Table of Contents

Municipality

- 74th Constitutional Amendment added Articles 243P to 243ZG and Schedule 12 which deals with provisions related to Municipality.

Historical Perspective

| 1687 | First Municipal Corporation in Madras setup |

| 1726 | Municipal Corporation setup in Bombay and Calcutta |

| 1870 | Lord Mayo’s Resolution on Financial Decentralisation visualised Local Self Government Institutions |

| 1882 | Lord Ripon‘s Resolution on Self Government . He is called Father of Self Government . But system wasn’t elective in nature and hence criticized |

| 1910s | Royal Commission on Decentralisation headed by Charles Hobhouse recommended Financial Decentralisation but due to World War I , nothing substantive came out of it. |

| 1919 | Dyarchy at the State Level started in which all subjects were divided into Reserved and Transferred . Panchayati Raj and Municipality were in Transferred Subjects which were to be headed by Indian Ministers. But in reality, power of control was still in the hands of British government |

| 1935 | Provincial Autonomy to States and since Local Government was State Subject, it came in control of Indians. But State Governments lacked resources and time, hence revolutionary changes weren’t introduced . |

Constitutionalisation process

| Rajiv Gandhi | In 1989 introduced 65th Constitutional Amendment(Nagarpalika) Bill ,passed in Lok Sabha but failed in Rajya Sabha |

| VP singh | November 1989 ; but Government lapsed |

| PV Narsimha Rao | Finally Constitutionalised it with 74th Constitutional Amendment |

74th Amendment Act,1992

1 . Three types of Municipalities

| Nagar Panchayat | Transitional area between Urban and Rural |

| Municipal Council | Smaller Urban Area |

| Municipal Corporation | Larger Urban Area |

2. Composition

- All members of Municipality to be elected directly

- State Legislature may provide for

- Manner of election of Chairperson of Municipality

- May provide for representation to persons having special knowledge in Municipal Administration without right to vote, MP and MLA from that area

3. Ward Committee

Ward Committees consisting of one or more wards within territorial area of Municipality having population of 3 lakh or more to be constituted

2nd Administrative Reforms Commission has criticized practice of clubbing together more than one ward to form Ward Committees which represent population of more than 3 Lakh (eg in Mumbai, each committee represent around 7 Lakh population) . Also this leads to system of Spoil Sharing with Chairmanship rotating between different Ward Heads. Commission has proposed alternate scheme .

4. Reservation of seats

| SC & ST | Reservation to Members and Chairpersons in proportion of their population |

| Women | Atleast 33.3% seats reserved (including the seats reserved for woman in SC/ST) |

| OBC | State legislature can reserve seats for them |

5. Duration

- Term of 5 years

- If dissolved earlier new elections should be held within 6 months (and hold office for remaining part of the tenure)

6. State Election Commission (SEC)

- Under Article 243 (K) and 243 (ZA) , State Election Commissioner has been made responsible for conducting elections of Urban and Rural Local Bodies .

- Election Commissioner to be nominated by Governor at state level

- Vested with powers to superintend elections of municipality and making electoral rolls etc

Role of State Election Commission

- Preparation of Electoral Roll

- Conducting elections of Panchayati Raj Institutions and Municipality elections

- Implement Code of Conduct so that illegal activities and electoral malpractices can be controlled.

- Recommending State Government to give Officers on deputation for conducting elections

7. Finance

- State legislature may authorize Municipalities to levy & collect property tax, duties, tolls & fees or assign municipality taxes or give grant in aid but ceiling and procedure to same can only be decided by State legislature

- After 5 years , Finance Commission to be formed by Governor to review the Financial Position of Municipality and suggest method to distribute taxes

8. Audit & account

- State legislature may make provisions wrt maintenance of accounts by municipality and auditing of such accounts

9. Application to Union Territories

- President can direct to implement these provisions in UTs with modifications

10 . Exempted areas

- Not apply to Scheduled Areas & Tribal Areas and shall not affect powers of Gurkha Hill Council

11. 12th Schedule

- Contain 18 functional items (29 – in case of Panchayats) placed within purview of Municipalities

- Urban planning including town planning.

- Regulation of land-use and construction of buildings.

- Planning for economic and social development.

- Roads and bridges.

- Water supply for domestic, industrial and, commercial purposes.

- Public health, sanitation conservancy and solid waste management.

- Fire services.

- Urban forestry protection of the environment and promotion of ecological aspects.

- Safeguarding the interests of weaker sections of society, including handicapped & mentally retarded.

- Slum improvement and upgradation.

- Urban poverty alleviation.

- Provision of urban amenities and facilities such as parks, gardens, play-grounds

- Promotion of cultural, educational and aesthetic aspects.

- Burials and burial grounds; cremations, cremation grounds and electric crematoriums.

- Cattle ponds; prevention of cruelty to animals.

- Vital statistics including registration of births and deaths.

- Public amenities including parking lots, bus stops and public conveniences.

- Regulation of slaughter houses & tanneries

- But provision is – powers may be devolved to enable them to carry responsibilities conferred upon them in Schedule 12 & is not a mandatory provision

- There appear to be certain incongruities in the Twelfth Schedule and several matters listed in the Eleventh Schedule that ought to have been included, have been omitted inadvertently.

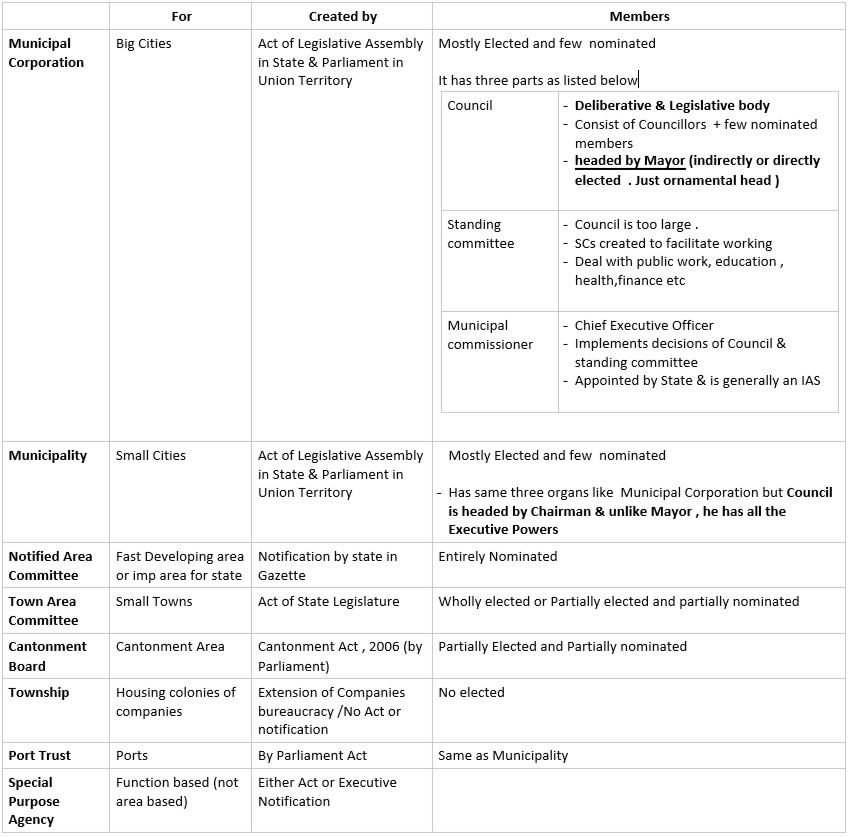

Types of Urban bodies

8 types of Urban Local Bodies have been created in India

1 . Municipal Corporation

- For big cities like Delhi, Mumbai, Kolkata, Hyderabad & others

- Created by Acts of Legislative Assembly in State & act of Parliament in Union Territory

- Has three authorities in it

| Council | – Deliberative & Legislative body – Consist of Councillors directly elected by people + few nominated members having knowledge of Municipal Administration – Reservation according to 74th Amendment for SC,ST & women – Council is headed by Mayor (can be elected by majority vote or directly . Not Uniform in all States . He is ornamental head ) |

| Standing committee | – Council is too large . Hence, Standing Committees created to facilitate working – Deal with public work, education , health, finance etc |

| Municipal commissioner | – Chief Executive Officer : Responsible for implementation of decisions of Council & standing committee – Appointed by State & is generally an IAS |

2. Municipality

- For administration of small cities

- Established by State laws in states & law of Parliament in UTs

- Known by various names like Municipal Council, Municipal Committee, Board etc

- Has same three organs like Municipal Corporation i.e. Council, Standing Committee & Chief Executive Officer but Council is headed by Chairman & unlike Mayor he has all the Executive Power

3. Notified Area Committee

- For administration of two types of areas

- Fast developing due to industrialisation

- Not fulfill all the conditions to form Municipality but are important for state

- Established by state notification in state gazette & those provisions are valid which are notified by state in gazette

- Entirely nominated body + non statutory body

4. Town Area Committee

- For administration of small town

- Created by State Legislation & May be wholly elected or partially elected partially nominated

- Semi- Municipal body & entrusted with limited functions like drainage, roads etc

5. Cantonment Board

- For administration of civilian population in Cantonment Area

- Setup under Cantonment Act, 2006 by Parliament(no State Act)

- Total 63 Cantonments in India & divided to 4 categories

| Category I | Above 50,000 |

| Category II | 10,000 to 50,000 |

| Category III | 2500 to 10,000 |

| Category IV | Below 2500 |

- Partly nominated & partly elected

- Commanding Officer of area is Ex-Officio President of board

- Functions performed by the Cantonment Board are similar to those of Municipality

6. Township

- Established by large enterprise to provide civic amenities to its staff & workers who live in housing colonies built near plant

- Enterprise appoint town administrator to look after administration of township

- No elected members & is extension of bureaucratic structure of enterprise

7. Port Trust

- Established in Port areas like Mumbai, Kolkata, Chennai etc

- To manage & protect ports and to provide civic amenities

- Created by act of Parliament and perform functions similar to those of Municipality

8. Special Purpose Agency

- These are function based & not area based committees

- Eg : Town Improvement Trust, Urban Development Authorities, Water Development Authorities,Pollution Control Boards etc

- Are either Statutory Bodies or can be created by Department Executive Resolution

- Are not subordinate to Municipal Bodies & act independently in functions allotted to them

Topic : Directly Elected Mayors

| 2nd ARC | Extensively discussed this topic and recommended Directly Elected Mayors with fixed tenure of 5 years |

| 2016 | Shashi Tharoor introduced Private Member Bill to introduce Directly Elected Mayors |

Present System

- Chairperson/Mayor in urban local government in most States enjoys primarily a ceremonial status. In most cases, the Commissioner, appointed by the State Government, has all the executive powers.

- Presently, there is not a uniform system for election of Mayors.

- In most major States, the Chairperson is indirectly elected by the elected Councillors.

- In Madhya Pradesh, Tamil Nadu and Uttar Pradesh , Chairperson is directly elected by the voters of the city.

- Term of Mayor isn’t uniform in whole country either

- 5 years in Kerala, Rajasthan, Tamil Nadu etc

- 1 year in Assam, Delhi, Haryana etc

- 2.5 years in Gujarat and Maharashtra

Examples from other Cities

- Mayors of New York and London are popularly elected by direct vote every four years.

- Mayor of Toronto is elected by direct popular vote once in three years.

In almost all these cities, the city government is a powerful institution with very real and effective role in the management of most aspects of the city

Various Contexts to decide whether we should adopt system of directly elected Mayors or not

1 . Stability

| Indirectly Elected | System prone to horse trading |

| Directly Elected | Fixed tenure and cannot ordinarily be removed from office by the Councillors |

2. Accountability

| Indirectly Elected | Held accountable by Councillors for all decisions |

| Directly Elected | Abuse of authority by the Mayor with a fixed tenure cannot be easily checked. |

3. Cohesion

| Indirectly Elected | No logjam between the Council and Executive Mayor. |

| Directly Elected | It is possible that the Mayor and a majority in the Council may belong to two different parties. This may lead to lack of cohesion causing delays and even paralysis. |

4. Representation

| Indirectly Elected | When a Councillor elected to represent a ward is elected as the Mayor indirectly, often it is difficult to enlarge his/her vision for the whole city. |

| Directly Elected | Direct popular mandate gives the Mayor the legitimacy to represent and speak for the whole city. |

5. Leadership Development

| Indirectly Elected | |

| Directly Elected | In the pre-independence era, great freedom fighters Chitta Ranjan (CR) Das & Netaji Subhas Chandra Bose were Mayors which proved stepping stone in becoming National Leaders Therefore direct election of the Mayor, is an important source of recruitment of talent into public life and leadership development. |

Considering above Pros and Cons, 2nd ARC recommended that it is desirable to choose the Mayors/Chairpersons through popular mandate in a direct election.

Other suggestion – Instead of directly electing Mayor, Indirect election in which members of Council elects Mayor (as is the present case) but all the Executive Powers can be vested in Mayor can also be considered (instead of Municipal Commissioner) . This will be more in line with our Parliamentary Government at State and Center level as well.

District Planning Committee

- Under provisions of Constitution, All districts have to constitute District Planning Committee

- Function : To consolidate plan prepared by Panchayats and Municipalities for District as whole

- State

Legislature can also make provisions for

- Composition of Committees

- Manner of election of members of such committees

- Manner of election of Chairperson

- 4/5 members should be elected from Panchayats and Municipalities in proportion of Rural and Urban population

- Chairperson to forward development plan to state government

Metropolitan Planning Committee

- All Metropolitan Areas to constitute Metropolitan Planning Committee

- Functions : To consolidate plan prepared by Panchayats and Municipalities for area as whole

- State

legislature can also make provisions for

- Composition of Committees

- Manner of election of members of such committees

- Manner of election of chairperson

- 2/3 members should be elected from Panchayats and Municipalities in proportion of rural and urban population

Discussion : Issues with Panchayati Raj Institutions (ie Rural and Urban both)

Even after the passing of the 73rd and 74th Constitutional Amendments, the transfer of funds, functions and functionaries (3Fs) has been nominal in most States with notable exceptions such as Kerala.

- Lack of Finance : Discussed below in detail

- Functions not devolved : Although functions of Union & state are clearly defined in 7th Schedule but that of Panchayati Raj Institutions are in Schedule XI & Schedule XII with option given to States to devolve these functions at their will. 2nd ARC Suggestion to remove this anomaly,

- Seventh Schedule should be amended by adding one more list of Local Governments & define functions to be performed by Panchayati Raj Institutions in 7th Schedule itself.

- There is an acute shortage of skilled staff in Panchayati Raj Institutions .

- Programmes to give proper training to employees of Municipalities can be answer .

- Restructuring of Bureaucracy keeping in view the requirements of Third Rung of Government is long overdue

- Central Programs like Smart Cities Program which mandates the creation of special purpose vehicles (SPVs) for Smart Cities which encroaches governance area of Municipalities

- Existence of Parastatals : Parastatals are institutions like District Rural Development Agency (DRDA), District Health Society (DHS) etc formed for delivery of specific services. Activities performed by many of these organisations are in the matters in 11th & 12th Schedule and their separate existence with considerable fund and staff , is an impediment to effective functioning of local government .

- Lack of credible data at city level on jobs, investments or tax collections. Hence, well informed policy cant be formed

- Election expenses and code of conduct to be better regulated and more powers should be given to the State Election Commission to do the same. Most of the Municipal Elections get rigged

Fodder : February 2016 – Municipal Corporation of Delhi (MCD) ran out of funds to pay salaries to its staffs. As a reaction, sanitation workers went on strike which created conditions of uncleanliness on Delhi roads.

Discussion : Financial Crunch of Municipalities

Main Committees regarding this

- 14th Finance Commission

- 2nd ARC

- Insufficient local revenue generation was also highlighted by Economic Survey 2017-18 as ‘Low Equilibrium Trap’, local bodies appear to be not collecting revenues from taxes to the extent they can

Mention these in answers.

Data to substantiate financial crunch of Municipalities

| India | Europe | |

| Local Government Expenditure out of Total Expenditure consisting Union, State & Local | 7% | 24% |

Issues with Municipal Finance

- Improper Devolution of Taxes : since it wasn’t necessary condition , most of the states haven’t devolved taxation powers.

- Issues with implementation of State Finance Commission (SFC) Recommendations: States don’t accept the recommendations of State Finance Commissions .

- Tied Fund / No Discretion : Major portion of the grants both from Union as well as the State Governments is scheme specific. Panchayats have limited discretion and flexibility in incurring expenditure

- Lack of Data: due to poor documentation of land and property, there is leakage in land tax that can be realised

- Absence of Taxation leading to lesser Accountability : in absence of robust Taxation System at local levels, local government is losing its legitimacy.

Way Forward to increase finances

- Property tax :

- Proceeds of the Property Tax should be given to Municipalities . Municipalities are best suited to collect and use that tax because people of area paying Property tax can hold Municipality accountable to use that tax properly.

- Frequent revision of Property Tax according to Inflation

- Other problems :

- The boundaries of municipal bodies are not expanded to keep pace with the urban sprawl;

- State laws often provide for exemption to a number of categories of buildings such as those belonging to religious or charitable institutions

- Professional tax :

- Increase from 2500 to 12,000 & give this tax to local bodies as has been done by Kerala & TN . Professional tax can be levied by State Legislature or Municipalities but its maximum limit can be decided by Parliament.

- For some cities, Professional tax is the most important source of income after property tax. In the Corporation of Chennai, for instance, it contributes Rs.200 crore annually, half as much property tax.

- Expand Entertainment Tax

- Entertainment tax net to be expanded : cable , net – cafè , boat rides should be included

- Amend Article 285(1) – Union Properties can’t be taxed by State /Local Bodies . 14th Finance Commission recommended that some money should be given in compensation for their loss

- Look for Non Tax Revenue

- Municipalities should look for Non Tax Revenue (as Railways is doing) . Eg : By renting the walls of its buildings to be used for advertisement

- Municipal Bonds

- For the future projects like Smart City etc large investment is needed in the cities. Government is looking towards Municipal Bonds for this

- Documentation of good practices: NITI Aayog can be roped in to keep inventory of local and international good practices and aid in their implementation.

- Land Leasing : Local Bodies have ownership of large chunk of lands. This can be used by Local Bodies to generate funds

- Many cities in China (eg Shanghai) have financed more than half of their infrastructure investment from land leasing

- Value Capture Financing : city governments raise resources by tapping a share of increase in value of land and other properties like buildings resulting from public investments and policy initiatives, in the identified area of influence.