Last Updated: May 2023 (Forex Reserves of India)

Table of Contents

Forex Reserves of India

This article deals with ‘Forex Reserves of India .’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Current Status of Forex Reserves of India

- Forex is the external assets that are readily available and controlled by the monetary authority for direct financing of external payment imbalances, for indirectly regulating the magnitude of such imbalances through exchange market intervention to affect the currency exchange rate and other purposes.

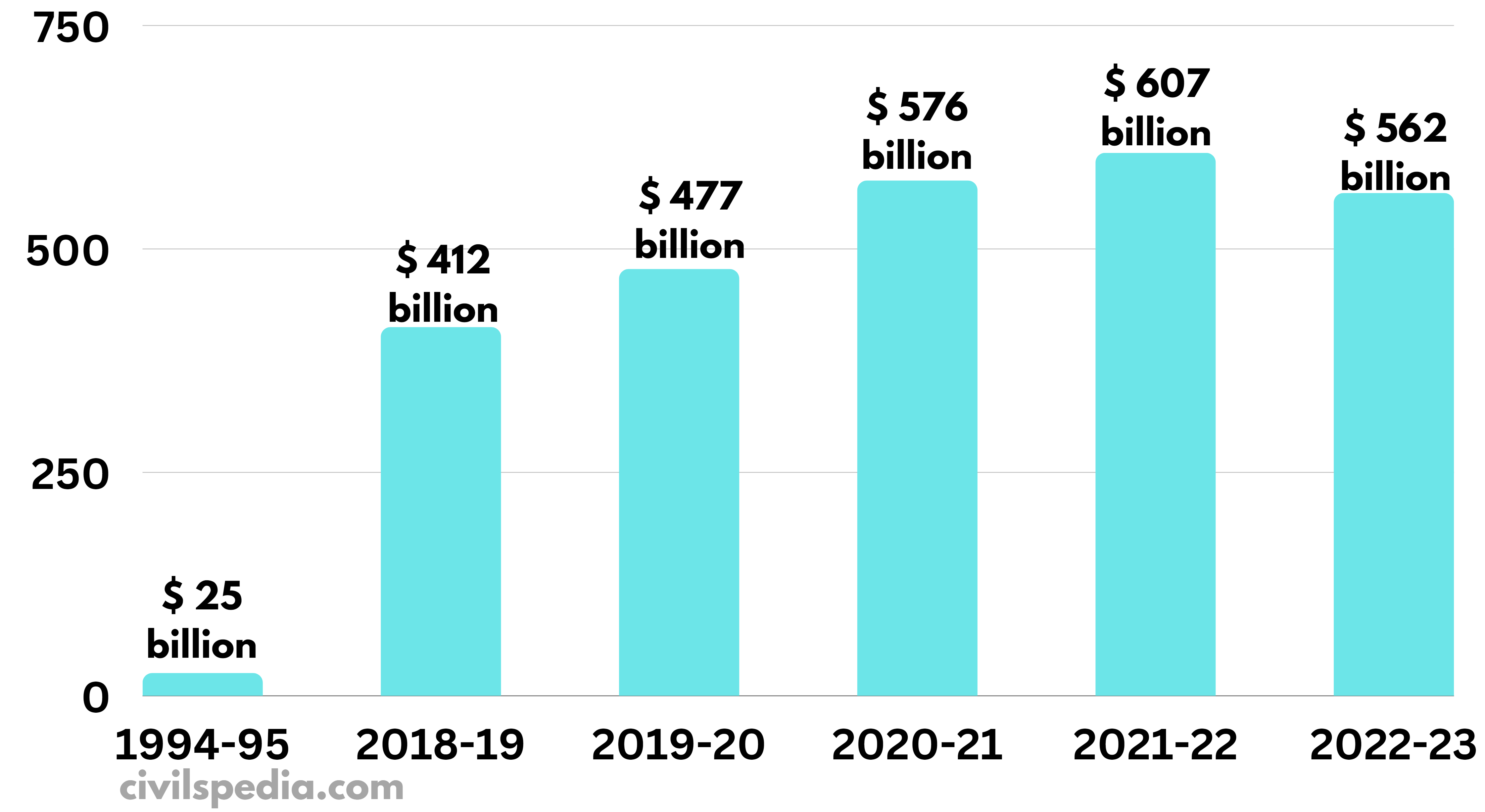

- India’s forex reserves are about $562 billion (Dec 2022).

- It is enough to finance about 9 months of imports. It has reduced from 13 months of imports in 2021. In March 1991, it was reduced to just 2.5 months of import coverage (which forced the country to seek International Monetary Fund assistance).

Ranking of Foreign Reserves with RBI

- Foreign Currency and Foreign Currency Assets

- Gold

- IMF’s SDR

- Reverse Tranche Position in the IMF

World Ranking of Forex Reserves ( India 6th and China topped with 3.2 Trillion Forex)

| Rank | Country | Forex |

| 1 | China | $ 3.2 trillion |

| 2 | Japan | $1.2 trillion |

| 3 | Switzerland | $812 billion |

| —- | ——— | ————- |

| 6 | India | $562.72 billion (Dec 2022) (Covering 9.3 months of imports) |

Forex Reserves of India are under pressure and decreased in recent times. The reason include

- Adverse global economic conditions and the fear of global recession led to a decrease in Indian exports.

- Sharp rise in the price of oil in the international market

- Fed Tapering led to an outflow of forex currency from India.

Reason for maintaining High Forex Reserves

- It reduces the risk of external vulnerabilities such as high oil prices or Fed Tapering.

- Exchange Rate Management: High Forex allows occasional RBI intervention to curb excessive volatility in the foreign exchange market.

- It increases the investor’s confidence in the economy of the country.

- It will help India to become a regional leader by signing currency swap agreements with other neighbours such as Sri Lanka, Bangladesh etc.

Issues with maintaining more than required Forex

While reserves are imperative in both preventing crisis situations and mitigating their impact, there are issues with maintaining more than required Forex Reserves. The problems with maintaining more than required Forex reserves include

- Lost Opportunity Cost: Holding more than the required Forex Exchange reserve has opportunity cost because the stored money could be used for improving infrastructure and social services (like health and education)

- Increase borrowing cost: Borrowing in foreign currency has high borrowing cost and is vulnerable to volatility in the exchange rate

Is India’s Forex Reserves enough?

As evident from the graph above, India’s Forex reserves have reduced. But it should not be a cause of worry as India has enough Forex Reserves based on the following yardsticks.

#1 IMF’s Guidotti–Greenspan Rule

- According to Guidotti-Greenspan Rule, the country should have enough Forex Reserves to cover the short-term external debt.

- Indian Forex Reserves comfortably meets this rule.

#2 RBI’s Tarapore Committee

- According to Tarapore Committee, the country should have enough Forex Reserves to pay for 6 months’ imports.

- Indian Forex Reserves comfortably meets this rule as well (Indian Forex Reserves can pay for more than 9 months’ imports).

Side Topic: How did China reach the top foreign exchange reserve position?

The term used for this phenomenon is ‘China’s Mercantile Policy’. Under this policy, China refrains from imports from other countries, and at the same time, exports are encouraged.

China restrains from imports in the following ways

| IT | SOEs (State Owned Enterprises) opaquely control the domestic market |

| Pharma | Inordinate delay in clearance |

| Food | SPS agreements used to ban imports |

| Manufacturing | Domestic products are too cheap |

At the same time, Exports are promoted by

- Keeping Yuan undervalued

- SOE get cheap loans

- Subsidies are provided on a large scale

- Tech-piracy is neglected

Side Topic: Manipulators of Currency

- US Treasury Department makes a list of countries which manipulate their currency.

- 3 Conditions to include any country in this list

- A trade surplus of over $20 billion with the US.

- The current account surplus is 3% of the GDP with the rest of the world.

- Persistent foreign exchange purchases of 2% plus of the GDP over 12 months.

- In 2018, India was included in this list. But India was removed in 2019.

- Countries which are included in this list include

- China

- Germany

- Japan

- South Korea

- Switzerland