Last Updated: May 2023 (Public Sector Undertakings)

Table of Contents

Public Sector Undertakings

This article deals with ‘Public Sector Undertakings / Enterprises.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

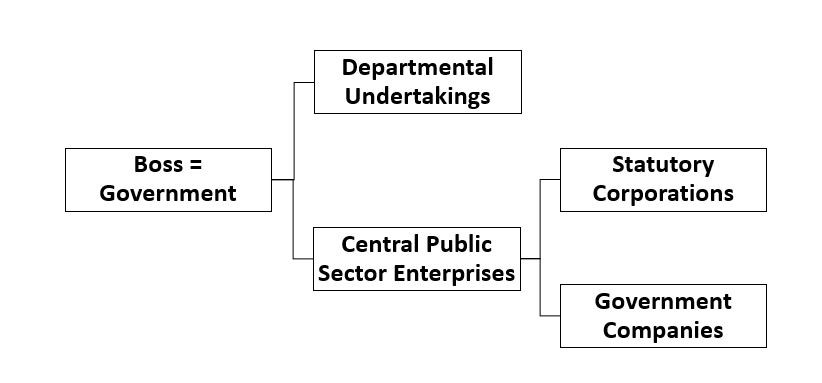

Types of Companies owned by Government

The Government owns three types of companies, and these are

1. Departmental Undertakings

- These are part of the ministry itself.

- E.g., Indian Railways (part of Railway Ministry), Indian Post (part of Postal Ministry).

2. Statutory Corporations

- These are the government-owned companies created by an act of Parliament or state legislature.

- E.g., RBI (created under RBI Act), LIC (under LIC Act), SIDBI, NABARD, NHB etc.

3. Government Companies

- These companies are registered under the Companies Act, and Government holds more than 51% shares.

- E.g., Indian Oil, Coal India, GAIL, SAIL, BHEL, Public Sector banks like SBI, Punjab National Bank etc.

Issues with Public Sector Undertakings / Enterprises

- Since Government is the majority shareholder, there is constant political interference in board appointments and policy decisions.

- There is a lack of innovation, and most of them have failed to change with time. E.g., BSNL and MTNL failed to change with the introduction of 4G internet and hence suffered losses.

- The staff is not consumer responsive.

- Employee unions reduce the efficiency of employees.

- Most of them are overstaffed, impacting their profitability.

As a result, most of the Indian Public Sector Enterprises are loss-making.

Ratna Status of Public Sector Undertakings / Enterprises

The main issue faced by the Public Sector Enterprises is the excessive control of the Government over these companies. Ratna status gives operational flexibility to them like hiring more professionals, acquiring other companies etc., without requiring government approval for every small decision.

There are three type of Ratna Companies

1. Miniratna Companies

- Miniratna status is given to Public Sector Enterprises which have made profits in last 3 years continuously.

- They can invest up to Rs. 500 crore on their own.

- E.g., National Film Development Limited, ONGC Videsh Limited, Airport Authority of India etc. (For complete list, CLICK HERE)

2. Navratna Companies

- Navratna companies have excellent ratings. They must have secured 60 out of 100 marks on various criteria set by the government are given Navratna status.

- They can invest up to Rs. 1000 crore on their own.

- E.g., HAL, NALCO etc. (For complete list, CLICK HERE)

3. Maharatna Companies

- Maharatna companies have a global presence and must be listed on the Indian stock exchange, with at least 25% of shares held by the public.

- They can invest up to Rs 5,000 crore on their own.

- There are 10 Maharatna companies

- BHEL

- GAIL

- Steel Authority of India (SAIL)

- Bharat Petroleum

- Hindustan Petroleum

- Indian Oil Corporation

- ONGC

- NTPC

- Coal India Limited

- Power Grid Corporation of India

Merger and Consolidation of Public Sector Undertakings

- To increase the efficiency of Public Sector Enterprises, they can be merged and consolidated.

- Example :

- BSNL and MTNL were both suffering losses and were unable to compete with Jio, Airtel etc. In 2019, both were merged by offering a Voluntary Retirement Scheme (VRS) to some employees to reduce the staff.

- Earlier, Government also merged Air India and Indian Airlines to rationalize the usage of its assets.

Disinvestment

When the government sells its shares from a PSU to a private company but remains the majority shareholder, it is known as Disinvestment.

Pros and Cons of Disinvestment

Pros of Disinvestment

- Managerial efficiency: If the number of shareholders is more, they will demand more accountability. Accountability will lead to Managerial Efficiency.

- Raising of Resources: Government gets cash for public welfare.

- It helps to improve governance because Government restricts itself to the core governance functions.

- The problem of Overstaffing can be solved because Private Management rationalises employee strength.

- Proceeds of Disinvestment can help in reducing the Fiscal Deficit.

Cons of Disinvestment

- It can create Private Monopolies.

- It will reduce the government’s income (because the government will not get dividends).

- When PSUs get privatized, they are not bound to implement the reservation for SCs, STs and OBCs. Hence, such steps are detrimental to uplifting people belonging to so-called lower castes.

Economic Survey Topic: Privatization and Wealth Creation

- There are many examples from history that can be quoted to prove that privatization/ strategic disinvestment of CPSEs will lead to gains in efficiency.

- In the 1980s, UK PM Margret Thatcher started privatization of the Government companies such as British Telecom, British Airways, water and electricity companies etc. It increased the profitability of those companies.

- During the NDA regime of Atal Bihari Vajpayee (1998-2004), 11 Government companies were privatized, such as Hindustan Zinc, Bharat Aluminium Company Ltd. (BALCO), Maruti Suzuki, etc. After strategic disinvestment (or privatization), profitability and sales of these companies increased significantly because these companies went for Technology Up-gradation and Efficient management practices by Private professionals.

- Adopt Singaporean Model of disinvestment: Many of the CPSEs are profitable, but their shares have generally underperformed in the market. Hence, the survey proposes the Singaporean Model of Disinvestment.

- In 1974, Singapore Government set up a holding company named “Temasek Holdings Company” (THC) and transferred its shares of PSUs to THC. THC was manned by professionals and had complete autonomy, which carried out the process of privatization with great efficiency.

- Economic Survey has suggested that the Indian Government should constitute a Holding Company just like Singapore, for strategic disinvestment (or privatization) drive and transfer its stake in the listed CPSEs to the Holding Company. The entity would be mandated to divest the Government stake in these CPSEs over some time. It will lend professionalism and autonomy to the disinvestment program.

Timeline of Disinvestment in India

| 1991 | The government announced 20% disinvestment in selected PSEs. |

| 1998-2000 | Vajpayee Government classified PSEs into two parts 1. Strategic: arms-ammunition, railway, nuke energy etc. – No disinvestment was to be carried here. 2. Non-strategic: those not in the above category were categorized as Non-Strategic, and disinvestment would be done in a phased manner. To expedite the process of disinvestment in the country, a full-fledged Ministry of Disinvestment was set up. |

| 2005-09 | Due to pressure from the coalition’s left parties, disinvestment was virtually abandoned in any government company. Ministry of Disinvestment was dismantled into the Department of Disinvestment under Finance Ministry. |

| 2009-2014 | – UPA-2 government was formed without the support of the Left Parties. Hence, the government started the work of disinvestment again. – It was decided that all Government companies can be disinvested up to 49%. |

| 2014- present | Modi Government has been carrying out the process of disinvestment at a rapid pace than seen in the case of any other previous government. Department of Disinvestment has been renamed to Department of Investment and Public Asset Management (DIPAM). Its work is divided under four major areas as: 1. Strategic Disinvestment & Privatization 2. Minority Stake Sales 3. Asset Monetization 4. Capital Management |

| 2021 | The government has made two categories i.e. 1. Strategic Sector (consisting Atomic Energy, Space, Defence, Transport, Telecommunication, Power, Petroleum, Coal and other minerals, Banking, Insurance and Financial Services). 2. Non-Strategic (i.e. remaining all sectors). The government has decided to either shut down or privatize all the PSUs in Non-Strategic Sector. In Strategic Sector, the government will keep at least 1 government company in a particular sector (i.e. will either merge or privatize if more than one PSU is present in one sector). |

| 2022 | National Land Monetization Corporation was set up to monetize the surplus land holdings of Central Public Sector Enterprises (CPSEs) and other government agencies. |

Disinvestment under Modi Government

Modi Government has been continuing the process of disinvestment with more vigour than any previous government. They are using the following methods for doing disinvestment.

1 . Initial Public Offering (IPO)

- Initial Public Offering, i.e. listing the Public Sector Enterprise (PSE) in the sharemarket to sell its shares.

2. Exchange Traded Fund (ETF)

- Exchange Traded Fund (ETF) is a security that tracks a basket of assets such as an index fund but trades like a stock on an exchange. The CPSE-ETF tracks the CPSE Index (of PSUs included in the ETF).

- Present Government has used this route twice for disinvestment in PSUs

- In 2014, CPSE-ETF of 10 blue chip PSUs was listed on BSE and NSE.

- 2017 and 2018: Bharat-22, an ETF made up by backing 22 PSUs, was launched by the Government in Nov 2017 & June 2018, mobilizing ₹80,000 cr each time.

3. Institutional Placement Program (IPP)

- Institutional Placement Program (IPP) offer shares only to institutional investors like Mutual Funds, Insurance companies, Pension funds etc.

4. Offer for Sale (OFS)

- In Offer for Sale (OFS), the company sells shares in the share market to institutional and retail investors.

5. Share Buyback

- The government company itself buys the shares from the government, thereby decreasing the government shareholding.

6. Monetizing the land assets

- Government Agencies and Public Sector Enterprises have a lot of surplus land assets. E.g., Railways has 0.51 lakh hectares of land assets lying vacant. The government is trying to monetize these assets either by selling or renting them.

- The government has also set up National Land Monetization Corporation for this purpose.

- Monetizing the Assets aims to start the Infrastructure Asset Monetization Cycle and create new infrastructure with the help of existing infrastructure.

7. Strategic Disinvestment

- It means selling more than 51% of shares to private parties and transferring management control. Hence, the Government’s shareholding becomes less than 49%. E.g., the Government is trying this in the case of Air India, IDBI Bank, Pawan Hans etc.

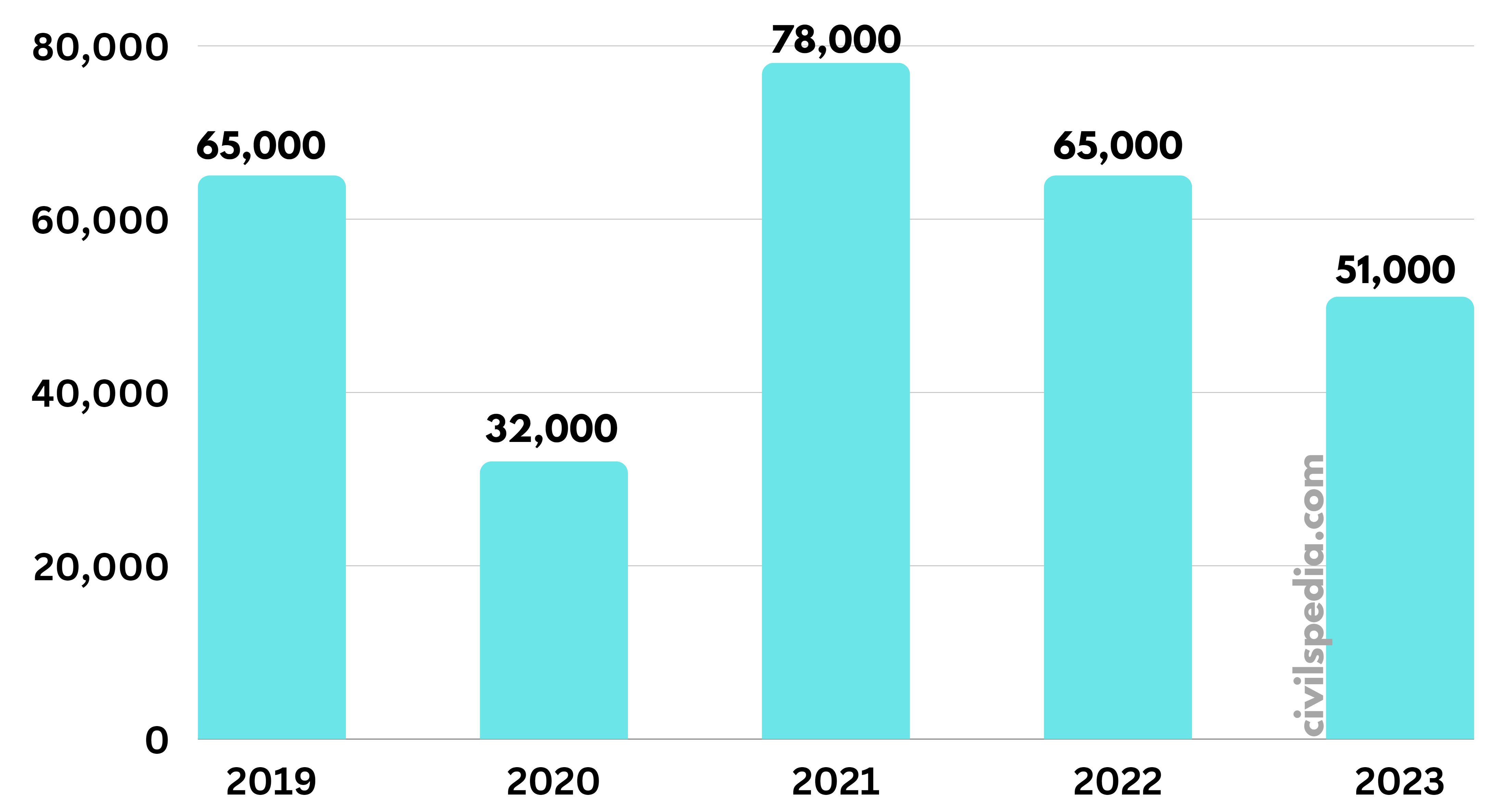

Disinvestment Targets

The proceeds of disinvestment go to the National Investment Fund (NIF), which is part of the Public Account. The government uses the NIF for subscribing to the shares being issued by the CPSE, including PSBs and public sector insurance companies, on a rights basis to ensure 51 per cent government ownership in them, Recapitalisation of public sector banks, Equity infusion in various metro projects etc.