Table of Contents

Climate Funding

This article deals with ‘Climate Funding – UPSC.’ This is part of our series on ‘Environment’, an important pillar of the GS-3 syllabus. For more articles on Science and technology, you can click here.

Introduction

As per the Sharm el-Sheikh Implementation Plan, released during COP27, an annual investment of $4 trillion must be invested in renewable energy until 2030 to reach net zero emissions by 2050. No single source will be sufficient for this amount.

Classification of Finance Sources

We can classify the cash streams based on who is the prominent player

1. Government Funding

1.1 Environment Tax

- An ‘‘environment” or ”green” tax is imposed on a product that damages the environment to reduce its production or consumption.

- It is in line with the ”polluter pays principle”.

Benefits of Environment taxes

- They internalize environmental costs into prices.

- Deter actions that lead to environmental damage

- Encourages innovation and development of new technology

- Government can use the revenue raised by environmental taxes for development activities and thus reduce the level of other taxes (e.g. income tax or excise duty on medicines)

Government’s initiatives in this regard

1. Clean Environment Cess

- The government introduced Clean Energy Cess on coal at Rs.50 per ton in 2010.

- The rate is subsequently increased to Rs. 400 per ton presently.

- The money thus collected is transferred to the National Clean Energy and Environment Fund.

2. Higher Excise Duties on SUV

- Government charges higher excise duty on fuel-guzzling SUVs.

2. Market-based Mechanisms

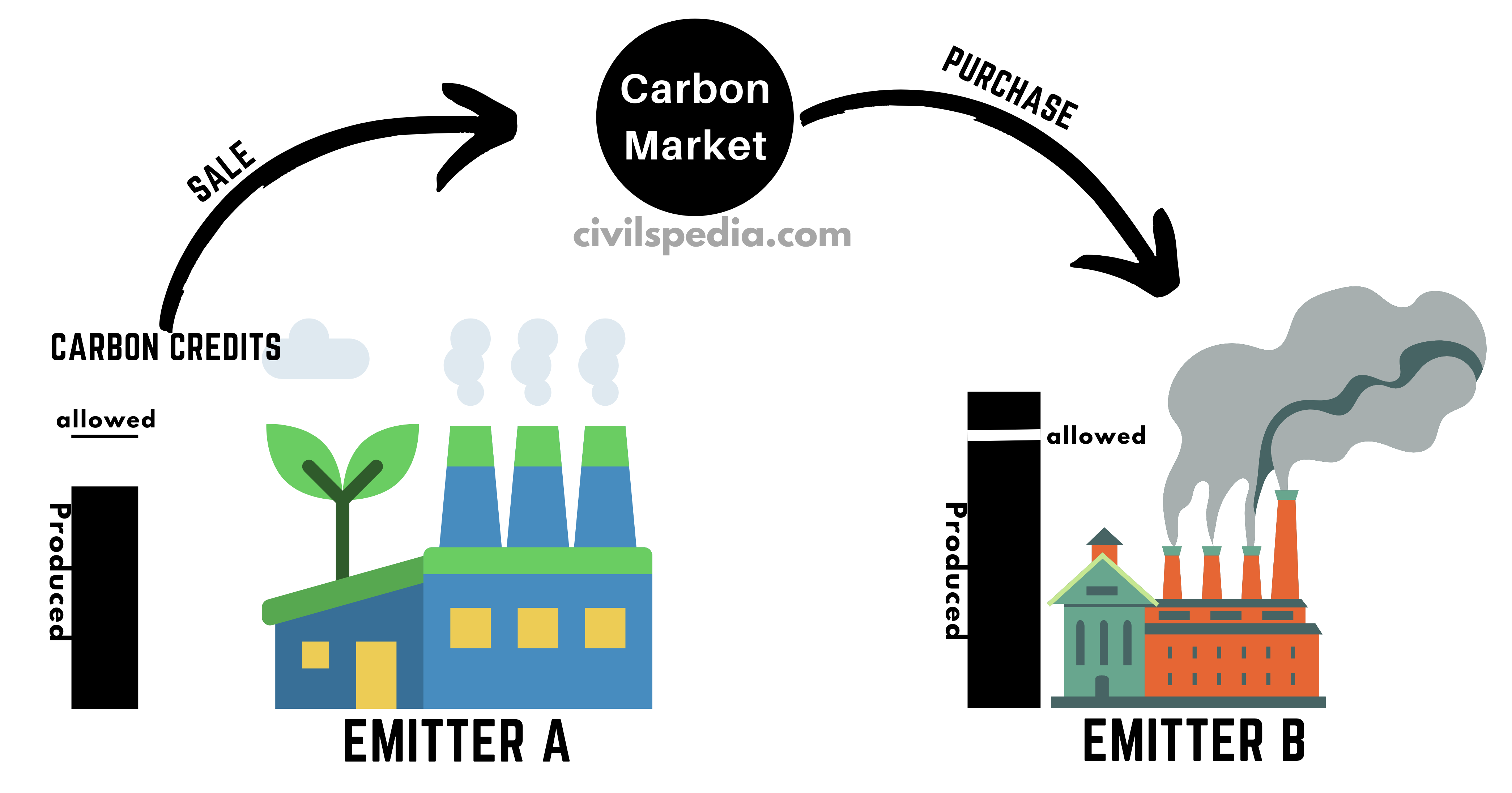

2.1 Carbon Trading or Cap and Trade

Carbon Trading, also called carbon emissions trading, is a market-based system of buying and selling permits and credits that allow the permit holder to emit carbon dioxide. The model used in most carbon trading schemes is called ”cap and trade”.

How does ‘cap and trade’ work?

- Setting a cap: An overall limit or cap is set on the amount of emissions allowed from significant carbon sources, including the power industry, automotive and air travel.

- Issuance of permits: Governments issue permits up to the agreed limit. Each permit is usually measured in terms of one tonne of carbon dioxide equivalent (CO2e).

- Selling and buying of permits: If a company curbs its own carbon significantly below the cap, it can trade the excess permits on the carbon market for cash. If it’s not able to limit its emissions, it may have to buy extra permits.

2.2 PAT (Perform Achieve and Trade) & ESCerts

- It was launched by the Bureau of Energy Efficiency (Ministry of Power) under the National Mission for Enhanced Energy Efficiency (NMEEE).

- It is a market-based mechanism in which sectors are assigned efficiency targets. Industries that over-achieve targets get incentives through Energy-Saving Certificates (ESCert). Other companies can buy those ESCerts to meet their targets

2.3 Renewable Purchase Obligations (RPO) & Renewable Energy Certificates (RECs)

- Under the Renewable Purchase Obligations (RPO) mechanism, DISCOMs must purchase certain percentage of their total energy in the form of renewable energy.

- Renewable Energy Certificates (RECs) are provided under the RPO mechanism if DISCOM is using more than the required Renewable Energy. DISCOM is entitled to RECs equivalent to the surplus

- Those Discoms, which are not able to use the required Renewable Energy can buy these RECs and claim that they have purchased renewable energy.

2.4 Green Bonds

What are green bonds?

- The Green Bond is a type of bond (debt instrument). But the issuer of a green bond publicly states that capital is being raised to fund ”green” (environment-friendly) projects, like renewable energy, clean transportation etc.

- It can be issued by Banks as well as Companies.

Timeline

| 2007 | In 2007, green bonds were first launched by European Investment Bank & the World Bank |

| 2015 | Yes Bank & later EXIM bank launched India’s first dollar-denominated green bond. |

| 2016 | SEBI issued Green Bond guidelines. |

| 2017 | L&T issued the first SEBI-approved Green Bonds. |

| 2022 | Budget 2022 announced that the Government of India would issue Sovereign Green Bonds (SGB) for projects leading to a less carbon economy. |

Importance

- India has set an ambitious target of generating 40% of its energy through Renewable sources by 2030 as part of its Paris Climate Deal obligations (INDC). It requires massive funding, and Green Bonds can help in raising that.

- Higher interest rates in India raise renewable energy costs by about 25%. Green bonds carry a lower interest rate

- Green bonds enhance an issuer’s reputation by showcasing its commitment towards sustainable development.

- It allows issuers to tap into pools of global investors & capital funds dedicated to ethical climate change and green investing.

Risks & challenges

- Greenwashing: There have been heated discussions regarding whether the projects that green bond issuers fund are environmentally friendly. E.g., Reuters reported how activists were claiming that the proceeds of the French utility GDF Suez’s $3.4 billion green bond issue were used to fund a dam project that hurts the Amazon rainforest in Brazil.

- Most green bonds in India have a shorter tenure of about 10 years (compared to international issuances). A typical loan is for minimum 13 years.

- Most Indian Green Projects are small and unattractive to investors due to their small scale.

- Borrowing costs and information asymmetry: In India, the cost of green bond issuance has consistently remained higher than that of other bonds.

Further steps required

- Standardizing the definition of green

- Going towards securitization & aggregation: Many standalone green projects such as rooftop solar, energy efficiency, and rural water supply remain unattractive to institutional investors owing to the smaller scale and vast geographical spread. Aggregation and securitization of such projects could be a welcome move in providing mainstream debt to small-scale green projects.

Side Topic: Blue Bonds

- It is a sub-type of green bond.

- Blue bonds are sustainability bonds used to fund initiatives to preserve and protect the ocean and its surrounding ecosystems. E.g.,

- Sustainable fisheries

- protection of fragile ecosystems

- reducing pollution and acidification

- E.g. 2018- Seychelles issued the world’s first ”Blue Bond” to expand its marine protected areas and fisheries sector.

3. International Funds

3.1 Adaptation Fund

- Adaptation Fund was established under United Nations Framework Convention on Climate Change (UNFCCC). 2% of the trade of Carbon Credits goes to Adaptation Fund.

- From the Adaptation Fund, the funds are sent to the National Implementation Entity (NIE) of countries.

- For India, this Agency is NABARD (it is the only NIE in the Asia Pacific)

3.2 Global Environment Facility (GEF)

- Global Environment Facility (GEF) was established during the Rio Earth Summit of 1992 to address the world’s most challenging environmental issues.

- GEF provides funding for 5 things

- UNFCCC

- Convention on Biological Diversity (CBD)

- Stockholm Convention on POPs

- Minamata Convention on Mercury

- UN Convention to Combat Desertification

- World Bank serve as the Trustee of the GEF

3.3 Green Climate Fund (GCF)

- It was established in 2010 at COP 16 held in Cancun.

- GCF raise money from rich countries to fight climate change. Projects will be carried out in developing countries to fight climate change using this fund.

- The aim is to spend $100 Billion per year from 2020.

- Countries have to appoint a National Designated Authority (NDA) that acts as the interface between their government and GCF. India’s NDA is NABARD.

Issues with GCF

- How to define Green Climate Finance. E.g :

- Will US NGOs (e.g. Ford Foundation or Melinda Gates Foundation) working on providing clean water in Africa be considered within US Green Climate Obligations in Account books? Developed countries are re-categorising all these funds under GCF Obligations.

- Is Technology Transfer part of Green Climate Finance? Suppose Patents are transferred like the US transferred patents to produce Solar Cells in India. Will the cost of the patent be counted under GCF obligations? Developed countries are in favour while Developing countries are opposed to this.

- Which Countries have the first claim over GCF Corpus? Should AOSIS Nations, which are most affected by Climate Change, get these funds or African Nations or Other developing countries?

- Whether to spend it on Mitigation or Adaptation projects