Last Updated: April 2023 (Utilization of Public Funds)

Table of Contents

Utilization of Public Funds

This article deals with the topic titled ‘Utilization of Public Funds .’ This is part of our series on ‘Ethics’. For more articles, you can click here.

Introduction

The Public fund is money that the government generates to provide goods and services to the general public. It is held by the government as a custodian and not an owner. Hence, judicious and effective utilization of public funds is very crucial. However, public funds are often subjected to inefficient utilization, diversions, etc., owing to factors such as corruption.

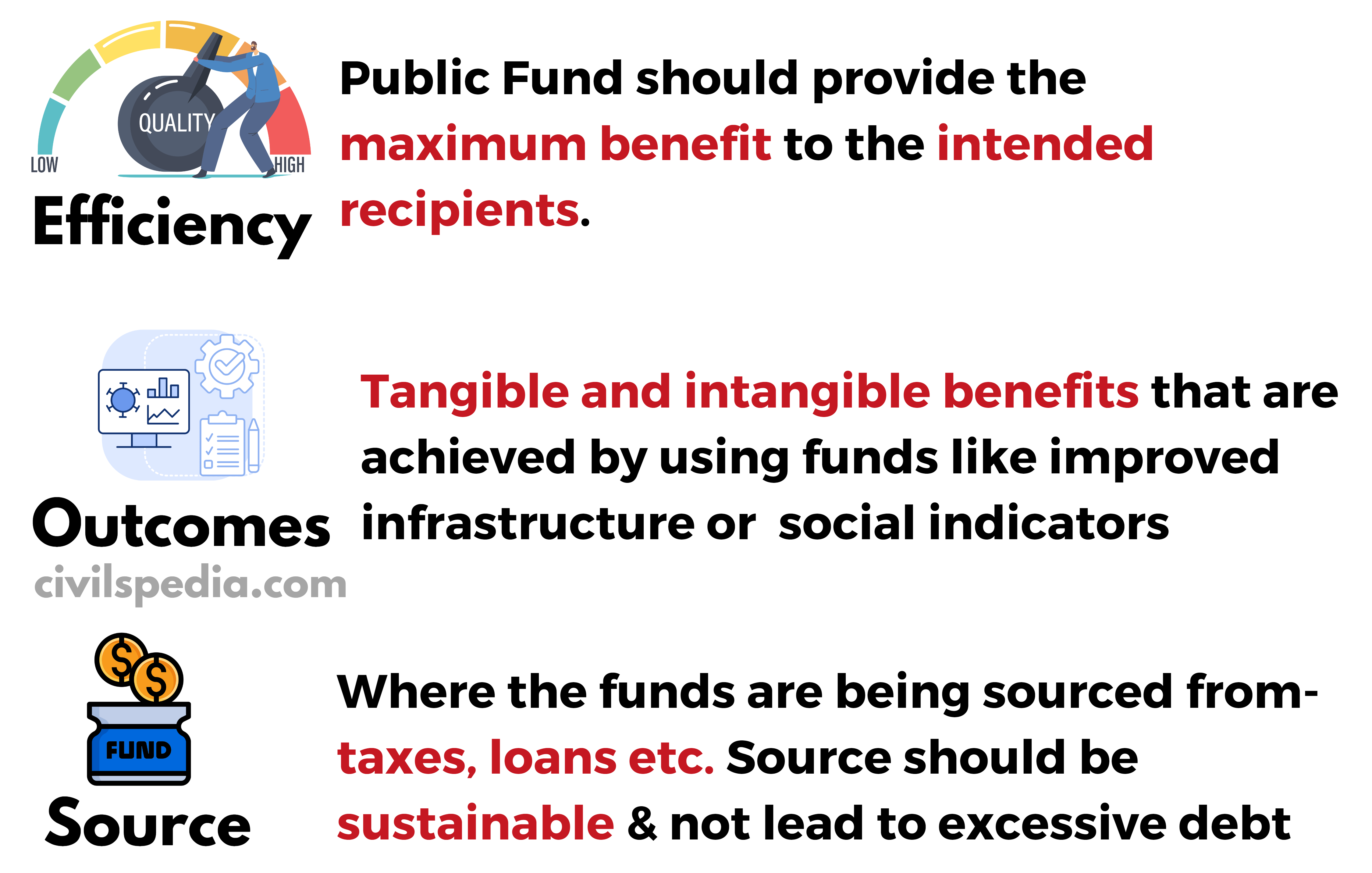

There are various aspects to consider when it comes to the utilization of public funds:

Problems in the Public Fund Utilization

CAG reports, and other academic studies have revealed the following problems in the public fund utilization

- Ministries release funds mechanically without considering the capacity of State Governments to absorb and utilize those funds. For example, in 2018, the Ministry of Health released Rs. 9,000 crores to various states for the implementation of the National Health Mission. But, many states were unable to utilize the funds due to a lack of infrastructure, inadequate human resources etc.

- Misuse of public funds for political purposes: It can be seen in the following examples.

- Freebies and schemes: Political parties offer freebies such as free laptops, TVs, and other household appliances, which depletes the public exchequer but creates an unfair advantage for the party

- Development projects: Political parties sometimes allocate public funds for development projects in areas where they have a strong vote bank.

- Internal audit functions within departments are inadequate due to various issues.

- Insufficient Resources: Internal audit team is generally understaffed or underfunded.

- Lack of Technical Expertise: Internal auditors may not have the technical expertise required to perform their duties.

- Ineffective Communication: The higher management generally doesn’t act on the findings and recommendations of the Internal Auditors

- State Governments are more interested in getting funds from the Central ministries than in ensuring the quality of expenditure. For instance

- Case of Centrally Sponsored Schemes (CSS): CSS are partially funded by the Central Government but implemented by State Governments. State governments focus more on meeting the conditions for receiving the funds rather than ensuring that the schemes are appropriately implemented to benefit the intended beneficiaries.

- To attract more Central funding, State Governments prioritize the allocation of funds towards projects that are likely to attract central funding rather than those that are genuinely important for the development of the state.

- March Madness or March Rush: Central Ministries are also more concerned with expenditure rather than the attainment of the objectives. Large parts of funds are generally released in the last month of the financial year, which could not be expected to be spent by the respective State Governments during that financial year. It is done to avoid the funds being surrendered to the government at the end of the financial year.

- Veracity and propriety of expenditure data cant be assured, and generally, expenditure figures given by IAS do not tally with the statistics reported by the District level agencies. On the whole, expenditure information is unreliable.

How the problem of misuse of Public Funds can be corrected

There are various ways to do this

1. Citizen Participation

Social Audit: The social audit evaluates and assesses the social impact of government policies and programs on various sections of society.

2. Audit

- CAG: Expenditures from all public funds must be properly accounted for and pass through the Comptroller and Auditor General (CAG) audit.

- Parliamentary Oversight: Major irregularities which emerge are also examined by parliamentary committees (Public Accounts Committee, Estimates Committee etc.)

3. Outcome-Based Approach to Evaluation

Outcome-Based Approach to Evaluation (OBAE) is a method of assessing the effectiveness of programs and policies by examining their impact on the desired outcomes. For example

- National Rural Health Mission (NRHM): The scheme aims to improve healthcare in rural areas. It is evaluated by measuring the progress towards the desired outcomes, such as reducing infant and maternal mortality rates.

- Sarva Shiksha Abhiyan (SSA): The scheme aims to provide free and compulsory education to all children aged between 6 and 14. It is evaluated by looking at desired outcomes, such as improving enrolment, retention, and learning outcomes

4. Informed Citizenry

The informed citizenry is essential for holding the government responsible for efficiently utilizing public funds. When citizens are aware of where their tax money is being spent, they can hold the government accountable for its spending decisions. For example

- Right to Information Act: RTI empowers citizens to access information about government expenditures. It has helped ordinary people to expose the corruption and misuse of public funds.

5. Use of e-Governance

5.1 Central Plan Scheme Monitoring System (CPSMS)

- CPSMS integrates tens of thousands of implementing agencies through a common system and tracks fund movement at successive stages, starting with the initial release from the Centre till the money actually reaches the ultimate beneficiaries. It has covered over 1000 Central Plan schemes, captured more than 75,000 sanctions for the release of funds, and registered nearly 20,000 programme-implementing agencies with the system. In addition, CPSMS is linking with State treasuries and State AGs to obtain real-time expenditure information for schemes for which funds are transferred from the Central Ministries to the States.

6. Canons of Financial Propriety

Public officials should be guided by following canons of financial propriety.

- Government officials are expected to exercise the same level of prudence in managing taxpayer funds as they would when handling their own personal finances.

- The expenditure should’ t be more than what the occasion demands.

- It is inappropriate for any authority to use its power to approve expenses resulting in direct or indirect benefits to itself.

- Public funds should not be spent for the benefit of a specific individual or group of people except in cases where it can be enforced in a court of law.

1 thought on “Utilization of Public Funds”