Table of Contents

Special Economic Zones

This article deals with ‘SEZs (Special Economic Zones) .’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

SEZs are geographical areas with economic laws different from a country’s general economic laws. Accordingly, they are delineated duty-free enclaves and shall be deemed foreign territories for trade, duties and tariffs.

India enacted the Special Economic Zones 2005 Act, which provided for establishing, developing and managing the SEZs. The SEZ law also provides for establishing the International Financial Services Centre (GIFT Center) and Free Trade and Warehousing Zones.

Timeline

| 1965 | Export Processing Zone (EPZ) opened in Kandla —> India was the first in Asia to do so |

| 2000 | First SEZ announced to attract larger foreign investment. |

| 2005 | Parliament passed SEZ Act |

| 2018 | Baba Kalyani Report on SEZs published |

| Present | The Government has approved over 400 SEZs, and over 230 have been operational. |

Salient Features

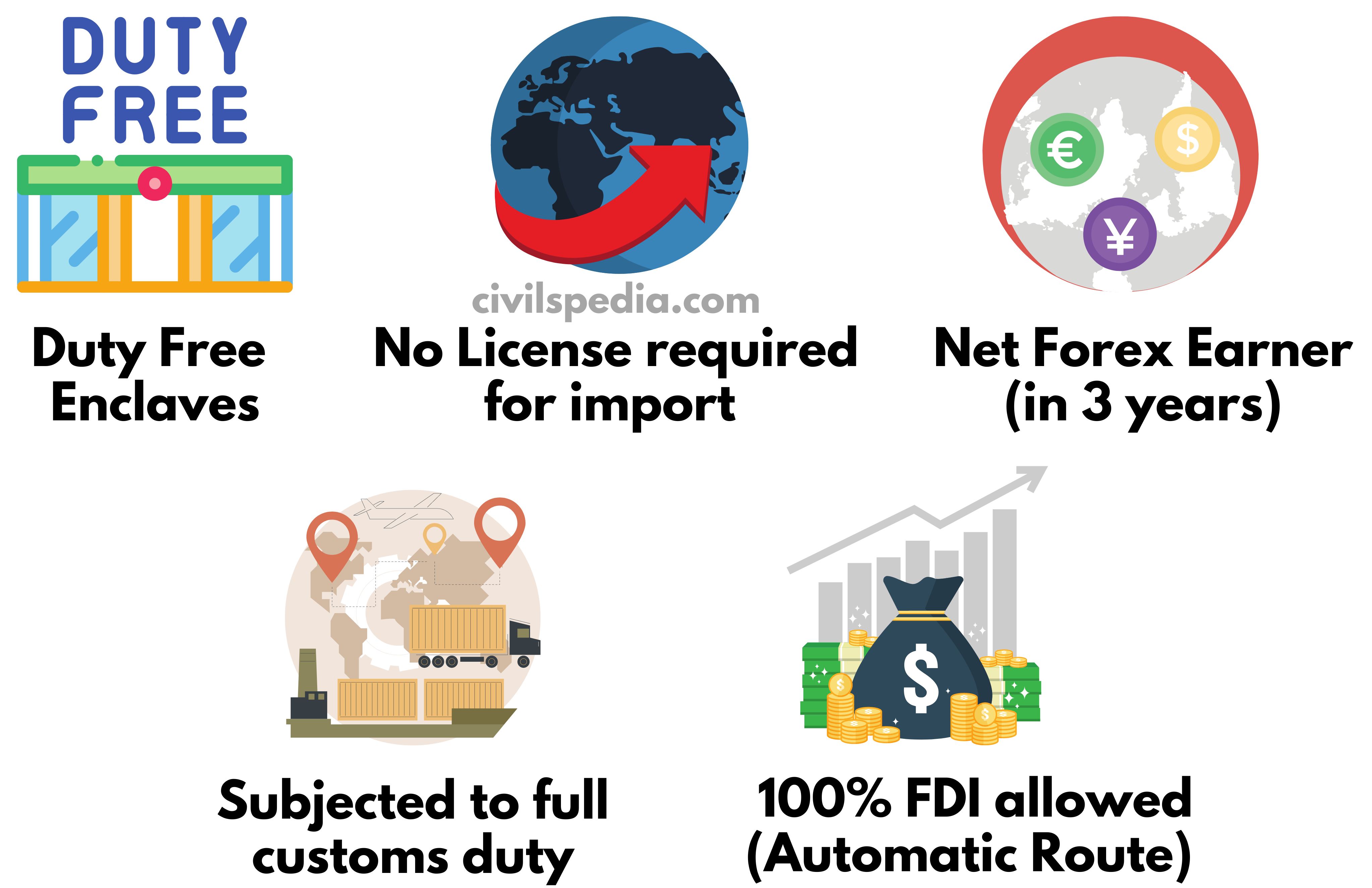

- Duty-free enclaves, i.e. treated as foreign territories for the purpose of trade as far as duties & tariffs are concerned.

- No requirement for a license for imports

- Units must become net foreign exchange earners within 3 years.

- They are subjected to full customs duty & import policy when they sell their products to the domestic market.

- FDI = 100% FDI allowed through Automatic Route.

- Examples: DLF Cybercity (Haryana), Kandla (Gujarat) and Vishakhapatnam (Andhra Pradesh)

Main Objectives of SEZ

- Generate additional economic activity

- Promote exports of goods & services

- Promote investment from foreign and domestic sources

- Create employment opportunities

- Develop Infrastructure facilities

Failed SEZ policy & reasons

1. Lack of Clarity in Policy

- A number of changes are done at frequent intervals. Hence, there is a lack of stability in policy.

2. Virtually no Income tax benefits now

- The income tax benefits were neutralized by introducing the 20% Minimum Alternate Tax (MAT) and the 20% dividend distribution tax (DDT) in 2011-12

3. Wrong location

India chose the wrong locations for SEZ.

- In China, most of the SEZs are located in coastal areas. E.g., Shenzhen.

- On the other hand, in India, many SEZs are located in the interior parts, such as Haryana. Even in some coastal states such as Tamil Nadu, SEZs are not located on the coasts.

4. Free Trade Agreements

- SEZs have access to duty-free imports of manufacturing inputs because, technically, they are considered outside the country’s domestic tariff area. But, with India signing Free Trade Agreements with countries where duties on many products are eliminated or reduced substantially, the advantage accruing to SEZs was negated.

5. Absence of complementary infrastructure

- Absence of complementary infrastructure like port connectivity via roads or railway lines

6. WTO – Countervailing Duty

- Tax incentives provided inside SEZs are considered against WTO principles by other nations, and they impose Countervailing Duties on products from Indian SEZs.

7. Custom duty on sending products to the Domestic Market

Today, it is better for you to manufacture in Thailand and get duty-free access to India than to manufacture in an Indian SEZ and face an import duty barrier. It is a considerable deterrent to Make in India. India should be signing an FTA with all the Indian SEZs first.

8. Land Acquisitions

500 Acre for Multisector and 50 Acre for Single Sector is difficult to acquire. Hence, land acquisition is one of the significant hurdles.

9. Labour Laws

Labour laws inside SEZs are equally harsh as the mainland. They can’t fire workers easily, and the Industrial Disputes Act (IDA) applies if the company employs more than 100 workers.

Case Study: Why are SEZs in China doing better than Indian SEZs?

The SEZ Model in India was inspired by China’s SEZs which were critical instruments of its export-led growth. Reasons for better functioning of SEZs in China are

- Location: Located close to ports from where it can export easily

- Size: China’s zones are few but huge in size. E.g. Hainan, a province in China, is one complete SEZ covering an area of 33,000 sq. km. Indian SEZs are barely 500 -1000 ha in size.

- Laws: China has amazingly business-friendly laws. Corporates must give an employee only one month’s notice before firing him. Contrast that to India, where businessmen must follow a lengthy procedure to fire an employee.

- In China, the thrust of SEZs has been to attract foreign investments and modern technology; in India, the emphasis has been on exports.

Way forward to improve them

- SEZs should be allowed to sell within the country without payment of customs duty on the product.

- Abolition of MAT and DDT (Dividend Distribution Tax).

- Provide relaxed labour laws there.

- Fiscal incentives need to be carefully designed so that it doesn’t violate WTO rules.

Baba Kalyani Report on SEZ (2018)

- Instead of giving them blanket general tax holidays, SEZ units should be given tax benefits linked to how many jobs have been created, how much FDI investment attracted, how many goods/ services have been exported etc.

- SEZs should be converted into Employment and Economic Enclaves (3E).

- Encourage Domestic Electronics Companies in 3Es so that India can end the Chinese monopoly in the Indian electronics market.

- Synergise SEZs with CEZs, DMIC, NIMZ , Mega Food Parks etc .

- Improve connectivity to SEZs.