Table of Contents

World Trade Organization

This article deals with the ‘World Trade Organization .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Chronology

| 1944 | – Bretton Woods conference was held. – They wanted to make ITO (International Trade Organisation), but it didn’t happen. |

| 1947 | – GATT (General Agreement on Trade & Tariffs) was established. – It was criticized for being ‘RICH MEN’S CLUB’. |

| 1947 to 1980s | – Various rounds of negotiations kept on happening during this period. |

| 1986 | – Uruguay Round started. – Service & Intellectual Property rights related topics were also included in the debate. – In 1993, everyone agreed on it. |

| 1994 | – In Marrakesh, Morocco, all nations signed the agreement & WTO was established. |

| 1/1/1995 | WTO came to being 1. Developed nations have to make laws in compliance with WTO rules within 1 year. 2. Developing nations (like India) have to make such laws within 5 years. 3. The least Developing countries (like Zimbabwe/ Somalia) were given a time limit of up to 10 years (till 2006). |

| 2001 | Doha Round started: a new round of trade agreement begin known as Doha round |

| 2013 | Bali: 9th Ministerial conference |

| 2015 | Nairobi Conference (10th) |

| 2017 | Buenos Aires Conference (11th) |

| 2020 | Astana Conference (Kazakhstan) |

| 2022 | As of now, WTO has 164 members (latest member: Afghanistan) |

Objectives of WTO

- To reduce tariff and non-tariff barriers.

- To eliminate discrimination in trade.

- To facilitate a higher standard of living.

- Stimulate economic growth and employment.

- Contribute to peace and stability.

- Give stronger voice to smaller nations.

- Establish rule-based order as rules reduce arbitrariness and opportunities for corruption.

- Cut the cost of doing business internationally.

- To ensure sustainable development in trade policies.

Organizational Structure of WTO

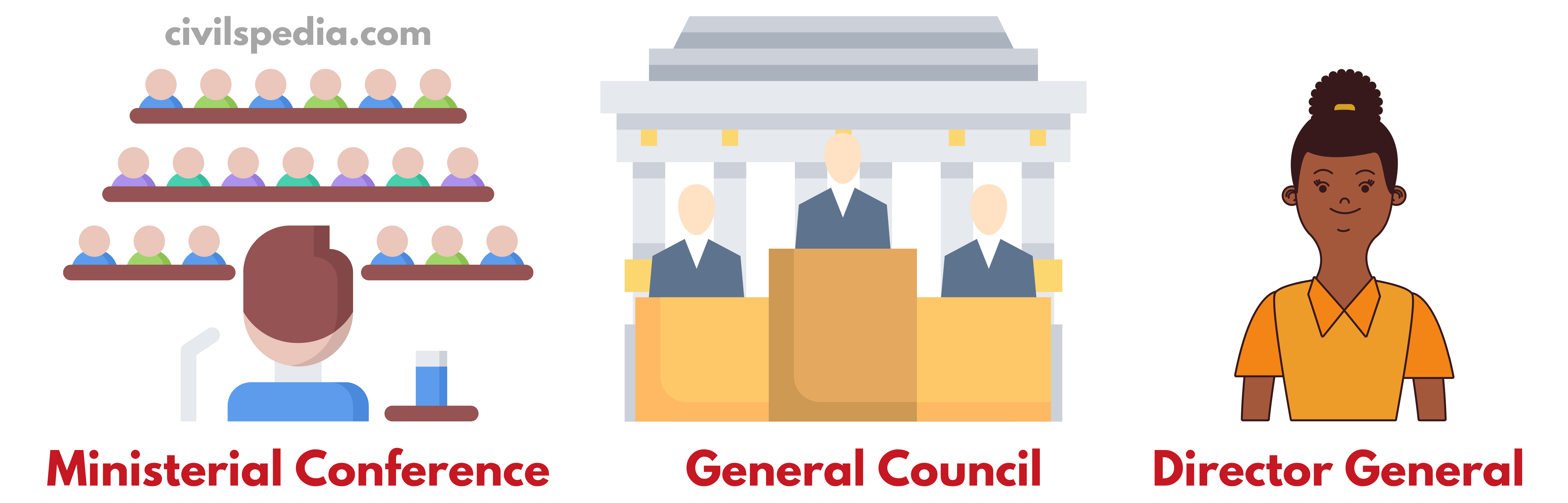

1. Ministerial Conference

- It is the supreme decision making body of the WTO.

- It (generally) meets once every two years to deliberate on trade agreements.

- The last ministerial conference was held in Geneva in 2021.

2. General Council

- It is the day to day decision making body of the WTO.

- It meets regularly in Geneva and implements the decision of ministerial conferences.

- It has a representative from each member state.

- Below the general council, there are Committees on individual agreements and annexes like anti-dumping, subsidies & countervailing measures (SCM) etc.

3. Director-General

- Present Director-General of WTO is Ngozi Okonjo-Iweala (having dual citizenship of Nigeria and USA) (she is the first female, first African and first US citizen to hold this post).

- Director-General heads the Secretariat at Geneva.

Dispute Settlement under WTO

- WTO has Dispute Settlement Body (DSB) that settles trade disputes among nations.

- WTO procedure requires 60 days of consultations among disputants to resolve the dispute, failing which dispute panel is set up.

- DSB’s conclusion can be challenged in the Appellate Body.

- The erring country is directed to change its laws to streamline them within a reasonable time & if the country doesn’t correct them, the complainant country can take retaliatory measures. But there isn’t any punishment for losing a country & practically poor countries cant retaliate against rich nations.

Trading Principles of WTO

1. No Discrimination

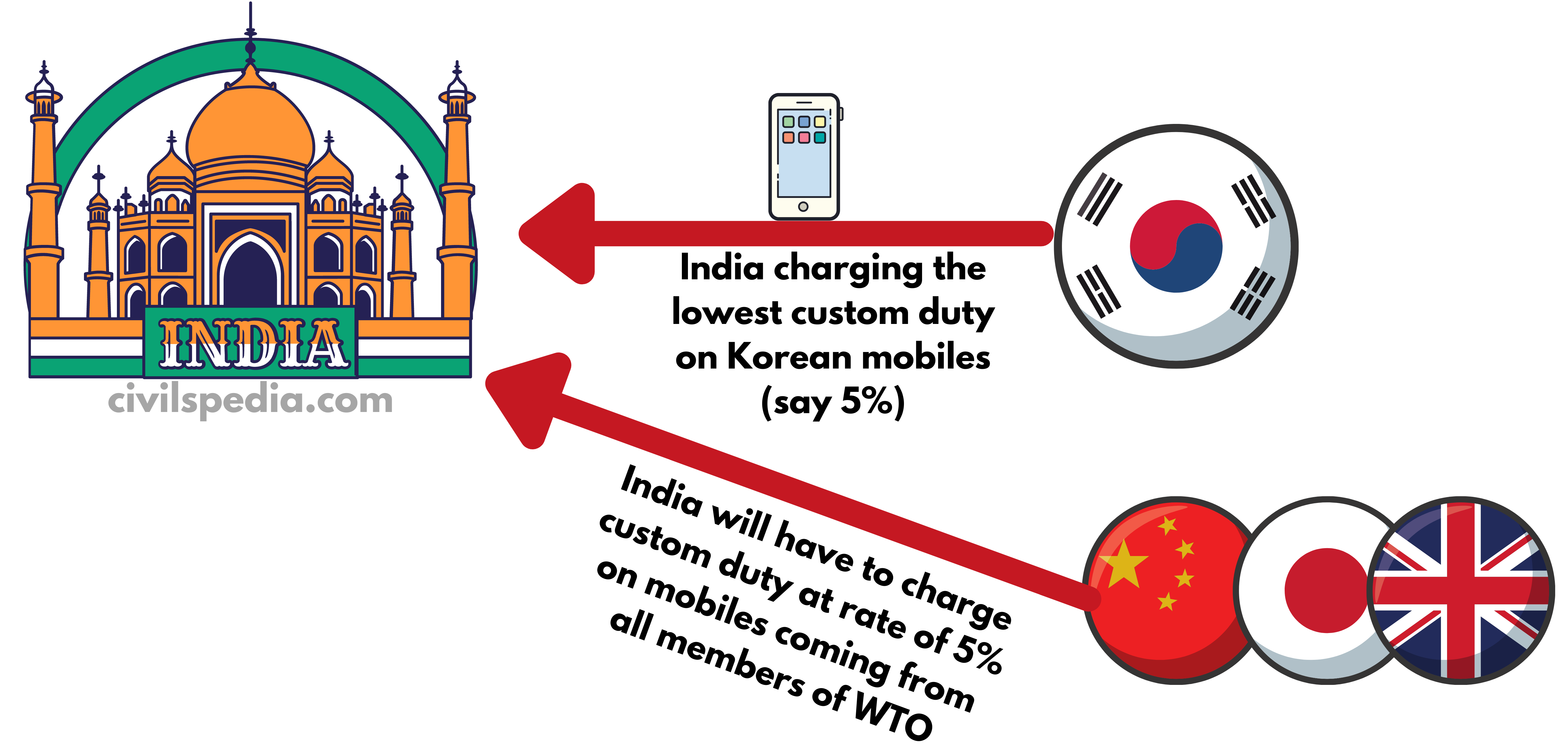

- Every member nation of the World Trade Organization is MFN (most favoured nation), i.e. if a country grants special favour to one nation, India will have to give special favour to all nations.

- The member country will have to treat local & foreign goods equally (i.e., say India can place tariffs when good from other countries is entering India, but after entering India, Indian good and good from other country cant be discriminated against in the market).

- Exceptions to this principle include

- Group of nations can form Free Trade Agreement (FTA).

- Country can give special favours to least developed nations (like duty-free quota-free access).

- A country can impose high import duty/ prevent the entry of goods from a nation doing unfair trade practices (like dumping).

2. Free trade

- WTO aims to bring down barriers in international trade by abolishing high custom duties, quotas, subsidies, red-tapism, artificial exchange rates etc.

3. Fair Trade

- WTO agreements prevent unfair dumping, subsidies, government procurement etc.

4. Member Driven Organisation

- Members take all decisions with the principle of One Member, One Vote at Ministerial Conferences.

Side Topic: Most Favoured Nation

Suppose India is charging a 5% Import Duty on mobiles from South Korea, i.e. in the mobile segment, India is offering the best deal to South Korea by charging just 5% duty. According to the Principle of Most Favoured Nation, India will have to give the same deal to all WTO members, which India is giving to the most favoured nation. It implies that on mobiles coming from China, India will charge 5% duty.

Pakistan Issue

- In 1996, India gave MFN status to Pakistan. But Pakistan didn’t reciprocate to Indian gesture.

- In Feb 2019, after Pulwama Attack, India withdrew the MFN status given to Pakistan and hiked the customs duty by 200% on goods originating from Pakistan.

Side Topic: Tariff and Non-Tariff Barriers

Tariff Barrier

- When government imposes very high tariffs/taxes on foreign products to protect their domestic market.

- It has been opined by various economists that Trade Barriers doesn’t correct trade imbalances of country. It just shifts trade imbalance to other countries. E.g., What the US was importing earlier from China will now be imported from India or Vietnam.

Non-Tariff Barrier

- In Non-Tariff Barriers, although there aren’t any tariff barriers, policies are made to make it hard for foreign players to compete with domestic players.

- E.g.

- Government putting tender that only domestic companies can compete.

- Not giving clearances easily on ports

- Setting export quality norms so high that other countries can’t export

- Providing subsidies to domestic producers

Case for and against Free Trade

Case for free trade

What are the reasons for the government not to interfere with trade?

There are three arguments in favour of free trade.

1. Free trade & efficiency

- Free trade promotes efficiency & avoids duplication of efforts

2. Comparative Advantage Theory

According to David Ricardo’s Comparative Advantage Theory

- Produce what you have comparative advantage and import other things.

- This system leads to better efficiency and output.

3. Economies of scale in production

- Develop particular industry in one country & let it trade with the bigger market of the world. This production on a large scale will lead to economies of scale.

4. Political argument

- A world that trades freely is a world that is at war less often.

The case against Free Trade

- Beggar thy Neighbour Policies: Countries do this, especially by devaluing their currency.

What India gained after joining WTO?

- Indian exports boomed due to low barriers. Indian exports have increased from $33.22 billion in 1998-99 to more than $100 billion.

- India won a multilateral dispute against the USA, which was otherwise impossible.

- India adopted international standards in IPR due to TRIPS. As a result, foreign flow increased in R&D.

- Textile boomed because MFA scrapped & ATC adopted under WTO.

Important Agreements

There are 19 agreements in WTO (we will discuss important ones)

1. Agreement on Agriculture (AoA)

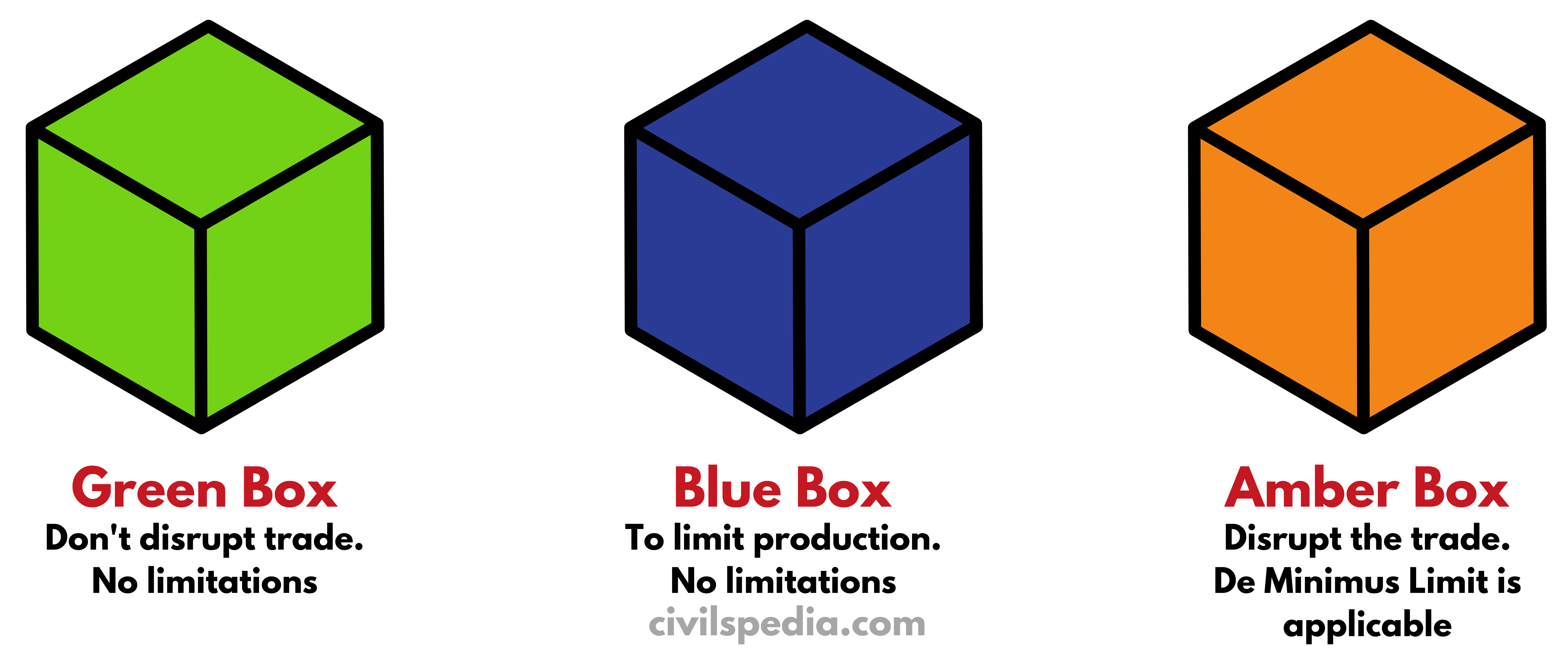

Under the Agreement on Agriculture, subsidies are divided into three categories, and member countries have been directed to cut down the Amber Box subsidies.

These three boxes of subsidies are

1. Green Box Subsidies

- Subsidies that don’t disrupt trade balance OR cause minimum damage to the trade balance.

- E.g. agriculture R&D, extension services, insurance money etc.

- Limits under AoA: Nothing, and Governments can give as much as they want.

2. Blue Box Subsidies

- Blue Box Subsidies aim to limit production.

- These subsidies don’t increase with production. For example, subsidies linked with acreage or number of animals.

- Few countries like Norway, Iceland, Slovenia etc., use the blue box subsidies.

- Limits under AoA: Nothing.

3. Amber Box Subsidies

- Amber Box Subsidies disturb trade balance like subsidies on fertilizers, seeds, power, irrigation and Minimum Support Price.

- They distort the trade balance because they encourage excessive production. Hence, a given country’s product becomes cheaper than others in the international market.

- Limits under AoA: De Minimus Limits are imposed on them. These are the minimal amounts of Amber box subsidies permitted by WTO, even though they distort trade.

| Type of Country | De-Minimus: Amber box subsidy quota |

| Developed | 5% of agriculture production in 1986-88 |

| Developing | 10% of agriculture production in 1986-88 |

| Least developed | Exempted |

- This system impacts India because these subsidies are calculated with 1986 as a base when India’s production levels were low. Along with that, Inflation is unaccounted in the calculation. As a result, India’s 10% subsidy is much lesser than USA’s 5% subsidy. In 2017, Bali Package was signed, under which developing countries, especially India, were allowed to breach the 10% limit until the solution to this problem was reached.

Critique of AoA

- The developed countries use the Agreement on Agriculture under the WTO framework as a tool to dismantle the public procurement infrastructure of developing countries. Developed countries such as USA and Canada produce food grains in large quantities, and they want to turn developing countries into a market to dump their surplus grains while converting the developing countries to produce tropical products needed by them at low prices.

- ‘Reference price’ for calculating support was the 1986-88 average world price of a crop which they converted to rupees at the then-prevailing ₹12.5 per dollar exchange rate.

2. Trade Facilitation Agreement (TFA)

Trade Facilitation Agreement (TFA) is aimed at overhauling the custom clearance by taking the following steps

- Facility to apply and pay fees/taxes online

- Single window for the document check

- Fast clearance for perishable goods

- No middleman/agent needed

- Coordination bodies at national & international level.

All this will lead to expansion in world trade to the tune of $ 1Trillion in World GDP & create 21 million jobs.

But TFA is applicable to the merchandise sector only. Since India has expertise export of services, the government is pitching to extend it to the service sector.

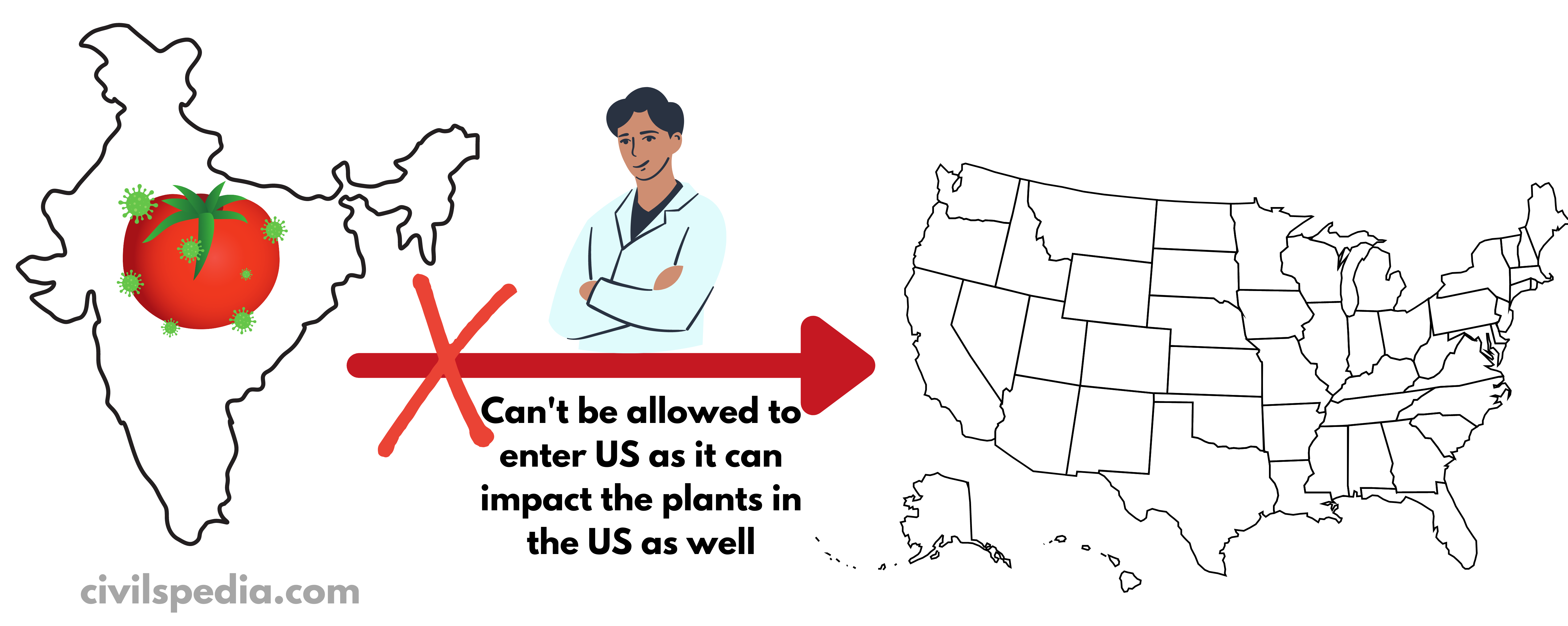

3. Sanitary and Phyto-Sanitary (SPS) Agreement

- Under this, the export of farm or animal products can be banned from a particular country to protect humans, plants & animals.

- Under this agreement, each nation can make its own Quality Control Rules given they are scientific.

- E.g., In 2014, European Union (EU) Trade commissioner banned imports of Indian Alphonso, eggplant & other vegetables due to fruit fly contamination in earlier shipments which can impact the health of plants in the EU.

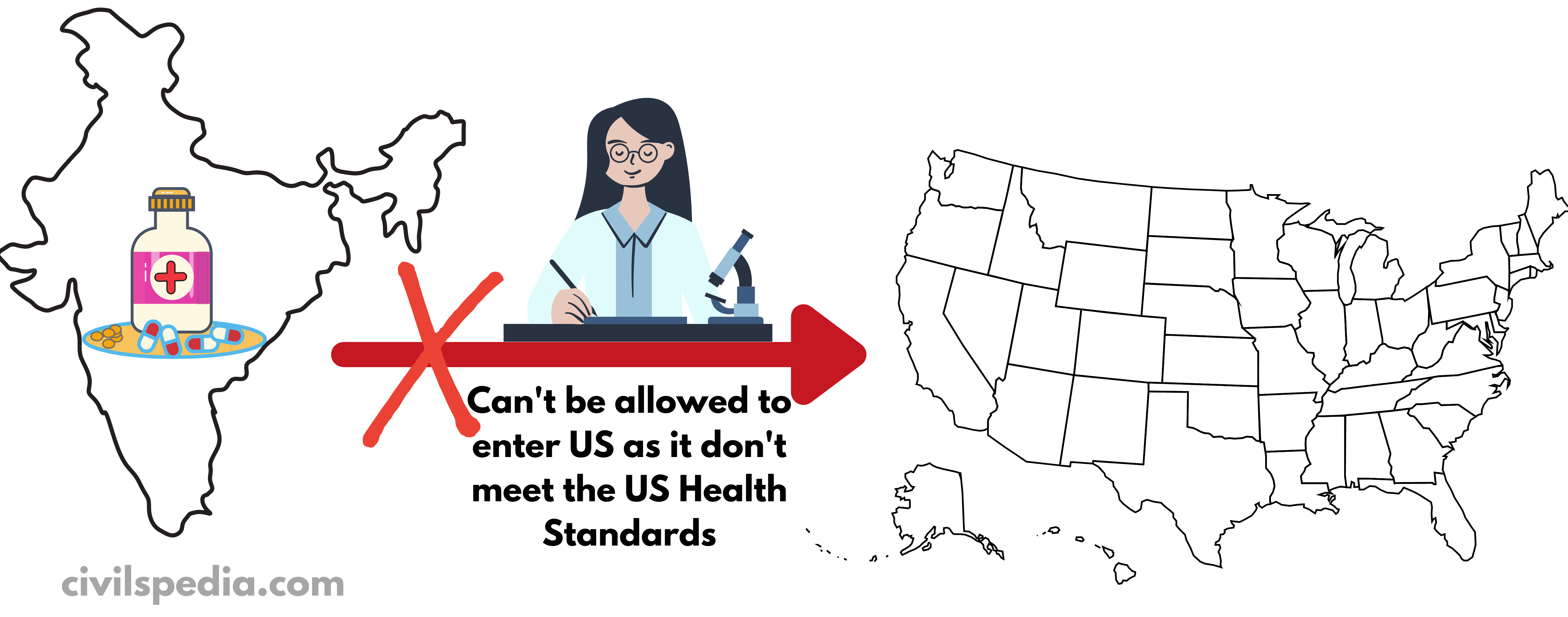

4. Technical Barrier to Trade (TBT) Agreements

- Under the TBT Agreement, the export of any non-farm product can be banned from a particular country if the product is dangerous to health or the environment.

- E.g., the US can ban entry of Indian Pharma Products under this agreement if they don’t meet health standards.

5. SCM (Subsidies & Countervailing Measures)

If the host nation is giving large subsidies to its domestic industries (non-farm), then importing nation can take the following actions

| Red | If China provides a subsidy to its products exported to India, then India has the right to ban the import of such products. |

| Amber | India can also put Countervailing Duty on such items or go to Dispute Settlement Procedure. |

| Green | In this case, India doesn’t take any step against China and let the trade happen without any restriction even if Chinese industry is getting massive subsidies. |

6. GATS (General Agreement on Trade in Services)

It has three main pillars

| Movement of Natural Persons | – Migrant workers can get temporary visas for providing services. – It doesn’t deal with granting permanent visas. |

| Airlines | – Deal with repair, maintenance and reservation of seats in airlines. |

| Telecom Sector | – Government of member country can’t discriminate with foreign players. |

7. TRIPS (Agreement on Trade Related Intellectual Property Rights)

- Intellectual Property Rights (IPRs) include copyright, patents, GI etc.

- The most revolutionary aspect of TRIPS is that it provides product patents instead of a process patents.

- TRIPS gives protection of 20 years for patents, 50 years for copyrights, 7 years for trademarks and 10 years for layout designs.

8. Agreement on Trade Related Investment Measures (TRIMs)

- TRIMs Agreement deals with the investment done by the businesses based in one country in a foreign country. It has the provisions of equal treatment of foreign companies wrt national companies.

9. Other Important Agreements

9.1 Information Technology Agreements

- It aims to eliminate the tariffs on computer-related products.

- India is not part of this agreement.

9.2 Multilateral Agreement on Investments

This agreement gives MNCs the right to establish any business in any country without being discriminated against by being foreign MNC.

Cases against India at WTO Dispute Settlement Body

- India’s Solar procurement under National Solar Mission

- USA filed a case against India, arguing that India’s National Solar Mission gave public procurement preference & subsidy to India-made solar panels, creating a non-tariff barrier for US solar panels. Subsequently, India lost the case and withdrew these barriers in 2017. But, the USA still alleges that India is still giving preference to local manufacturers.

- Ban on American Poultry

- In 2007, India banned the import of US poultry under the provisions of the Indian Livestock Importation Act, 1898 due to the fear of avian influenza/bird flu (H5N1). The USA alleged that these claims had no scientific basis, and the ban was imposed to protect local business interests. In 2016, WTO ruled in favour of the USA. The USA alleges that India is still creating barriers to its poultry imports and hence demanded $450 million compensation from India in subsequent cases filed in 2018.

- Export Incentive Schemes of India

- In 2018, the USA filed a complaint against export incentive schemes of the Indian government viz. (1) Merchandise Export from India Scheme (MEIS), (2) Export Oriented Units (EOU), (3) Electronics Hardware Technology Parks (EHTP), (4) Special Economic Zone (SEZ) and (5) Export Promotion Capital Goods. Under this scheme, India gives tax reliefs and subsidies to its exporters. The argument of the Indian government was based on the fact that they will phase out these schemes after 8 years from and these subsidies and tax reliefs were needed as India is a developing country.

- But WTO ruled against India in 2019 and ordered India to stop such schemes within the next 90-180 days. But India challenged this in WTO Appellate Body

DOHA Round and various Ministerial Conferences

In WTO, negotiations related to trade are taken up in different rounds. E.g. WTO was formed as a result of the Uruguay Round. In 1986, these countries started to negotiate on a specific determined set of things under the Uruguay Round on which the decision was reached in 1993. After that, countries decided to move ahead to take other subjects in order to make the trade even freer. Hence, Singapore Round started in 1996 in which discussion was to be held on investment, government procurement, labour, environmental laws etc. But Uruguay Round had certain shortfalls which started to impact developing countries, and they started to protest. Hence, Singapore Round was scrapped, and negotiations started under Doha Round in 2001. Presently all the negotiations are going under Doha Round

Doha Development Round (DDA) officially began in November 2001 (4th Ministerial). DDA was set up to deal with many deficiencies of WTO significantly impacting developing countries. These include

- Public Stockholding: Developing countries wanted special safeguards & a change of rules relating to public stockholding for food security.

- Introduction of measures to blunt the market power of large firms in the pharmaceutical industry

- Making trade of goods and services easier across national borders

- Freer mobility of labour in global services trade

Principles of Doha Round

1. Single Undertaking

- ‘Nothing is agreed until everything is agreed‘ i.e. the developed countries can’t cherry-pick which parts to prioritize.

- It is the root cause of why the Doha Round is struck.

2. Transparency

- The negotiations have to be transparent.

3. Special & Differential Treatment

- The member countries will take the principle of special & differential treatment for developing & least developed countries into account while negotiating.

India’s stand at Ministerial Conferences

- Export Subsidies: Reduce export subsidies given by developed nations.

- Special Safeguard Measures: USA, Canada, and other developed countries give their farmers 70-80% subsidies. If such produce is exported to developing countries, it can crash the price of agricultural commodities in those countries, negatively impacting local farmers. Hence, India and other developing countries want Special Safeguard Measure (SSM) under which such countries can raise the tariff on agricultural commodities temporarily to deal with the fall in the price of agricultural goods. There is a difference between developed and developing countries over the trigger factor at which SSM can be activated.

- Stockholding: A permanent solution to public stockholding to ensure the continuation of its food subsidies for public distribution programs.

- Re-affirming the Doha Development Agenda (DDA) and supporting the argument that new issues like—global value chain, e-commerce, competition laws, labour, environment and investments should be introduced only after settling all the issues to be discussed under DDA.

Why DDA is facing the roadblock?

The reason is the fight between the developed and developing countries with differing demands

Developed Countries (headed by US , EU, Japan etc) => Bring back the Singapore Issues

- They want a start to negotiations for new trade agendas, including investment, competition policies, government procurement, labour, environment and climate change.

- Developing Countries are against any conclusion of the Doha Round without a clear decision regarding the solution on key existing issues.

Developing Countries (headed by China, India etc)

- They want Doha Agenda negotiations to be completed before moving on to other items.

Consequences of DDA roadblock

Since WTO is not going anywhere and has stuck since decade, nations have started to look towards Regional Trade Agreements (RTAs). These developments have posed a question regarding the future of the multilateral trading system under the WTO.

- With this, it is not surprising if the members no longer value the relevance of WTO & become more frustrated with its process. Consequently, members will be more eager to look for alternate routes outside the WTO, notably via Regional Integration.

- Earlier TPP among the 12 nations (which was scrapped by Trump) and RCEP & TATIP can be understood as a pragmatic response to the DDA roadblock.

- In all, Bilateral Free Trade agreements have increased from 124 in 1994 to 600 in 2015

But neither approach with its inherent discriminatory nature is a substitute for WTO and its strong edifice of a multilateral system of rules based on egalitarian principles and effective dispute settlement mechanism.