Table of Contents

Privatisation of Banks

This article deals with the ‘Privatisation of Banks.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

- The government is also reducing its shareholding to less than 50% in Public Sector Banks. This is known as the Privatization of Public Sector Banks.

- E.g.:

- Government-owned UTI Mutual Fund applied for UTI Bank License in the 1990s. Later, after the scam, UTI Bank was privatized into Axis Bank.

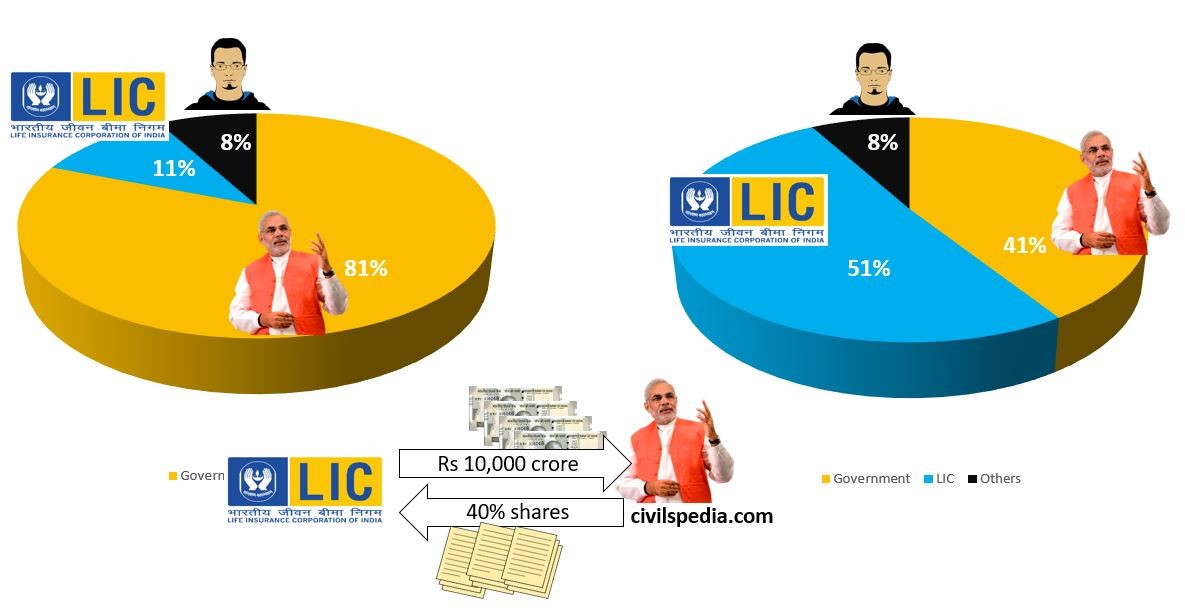

- 2018: IDBI Bank privatization

- 2021 Budget: The government announced to privatize two Public Sector Banks (PSBs).

Case for Privatisation of Banks

- Improve the overall efficiency of the Banking Sector: Even though the PSBs and New Private Banks are operating in the same domestic market, the PSBs are considered less efficient, thus leading to the loss of taxpayers’ money.

- Government’s Monopoly: The Government ownership in the PSBs, which account for almost 70% of the Banking assets, has led to a kind of virtual monopoly of government that reduces the competition, breeds inefficiency and thus hurts the overall growth of the Banking Sector.

- Better human resource management: Privatisation will help in introducing a high degree of professional management. On account of the huge human capital deficit, PSBs are seriously handicapped vis-à-vis their competitors.

- Reduce the burden on the government by doing away with the need for undertaking their recapitalization to comply with the higher BASEL III requirements

Arguments against Privatisation

- Improve the Governance framework of PSBs: The main reason for the lower efficiency of the PSBs is actually the government’s political intervention in the functioning of the PSBs, which is in turn leading to a lack of autonomy and freedom to the PSBs and thus hurting their revenues.

- Financial exclusion of weaker sections: It can lead to financial exclusion of weaker sections as the private sector cares about profits.

- Job loss: Public Sector Banks employ a large number of people who can lose their jobs in case of privatisation of banks as one of the first things banks do after privatisation is employee retrenchment and branch closures.

- Depriving SC/ST/OBCs of benefiting from reservation: Since private banks are not mandated to provide reservations to SC/ST/OBCs in jobs, it hurts the social empowerment of weaker sections of society.

- Concerns regarding bank failures and safety of deposits: Private sector banks are prone to failures due to the absence of sovereign guarantees. Bank failures have a large contagion effect on the economy as the savings of the households get locked.

- The macroeconomic effects of bank failures can cause tremendous contagion effect and derail the economy. E.g. From 1935 to 1947, there were 900 bank failures in our country. From 1947 to 1969, 665 banks failed. It became the driving factor for bank nationalisation in 1969.