Last Updated: Feb 2025 (Surrogacy and Issues)

Table of Contents

Surrogacy and Issues

This article deals with ‘Surrogacy and Issues – UPSC.’ This is part of our series on ‘Science and Technology’, which is an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction

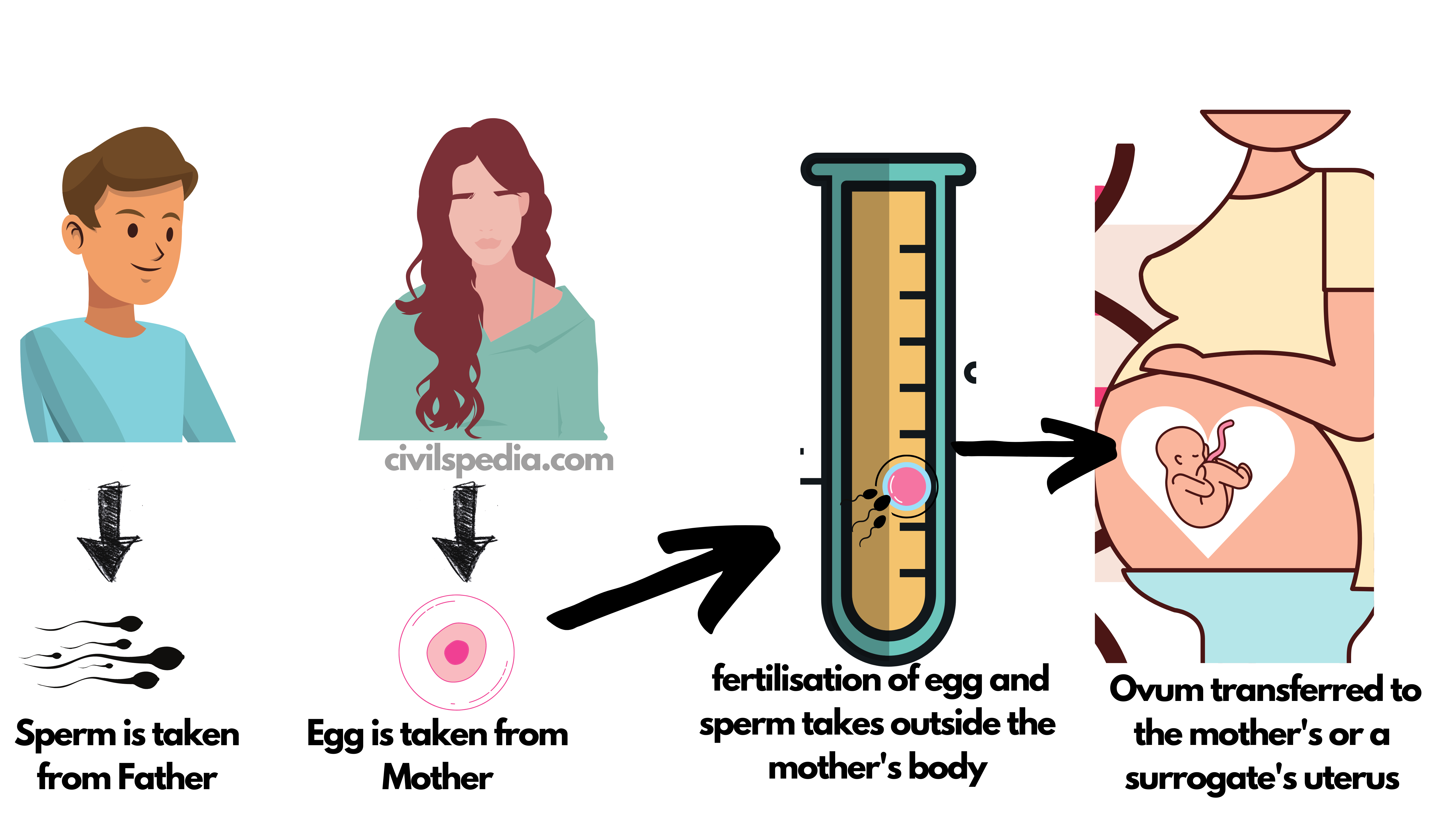

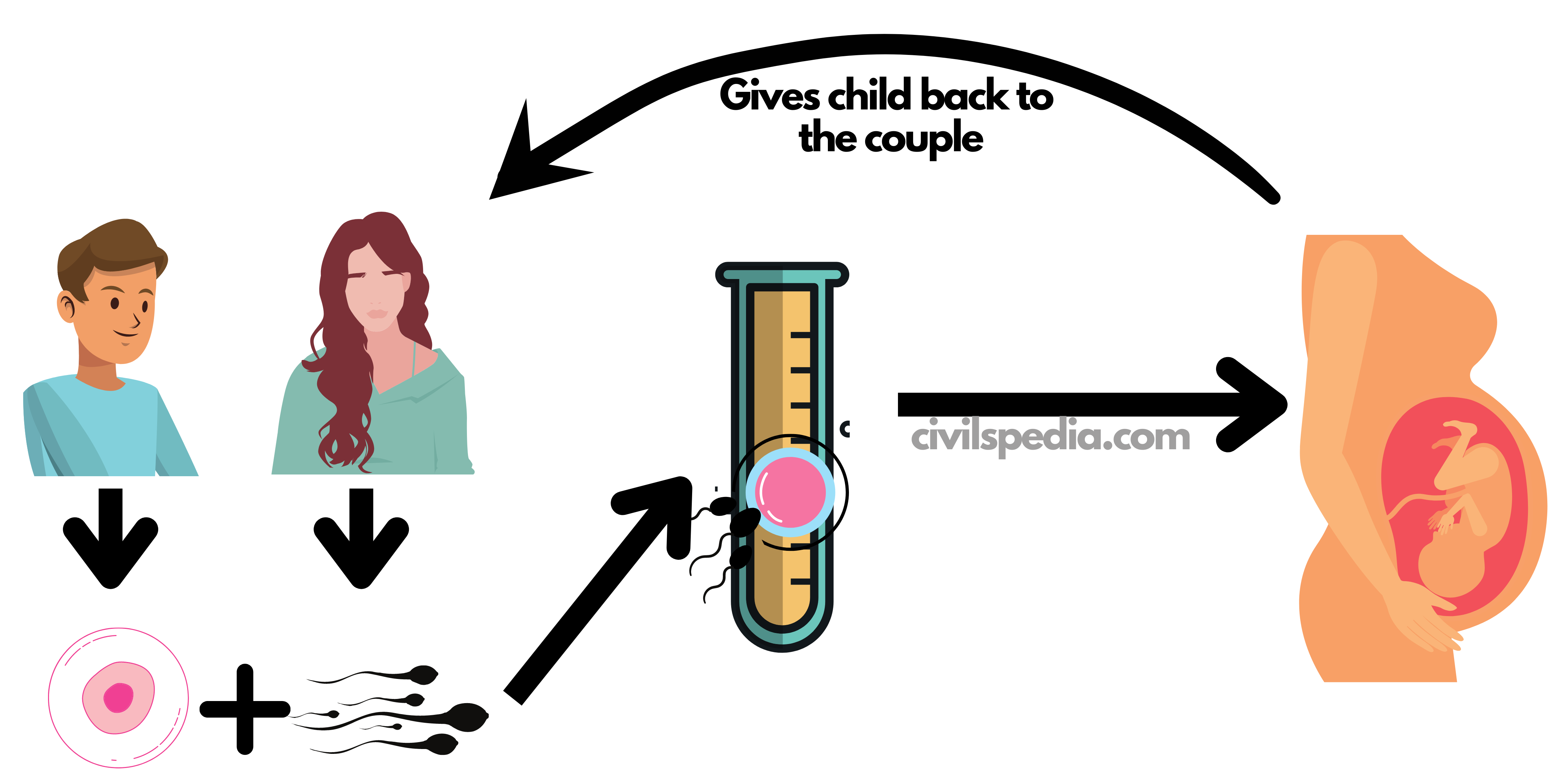

- Surrogacy is the practice in which one woman carries the foetus in her womb in an arrangement where the child has to be handed over after the birth.

- Surrogacy can be of two types.

- Altruistic surrogacy: The couple doesn’t pay any compensation to the surrogate mother except for medical expenses.

- Commercial surrogacy: Couple pays compensation to the surrogate mother.

- India has a well-developed surrogacy industry with more than $2.3 billion annual revenue.

- India has emerged as a reproductive tourist industry capital of the world.

Anti-Surrogacy vs Pro-Surrogacy Debate (General)

Anti-Surrogacy Arguments

- Physical stress, risk, and emotional trauma to surrogate mother on abrupt separation from baby carried in the womb for nine months.

- Children face health concerns such as being breastfed for at least six months.

- The use of surrogacy is cheapening the idea of having a child as a commodity.

- Sex selection is the ‘dirty secret’ of commercial surrogacy (the discarded foetus is usually female).

Pro-Surrogacy Arguments

- The surrogate mother has the right to assert her independent agency and make choices in her best interest.

- In case government bans surrogacy, the market will go underground, leading to further exploitation of surrogate mothers. Hence, instead of banning the practice, it should be regulated.

Surrogacy (Regulation) Act

Need for the law of Surrogacy

| Post-2000 | Surrogacy became a crucial medical industry in India, with more than $ 2.3 billion in revenue. |

| 2008 | Baby Manji case happened, and the need was felt to have a comprehensive law on Assistive Reproductive Techniques (ART). |

| 2014 | Assisted Reproductive Techniques (ART) Bill was introduced in Parliament (covering all aspects). |

| 2016 | Bill was introduced by the NDA government banning commercial surrogacy and allowing just Altruistic Surrogacy. |

| 2019 | Bill was re-introduced due to inherent deficiencies. |

| 2021 | The Bill was passed and became an act |

In the absence of law, many problems were coming

- Medical problems wrt foetus, e.g., the surrogate child is disabled or has any genetic disease and parents refuse to accept the child.

- Non-payment to surrogate mothers, especially when the child is born still or dead or born with a disability.

- Baby Manji Case (2008): Baby Manji was commissioned by Japanese parents (through an unknown egg donor and husband’s sperm) and was born to a surrogate mother in Gujarat. The parents divorced before the baby was born. The genetic father wanted the child’s custody, but Indian law barred single men from it, and Japanese law didn’t recognize surrogacy. The baby was ultimately granted a visa, but the case underscored the need for a regulatory framework for surrogacy in India.

- Law Commission of India has recommended prohibiting commercial surrogacy and allowing altruistic surrogacy by enacting appropriate legislation.

Provisions of the Surrogacy Act, 2021

- Defines Surrogacy: The Act defines surrogacy as ‘a practice where a woman gives birth to a child for an intending couple to hand over the child after the birth to the intending couple.’

- It bans commercial surrogacy and allows only allows Altruistic Surrogacy.

- The following can opt for surrogacy.

- Any heterosexual Indian couples or couples of Indian origin have a medical condition requiring gestational surrogacy.

- only for altruistic surrogacy purposes

- not for producing children for sale, prostitution or other forms of exploitation

- Couples shouldn’t have any surviving child (either biological, adopted or surrogate)

- The couple going for surrogacy should have a ‘certificate of essentiality’ and a ‘certificate of eligibility’ issued by the appropriate authority.

- The couple can only approach a close relative for surrogacy.

- The surrogate child should be considered the biological child of the intending couple.

- Regulatory Bodies: Regulatory bodies to regulate surrogacy clinics will be established at national and state levels

- National Assisted Reproductive Technology & Surrogacy Board at the central level

- State Assisted Reproductive Technology and Surrogacy Boards in the states

- The act has also laid down the criteria for surrogate mothers, which include

- Married women aged between 25 to 35 years having their own children.

- Can become a surrogate only once in her lifetime.

- Posses certificate of fitness for surrogacy

- Insurance cover: 36 months for the Surrogate Mother to take care of all her medical needs and emergency conditions/complications.

- Penalty: The penalty for going against the provisions of the act includes up to 10 years of imprisonment and a 10 lakh fine.

Issues with the Act

- An outright ban on surrogacy will push this industry underground, increasing the vulnerability of women even more. It was seen in Thailand.

- Act borrows heavily from the UK’s altruistic surrogacy Bill but has changed the British provision to allow only blood relatives to “close relatives”. Close Relative is a vague term open to legal challenges. Even the Select Committee has recommended changing the term ‘Close Relative’ with ‘Willing Woman.’

- Violates Right to Equality: Restricting surrogacy to married Indian couples and disqualifying others based on nationality, marital status, sexual orientation or age does not appear to qualify the test of equality.

- Violate Article 21: Right to life includes the right to reproductive autonomy.

- Supreme Court decriminalized homosexuality. Unfortunately, the Bill scarcely bears an imprint of the verdict & continues to speak the discriminatory language of Section 377.

- The Bill violates UNDHR. Article 16 of the United Nations Declaration of Human Rights gives the right to men and women of full age to found a family.