Last Updated: May 2023 (Deficit Financing)

Table of Contents

Deficit Financing (2023)

This article deals with ‘Deficit Financing .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Deficits and FRBM Act

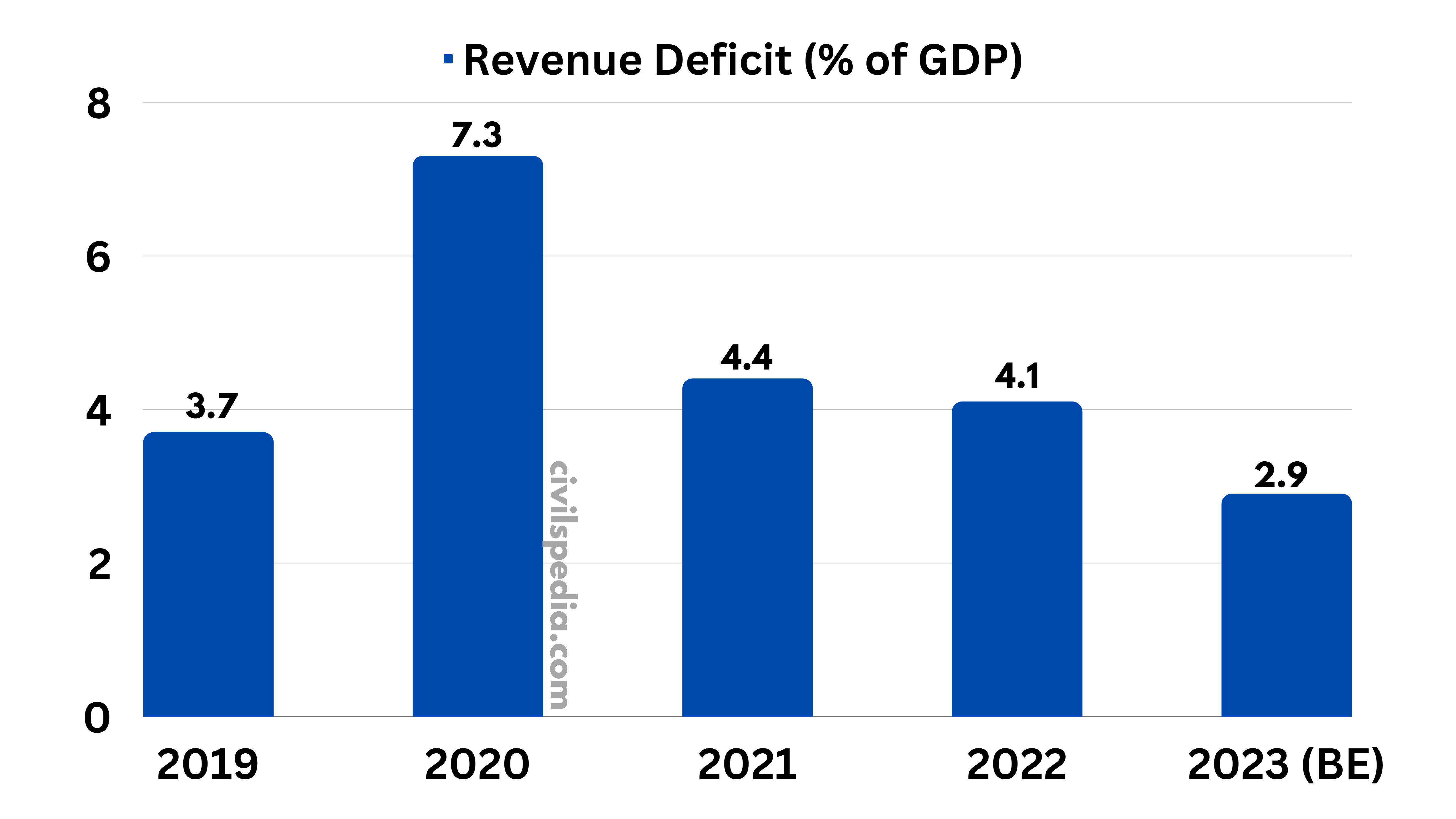

Revenue Deficit

- It is the amount by which revenue expenditure exceeds revenue deficit.

- It is generally given as a percentage of GDP.

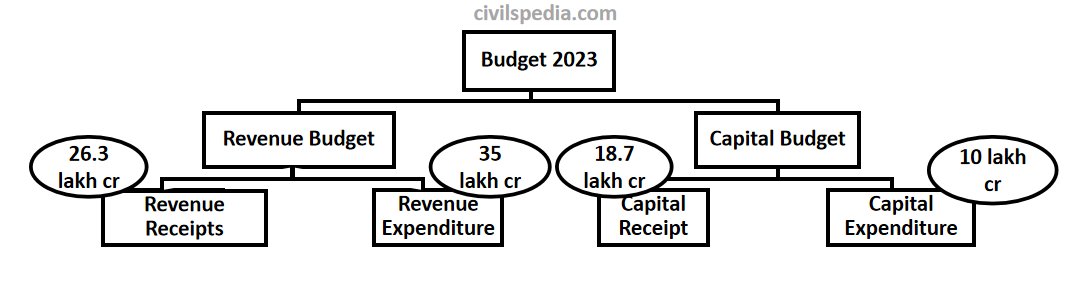

Budget 2023 Revenue Deficit

- For 2023, the Revenue Deficit target is 2.9% of GDP.

- In absolute terms, the Revenue Deficit of the Indian Budget is ~Rs. 9 Lakh crore.

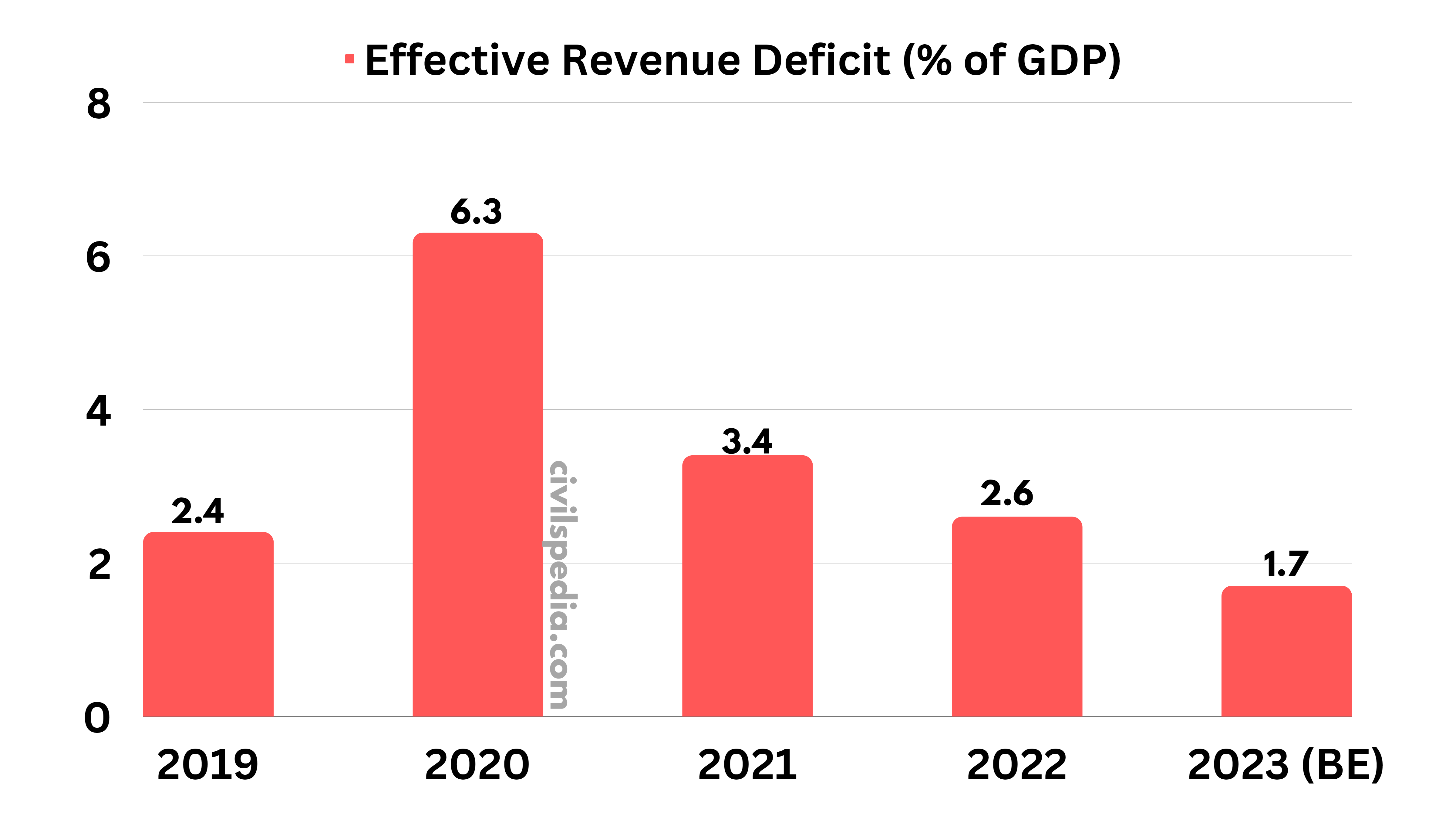

Effective Revenue Deficit

- Some of the grants given by the Union to the State governments are used to build assets. Hence, those grants should not be counted in the calculation of Revenue Deficit. Using this argument, the UPA government introduced the concept of Effective Revenue Deficit.

- Effective Revenue Deficit = Revenue Deficit MINUS Grants used for asset generation.

- For 2023, the Effective Revenue Deficit target is 1.7% of GDP.

Budget Deficit

- The budget deficit is the difference between receipts and expenditure (both revenue and capital) (Always Zero)

- = Total expenditure MINUS total receipts

- = (Revenue expenditure + Capital Expenditure) MINUS (Revenue receipt + Capital receipt)

- But it is zero because the government is borrowing the money.

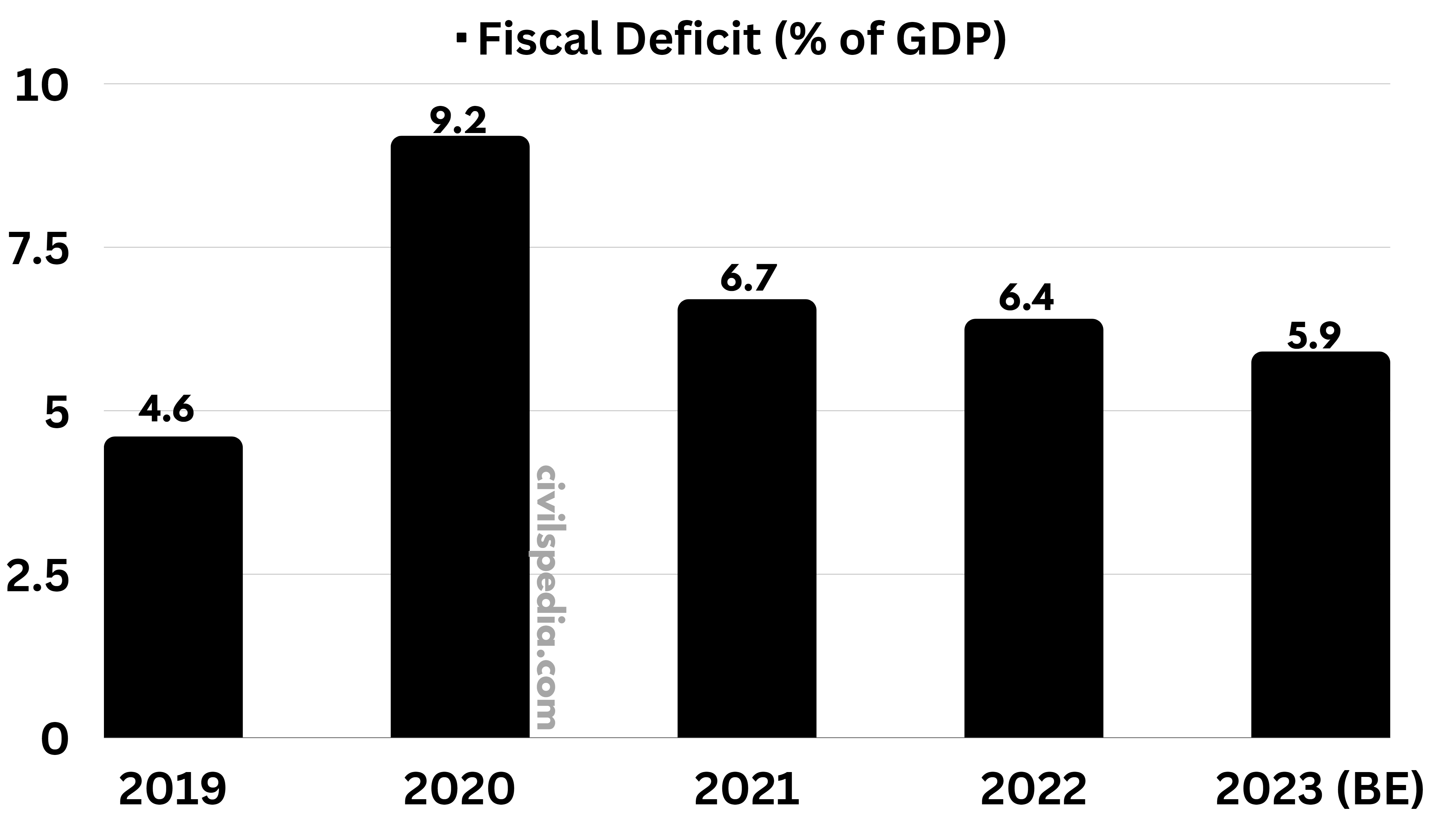

Fiscal Deficit

- Since the budgetary deficit is ZERO, it doesn’t show us the actual status of the government’s financial “health”.

- Therefore, in the late 90s, Sukhmoy Chakravarti Committee recommended a new type of deficit, called Fiscal deficit

- Fiscal deficits are the borrowings (external and internal) that the government is doing to make Budget Deficit zero

Fiscal Deficit = Government Borrowing

- Target for 2023 = 5.9% of GDP (~Rs 17.8 lakh crore in absolute terms).

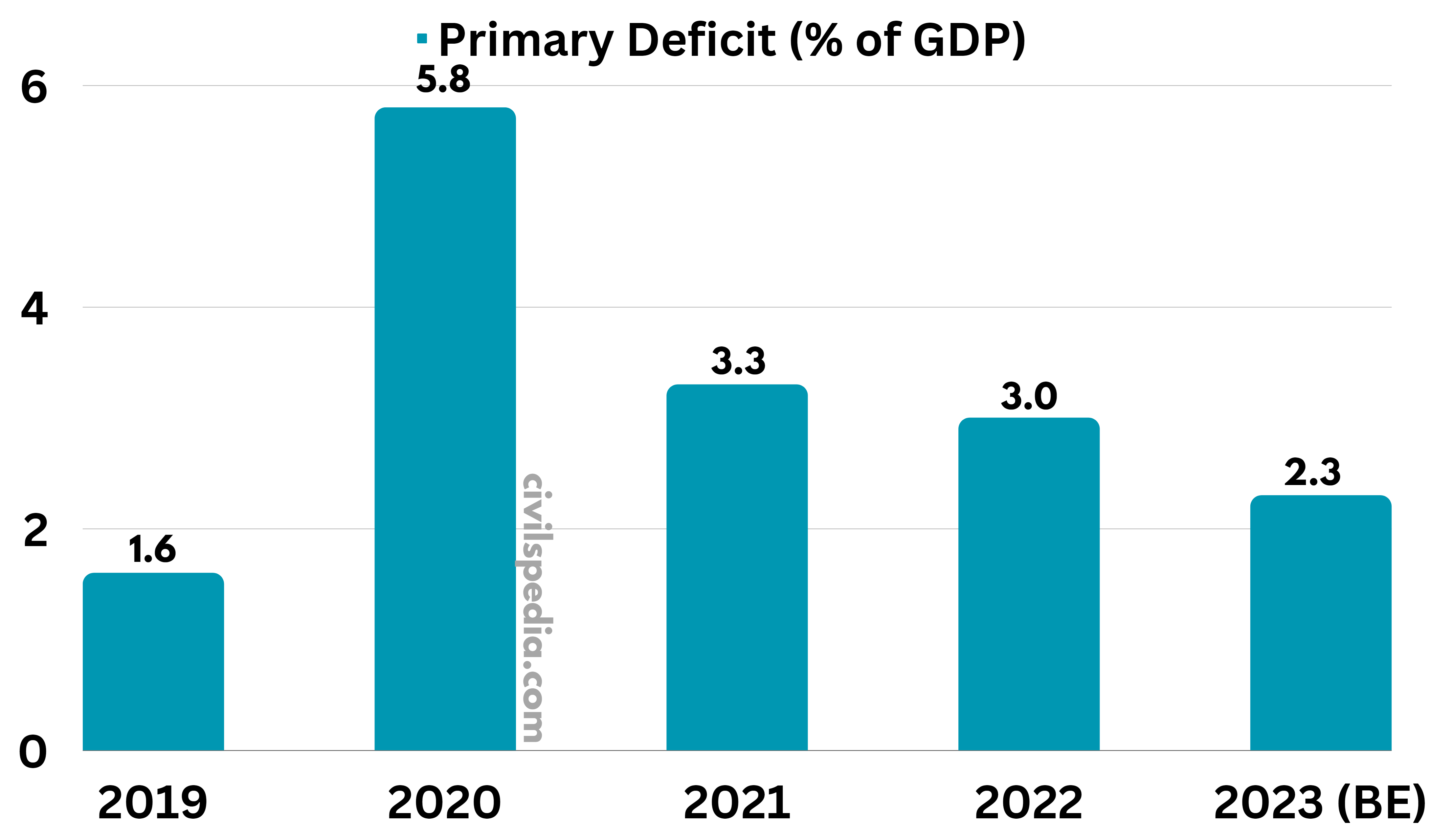

Primary Deficit

- If we subtract the amount paid as interest payment on old loans from the Fiscal Deficit, we get Primary Deficit.

- Thus, the primary deficit reflects the borrowing requirement of the government exclusive of interest payments.

- Manmohan Singh mentioned it for the first time in the 1993 Budget.

- Budget 2023: 2.3% of GDP.

Deficit Financing

Introduction

- The act/process of financing a deficit budget by a government

- In this, the government knows well in advance that total expenditure would be more than total receipts & hence enacts such policies to sustain the burden of deficits.

- The first to use this was the USA in the 1930s to combat the Great Depression of 1930. In the 1960s, this idea became well known in the world.

- India tried her hand in deficit financing in 1969 & since the 1970s, it has been a common phenomenon. But the levels of fiscal deficit reached unsustainable levels & its composition was also unjustifiable, not based on sound fundamentals of economics.

Means of Deficit Financing

Means are given below in order of their preference

1. External aids

- These are the best money to fulfil a government’s deficit requirements, even if it comes with soft interest.

- If it is coming without interest, nothing would be better than that.

2. External Borrowings

Although considered as erosion of nations sovereignty but are better than internal borrowings because of two reasons

- External borrowings bring hard currency, which has an extra edge in spending.

- It doesn’t cause a crowd-out effect & other sectors can use saving.

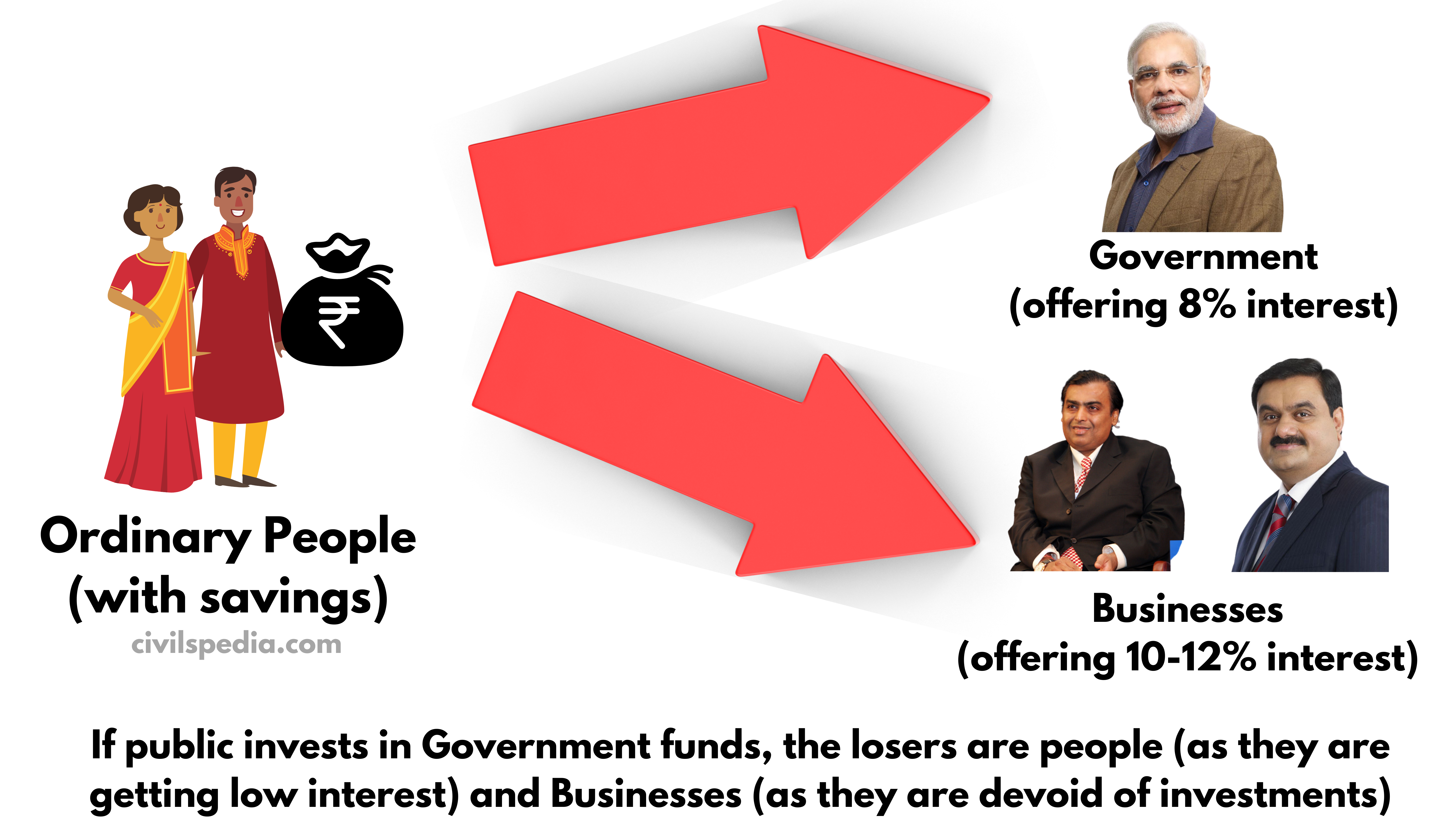

3. Internal borrowings

- Going through this route hampers investment prospects of the public & corporate sector (leads to Financial Repression).

- The economy moves either towards stagnation or slowdown.

- It happened in India in the 1960s, 70s, 80s.

4. Printing Currency

- It is the last resort.

- It has significant damaging effects on the economy.

- It increases inflation proportionally because of more money in the market without a proportional increase in goods.

- It brings steady pressure & obligation on government for an upward revision in wages & salaries of employees. Hence, government expenditure increased, leading to further printing & vicious circle continues.

India & Deficit Financing

- Keynes advocated the idea of the fiscal deficit, but it has catch in it & third world countries overlooked that. The catch is related to why the economy should go for this & what should be the composition of the fiscal deficit.

- The best composition is a fiscal deficit with the revenue surplus budget or zero revenue deficit budget.

- Deficit requirements of lower revenue expenditure & higher capital expenditure is the second-best option provided revenue deficit is eliminated soon.

- The last situation could be a major part of deficit financing is going for revenue expenditure.

- India & other third world economies had gone for the third option & it proved dangerous for them.

Why Fiscal Deficit is bad for the health of the Economy?

- Sovereign rating downgrade: Credit rating companies can downgrade country ratings in case of higher fiscal deficits. It affects investor confidence.

- Crowding out / Financial repression: Government forces Public Sector Banks to purchase more Government Securities (G-Secs), reducing the capital available to the private sector. It raises the borrowing cost for private enterprise.

- Intergenerational parity: It hurts the future generations as they will have to pay increased taxes to settle the government debt.

- Inflation: Too much government debt can lead to inflation and reduce real interest rates.

- Exchange rate risk: Poor credit rating pushes the exchange rate down, increasing foreign borrowing and making imports expensive.

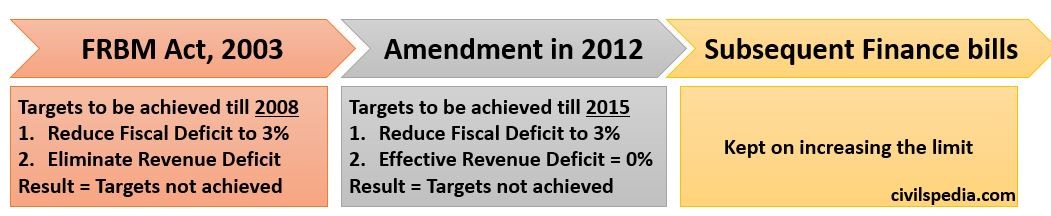

Fiscal Responsibility and Budget Management (FRBM) Act, 2003

- The key trigger of the default in 1991 was irrational public spending by borrowing money in the late-1980s. FRBM law (2003) was aimed at limiting the government’s borrowing under Article 268 of the Indian Constitution.

- Targets under the FRBM Act

- Under the original act, the Fiscal Deficit was to be reduced to 3% of GDP (for Union), and 3% of GSDP (for States) and Revenue Deficit was to be eliminated, i.e. reduced to 0 till 2008.

- The act was amended in 2012, and the new target was changed to 0% Effective Revenue Deficit and 3% Fiscal Deficit till 2015.

- The deadlines to achieve the targets were extended further in subsequent Finance Bills.

2018 Amendment to FRBM Act

- These amendments are based on NK Singh Committee Report.

- New Targets to be achieved till 2024-25 budget under FRBM Act are

- Public debt has been made the main anchor, and the Centre’s Debt to GDP ratio should be brought down to 40%, and the overall (Centre+ States) ratio should be brought down to 60%.

- Fiscal Deficit should be brought down to 3%.

- Primary Deficit should be brought down to 0%

- Revenue Deficit and Effective Revenue Deficit will not be used as main anchors in the FRBM Act.

- Escape Clause has been introduced, i.e. during the war, national calamity, collapse of agricultural output, fall in GDP growth rate or structural reforms in the economy, the government can cross fiscal deficit target by 0.5% of GDP.

Side Topic: Counter-Cyclical Fiscal Policy

It simply means that when the economy is passing through a slowdown, the government should spend more, even by increasing the fiscal deficit, to revive the economy. On the contrary, when the economy is booming, the government should let the private sector lead the spending.