Last Updated: Feb 2023 (Sugarcane Pricing Issue)

Table of Contents

Sugarcane Pricing Issue

This article deals with the ‘ Sugarcane Pricing Issue.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Importance of the Sugar Industry

The sugar industry is vital as

- It is India’s second largest agro-based industry, next only to cotton.

- 5 crore farmers are directly or indirectly involved in this.

- India’s annual sugarcane production is around 35 crore tons, which is used to produce 2.6 crore tons of sugar.

- India’s domestic sugar production is more than domestic consumption.

Regulated Nature of Sugar Industry

The sugar industry is highly regulated.

Regulations at Farmer Level

- Farmers are obliged to sell produce at the nearest mill only. Mills are obliged to purchase from all farmers.

- Wrt sugarcane pricing, the Union government announces the Fair and Remunerative Price (FRP) suggested by the Department of Food and Public Distribution and approved by Cabinet Committee on Economic Affairs.

- State governments announce State Administered Prices (SAP), which are usually higher than Union’s FRP due to vote bank politics.

Regulations at Mill Level

- Mills must purchase from all farmers at FRP or SAP (whichever is higher).

- Sugar mills can buy sugarcane only from farmers within a specified radius, known as Cane Reservation Area.

- The government also fixes the Minimum Selling Price of sugar (which as of 2021 is Rs 3,100 per quintal).

- The Centre also fixes the mill-wise sales quota of sugar.

- Centre’s Sugarcane (Control) Order mandates mills to pay the FRP within 14 days of cane purchase from farmers, failing which 15% annual interest is charged on the due amount for the delay period.

- Government levy: Earlier, mill owners had to give 10% of their production to the central government at the government-determined price (which was much lower than the market price). This provision has been abolished now.

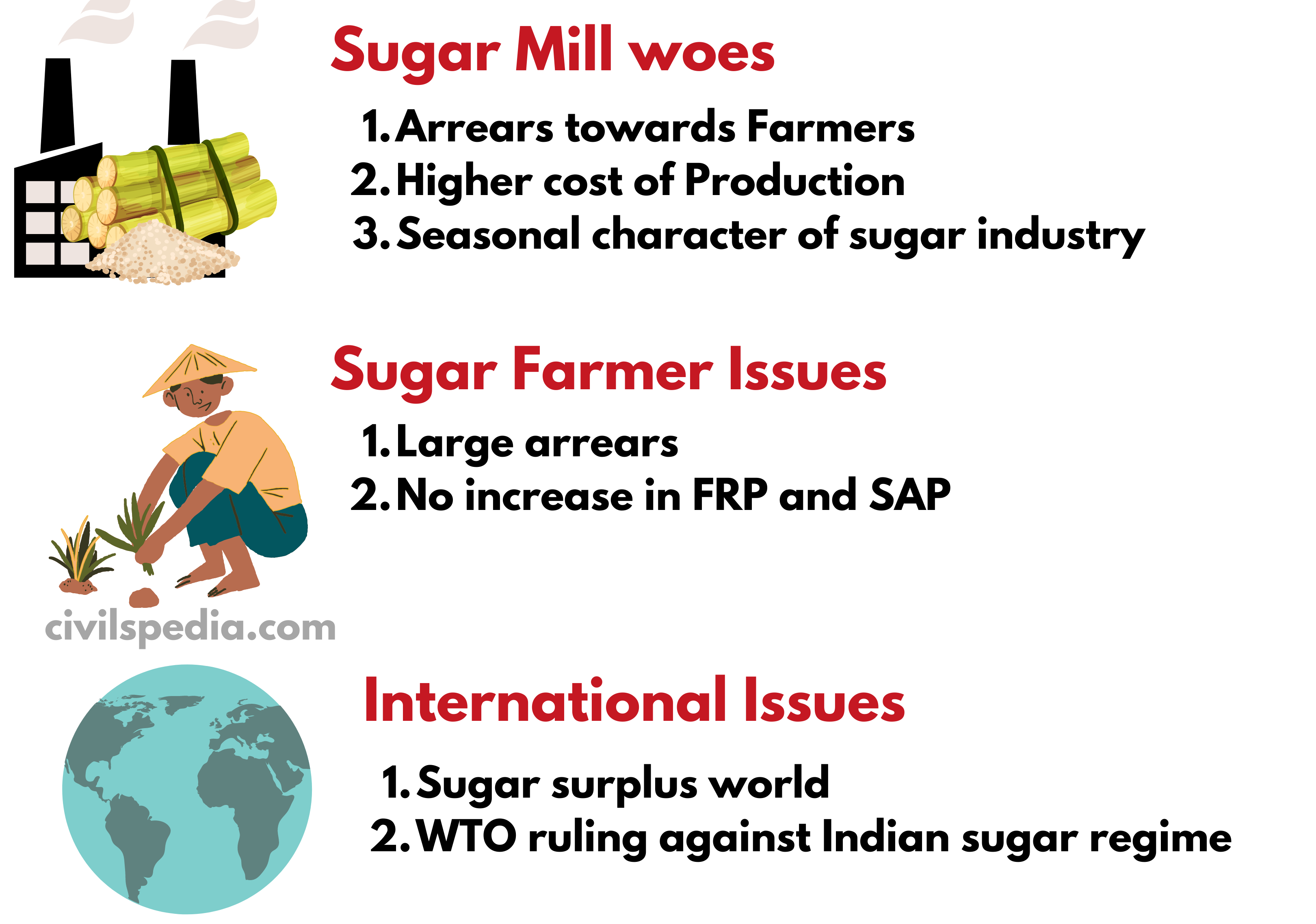

Main Problem of the Sugar Industry (price related )

- The cost of Production of Sugar (of Mills) is greater than the Market Price of Sugar.

- Significant arrears of sugar farmers towards Sugar Mills to the tune of ₹22,000 crores are still lying.

- Union and State governments announce high FRP & SAP due to vote bank politics.

- The sugar industry has a seasonal character – mill, and the workers remain idle for almost half a year.

- The sugar recovery rate in India is less than 10% compared to Java and Hawaii, where it is up to 14%.

- Low Sugar Prices in World Market: The world is sugar surplus. Mill owners can’t increase the price of sugar due to the import of foreign sugar.

- WTO ruling against Sugar Pricing Regime: Australia, Brazil, and Guatemala filed a complaint against India in 2019 that the Indian government supports its sugarcane farmers that go against the WTO principles and breach the de-minimus limit. In 2021, WTO Dispute Settlement Body ruled against India.

Suggestions to address woes of the Sugar Sector

- C Rangarajan Panel on Sugar Pricing recommended that States should stop announcing SAP and go with FRP suggested by Union.

- The Union government should devise a proper mechanism to arrive at FRP. Presently, Union Government doesn’t reduce FRP even if sugar prices are low.

- Proper utilization of the by-products of Sugarcane like Ethanol, Bagasse etc.

- The industry association opines that if states announce SAP higher than FRP, the state governments should bear such price differential.

- Power generation using cogeneration technology & generating revenues by selling extra electricity.

Steps taken already

- Union Government has given soft loans with low interest to sugar mill owners to pay the arrears of farmers.

- Import duty on the import of sugar was increased from 50% to 100%.

- Export duty on exporting sugar has been scrapped.

- National Policy on Biofuels, 2018: It has set the target of 20% ethanol blending of petrol by 2030 to provide a market for the by-products of the sugar industry.

- State-Specific Steps: In 2020, the Maharashtra government gave a state guarantee for loans to Sugar Cooperatives to buy sugarcane from farmers on time.

Side Topic: Ethanol

- Ethanol is a by-product of the sugar industry

- Use: It can be used as fuel by mixing with petrol.

- To offset their losses, Sugar Mills can go towards Ethanol manufacturing.