHATEVER IS MORE.

c. Dividend Distribution Tax

- When the company pays a dividend to their Shareholders, shareholders had to pay the Dividend Distribution Tax to the government.

- The government has abolished this tax in Budget 2020.

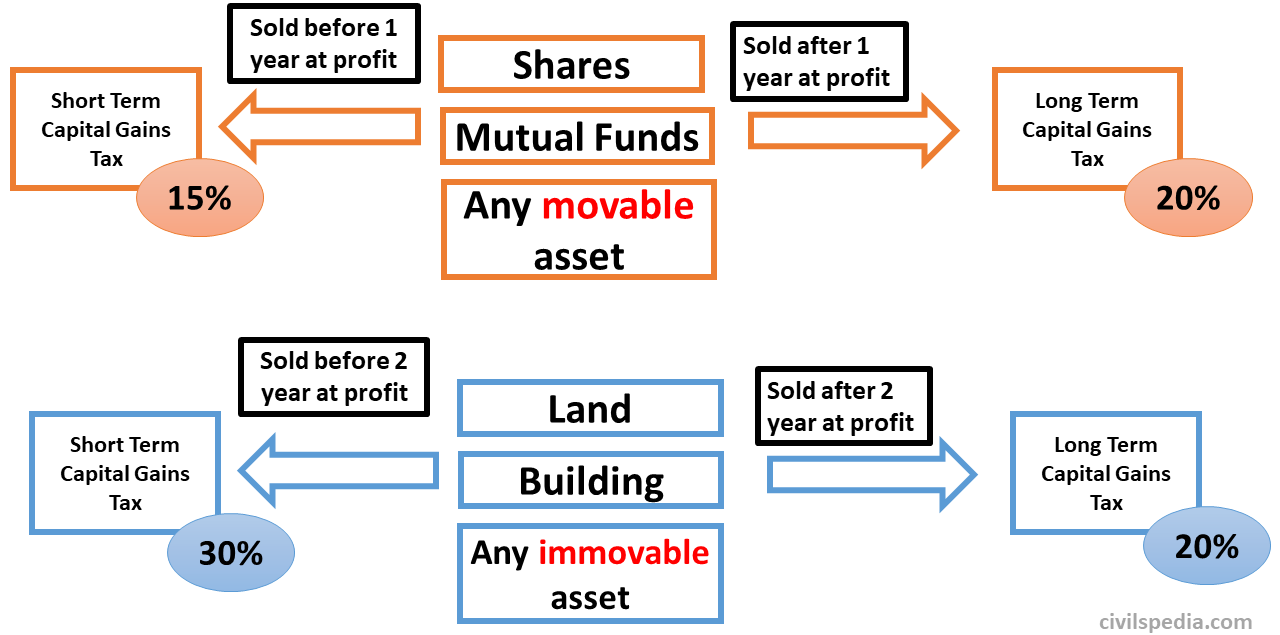

d. Capital Gains Tax

- When an owner makes a profit by selling his capital assets, such as non-agricultural land, property, jewellery, patents, trademarks, shares, bonds etc., he must pay the Capital Gains Tax (CGT) on the profit earned.

- It is of two types i.e.

- Long Capital Gains Tax (LCGT): if the asset is kept for a long (the period varies according to the type of asset, like 1 year for Shares, 2 years for property etc.) before selling and sold at a profit, LCGT is to be paid on the profit earned.

- Short Capital Gains Tax (SGCT): if the asset is kept for a short time before selling and sold at a profit, SCGT is to be paid on the profit earned.

- It follows the principle of Tax Deduction at Source (TDS), i.e. buyer will deduct CGT from the amount to be paid to the seller and deposit it to the government.

- Budget 2022 has placed a 30% tax on virtual digital assets (like bitcoins, NFT etc.).

Security Transaction Tax

- STT is charged at a rate ranging from .001% to .125%, depending on Security.

- It is applicable to Shares, Mutual Funds etc.

- Capital Gains Tax is charged when there is profit, but STT is charged for trading the Securities and will be charged immaterial of profit or loss.

e. Income Tax

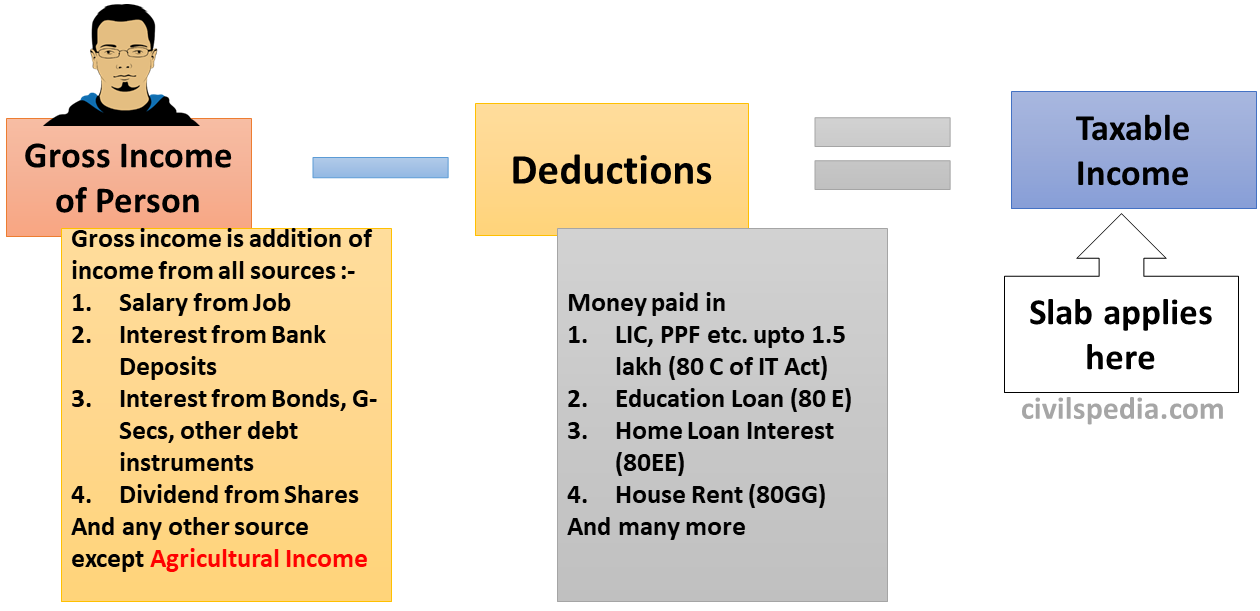

- Income tax is the direct tax on the taxable part of an individual’s income.

- Taxable Income = Real Income from all sources – (minus) various deductions claimed (like investment in LIC, PPF etc., Education loan, Home Loan Interest etc.

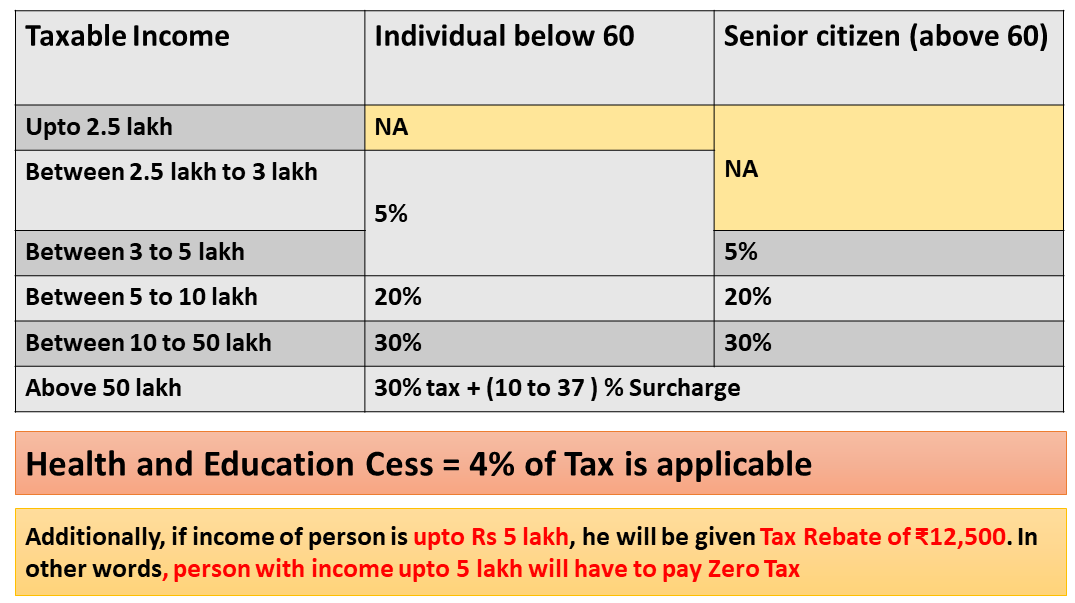

1st System (Old Tax Regime (OTR))

- Income tax is paid by the person at different rates, as mentioned below. These slabs were modified in 2019 and have remained unchanged since then.

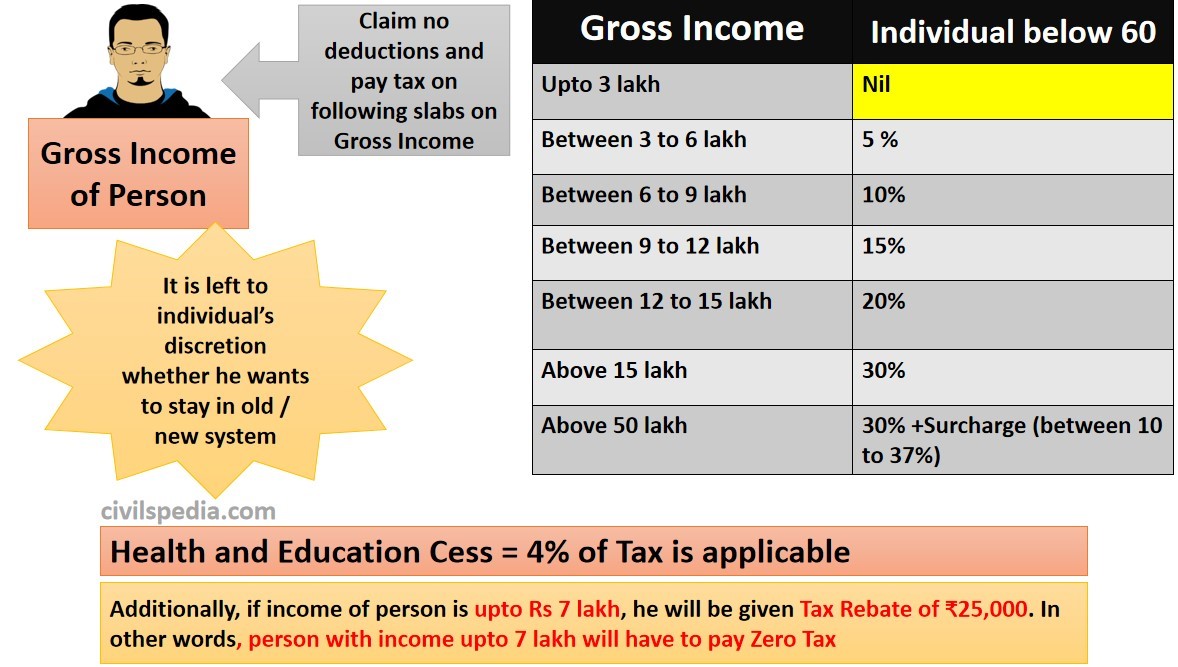

2nd System (New Tax Regime (NTR)- 2023)

- The system mentioned above was very complex, as a normal person couldn’t easily comprehend the system of various deductions. He has to pay a hefty bill to Chartered Accountants for filing up tax. In Budget-2020, the government decided to give an option to people, i.e. either they can fill their taxes according to the system mentioned above or follow another method in which the government will provide no deductions but will reduce the overall tax rate. The slabs were updated in Budget 2023 and known as New Tax Regime-2023.

- In effect, Middle-class people will have to pay less tax via the new system. This system will increase the disposable income in the hands of people and increase the demand in the economy.

Switching between NTR vs OTR

- The New Tax Regime (NTR) is the default system wef Budget 2023. If a person or businessman wants to choose OTR, he must mention it specifically.

- Regarding switching between NTR and OTR, there are different rules for Salaried Employees on the one side and Businessmen and Freelance Professionals on the other side.

| Salaried Employees | They can choose which system to opt for every financial year. |

| Businessman and Freelancers | They are allowed to choose between OTR and NTR only once in a lifetime. |

Issue with Income Tax in India

In India, just 4% of Voters file their Income Tax returns.

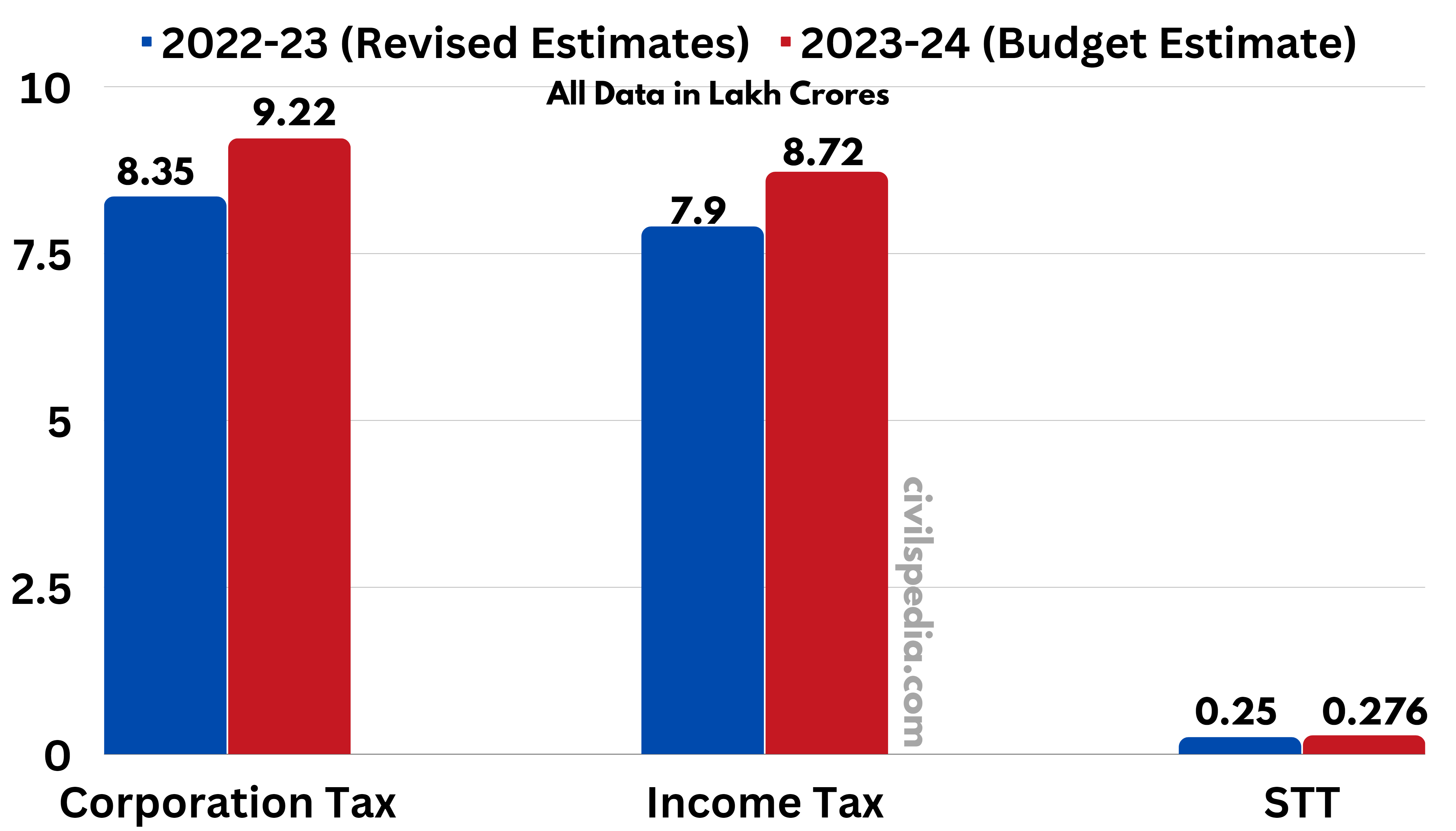

Ranking of tax collected via Direct Taxes

Cess & Surcharge

The general rule is,

- The surcharge is applied on the Tax

- Cess is applied on (Tax+ Surcharge)

Surcharge vs. Cess

| Surcharge | Cess |

| Generally, there is no specific purpose for a surcharge | Cess is levied for a specific purpose. E.g., Education Cess goes to Prarambik Siksha Kosh for Sarva Shiksha Abhiyan |

| Its proceeds go to Consolidated Fund (Art 271) | Its proceeds go to Public Account or Consolidated Fund (case to case) |

| Finance Commission doesn’t share it with states | Finance Commission doesn’t share it with states |

Cess and Surcharge in previous years

- Health and Education Cess levied at the rate of 4% on direct taxes such as Income Tax and Corporation Tax.

- Social Welfare Surcharge on imported goods (10% of the Customs Duty).

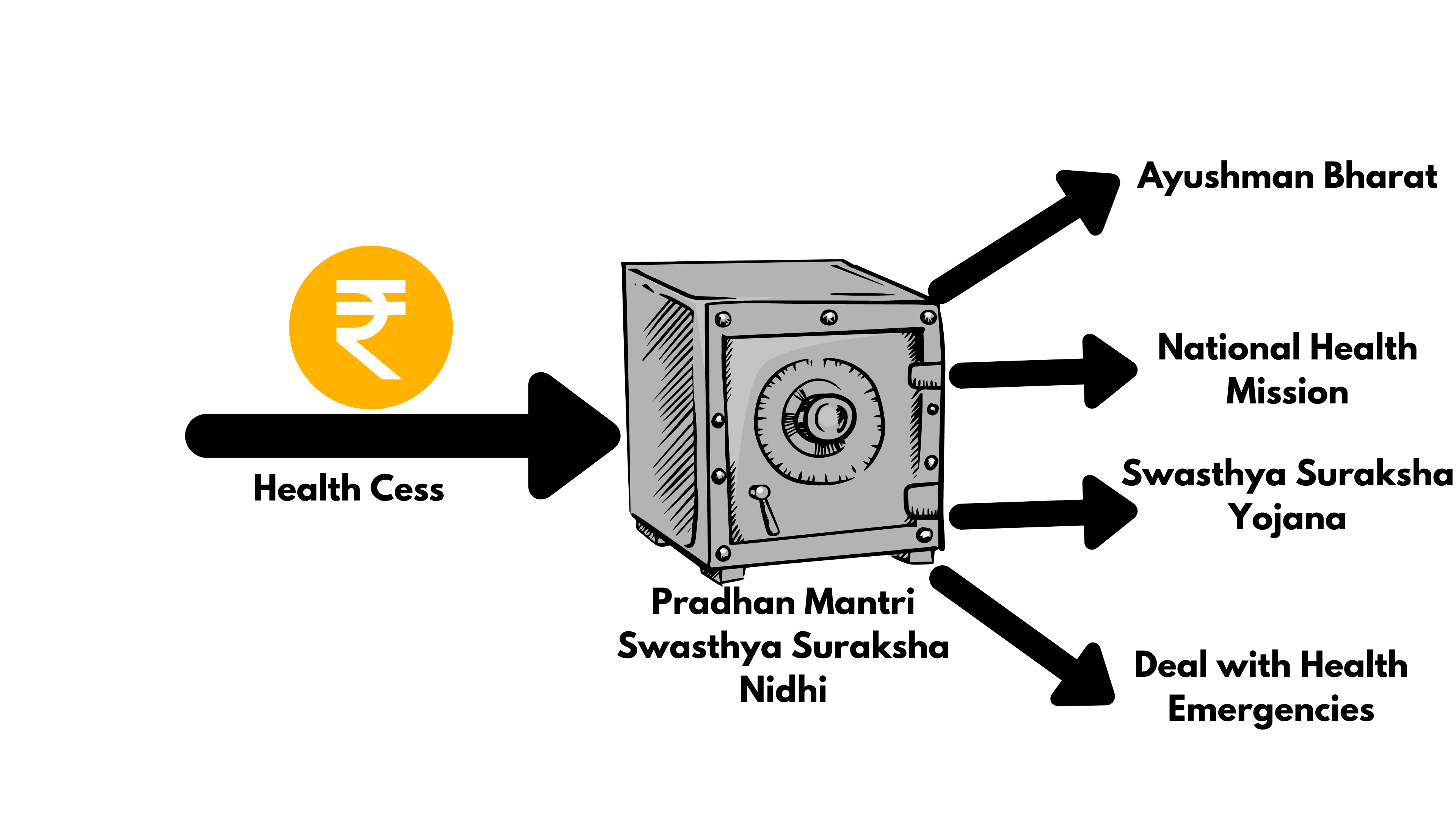

- Health Cess on imported medical devices (5% of Custom Duty) for building infrastructure for Ayushman Bharat.

- Agriculture Infrastructure and Development Cess on imported goods such as gold, alcohol, urea, apple etc.

Side Note: Why (Union) Government Loves Cess?

- While the Centre has to share the revenue from other taxes with the States mandatorily based on the recommendations of the Finance Commission (under Article 270), it retains the entire kitty with a cess.

- Governments often resort to cesses to generate tax revenue, as they offer a relatively simple and straightforward way to do so. Cesses can be introduced, altered or repealed with relative ease through the issuance of a notification, making them a flexible tool for policymakers to raise funds.

Side Topic: Direct Tax Code

There are many issues with the Direct Taxes of India. As a result, just 4% of voters pay income tax; corporates suffer from high Corporate Taxes, and foreign companies don’t invest in India due to high Corporate Taxes on foreign companies. To overhaul the Direct Tax System of India, the government set up a task force under Arbind Modi. It suggested the following in its report submitted in August 2019

- Replace the complex Income Tax Act of 1961 with a simple Direct Tax Code.

- Further reduction in Corporation Tax.

- The same taxation system should apply to foreign and domestic companies.

- Provide additional tax relief to the Startups.

- More tax slabs should be introduced.

- Set up Litigation Management Unit to look after tax-related court cases efficiently.

1.1.1.2 Indirect Taxes

- Indirect Tax is levied on the purchase of goods and services and paid indirectly to the government.

- Unlike direct taxes, it is charged from all people at the same rate (irrespective of their economic status).

- In this, tax incidence and tax impact are at different points.

Pros and Cons of Indirect Taxes

Pros

- Wider Coverage Base: All consumers, whether rich or poor, have to pay indirect taxes

- Economical to collect: As producers and retailers collect tax and submit payments to the government, the cost of collection is reduced. The merchants serve as honorary tax collectors.

- Checks harmful consumption: The Government can impose indirect taxes on commodities detrimental to health, e.g. tobacco, liquor etc. They are known as sin taxes.

- Convenient to pay: Consumers can pay indirect taxes easily when they purchase a good or service.

Cons

- Regressive nature: Indirect taxes are regressive since both rich and poor persons have to pay the taxes equally, irrespective of their income level.

- Uncertainty: The implementation of indirect taxes results in an increase in prices and subsequently leads to a reduction in the demand for goods. It, in turn, creates uncertainty for the government regarding the anticipated revenue collection.

- No Civic Consciousness: As the indirect tax hides in the price, the consumers are unaware of paying the tax.

- Cascading Effect: If the input tax credit is not given, Indirect taxes can lead to a cascading effect, i.e. Final consumer will have to pay tax on taxes.

Theory: Ways to impose Indirect Tax

Indirect Tax can be imposed in two types

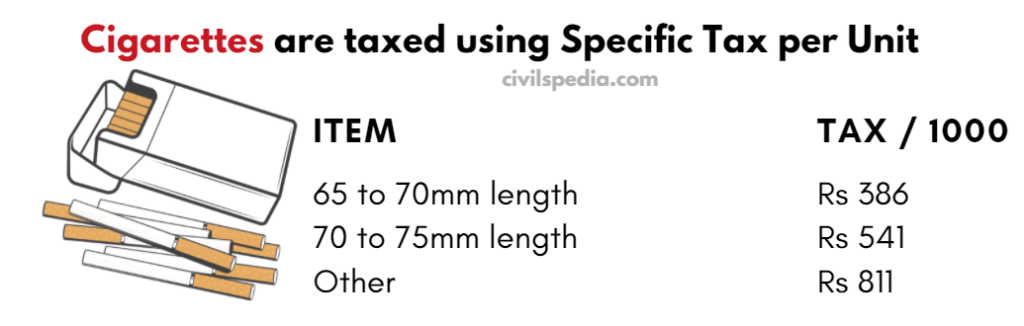

- Specific Tax per Unit

- Ad Valorem

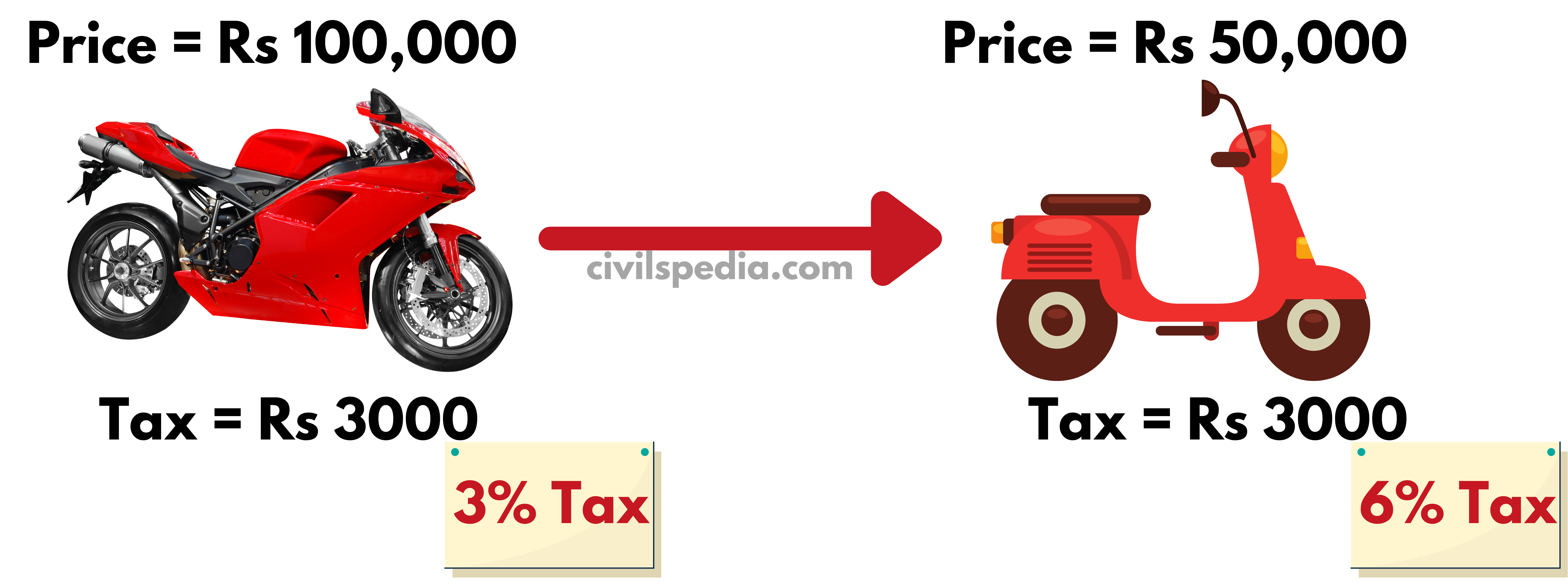

1. Specific Tax per Unit

- In this, tax is charged per unit (immaterial of the unit’s price).

- E.g., In the example below, the tax on bikes is fixed at Rs 3000 per unit (irrespective of cost).

Problem

- The government’s tax revenue doesn’t rise automatically with the rise in the prices of goods. Hence, the government must frequently increase the tax rates in this system.

- It also leads to inspector raj as traders can find loopholes – first to make bigger units and then ask retailers to cut into smaller pieces.

But in some cases, we prefer the Specific Tax per Unit. These include cigarettes and other demerit goods.

2. Ad Valorem

- In this, tax is charged per unit price.

- E.g., say tax for the bike is 3% of the price.

This system is beneficial as the government’s tax revenue increases naturally with a price increase. Along with that, tax dodging is not possible in this. Hence, we prefer Ad Valorem System in most cases.

Different Indirect Taxes

a . Excise and Custom Duty

Excise Duty

- Excise Duty is the indirect tax levied when a product made in India is sold in India.

- After GST, Excise Duty on all except Petroleum Products has been removed.

Custom Duty

- It is the indirect tax levied when some other country’s product is imported to India or Indian product is exported abroad.

- Customs duty on imported and exported goods is still intact after GST.

- If the government wants to protect the domestic industry, it can increase the customs duty on those goods. E.g., the government increased the customs duty on imported raw materials, capital goods and project imports in the Budget (2023) to increase their domestic production.

Side Topic: Anti-Dumping Duty

- Anti-Dumping Duty is a protectionist tariff a domestic government imposes on foreign imports if it believes it is priced below fair market value.

- Suppose it costs Rs 100 to produce 100 ml of Coconut Oil in India. The producer will sell this in the market at a rate of Rs 100 plus excise duty (or GST).

- Suppose that producers in China are also producing the same coconut oil at Rs 100 and selling it at 100 plus excise duty in the Chinese market. But when they export the same thing to India, they charge just Rs 60 (due to various Export Subsidies given by the Chinese government).

- In such a case, since Chinese products are being dumped in India, India can impose a Dumping Duty on that along with Custom Duty such that it costs the same in India as Indian Products.

b. GST

- GST is the major tax reform of the government that has subsumed all the indirect taxes in itself.

- Dealt in a separate article (CLICK HERE).

Side Topic: Financial Transaction Tax – Tobin / Robinhood Tax

- If Foreign Investor is speculating by investing in different countries and immediately withdrawing his money, it will lead to

- Volatility in the exchange rate

- Volatility in the share market

- James Tobin (American Economist) proposed that Tobin Tax be imposed whenever currency is converted to address speculative investments.

- In India, whenever a foreign currency is converted, it is subjected to Service Tax / GST. It is a type of Tobin Tax.

Hence, the Properties of Tobin Tax include

- It is the tax on all foreign exchange transactions when foreign capital enters & leaves the country.

- It aims to check speculative flows.

- Its characteristic feature is it is levied twice.

- Long-term investments like FDI don’t suffer because of this, while FII suffers.

Side Topic: Pigouvian Tax

- Pigouvian tax is imposed on bodies having negative externalities.

- The effect of one person’s action on the well-being of a third party is known as an externality.

Clean Environment Energy Cess

- It is imposed on the imported Coal, peat & lignite and desi coal at the rate of ₹ 400 / ton.

- Money goes to Clean Energy Fund & is used to fund clean energy projects.

- The government has decided to use the proceeds of this cess for Compensation of Losses of States due to GST implementation.

Side Topic: Windfall Tax

- A windfall tax is levied on unexpected or unplanned profits, often resulting from a significant event such as a natural resource discovery or unexpected price increase of any good. The purpose of a windfall tax is to capture some of the unexpected profits and redirect them towards public benefit.

- It happened in the case of petroleum.

- In June-July 2022, Fuel prices witnessed an exponential increase in the global markets. Indian refineries, which export a large amount of petroleum and diesel, started to make huge profits. Hence, the government imposed Special Additional Excise Duty (SAED) on the export at the rate of ₹6/litre for Petrol and ₹12/litre for diesel.

- But towards the end of August 2022, as fuel prices started to decline in the global market, the Indian government started to eliminate or reduce the duty.

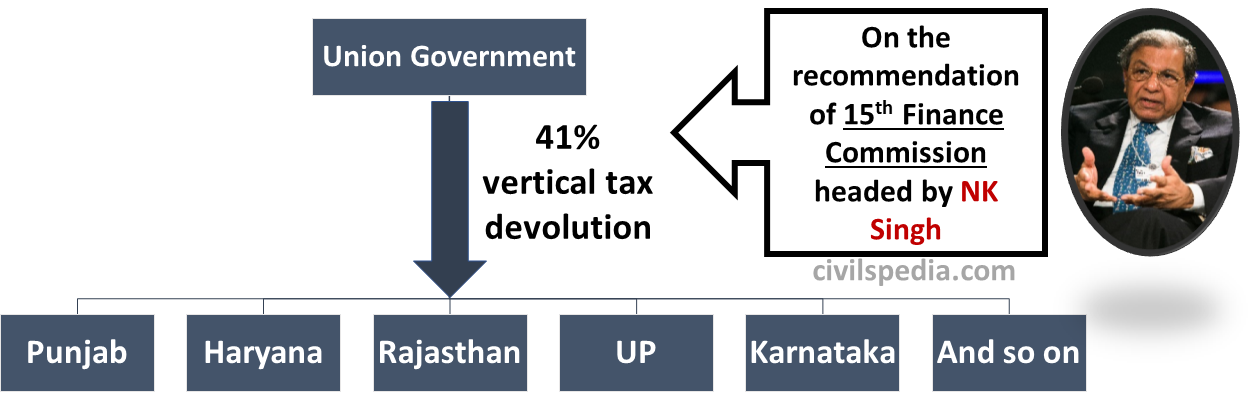

Devolution of Central Taxes on the recommendations of Finance Commission

All the money collected by the Union government through direct and indirect taxes is shared with the states on the formula suggested by the Finance Commission (under Article 280 of the Constitution).

Such an arrangement has been made because

- The taxation powers of State governments are low.

- The Union government collects all the important direct taxes like Income and corporate tax.

Presently, the 15th Finance Commission has recommended that Union should share 41% of divisible taxes with the states.

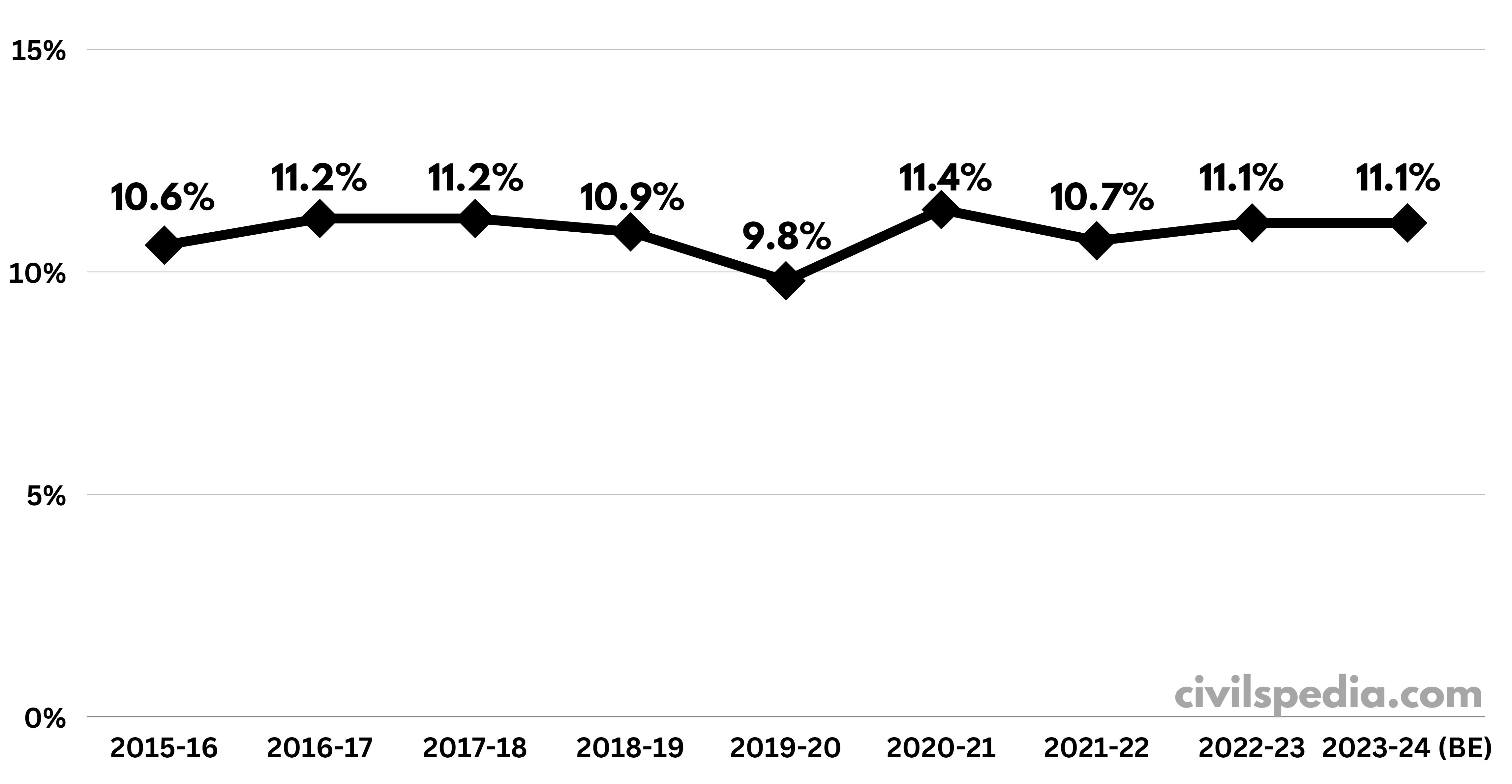

Tax to GDP in India

- The Tax: GDP ratio of India is 11.1%.

- Considering India’s development levels, the Tax: GDP ratio should be around 20%. But India has a low Tax: GDP ratio due to various reasons like

- Tax Evasions

- Black Money

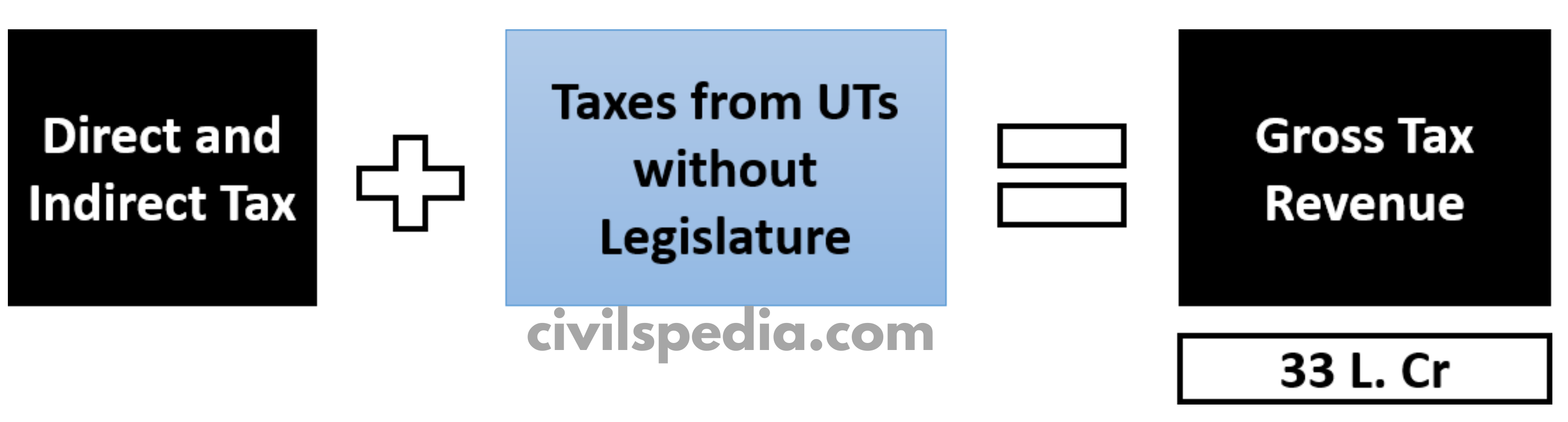

Gross Tax Revenue & Net Tax Revenue

- In Budget 2023 projections, Union Government will receive ₹33 lakh crore from Direct and Indirect Taxes and taxes collected in Union Territories without legislature.

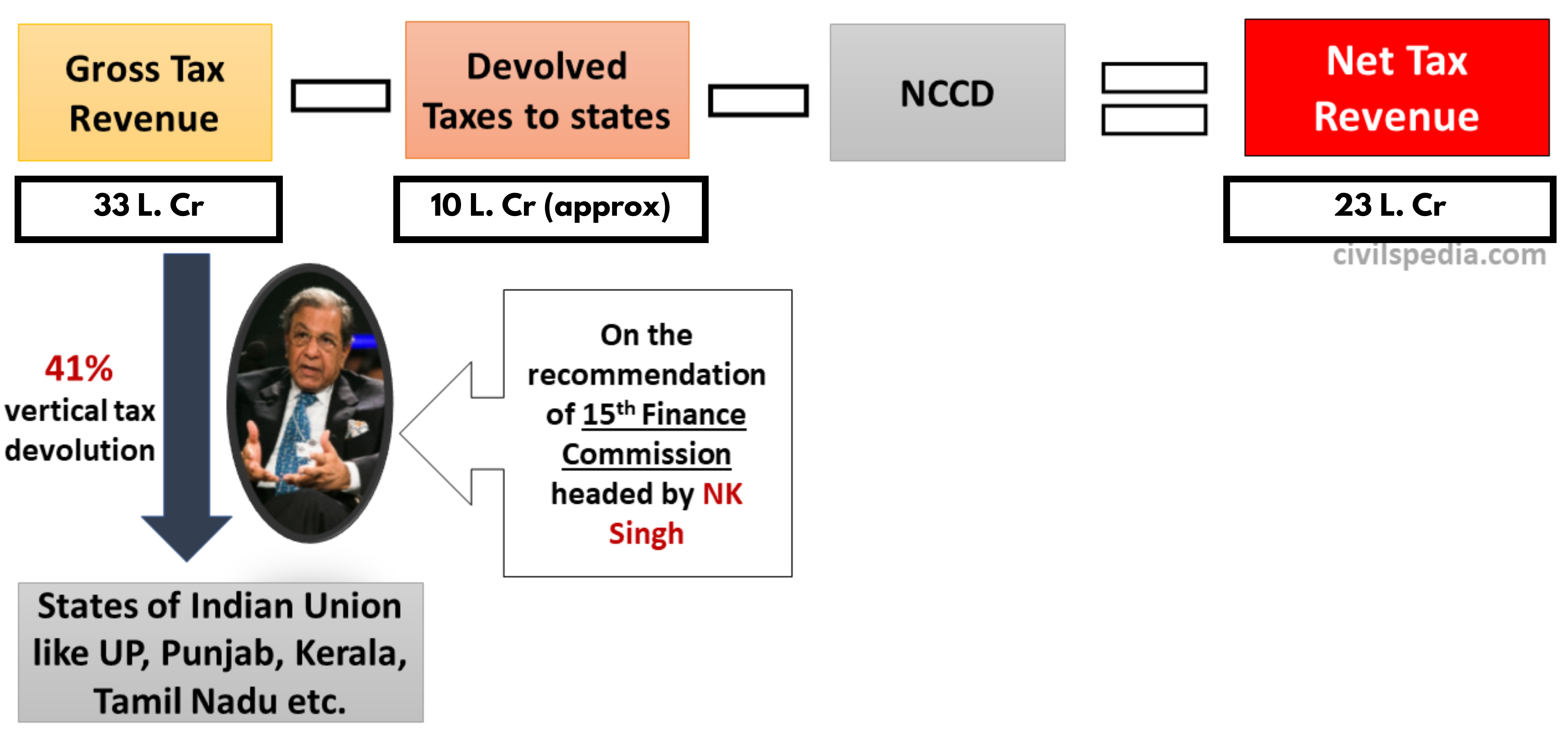

Net Tax Revenue

- From Gross Tax Revenue, Union is bound to share 41% of divisible taxes with the states, according to the 15th Finance Commission. Net Tax Revenue is the amount that the Union retains after vertical devolution.

1.1.2 Non-Tax Revenue Receipt

The revenue obtained by the government of India from sources other than tax is called Non-Tax Revenue. These include

- Revenue from selling goods and services like post-office services, selling telecom spectrum etc.

- Dividends and profits received from Public Sector Enterprises, RBI etc.

- Interest received on loans given to states, foreign countries etc.

- Grants received by the Union government from foreign countries or organisations (these grants are not to be paid back)

- Escheat: When a person dies without leaving a will or legal heirs, the state is entitled to their property.

Non-tax revenues are significantly lower than tax revenues. E.g. for 2023, Net Tax Revenue is projected to be Rs 23 lakh crore, and Non-tax revenue is projected to be Rs 3 lakh crore.

1.2 Revenue Expenditure

Revenue Expenditure is that component of government expenditure that is not used to produce any productive asset. Instead, the government incurs these expenditures for its operational needs like salaries, interest on loans, etc.

Different Revenue Expenditures

a. Interest paid on loans

- Union Government takes a considerable amount of loans. Interest paid on loans taken in the past is counted in the revenue expenditure.

- It is the biggest component of expenditure. In 2023, Union Government paid Rs 10 lakh crores as interest on its previous loans.

b. Grants given

- Union Government gives a large number of grants as well. These include

- Grants given to states on the recommendation of the Finance Commission.

- Grants given to foreign countries as part of soft-power diplomacy.

- The recipient of the grant doesn’t pay it back (it is not a loan but a grant)

- It consumes the second most significant chunk of revenue expenditure. In 2023, the Union government will give ~Rs 6.6 lakh crores in grants.

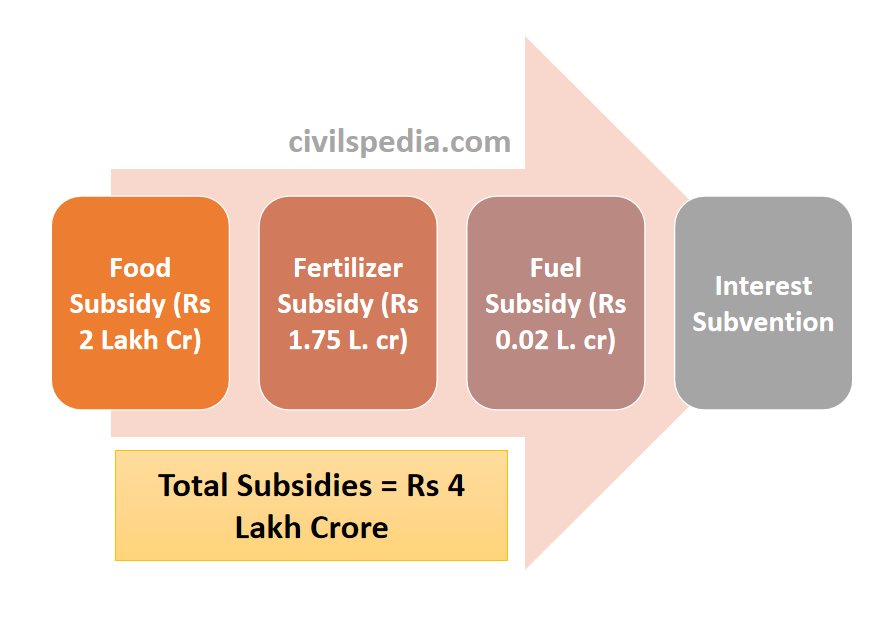

c. Subsidies

- Subsidies are the benefits given to individuals or firms by the government to reduce the financial burden of a specific section of society.

- Union Government gives various types of subsidies like

- Food Subsidy: The government buys wheat and rice from farmers at MSP and then distributes the food to the poor at low prices under the provisions of the Food Security Act.

- Fertilizer Subsidy: It is used to provide urea to farmers at a low price.

- Fuel Subsidy: LPG cylinders are given to households at a price lower than the market price.

- Subsidies on loans are given to various sections like farmers, MSMEs etc.

- In 2023, the Indian government gave Rs 4 lakh crore in subsidies.

Side Note: Impact of Subsidies

Subsidies can have both positive as well as negative impacts.

- Subsidies given on merit goods like healthcare, education etc., show a positive impact as it leads to better health and educational outcomes.

- But in some cases, like subsidies given on urea can encourage farmers to use excessive amounts of urea, impacting the farm’s fertility and leading to environmental degradation.

- Along with that, subsidies increase the fiscal deficit of the government.

Issues with Subsidies in India

- Subsidies in India are regressive in nature due to their universal nature. Hence, richer households get more subsidies in comparison to poor households. E.g., Electricity subsidy benefits the richer as they consume maximum electricity.

- Inclusion and Exclusion errors in subsidies: Ideally, only the poor should receive a government subsidy. But it has been observed that most of the subsidy leaks are due to exclusion and inclusion errors.

- Exclusion Errors: Poors who should receive subsidies don’t benefit from subsidies.

- Inclusion Errors: Rich and ghost beneficiaries who shouldn’t get any subsidy enjoy the benefit of subsidies.

- It hurts the government finances as well without yielding the required benefits. Indian government gives Rs. 3 to 4 lake crore on subsidies.

Side Note: Steps taken by the government wrt Subsidies

- Targeted beneficiaries: To identify people who should receive a subsidy, the government is using Socio-Economic Caste Census (SECC).

- Direct Benefit Transfer: Subsidies are directly transferred to the bank account of the beneficiary using the JAM platform.

- Ghost beneficiaries have been removed by linking subsidies with Aadhar.

- Subsidies on things like petrol and diesel have been removed.

Economic Survey Topic: Using Behavioural Economics to reduce subsidy expenditure

Government should use behavioural economics to encourage people above the poverty line to give up subsidies voluntarily in the following ways.

- Generally, people go with the status quo. So, the ‘Default ticked option’ in LPG registration forms should be ‘I wish to give up the subsidy’. Hence, the person will be ‘forced’ to untick the option to avail of the subsidy benefit.

- Advertisements to highlight that “people are helping in poverty removal by giving up subsidies. “

- The online ‘subsidy giving up process’ should be quick and hassle-free.

- Disseminate the name of people who have given up subsidies in the neighbourhood using SMS or other online forums so that others can follow in their footsteps.

d. Defence Expenditure

- Defence revenue expenditure is the expenditure to give salaries to the armed personnel and buy ammunition for the defence forces. But it doesn’t include expenditure to purchase new weapons.

- In 2023, the Indian government spent Rs 2.79 lakh crore in defence expenditure.

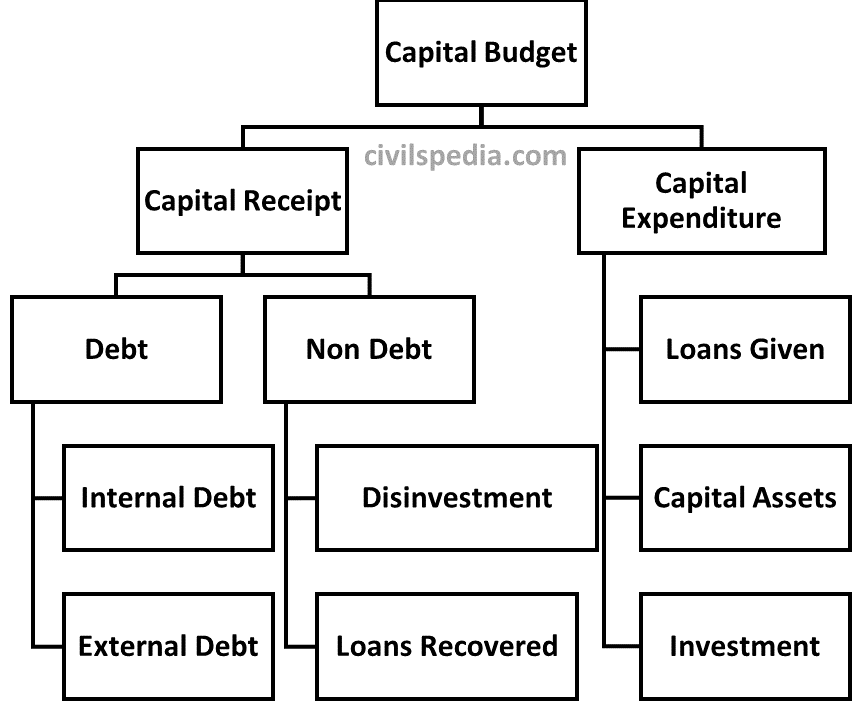

Capital Budget

It consists of capital receipts and capital expenditure.

2.1 Capital Receipt

- Unlike Revenue Receipts, Capital Receipts are those receipts that lead to a claim on the government.

- In simple words, this is such cash received by the government that needs to be paid back by the government in the future.

It can be further divided into debt and non-debt.

a. Debt Receipt

Debt is the government borrowings. Government can borrow money either internally or externally.

a.1 Internal Debt

- Internal debt is a loan taken by the government from the citizens or different institutions within the country.

- Primary sources of Internal Borrowings include

- Individuals who buy the bonds issued by governments.

- Banks purchasing government bonds and securities.

- Institutions like LIC, GIC etc., can also buy government bonds.

- Provident fund

- Small saving schemes

- For 2023, the target of internal debt is Rs 17 lakh crore.

a.2 External Debt

- The external loan is the loan taken from the government of other countries or an international organization (like the World Bank, IMF, BRICS Bank etc.).

- The government will borrow Rs 22,000 crore from external sources in 2023.

b. Non-Debt

It has two components

b.1 Loans Recovered

- It consists of the principle of loan given back by states or other countries to which India has lent.

- Union will recover Rs 23,000 crore in 2023.

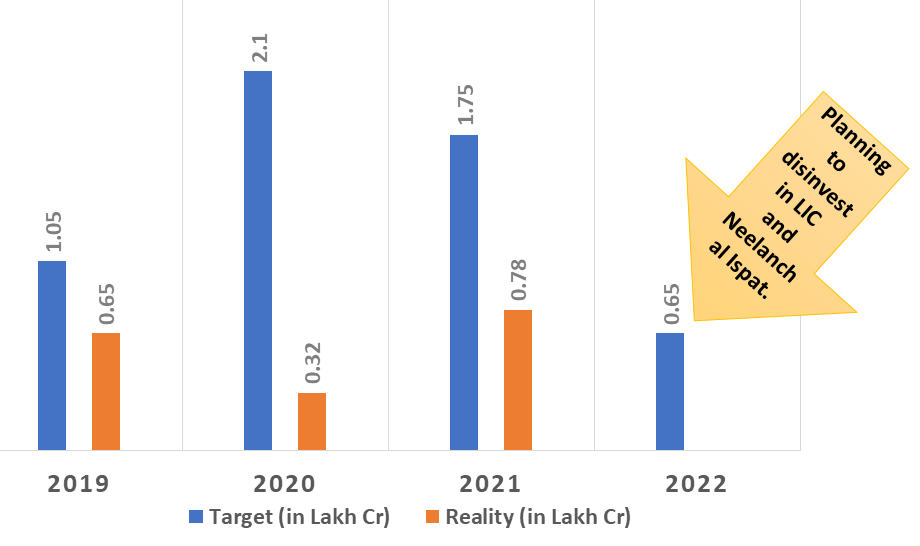

b.2 Disinvestment

- Cash received by the government by selling the shares of Public Sector Enterprises.

- In 2023, Government will raise Rs 61,000 crore via disinvestment.

2.2 Capital Expenditure

It consists of

- Paying back the principles of loans earlier taken.

- Expenditure on making of the capital assets like roads, buildings etc

- Giving debt/equity finance to PSUs & foreign institutes, providing loans to State Government & Foreign Government.

In Budget 2023, Capital Expenditure is pegged at Rs 10 lakh crores.

Side Topic: State CAPEX Loans / Special Assistance to States for Capital Expenditure

- To deal with the Covid pandemic, the Union government has decided to give interest-free 50-year loans to states for capital expenditure. States can spend this on building infrastructure in health, rural development, water supply, irrigation, power, transport, education and urban development.

- In Budget 2022, the government has decided to give CAPEX loans of Rs 1 lakh crores to the states.

- In Budget-2023, the government announced that a proportion of State Capex loans will be linked to

- Reforms in the Finances of the Urban Local Bodies

- Scrapping old vehicles

- Construction of Unity Malls etc.