Table of Contents

International Monetary Fund

This article deals with the ‘International Monetary Fund .’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

- IMF was established in 1945 as a direct result of the Bretton Woods Conference.

- The primary function of IMF was to assist the member countries to tide over the short term Balance of Payments crisis.

- It has 189 members, with Nauru as the latest member (joined in 2016).

Objectives of IMF

- To solve the problem of international liquidity.

- To stabilize exchange rate

- To facilitate international trade.

- To enable international payment system

Functions of IMF

- Correcting short-term Balance of Payment disequilibrium either by selling or lending foreign currencies to the member nation

- Bringing stability in the exchange rate

- Balancing demand and supply of currencies by increasing the supply of scarce currency and purchasing excess currency

- Reducing trade restrictions, i.e. tariffs and other trade barriers imposed by the member countries

- Providing credit facilities like basic credit facility, extended fund facility for three years, compensatory financing facility and structural adjustment facility

Structure of International Monetary Fund

IMF consists of

1. Board of Directors

- All nations (189) are represented here.

- It meets annually.

- The following officials represent India

| Finance Minister | Ex Officio Governor |

| RBI | Alternate Governor |

2. Executive Board

- Executive Board performs the routine functions of IMF.

- It has 24 members.

- Presently, all the members are elected. (earlier: 5 seats were reserved for USA, UK, Japan, Germany & France who were largest quota holders).

3. Managing Director

- Present Managing Director of IMF is Kristalina Georgieva (of Bulgaria)

- The office is based in Washington (headquarters of IMF).

Famous Reports of IMF

- World Economic Outlook

- Global Financial Stability Report

Special Drawing Rights

- When a country faces a Balance of Payment (BoP crisis), it approaches the IMF for help through Extended Fund Facility.

- At the time of formation, the IMF fixed quota in which countries contributed according to their (economic) size. With the backing of all the money the IMF accumulated, a new currency called SDR (Special Drawing Rights) was created. At the time of its formation , 1SDR = 1$ =.88 grams gold. It was also called paper gold because of this reason.

- IMF works in the same way as banks. They take money from ‘Depositor nations’ & give interest to them. The same money is then given to ‘Borrower nations’ who pay interest to IMF.

How value of SDR is calculated?

- Till 1970s, the conversion of 1SDR = $ 1 = 0.88 grams of gold was maintained.

- Present system: It is a weighted average of 5 currencies with the following weights.

| Currency | Weightage |

| Dollar | 41.73 |

| Euro | 30.93 |

| Yuan (added in 2015) | 10.92 |

| Yen | 8.33 |

| Pound | 8.09 |

- Presently, the conversion ratio is 1 SDR = 1.418 $.

Triffin’s Dilemma

- Since the EU/US financial crisis, voices have been raised worldwide against the US dollar as an international currency. Zhou Xiaochuan, Governor of Peoples Bank of China, has proposed the adaptation of IMF’s SDR as an international currency. He argued that a national currency was unsuitable as a global reserve currency because of Triffin’s Dilemma, i.e. difficulty faced by reserve currency issuers in simultaneously achieving their domestic monetary goals & meeting other country’s demand for a reserve currency.

- Keynes and Schumacher also conceptualised such a currency for International Settlement in 1940-42, called Bancor. It was to be introduced by the United Kingdom after the Second World War. However, the US keeping its own interest in mind, made the US dollar the world key currency at Bretton Woods Conference.

Quota and Governance Reforms in IMF

Two sets of Reforms were being demanded for decades & finally, they have been accepted.

Reform in Quota

- SDR Quotas determine

- Voting power to influence lending decisions to other countries

- Tap into the funds themselves.

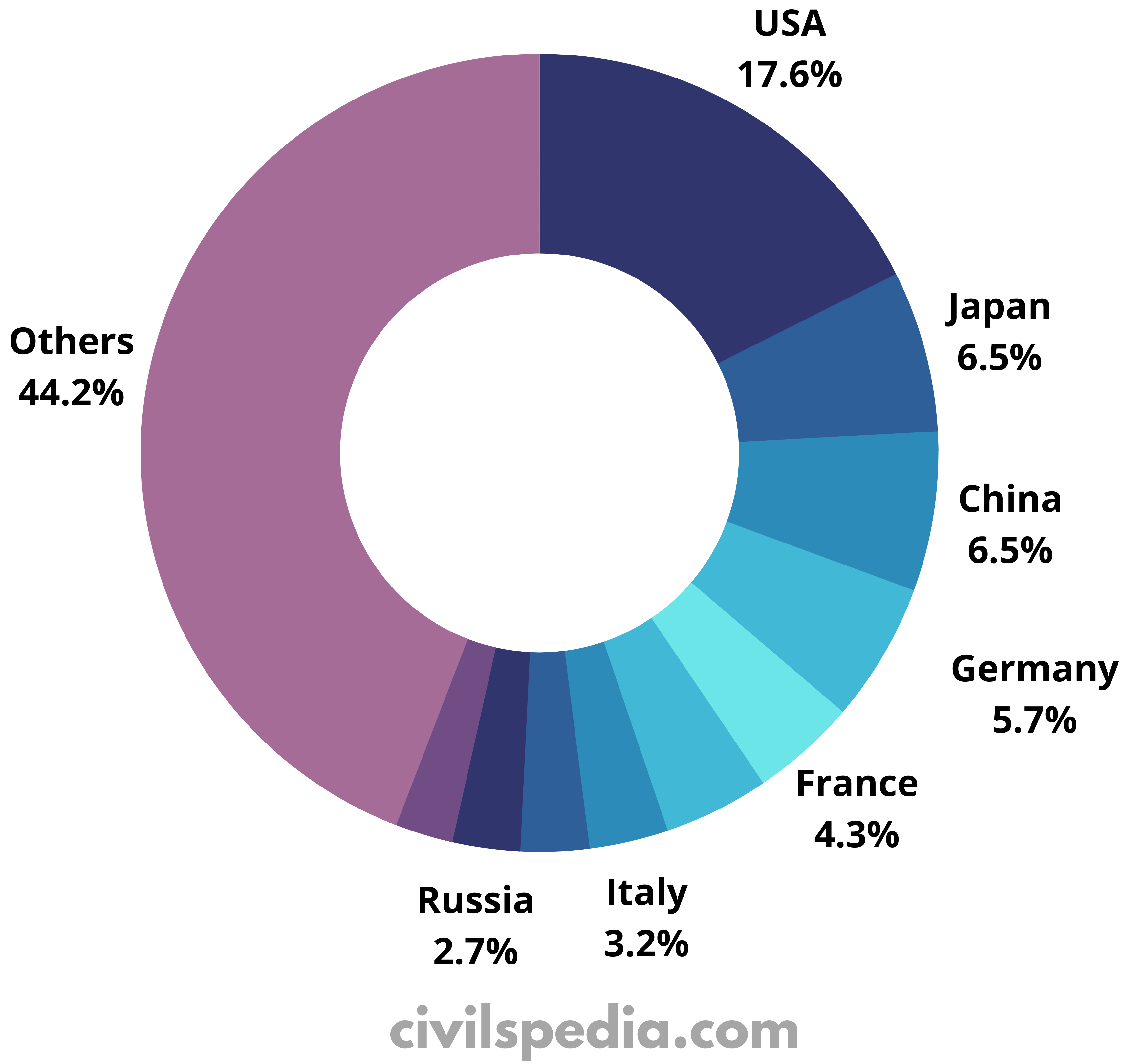

- The IMF executive board decides each member’s quota based on various parameters, including GDP & tariff barriers. But the formula is designed in such a way that the US has an 18% quota while India & Russia has barely 2.5% each.

- These Quotas are revised from time to time under a process called General Review of Quotas (GRQ).

- Since the subprime crisis, BRICS & developing economies have been against the present Quota System. In 2010, under the 14th GRQ, Board decided to increase the quota of developing countries. But it faced obstacles as the vote of countries holding 70% of the quota was required to implement this reform. Hence quota reform was difficult.

- In 2016, quota reform was accepted, under which the quota of developing countries such as India, China, Russia and Brazil was increased. Indian quota was increased from 2.445% to 2.78% making it 8th largest quota holder.

Reform in Governance

- Till 2016, in the Executive Board, 5 out of 24 directors were permanently decided by the five largest quota holders (known as Executive Directors).

- But under the 14th GRQ, reforms were passed under which all directors will be elected, ending the category of Executive Directors.

15th GRQ

- 15th General Review of Quotas (GRQ) is the new round of attempts to revise the size and composition of the system.

- It was to be completed by October 2017, but it was extended to 2019. But, the 15th GRQ hasn’t passed yet, even in 2022.

India & IMF

India has been major beneficiaries of IMF’s Fund assistance. India has borrowed twice .

| Between 1981-84 | SDR- 3.9 billion |

| During 1991 | SDR- 3.56 billion |