Last Updated: Feb 2023

Table of Contents

Monetary Policy

This article deals with ‘Monetary Policy .’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Demand – Supply Theory

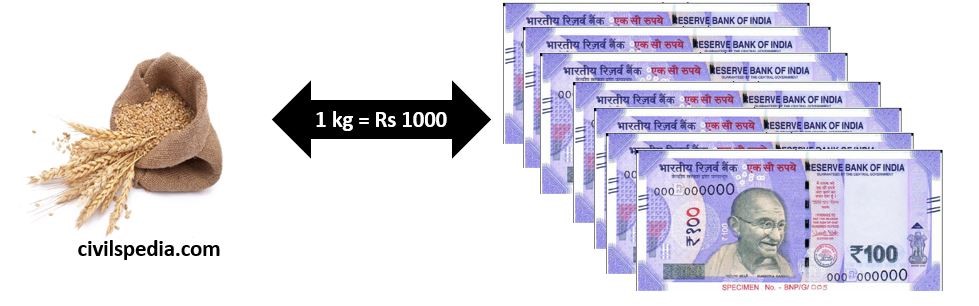

Suppose, at a particular time, equilibrium is reached for the price of any product, say wheat.

Now, the government decides to print a lot of Currency and distribute it to the public as an election gimmick to win elections. Will this practice end poverty in India? The answer is negative because although the money supply has increased, the number of goods in the economy hasn’t increased in the same proportion. It will lead to inflation as too much money is chasing a few goods. The wheat that was sold at Rs 100 will now sell at Rs 1000 (hypothetical amounts).

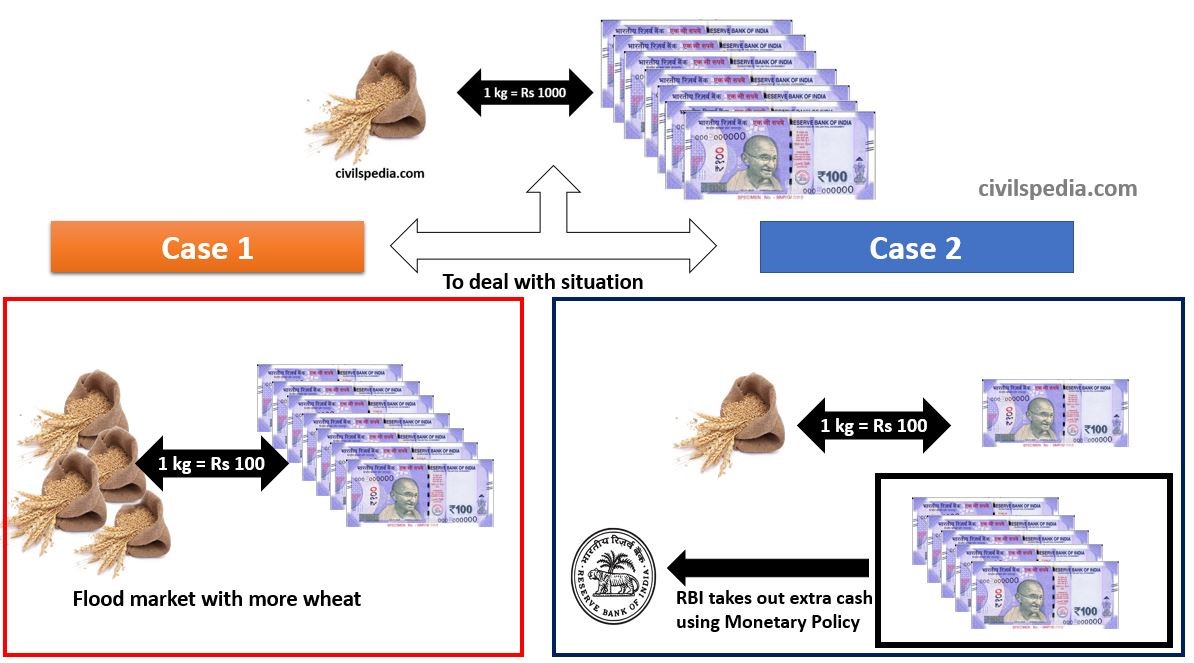

If we want to cope with this situation, there are two ways

- Either increase the supply of wheat (can be done by the government by asking FCI to overflow the market with wheat) or

- Reduce the supply of money (can be done by RBI via Monetary Policy)

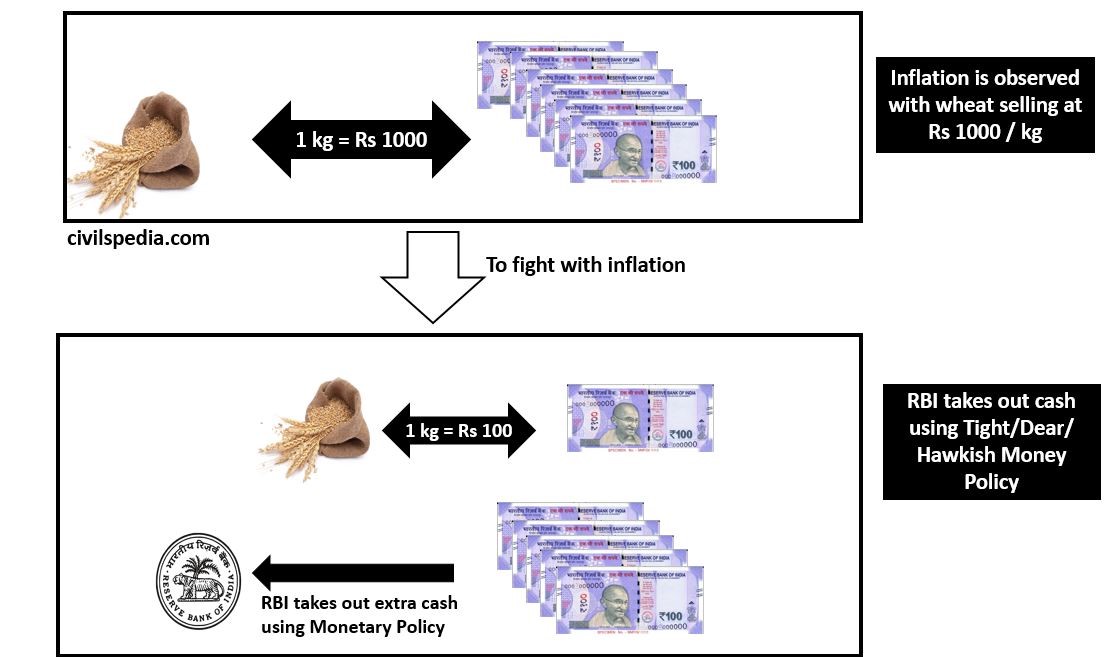

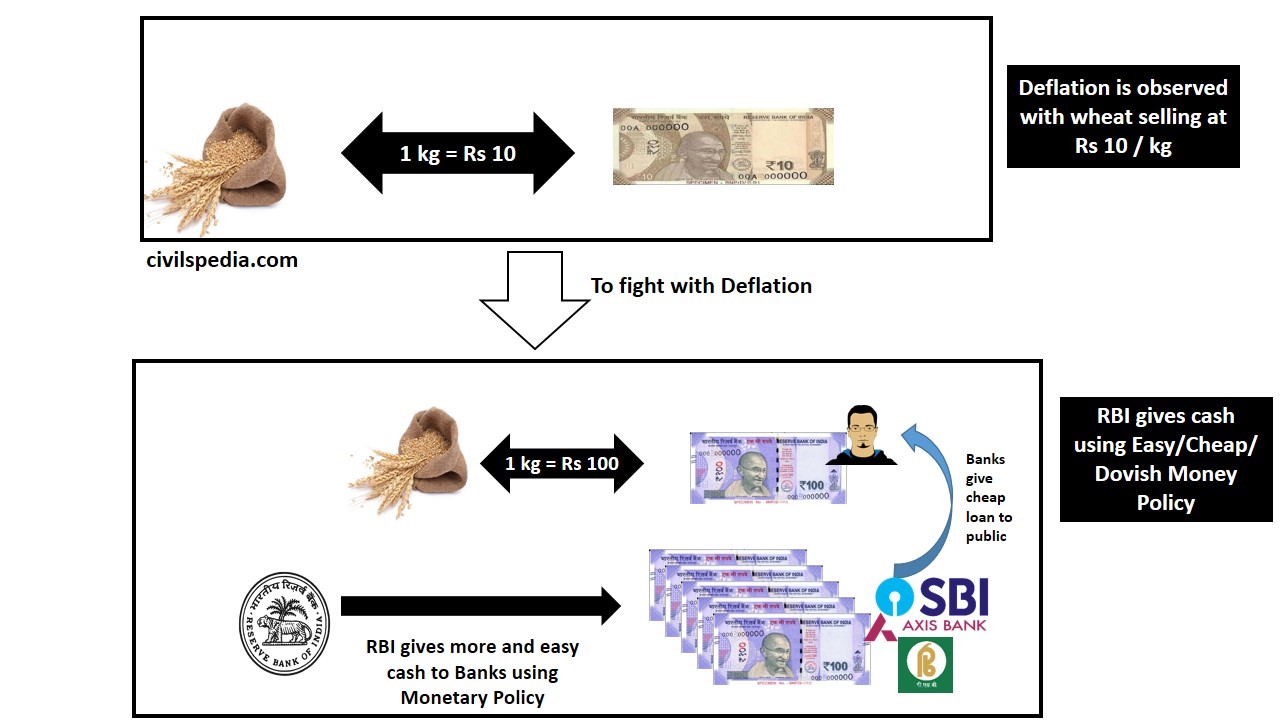

What can RBI do to control inflation or deflation?

| Combat Inflation | Combat Deflation |

| Reduce consumption by making the loans expensive. | Encourage consumption by making loans cheaper. |

| For this, RBI should decrease the money supply. | For this, RBI should increase the money supply. |

| RBI should follow – TIGHT MONEY POLICY – DEAR MONEY POLICY – HAWKISH MONEY POLICY | RBI should follow – EASY MONEY POLICY – CHEAP MONEY POLICY – DOVISH MONEY POLICY |

Combating Inflation

Combating Deflation

What is Monetary Policy?

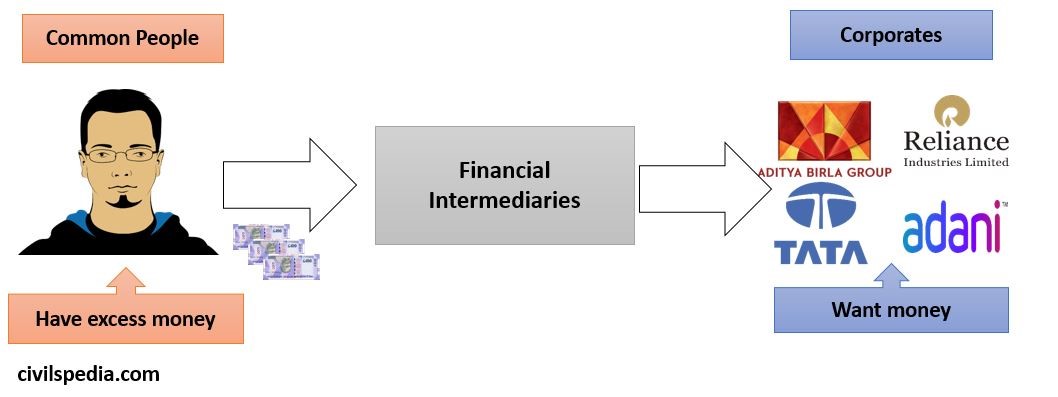

In any economy, there are the following actors

- The Central Bank of the nation formulates monetary policy to control the money supply in the economy.

- Objectives of monetary policy can be (depending on the economy)

- Control inflation

- Accelerating the growth of the economy

- Exchange rate stabilization

- Balance savings & investments

- Generating employment

Monetary policy can be

1. Expansionary

- Expansionary Monetary Policy increases the total money supply in an economy.

- E.g.

- In 2008, all countries, including India, used this to beat the recession.

- During the Covid crisis, all the countries, including India, used this to spur the demand in the economies.

- Traditionally Expansionary Monetary Policy is used to combat unemployment in a recession by lowering the interest rate.

2. Contractionary

- Contractionary Monetary Policy decreases the total money supply in the economy.

- E.g.

- 2010 onwards, India & many other countries used it.

- Post Covid Crisis, almost all the countries, including India, used it to remove excess liquidity from the economy.

- Traditionally Contractionary Monetary Policy is used to combat inflation in the economy.

When is the Monetary policy announced in India?

1. Till 1988-89

It was announced twice a year according to agricultural cycles

| Slack season policy | April -September |

| Busy season policy | October -March |

2. After 1989

- Since the economy became more dynamic, RBI reserved its right to alter it from time to time, depending upon the state of the economy.

- Additionally, the share of credit toward industry has increased, which was earlier dominated by agriculture. So aligning the Monetary Policy with agriculture doesn’t make sense.

- The major policy was announced in April & reviews took place every quarter. But within a quarter at any time, RBI could make any major change in policy depending upon the need.

3. Now

- Changes can be made at any time when RBI feels but announced necessarily after two months.

Tools used by RBI for Monetary Policy

RBI implements it using two tools

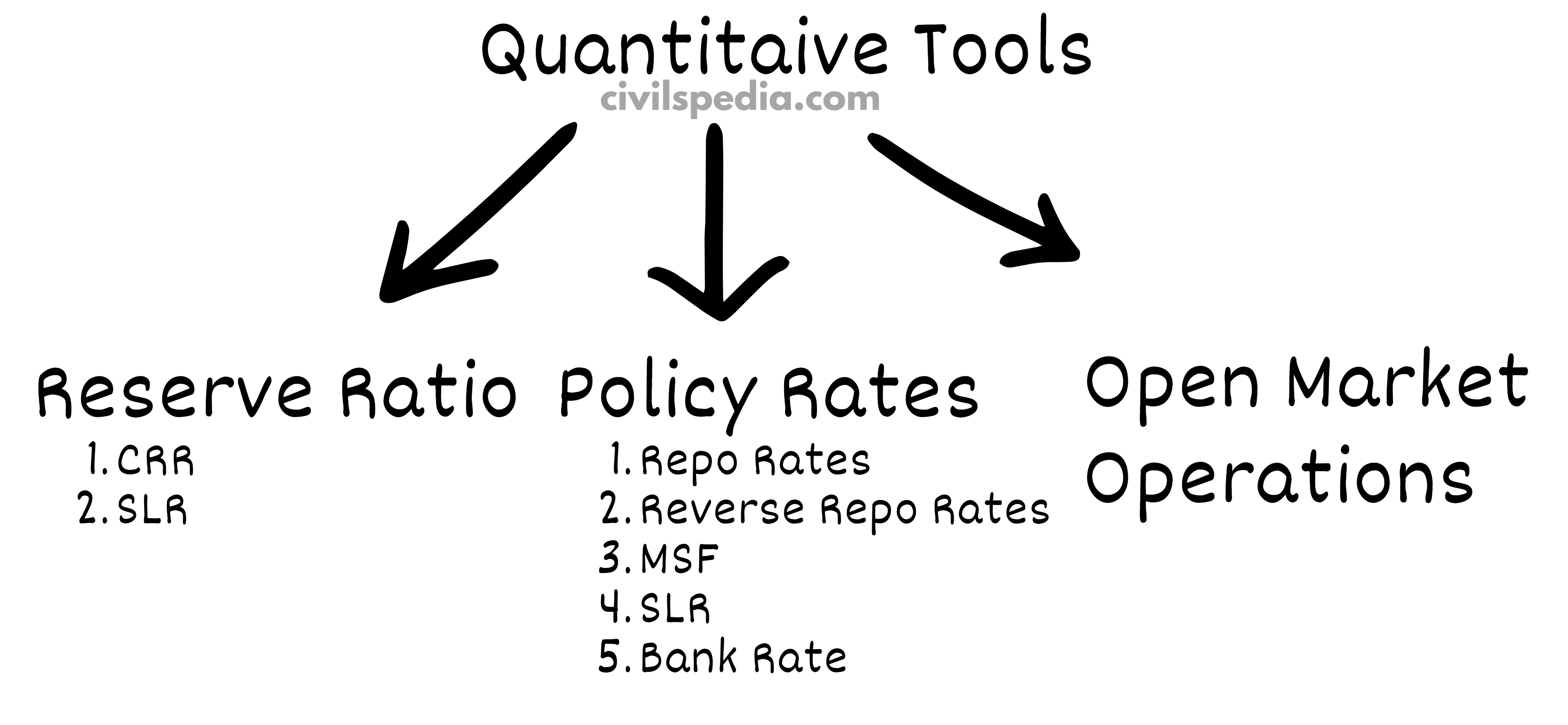

a. Quantitative /Indirect/General Tools

- Reserve Ratios (CRR, SLR)

- OMO (Open Market Operation)

- Rates (Repo, Reverse Repo, Bank Rate, Standing Deposit Facility, Marginal Standing Facility etc.)

b. Qualitative /Selective/Direct Tools

- Margin / Loan-to-Value Ratio

- Consumer Credit Control

- Rationing

- Moral suasion

- Direct Action

We will discuss all this in detail.

Quantitative tools

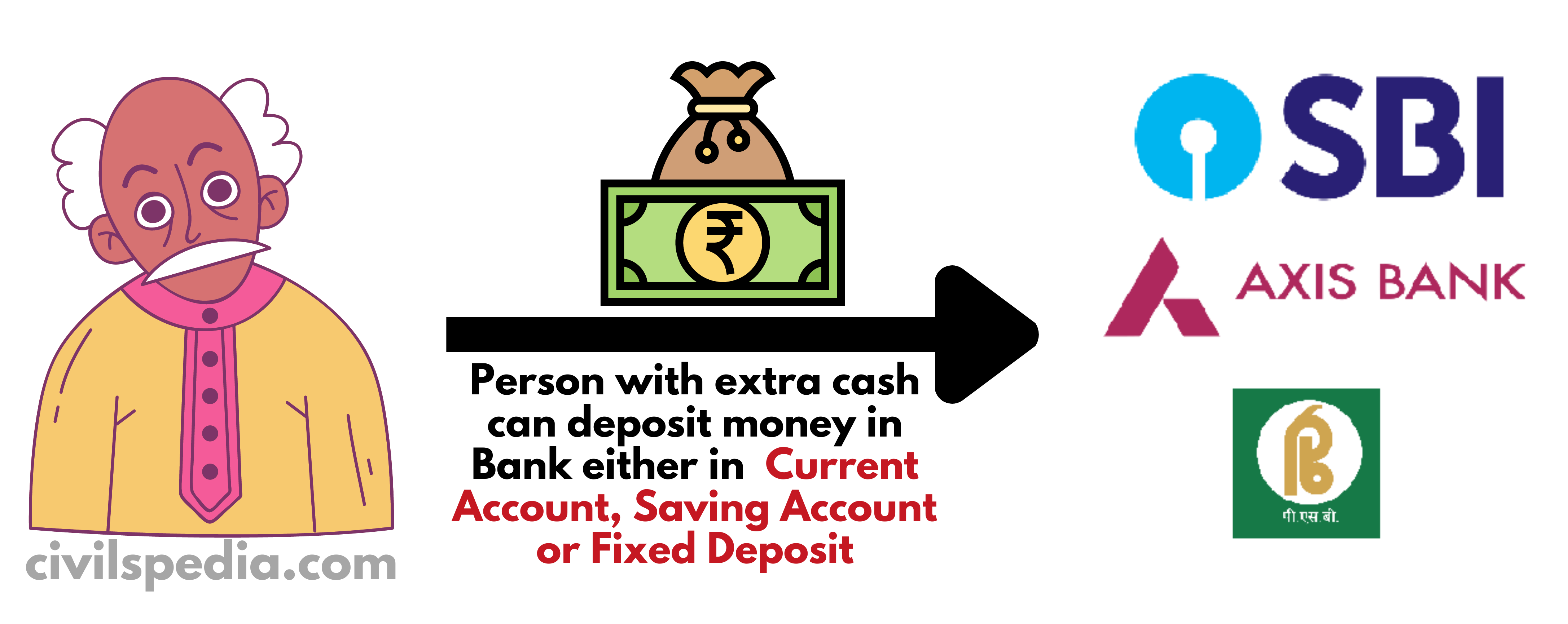

Side Topic: Net Demand & Time Liabilities (NDTL)

Before proceeding further, we will look into the concept of Net Demand & Time Liabilities(NDTL)

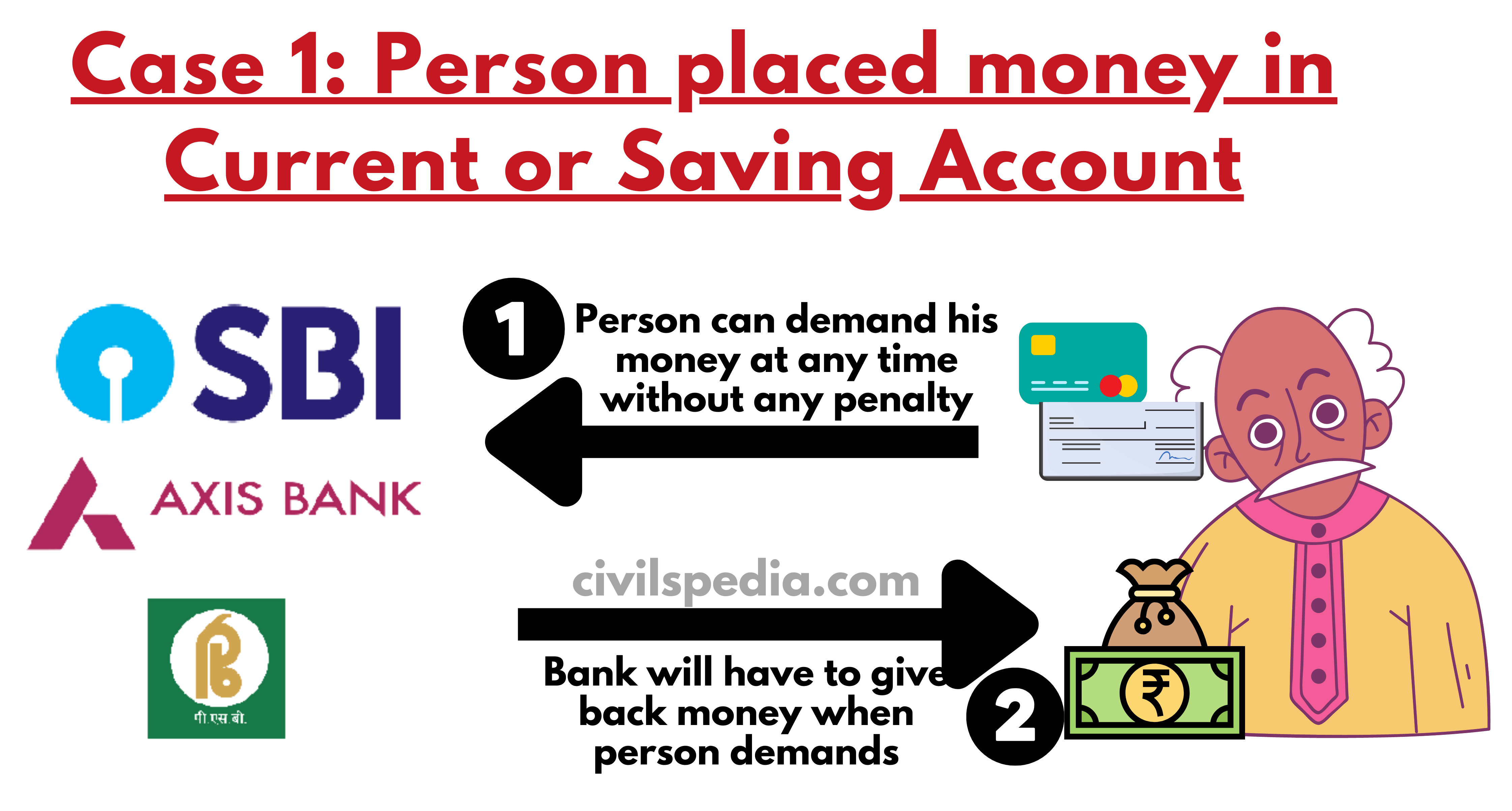

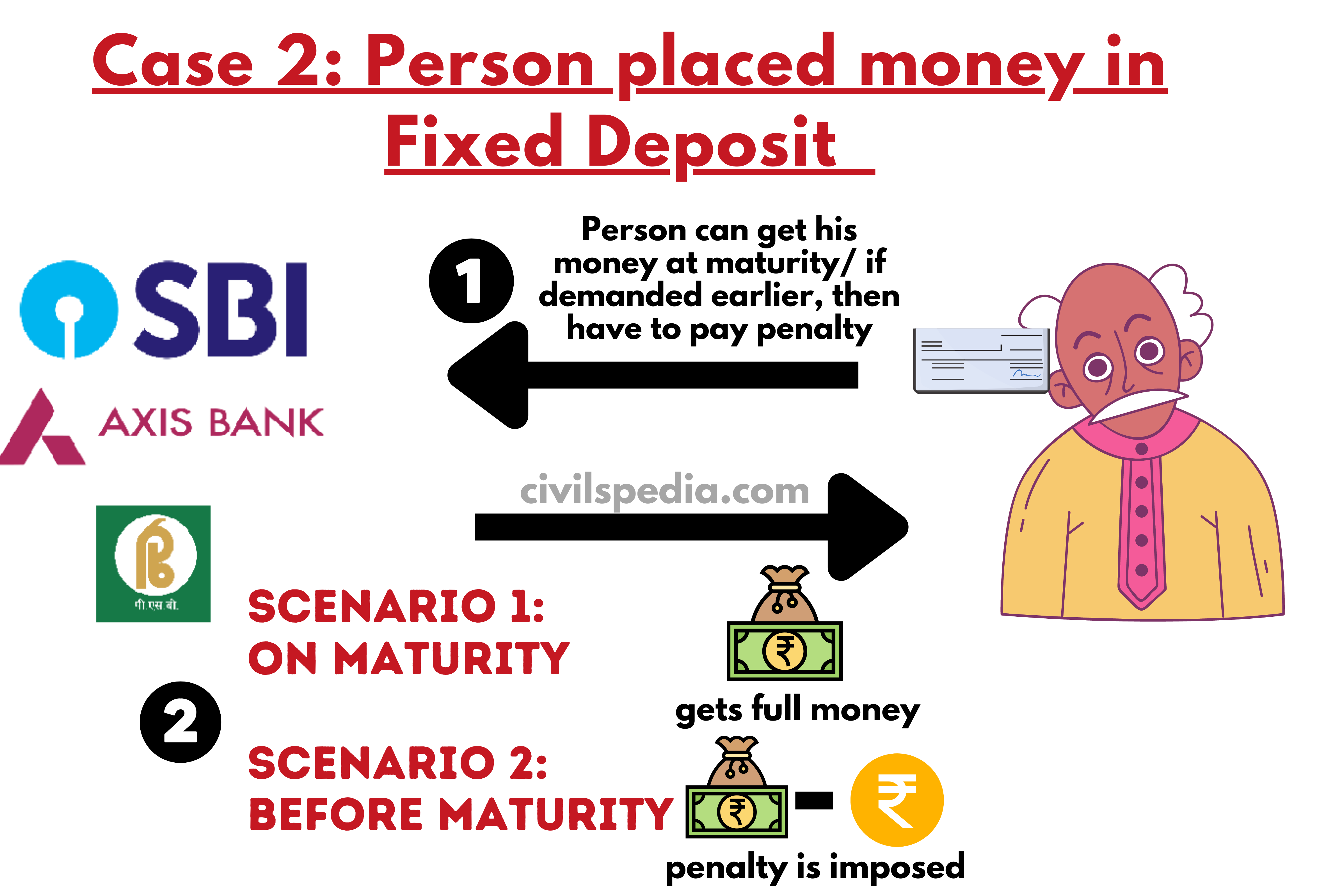

| Demand Liabilities | Time Liabilities |

| Demand liabilities are those liabilities on the banks which depositors can demand at any time. | Time Liabilities are those which mature after some time. If withdrawn before that, then some penalty is charged. |

| Demand Liabilities are more liquid as the depositor can easily convert them into cash without penalty. | Relatively less liquid as a person will have to pay the penalty if withdrawn before the maturity. |

| Consist of money deposited in Current Account & Saving Account | Consist of money deposited in 1. Fixed deposits 2. Recurring Deposits 3. Cash Certificate 4. Staff security deposit |

| Banks pay less interest on demand liabilities. | Banks pay more interest on demand liabilities. (= people tend to place money here because of more interest) |

The sum of both Demand & Time Liabilities is known as Net Demand & Time Liabilities.

1. Reserve Ratios

1.1 Cash Reserve Ratio (CRR)

- CRR is the percentage of public deposits (Net Demand and Time Liabilities (NDTL)) that banks have to keep with the RBI in cash at any point in time. Usually, RBI doesn’t give any interest in this.

- CRR provisions apply to Scheduled Banks, Non-Scheduled Banks & Cooperative Banks.

- RBI get these powers to impose CRR from RBI Act.

- Present Rate (Feb 2023): 4.5% of Net Demand and Time Liabilities

1.2 Statutory Liquidity Ratio (SLR)

- SLR is the percentage of NDTL that banks must maintain with themselves in the form of specified liquid assets (like cash, gold & government securities, or RBI-approved securities) at any point in time.

- It is mandated under RBI Act.

- SLR applies to all Scheduled Banks, Non-Scheduled Banks, Cooperative Banks and NBFC deposit-taking. RBI can prescribe different levels for each.

- Although not used as Monetary Policy Tool, but if decreased, a large amount of capital is infused into the economy.

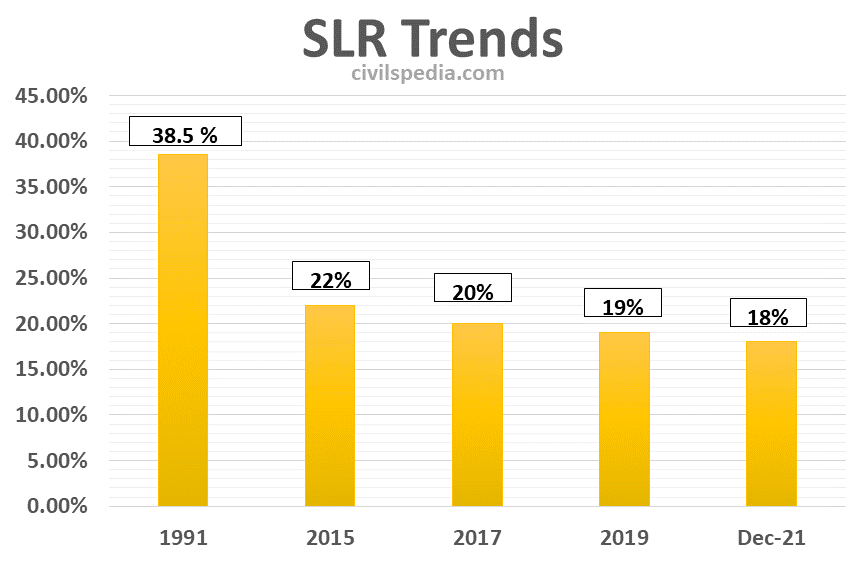

- Present Rate (Feb 2023): 18% of Net Demand and Time Liabilities

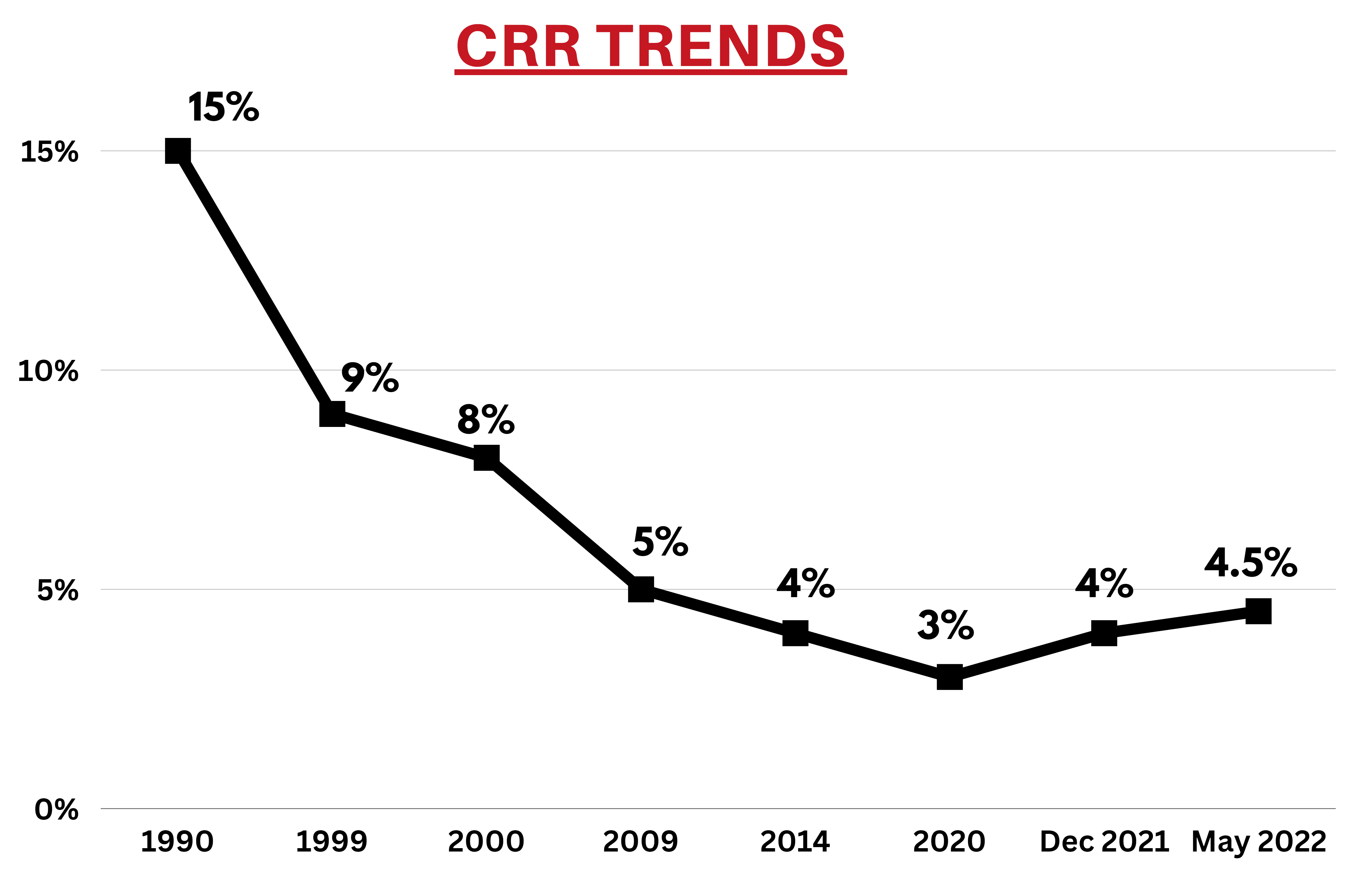

Trends of CRR and SLR

Note: Previously, CRR & SLR were very high (53% combined). As a result, banks had significantly less money to lend. It impacted the Indian Economy because the rate of loans was high, and businesses were not expanding. It was one of (the many) reasons for the 1990 Balance of Payment Crisis. Narasimhan Committee & other experts recommended reducing this. As a result, it was gradually reduced.

CRR Trends

The RBI’s move to hike the CRR by 50 bps resulted in a withdrawal of primary liquidity to the tune of ₹87,000 crore from the banking system.

SLR Trends

Use of CRR and SLR

CRR and SLR can be used to fight Inflation and Deflation

| Inflation Fight | Deflation Fight | |

| Method | Tight | Dear Policy | Easy | Cheap Policy |

| CRR, SLR | Increase | Decrease |

They also act as security in case of bank runs.

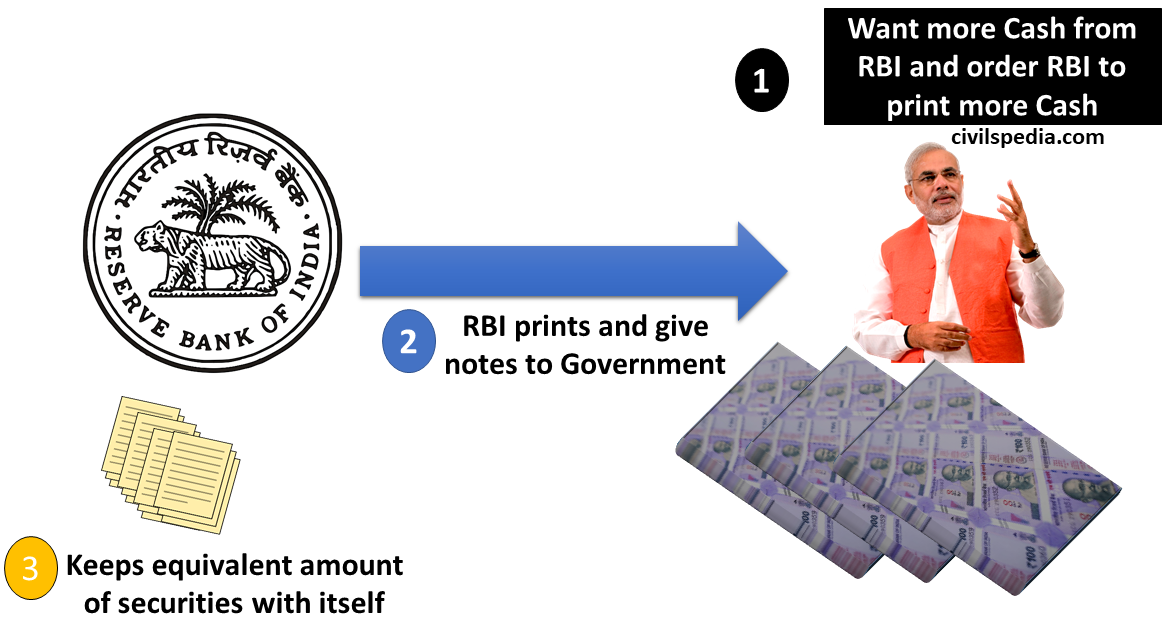

Side Topic: What are G-Secs?

- Concepts like Repo, Reverse Repo and Open Market Operations involve the concept of G-Secs (or Government Securities). Hence, we will first deal with the concept of G-Secs.

- When the Government wants extra money to fund its projects, it asks RBI to arrange it (as RBI is the Government’s Debt Manager). The Government gives the required cash to the Government and prints equivalent Government Securities (G-Secs).

- Government Security (G-Sec) is a tradeable instrument issued by RBI on behalf of the Central Government or the State Governments. It acknowledges the Government’s debt obligation. It promises that Government will pay interest of x% to the holder for y years and pay principal at the end of tenure.

- Now RBI can use these G-Secs for various operations. E.g. to absorb the excess liquidity from the market etc.

- In India, the Central Government can issue Treasury Bills (or T-Bills) and Dated Securities, while State Governments can only issue Dated Securities to raise funds.

Types of G-Secs

1. T- Bills

- T-bills are the short-term debt instruments issued by the Union Government. Presently, they are issued in three tenors, i.e., 91-day, 182-day and 364-days.

- They are zero-coupon securities, i.e. Government pays no interest. Instead, they are sold at a discount on face value and redeemed at face value.

2. Dated G-Secs

- Dated G-Secs have a fixed interest rate on the face value and a tenor ranging from 5 to 40 years.

2. Policy Rates/ Liquidity Adjustment Facility (LAF)

- Under LAF, Central Bank tends to reduce short-term liquidity fluctuations (money supply) in the economy through Repo and Reverse Repo transactions.

- The official policy rate in India is REPO RATE (i.e. RBI announces Repo Rate only).

- Repo & Reverse Repo operations can only be done in Mumbai & through securities as approved by RBI.

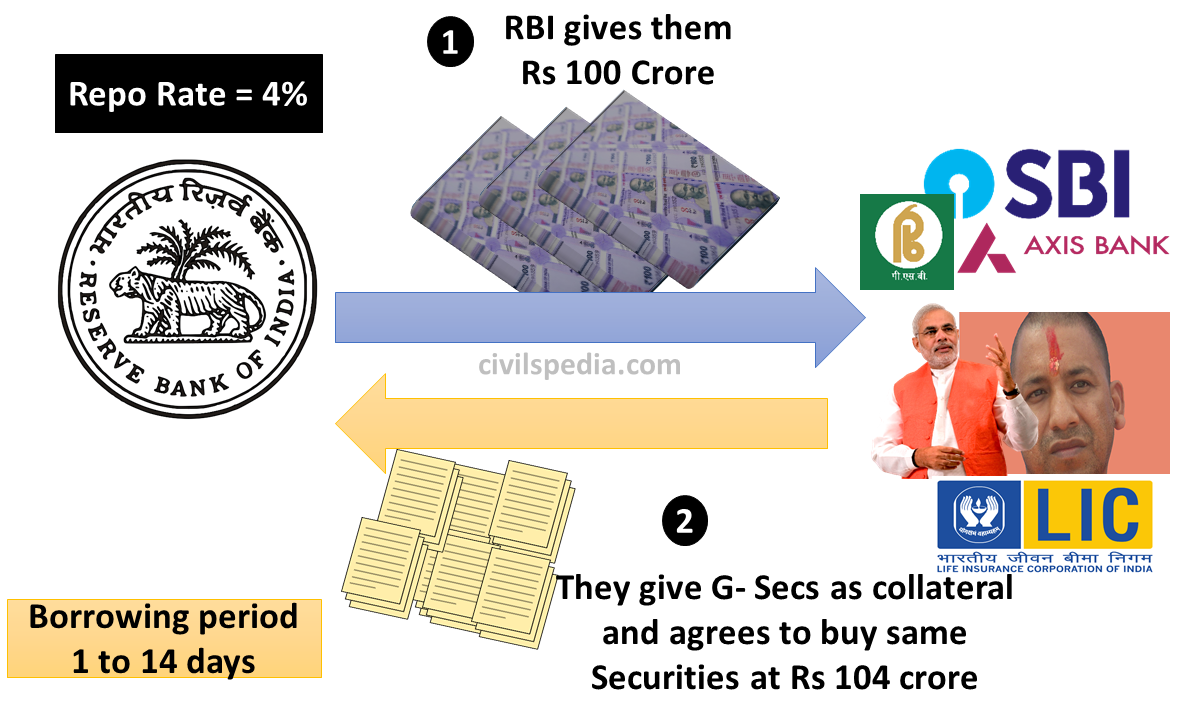

2.1 Repo Rate

- Repo Rate is a short form for Repurchase Rate.

- In this, Bank borrows immediate funds from the RBI for the short term (up to 14 days) with Government Securities as collateral and simultaneously agrees to repurchase the same Securities after a specified time at a specified price. For example, when a bank borrows, it will give its securities worth, say, ₹ 100 crores, & agree to repurchase it back at a rate of ₹ 104 crores ( if the repo rate is 4).

- The amount that can be borrowed under this facility is: From 5 crores to unlimited.

- All Banks, Central & State Governments and Non-Banking Financial Institutions are eligible for Repo Operations.

- But during the whole operation, the Bank has to maintain its SLR, i.e. Collateral securities can’t be from the SLR quota.

- Present Repo Rate is 6.50% (Feb 2023)

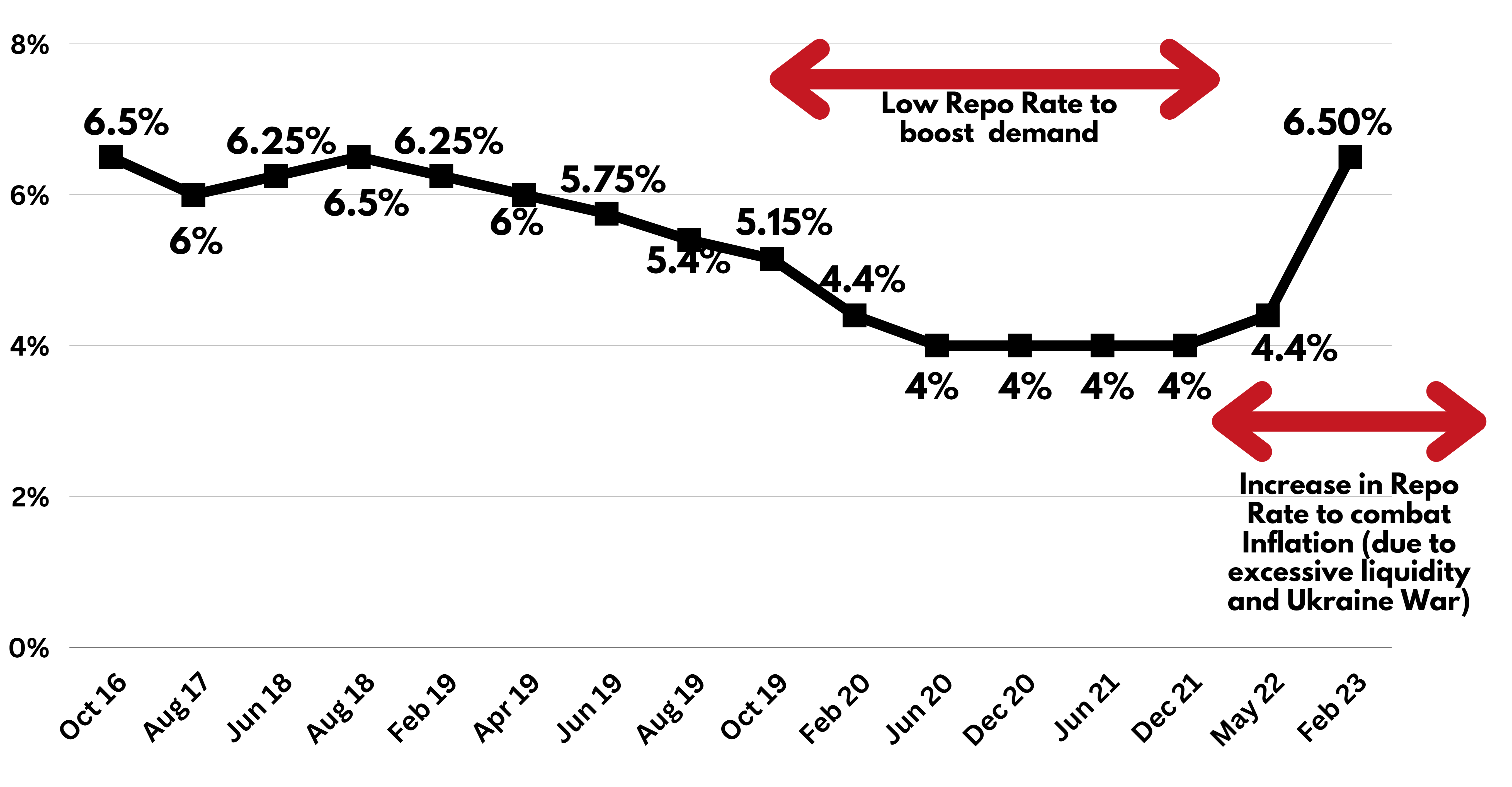

Recent Trends

- RBI was reducing the rates during the Covid pandemic to spur economic activity. RBI has kept the Repo Rate at 4% to increase the demand in the market.

- But Easy Money policy led to excessive liquidity in the economy. Additionally, Russia-Ukraine War increased the price of commodities, especially oil and food grains. Hence, RBI changed its stance and started to increase the Repo Rate to remove excess liquidity from the economy.

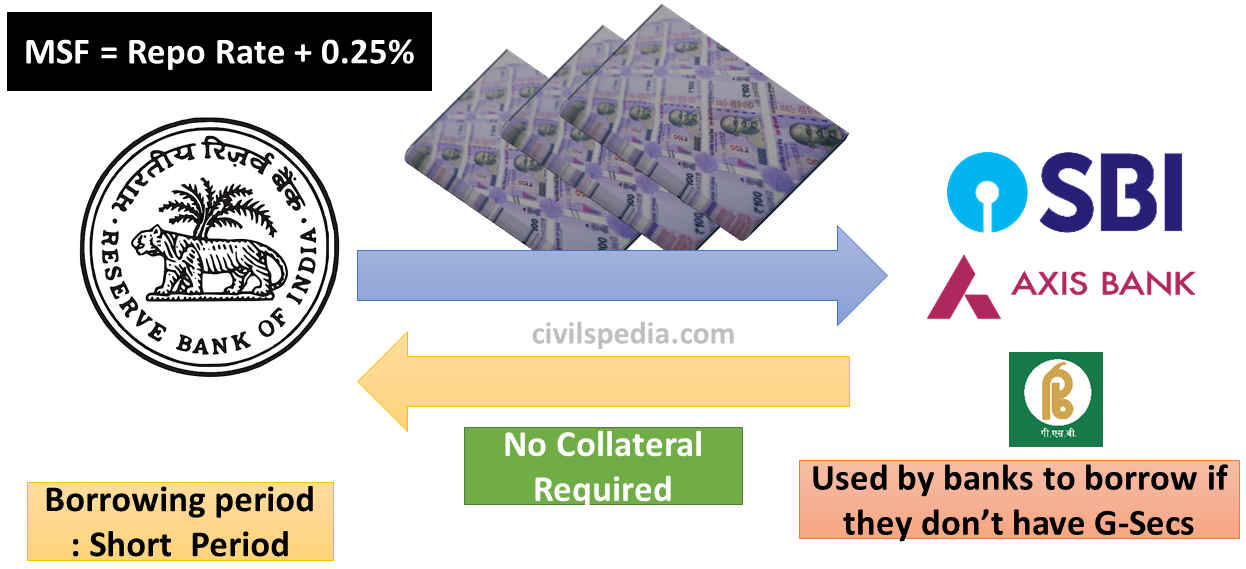

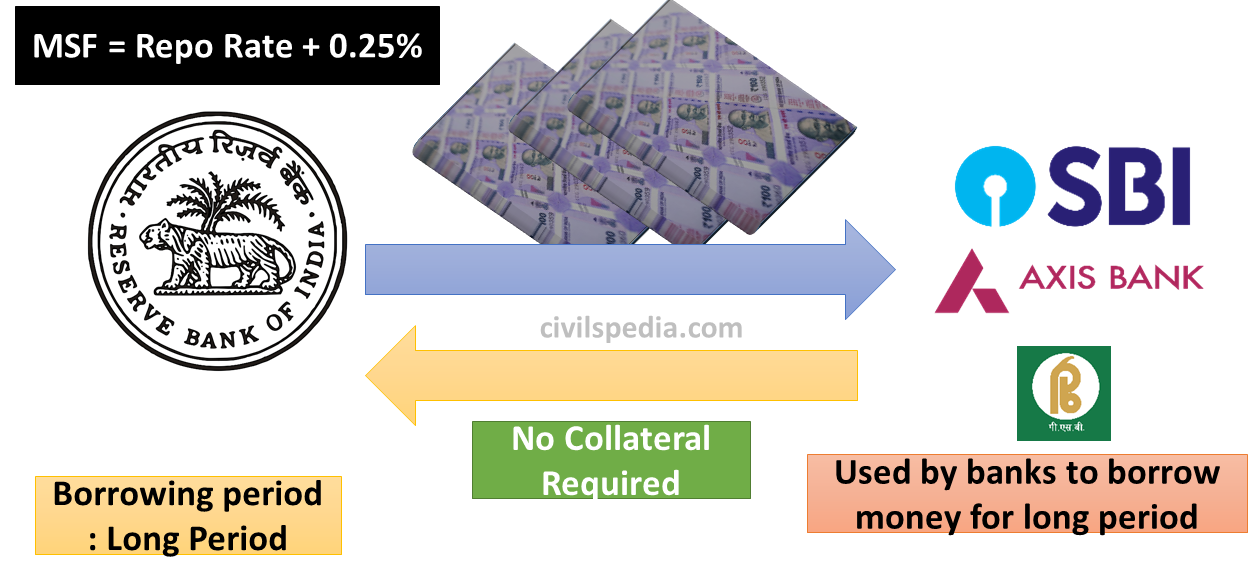

2.2 Marginal Standing Facility (MSF)

- Marginal Standing Facility was introduced in 2010.

- Suppose the Bank is in dire need of cash but doesn’t have spare securities. Under such conditions, the Bank can borrow overnight under MSF without any collateral. But they will have to pay 0.25% higher than Repo Rate (say as punishment)

MSF= Repo + 0.25%

(Presently (as of Feb 2023) = 6.75%)

- Only Scheduled Commercial Banks can avail this facility within a range of a minimum of 1 crore & Maximum of 1% of Net Time and Demand Liabilities.

- It helps to solve short-term crunch.

- It is also necessary because Repo operations are limited to a specific period during the day.

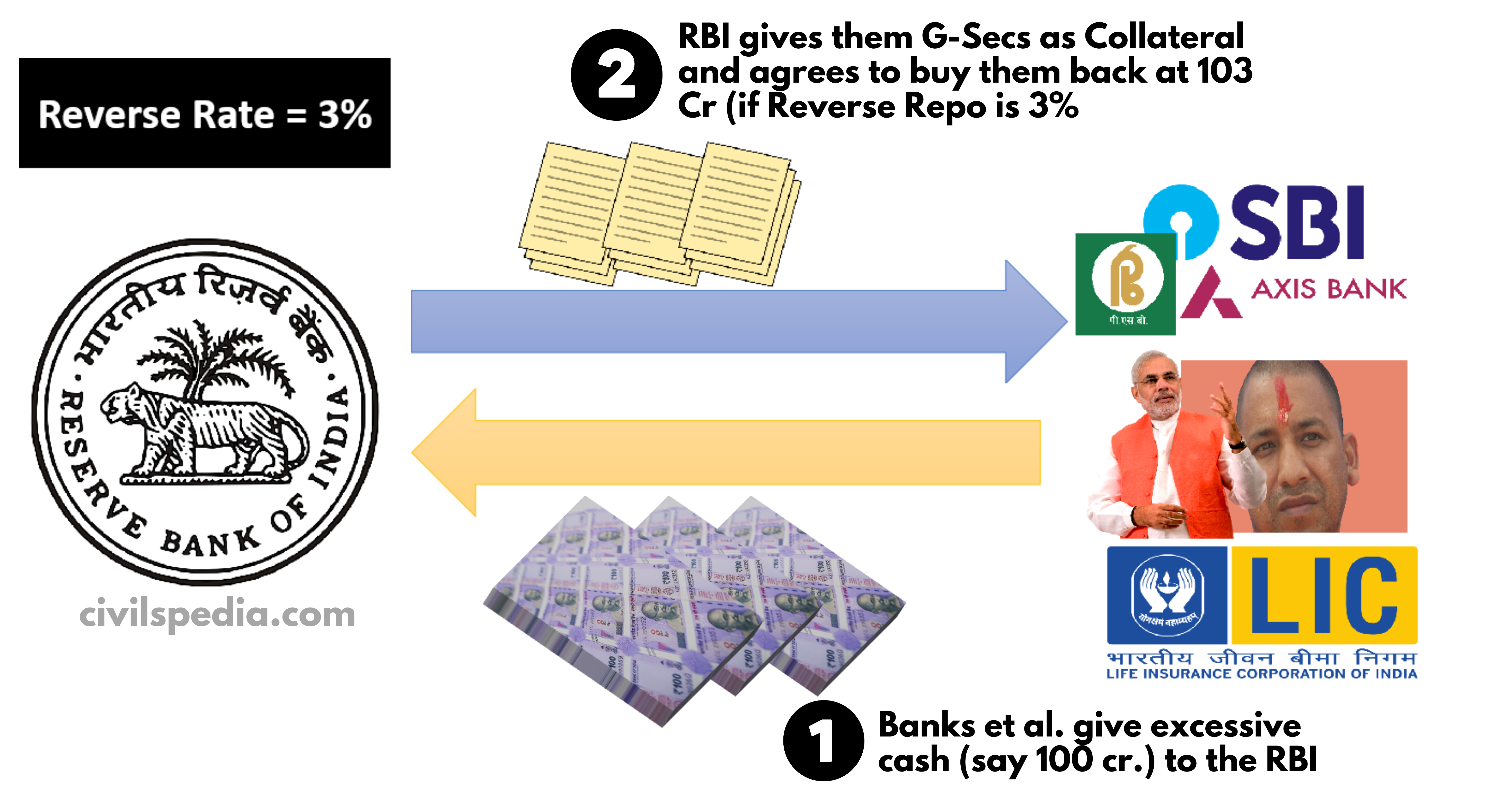

2.3 Reverse Repo Rate

In this, RBI takes money from banks & gives them securities (opposite of the Repo Rate) (explained in the Infographic below)

- RBI pledges securities in the form of G-Secs.

- All clients eligible in the Repo rate are eligible here as well.

- The current Reverse Repo is 3.35%.

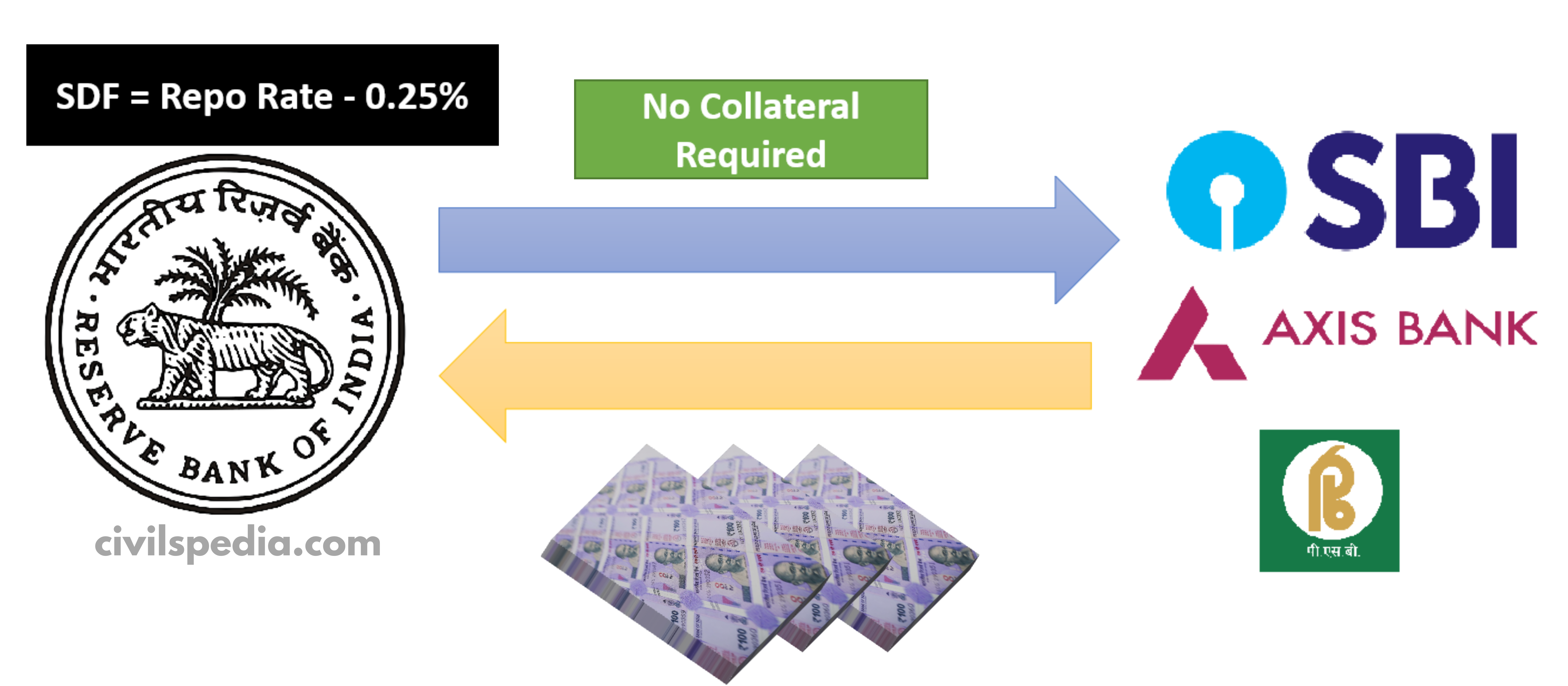

2.4 Standing Deposit Facility (SDF)

Timeline

- 2013: Urjit Patel Committee on Monetary policy proposed a standing deposit facility (SDF)

- 2018: The government included Standing Deposit Facility as a Monetary Policy Tool

- 2022: RBI’s Monetary Policy Committee introduced Standing Deposit Facility as Monetary Policy Tool

About SDF

- Under SDF, RBI can absorb the excess liquidity from banks without the necessity of collateral in the form of government securities.

- It is helpful in situations when RBI has to absorb excessive liquidity in situations such as demonetisation.

- SDF is the direct opposite of MSF. SDF is used for liquidity absorption, while MSF is used for liquidity injection.

SDF = Repo – 0.25%

(Presently (as of Feb 2023) = 6.25%)

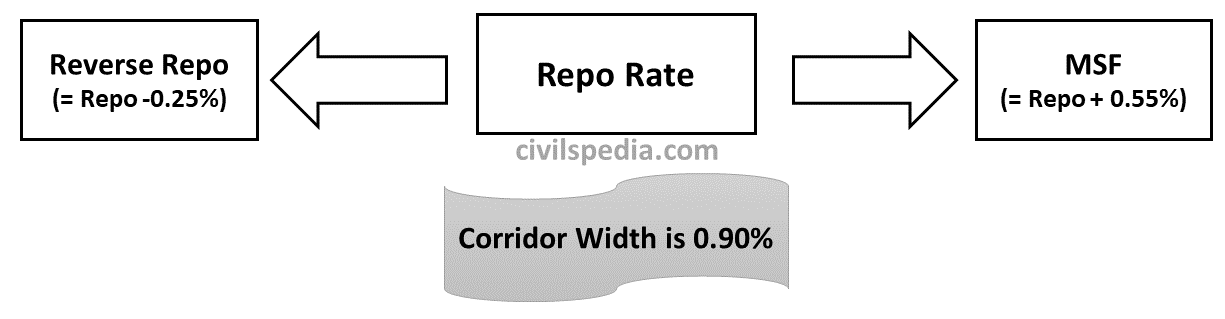

Policy Corridor/ Liquidity Adjustment Facility (LAF) Corridor

- Policy corridor is the difference between Marginal Standing Facility (Repo + 0.25%) and Standing Deposit Facility (Repo-0.25%)

- The formula has changed recently,

- Before April 2022: Policy Corridor = total width between MSF <—> REPO <—> Reverse

- After April 2022: Policy Corridor = Total width between MSF <—> REPO <—> SDF

- Hence, SDF has replaced the Reverse Repo Rate as the floor of the Policy corridor.

2.4 Bank Rate

- Bank Rate is the interest rate at which the central bank lends for the long term to commercial banks.

- No collateral is required under these operations.

- Presently: 6.75% (Feb 2023) (although Bank Rate = MSF, but both are declared separately)

Although RBI doesn’t use this tool to control the money supply, if it does, the same theory applies here as well.

| Inflation Fight | Increase Bank Rate |

| Deflation Fight | Decrease Bank Rate |

- It is not the primary tool to control the money supply these days but acts as a penal rate charged to banks for shortfalls in meeting their reserve requirements. How is it done?

- If a bank is not maintaining its SLR or CRR, it is fined a penalty on whatever amount is less than the amount to be maintained. Rate Charged is determined as:-

- First time: Bank rate +3%

- Second Time: Bank Rate +5% and so on

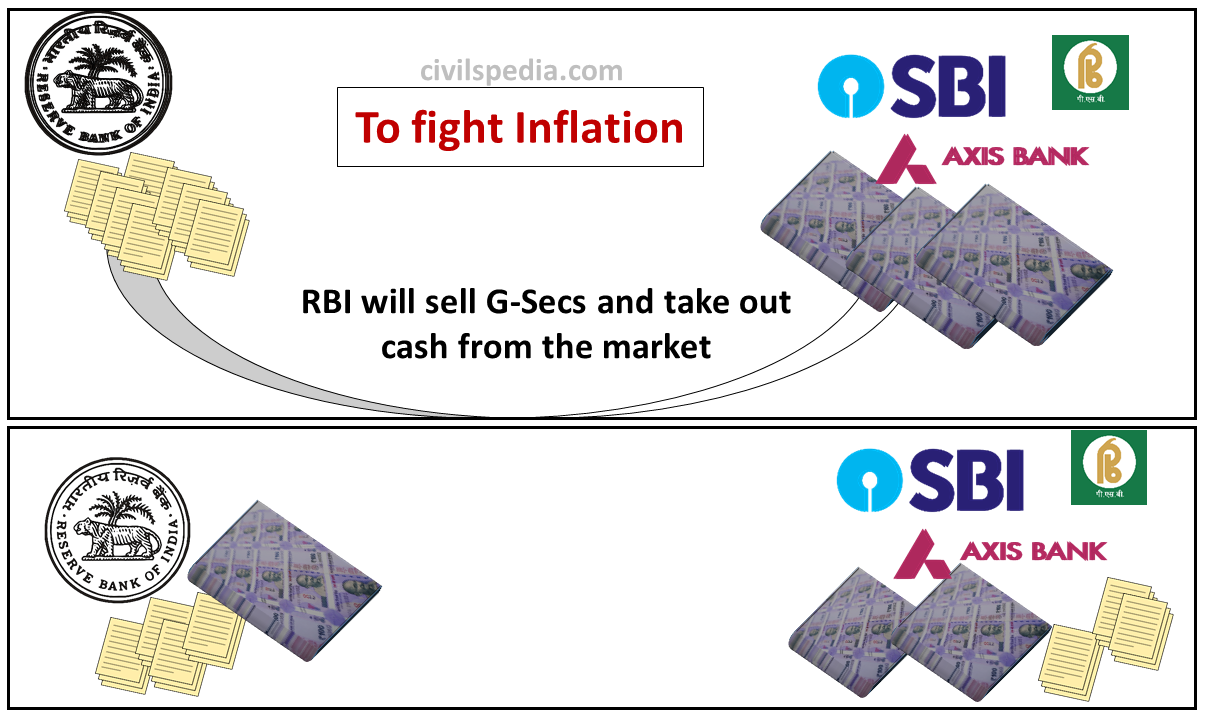

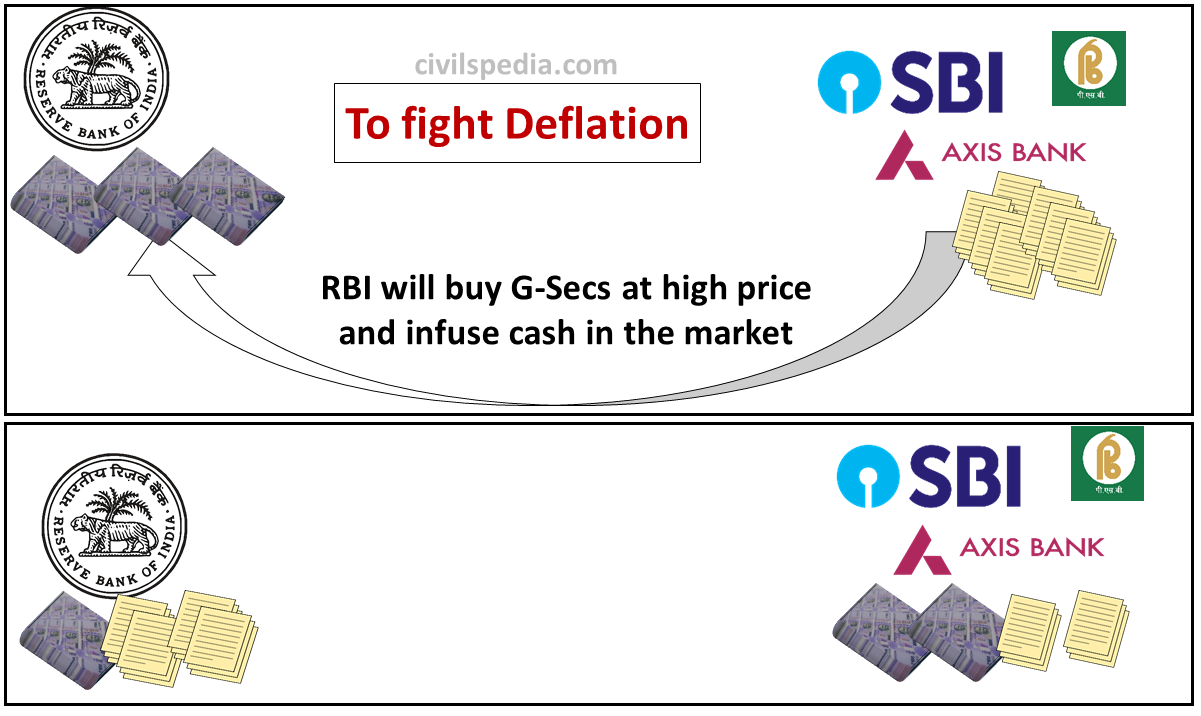

3. Open Market Operations (OMO)

- In Open Market Operations (OMO), the Central Bank (RBI) buys and sells Government Securities to influence the money supply in the economy.

- It is different from Repo and Reverse Repo Rates because there is no promise by either party to repurchase it back. RBI will pay the interest rate to the holder of the security, but there is no repurchasing agreement.

How does the government use this to control the money supply?

- Case 1: When there are inflation trends in the market, RBI issue these securities. Banks buy these securities & the money supply decreases.

- Case 2: When the government wants to increase the money supply, it starts buying these securities at a high price.

Why do banks go for OMO, although there are no compulsions on this?

- A lot of money keeps on lying idle with banks. Banks don’t earn any interest on that. Hence, investing those in govt securities & earn ~8% interest on them is a better option.

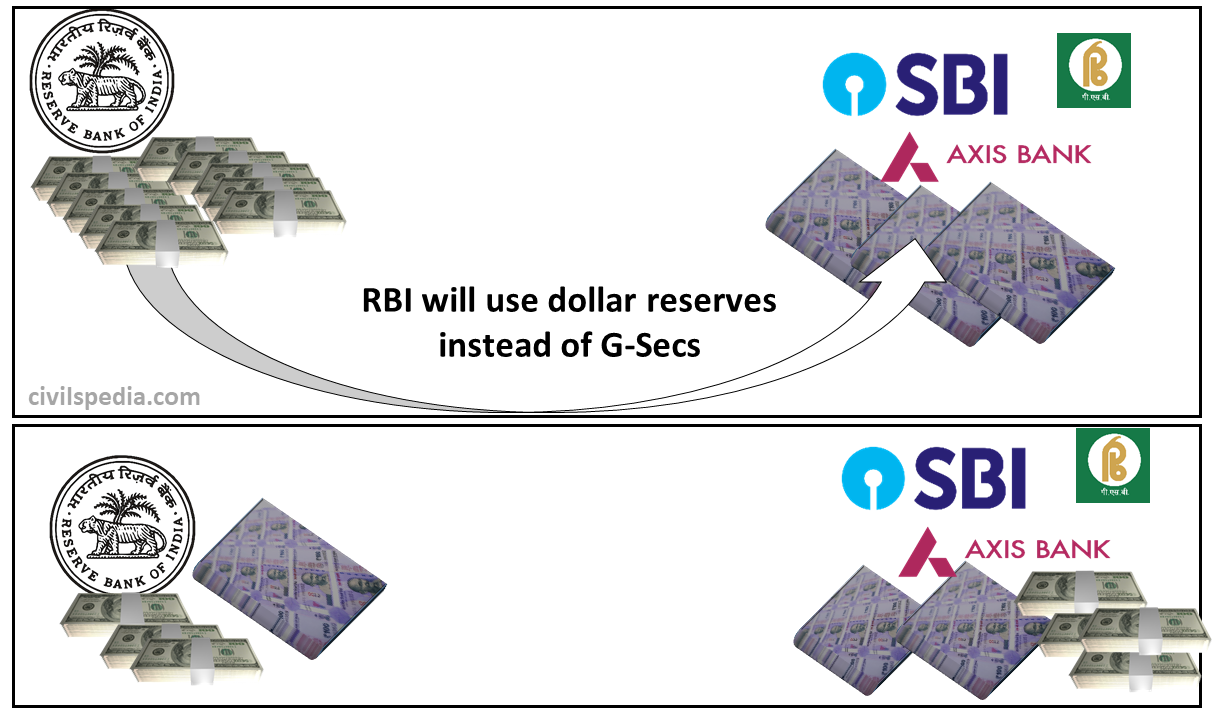

Dollar-Rupee swap

- To manage liquidity in the market, RBI has developed a new tool. It was started in 2019.

- Under this, RBI purchases dollars from banks in exchange for rupees.

- Increasing liquidity = Buy $ from Banks and give them ₹

- Decreasing liquidity = Give $ to Banks and take ₹ from them

For example: In March 2022, RBI conducted a swap of $5 billion by infusing dollars and sucking rupees equivalent to $5 billion from the Indian economy.

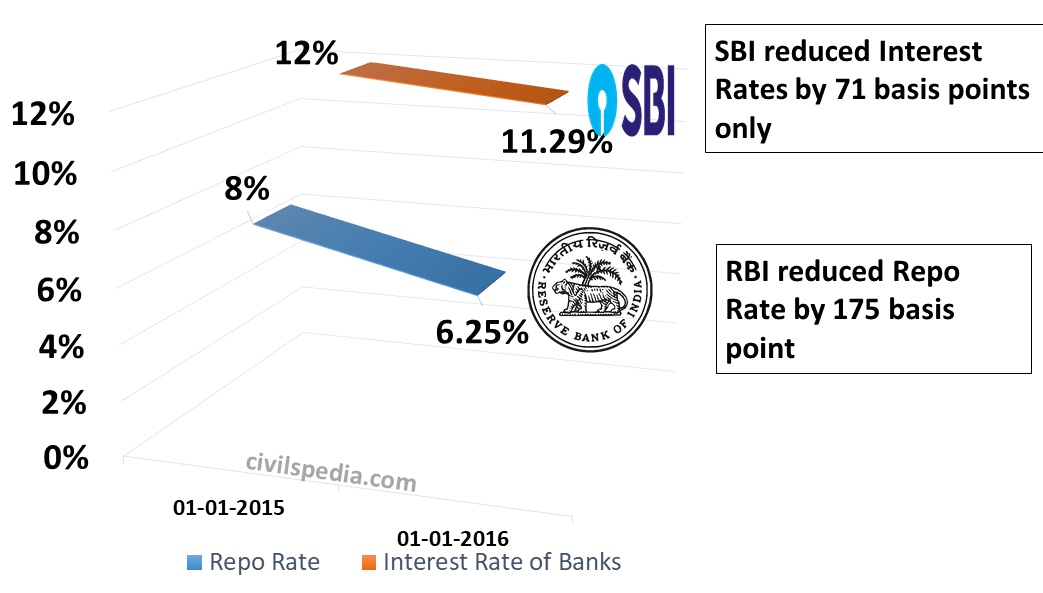

Incomplete Transmission of Rate Cut by Banks

Monetary policy transmission refers to how changes in the RBI’s policy rates (such as Repo) lead to commensurate changes in the rates of Interest of the Banks.

Issue

Earlier, when RBI decreased Repo Rate, Banks didn’t reduce their interest rates proportionately.

Why don’t banks transmit Repo Rate cuts to borrowers?

1. Banks don’t depend on RBI

- In India (& all developing countries), RBI is not the primary source of money for banks. Ordinary people are the main supplier(mainly because people don’t have many options to invest money in alternate investment facilities, e.g. mutual funds etc.)

2. Small saving schemes rate not reduced

- High small savings rates also limit transmission as banks worry that if they cut their deposit rates, customers will flee to small savings instruments such as PPF, NSC etc.

3. High Statutory Liquidity Ratio

- Significant money must be kept idle as SLR, which banks can’t lend. It reduces their ability to pass the benefit to consumers.

4. Banks increasing their Spread

- Due to losses incurred by banks due to high NPAs, banks increased their Spread to maintain their profits in absolute terms.

5. Higher NPAs

- Indian banks face the issue of huge NPAs, which reduces banks’ profitability.

To deal with the inadequate transfer of Repo Rate cuts by banks to borrowers, RBI Came up with MCLR and External Benchmark Rate System.

External Benchmark System

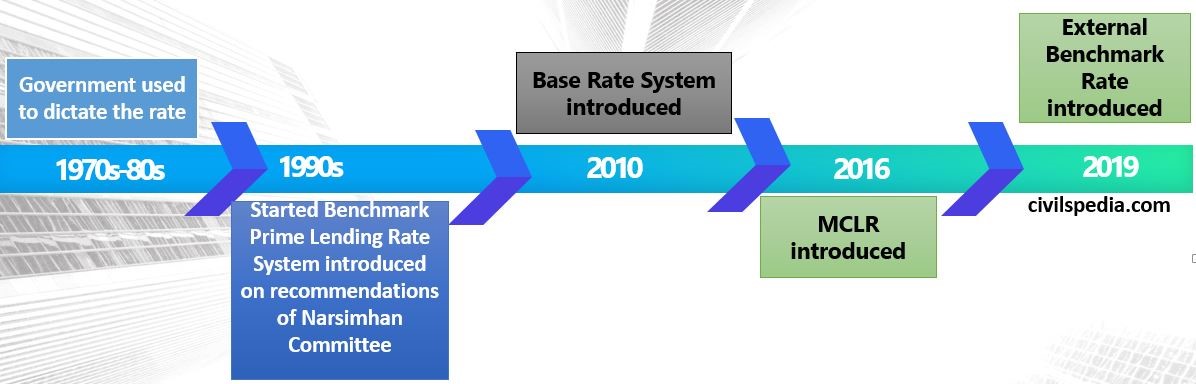

How Banks decide their Interest Rate: Timeline

| 1969 | The government began nationalising private banks and ‘administered interest rates‘ on them. |

| 1991 | M.Narsimhan suggested deregulation: Government should not dictate/administer individual banks’ interest rates & RBI should only give a methodology to banks. |

| 2003 | RBI introduced Benchmark Prime Lending Rate (BPLR). |

| 2010 | RBI introduced the BASE Rate + Spread system; update frequency was at individual banks’ discretion. |

| 2016-17 | RBI introduced the Marginal Cost of Funds based Lending Rate (MCLR) +Spread system. – Banks to calculate the lending rate on a monthly basis. – Lending Rate to be calculated using of CRR Cost, Operating Cost, and Marginal cost of funds (calculated using Repo Rate) (don’t need to go into detail. Just remember, MCLR has Repo Rate as a component in it). Benefits? – Better transmission of Monetary Policy. – Transparency & accountability to borrowers. RBI’s Janak Raj internal study group (2017) showed MCLR did not yield all benefits. So banks keep on increasing Spread based on their discretion. Hence, a new method was introduced. |

External Benchmark System

- Applicable from April 2019 (on recommendations of Dr Janak Raj Committee).

- All New Loans are to be linked with the External Benchmark system.

In this system

- Banks have been asked to choose any of the following 4 benchmarks like

- Repo rate or

- 91-day T-bill yield or

- 182-day T-bill yield or

- Any other benchmarks by Financial Benchmarks India Pvt. Ltd.

- It has to be updated at least every 3 months.

- The Lending Rate of the Bank will be External Benchmark + Spread (e.g. if Bank choose Repo Rate as External Benchmark, then Interest Rate will be Repo Rate + Spread)

Benefits?

- Better transmission of Monetary Policy.

- Better transparency and accountability.

Qualitative / Selective / General tools

These measures are used to regulate the money supply in specific sectors (i.e. these are sector-specific measures).

1. Marginal Requirements/LTV (Loan to Value)

- If Spice Airlines wants to borrow money from SBI and pledges ₹100 crore collateral but RBI prescribe a margin (Loan to Value ratio) of, say, 65%, then SBI can give only a 65 crore loan.

- It is obligatory for SBI to obey the directives of RBI in this context (unlike the base rate)

- Hence, it is a Selective & direct tool.

2. Consumer Credit Regulation

- In this, RBI can make various regulations on credit.

- E.g

- Increase down payment from 10% to 30% (it will force some people to delay buying vehicles financed through bank loans).

- Decrease the least EMI for the automobile sector, say, from ₹ 5,000 to 3,000.

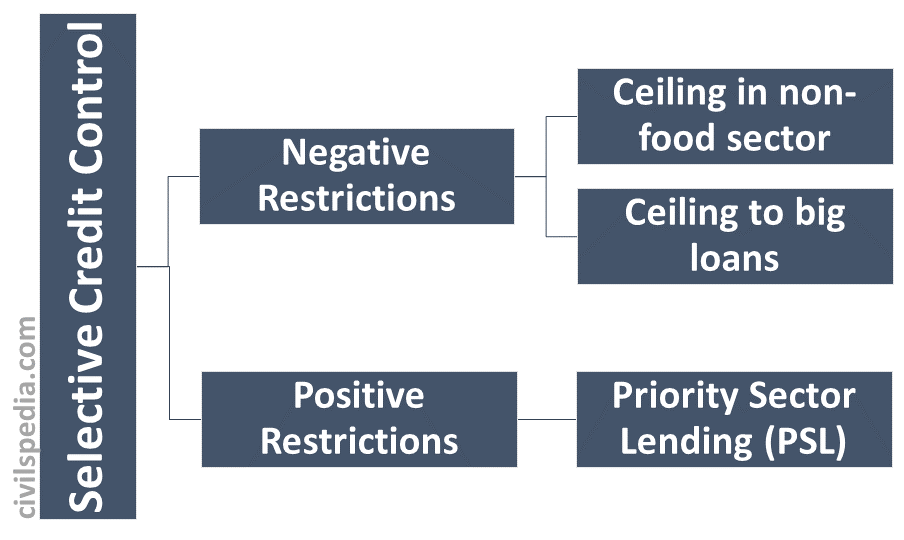

3. Selective Credit Control

- In this, RBI can instruct banks not to extend loans to a particular sector (Negative / Restrictive Tools) or give a minimum %age to a particular sector (positive).

- These are Qualitative and Direct Tools.

Negative Restrictions

3.1 Ceiling to big loans

- It was operational from 1965 to 1989.

- Under this, all Commercial Banks had to obtain prior approval from RBI before giving loans greater than ₹ 1 crore to a single borrower.

3.2 Ceiling on Non-Food Loans

- It started in 1973.

- To boost Green Revolution

- So that more loans go towards the agriculture sector

These tools were used before LPG Reforms, but they weren’t effective because these can be easily flouted using loopholes.

Positive Restrictions

3.3 Priority Sector Lending/Rationing

- Rationing is the main feature of the communist economy. E.g. in the Soviet Union, they used to make provisions like giving a particular amount of loan to a specific sector. PSL is a form of Rationing.

- PSL means giving a specific minimum amount of loans to some Priority Sectors. In India, 40% of loans are given to Priority Sectors.

- Government can increase the supply of money to that sector by increasing its limit.

4. Moral Suasion

- Moral Suasion is “persuasion” without applying punitive measures. RBI governor tries this tactic via conferences, informal meetings, letters, seminars, convocations, panel discussions, and memorial lectures.

- Eg

- Please reduce giving automobile loans instead; invest your money in government securities.

- I have reduced the repo rate; now, you also decrease your base rate.

- It is not obligatory on the part of the Bank to follow orders, but generally, they do follow.

5. Direct Action

- RBI can take direct action against any bank for going against the rules. RBI gets this power under the Banking Regulation Act, RBI Act, Foreign Exchange Management Act, Prevention of Money Laundering Act etc.

- E.g., if Bank is not maintaining CRR or SLR, RBI can scrap its license.