Table of Contents

Legislative Procedure in Parliament

This article deals with ‘Parliament – Legislative Procedure in Parliament .’ This is part of our series on ‘Polity’ which is important pillar of GS-2 syllabus . For more articles , you can click here

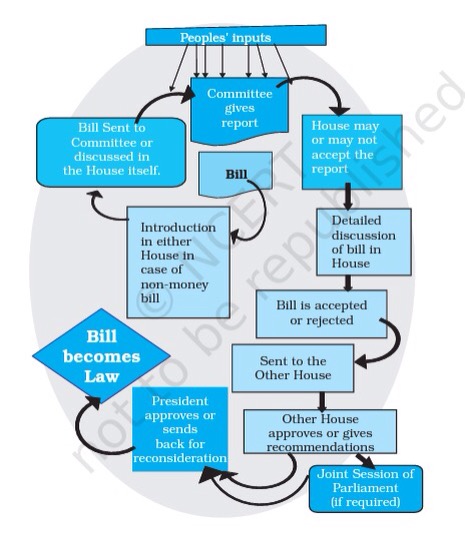

Legislative Procedure in Parliament

Legislative procedures same in both the houses.

Bills are of two kind – Public Bill & Private Bill

1 . Public Bill

- Introduced by Minister

- Reflects policies of government

- Greater chance of approval

- Its rejection can lead to No Confidence Motion

- Requires 7 days notice

- Drafted by concerned Department with help of Law Ministry

2. Private Bill

- Introduced by any Member

- Reflect stand of opposition party

- Lesser chance of approval

- No such implication on its rejection

- Requires one month notice

- Responsibility of member concerned

It is very difficult to get Private Bill Passed

- Only 14 private member’s bills have been passed in Parliament’s history and last one of them was in 1970 . This was the Supreme Court (Enlargement of Criminal Appellate Jurisdiction) Bill, 1968.

Bills can also be classified in other way

| Ordinary Bill | Concerned with any matter other than financial |

| Money Bill | Concerned with financial matters like taxation, public expenditure |

| Financial Bill | Concerned with financial matters but different from Money Bill |

| Constitutional Amendments | Seeks to amend the Constitutional Provisions |

1 . Ordinary Bill

| Introduced by | Any Member |

| Introduced in | Any House |

| Stages to pass | 5 in each House |

First Reading

- Bill is introduced by reading its Title and Objective

- Published in gazette of India

Second Reading

Has three substages

| Stage of General Discussion | – Printed copies of bill are distributed to all members – Principles of Bill & its Provisions are discussed generally but details are not discussed and then referred to Select Committee or Joint Committee . |

| Committee Stage | – Usual practice is to send it to Select Committee – Committee examines the Bill thoroughly & in detail, clause by clause – It can amend Provision but without altering principles underlying it . |

| Consideration Stage | – House considers Provisions of Bill clause by clause – Each clause is discussed and voted upon separately – Amendment can be done here. |

Third Reading

- In this Stage, Bill should be accepted or rejected in full and no amendments are allowed

- If Bill is passed by Majority, then it goes to other house

Bill in Second House

In other House, it goes through all three readings and then put to vote

There are possibilities

| Possibility | Result |

| May pass the Bill | Deemed to be passed & send to President |

| 1. May Reject it 2. Mayn’t take any decision for 6 months 3. May pass it with Amendment and return to 1st House for reconsideration . But 1st house Rejects proposed Amendments | – Results in Deadlock – To resolve Joint Sitting of two houses and bill put to vote – If passed by Simple Majority, then it is deemed to be passed |

Assent of President

After it is passed by both Houses , it is sent to President for its approval and President has three options

| May give Assent to it | Bill becomes Act |

| May withhold his Assent | It ends and not becomes Act. |

| May send it back for reconsideration | If both Houses again pass it with or without Amendment, he has to give his assent – Suspensive Veto |

Joint Sittings

- A deadlock is deemed to have taken place after a bill has been passed by one

House and transmitted to the other House

- if the bill is rejected by the other House;

- If Second House pass it with Amendment and return to 1st House for reconsideration . But 1st house Rejects proposed Amendments

- If other house doesn’t take any decision for more than six months

In the above three situations, the President can summon both the Houses to meet in a joint sitting for the purpose of deliberating and voting on the bill.

- Joint Sitting is applicable

to

- Ordinary bills or

- financial bills only

- And not to

- Money bills : Lok Sabha has overriding powers

- Constitutional amendment bills : bill must be passed by each House separately.

- Speaker of Lok Sabha presides over a joint sitting

- Quorum : one-tenth of the total number of members of two Houses.

- Governed by the Rules of Procedure of Lok Sabha and not of Rajya Sabha.

- If the bill in dispute is passed by a majority of the total number of members of both the Houses present and voting in the joint sitting, the bill is deemed to have been passed by both the Houses.

So far Joint Session was conducted for 3 times.

- Dowry Prohibition Bill 1960

- Banking Service Commission (Repeal) Bill, 1977

- Prevention of Terrorism Bill 2002 (POTA)

2. Money bills

Prerequisite about Money Bill

- Article 110: Defines what is Money Bill

- It relates only (6 matters) to following things

- Imposition, abolition ,alteration or regulation of any of the tax

- Borrowing of money by Union government

- Custody of Consolidated Fund & Contingency Fund

- Appropriation of money out of Consolidated Fund

- Declaration of any expenditure charged on Consolidated fund of India

- Receipt of money on account of Consolidated Fund of India or Public Account of India

Money bill should contain only matters listed under article 110 (1). If a bill is a combination of any of the above and some other provisions not incidental to those matters, it cannot be called a Money Bill

| Who decides | Speaker of Lok Sabha (& not challengeable) Our Constitution follows the British procedure . However, there is a key difference. House of Commons appoints two senior members who must be consulted before the Speaker gives the certificate. In India, the Speaker makes the decision on her/his own. |

| Introduced in | Lok Sabha only |

| Introduced by | Minister only with permission of President |

Introduced in Lok Sabha (only) . Then pass through first three readings (same as Ordinary Bill) and after passing moved to Rajya Sabha

Rajya Sabha has very limited Power

- Can’t reject or amend bill ,can only make recommendations. Lok Sabha can accept recommendation or pass it otherwise and then Bill send to President for assent

- Should pass bill within 14 days. If not , Bill is deemed to be passed

Due to lesser power of Rajya Sabha wrt Money Bill, when ruling party doesn’t enjoy majority in Rajya Sabha, they try to label Bill as Money Bill to circumvent Rajya Sabha.

President also has limited power and can

- Give Assent to Bill – Generally this happens because Bill is introduced with his prior permission

- May not take any decision

- But cant send back Bill for reconsideration

Issue : Circumventing Upper House through Money Bill Strategy

- Recently Opposition alleged

that Government was

eroding Legislative Powers

of Rajya Sabha

by deliberately introducing

crucial bills as Money

Bills.

- 2017 Budget : Government brought

about 40

amendments through Money Bill Route ,

many of which are related to several other laws like

- Merging eight tribunals and the changing of rules for appointments

- Remove the cap of 7.5 % of net profits for corporates to donate to political parties

- Give greater powers to tax officials

- 2016: Important bills like Aadhar Bill, 2016 was labelled as Money Bill.

- 2017 Budget : Government brought

about 40

amendments through Money Bill Route ,

many of which are related to several other laws like

However, the Constitution makes it abundantly clear that Money bills should contain only 6 matters listed under article 110 (1). If a bill is a combination of any of the above and some other provisions not incidental to those matters, it cannot be called a money bill.

- Speaker, while certifying a bill as Money Bill, is in effect depriving the Rajya Sabha of its Legislative Power to disapprove a Bill. There is no remedy lying with Rajya Sabha

- Mohd Saeed Siddiqui vs State of UP (2014) :Supreme Court => decision of Speaker “that Bill in question is Money Bill is final ”.

- But Constitution Bench in Raja Ram Pal v. Hon’ble Speaker, Lok Sabha (2007), ruled that SC can interfere when Speaker’s choice is grossly illegal

3. Financial Bills

- Deals with fiscal matters i.e. Revenue & Expenditure

| Financial Bill(1) | Art117(1) |

| Financial Bill(2) | Art117(3) |

- Money Bill is also Financial Bill but because of importance of those matters other category is given to them

Financial Bill(1)

| What | Bills that not only contains matters related to Article 110 but some other matters too |

| Similarity To Money bill | – Can be introduced only in Lok Sabha – Can be introduced only on recommendation of President |

| Similarity To Ordinary Bill | – Can be rejected or amended by Rajya Sabha – In case of deadlock Joint Sitting can be called President can send it back for reconsideration |

Financial Bill(2)

| What | Relating to provisions involving Consolidated Fund not mentioned in Article 110 |

| Special Features | It can’t be passed by either House of Parliament unless President has recommended to House for consideration of Bill |

| Other features | Rest all features similar to Ordinary Bill |

4. Budget in Parliament

- Term Budget is nowhere mentioned in constitution

- Mentioned term is Annual Financial Statement (Article 112)

- Article 112 of Constitution deals with it

Budget contains following

- Estimates of Revenue & Capital Receipts

- Ways & means to raise Revenue

- Estimates of Expenditure

- Details of Actual Receipts & Expenditure of closing years & reasons for Deficit or Surplus

- Economic & Financial policy of coming year i.e taxation ,spending program etc

Earlier , Government of India used to present two Budgets

| Railway budget | Presented by Railway Minister |

| General budget | By Finance Minister |

Separation was done in 1921 on recommendations of Acworth Committee Report (British legacy). But , two Budgets were again merged into one in 2017 by NDA Government.

Constitutional Provisions regarding Budget

- President shall lay before Houses of Parliament estimated receipts & expenditure every financial year

- No Demand for Grant shall be made except in recommendation of President

- No money shall be withdrawn from Consolidated Fund except under Appropriation made by Law

- No tax shall be levied or collected except by Authority of Law

- Estimates of Expenditure embodied in Budget shall show separately Expenditure Charged on Consolidated Fund & Expenditure made from Consolidated Fund

- Budget shall distinguish expenditure on Revenue Account from other Expenditure

Charged Expenditure on Consolidated Fund

Following consist of Charged Expenditure

- Emolument and Allowances of President, Vice President , Deputy Chairman of RS, Speaker & Deputy Speaker of Lok Sabha, CAG , Members of UPSC

- Salaries , Allowances & Pension of Judges of Supreme Court + Pensions of Judges of High Courts

- Any sum required to satisfy any Judgement ,decree or award of any Court or Tribunal

- Any expenditure declared by Parliament to be Charged

(Note : Salary of Governor is not Charged on Consolidated Fund)

Stages in enactment of Bill

Stage 1 : Presentation of the Budget

- Budget is presented by Finance Minister on first working day of February with the Budget Speech in Lok Sabha. Then, laid before Rajya Sabha which can only discuss it and has no power to vote on Demand for Grants

Stage 2 : General Discussion

- Begins a few days after its presentation

- In both the Houses of Parliament

- Lasts for 3-4 days

- Lok

Sabha can discuss the Budget as a

whole or on any question of principle involved . BUT

- No Cut Motion can be moved

- Budget cannot be submitted to Vote of the House

Stage 3 : Scrutiny by Departmental Committees

- When General discussion is over , Houses are adjourned for 3-4 weeks . 24 Departmental Standing Committees of Parliament examine and discuss in detail Demand for Grants for the concerned Ministers and prepare reports . Reports are then submitted to both houses for consideration

- Note : Standing Committee System introduced in 1993, expanded in 2004 . It makes Parliamentary Financial control over the Ministries much more detailed , close , in depth and comprehensive

Stage 4 : Voting on Demands for grants

Lok Sabha takes up voting on Demand for Grant . Presented ministry wise . Demand becomes Grant only after it has been duly voted.

Important points :

- Voting in Demand for Grant is the exclusive power of LS . RS has no power .

- Voting is confined to the votable part of the Budget . Expenditure Charged on Consolidated Fund of India is not submitted to vote . It can only be discussed.

Cut Motions

Members of Parliament can discuss the details of the Budget and can also move Motions to reduce any demand. Three such Cut Motions

| Policy Cut Motion | – Represents the disapproval of the policy underlying the demand – States that amount of the demand be reduced to ₹ 1 |

| Economy cut motion | Represents that amount of the demand be reduced by a specified amount ( which may be either lump sump reduction in the demand or omission or reduction of an item in the demand ) |

| Token cut motion | Reduces the amount of demand by ₹ 100 , ventilating a specific grievance that is within the sphere of responsibility of the GoI |

Conditions to be satisfied the cut motion

- Relate to one demand only

- Be clearly expressed . No arguments or defamatory statements

- Confined to one matter only

- No suggestions for amendment or repeal of existing laws

- Not refer to matter that is not of primary concern to Union government

- Not relate to expenditure charged on Consolidated Fund of India

- Not relate to matter under adjudication by the court

- Not raise a question of Privilege

- Not revive a matter on which discussion has already taken place in same session

Significance of the cut motion

- Concentrated discussion of specific demand for grant

- Upholding the principle of responsible government by probing the activities of the government

Not of much utility in practice

- Only moved and discussed in the house

- Not passed as government enjoys the majority support

Their passage in Lok Sabha amount to want of Parliamentary confidence in government and may lead to resignation

In total 26 days for voting on demands => on last day speaker puts all the remaining demands to vote and disposes them whether discussed or not => GUILLOTINE

Stage 5 : Passing of the Finance Bill

- Finance Bill is introduced to give effect to the Financial Proposals of Government of India for the following year

- Unlike Appropriation bill , amendments can be moved in case of Finance bill

- Finance Act legalises the income side of the budget and completes the process of settlement of the budget