Last Updated: June 2023 (e-Governance (UPSC Notes))

e-Governance (UPSC Notes)

This article deals with the ‘e-Governance (UPSC Notes).’ This is part of our series on ‘Governance’ series, which is an important pillar of the GS-2 syllabus respectively. For more articles, you can click here.

Introduction

It is of the following forms

| Government to Citizens (G2C) | E.g., e-District, Pravahan etc. |

| Government to Government (G2G) | E.g., Pragati, e-Samiksha etc. |

| Government to Business (G2B) | E.g., e-Procurement, GSTN etc. |

Note: e-Governance is not just using Apps or Websites for the purpose of Governance (as people assume it commonly). In fact, it covers the use of a whole range of Information and Communication Technology (ICT) tools.

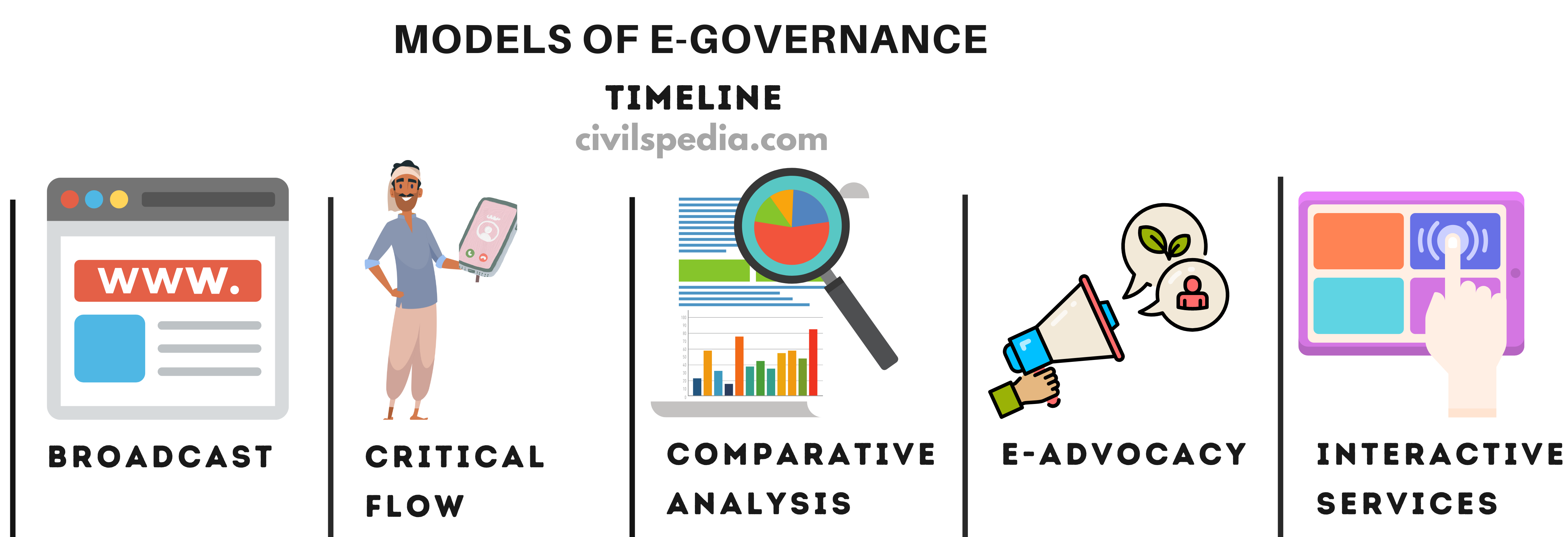

Models of e-Governance

US Prof Arie Halachmi gave 5 models of e-Governance

1. Broadcasting

- Use of Information and Communication Technology & Media to disseminate/broadcast governance info that is already present in paper form.

- For example, Broadcasting Laws, Rules, Judgements, result-mark sheets on the internet.

2. Critical Flow

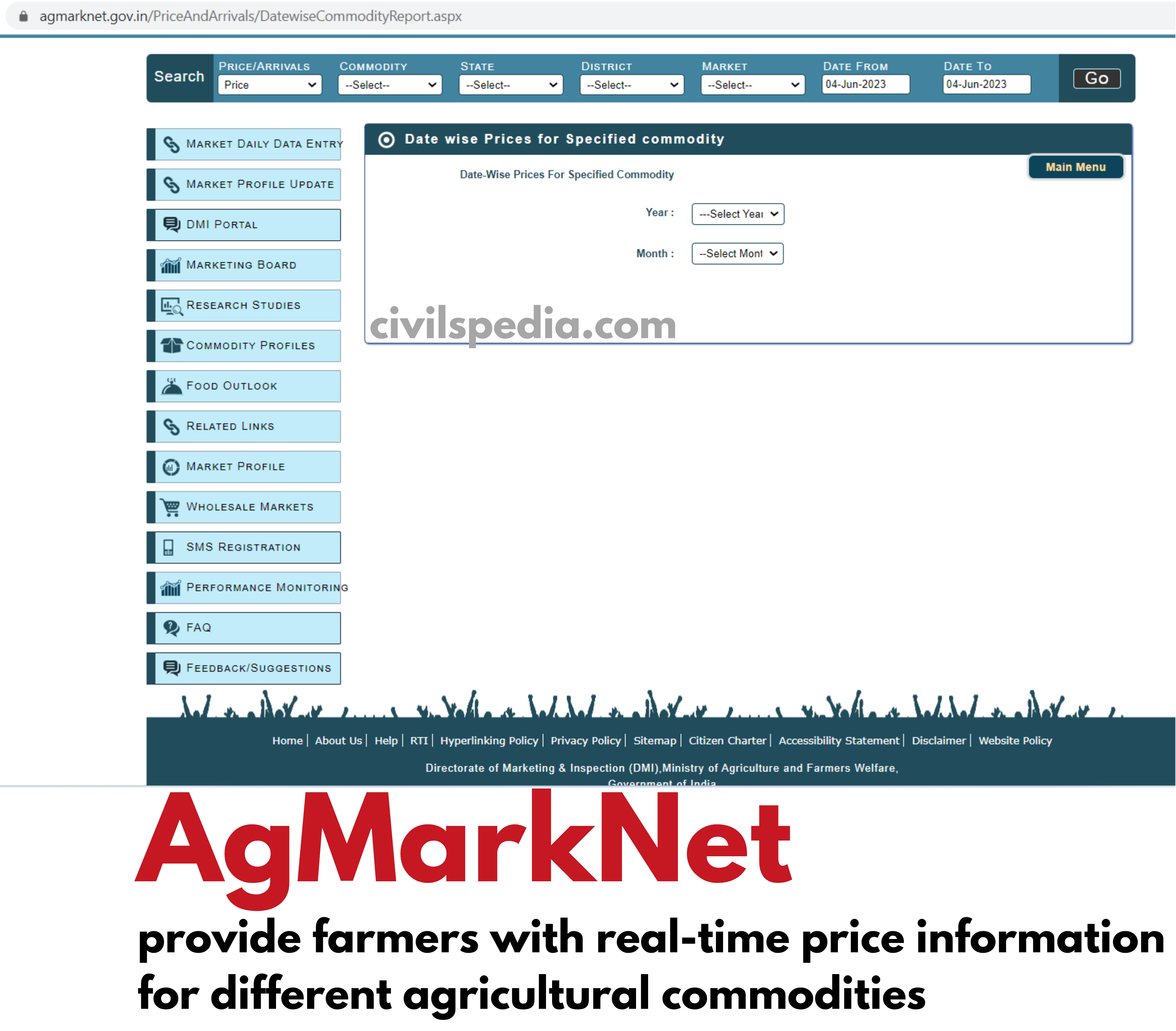

- Only critical information is released using ICT to the targeted audience (like weather forecasts or crop prices to farmers)

3. Comparative Analysis

- Benchmark parameters are created (like IMR, MMR, Life expectancy etc.) & then Regional parameters at District, State & National levels are measured and compared with the benchmark parameters

4. e-Advocacy Model

- Place the opinion of eminent persons or the opinion of the public collected through surveys on an online forum & try to change public opinion on certain laws or policy stances.

5. Interactive Services

- It is a 2-way channel that is used to provide public services online.

- For example E-Payment of Taxes, Electricity Bills etc.

Benefits/Potential of e-Governance

- Accessibility and Convenience: e-Governance makes government services accessible to citizens and saves them from visiting government offices physically. For instance, citizens can digitally apply for driving licenses and vehicle registrations using the “Parivahan” portal (by the Ministry of Road Transport and Highways).

- Transparency and Accountability: e-Governance promotes transparency and accountability by making the information accessible to the public. E.g., the Right to Information (RTI) Act has a provision for digitizing documents, thus promoting transparency and increasing accountability.

- Efficiency and Cost Savings: e-Governance helps streamline administrative processes, leading to faster service delivery. E.g. Direct Benefit Transfer (DBT) of subsidies into the bank accounts of beneficiaries. It decreases the leakages and also reduces the cost of transfers.

- Increased Citizen Engagement: e-Governance promotes citizen engagement in governance through processes such as citizen feedback and surveys. E.g., MyGov enables citizens to provide feedback and suggestion on various government initiatives.

- Financial inclusion: e-Governance initiatives such as Direct Benefit Transfers and UPI have helped in increasing financial inclusion in India.

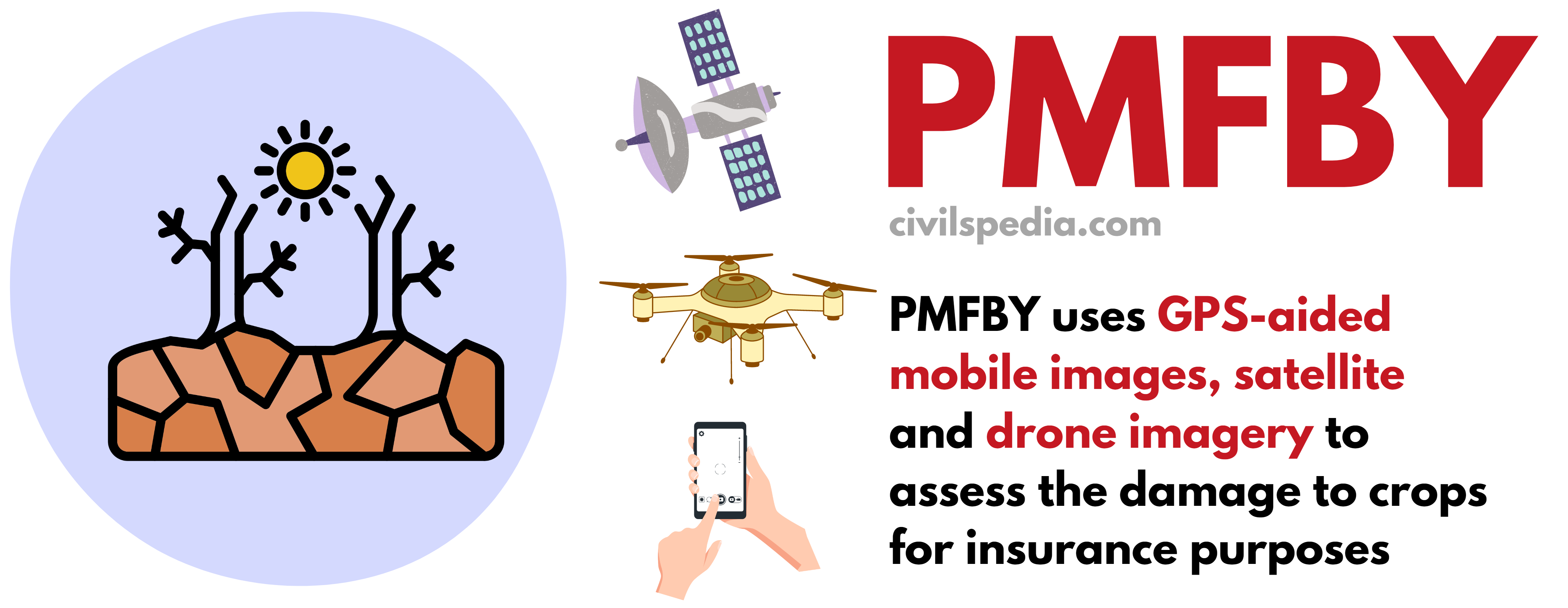

- Data-driven Decision Making: e-Governance initiatives generate enormous data which can be utilized for data-driven, evidence-based decision making. E.g., National Health Stack (NHS) will integrate health data from different sources to create a comprehensive health information system enabling the government to make data-driven decisions to promote health services in India.

National e-Governance Plan (NeGP)

- NeGP is the joint initiative of the Ministry of Electronics and Information Technology (MEITY) and the Department of Administrative Reforms and Public Grievances (DARPG).

- It was started in 2006.

- The NeGP comprises 31 Mission Mode Projects (MMPs) and 10 components.

- It aims at improving the delivery of government services to citizens and businesses with the vision of making Govt. services accessible to the common person through common service delivery outlets and ensuring transparency, reliability and efficiency of services at affordable costs.

- Some of the Mission Mode Projects implemented under NeGP include

- e-District: Aimed to digitize the delivery of services at the district level, like issuance of certificates, licenses, and permits.

- National Land Records Modernization Program (NLRMP): To computerize land records

- National Citizen Database: Create a comprehensive database of citizens, including demographic and biometric information

- e-Procurement: Digitize government procurement processes

- Common Service Centers (CSCs): Physical centres at the village level equipped with computers and internet connectivity to provide access to several government services to citizens.

- State Wide Area Networks (SWANs): To establish robust and secure communication networks across states to connect government departments, enabling them to share data and information seamlessly with each other.

- State Data Centers (SDCs): Centralized repositories for storing and managing government data.

ICT Initiatives in Governance

G2G or Government to Government Initiatives

1. National e-Vidhan Application

It is a mission-mode project to make the functioning of State Legislatures paperless.

It is a Software suite of

- Public website

- Secure website (for members)

- Mobile apps

that fully automate the functioning of the legislative assembly

What will be done?

- No papers in the House: All replies to questions, copies of bills and reports will be provided online

- MLAs will use touch-screen devices.

- Government departments will communicate with Vidhan Sabha online to send replies to approved questions.

- The government will cut down expenditures incurred on the use of paper and other overheads.

- Common people will also get access to important documents and videos. They can also ask questions from the MLAs and MPs.

2. PRAGATI (Pro-Active Governance and Timely Implementation)

- Aim: Timely implementation of government programs (especially in infrastructure, worth trillions of rupees.)

- The PMO, Union Government Secretaries, and State Chief Secretaries constitute the PRAGATI application, and hence it is a three-tier system.

- PM holds monthly meetings with Secretaries of the Union government and Chief Secretaries of all state governments to scan the progress of projects under implementation. Meetings are held through video conference.

3. e-Samiksha

- e-Samiksha is an online monitoring and compliance mechanism developed by the Cabinet Secretariat.

- It is used for tracking the progress of projects & policy initiatives by the cabinet secretary and PM on a real-time basis.

4. UPaAI System

- UPaAI (Unified Planning and Analysis Interface), or ‘solution’ in English, provides an integrated platform for data on infrastructure and social indices for each constituency to the MP and helps them take better decisions related to MPLAD funds and other Central Schemes.

- It is monitored by PMO too.

- In the next phase, it will be extended to include state schemes and bring district magistrates and members of legislative assemblies on the same platform.

5. e-Office

- NIC has developed an e-Office application to transform the traditional functioning of government departments.

- It has functions like

- Unified Internal Messaging

- E-Files: To make digital files and share them with others

- E-Financial Management

- Knowledge Management System providing essential documents and files accessible at any place

G2C or Government to Citizen Initiaves

1. e-District

- e-District digitize the delivery of services at the district level, like issuance of certificates, licenses, and permits through Common Service Centers (CSCs)

2. Digilocker

- It is a cloud-based application that allows people to store and access their documents digitally.

- Citizens can store their documents digitally and also shares them with government agencies and other organizations.

3. Pravahan

- It is an initiative of the Ministry of Road Transport and Highways

- Pravahan allows citizens to digitally apply for and renew their driving licenses and vehicle registrations

4. UMANG

- UMANG is a mobile app that provides access to various government services like passport services, income tax filing, and utility bill payments through a single platform.

5. e-Ticketing

An initiative of Indian Railways which allows passengers to book tickets, check seat availability, and make payments electronically.

6. MyGov

- MyGov is an online citizen engagement platform that allows citizens to participate in policy-making and Governance through their suggestions and feedback on various government initiatives and programs.

G2B or Government to Business Initiatives

1. MCA21

- Ministry of Corporate Affairs 21, or MCA21, allows electronic filing as well as retrieval of documents such as company registration and compliance certifications.

2. e-Biz Portal

- It is a unified platform for various regulatory clearances and permits.

- It has simplified the process of starting and operating businesses.

3. Government e-Marketplace (GeM)

- GeM helps to ensure that public procurement of goods and services is carried out through the online platform.

- It promotes transparency & eliminates corruption.

- Helpful in easy auditing because it will leave an audit trail.

4. Goods and Services Tax Network (GSTN)

- GSTN is the technology platform that is the backbone of the GST regime.

- It handles the registration under GST, filing and payment of GST, handling complex system of GST credits etc.

5. e-NAM

6. Indiastack

- IndiaStack is a collection of open APIs and digital public goods.

- API or Application Programming Interface allows two applications to interact with each other.

- IndiaStack includes APIs of Aadhaar, Unified Payment Interface (UPI), DigiLocker, Aarogya Setu, eSanjeevani, UMANG, DIKSHA, etc.

- Software makers can use these APIs in their software to utilize their functionality. E.g., UPI API is used by Banking Applications of various banks.

Challenges

- e-Governance is seen more as computerization & office automation rather than as a means to transform citizens from passive to active participants in Governance.

- Digital Divide: According to INDIA INEQUALITY REPORT 2022 by Oxfam, there is a huge digital divide in India. For instance, 61% of men-owned mobiles in contrast to 31% of women

- Funding for these programs is short in comparison to the huge ambitions we have placed on these schemes.

- Privacy & No Data Protection Law (Legal Vacuum): Aadhar information & other records are to be used, but there is no law to ensure privacy.

- The quality of local content is not good. Most portals aren’t user-friendly.

- No special programs to make the public aware of these programs.

- A status-quo attitude of the government departments: Despite a push for e-governance initiatives, many government departments continue insisting upon physical forms and signatures.

Conclusion

According to Kentaro Toyama, formerly Microsoft India’s CEO, IT intervention has a limited impact on developmental outcomes when political will is absent. It is because technology can only be the ‘force multiplier’; it is not the force itself. The positive intent must originate in politics and motivate the bureaucracy to deliver on its mandate.