Last Update: Jan 2025 (Role of Media in Internal Security Challenges)

Table of Contents

Role of Media in Internal Security Challenges

This article deals with the ‘Role of Media in Internal Security Challenges.’ This is part of our series on ‘Internal Security’, an important pillar of the GS-3 syllabus. For more articles, you can click here.

Introduction to Media

- Media is derived from the word medium (meaning carrier or mode).

- It denotes an item through which any kind of information, news, entertainment, education, data, promotional messages etc., can be disseminated.

Different types of Media

Media itself can be divided into several categories like

| Print Media | Newspapers, Magazines and Books |

| Electronic Media | Television, Radio, Websites etc. |

| Social Media | Facebook, Instagram, Youtube etc. |

Role of Media

The role of media in a country is crucial, and it is said to be the ‘Fourth Pillar of Democracy‘.

- It helps citizens to make responsible and objective choices

- It promotes government accountability by providing information about its functioning to the common public.

- Media is used to educate people through the news and social commentary.

- Media plays an instrumental role in bringing change in the attitudes and habits of the masses. For example, Swachh Bharat Abhiyan.

- Media also helps in the project of national integration by providing information about different parts of India.

- Media plays the most critical role in shaping public perception.

Constitutional and Legal provisions regarding Media

- Article 19 of the Indian Constitution deals with freedom of speech and expression.

- Articles 105(2) and 194(2) allow the Indian Press to publish or report the proceedings of the Parliament and the State Legislatures.

- The Press Council of India is the regulatory body of the Indian press. Its main functions include

- Preserve the freedom of the press

- Maintain & improve the standard of newspapers and news agencies in India.

- It can receive complaints of violation of journalistic ethics or professional misconduct by an editor or journalist.

- News Broadcasting Standards Authority (NBSA): NBSA is an independent watchdog set up by the Indian News Broadcasters Association on its own to consider and adjudicate complaints about broadcasts.

- Broadcasting Code: Originally, the code was set up to govern All India Radio (AIR). But all the major media organizations also follow this code voluntarily. The principles include:

- Addressing controversial issues impartially and dispassionately

- Ensuring the objective reporting of news and unbiased commentary in order to improve culture and education

- Raising and maintaining high standards of decency and decorum in all programs

- Encouraging religious tolerance, communal harmony, and international understanding

- Respecting human rights and dignity

But there are some restrictions on the media as well. These include

- Union & State legislatures can put ‘reasonable restrictions’ on free speech under Article 19(2) on 8 grounds i.e.

- Sovereignty & integrity of the nation

- Security of state

- Friendly relations with foreign states

- Public order

- Decency and Morality

- Contempt of court

- Defamation

- Incitement to an Offence

- Defence of India Act, 1962: It was passed in the wake of the Sino-India war of 1962. It empowers the Central Government to issue rules with regard to prohibiting publication which would undermine or threaten the civil defence.

- Civil Defence Act, 1968: It enables the government to establish rules prohibiting the production and dissemination of any book, newspaper, or another item that compromises the nation’s and its citizens’ civil defence.

Principles of Self-Regulation for Media

Media has the power to influence the decisions of others and play an essential role in informing others. Hence, it becomes necessary that media follows certain principles of self-regulation.

- Accuracy and Objectivity in Reporting: Accuracy is at the heart of reporting & errors must be corrected promptly.

- Ensuring Neutrality and Impartiality: Media platforms should give equality to all affected parties. They should ensure that allegations are not portrayed as facts and that charges are not portrayed as an act of guilt.

- Media should take care that they do not indulge in sensationalizing news to gain more TRP.

- There should be a wall between managerial/ownership activities and editorial jurisdiction.

- The media shouldn’t glorify crime and violence. Media platforms should not glamorize it, whatever their intention may be, as it influences the young generation negatively.

- The media shouldn’t depict a woman or juvenile victim or witness of rape, aggression or trauma without concealing their identity. Media shouldn’t show nudity or porn in any form and shouldn’t intrude on private life unless a larger public interest is involved.

- Don’t endanger National Security: Media platforms should use maps and terminology mandated by the law. Media shouldn’t broadcast content that encourages secessionist groups and furthers their interests.

- Media platforms should refrain from advocating or encouraging superstition or occultism.

- Media must not intrude on individuals’ private lives or personal affairs unless there is an established larger and identifiable public interest.

- Sting operation should be the LAST RESORT: Media platforms cannot use sex or narcotics to carry a sting. Along with that, the sting should be in the larger public interest. Additionally, footage should be shown in full without alteration in the footage.

Self-regulation is the best form of regulation, especially in the case of media. Hence media should try to stick to the above principles so that its freedom remains ensured.

How does Media threaten National Security?

- Breaking News Phenomenon: In India, far too many channels compete for viewership. With the phenomenon of ‘Breaking News’, news channels start to run any news without checking the veracity of facts. It frequently culminates into social tensions, communal riots and regional tensions between various ethnic groups. E.g., Mass exodus of North-Easterners from Bangalore.

- Sensationalization of National Security-related Issues: During the hijacking of flight IC 814 to Kandahar, Indian media accurately reported the movement of army personnel and influenced the decision of political leadership, which led to poor negotiations and the eventual release of terrorists.

- Reporting on the Sub-judice Matter: Matters pending in the court are freely reported and discussed in the media. A parallel trial by the media can potentially vitiate the atmosphere around which a citizen is supposed to get justice. In certain high-profile cases, the media almost declares someone guilty or innocent, thereby putting the judiciary under tremendous pressure. For example, the media trial on the Sushant Rajput suicide case (2020), Jessica Lal case(2010) and Priyadarshini Mattoo case (2006)

- By telecasting live coverage of Anti-terror operations, media can provide information on the deployment of security forces to the terrorists. For example: during the 26/11 Mumbai attack, the media telecasted live the operations carried out by the security forces. Terrorists also got access to the information resulting in significant casualties. Later, the government added a new clause to the 1994 Cable Television Network Rules’ Program Code. This provision limits media coverage of counterterrorism operations to periodic briefings by an authorized officer and forbids live coverage of such operations.

- Media can flare communal riots by irresponsibly reporting on sensitive issues such as caste and communal conflict. E.g., The Muzaffarpur riots of 2013 or the Delhi riots of 2020.

- Fundamentalists can also use media to spread hate speech and radicalize the population. For example,

- Zakir Naik’s Peace TV was spreading hate speeches against different religions and sects other than the Sunni sect of Islam. It has played an important role in radicalizing youth in Bangladesh. Zakir Naik and his TV is already banned in the UK, Canada and Malaysia. India, too banned his NGO & TV in 2016.

- Channels like Sudarshan news spread hate against the Muslim community. SC had to intervene to impose a pre-telecast ban on its “UPSC Jihad” program.

- Indian media’s analysis of national security issues by groups of former diplomats, generals and self-proclaimed patriots (like Shifuju) distorts national security perspectives.

To prevent terrorists from using the media to achieve their goals, the media must exercise caution. Years ago, terrorism specialist Brian Jenkins said, “Terrorism is theatre.” Media also likes theatre. How many videos produced by the Islamic State may then be aired on TV without furthering their cause? There is no conclusive response. Their videos accomplish a dual aim by horrifying and motivating different groups of people.

Case Study: Media (Radio) during the Tutsi Genocide (Rwanda)

- In early 1990, anti-Tutsi articles and cartoons started to appear in the Kangura newspaper.

- In June 1993, the RTLMC (Radio Station) started broadcasting in Rwanda. The radio station used rowdy language spoken by street thugs. It was specially designed to appeal to the unemployed.

- “Slavery” was a term repeated throughout the transcripts, with guests on the radio station recalling the state of Hutu slavery during colonization. Drawing on such a vocabulary, the radio broadcasts characterized the Rwandan genocide as a slave rebellion.

- During the Riot, RTLMC was broadcasting such sentences again and again.

- “The graves are not yet full.” – This means killing more Tutsis.

- “go to work” – Meaning get your machete and kill Tutsis.

If the radio was a powerful medium then, where you only needed a transistor & few batteries, we have smartphones & WhatsApp today. The plethora of hate messages we get on WhatsApp mirror the phenomenon of the RTLMC, a concerted attempt to fabricate a newer version of history.

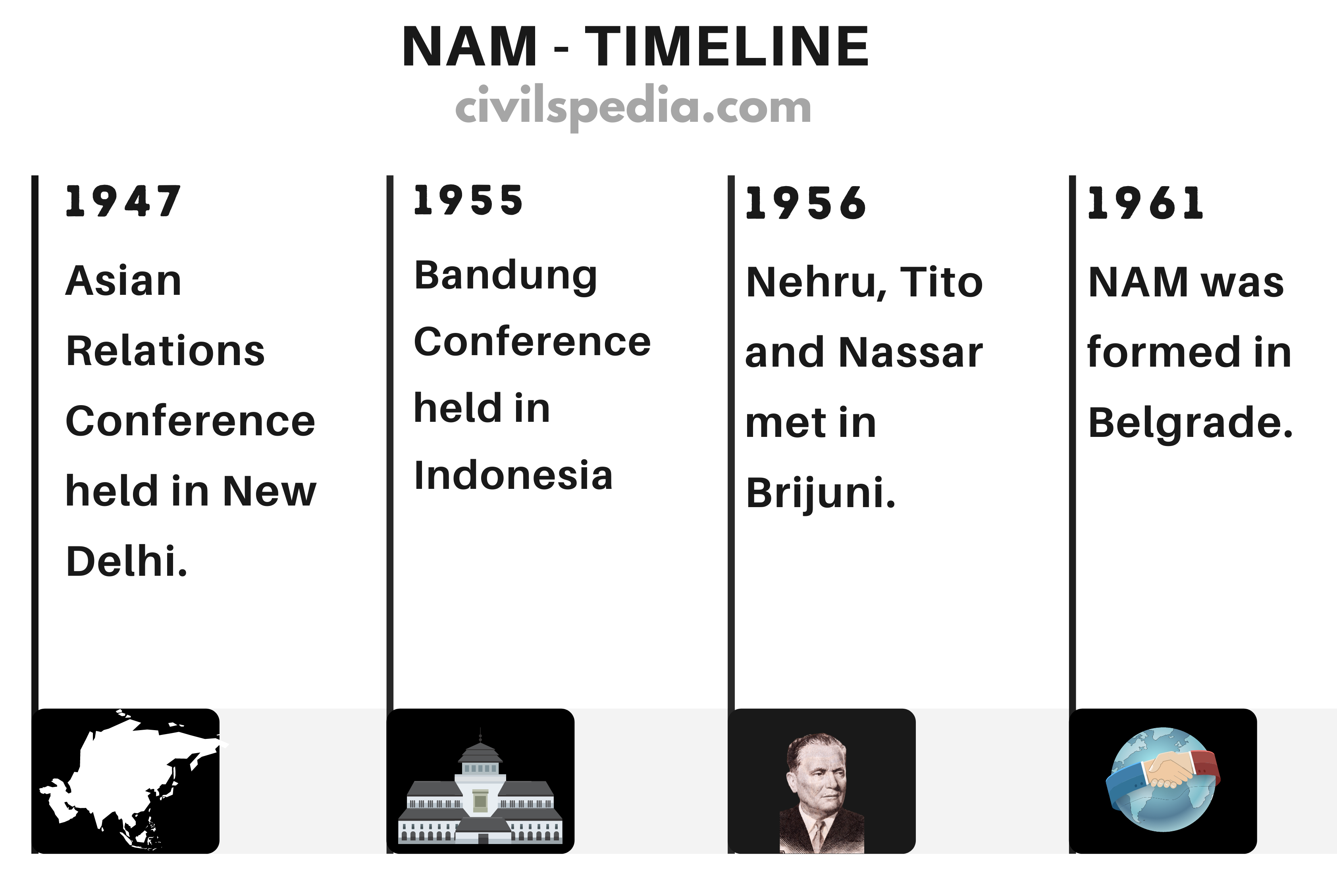

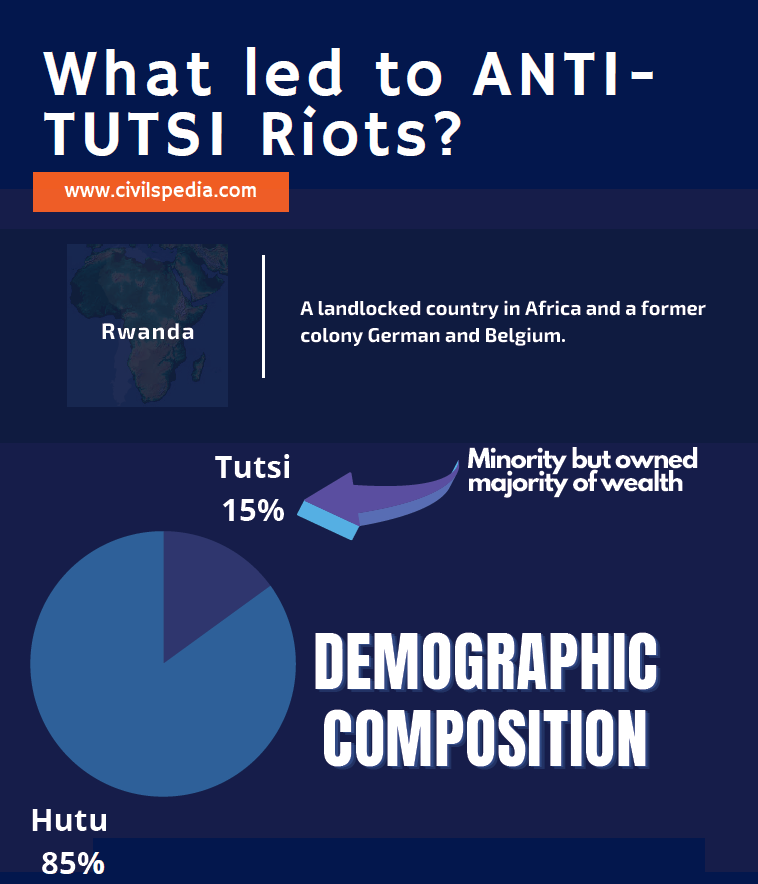

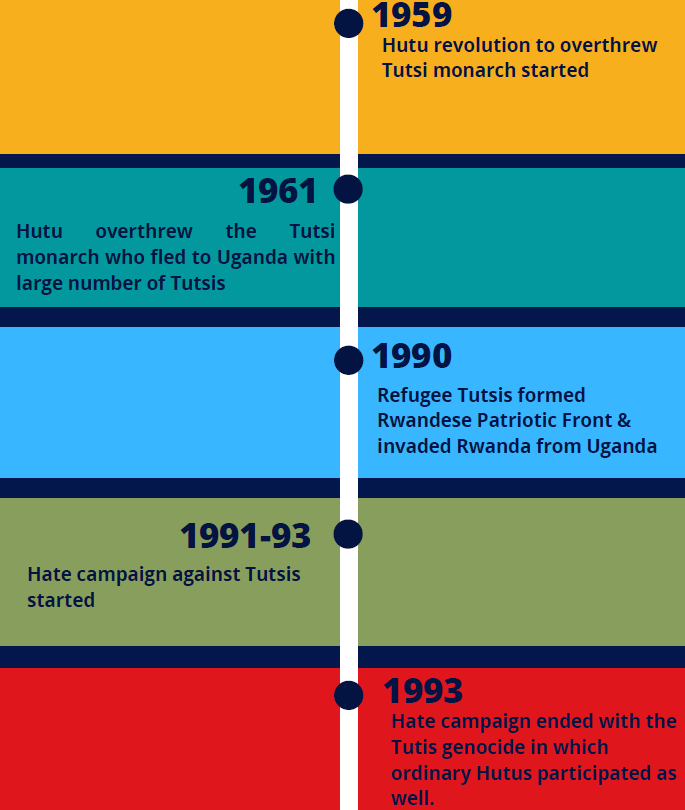

Side Note: Background to the Tutsi Genocide

Way Forward

- Press Council of India should be empowered to penalize newspapers, news agencies, editors, etc., for the violation of its guidelines.

- News Broadcasters Association (NBA) which represents private television news broadcasters, should be given statutory status on the lines of the Press Council of India.

- Media should not indulge in ‘Media Trials’ as it meddles with a trial in accordance with the law.