In this article , we will look into Money Laundering as per the needs of UPSC examination.

Table of Contents

Money Laundering

Money laundering is the process of taking money earned from illicit activities, such as drug trafficking or tax evasion, and making the money appear to be earnings from legal business activity.

Money laundering is a way to conceal illegal funds and works by transferring money in an elaborate and complicated manner and to mislead anyone who may seek to trace the transaction. The objective is to make difficult to trace the original party to the transaction also referred to as the launderer.

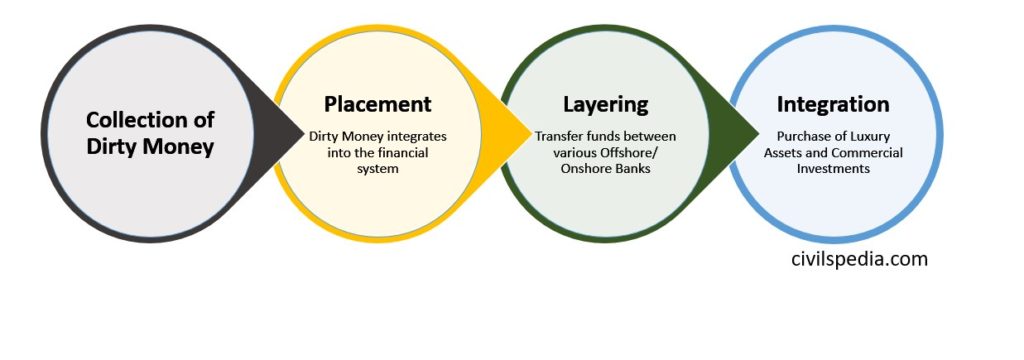

Process

- Placement

- It refers to moving the funds from a direct association with the crime .

- It involves the initial entry of dirty cash into financial system.

- The aim at this stage is to remove the cash from its location of acquisition to avoid detection by legal authorities

- This is the most vulnerable stage in the money laundering

Done through

- Currency exchange

- Gambling

- Purchasing assets

- Repayment of loans Etc

2. Layering

- This is the second and the most complex stage in the process of money laundering .

- It often involves international movement of funds

- During this stage , launderers may begin by moving money electronically from one country to another and then investing them back into the markets abroad. This is especially prevalent in those countries that don’t cooperate on anti-money laundering investigations

3. Integration

- The final stage involves integration of the money into the legitimate economic and financial system. By this stage , it is extremely difficult to distinguish between legal and illegal wealth.

- Some of the

ways it is carried out includes :-

- Creating front companies and false loans . Such companies are incorporated in countries wth corporate secracy laws in which criminals lend themselves their laundered proceeds in legitimate transactions .

- Property dealing

- Generation of false import and export invoices

- Complicity with foreign banks

Causes why India has high levels of money laundering

- Poor tax administration

- For a long time , India didn’t have any specific law for dealing with money laundering

- Level of corruption is very high in India

- Secrecy clauses in DTAAAs (Direct Tax Avoidance Treaties)

- Nexus between bureaucrats , political leaders and criminals

Hawala & Money Laundering

- Hawala works by transferring money without actually moving it.

- It is an alternative or parallel remittance system, which works outside the circle of banks and formal financial systems.

- It is frequently used by criminals to launder money for their illicit acts like terrorism, drug trafficking etc

- As hawala transactions are not routed through banks, the government agencies and the RBI cannot regulate them.

Status of Hawala in India

- Hawala is illegal in India, as it is seen to be a form of money laundering

- FEMA (Foreign Exchange Management Act) 2000 and PMLA (Prevention of Money Laundering Act) 2002 are the two major legislations which make such transactions illegal.

Cryptocurrency: The New Hawala

- Cryptocurrency like Bitcoin provides anonymity & facilitates terror financing which was evident in 2015 Paris terrorist attack.

- FATF reported in 2015 that some terrorist websites encouraged sympathisers to donate in bitcoins.

- After, demonetisation action by the Government of India in 2016, there was noticed a flood of such digital transactions.

Impacts of Money Laundering

- Social Impact

- Transfers the economic power from the right people to the wrong

- Increases income inequality

- Loss of morality and ethical standards leading to weakening of social institutions

- Economic Impact

- Volatility in exchange rates and interest rates due to unanticipated transfers of funds

- Discourages foreign investors

- Policy distortion occurs because of measurement error

- Legitimate businesses lose , as there is no fair competition involved

- Political Impact

- Affects the Government’s capability to spend on development schemes thereby affecting a large section of populations who could have benefitted from such spending

- Security impacts

- Laundered money is used to fund terrorist organisations

Steps Taken

- Statutory : Prevention of Money Laundering Act (PMLA) 2002

- Institutional framework: Two bodies:

- Enforcement Directorate : Enforce certain provisions of Prevention of Money Laundering Act (PML)

- Financial Intelligence Unit – India (FIU-IND) : International coordination in Money Laundering cases

- International :

- Financial Action Task Force (FATF) :

- Asia – Pacific Group on Money Laundering (APG) : India is member

Other International Steps

- Vienna Convention : 1988| To combat money laundering in Drug Trafficking

- Basel Statement of Principles in 1989

- Financial Action Task Force : Integovernmental body sponsored by OECD & based in Paris . India is member

- UNCTOC (UN Convention on Transnational Organised Crimes)

Prevention of Money Laundering Act (PMLA)

- Defines offence of money laundering

- Impose obligation on financial institutions and intermediaries to verify identity of clients , maintain records and furnish informations to Financial Intelligence unit -India (FIU-Ind)

- Brought certain offences under IPC, Narcotic Drugs and Psychotropic Substances Act, Arms Act, Wild Life (Protection) Act, Immoral Traffic (Prevention) Act and Prevention of Corruption Act, proceeds of which would be covered under this Act

- Tackles Cross border money Laundering: It allows Central Government to enter into an agreement with Government of any country for enforcing the provisions of the PMLA

- Confiscate the illegal property

- An officer not below the rank of a joint secretary would be appointed for management of properties confiscated under this.

- Punishment shall not be less than 3 years & can be extended to 7 years . May be extended to 10 years in case it is under Narcotics & Psychotropic Substances Act , 1985

- Special Courts set-up in a number of States to conduct the trial of the offences of money laundering.

Challenges

- Rapid advancements in digital technology : The enforcement agencies are not able to match up with the speed of growing technologies. Eg : Bitcoins etc used by money-launderers

- Tax Haven Countries : Their strict financial secrecy laws prohibit the disclosure of financial information.

- Involvement of employee of financial institution : usually employees of the financial institution are involved in money laundering

- Lack of comprehensive enforcement agencies : In India, there are separate wings of law enforcement agencies dealing with money laundering, terrorist crimes, economic offences etc. and they lack convergence among themselves.

- Low Financial Education and use of Jan Dhan Account holders as money mules .

- Failure of Banks to effectively implement KYC norms as stipulated by the RBI

Thank you, Civilspedia, for imparting such complete data on cash laundering. Your in-depth insights and explanations are notably precious for these looking for to apprehend this complicated issue. Keep up the notable work in instructing and elevating recognition about economic crimes and their consequences.