Last Updated: May 2023 (Convertibility of Current Account & Capital Account)

Table of Contents

Convertibility of Current Account & Capital Account

This article deals with ‘Convertibility of Current Account & Capital Account .’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Why restrictions on Convertibility?

- Central Bank can’t manage a floating exchange rate regime all the time. Otherwise, Forex reserve will get empty. Hence, quantitative restrictions are placed on the conversion of ₹ to foreign currency.

- There can be two types of restrictions, i.e. on the Current Account & Capital Account.

Current Account Convertibility

- Current account convertibility means the freedom to convert currency for current transactions in terms of outflows and inflows.

- In the case of India, Current Account is fully convertible (since 1994) & there are no quantitative restrictions. It means ₹ is fully convertible into another currency for current account transactions & vice versa is also true.

Capital Account Convertibility

- Full capital account convertibility means :

- A foreign investor can convert any amount of foreign currency to Indian Rupees and invest in any asset in India without any restriction. This investor can also sell the investment without any restriction, convert the resulting Indian Rupee amount to a foreign currency and take it out of the country.

- A Domestic Investor can convert Indian Rupee to foreign currency and invest in any asset abroad without any restriction.

- A Domestic Investor can raise any amount from External Market and convert it into Indian Rupees to invest that amount in India.

- ₹ is not fully convertible on the capital account. But after the S.S. Tarapore Committee (1997) recommendations on Capital Account Convertibility, India has been moving toward allowing full Capital Account Convertibility.

- There are the following limitations on Capital Account Convertibility

- Indian corporates are allowed full Convertibility of up to $ 500 million annually for oversea ventures.

- Individuals are allowed to invest in foreign assets, shares, etc., up to $ 2,50,000 per annum.

Liberalised Remittance Scheme (LRS)

- LRS was started by Government in 2004.

- Under the scheme, an Indian resident (including a minor) is allowed to take out up to $2,50,000 from India either for a current Account or capital account transaction. (e.g. paying for college fees abroad, buying shares, bonds, properties, and bank accounts abroad.)

- Issue: Panama papers allege various Bollywood celebrities used the LRS window to shift money from India to tax havens for tax avoidance.

Debate : Should there be Full Capital Account Convertibility?

There is an ongoing debate that there should be full capital account convertibility.

Arguments in favour of full Capital Account Convertibility

- If the capital account is fully convertible, India can attract more FDI, FPI and ECB to India, creating new jobs & pushing economic growth.

- It will increase the choices for investments– Investors get the opportunity to base their investment and consumption decisions on world interest rates and world prices for tradeable.

- Various committees like SS Tarapore Committee have also accepted this.

Arguments against Capital Account Convertibility

- IMF study says there is no correlation between full Capital Account convertibility & business growth.

- It could lead to the export of domestic savings.

- Companies that would get money in $ via ECB would be returned in $s only. But this is not favourable in times of Exchange rate volatility.

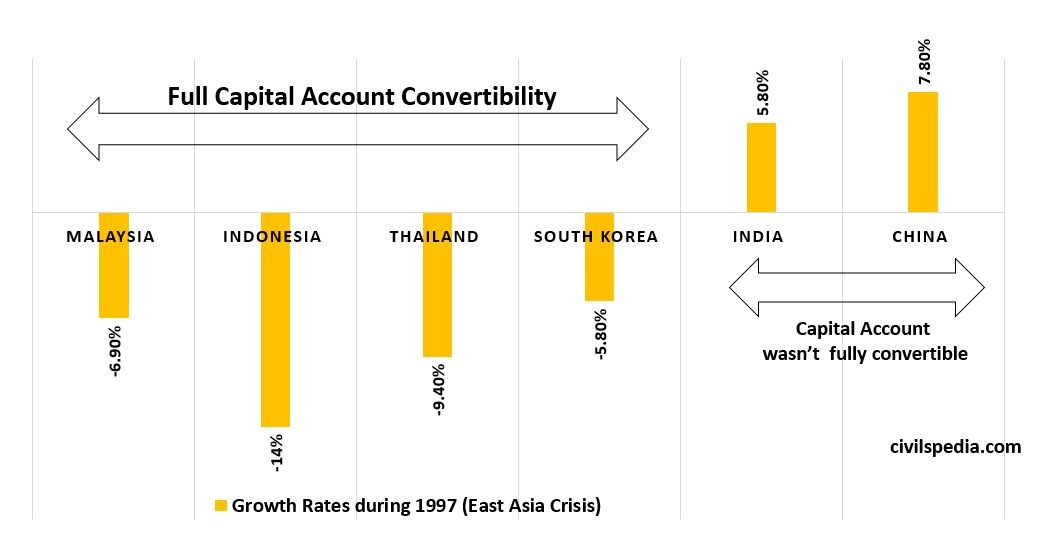

- If our currency falls, the whole system can collapse, as happened in the East Asian Crisis of 1997. India & China survived the crisis because both didn’t have full capital account convertibility.

- Various committees, like HR Khan Committee, have rejected full Capital Account Convertibility.

Side Topic: East Asian Financial Crisis

- Before 1997, All East Asian Economies deliberately kept their currencies undervalued to boost export. (like China is doing now)

- All these countries had full capital account convertibility. Foreign investment was quite high, and GDP growth was in double digits.

- But then came Asian Crisis

- Thailand’s steel & automaker companies filed for bankruptcy. Foreign investors panicked and started to pull out $s from similar companies from all South East Asian Nations. As a result, their currencies & economies collapsed. E.g.: Indonesian Rupiah collapsed from 1$ = 2,000 to 1$ = 18,000 Indonesian Rupiah.

- It led to high inflation culminating in rioting & political instability.

- On the other hand, India and China survived this tumultuous period because their capital account wasn’t fully convertible. Hence, investors couldn’t pull off their investments overnight due to restrictions under Capital Account convertibility.

SS Tarapore Committee (1997)

The recommendations of the committee were as follows

- He was in favour of Full Capital Account convertibility, but he also feared that a crisis like East Asian Crisis could happen in India too. For this, he advised that there should be some conditions before doing that

- Conditions

| Conditions | India’s situation |

| Forex to sustain 6 months of imports | Yes, India has a forex of more than $550 billion (i.e. Can sustain 11 months of imports) |

| Fiscal Deficit of 3.5% of GDP | Target for 2020 is 3.5% (but will be breached due to Corona pandemic induced slowdown) |

| Inflation should be between 3-5% (for 3 years) | Under the new Monetary Policy Framework, it should be contained between 2-6% |

| Bank NPA should be less than 5% | They are above 10% |