Table of Contents

Money Supply

This article deals with ‘Money Supply .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-2 syllabus. For more articles, you can click here.

Introduction

It is the total stock of all types of money (currency and deposits) held by the public at any time. The term public includes all economic entities other than the government and banking system.

Factors affecting Money Supply

| Season | For example, during November & April, crops are harvested, and industries also buy their raw material leading to more money in the hands of a farmer. Hence, the Money supply will increase. |

| Trade cycle | – Boom: Money supply increases. – Depression: Money supply falls. |

| Fiscal policy | – Money supply decreases with higher taxation and the sale of G-sec and vice-versa. |

| People’s choice | – If people deposit more of their income in banks (instead of storing it in their lockers), the bank can expand loans. The money supply rises in such cases. |

| Monetary policy | – If RBI follows a dear money policy = the money supply decreases. – If RBI follows a cheap money policy = the money supply increases. |

Why should we measure the money supply?

- The job of RBI is to control inflation through qualitative & quantitative tools (i.e. Repo Rate, Cash Reserve Ratio etc.)

- But for this, RBI must first know how much money supply is in the system. Only then RBI can make a policy to control the money supply.

Types of Money

M0 (Reserve Money or High Powered Money)

- It is the total stock of currency held by the public and banks.

- Mo is the base for creating a Broad Money supply (M3)

- Mo is the sum of the following things

- Currency held by the Public and Banks

- Bankers’ deposits with RBI plus

Basically, it is the Total Currency Printed by RBI. RBI prints money equivalent to bonds or G Secs it gets from Government.

M1 (Narrow Money)

- M1 includes

- Currency with public

- Demand deposit in all banks (i.e. Deposit in the current account and savings account)

- Basically, it denotes a situation when a person has money; he can do two things to maintain liquidity. He can keep that money in its hard form or deposit it in the bank in a Current or Savings Account (not a Fixed Account).

M2 (Narrow Money )

- M2= M1 + Demand Deposits in Post Office

- M2 includes

- Currency and Coins with public

- Demand deposit in all banks

- Demand Deposits in Post Office

M3 (Broad Money or Money Aggregate)

- M3 = M1 + Time deposits with Commercial Banks

- M3 includes

- Currency and Coins with public

- Demand deposit in all banks

- Time deposits with banks

- M3 is most commonly used to measure money and is regarded as the primary indicator of money supply in the economy.

- M3 is the Net Demand and Time Liabilities (NDTL).

M4 (Broad Money)

- M4 = M3 + total Post office Deposits

- M4 includes

- Currency and Coins with public

- Demand deposit in banks

- Time deposits with banks

- Demand deposit in post-offices

- Time deposits with post-offices

Ranking of Liquidity

Liquidity is the ease with which an asset can be converted into cash.

| Name | Liquidity | Liquidity Rank |

| M1 | highest | 1 |

| M2 | less than M1 | 2 |

| M3 | less than M2 | 3 |

| M4 | lowest liquidity | 4 |

Liquidity Ranking : M1 > M2 > M3 > M4

Money Multiplier

Before looking into the concept of Money Multiplier, we will look at the concept of the velocity of Money Circulation.

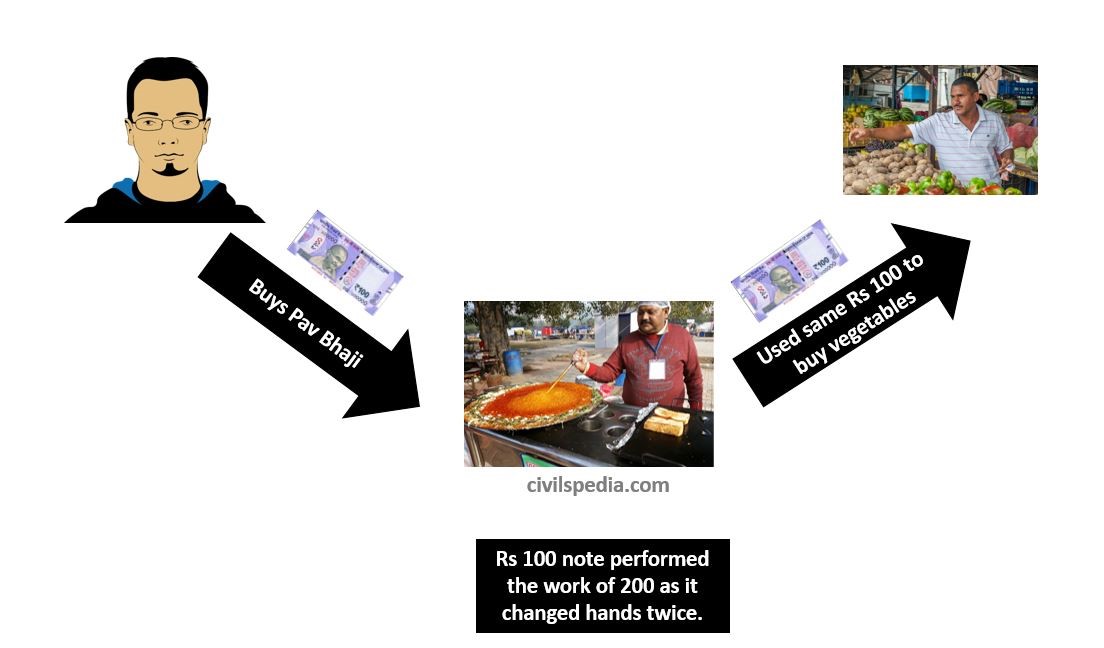

Side Topic: Velocity of Money Circulation

The average number of times money passes from one person to another during a given period.

Factors affecting Velocity of Money Circulation

- Low financial inclusion means less velocity because banking penetration is low. People tend to save more on physical assets. Hence, money doesn’t change hands much.

- Poor people immediately use their money. Hence, cash in the hands of the poor has a higher velocity.

- Booming period = higher velocity.

- If more people use EMI loans for purchases, the velocity is high.

Money Multiplier – 1st Approach

- The Money Multiplier is the Ratio of Broad Money & Reserve money, i.e. M3 / Mo

M3 = Mo X Money Multiplier

- Its value depends on the credit creation capacity of banks, which depends on the following

- Banking habits of the public

- Monetary Policy

- In India, Money Multiplier generally revolves around 5. So, for example, in Dec 2021, India’s Money Multiplier was 5.3.

Money Multiplier – 2nd Approach

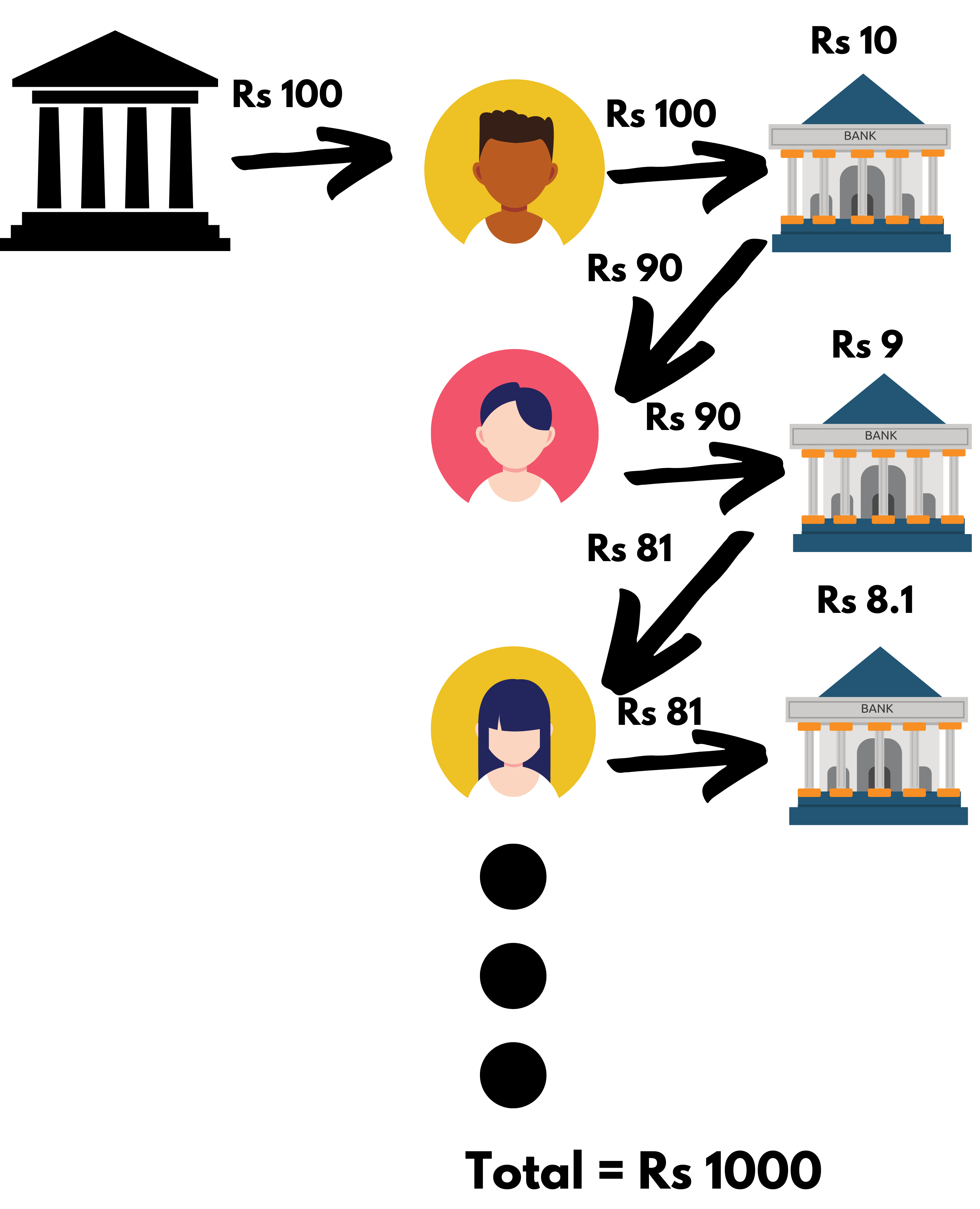

Money Multiplier is 1/R (R= Cash Reserve Ratio)

Explanation of the above formula?

Consider a situation in which a Person deposited ₹ 100 hard currency in the bank. Let’s assume that Cash Reserve Ratio (CRR) fixed by RBI is 10%. First Bank will keep aside ₹10 & give ₹90 as a loan to some person. Then the person who got the loan again paid another person through the bank by depositing money in the person’s bank account. This bank will keep ₹9 (10% of 90) aside and give 81 as a loan to some other person. And the game keeps on going like this. So, ₹ 100 printed by the RBI generated a value of ₹ 1000 (i.e. 100 X (1/10%)) if the CRR was 10% and money was used through the banking system up to its full potential.

Note: Presently, Money Multiplier is around 5. But considering the 4.5% Cash Reserve Ratio, it should be 22.22.

Reason for low Money Multiplier than theory

- Since Financial Inclusion is low, there might be a case that either banks have money, but people are not available to take loans, or people cannot keep their money in banks.

- Along with that, Banks aren’t always willing to give loans.

- Significant cash in India is stored as Black Money and is never stored in Banking System.