Labour Reforms in India

This article deals with ‘Labour Reforms in India – UPSC Notes.’ This article is part of our series on ‘Economics’ which is an important pillar of the GS-3. For more articles, you can click here.

The issue with Indian Labour Laws

- Labour is in the Concurrent List of Schedule 7. Hence, both Union and State can make laws on labour.

- India has 44 labour laws at the Central level & more than 150 at State Level. Many provisions in these acts overlap, making it impossible to comply with all. It has led to bribery & inefficiency in Inspector Raj.

- Companies prefer to remain small because if they expand, they come under a net of many regulations, increasing the cost of compliance. Hence, they can’t reap the benefit of economies of scale.

- To bypass these laws, companies prefer to hire via contractors to remain outside the scope of labour laws. Hence, it has increased Contractual labour in India.

- Companies prefer mechanization over employing more persons due to the difficulty in complying with these acts.

- Lack of Social Security: Despite various labour laws aimed at ensuring social security benefits for workers, a significant number of workers in India still lack access to essential benefits such as health insurance, retirement benefits, and unemployment protection.

Hence, under existing laws, both factory owners & workers suffer because factory owners cant comply with Labour Laws & try to evade them, and labour remains in the informal sector.

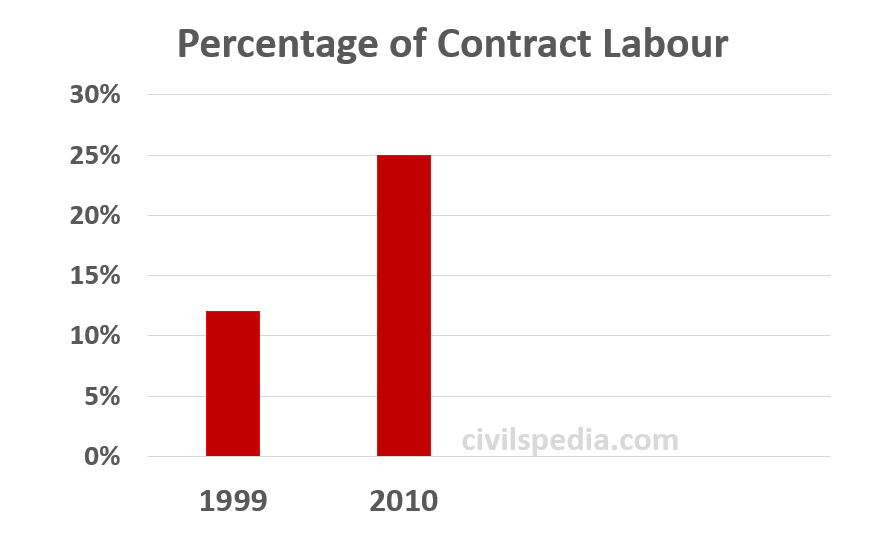

Side Topic: Rise of Contract Labour in India

- Companies that employ more than a certain number of employees come under many regulations. To avoid this, companies prefer to hire via contractors as these employees are considered employees of the contractor, and the firm stays small enough to be exempt from labour law.

- The number of Contract Workers in India has increased at a fast pace. In 2010, 25% of the total workers in India were contract workers.

Hiring via contractors is not an ideal solution for the firms due to the following reasons

- It costs more to hire via contractors (15% more expensive, according to the Indian Cellular Association).

- Contract workers don’t have loyalty to the firm.

- Contract workers don’t accumulate “firm-specific human capital” because contractors keep on changing their postings.

What kind of Labour laws are needed?

- A balance between Labour and Employers’ Interests is the need of the hour.

- Market evangelists opine that employers should have the power to hire and fire, and there should be no regulation by law. The free market principles and demand and supply should decide the wages and other conditions. But, Government is not ready to completely hand over the control of terms and conditions of employment to the employers.

- Labour markets need to be regulated by law much more than goods markets because workers are not commodities; they are human beings and citizens, and individual workers are also the weaker party in any employer-employee relationship.

- Hence, the Government of India is equally concerned with protecting the interest of workers and that of the management.

Side Topic: Race to Bottom

- It refers to an economy’s tendency to provide minimum security/protection to its workers.

- Reason: Competition between Countries to attract MNCs to the setup manufacturing base in their country. In such a situation, MNC will set up a base in the economy with a minimum compliance cost.

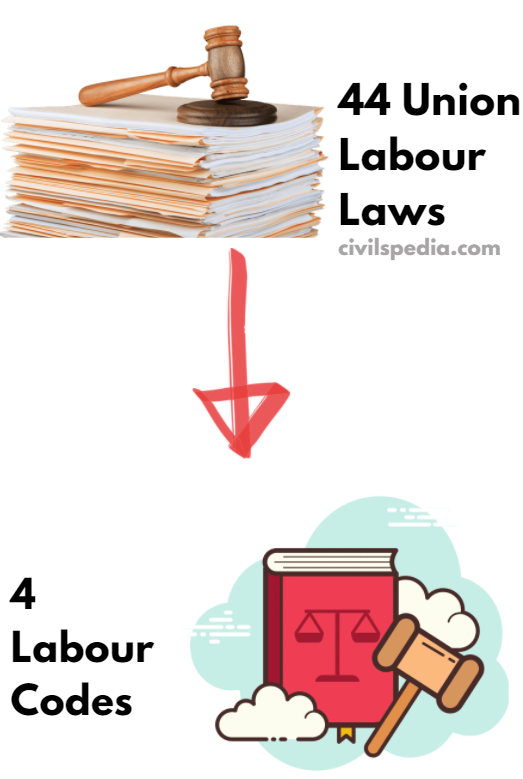

New Labour Codes

The Government created 4 labour codes instead of 44 Union Labour Laws i.e.

- Code on Wages, 2019

- Industrial Relations Code, 2020

- Code on Social Security, 2020

- Occupational Safety, Health & Working Conditions Code, 2020

The new codes are in line with shifting labour market trends and the welfare needs of unorganized sector workers, including the self-employed.

1. Code on Wages

- The wage Code is based on recommendations of the 2nd National Commission on Labour.

- It consolidates all laws relating to wages.

- The code will apply to all industries, trade, business, manufacturing or occupation, including government establishments.

- The Wage Code has introduced Statutory National Minimum Wage for different geographical areas. Hence, State Government can’t fix the minimum wage below the National Minimum Wage for that area.

2. Industrial Relation Code

- The requirement of government permission before layoff has been increased to workers employing more than 300 (earlier 100).

- To form a trade union, 10% of the workers must join it.

- Removed the need to give one month’s notice before removal if the company employs more than 50 workers.

3. Code on Social Security

- It will cover every worker, whether they belong to the organized or unorganized sectors.

- Further, the Central Government can notify that this code applies to any other establishment.

- Gratuity is to be payable to the employees upon termination if the employee is associated with the organization for at least 5 years.

- It proposes National Social Security Council (NSSC), chaired by the Prime Minister.

Note: Earlier, almost 90% of the current workers were not covered under any social security.

4. Occupational Safety Code

- It applies to factories with at least 10 workers (using power) and 20 workers (if not using power).

- Annual health checks are to be made mandatory in factories.

- National Occupational Safety Advisory Board to recommend standards on related matters.

- The code empowers the respective State Governments to exempt any new factory from this code to generate employment and economic activity in the sector.

Will Labour Reforms prove to be magic wand to propel Employment Intensive Growth?

Labour reforms will help to create jobs, as mentioned in the discussion above.

These Labour Reforms are desirable conditions but are not going to guarantee employment-intensive growth. A large number of other things are also required.

Companies from China, where wage levels are increasing, will move to India not only because of Labour Reforms or Low Wages but along with that they need other things as well.

- Skilled Labour: India will have to invest in Skilling the workforce.

- Infrastructure: For fast movement of raw materials & finished products.

- Taxation Policies: Governments’ Taxation policies must be attractive enough for foreign manufacturers to set up manufacturing units in India.

- Upgradation of Supply Chain Logistic Management.

Schemes of the Ministry of Labour

1. Shramev Jayate Karyakaram

This scheme has various components

1. Shram Suvidha Portal

- To promote self-certification.

- Under the scheme, Labour Identification Number (LIN) is given to companies.

- The Portal also allows the companies to file online compliance for labour laws.

2. Transparent Labour Inspection Scheme

- Random selection of Units for inspection

- Inspection Report has to be mandatorily uploaded to the Portal within 72 hours of the inspection.

3. Universal Account Number (UAN)

- It is a single Employee Provident Fund (EPF) Number.

- A Provident Fund account is portable if an employee changes companies. Earlier, on changing jobs/companies, an employee would have to open a new EPF Account.

4. Apprentice Protsahan Yojana

- Reimbursing 50% of the stipend paid to apprentices during their first two years of training.

2. Atma Nirbhar Bharat Rozgar Yojana

- If a firm has up to 1000 workers, then Government will contribute 12% (of workers) and 12% (of employer) (i.e. 24%) in EPFO for new workers.

- If the firm has more than 1000 workers, then Government will pay 12% (of workers) only.

Side Topic: Contributions to EPF

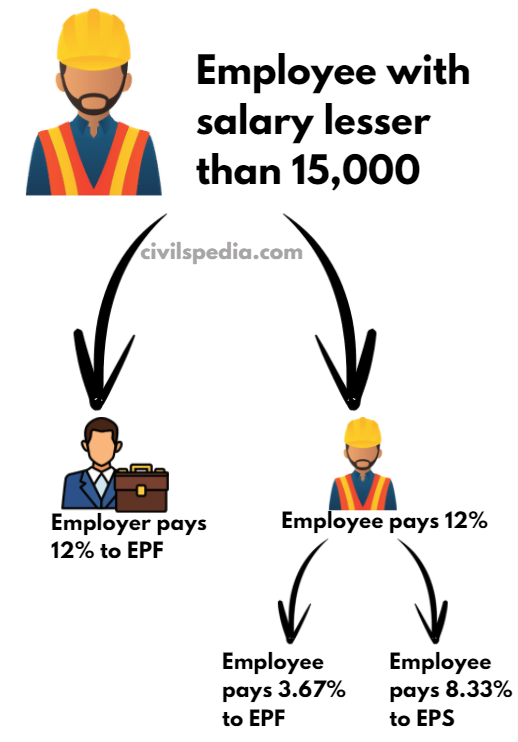

Under the law, if a company is employing a worker at a wage below ₹15,000, under that condition, the employer and employee have to mandatorily make the following contribution to Employee Provident Fund (EPF) and Employee Pension Scheme (EPS). Due to these contributions, employers prefer to give informal jobs to the employees.

3. Pradhan Mantri Shram Yogi Mandhan (SYM)

- It was announced in 2019.

- Under the scheme,

- The beneficiary will get a pension of ₹3,000 per month.

- Beneficiaries of the scheme include workers working in the unorganized sector having monthly salaries below ₹15,000.

- The pension will start once they attain the age of 60.

- To get the benefits, the beneficiary will have to make a monthly contribution of ₹55 from the age of 18 or ₹100 from the age of 29.

4. e-Shram Portal

- The Labour Ministry started this Portal in 2021 for Unorganized Sector Workers.

- The Portal is the first-ever national database for unorganized workers in India, containing the name, Aadhar ID, occupation, address, educational qualification etc.

- The workers who register get Universal Account Number (UAN).

- Under the scheme, the workers must register on the e-Shram Portal. In return, Government gives a card, and workers become eligible for the Pradhan-Mantri Suraksha Bima Yojana benefits.

- Rs. 1 lakh for partial disability

- Rs. 2 lakhs for accidental death

As of 31 December 2022, over 28.5 crore unorganized workers have been registered on the e-Shram portal.

5. PM Street Vendor’s Atmanirbhar Nidhi Scheme (PM SVANidhi)

- PM SVANidhi Scheme was launched in 2020 to empower street vendors by offering loans of up to Rs. 10,000 with a one-year tenure and free onboarding on digital payment platforms.

- Beneficiaries are also eligible for the second tranche of loan up to `20,000 with 18 months tenure after timely repayment of the first tranche.

6. National Carrier Service

It aims to bridge the gap between

- Workers who need jobs and Employers who want to hire them.

- People who are seeking career guidance and training and those who can provide the counselling and training.

7. PENCIL

- PENCIL Portal is an electronic portal to combat the menace of child labour and trafficking in India.

8. Rehabilitation of Bonded Labourers

- Labour Ministry provides financial assistance for the rehabilitation of rescued bonded labour.