Table of Contents

Introduction to Budget

Last Updated: April 2023 (Introduction to Budget)

This article deals with ‘Introduction to Budget .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Fiscal Policy

- The term ‘fiscal‘ is derived from a Greek word that means ‘basket‘ and symbolizes the public purse.

- Fiscal Policy is a set of government decisions concerned with raising revenue through taxation & with deciding on the amount & purposes of its spending.

- It involves the use of taxation & government spending to influence the economy.

- The budget is the primary tool used by the Government to implement its fiscal Policy.

Introduction to Budget

- The word ‘Budget’ is derived from the French word ‘baguette’ means a leather bag as Finance Minister keeps the leather budget bag and presents them in Parliament.

- The Budget 2023 has mentioned 7 priorities, i.e. ‘Saptarishi‘ for Amritkaal, which include

- Inclusive Development

- Infrastructure and Investment

- Reaching the Last Mile

- Financial Sector

- Green Growth

- Unleashing the Potential

- Youth Power

- The term ‘Budget’ is not mentioned anywhere in the constitution. But the following provisions of the constitution are related to the budget.

- Annual Financial Statement (Article 112)

- Finance Bill for collecting taxes (Article 265)

- Appropriation Bill for spending money (Article 114

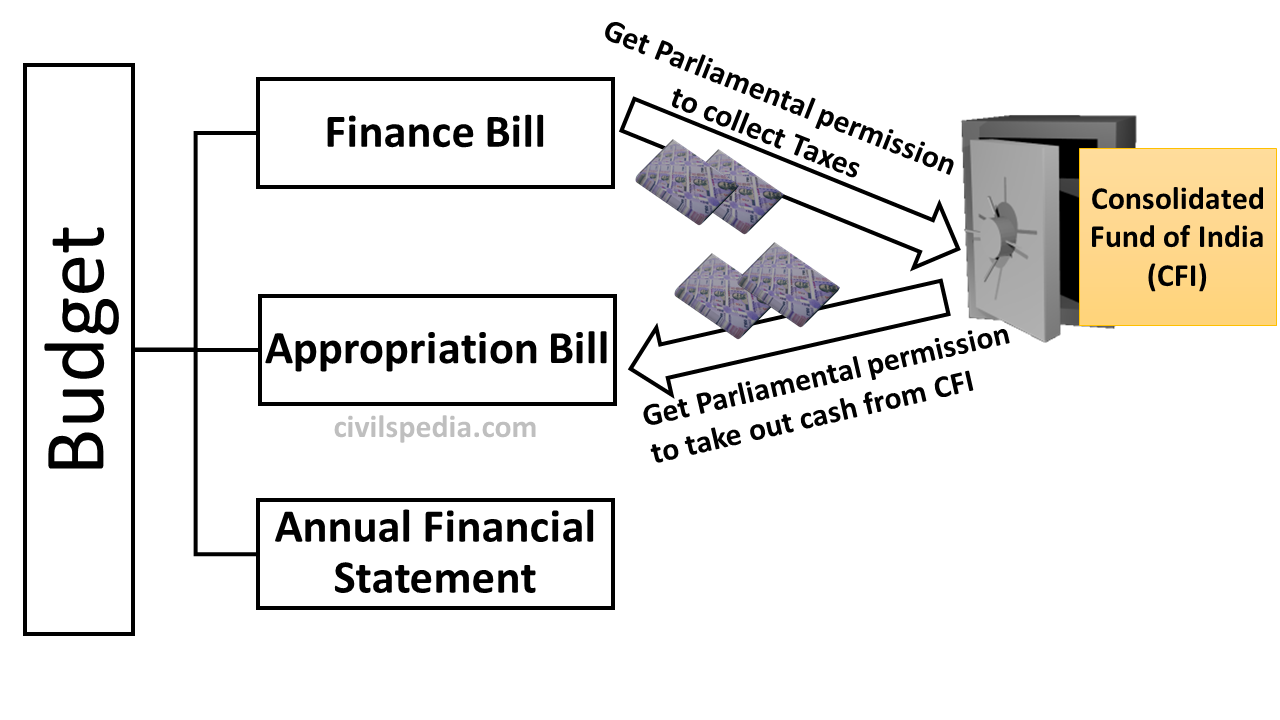

To comply with these provisions, Finance Minister presents three things in the Parliament every year, collectively known as the budget.

1. Finance bill

- Constitutional Provision under Article 265 says that ‘Without Parliament’s permission, Government can’t collect taxes.’ Hence, Finance Bill is introduced in the Parliament to get permission to collect taxes.

- All the money collected through taxes goes to the Consolidated Fund of India.

2. Appropriation Bill

- Constitutional Provision under Article 114 says that ‘to take out the cash from the Consolidated Fund of India, Government needs the Parliament’s approval.’ Hence, Appropriation Bill is introduced in Parliament to get that permission.

- Appropriation Bill has two types of Demands for expenditure.

- Demands on Grant: They are to be discussed and voted on. E.g., cash required for various schemes

- Expenditures ‘charged’ upon the Consolidated Fund of India. These expenditures can be discussed but are non-votable & get approved automatically. E.g., Salary of Supreme Court Judges, Pension of Supreme Court and High Court Judges etc.

3. Annual Financial Statement

- Article 112 states that President should lay the Annual Financial Statement in Parliament each Financial Year.

- The Annual Financial Statement is introduced in the Parliament to show data about incoming and outgoing money.

- There isn’t any specific format mentioned in the constitution except that Annual Financial Statement should show Revenue Expenditure separately from other Expenditure.

Budget speech + Economic Survey of India

- Finance Minister also releases Economic Survey and gives a Budgetary speech in Parliament. But there isn’t any constitutional obligation to present these things.

Note: Finance Bill and Appropriation Bill are Money Bills under Article 110 of the Constitution. Rajya Sabha has very little power wrt Money Bill, and they can delay it for 14 days. Rajya Sabha can only suggest an amendment to Money Bill, which Lok Sabha may or may not accept.

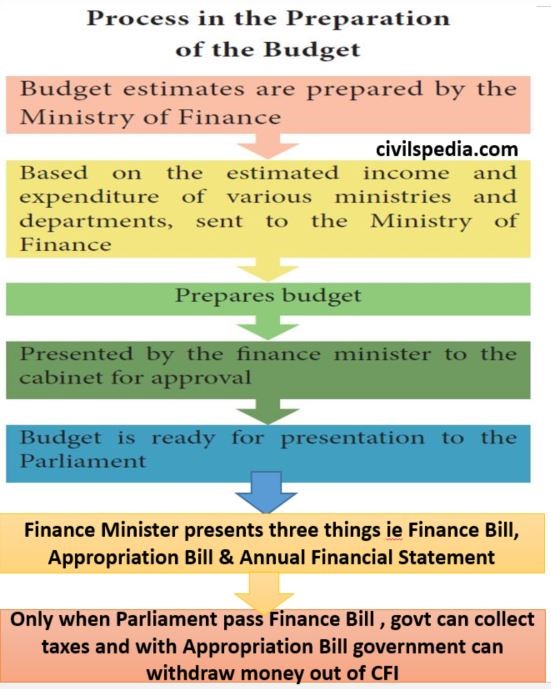

Side Topic: Budgetary Process

Side Topic: Changing Styles of keeping Budget Papers

- Traditionally, Finance Ministers kept budget papers in a leather suitcase.

- In 2019, FM Nirmala Sitaraman changed the tradition and kept the documents in red coloured cloth called ‘Bahi Khata‘.

- In 2022, the finance minister used red velvet cloth over the “digital tablet” to present the digital budget.

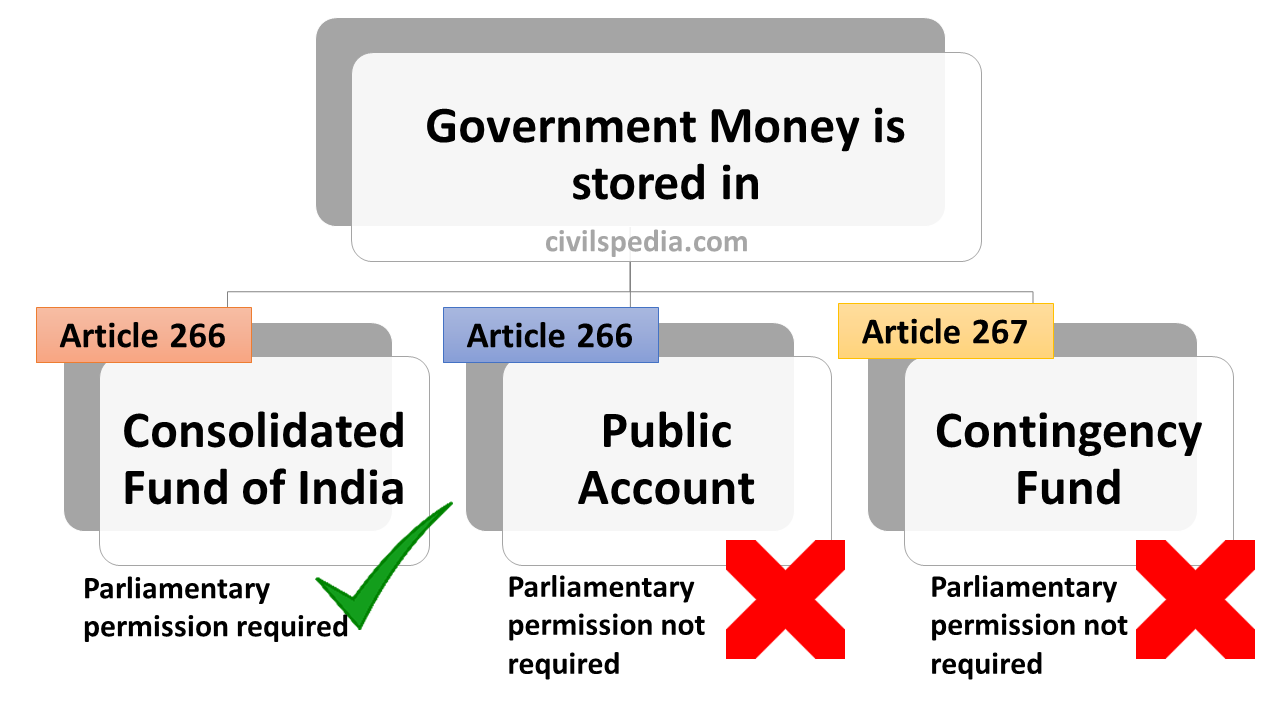

Type of Funds of Government

Whatever money government gets (through taxes or any other source) is stored in three places.

1. Consolidated Fund of India

Consolidated Fund is the largest of the three funds & Parliament’s approval is needed to spend money from this fund. It includes the following:-

- All the cash from direct & indirect taxes

- All loans taken by the Government of India

- Whenever someone returns the principal/interest of loans of the Government of India

- All cash received in Surcharge

2. Public Account

- Public Account includes the temporary money which came from somewhere & going to be spent somewhere else. In this government acts as Banker.

- It is made up of :-

- Bank savings account of the departments/ministries (for day-to-day transactions)

- National Investment fund (made up of the money earned from disinvestment)

- Natural Disaster Response Fund (NDRF)

- National Small Savings Fund

- Prarambhik Shiksha Kosh

- MNREGA fund

- Provident fund

- Postal insurance etc.

- The government doesn’t need the authorisation of Parliament to spend money from this account.

3. Contingency Fund

- The President of India holds it.

- President can spend cash from this fund to deal with emergency/unforeseen circumstances.

- It has a corpus of ₹ 500 Crore.

- President doesn’t need the Parliament’s authorisation to spend money from this account.

Financial Year of India & should it be changed?

The financial year in India begins on 1st April and ends on 31st March.

Timeline

| 1867 | Britishers introduced this system. Hence, it is a colonial legacy. |

| 1950 | Indian constitution doesn’t define the financial year. The only condition is that the President will lay an Annual Financial Statement each Financial Year. |

| 2016-17 | Viral Acharya Committee was formed to determine whether we should change the financial year or not. It was in favour of changing the financial year. |

| 2017 | Not all states favoured changing Financial Year as it was difficult to change their accounting practices and software involved in this process. |

So, should it be changed?

It is a debatable issue, and arguments are present on both ends of the spectrum.

Government should change it due to following reasons:-

- Many committees and Commissions have recommended that Financial Year starting from 1st April is not appropriate for India. These include

- Chamberlin Commission of 1913

- Sir Dinshaw Wacha Committee, 1921

- 1st ARC, 1966

- C Rangarajan Committee, 2011 (Planning Commission)

- Shankar Acharya Committee (formed in 2016 by Modi Government)

- Agricultural Economy demands this change: In India, rain happens in June-July-August, and the economy depends upon the quantity of rain (since 49% population depends on agriculture). In case of insufficient rainfall, the government’s revenue can decrease, and expenditure can increase (because MNREGA demand will increase). But the government can’t change budgetary allocations because the Budget is made just before the monsoon.

- Other Countries such as Austria, Brazil, China, Germany, Netherlands, Russia, and most MNCs start their financial year on 1st January. Hence, it will help in ease of doing business.

- It is a Colonial Legacy and doesn’t have any cultural and psychological connection with India.

Government shouldn’t change it due to the following arguments:-

- All laws will need to be amended, which will divert the workforce’s attention. When the global and Indian economy is passing through tumultuous times, this adventurism is uncalled for.

- The system is working fine. As the famous adage goes, ‘don’t fix what isn’t broken’; the government should refrain from interfering with this.

Conclusion: Changing Financial Year is worth consideration, but it should be accomplished gradually.

Side Topic: Data in Budget

Three types of data are mentioned in the Budget, i.e. Actual Data, Provisional Data and Budgetary Data.

Actual Data

Of the preceding year, i.e. one year before the year in which the budget is presented

- Budget for the year: 2023-24

- Actual Data: 2021-22

Because actual data comes after a lag of one year.

Provisional Data (PD)

Of passed year

- Budget for the year: 2023-24

- Provisional Data: 2022-23

Budgetary Estimates (BE)

For the following year of which the budget is presented

- Budget for the year: 2023-24

- Budgetary Estimate: 2023-24

Interim Budget

- It is an ‘unwritten convention’ that the ruling government shouldn’t initiate any significant policy change or scheme when a general election is nearby. It can unduly influence voters’ voting behaviour favouring the party in power.

- Hence, the government introduces a very slim version of the budget in an election year, and such a budget is known as the Interim Budget.

- Interim budgets were introduced in 2004, 2009, 2014 and 2019, i.e. election years.

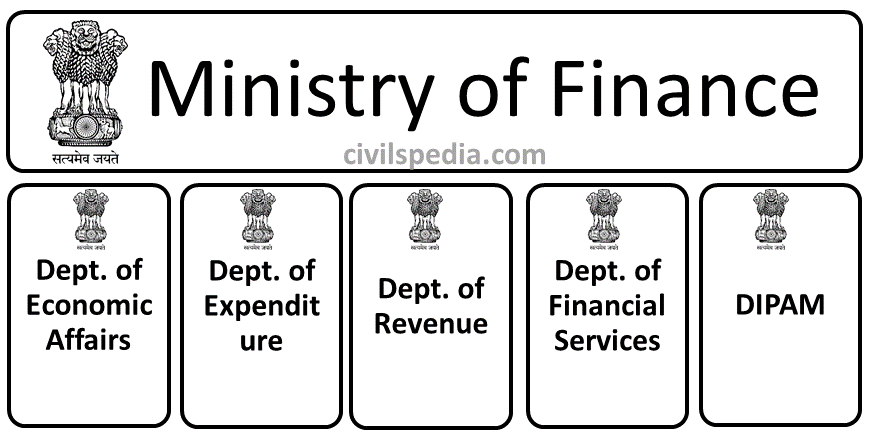

Ministry of Finance & its 5 Departments

The primary ministry involved with the work of preparing and introducing the Budget is the Ministry of Finance. Hence, we should have a look at the structure and main functions of each department.

1. Department of Economic Affairs (DEA)

- It looks after the preparation of the budget & economic survey.

2. Department of Expenditure

- It prepares an estimate of how much amount is to be spent by different departments.

3. Department of Revenue

- It looks after the collection of revenue, like direct and indirect taxes.

4. Department of Financial Services

- It looks after Public Sector Banks and their recapitalisation, Regional Rural Banks, etc., and financial sector regulators like IRDA, PFRDA etc.

5. Department of Investment & Public Asset Management (DIPAM)

- It looks after the disinvestment of Public Sector Enterprises as well as the management of their assets.