Basics of Radioactivity

This article deals with ‘Basics of Radioactivity .’ This is part of our series on ‘Science and Technology’ which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

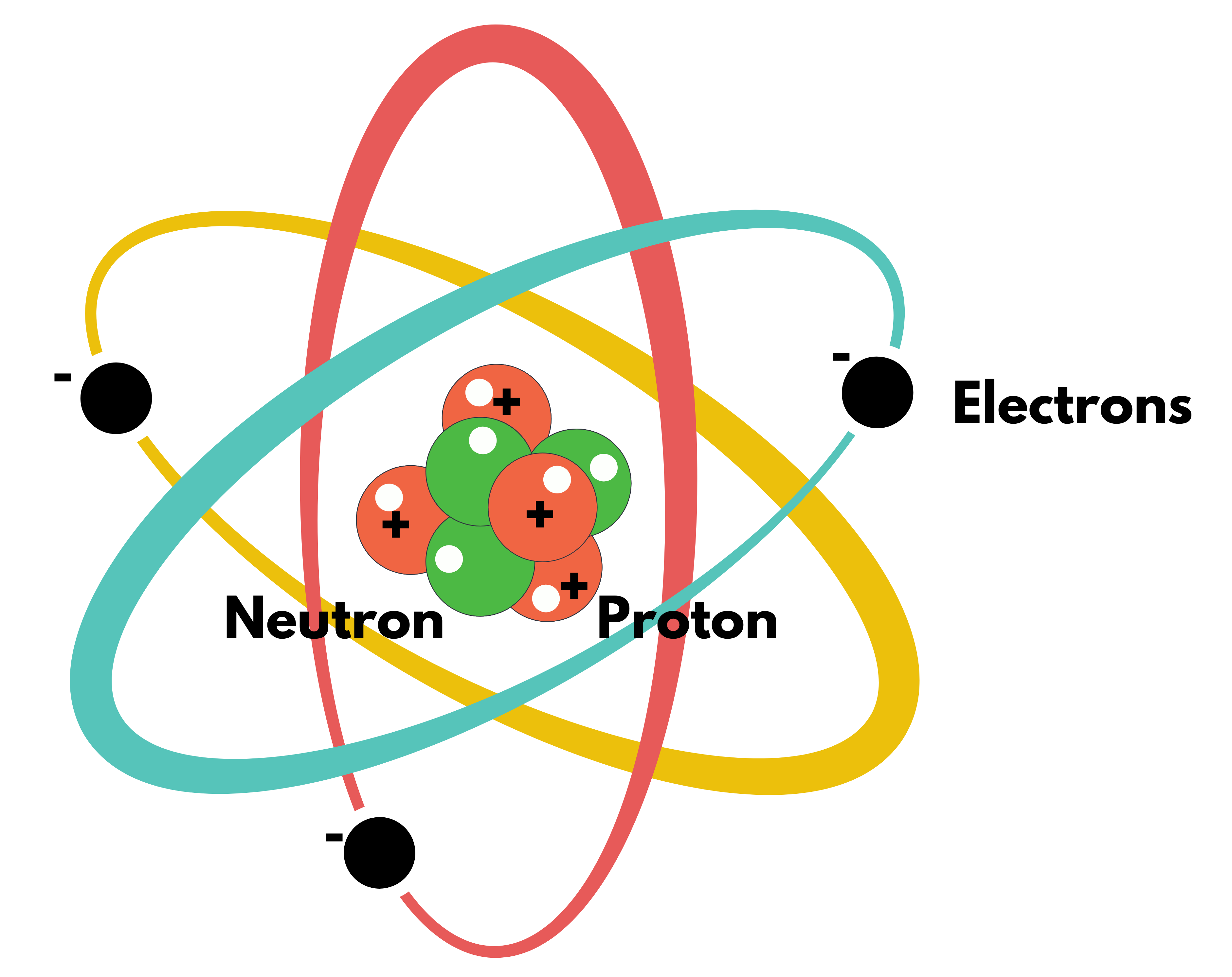

Constituents of Atom

Atom has the following three constituents

| Particle | Mass (Kg) | Charge (Coulomb) |

| Proton | 1.672 X 10^-27 | + 1.6 X 10^ -19 |

| Neutron | 1.675 X 10^-27 | Neutral |

| Electron | 9.108 X 10^-31 | 1.6 X 10^-19 |

Mass of Proton almost = Mass of Neutron = 1830 X Mass of Electron.

Atomic Structure

- In an atom, Central Nucleus is surrounded by electrons at various energy levels.

- The most successful model is Wave Mechanical Model, but that is a mathematical rather than a visual model.

- For our purpose, Bohr Atomic Model is enough.

Bohr Atomic Model

- Atom consists of

- Central Nucleus: Containing all Protons & Neutrons with almost the whole mass concentrated here.

- Electrons: Revolves around the nucleus in a circular pattern (like planets around the sun)

- Electrons can revolve only in certain specified orbits, with the electron in the innermost orbit having the smallest energy and the electron in the outermost orbit having the largest energy.

- When an atom is provided energy either by strong heating or by bombardment with some fast-moving particle, Electrons in a natural state can jump to higher energy levels. But the atom doesn’t remain in that state for more than 10^-8 s & comes back to a normal lower energy level, emitting surplus energy in the form of Photons.

- Emitted energy can be Visible, UV or X-Ray, depending on the energy difference.

Radioactivity

- The property under which a heavy nucleus of an element disintegrates itself into smaller nuclei along with alpha, beta & gamma rays without being forced by any external agent to do so is termed radioactivity.

- The phenomenon of radioactivity is natural and can’t be stopped.

- It is found that all atoms with more than 83 protons; and a neutron-to-proton ratio of more than 1 as they are unstable. To achieve stability, unstable nuclei disintegrate spontaneously with the Alpha, Beta & Gamma Rays emission.

- Henry Becquerel discovered the phenomenon of radioactivity.

Reason of Radioactivity

- Inside the nucleus, positively charged Protons & Neutral are present. Hence, if only Electrostatic Force is there, all nuclei must have split apart due to repulsive forces. But this is not the case & the nucleus is stable.

- But another force called Nuclear Force is working here. IT IS ATTRACTIVE FORCE EXISTING BETWEEN PROTON & PROTON and PROTON & NEUTRON. BUT THIS FORCE ACTS AT A VERY SMALL DISTANCE. Generally, Nuclear Forces overpower Electrostatic Forces inside the nucleus.

- But in the case of larger nuclei, nuclear forces cannot overpower electrostatic forces, and they exhibit radioactivity.

Alpha, Beta & Gamma Radiations

The most common types are

| Alpha | Beta | Gamma | |

| Similar to Helium Nuclei (He (2,4)) and generally emitted by a large nucleus | These are fast energy electrons | – Gamma Radiations are electromagnetic radiations of high frequency – Generally emitted by unstable atoms to become stable by releasing energy | |

| Penetration | It can penetrate 5 cm of air only. | It can penetrate air and paper. | It can penetrate most things except a thick sheet of lead or a very thick concrete wall. |

| Mass | Heaviest (4 amu) | Lighter (9.1 X 10^-31 kg) | Massless |

| Speed | Around 1/100 of the speed of light | 33% to 99% of the speed of light | Equal to the speed of light |

| Ionising power | Maximum due to maximum charge (+2) and maximum mass | Intermediate between beta & gamma | Minimum due to zero charge |

| Effect on Photographic plate | Produce smaller effect | More effect | Maximum effect |

| Effect of Electric and magnetic field | Show deflection | Show deflection | Don’t show any deflection |

| Effect on the human body | It causes a burning effect | It can cause a shock on longer exposure | It can cause cancer |

Transmutation

- Transmutation is the process of altering one element to another.

- Reason = Natural Radioactivity, Artificial Transmutation etc.

- Artificial Transmutation is used to obtain elements with Atomic numbers greater than 92.

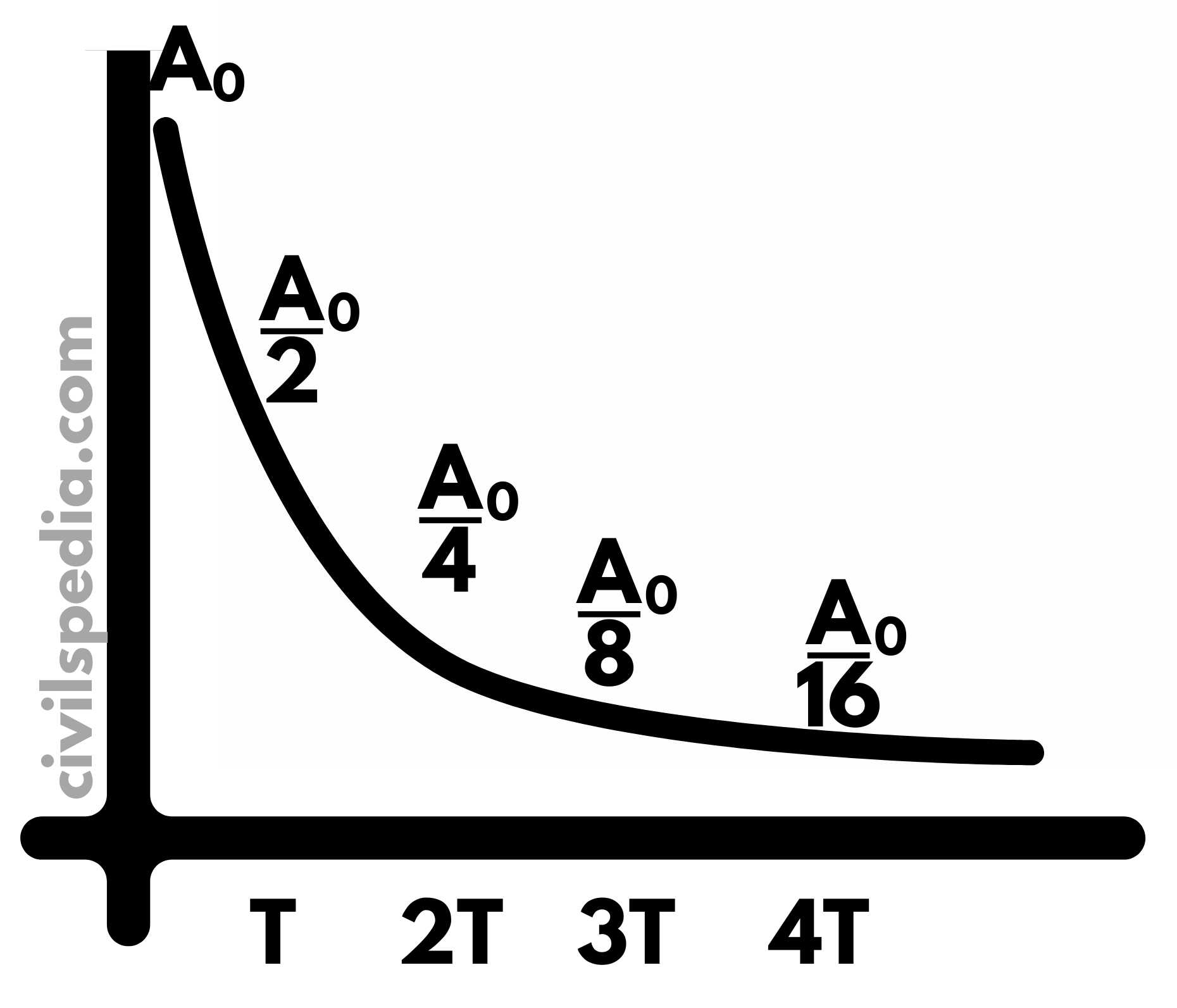

Half Age

It measures the time it takes for a given amount of the radioactive substance to become reduced to half due to decay and, therefore, the emission of radiation.

Carbon Dating

- The technique of estimating the age of the remains of a once-living organism, such as a plant or animal

- It involves measuring the radioactivity of its C-14 Content (the half-life of C-14 is 5570 years).

- The ratio of C-14 / C-12 in nature is 1/106.

Uranium Dating

- Uranium Dating is used for dating older but non-living things like rocks.

- The age of rocks from the moon has been estimated to be 4.6 X 10^9 years, nearly the time of Earth’s origin.

Isotope, Isobars & Isoneutrons

- Atomic Number (Z) = Number of Protons

- Mass Number (A) = Number of Neutrons & Protons

Isotope

- Isotopes are nuclides with same Atomic Numbers but different Mass Numbers.

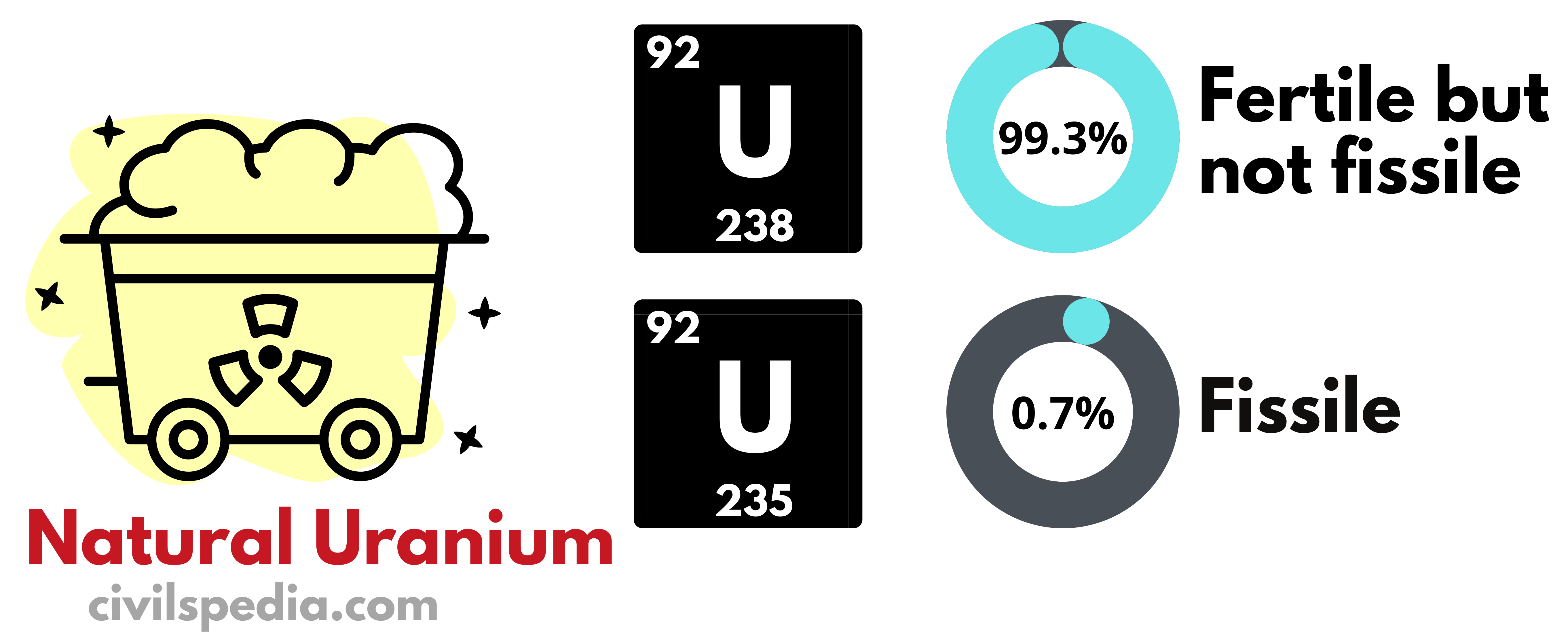

- E.g., U (92,235) & U (92,238 ) + C-12 & C-14

- Generally, isotopes don’t have different names except for isotopes of Hydrogen named Protium (H(1,1), Deuterium (H (1,2)) & Tritium (H(1,3)).

Isobars

- Isobars are nuclides having same Mass Number but different Atomic Numbers.

- E.g., K (19,40) & Ca (20,40) + C (6,14) & N (7,14)

- They have different names.

Isoneutrons

- Isoneutrons are nuclides having the same number of neutrons.

- Examples include

- C (6,14) & O(8,16): Both have 8 neutrons

- H (1,3) & He (2,4): Both have 2 neutrons