Last Updated: June 2023 (Infrastructure)

Table of Contents

Infrastructure

This article deals with ‘Infrastructure – upsc.’ This is part of our series on ‘Economics’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

What is Infrastructure?

According to the Department of Economic Affairs, Infrastructure is the set of basic facilities that help an economy to function & grow, such as transport and logistics, energy, water and sanitation, communication and social and commercial infrastructure (like hospitals, schools, sports infrastructure, industrial parks etc.)

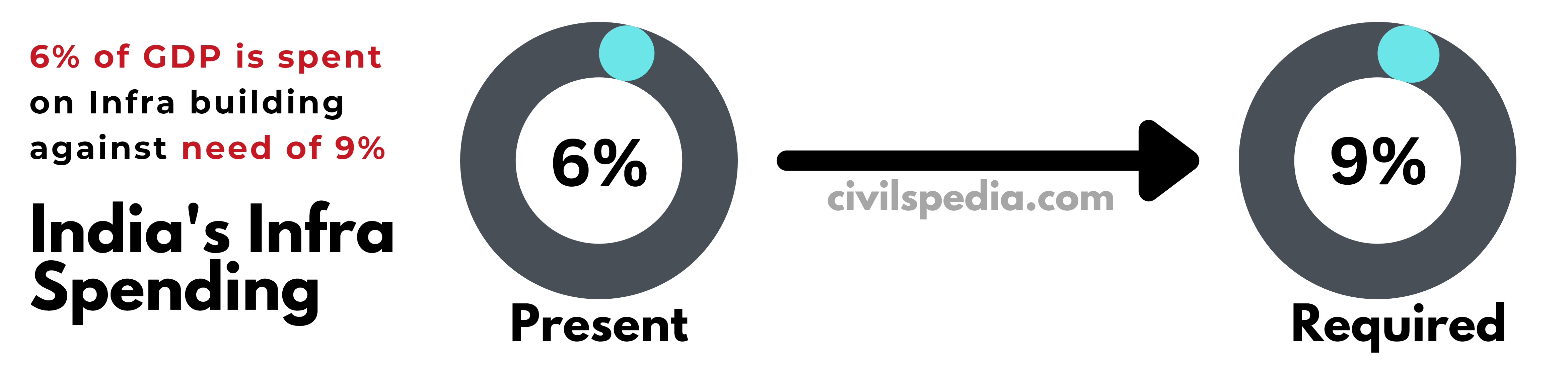

Since infrastructure benefits the whole economy, economists often argue that the government should fund the sector by means of taxation, partly, if not wholly. India needs to invest massive amounts to build infrastructure vouched by following data

Additionally, Sustainable Development Goals (SDG) also talk about building resilient infrastructure.

Why India should Invest in Infrastructure?

- To achieve the vision of $5 Trillion Economy: To sustain the growth and achieve 5 Trillion economy, India needs to improve and invest in the infrastructure sector.

- To create employment: Construction activities creates large number of jobs.

- To support the increased urbanization: India is urbanizing at a massive pace. Hence, the investment in infrastructure should be increased commensurately to make the process of urbanization sustainable.

- Climate and disaster resilient Infrastructure: India will have to invest massively to make the existent infrastructure climate resilient in view of climate change and increased number of disasters.

Infrastructure Bottlenecks: Reasons due to which projects get stalled

Infrastructure is the lifeline of an economy. One of the biggest problems hampering the growth of the Indian Economy is infra bottlenecks. These bottlenecks include

1. Large Number of Clearances

- There is no ease of doing business & a large number of clearances are required for building infrastructure projects.

- E.g., In Airport Construction, clearances are needed from DGCA, the Ministry of Defence etc.

2. Systemic Bottlenecks

- Land acquisition, environmental clearances, delays in procurement etc., have added to project delays.

3. Over-Leveraging

- Aggressive bidding during the high growth phase and subsequently slowing down has made their balance sheets highly debt-ridden.

4. Issues with Dispute Redressal

- The dispute redressal process is painfully long in India. It takes 3.8 to 4.3 years on average to settle commercial disputes.

5. Credit Crunch

- Projects have long gestation periods, and banks can’t fund such long-term projects. Moreover, Banks are suffering from high NPAs, and the corporate bond market has not developed sufficiently. Hence, many projects at various stages of completion are facing Credit Crunch and are not able to complete.

Measures to address these problems

- Form a specialized body to make better contracts for PPP projects so that they don’t face legal hurdles in future (E.g., 3P India).

- Addressing systemic delays

- Swifter environmental clearances should be given to linear infra projects.

- Plug-and-Play Mode: Government agencies should ensure regulatory clearances before awarding infra projects so that the winning bidder can get to implementation straightaway.

- Overhauling Dispute Redressal: The BK Chaturvedi Committee was constituted in this regard. Additionally, Commercial Courts have been formed, and Arbitration and Conciliation Act has been passed.

- Expanding the corporate bond market: Since long-term financing is required, bank lending has limited capacity. Thus, the corporate bond market must be deepened & expanded. Bankruptcy Code will help in this regard by developing Corporate Bond Market.

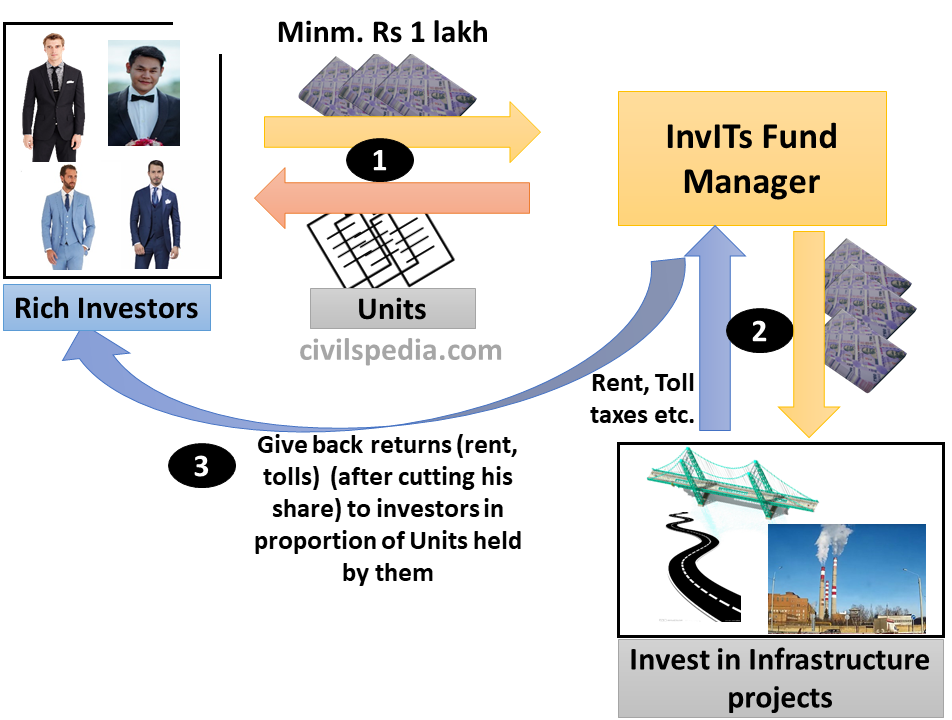

- Infrastructure companies can now use REITs & InvITs to attract funds for infrastructure projects.

- The government is now emphasizing EPC (Engineering- Procurement- Construction) & Hybrid Annuity Model rather than BOT (Build-Operate-Transfer) Model.

Side Topic: Pragati Program

- Aim: Timely implementation of government programs (especially in infrastructure, worth trillions of rupees.)

- PM has launched PRAGATI— Pro-Active Governance and Timely Implementation to monitor the progress made wrt these projects himself.

- PM holds monthly meetings with Secretaries of the Union government and Chief Secretaries of all state governments to review the progress of projects under implementation. Meetings are held through video conference.

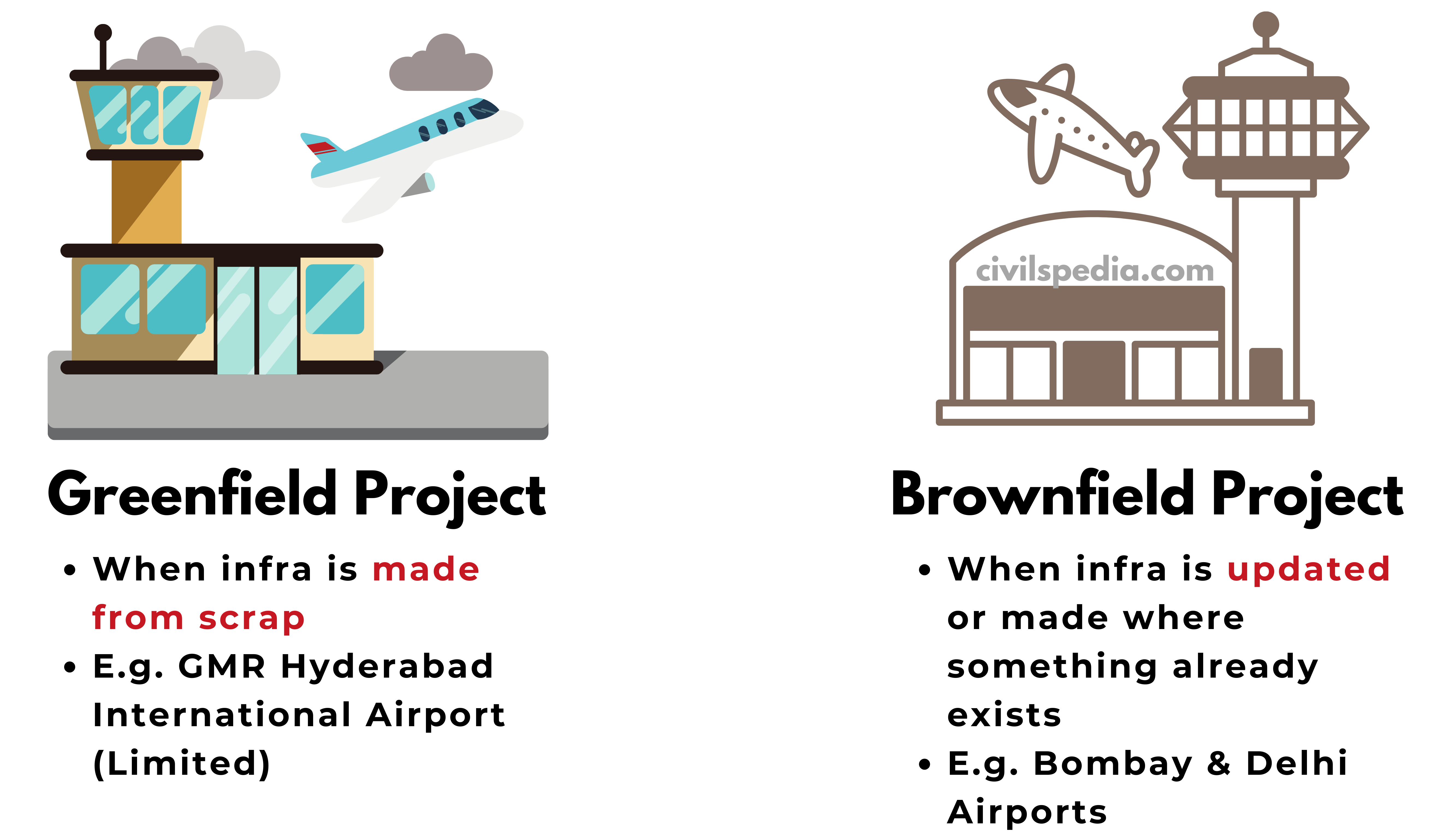

Side Topic: Type of Projects

Infrastructure Financing

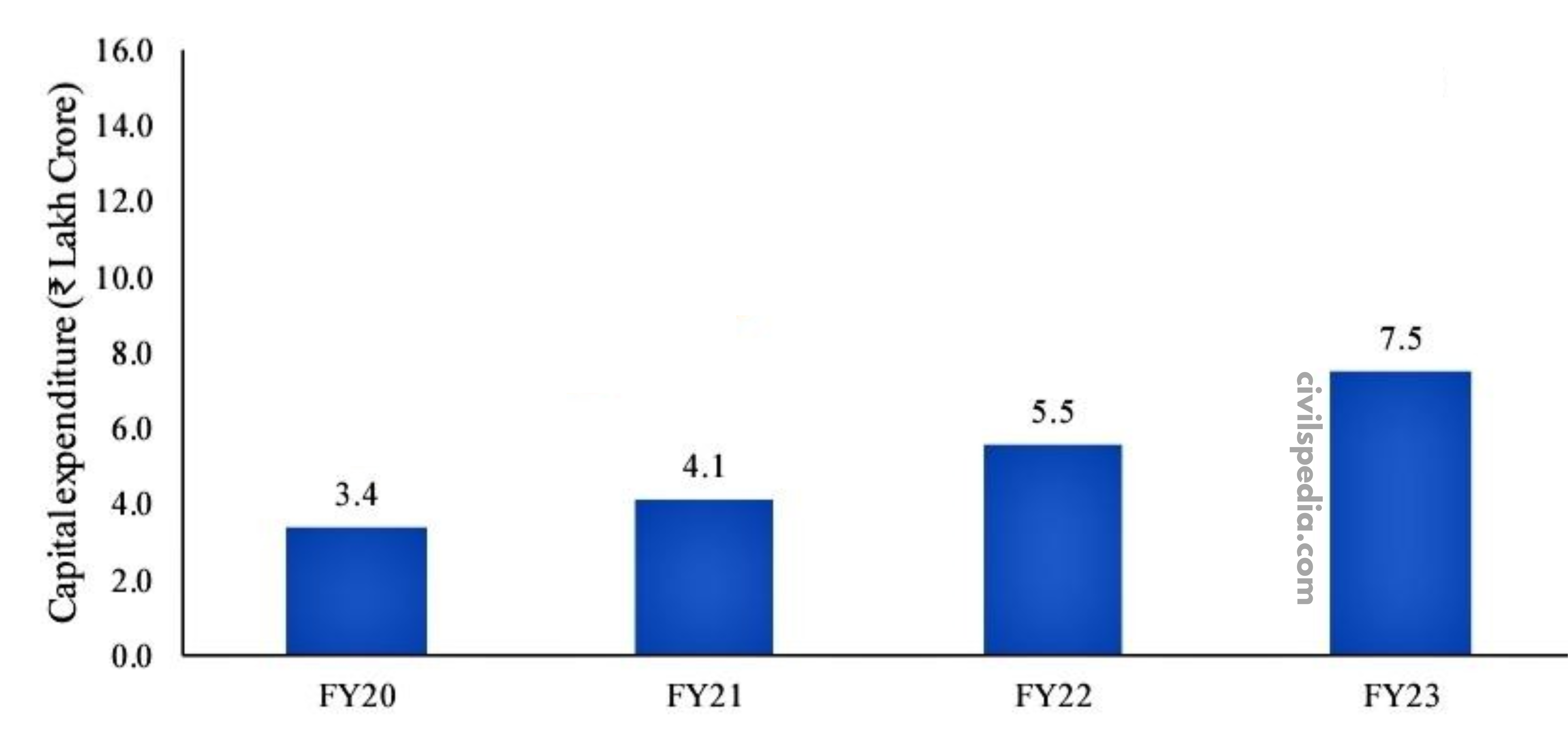

The central government is one of the major financers of infrastructure in India. In recent times, the amount of the government’s capital expenditure on infrastructure has increased sharply.

But the government can’t fund all the infrastructure projects given the FRBM targets. Hence, the following routes can be adopted to finance infrastructure projects.

1. National Monetization Pipeline

- Monetization means transferring the revenue rights to a private party for a specified transaction period in return for upfront money, a revenue share and a commitment to investment in the assets.

- Under the Scheme, the government will first identify the already created assets, such as National Highways, Railway Lines, Power Transmission Lines, Pipelines etc. These brownfield assets will then be leased to the private sector for a certain period. The money thus raised will be used for the creation of new assets. Hence, it is a limited period transfer of Brownfield Infrastructure Assets (where investment is already being made, but assets are either languishing or not fully monetized or under-utilized) to unlock “idle” capital.

- The aim of the initiative is to monetize government assets through limited private participation. The target is to raise Rs. 6 Lakh Crores in the next 5 years.

- It will promote Public-Private Partnerships, each excelling in their core competencies like the government’s ability to deliver socio-economic growth and the private sector’s ability to provide quality service.

2. National Bank for Financing Infrastructure and Development (NaBFID)

- NaBFID was set up in 2022 as a statutory Development Financial Institution for financing infrastructure.

- It will provide ₹5 lakh crore long-term infrastructure funding in the next 3 years.

3. National Infrastructure Pipeline

- In 2019, Finance Minister created National Infrastructure Pipeline (NIP) to mobilize ₹111 lakh crore for building infrastructure in the next five years (2019-20 to 2024-25). It aims to develop a comprehensive view of infrastructure development in the country, monitoring its progress at the highest levels in the government for timely completion and enabling a pipeline view for investors to plan infrastructure investments.

- Funds collected under NIP will be used to fund projects spread across Energy (24%), Roads (19%), Urban (16%), Railways, Irrigation etc.

4. Masala Bonds

- Masala Bonds are offshore ₹ denominated bonds.

- These are already used by Railways, NHAI etc., to gather funds for building infrastructure.

5. Infrastructure Investment Trust (InvITS)

For more details, CLICK HERE.

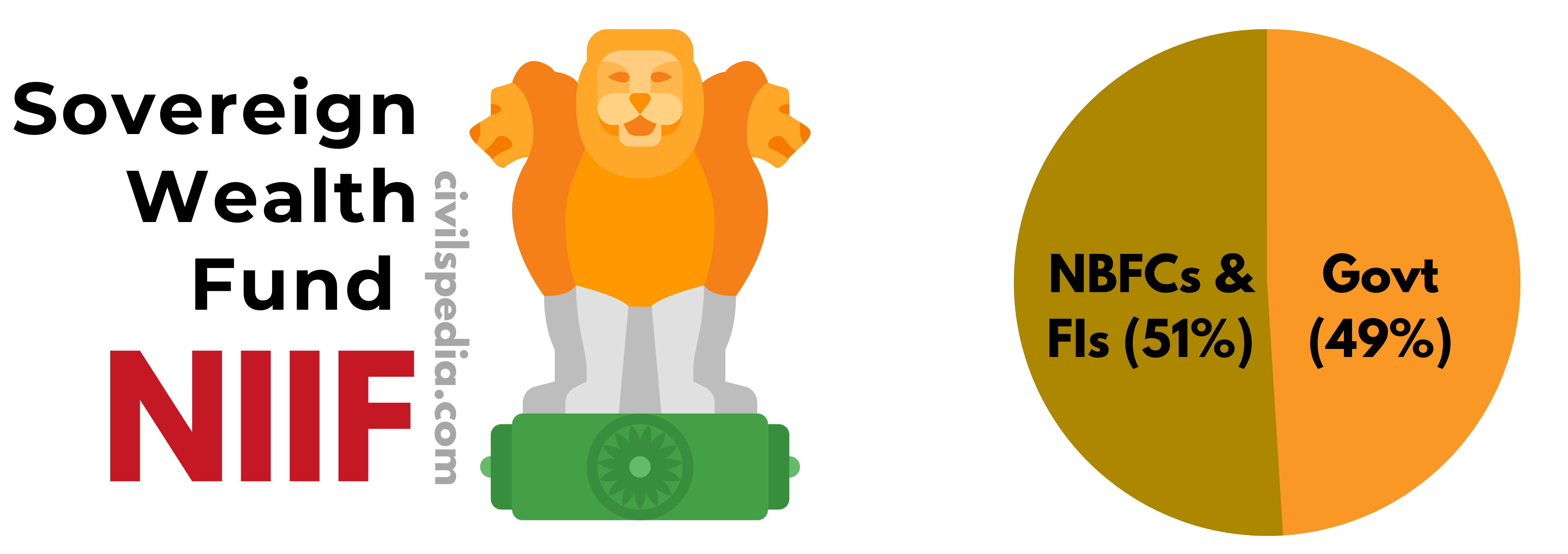

6. National Investment and Infrastructure Fund (NIIF)

- NIIF is a Sovereign Wealth Fund of India (i.e. it has the guarantee of the government of India.)

- It has a corpus of ₹ 40,000 crores.

- Ownership of NIIF is as follows.

7. Bank loans

Bank Loans can also be taken to fund infrastructure projects. But due to high NPA levels and the long gestation period of such projects, it is not considered a good option for financing infrastructure projects.

8. PPP

- The private sector is roped in the infrastructure projects via Public Private Partnerships.

9. Pension Funds

- Pension Funds are very stable and long-term in nature.

10. Value Capture Financing

- It is an innovative type of infrastructure financing in which the value of public infrastructure (like road building, sewage etc.) is recovered from the landowners who stand to gain from the construction of that infrastructure due to appreciation in the value of that land.

Side Topic: Harmonized List of Infrastructure Sector

Finance Ministry notifies the list of sectors included in Harmonized List of Infrastructure. Presently, there are 5 Main Sectors and 34 Sub-Sectors included in the list

- Transport and Logistics: Roads, Railways, Waterways, Airports, Pipelines and Multi-Modal Logistic Parks

- Energy: Generation, Transmission, Distribution, Storage of Oil or Gas or LNG

- Water and Sanitation: Solid Waste Management, Irrigation, Water Treatment Plants

- Communication: Telecommunication Towers and Services

- Social and Commercial: Educational Institutions, Sports, Hospitals, Tourism Infrastructure, Cold Chain Infrastructure, Affordable Housing, Affordable Rental Complex, Exhibition and Convention Centres.

Benefits of Inclusion in Harmonized List of Infrastructure

- Access to long-term credit at concessional rates from banks and financial institutions

- Easier access to overseas borrowings

- The sector becomes eligible to borrow from development banks like India Infrastructure Financing Company (IIFCL)