Table of Contents

History of Banking System

Last Updated: March 2023

This article deals with the ‘History of Banking System.’ This is part of our series on ‘Economics’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Financial Intermediaries

For the economy to function properly, savings must be channelled into investments. But there is a conflict here between savers and businesses/corporates.

- Savers: Want instant access to their savings in case of unexpected expenditure.

- Businesses/Corporates: Want promise that they will not be forced to repay loans prematurely.

Banks can solve this problem by acting as an intermediary between savers and businesses (Ben Bernanke et al. )

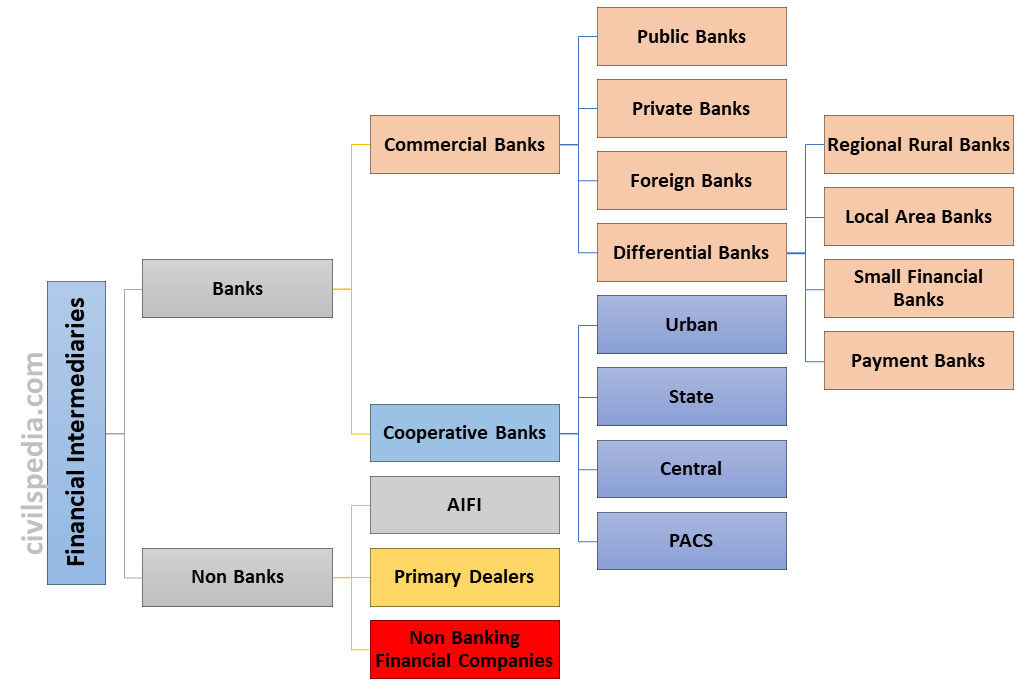

- These include banks, insurance companies, pension funds, mutual funds etc.

Banking System

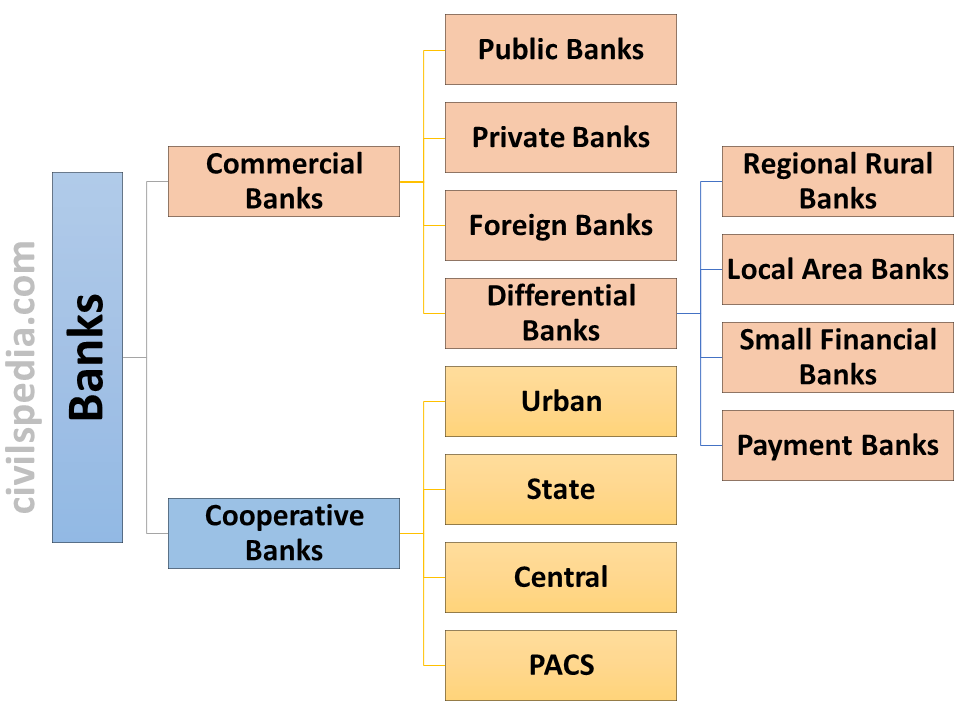

Scheduled Commercial Banks

When RBI is satisfied that a bank has (Paid Up Capital + Reserves) of at least 5 Lakhs & it is not conducting business in a manner harmful to its depositors, such bank is listed in the 2nd Schedule of RBI Act, and it is known as a Scheduled Bank.

It is different from the Non-Scheduled Banks in the following way

| Scheduled Banks | Non-Scheduled Banks |

| – Scheduled Banks are bound to maintain Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) as mandated by the RBI. | They are not required to maintain SLR and CRR. |

| – They are eligible to borrow funds via Liquidity Adjustment Facility (Repo and Bank Rates). | It depends on RBI’s discretion to borrow via this mechanism. |

| It can be subdivided into various parts 1. Scheduled Commercial Banks, e.g. SBI, Axis, PNB, ICICI Bank etc. 2. Schedule Cooperative Banks like Haryana Rajya Sahakari Bank etc. 3. Schedule Payment Banks like PayTM Payment Bank, Fino Payments Bank etc. | Hundreds of cooperative banks are non-Schedule Banks. |

Topic: History of the Banking System in India

History of the Banking System in India before Independence

- The present Banking System was introduced in the western world and was later introduced in India during the British Raj.

- During British times, there were two types of Banks

1. British Banks

East India Company established Banks in 3 Presidencies.

| Bengal | 1806 |

| Bombay | 1840 |

| Madras | 1843 |

- In 1921, these three merged to form the Imperial Bank of India. Later, it was nationalized and became SBI.

- It provided services to British Army officers, Civil Servants & Judges.

2. Swadeshi Banks

- These were set up by the Indians parallel to the British Banks.

- First Indian Bank to be opened was Allahabad Bank(1856). Later, other banks such as Bank of Baroda (backed by Gaekwads of Baroda), Punjab National Bank (the role was played by Lala Lajpat Rai in its formation), Punjab & Sind Bank (by Bhai Vir Singh).

- These banks targeted big merchants, particularly raw-material exporters.

But neither helped in financial inclusion.

Birth of RBI

- By the early 1930s, many banks were operating in India. They were registered under the Company Law, and regulations on this sector were not present. But the problem arose during The Great Depression (1929), which started in the USA. Due to this, the demand for Indian exports in the foreign market decreased, and Indian merchants began to default.

- Consequently, a large number of Indian banks collapsed.

- To deal with such a situation and bring the banking sector under regulation, the British Indian government set up the Reserve Bank of India in 1934 under the recommendations of the Hilton Young Royal Commission.

History after Independence

The Government of India took two important steps

- Nationalisation of RBI

- Banking Regulation Act,1949: It empowered RBI to control & regulate the Banking sector in India.

Nationalisation of Banks

Nationalisation of Banks: SBI Case (1st Round )

| 1955 | Imperial Bank was nationalized & renamed SBI. (At the same time, the Nationalization of Insurance Companies was also done) |

| 1960 | 8 Banks were nationalised & made subsidiaries of the State Bank of India. |

| 1963 | Two subsidiary Banks were merged (State Bank of Bikaner & State Bank of Jaipur), leading to the formation of the State Bank of Bikaner & Jaipur. |

| 2008 | State Bank of Saurashtra merged with Parent Bank. |

| 2010 | State Bank of Indore merged with Parent Bank. |

| Till recent times | There were 5 subsidiaries of SBI 1. State Bank of Bikaner & Jaipur 2. State Bank of Hyderabad 3. State Bank of Mysore 4. State Bank of Patiala 5. State Bank of Travancore |

| 2017 | All subsidiaries merged into Parent Bank |

Nationalisation of Banks: Except SBI (2nd Round)

- 1969: 14 Banks having deposits of more than ₹ 50 Crore were nationalized.

- 1980: 6 more banks Nationalized, having deposits of more than ₹200 Crore.

| Nationalised in 1969 | Punjab National Bank, Canara Bank etc. |

| Nationalised in 1980 | Punjab & Sind Bank, Vijaya Bank, Oriental Bank of Commerce etc. |

Reasons of Nationalisation

- To remove control & concentration of economic power in the hands of a few industrialists.

- Due to misuse of funds by owners.

- Due to the tendency of banks to ignore the needs of small-scale industrial sector & agriculture.

- To remove the concentration of the banking sector mostly in Urban areas.

Objectives after Nationalisation

- To open more banks in rural & semi-urban areas & to collect savings from these areas.

- To provide credit facilities to areas defined as Priority Sector in the economy.

Has the nationalization of private banks benefitted India?

- According to Economic Survey (2020), banking resources to rural areas, agriculture, and priority sectors have increased due to the nationalization of banks. For example, in the period between 1969-90

- The number of rural bank branches increased ten-fold.

- Credit to rural areas increased twenty-fold.

- Agriculture credit expanded forty-fold.

- The US Banking System shows the inefficiencies of the Private Banking System during the successive financial scams, including the Subprime crisis of 2008, lending to subprime borrowers, bias against people of colour etc. These things have not happened in India as the banks were nationalized in India.

- But at the same time, Economic Survey (2020) doubts whether these benefits were entirely caused by nationalization as the period also saw various other events like green revolution, anti-poverty programmes (like the Integrated Rural Development Programme) and policies of RBI (such as RBI’s 4:1 formula).

Issues faced by Public Sector Banks due to Bank Nationalisation

- Since the government was the majority shareholder of the banks, it started to give loans at populistic ‘Government Administered Interest Rates’, which decreased the banks’ profitability.

- Banks were forced to give loans to fund unviable projects based on political considerations, which increased the NPAs of Public Banks as the recovery of such loans was low.

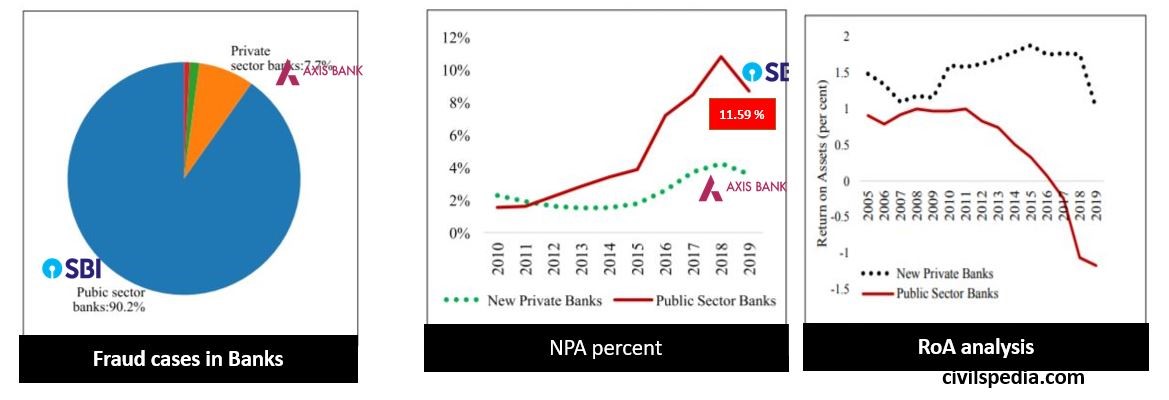

- Public Sector Banks account for 92.9% of bank fraud cases. A large majority (90%) were related to advances, suggesting the poor quality of screening and monitoring processes for corporate lending adopted by Public Sector Banks.

- PSBs perform poorly on Return-on-Assets (RoA), Return-on-Equity (RoE) etc., when compared with Private Banks. Public Sector Banks are having negative RoA presently.

- The politicization of Bank Boards happened with the government placing its favorites in the Board of Directors irrespective of their knowledge and talent. It reduced the professionalism in the banks.

- Due to the above reasons, RBI feared that banks could collapse. Hence, it mandated a high Cash Reserve Ratio (CRR), reducing the funds at the disposal of banks for loan purposes.

- A large staff was hired in banks, even more than required, to create government jobs. It led to the unionization of staff and inefficient customer services. Frequent hartals of bank employees were observed in the period after nationalization.

PSB officers are subjected to extra scrutiny by the Central Vigilance Commission and CAG. Officers are wary of taking risks in lending or in renegotiating bad debt due to fears of harassment under the veil of vigilance investigations.

Side Topic: Number of Public Sector Banks Today

- Public Sector Banks = 13 ( on January 2022, including India Post Payment Bank)

Old Private Banks

- All the Big Private Banks were nationalized. But there were Small Private Banks whose deposits were less than limits and weren’t nationalized. These Banks are now called Old Private Banks.

- There are 12 such banks in India.

- These are Scheduled Banks and have to maintain Cash Reserve Ratio & Statutory Liquidity Ratio.

- Examples: Catholic Syrian Bank, Dhanlaxmi Bank, Federal Bank, Jammu and Kashmir Bank etc.

Narsimham Committee and (Rise of ) New Private Sector Banks

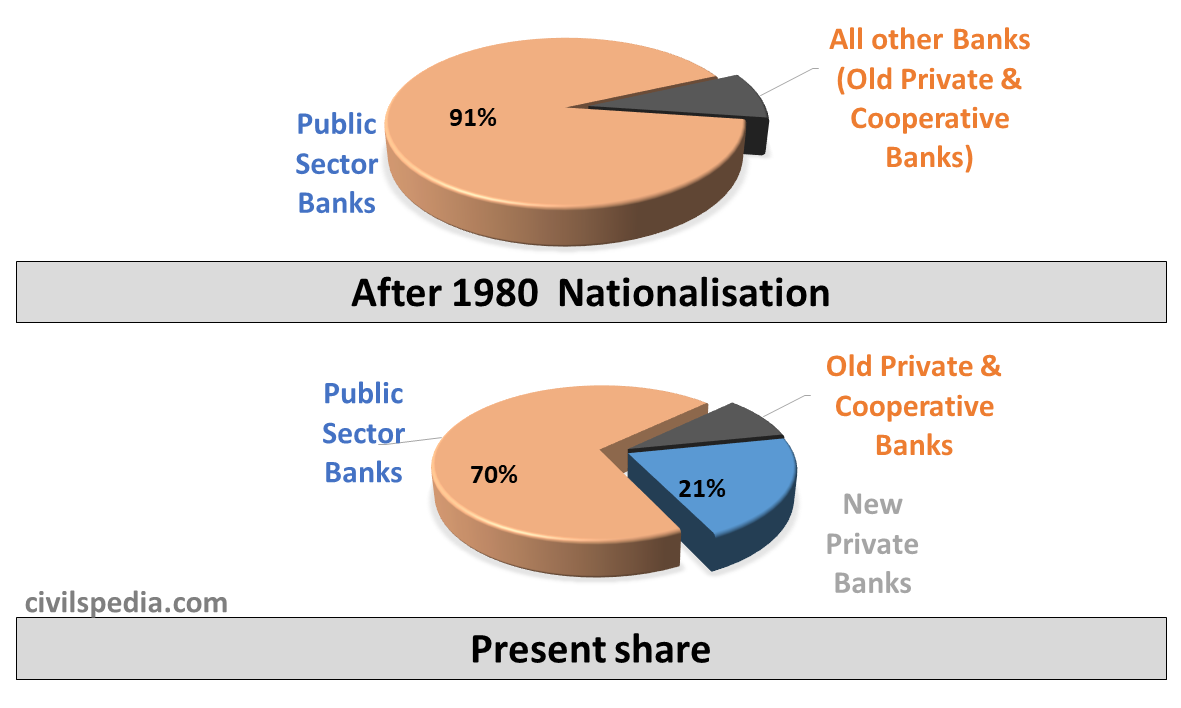

After the 1980 nationalization, Public Sector Banks had a 91% share in the national banking market which has reduced to 70%. The reduced stake has been absorbed by New Private Banks (NPBs), which came up in the early 1990s after liberalization. It brings us to the topic of New Private Banks.

Private Sector Banks

The Balance of Payment crisis of 1991 finally forced the government to set up a Committee for Banking Sector Reforms under the former RBI Governor M Narsimham. He recommended following

- Government should decrease its shareholding in Public Sector Banks.

- The banks’ resources came from the general public and were held by the banks in trust that they were to be deployed for the maximum benefit of the depositors. Even the government had no business to endanger the solvency, health and efficiency of the nationalized banks under the pretext of using banks, resources for economic planning, social banking, poverty alleviation, etc.

- RBI should decrease Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR).

- Priority Sector Lending (PSL) given to agriculture and Small Scale Industries (SSIs) should be phased out gradually as they had already grown to a mature stage.

- Government should not dictate interest rates to Banks.

- Liberalize the branch expansion policy.

- Allow entry of New Private Banks and New Foreign Banks.

This led to 3 Rounds of Banking Licences.

| 1st Round (1993-95) | 10 licenses were given to open the following banks. 1. ICICI 2. HDFC 3. Indus 4. DCB 5. UTI (later became Axis bank) 6. IDBI (presently owned by LIC) 7. Global Trust Bank (later merged with Oriental Bank) 8-9-10: Bank of Punjab, Centurion Bank, and Times Bank were merged into HDFC |

| 2nd Round (2001-04) | 2 licenses were given in the 2nd Round 1. Kotak Mahindra 2. Yes Bank |

| 3rd Round (2013) | Bimal Jalan Committee made selections 1. Bandhan Bank (Originally, a Microfinance company based in West Bengal) 2. IDFC (Originally, an infra finance NBFC based in Maharashtra). |

Side Topic: Number of Private Banks in India

- 22 presently (after IDBI is privatised).

On Tap System of Banking License

- Earlier System: Start & Stop System

- RBI issues notification and interested entities can apply at that time only..

- Till now, 3 such rounds have happened

- The new system proposed in 2016: On Tap System

- In this system, there will be no deadline for application. Hence, there is no need to wait for notification.

- When an entity thinks it is fit to become a bank, it can approach RBI with the application.

- RBI has issued guidelines regarding this too.

- In 2021, RBI gave Small Banking License to Unity Small Finance Bank through this route.

The following company can apply for Bank License via the ‘On-Tap’ System

- The company must have a minimum of 500 crores paid-up capital.

- The company must have 10 years of record in the banking/finance sector.

- Initially, it must be controlled by Indians (100% shareholding should be with Indians).

- Applicant must be willing to open a minimum of 25% branched in rural areas.

- They have to maintain CRR, SLR, PSL etc.

- But large industrial houses and NBFCs can’t open banks via this route.

Foreign Commercial Banks

- In the Nehruvian Socialist Economy, there was disdain & apprehensions about Foreign Banks. Only a handful of them was allowed to open branches. But, Post-Narasimham-Reform, foreign banks approval policy was liberalized.

- In 1991, M Narsimham Committee recommended allowing Foreign Banks on a reciprocal basis. The government accepted this proposal.

- There are 44 Foreign Banks in India

- AB Bank

- Abu Dhabi Commercial Bank

- American Express banking

- ANZ Banking Group

- Bank of America

- Bank of Bahrain and Kuwait

- Barclays Bank

- BNP Paribas

- Citibank

- Commonwealth Bank of Australia

- CCRB

- Credit Agricole

- Credit Suisse

- DBS Bank

- Deutsche Bank

- Doha Bank

- FirstRand Bank

- Industrial and Commercial Bank of China

- Industrial Bank of Korea

- JP Morgan Chase Bank

- JSC VTB Bank

- KBC Bank

- KEB Hana Bank

- Krung Thai Bank

- Mashreq Bank

- Mizuho Bank

- National Bank of Australia

- National Bank of Abu Dhabi

- PT Bank

- Maybank Indonesia

- Sberbank

- SBM Bank

- Shinhan Bank

- Societe Generale

- Sonali Bank

- Standard Chartered Bank

- Sumitomo Mitsui Banking Corporation

- Bank of Nova Scotia

- Bank of Tokyo

- The Hongkong and Shanghai Bank

- Royal Bank of Scotland

- United Overseas Bank

- Westpac Bank

- Woori Bank

- First, foreign banks have to open an Indian Subsidiary registered in India under the Companies Act.

Core Banking Solution

- Core Banking Solution (CBS) is the networking of branches, enabling customers to operate their accounts and avail banking services from any branch of the Bank on the CBS network, regardless of where he maintains his account. The customer is no more the customer of a Branch. He becomes the Bank’s Customer.

- It has helped in converting Branch Banking to Branchless Banking.

Entry of Business Houses in the Banking Sector

Procedure to open a new bank

- Register the company with the Ministry of Corporate Affairs.

- The company has to issue IPO in the share market after taking SEBI’s permission to arrange the capital.

- Then, the company has to take permission from RBI through the ‘On Tap’ System.

- After doing this, the company will initially get a Non-Scheduled Bank License. After some years, when RBI is confident that the bank has good health, RBI will upgrade the license of the Bank to Scheduled Commercial Bank.

Analysis: Should private houses be allowed to open banks

Arguments in favour

- More competition will lead to better services, higher interest rates and better customer services.

- Existing banks have stressed balance sheets due to high NPAs. Hence, they have become over cautious while giving new loans. The entry of fresh banks will re-invigorate the lending process.

- It will help the ‘shadow banks’ such as IL&FS and DHFL to become banks and come under the proper supervision of RBI.

Based on the above arguments, PK Mohanty Committee, to review the corporate structure for Indian Private Sector Banks (2020), recommended allowing private houses’ entry into the banking sector.

Arguments against

- Connected Lending: In Connected lending, promoters of the bank lends loan at favourable terms to the companies owned by that group. The issue of connected lending was rampant in India from 1947 to 1958, which led to the failure of 361 banks in India during that phase.

- Circular Banking: It has the potential to lead to circular banking under which a bank controlled by Corporation A lends a loan at favourable terms to Corporation B and a bank controlled by Corporation B lends a loan at favourable terms to Corporation A. In the process, the interests of the depositors are jeopardized.

- The higher competition will lead to excessive loan disbursement and misspelling of the banking products to gain new customers and retain the old customers. These types of practices led to Subprime Crisis in 2007-08. After the subprime crisis, most countries have become cautious to such ideas.

- History: Corporate houses were active in the banking sector till five decades ago, when the banks promoted by them were nationalized in the late sixties amid allegations of connected lending and misuse of depositors’ money.

- RBI cannot effectively regulate the existing banks as shown by various scams like Yes Bank-Rana Kapoor Scam, ICICI-Vodafone Loan Scam, Punjab National Bank-Nirav Modi Scam etc. Hence, it is not guaranteed that RBI will be able to regulate the new banks effectively.

- Large industrial houses face severe corporate governance issues, as epitomized by Ratan Tata- Cyrus Mistry and Narayan Murthy-Vishal Sikka controversy. In such a situation, allowing them to open banks is not advisable.

- Banks controlled by big business houses can be misused for nefarious activities such as money laundering.

- It can create very powerful oligarchs with large economic power.

- Even regulators in developed countries don’t encourage the entry of business houses in the banking sector.

Considering the above discussion, the risks outweighs the benefits. Government can take steps to strengthen the corporate structure and health of the present banking sector.

This marks the end of the article on “History of Banking System.’